Private Money 411 - Special Supplement from Realty411

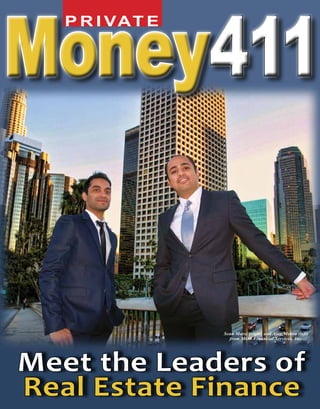

- 1. P R I VAT E 411 Sean Morsi (right) and Ajay Mehra (left) from MOR Financial Services, Inc. Meet the Leaders of Real Estate Finance

- 2. 1

- 3. FirstKey Lending America’s premier financing resource for 1- to 4-family rental housing portfolios — provides loans from $1 million to $100 million. Whether you own 5 rental properties or 5,000, FirstKey Lending can provide you with the financing you want and the service you expect. CONTACT FIRSTKEY LENDING TODAY Call us at 1-855-299-1944 or email info@firstkeylending.com www.firstkeylending.com © 2013 FirstKey Lending, LLC. All rights reserved.

- 4. FirstKey Lending Unleashes Big Capital For Smaller Investors © 2013 FirstKey Lending, LLC. All rights reserved. S ince it’s inception FirstKey Lending has been specializing in the finance of single family portfolios in the $5 to $100 million range. Several months ago the media was abuzz with news of private equity giant Cerberus Capital Management lending its billions to owners of 1 to 4 unit rental portfolios. Now, New York-based FirstKey Lending has further expanded this initiative with the unveiling of its Lending Express program, designed specifically to accommodate owners of 1 to 4 single family portfolios who are looking for financing in the $1 to $5 million range. Cash is now flowing to an expanded group of investors through FirstKey’s new program, creating new opportunities for smaller rental portfolio investors to tap into. FirstKey’s Randy Reiff Leaks the 411 on Express Lending FirstKey is known for their $1 to $100 million loans and boasts an impressive executive team of some of the top minds, money managers and mortgage experts in the industry. Randy Reiff is the firm’s Chief Executive Officer, whose resume is a lineup of notable positions, including heading up the Global Commercial Mortgage Business for both J.P. Morgan and Bear Stearns. In an exclusive interview with Reiff, he broke down the advantages of the new Express program for Realty411 readers… It’s no secret that it has historically been challenging for real estate investors looking for funding under $10 million. Reiff explains that it was this void and need in the market, as well as a unique advantage in efficiency and infrastructure, which were behind the decision to launch FirstKey’s new small balanced lending program. Specifically the CEO says: “FirstKey’s infrastructure and expertise have enabled us to role out this exciting new product, which caters to customers borrowing $5 million or less. The FirstKey Lending Express program offers a streamlined documentation and closing process tailored specifically to this customer base.” Why You Want This Loan The FirstKey Lending Express product provides swift funding for deals in the $1 million to $5 million range. Reiff explains it has been “specifically designed for smaller port- By Tim Houghten folios of 1 to 4 family rental homes. The company employs a team of individuals who are intricately familiar with the nuances of financing these portfolios effectively.” In other words you are not just dealing with an out-of-touch lender that doesn’t understand the title, documentation and performance history hurdles that can come Loan Amounts: with acquiring $1,000,000 to $5,000,000 or refinancing a pool of cash Rate Type: Fixed flowing properLoan Terms: 5 and 10 year ties. Other factors to love about this Property Type: 1 to 4 mortgage program Single residential family include the poLoan-to-Value: Up to 75% tential to borrow under an LLC or Amortization: 20 to 30 year commercial entity Interest Rate: Competitive pricing with non-recourse loans, very competitive rates, up to 30 year amortization, and the speed of getting to the closing table. Borrowers can take advantage of 5, 7 and 10 year loan terms, across the U.S. with LTVs as high as 75%, to enable portfolio growth and/or continually optimize investor performance. According to Reiff, current turn times are “generally around 4 to 6 weeks,” depending on portfolio size, which is pretty impressive in this arena. Given the granularity of a portfolio, third party reports and title work are the biggest lead-time items and are generally tackled immediately, to expedite the approval process. Reiff welcomes investors to “bring us your Randy Reiff portfolio and let us evaluate your options.” FirstKey Lending Express Program Features: For fast loan assistance, real estate investors can either call 855-299-1944 or visit FirstKeyLending.com. Borrowers can take advantage of 5, 7 and 10 year loan terms, across the U.S. with LTVs as high as 75%, to enable portfolio growth and/or continually optimize investor performance. Realty411Guide.com PAGE 51 • 2014 reWEALTHmag.com

- 5. An Interview with Managing Partners of MOR Financial Services, Inc., Sean Morsi & Ajay Mehra I Meet the Future of Private Money By Tim Houghten n the words of the great Bob Dylan: the times “they are a-changin,” for Sean Morsi and Ajay Mehra — CEO and CFO of MOR Financial, respectively — the notion of shaking things up has been woven into their company’s genetic code. It may come as a surprise to hear that an asset-based lender, known for utilizing cutting-edge marketing and high-tech analytics, assert for a traditional approach in customer service and building lifelong client partnerships. With an average yield returning 10.5% for their lenders, Morsi and Mehra have compiled more than $70 million in committed capital from their investors, with roughly $35 million in their active in-house servicing portfolio. Built in a relatively short period of time with a focus in Southern Cali- Realty411Guide.com fornia, where both were raised, the two have also set their sites on penetrating the Florida, Nevada and Arizona markets. Ajay came on board as a partner in MOR Financial in 2009, with both partners coming from established lending backgrounds before re-shifting focus after the market crash. “Since then, we’ve grown into a premier private lender here in Southern California, specifically around Los Angeles County,” notes Morsi. As the new kids on the block, the business moguls captured a very large percentage of the market in a very short span of time. A large percentage of their competition has been in the private money lending sector for 20 years or more. Mehra PAGE 52 • 2014 reWEALTHmag.com

- 6. added that the industry had always been something of an “intuitive-based” one, which both men felt kept it from growing like it could. “We wanted to deliver structure,” said Mehra. “We wanted to shift the industry from the whimsicality it had.” The demographic for private money investors today, according to the executives includes much of the younger mindset than was seen 10 or 15 years ago. The MOR Financial Team The change in development is spawned mainly from “Maybe 20 years ago, that was the case, but a lot has changed. disappointed and lack of confidence with the stock market and Banking guidelines being as stringent as they are have really the desire for more tangible investments. opened things up for private money lending. Where else are peo“Thanks to the stock market crash, several savvy financiers ple supposed to go to get the access to leverage?” have a sour taste in their Morsi adds, “Today’s mouths, yet are still huninvestors are strong and gry for yield,” said Mehhungry.” Since MOR comes ra. “We are seeing people, from the customary lending who would otherwise side, the company strives have investment portfolito maintain and deliver on Listen To Your Head. View every house you buy as a busios centered around Wall customer service. And deliver ness transaction; don’t let your heart interfere. “You’ll Street now, deviating they did. MOR Financial has get carried away,” said Mehra. “You’ll get wrapped up in into real estate.” Today, set themselves apart by taking making things the way you would want them if you were instead of owning Micthe insight of due diligence going to live there -- and that’s not necessarily attractive rosoft as a growth stock, and recalibrating it in a way for an end buyer. That’s how you end up overspending.” youthful investors would to center on becoming trusted rather invest in assets they advocates for their borrowers. • Have A Plan. Take the time to map out an implecan hedge. The emerging “We always try to play the mentation plan and do your homework on the industry generation with access to devil’s advocate for their ben-- in particular, the area where you’re buying. “Often capital doesn’t have faith efit,” said Mehra. “Not to kill our buyers have great ideas, they’ve got a lot of knowlin the stock’s paper and the deal, but to make sure our edge they’ve accumulated from clubs and seminars, would rather place funds affiliates aren’t walking into a but they’ve got no idea what to do with it,” said Mehra. into something concrete. black hole. “They want to implement, but they don’t know how. Our At the end of the day, a As the company’s directors, next MORSYNERGY event in February is going to be hard asset like real propSean and Ajay look at every focused solely on implementation.” erty is never worth zero. deal as though it was their They can hang their hat own so they can provide bona • Have A Team. The best deal can be derailed without on that! fide feedback to their clienhaving a team together to back it up -- specifically, conAnother way the industele. tractors. “You’ve got to have a really fantastic contractor try looks different today With repeat borrowers, in place before you even start writing offers,” said Mehis the high-creditworthiMOR has rapport in the ra. “Get references for your contractors, and call the refness of the borrowers. For industry. The company aims erences -- that contractor can be the ‘make or break’ of the most part, the “flipto educate everyone from their your deal.” Morsi agreed: “That’s typically what destroys pers” and other borrowers able borrowers to individuals a flip,” he said. MOR Financial provides an approved list MOR Financial scopes just breaking in — and they of contractors who are reliable and experienced. have great credit. In the work with a lot of beginners.” past, hard money lending “We’ve always felt that the • Take Action. “Nothing beats getting out there and was often seen as the most durable relationships are doing your first deal,” said Morsi. “Once you have your realm of the hard-luck built through education,” mensystem and team in place, then you can go out there and borrower. Mehra suspects, “Tips for Successful Flips” really hit it hard.” Realty411Guide.com Continued on pg. 62 PAGE 53 • 2014 reWEALTHmag.com

- 7. Five Steps to Raising Private Capital M Jillian Ivey Sidoti, Esq. any people assume that in order to raise capital all they have to do is go out and find potential investors to whom they may pitch their idea. However, the laws regulating the sale of any security are such that operating in such a matter would be illegal. Too often, people learn fact and decide that their aspirations are out of their reach… or worse, raise the capital illegally, putting themselves at risk to suffer very serious consequences should the SEC catch on to what they are up to. Truth is, with the appropriate planning and effort, anyone can raise the capital necessary to execute their business plan. At a very abstract level, there are five steps to raising private capital, and they are as follows: 1. Develop Your Business Plan: One cannot very well start a company without a plan! At the very least, you want to put together bullet points of the “who,” “what,” when,” “where,” “why,” and “how” you will put your company to work and start generating income. From there, you can flesh out the details. 2. Set Up Your Company: Your next step is to decide what type of entity is appropriate for your business plan, and in which state. A corporation, limited liability company, and limited partnership each have their respective positives and negatives. The particulars of your situation will dictate what best fits your company. your capital raising efforts in the correct manner, then you will be well on your way to meeting your capital goals. 3. Decide What To Offer Investors: If people are going to invest money in your company, one of the most important questions they will have is “what do I get out of this?” First and foremost, you have to analyze your business plan to determine your baseline of what you can afford to offer investors in addition to what the market dictates in your particular industry. You must then determine what you are comfortable offering investors and land somewhere between those points. This could be a percentage return on their capital investment, simply just a share of profits the company earns, or a combination thereof. Jillian Ivey Sidoti is a partner in Trowbridge, Taylor & Sidoti, a boutique securities law firm with locations in California and Florida. Jillian may be reached for consultation at 323-799-1342 or at: jillian@jilliansidoti.com 4. Put Your Offering Documents Together: Not only may you be required by law to present offering documents (called a “Private Placement Memorandum”) to your prospective investors before taking their money in order to ensure you have made all the appropriate disclosures, but such documents will provide all the information they need to decide to make the investment. The private placement memorandum encompasses the three “D’s” – disclaimers, disclosures, and details. 5. Find Investors: For many entrepreneurs, finding investors is the most intimidating step in the process. However, if you organize and execute Realty411Guide.com PAGE 54 • 2014 reWEALTHmag.com Image: Pogonici / 123RF.com Yes, this is a very boiled down step-by-step. Yes, you will need the advice of a professional to help you along the way. However, you need to realize that if you do give all the above steps the appropriate amount of attention, there is no reason that you cannot raise the capital you need.

- 8. No Fluff! The Godfather of Hard Money on Private Money Lending in Today’s Market L By Robb Magley “Hard money” lending gets its Leonard Rosen name from the practice of basing loans strictly on the hard equity and hard asset – “no fluff,” said Rosen, no long stories about a borrower’s 20-year plan for a particular property. “The only questions are, one, what is the property’s value, and two, how much equity does the borrower have in it?” said Rosen. “The loan is based on the amount of equity they have in the real property – that’s it.” These loans have been a part of the marketplace for half a century, according to Rosen, but since 2008 and the real estate “implosion,” private money lending has grown to fill the gap left by traditional lenders. “(The banks) have extremely tight lending criteria now, from a creditworthiness standpoint and a regulatory standpoint,” said Rosen. “They are not taking the normal business risks they were over the past 10 years; unless you have stellar credit, and a piece of real estate that you have significant equity in, the chances of getting any kind of real estate financing from them is very slim.” Enter the “hard money” investors. The loans are primarily used in commercial real estate, investor fix-and-flips, or any short-term project where borrowing is used to solve a problem or bridge a situation until the implementation of an exit plan – for example, to refinance or sell a property within a year or so. “Sometimes investors will buy property on the courthouse steps, or REOs from the bank, and they’ll get them at wholesale prices,” said Rosen. “Imagine a property’s worth $100,000, and an investor has $35,000 into it. In comes the hard money eonard Rosen is known alternately as “the Godfather of hard money” (he’s been in the business for 35 years) and “the Pitbull.” Unsurprisingly, the second nickname has a good story behind it. “Back in 1982 was my debut as a six o’clock anchor on the national cable network, Financial News Network,” said Rosen. “My very first night going on I was nervous. We had put all of what I was going to say on a teleprompter – 13 minutes of me speaking. As I was getting ready, and the director was counting me down, he said ‘6 ... 5 ... 4 ... 3 ... Leonard, I’m sorry, we lost everything on the teleprompter ... 2 ... 1 ... you’re live.’” He laughed. “And I do this,” he said. “I went 14 minutes, live, first time on national television. The guy walked up to me after and said, ‘Only a pitbull could make that happen.’ And it just kind of stuck.” It’s hard to find a more fervent booster for the industry, whether you call it “hard money” or just “private money lending”; Rosen’s “Pitbull Conference,” which teaches the insand-outs of these loans for real estate, has produced 31 national conferences, with the next one set for February 20th in Ft. Lauderdale. And he doesn’t see enthusiasm for the product dying down any time soon. “I think it’s one of the best investments in today’s marketplace,” said Rosen. “I think being a hard money lender is a great opportunity, and I think being an investor who invests with a hard money lender is a great opportunity.” Realty411Guide.com PAGE 55 • 2014 lender with the remaining $65,000; the investor improves the property, puts it on the market, sells it, pays the hard money lender back, makes a profit – everybody wins.” And, if the borrower doesn’t pay, the hard money lender is in first position to take the property. Rosen points out that most lenders have no interest in being in the real estate business. “They want to be in the lending business,” he said. “But if they have to take it, they can.” One of the big keys to making the investment more secure for the hard money lender, according to Rosen, is to underwrite the asset correctly; loaning too much for a property can spell disaster should the need to liquidate arise. “Every asset, and this includes real estate, has a retail value and a wholesale value,” said Rosen. “A retail value is what a property is worth given a 12-month marketing time to liquidate the property; the wholesale value is whatever the property is worth in a ‘fire sale’. If I had to sell this property in 30 days, what is it worth? Those are going to be different numbers.” A hard money lender has to lend based on that lower value, so they have comfortable “cushion” built-in – just in case they suddenly find themselves in the real estate business. Rosen’s conferences put a lot of focus on a trend he’s watched become increasingly important in his industry: the creation of real estate funds, where a lender deploys not only his own capital but also that of a group of small investors under him. Continued on pg. 61 reWEALTHmag.com

- 9. Market Intelligence with Robert Fragoso anchor Loans M And while the acquisitions arm is significant – in 2011, Anchor Loans itself flipped around 500 properties in L.A. County – the lending is still the company’s “backbone.” Fragoso said Anchor Loans is, in important ways, more of a private equity firm than a traditional “hard money” lender. “We don’t have a set matrix,” said Fragoso. “It’s very easy for us to adapt and tailor make a loan program required to meet any needs.” by Robb Magley arket statistics roll off the tongue of Anchor Loans’ Robert Fragoso with the practiced ease of a true industry wonk; he’s got a real interest, not only in what makes things tick, but in knowing about it before the next guy does – and in making sure his investors can act on that information. Having the best information means the difference between having a great year and living through a financial disaster, according to Fragoso, Anchor Loans diverse organizational interests is part of what gives them their “edge” over the competition. In addition to offering private financing for investors who fix and flip properties, Anchor has an escrow company, a construction company, a software development division and an acquisitions arm – each offering ground-level market intelligence to one another that can prove invaluable. “Most lenders look at loans strictly from a lending standpoint,” said Fragoso. “But because we’re actually in the market ourselves, we can adjust more quickly than others might. We’re able to see construction costs the day they change. Every time there’s a shift in the market, we can see the effect in our own listings.” Realty411Guide.com flow perspective,” said Fragoso. “During the downturn in 2008, We had a positive – albeit slightly positive – year because we were able to read the writing on the wall and prepare and guide our clients through the murky waters.” Today, Fragoso pointed out, inventory is lower even than it was in 2005; the challenge, however, is that in addition to low inventory and low interest rates, the market is facing low buyer demand. “Nationally, 58% of all sales are cash sales,” “It’s very easy for us to adapt and tailor make a loan program required to meet any needs.” When new information comes along, Fragoso and Anchor Loans tell their investors to adapt too. Two years ago, according to Fragoso, a lot of people were having difficulty finding deals for fix-andflips in the cash-flow attractive, lower-priced properties. Because the company had carefully studied the goals and buying parameters of the large hedge funds investing in the area, Fragoso and Anchor were offering what seemed like counterintuitive advice: spend more per deal. “We told our clients, look, you realize all these hedge funds are coming in to buy these properties, and it’s like trying to fight an 800-pound gorilla,” said Fragoso. “They don’t care about the price, and they have a billion dollars to put out there.” So their guidance was to step out of that price point and look at higher-priced opportunities. “The big guys couldn’t buy properties at $400,000 and above, because it didn’t make sense from a cash PAGE 56 • 2014 said Fragoso. “That means cash sales have surpassed not just the first-time home buyer, but every home buyer.” That means the fix-and-flip investor needs to re-think their rehabs to match the market – and the all-cash investor isn’t necessarily looking for the same things as a first-time home buyer. “Especially the guys who fix and flip in high volume, they tend to have a cookie-cutter approach – where they do the same thing to every house, every time,” said Fragoso. “The problem with doing that is you miss out on opportunity when changes occur. If you look at the all-cash investor, they’re looking for value add and additional opportunities. Gearing your rehabs toward those people might mean, for example, not completely 100% remodeling the house – the opposite of what a first-time home buyer would want. Analysis in every region is more importContinued on pg. 58 reWEALTHmag.com

- 11. JasonHartman.com The Complete Solution for Real Estate Investors TM So you love real estate... but you hate management? Passive Income 12.25% First Trust Deeds We have access to very unique "insider" private lending opportunities. You’ve never seen hard money lending like this before. If you have $100,000 or more to invest and you want conservative, diversified, quick-turn, non-pooled investments that repay in about four to six months contact us for details. Our private lending program is simple and proven. The simplicity of our private lending program is unmatched. Visit www.JasonHartman.com or call 480-788-7823 today. Listen to The Creating Wealth Show, Jason's Highly Acclaimed Investor Podcast: CW 274 - Market Intelligence with Robert Fragoso, pg. 56 ant today.” According to Fragoso, income levels now are about a third lower than they were in the previous real estate cycle, and home prices are off only by about 20%. The result is an unsettling disconnect, an insecurity that’s contributed to weak demand every bit as much as the higher bar conventional lending has set. “When home buyers find it more difficult to qualify for conventional loans, you’re going to see a buildup of inventory and a lack of demand,” said Fragoso. “Forecasting for 2014, I think it’ll seem like a sluggish year but still positive due to low inventory. But there are niches in this market that are going to identify themselves that will make some people a lot of money, if they can capitalize on them.” When a market trends downward, according to Fragoso, a lot of investors worry themselves into inaction, thinking they can’t buy anything. But the beauty of fix and flips, he added, is that you’re not in the market that long. “You’re in and out relatively quickly,” said Fragoso. “As long as you don’t have a depreciation factor of 2% or more per month, you can adjust your percentage of profit and you can still make money.” And, while it might not be as much as you might have made in a different market, you’re still in there. “It’s easy to forget, but people made money in 2009, 2010, and 2011,” said Fragoso. “You can’t be afraid of a down market. You just have to be able to identify where it’s headed.” For more information about Anchor Loans, visit the website: www.AnchorLoans.com Fiscal Hangover & Global Change with Keith Fitz-Gerald CW 273 The Decline of the EuroZone with Alasdair MacLeod CW 269 SWOT Analysis of Income Property, Facebook IPO & Case Study See terms of service at: www.JasonHartman.com/terms Podcast Realty411Guide.com PAGE 58 • 2014 reWEALTHmag.com

- 13. 6 Tips for a Successful Private Lending Practice By Mark Hanf, CEO of Pacific Private Money five $50,000 loans than one $500,000 loan or even a $1 million loan! You can charge more points on smaller loans, plus the fees. They close quicker and easier. Larger loans fail to close at a much higher rate than smaller loans. Tremendous opportunities exist today for private money loan brokers. We found the following disciplines helped tremendously in growing a thriving private lending brokerage. Image: Alex Millos / 123RF.com Stay local. The private lending business model is most successful when you focus locally. Most of your loans should be within 100 miles of your office. Most of your private lenders will be local to your community. You will succeed in funding loans because you are a local expert and you understand your local marketplace. Remember that a reputable private lender is really in the investment business first, and the lending business second. Invest in what you know and where you know. For example, we are Northern California-based, and we don’t spend time on most Southern California loan applications. Find your sweet spot. If the funding capacity of the majority of your investors ranges from $50,000 to $250,000 then market this range as your niche. Be honest with your referral network as to your sweet spot. Besides, a guy that needs a $50K loan will not be well served by a broker who regularly funds million dollar loans. Build your book of business by starting out small, creating volume, then working your way up to larger loans. You can earn more in fees by doing Realty411Guide.com Focus. Be specific in your advertising and marketing. Don’t say that you are “nationwide” and you fund “all loan types” and loan amounts. I guarantee you that brokers who market themselves as such do not have a thriving business. Strive for total transparency. If you check out our website you will notice that we don’t have pictures of skyscrapers or smiling people in suits shaking hands. We have pictures of actual deals we have funded. We have our names, addresses, pictures and email addresses for all the world to see. We use our direct phone number with area code so people know our business is located in the San Francisco Bay Area. Google us and you will find our detailed LinkedIn profiles. We’ve never pretended to be something we weren’t. Your authenticity and transparency will attract customers to you in a big way. Refer, don’t broker. We originate loans. We rarely broker loans to other brokers. But we refer deals PAGE 60 • 2014 almost every day. When a call comes in for a loan that’s outside of our area, expertise or capacity, we will refer that caller to one or more brokers from our database of reputable private loan originators. Brokering, in most cases, is a waste of your focus and time. Especially if the lead is coming from another broker. You do not want to be in the middle of a daisy chain. Daisy chain deals mostly fail because the borrower does not get well served. The reason they fail is that there is no way for every agent to get paid without over-charging the borrower. The universe will reward you if you selflessly refer to other brokers those leads which don’t fit your niche. Because of the literally hundreds of leads we have referred to other lenders over the past several years, the goodwill it created has resulted in referrals coming back to us daily from people to whom we selflessly referred business months or even years ago. Coaching, Mentoring & Consulting. The best investments you can make are in yourself and your business. Success and leadership coaching are an important part of my life. The books you read, the seminars you attend, and the videos you watch will help you to master the disciplines you need in order to succeed in a world full of distractions and naysayers. Attend industry conferences and seek out those who have achieved success in this business and follow their advice. Hire an industry professional to review your practices and help you achieve compliance with state and federal regulations. Conduct this business properly, and soon you will have a steady stream of new leads as you grow your local reputation for performance and thoroughness. For more information about Mark Hanf, please visit: www.pacificprivatemoney.com reWEALTHmag.com

- 14. The Godfather of Hard Money, pg. 55 “That’s where the market is going,” said Rosen, “and that’s what I specialize in, helping investors create real estate funds.” Rosen said he’s seeing more and more investors deploy capital utilizing different types of retirement accounts, such as self-directed IRAs, and start (or join) these funds to enjoy better returns and increased security; there’s little not to like. “At the end of the day, the borrower gets to borrow money,” said Rosen. “The investors in the fund get a good dividend yield, secured by a good position on prime real estate. The hard money lender gets the origination points, the arbitrage spread – the difference between what you pay your investors and what you charge your borrowers – and fees for management and servicing of the fund. In a perfect world, everybody walks away happy.” And Rosen will continue to spread the message: Shifting at least some of your investments away from the equities market and into the real estate market by becoming a hard money lender can increase returns and, done correctly, make your investments more secure. And it’s just the right time for it, he said. “I’m a big advocate for the private lending sector in this economy,” Rosen said. “I think it produces jobs, it produces commerce, it puts people to work. It does a lot of good things.” For more information about Leonard Rosen and hard money lending opportunities, visit the website at: www.pitbullconference.com More Choices. More Control. A Better Retirement with a Self-Directed IRA. Protect your nest egg by diversifying your retirement portfolio with real estate and other “alternative” assets. OPEN AN ACCOUNT FOR FREE*! Go to www.IRAServices.com and open your account using our secure online application system. *To be eligible for the account setup fee waiver, enter Registration Code REA17 when prompted during the online application process. Take control of your retirement with a Self-Directed IRA Custodian that provides you with over 30 years of experience, superior customer service, competitive fees and an opportunity for better returns. IRA Services Trust Company Realty411Guide.com · PO Box 7080, San Carlos, CA 94070 PAGE 61 • 2014 · 1-800-248-8447 · www.IRAServices.com reWEALTHmag.com

- 15. two notices of default have occurred. One of MOR Financial’s core principals centers on the belief of education and the conventional techniques of equity partnership arrangement, mainly structured for borrowers who are just starting out. “You can literally walk into a deal with no cash out of your pocket,” said Morsi. “We’ll provide the investors willing to bring capital to close and supply the rehab funds. All you need to have is a great asset and an ability to manage a property. The financing side we’ll take care of.” The program has allowed many of MOR Financial’s clients to evolve. With their eminent skill and market presence, they’ve won over the masses. Clients effortlessly transform from wholesaling a deal to doing their first flip. MOR Financial is giving beginners an opportunity that cannot be captured elsewhere. The MOR Financial Team The Future of Private Money, pg. 53 For information about MOR Financial and their upcoming MORSYENRGY event in February, visit wwwMORFinancial.com tioned Mehra. Since MOR has considerable professional relationships with their borrowers, it brings perhaps an unexpected benefit: fewer defaults. Mehra and Morsi both feel strongly on not being viewed as a corporation, but as a part of a business network working conjunctively to meet each other’s needs. Out of 360 plus transactions that they’ve written, only Realty411Guide.com PAGE 62 • 2014 reWEALTHmag.com

- 16. Don’t Miss The Premier DALLAS-FORT WORTH Real Estate Expo in the th JANUARY 25th Nation this 2014! -26 AMERICA’S PREMIER REAL ESTATE EXPO 4 OPPORTUNITY 4 NETWORKING 4 EDUCATION 4 DEALS THE REI EXPO has quickly grown to become America’s new premier real estate networking and educational gathering. With THE success and has quickly grown to become America’s new premier real from coast to coast. incredible REI Expoan over-whelming demand for more, the REI Expo has now gone national,estate network- We closed out the year in Anaheim with record numbers of investors and look to build upon that demand for ing and educational gathering. With incredible success and over-whelming success in 2014. On January 25th & REI 2014 we are making ournational, to the Dallas-Fort Worth Metroplex for our 4th Annual REI Expo. more, the 26th, Expo is now gone way back from coast to coast. We closed out the year in Join over 1,000 investors from around the nation to hear from industry experts and leaders. Choose from over 50 classes, then Anaheim with record numbers of investors and look to build upon the success in 2014. network and build your business in the largest Real Estate Investor tradeshow in the nation. THESE SPONSORS & MORE WILL BE AT THE EXPO: Color B2R Finance “It was great. Not a lot of hard sales; with the books & stuff like that. We are fairly seasoned investors & got a lot of ideas we will put them into use.” – Emily America’s Buy to Rent Lender “The event was awesome. Well planned. The speakers Black & White were well informed, very educational. I highly advise people to come next year.” B2R FinancePatty L. – America’s Buy to Rent Lender th Chicago - July 26th Color B2R Finance “There was a lot of great people here, Black & White it’s a fantastic opportunity to network, meet investors, find deals, a myriad of vendors...& just awesome resources.” B2R Finance – Shane E. Baltimore - April 26th & 27th & 27th • LA/Anaheim - November 1st & 2nd Dallas-Fort Worth January •25-26 at the Gaylord Texan Resort & Convention Center B2R B2R WWW .REIEXPO.COM White on Dark Background White on Dark Background Finance Finance America’s