Discover strategies for real estate wealth and passive income

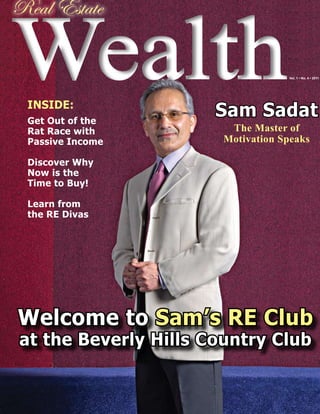

- 1. Wealth Real Estate Vol. 1 • No. 4 • 2011 INSIDE: Get Out of the Sam Sadat Rat Race with The Master of Passive Income Motivation Speaks Discover Why Now is the Time to Buy! Learn from the RE Divas Welcome to Sam’s RE Club at the Beverly Hills Country Club

- 3. Realty411 Wealth Real Estate FOUNDER ADVERTISING Linda Pliagas Kelly Global Marketing info@realty411guide.com 310.439.1145 EDITORIAL STAFF EVENTS & EXPOS Lori Peebles Lawrence Ruano Anita Cooper CALIFORNIA DISTRIBUTION Andre Sanchez Professional Distribution Solutions Brianna Bertrand 1.877.418.6500 COPY EDITOR NATIONAL DISTRIBUTION Anita Cooper KJ Banks: 805.377.6328 Andre Sanchez PUBLISHED BY PHOTOGRAPHERS Manifest Media Partners Sam Green John DeCindis SUBSCRIPTIONS/INFO: COLUMNISTS 310.499.9545 Sam Sadat Realty411Guide.com Dave Lindahl reWEALTHmag.com Charles Salisbury info@realty411guide.com PRODUCTION realty411guide@msn.com Emma Krull Join Our VIP Social Network: Augusto Meneses http://realty411guide.ning.com To Educate, Motivate & Inspire Real Estate Investors Realty411/Real Estate Wealth is published in Santa Barbara County by Manifest Media Partners (550 Pine St., Solvang, CA 93463). ©Copyright 2007-2011. All Rights Reserved. Reproduction without permission is strictly prohibited. The opinions expressed by writers and columnists are not endorsed by the publishers and/or editorial staff. Before investing in real estate, seek the advisement of a trusted financial adviser, attorney or tax consultant. Real estate investing is risky & may result in loss of capital. Please invest responsibly. PRINTED IN THE USA. GOD BLESS AMERICA Connect to our virtual network ~ online 24/7/365 Realty411Guide.com PAGE 3 • 2011 reWEALTHmag.com

- 4. Chris & Ruth Property Flipping Experts Share their Secrets on how to rehab and flip properties for Big Profits in this great Foreclosure Market in the Southern California Area. BEFORE AFTER Upcoming Property Tour Event Check our website for Calendar of Events in Southern California Only. www.CaliforniaHomesRepos.com/blog Free! Receive Chris & Ruth’s “Property Analyzer” and guide to “How To Start Your Flipping Business” 562-304-7787 or log on to: CaliforniaHomesRepos.com/blog/realty411 www.CaliforniaHomesRepos.com

- 5. contents 8 and 22 Top secrets from master investor and educator Dave Lindahl. 10 An interview with Sam Sadat, the director of Sam’s Real Estate Club. 15 Invest with the best, invest with MemphisInvest.com. 19 Entrepreneur and investor Kent Clothier takes the road less traveled and succeeds. 20 Black Belt Investors teaches us how to master the art of the flip. 24 True Wholesale Houses delivers steady returns for investors in a volatile industry. 27 Market spotlight: Kevin and Alex are at the forefront of multiple top South Eastern markets. 28 Americans Flip to Australians in AZ. 29 Tyrone Jackson wants to diversify your real estate portfolio with stocks. 30 Christian and Ruth teach Southern Californians their property rehab secrets. ���������������������� ���������������������� 33 Richard Barrett asks: What is ������������������ ���� ������� ������� ������ ��� ����� �������� your real estate time? ������������������������������ ������������� ����������� ���� �� ������������������������������������������������ ���������� ����� ����� ������� ������������������������������ ����� ��� ����� �������� ����� ������ ���� ���� ��� 34 In memory: Fred Tingley’s ������� ������ ������ ������� ���������������������������������� ��������������������������������������������� last real estate column for fans. ������� �������� ����� ������� �������������������������������� ������ ������ �������� ����� ����������������������������� ����������������������������������������������������� ������������������������������������������������� 35 Market spotlight: Phoenix, Ariz. ��������������������������������� ��������������������������������� ������������������������������� ��� ����� ��� ���� ���� ��� ���������� ����� ���� �������� ���� ���� �������� ��� ��������������������������������������������������� 36 Top 20 excuses for failure. ���� ������� ������������ ������������������������������ N ATIONAL R E EAL STATE ���������������������������������������������������� ���������������� �������������� 38 Gary and George’s monopoly����������������� secret. ������������� I NSURANCE G ROUP , LLC �������������������������������������������������� ������������������� ���������������� ���������������������������������������������������� 39 to 53 Meet the hip real �������� ��� ���� ��� �� ���� ��� ���� ���������������������������������������������������� ����������� ����� ����� ���� ������ estate divas of today: ������������������� �������������������� ������������������ Ladies in the industry give ������ ���������� ������� ���������� ��� ���� ��� �� ���������� their advice and tips. ��������� �������� ���������������� ���������������������� ����� �������� ��� �������������� 54 Maximize your legal protection. ������������������ ��������������� �������� ��� ���� �������������������� ���������������� ��������������������� 57 Inside the cashflow board games. ����� ��������� ������ ������ ���� ���� ��� ���� ������� ������������������ 58 Tom Wilson gives his insight �������������������������������� ����������� on the market recovery. ��������������������������������� ������������������������������ 61 Guild Mortgage clarifies misconceptions about financing. ���� ����� ����� ��� ��������������������������������� ������������������������������� ��� �������� ���������� ����� ������� ��� ������������ ���������������������������� ��������������������� ����� ������� � Questions? Need a Referral? ������������������������������ ������������������������������� ����� ������ � �������������������� ������������������������������ 805.693.1497 or 310.499.9545 �������������������������������� ����� ��������� �������� �� ���� ���������������������������������� �������������������������������� ������������� ������ ���� ���� ������� ��� ����� ���� ��� ����������� ��������� ���������������������������������� ������������������������������������� Photo credits top right and clockwise: Sam Sadat, Kent Clothier, ��������������������� ���� ������� ����� ��� ������ ������������������������������ Kathy Fettke, Terica Kindred, Tyrone Jackson and Jay Hinrichs �������������������� ������ ������ ���� ����� ���� ��������� ������ ���� ����� Realty411Guide.com PAGE 5 • 2011 �������������������������������� �������������������������������� ������������������ reWEALTHmag.com ����������������������������� �������������������������� ������ ���� ��� ���� ������� ��� ������ ���� ���� ������� ����������������������������� �������������������

- 6. Actual House Sold CREATIVE REAL /ESTATE INVESTMENTS Zero Money No Money Down All Properties are á Memphis á Jackson Located Out of The á Atlanta á Indianapolis State of California á St Louis á Kansas city We offer real estate investment in Birmingham, Detroit, Atlanta, St. Louis, Minneapolis, and Kansas City. These are real estate investment markets where our creative real estate program produces you positive monthly cash flow. Benefits & Features: • No money down – participate using your good credit alone to purchase a real estate investment • You do nothing - every step of the investment process is handled for you • Best real estate buying prices - you buy property at steep discounts, real estate deals • Hassle free investing - you never have to deal with tenant issues, yet gain the benefits of a cash flowing investment property • Cash Free Investing - the company even pays your mortgage for any vacant month for the first half year • High return - You keep 100% of the final resale net profits and the monthly rental net profits • Huge opportunities - quick resales for up to 10 investment properties per year All of the rent and end sales profits are yours, without any direct involvement in your investment property. This is no fuss real estate investment that works best for you. www.zeromoneyinvestment.com

- 7. YOUR INVESTMENT IS PROTECTED WE UNDERSTAND THAT EACH REAL ESTATE INVESTOR HAS THEIR OWN Great Properties For You To Invest In GOALS AND TARGETS FOR RETURNS What risks do investors take by working with Zero Money Investments ON THEIR INVESTMENTS. and how does Zero Money Investments mitigate those risks? We have tailored our programs for your RISK SOLUTION goals. Our innovative programs have been put to the test and can be put to Depreciation All properties have at least 20% equity to protect against market fluctuations. work for you. Discover which program is best for you. Down Zero Money Down up cash and can allow you to Payment purchase multiple investment properties. Stress We connect you with pre-qualified property management companies in the area your investment property is located in. Vacancy We offer a 6 month mortgage guarantee. Repairs Before you close we will rehab the investment property for you. This will minimize your need for immediate repairs. Negative All of our investment properties are positive real Cash Flow estate cash flow with a tenant immediately provided. Beyond Real Estate, A Bigger Vision of Helping 866-488-1820

- 8. If Single Family Homes Are Such Great Investments, Why Do Most ‘Investors’ Still Go To Work Every Morning? W by Dave Lindahl ouldn’t you love to discover how to make $9,700 plus in passive income month after off, or can’t work for awhile, month… and how to reap huge positive you have no income. That’s not cash flows from real estate — with less financial freedom. risk, less money down, and no tenant headaches? 4) The government takes I’ll tell you what, if you want to collect 33%-50% of your profits! an automatic monthly income of $9,700 When you hold houses for less or more — without having to get up ev- than a year, your profits are ery morning and “go to work” — then taxed at the painfully high rate you need to know that most real estate of “ordinary income”. Com- experts are giving you the wrong ad- pared to my approach, you have vice! far less cash to roll into the next See, they rave about buying and selling property. The result: It could single family homes, but they don’t tell take you twice as long to attain When you’re flipping houses, you’ve got to keep working to earn your next “paycheck”. you about the risks and downsides. They 1) You’re at the mercy of contrac- financial independence. don’t admit that single family homes are tors. Most bargain homes are in disre- If you’ve read the best-selling book poor investments for passive income... pair. You’ve got to renovate them, but Rich Dad Poor Dad, you understand that for attaining real financial freedom. most contractors are unreliable. You’ve income-producing assets are the key to Now don’t get me wrong, if you can got to oversee everything they do, or risk financial freedom. You also know that wait a few years for your upside, single paying for their mistakes. And the good Robert Kiyosaki (the book’s author) built family homes have a history of appreci- ones are always booked up for months in his personal fortune through buying and ating nicely. And if you’re happy making advance. holding real estate. one-shot profits, flipping houses can be Unfortunately, Kiyosaki doesn’t go an exciting business. Over the past eight 2) You lose money for four to six into detail about how he selected, man- years, I myself have bought, rehabbed, months. That’s how long it takes to fix aged, or sold his properties. That’s why and/or sold 422 houses. If you can pull up a house and resell it. When your con- I’m writing, “The Real Secret…Apart- it off (despite the risks), you can make tractors drag their feet, you’re left help- ment Buildings And How To Manage a big profit in four to six months. It can less and stressed out. Every day your 642 Units With One Phone Call Each be a good business model. But it’s not house sits vacant, your bank account is Month!” financial freedom. further depleted by loan payments, taxes, Today, I own 33 multi-family apart- When you’re flipping houses, you’ve insurance, and utilities. ment complexes, with 7,322 units in all. got to keep working to earn your next Yet, I never deal with a single tenant, “paycheck”. You’ve got to keep market- 3) Your job never ends. When you their complaints, any repairs, or vacan- ing, buying, renovating, and selling. finally sell, you’ve got to start all over cies. again, marketing, negotiating, and over- My carefully chosen property manag- This is the life of a “house flipper”; seeing your contractors. If you take time ers handle 100% of the tenant manage- Realty411Guide.com PAGE 8 • 2011 reWEALTHmag.com

- 9. ment. I have one phone call per month from bonds, CDs, or mutual funds, infla- Fortunately for you, I have created with each of them; that’s it. tion devalues your principal. But when a very successful but limited mentor- Last year, I sold four of my proper- your buildings appreciate and your ten- ship program. Its aim is to take you by ties. After paying off my loan balances, ants pay off your loans, you create huge the hand and share with you the proven I received four separate checks for over equities, and eventually own them free tools you need to be successful in invest- $200,000 apiece. And I used a legal and clear. ing. But with everything in life there is tax loophole to pay zero taxes on three of course a catch. And the catch is that of them. I can show you how to do the 4) Hands off management. Because I can’t work with everyone. There isn’t same. Why haven’t you heard more apartment houses offer so much income, enough time in the day. But my strate- about apartment buildings? Because apart- ment inves- tors don’t want the general public to know about their successes. Apart- ment inves- tors are already wealthy. Just look at the late Red Auerbach of the Boston Celtics. He made his real mon- ey buying apart- ment buildings, then branching off into hotels. Like- wise, Arnold Schwarzenegger made his first for- tune buying apart- ment houses in Colorado. Here Are The Big- gest Advantages That I See In Apart- property managers charge an average of gists and I can work with a select group ment Investing: just 4% of the gross rents (versus 10% of people. for single family homes). There is no better time than right now 1) Apartment buildings are “cash to find out if you qualify for the mentor- cows”, especially when compared to sin- 5) Cut your taxes in half. Instead of ing program. gle family homes. For example there is a paying 33% - 50% in taxes, you’ll pay To take my brief questionnaire to de- six unit building I own in Brockton, MA, the low capital gains rate (now 15%). termine if apartment investing is right for that nets me $1,877 per month (after all you, and to see if you qualify to become expenses)! Think about it, more units in Seventeen years ago, I was fortunate one of the lucky few people I will men- each property brings you more income. to have a mentor that showed me the tor, visit Rementor.com/Realty411, do truth about apartment investing and he it now. 2) You start profiting instantly. Rather was there to take my hand and get me My mentor made me promise that than being drained for 4 to 6 months, started! when I became successful, I would pass carrying the costs of a vacant house, you Now whether you have ever invest- on my knowledge. I hope you are one of enjoy positive cash flows from day one. ed in real estate before or if this is just the few people I take under my wing to And you can live off that income, so you something that you have always thought share these powerful techniques. don’t have to go to a job everyday! about doing, I would love to take your hand and share with you the exact strate- See How One Mom Makes $7,487/Month 3) Build huge equity and live off the gies and processes that have made me a Part-Time at: cash flow. If you live off the income multi-millionaire. www.Rementor.com/Realty411 Realty411Guide.com PAGE 9 • 2011 reWEALTHmag.com

- 10. Mr. Motivator The founder of Sam’s Real Estate Club in Beverly Hills discusses his start in real estate and explains why his message of abundance is so urgently needed into today’s volatile market. article by Linda Pliagas photography by John DeCindis the nation and eventually made his home base in Santa Monica, Calif. Sam’s passion, other than putting togeth- er real estate transactions, is the study of metaphysics and spirituality. It is this reap- and-ye-shall-sow philosophy, which also permeates at his club, that has attracted many loyal monthly followers to converge at the Beverly Hills Country Club. “I try to shift people’s mindset from scar- city and lack to that of abundance,” reveals the daily meditator. “Most people think that motivation comes from the outside, but that is an illusion. The fact is, motivation comes from within.” Sadat began his quest for real estate knowledge shortly upon graduating from T The University of Texas at Austin, with a degree in mechanical engineering. He re- calls: “At the time, I was working for cor- he Westside of Los which encourages individuals to take action porate America. I took a hard look at my Angeles is hustling for a life of fulfillment. bosses, who had already been working with investor activity. With over 2,000 members throughout there for 20 to 30 years, and I knew there Within a five-mile ra- Southern California, Sadat attracts visitors had to be a better way.” dius there are no less from up to two hours away. His club also In his quest for real estate, he first became than seven real estate hosts some of the nation’s most sought-after attracted to real estate finance because he clubs, serving thou- speakers, such as Than Merrill, Scott Mey- realized that “knowing the numbers,” was sands of investors. But ers, Richard Roop and Reggie Brooks. vital. Part of Sadat’s real estate education one organization goes way beyond simply Sam’s Real Estate Club founder is Sam led him to start attending real estate clubs. being a club that talks about real estate. It Sadat, a spirited U.S. immigrant of Persian He fondly recalls attending investment is more of a self-help investor organization, descent who has lived in numerous parts of gatherings in different parts of the country, Realty411Guide.com PAGE 10 • 2011 reWEALTHmag.com

- 11. including Colorado. By the time Sadat be- “Fear.” He adds: “That is really the funda- creative transaction, later he found out the gan to live in Los Angeles, he was already mental reason why people don’t act, it’s be- seller was attempting to sell the same prop- experiencing phenomenal success in real cause of fear. The fear of the unknown and erties again! estate finance, including traditional mort- fear of failure are really two of the most “It was a learning experience for me and gage and hard money lending. He was also incredible fears that we have.” for others of what not to do, not having buying, rehabbing and flipping properties While Sadat is thankful for the success gone though a traditional escrow caused as a sole investor and also with partners. he has found in real estate, it hasn’t al- me a lot of aggravation and money because It is then that he says he felt a longing ways been smooth sailing. “I lost millions I ended up having to take legal action.” to create his own space. “I wanted to have because of the Northridge earthquake in During emotionally and finan- a forum for me. I wanted to make sure I 1994,” he confides. (Most Californians do cially devastating times, Sadat turns in- could inspire people.” ward for strength and relies He carved out a space in on words of wisdom from Van Nuys and began to host monthly meetings in The Scoop on Sam’s Real Estate Club the individuals he admires most: Carl Yung, Wayne May 2003. The number Join Sam Sadat the 4th Wednesday of every Dyer, Ralph Waldo Em- of guests soon swelled month at the beautiful Beverly Hills Country erson and Rumi, a Persian into hundreds of people. poet. Sadat prides himself in Club. Meetings start at 7:30 p.m. and usually Successful attributes in having a club where edu- last about 2 1/2 hours. Reserve your seat online life, like in real estate, need cation, not promotion, is for $10 per person, which includes valet parking. to be developed. “I’ve heard the focus. my shares of ‘no’. I’ve had His goal is to transform Please register for the club meeting online at: to work on myself. It’s a life each one of his members www.SamsREClub.com mission.” from being a potential in- For Sadat that calling vestor into an active one. is not merely a personal, “My main focus has become teaching not carry earthquake coverage due to its internal goal, as much as it is an evolving and mentoring my students because often lack of affordability.) Another tough lesson and fully dimensional manifestation. It is you have to hold their hand and literally he learned was that no matter what type of an avocation that he says he hopes will el- push them to act upon their knowledge.” transaction a real estate investor does, they evate all those he reaches. When asked why so many people sit on need to hire an independent escrow com- the sidelines when it comes to taking ad- pany to make sure the contract is followed Be sure to visit Sam’s Real Estate Club on- vantage of the greatest buyer’s market of accordingly. Sadat learned the importance line for a schedule of speakers: all-time, he replies with one simple word: of this when he purchased three homes in a www.SamsREClub.com “Most people think that motivation comes from the outside, but that is an illusion. The fact is, motivation comes from within.” Realty411Guide.com PAGE 11 • 2011 reWEALTHmag.com

- 12. This is Your Chance to Learn to Be the Bank! Private lending can generate mas- sive cash flow with all these benefits, along with the security to allow you to enjoy the life you’ve always dreamt of. h MEET OUR ed What is private lending? TEAM A private lender is somebody (who is not necessarily licensed) that under- - GARY BOMERSHINE stands the secrets of private lending, Gary’s strong domain ex- and how to use OPM (Other People’s pertise in creative real estate Money) to make a ‘spread.’ de transactions, sales & mar- Gary Boomershine Private lenders borrow money at a de Gary’s strong him a unique in keting, give domain expertise lower rate and lend it out at a higher ability to work with entre- creative real estate to grow preneurs looking transactions, rate, making a nice profit or spread, ide sales & marketing, give him a unique their business. just like the bank! ability to work with entrepreneurs looking to grow their business. day Success in life comes with having GEORGE ANTONE Over the past five years, Mr. the knowledge to make the right George Antone his Antone has established decisions. WealthClasses offers reputation as an expert in Over the past five years, George has fields of private money as an the established his reputation you that knowledge. Let us help lending and trust deed expert in the fields ofbecomemoney investing, and has private a lending and trust deed investing and you build the wealth and the life national speaker and teacher hasthe subjects. on become a national sepaker and you’ve always wanted! teacher on the subjects. il- gh Banks borrow money at a lower rate and lend it out at a higher rate. CONTACT US TO LEARN MORE: Wealth Classes, LLC. ‘spread’ game. Banks make money, and so as private They’re playing the r- 1255 Treat Blvd ys lenders we learn to be the BANK, for the same amazing benefits! Suite 230 Walnut Creek, CA 94597

- 13. Experienced investors know you need CASHFLOW first This Special SECRET Report Reveals: Investors, Just Imagine This... * Massive Cashflow Without Tenants! * Massive Cashflow Without Using Your Money! * Massive Cashflow Without Owning Properties! * Massive Cashflow Without Having Good Credit! * Massive Cashflow Without Qualifying For Mortgages! Imagine – appreciation without tenants, without qualifying for mortgages, without having good credit or using your own money – or even without owning any properties! It’s Your Turn to Beat the Bank! WealthClasses will help you build wealth and the life you always dreamed of; by helping you find the path that works for you to get you there. You’ll discover how to get started, make money, save money increase cash flows and most importantly Build Wealth! Get Your FREE Report by Visiting: www.WealthClasses.com/Realty411 or Calling 1-888-888-3612 ext. 1

- 15. Invest with the Best The Market Leader is MemphisInvest.com Photograph from left to right: Chris Clothier, Brett Clothier, Kent Clothier Jr. and Kent Clothier Sr. “If you commit to getting better every day, your customers will demand you get bigger.” T — S. Truett Cathy, founder of Chick-Fil-A. his sage advice, as well you plan to invest out of state, you need an out of state investor. as nuggets of gold from to find the right company to partner with Chris continues, “You are looking for other customer focused gu- — someone that has experience, that has someone with all the business acumen to rus, has been adopted into knowledge not only of the industry but of put together all the steps that make sense.” MemphisInvest.com’s own the market, and someone that is a true turn- The Clothier family established Mem- company goals and aspira- key provider.” phisInvest.com and her sister companies, tions; namely to be the absolute best turn- While there are many companies who Memphis Invest Renovation Services and key investment company possible. call themselves “turn-key” (so much so that Premier Property Management on the firm Many investors try their hand at out-of- he feels it has become an overused phrase), belief that out of state investors need ac- state investing only to become frustrated Chris believes that investors searching for cess to proven, qualified professionals who with the less than stellar returns they expe- a turn-key company to partner with should understand their needs. MemphisInvest. rience when dealing with companies who look for organizations who “own and op- com partners with investors by handling all claim to be “turn-key” investment compa- erate every step of the equation.” This of the details — from purchasing invest- nies that simply provide contacts, leaving way, investors are not getting a company ment properties to ongoing maintenance customer service out of the equation. that says: “buy from me and I will give and property management, helping to al- Chris Clothier of MemphisInvest.com you contacts for renovation, or contacts leviate the stress that often accompanies offers his advice for individuals who are for property management or contacts for buying properties far from home. interested in finding a true turn-key com- insurance.” Chris says this is a recipe for MemphisInvest.com makes investing pany for their out of state investments. “If disaster and it is a lot of hands-on work for Continued on pg. 17 Realty411Guide.com PAGE 15 • 2011 reWEALTHmag.com

- 17. simple for out-of-state investors. “You make one phone call,” states Chris, “and you’ve got every department, any answer — access to every single person in this company, so [the process is] very stream- lined.” Chris believes that successful investors possess some common traits — “they have to be inquisitive, they have to have curios- ity. They shouldn’t ever take everything at face value. They should be inquisitive as to who they’re dealing with, and what mar- kets that they’re looking to buy in. They should be willing and able to do some homework, look around, and ask the right questions. They should also have a long- term mentality. This is not get rich quick by any means. The other thing that inves- tors need to be successful in long-term buy and hold is they need access to capital. No Top: An out of state real estate investor celebrates purchasing two investment properties. money down is not an avenue to success. You have to have access to some capital and be able to build a long-term portfolio whether you use straight cash or some kind of leverage.” MemphisInvest.com, possessing a strong customer service focus and attitude, makes sure that an investor knows, from the start, if this opportunity is right for them. “I don’t want to waste an investor’s time or raise their hopes,” says Chris. “We are very up front and very frank when we have our discussions. We need to know the financial strength and ability of an investor so we can help make sure they’re successful.” Investors who partner with their compa- ny will realize that “they have found a great opportunity in Memphis, they’ve identified one of the premier turn-key investment Top photo: Customer Service Team at MemphisInvest.com Carol Henderson, Cyndy companies in Memphis, and they’ve com- McCrary, Ashley Claunch; Bottom photo: Brett Clothier gets ready to speak to a room full of real estate investors at a buyer tour in Memphis, Tenn. municated real clearly exactly what they want — from there they just let us do it, and then they buy the opportunities that we bring to them,” says Chris. He continues: “This is about buying cash flow investment property, if an investor tells us that they need to earn a certain amount of cash flow to pay their bills each month, we are very adamant that they need to look at other financial opportunities, other finan- cial advice before buying real estate.” For the Clothiers, “There is no sale worth making that’s gonna hurt somebody, just for us to make a little bit of money,” states Chris. Why would an investor choose to partner Continued on next page Continued on pg. 31 Realty411Guide.com PAGE 17 • 2011 reWEALTHmag.com

- 18. with MemphisInvest.com? “As a company, we hold in very high regard the customer service that we pro- vide,” says Chris, “we have three dedicated employees that provide customer service, including calling every one of our clients every month on behalf of our property management company and on behalf of the Clothiers, as the owners — and they ask the simple question: “What can we do for you?” Chris shares the reason for MemphisIn- vest.com’s amazing growth. “About a year ago we started to take time every single week to stop everything, and come togeth- er and study how to get better at customer service, and at business as a whole.” The investment in customer service has paid off — in spades. Top photo: Premier Property Management of Memphis is the In the first half of key to their investors’ success! Left photo: Mark Anderson, a 2011, MemphisInvest. portfolio advisor at MemphisInvest.com meets with a couple com became the larg- from California who purchased three rental properties. est private home seller in west Tennessee. The only companies who sell more homes than MemphisInvest.com Memphis Invest are Fannie Mae and the De- Rental Opportunity partment of Housing and Urban Development. “To date,” said Chris, “we closed 163 transactions so far in 2011. Last year at this time, we had closed 79 transactions.” The integrity and distinction that MemphisInvest.com brings to the turn-key investment industry is seen clearly by their actions: MemphisInvest.com doesn’t recommend properties that they wouldn’t buy themselves. In fact, their investors buy and own in the same neighborhoods that the Clothier family buys and owns in. Traveling to many areas, such as New York, Chicago, Boston, and all major California cities, MemphisInvest.com takes time to visit their clients face to face. Why? “We’re willing to do whatever it takes to provide the best service possible and to show our clients that we’re there for them,” Chris replies. Here is one sample property, this home is already — Interview by Anita Cooper sold, but other great rentals are still available. Be sure to add one to your portfolio. 3 Bed/2 Bath with 2 car garage MemphisInvest.com invites readers to join Built in 2000 - Sq. Footage - 1,601 them at their events in the following cities: Purchased for $69,000 OR $37.41 PER SQUARE FOOT •September 8th-11th - New Orleans $10,000 in full renovation work completed •October 1st - Boston Tax assessed value in 2010 of $104,000 •October 18th - Phoenix Gross yearly rents between: •October 29th - NY $9,900 and $10,740 •November 12th - Vancouver Assuming 30% of rents for yearly expenses and •December 1st - San Jose the property has a cash-on-cash ROI •December 3rd - San Diego of approximately 10% Realty411Guide.com PAGE 18 • 2011 reWEALTHmag.com

- 19. Kent Clothier Chooses to Follow the Road Less Traveled by Anita Cooper well as always doing what’s O necessary, even the “dirty ne conversation with Kent work” that nobody else Clothier will open your eyes to wants to do, has been the a fatal flaw found in many real key to Kent’s success. estate programs: Most of the “If you’re willing to do gurus who pitch the products don’t actu- what others are not, then you ally utilize them. Well, here is some inside will find that success will scoop: Kent Clothier (and his entire fam- usually follow,” said Kent. ily and team) actually use the systems Kent Kent believes that his suc- promotes. As owner of 1-800-SELLNow, cess, and that of his family, “If you’re willing to do what others are not, then you will find that success will usually follow...” the systems Find Cash Buyers Now and the Clothiers, “...lies in the Find Private Lenders Now, and as co-owner fact that we’re willing to do of MemphisInvest.com, Kent Clothier uses something that others aren’t. the same knowledge that he shares with his We are always willing to clients, many have already seen great suc- send someone down to the cess in their own right. county clerk’s office to sift Kent Clothier “The industry is filled with people through property records to find cash buy- who want to tell you how to do it,” notes ers, people that are in our back yard, that we and access to fantastic products, investors Kent, “but they’re not doing it themselves. get to know, and by doing that we’ve built a learn how to “run their business like a busi- There’s a lot of people who want you to buy very successful business, not a hobby.” ness.” this program, or buy that program, [but] When Kent and his family shared the “In our real estate education classes, we the actuality is, very few of them are doing methods they utilized in growing their only spend 20 percent of our time teaching deals. Not only do we educate people, but business with others in the real estate in- people on real estate, and we spend prob- we’re also buying and selling three to four vestment industry, they were surprised at ably 80 percent of our time educating them hundred houses per year.” the reactions they encountered. Individuals on how to be an entrepreneur, or how to Kent got his start in real estate after a were amazed that the Clothiers could find actually get in the game the right way,” successful career in the wholesaling busi- cash buyers, and build a brand for their in- said Kent. ness with a multi-billion dollar company in vestment business. Rather than wait for the elusive (read: the grocery industry. After leaving the gro- Kent’s businesses were “born out of our “non existent”) “perfect” time to invest, cery business, he was, like many individu- own investing interest. We realized that Kent advises his clients to realize that als, “sucked into” the real estate industry what we were doing was so unique, that we “there will never be a better time, [your] by those infamous late nite infomercials, needed to share it with other people.” inaction is costing [you] the opportunity of however unlike so many who try their hand Investors who purchase their systems are a lifetime!” at real estate investing and fail, he put ev- provided with access to a wealth of infor- “There’s never going to be another op- erything into his businesses and has grown mation on real estate investing, including portunity like this,” said Kent, “and yes, it’s three successful ventures in addition to webinars, access to online cash buyers, supposed to be scary, it’s supposed to be a working with his family’s business, Mem- continuous customer support and access to little unnerving, but it’s also what makes phisInvest.com, a truly wholesale invest- private lenders; virtually everything a seri- it exhilarating, it also makes it very excit- ment company. ous individual needs to grow their invest- ing, it also makes it so rewarding when you A focus on creating a relationship with ment business. finally get there, when you finally achieve their clients and meeting their needs, as More than just great customer service the level of success you desire. ” Realty411Guide.com PAGE 19 • 2011 reWEALTHmag.com

- 20. Disciplined Investing Mastering the Art of the Flip by Anita Cooper Mastering the art of wealth creation takes a transaction — you’re flipping real estate time, it takes dedication, and most impor- without the risk. get past that obstacle, whether you have to tantly, it takes direction - guidance from Black Belt Investors is unlike many oth- go around it, over it, through it or under a wise investor who has himself mastered er real estate consulting, educa- it. If you can learn that from your coach, his own destiny through smart investment tion and investment firms. you will find yourself in a profitable posi- strategies. “I truly believe that if you tion. I know with a few of my realty-based Sensei Gilliland, founder and presi- want to become a real es- techniques, you will be able to pass any dent of Black Belt Investors, has trained tate entrepreneur and cre- obstacle and get paid.” hundreds of investors to grow their ate your real estate cash “One thing about Black Belt Investors,” wealth through his “action oriented and machine,” shared Sensei, shared Sensei, “is that one of our primary results focused” training programs. Uti- “you need proper training goals is keeping our investors engaged all lizing discipline gained through years of by an experienced instruc- the time. We’re not a fly by night company martial arts training, Sensei has created tor that practices what that trains students for 3 days and leaves a program designed for all levels he teaches. You them to do the work on their own. We’re a of investors who need guid- also need company that reaches out to help the stu- ance and direction and the instruc- dent to get to the next level. We accom- who desire to create a tor to take plish this through my coaching program real estate business you from which is directly with me and not through that is cash flowing classroom a call-in center that answers questions tens of thousands instruc- from a script. We also keep investors en- of dollars every tion to gaged through multiple free webinars, month. applying workshops, on-site mentoring and my Every experi- the tech- free monthly real estate club meetings in enced, or “black niques in the Southern California, which keeps me ac- belt” investor, was trenches to help countable as I must show my face there once a “white belt” you develop every single month. If I was over promis- (beginner). He did not your newly ing and under delivering, then I would be attain to his advanced posi- acquired skills exposed at that club meeting. Our inves- tion overnight; his knowl- and put you on tors keep coming back because they’re en- edge increased as he put the fast track gaged, and when they’re engaged they be- Deals are not going to fall in your lap, deals are created. his training into practice. He also did not to getting paid. There’s a lot of real estate come more successful. The only way not train on his own, rather he had a teacher trainers and gurus out there that just pro- to be successful after one of my trainings that led the way. mote fluff and stuff. They glamorize real is if you were to unplug yourself.” It’s vital that you find a successful men- estate to be extremely easy and profitable You will learn by doing. “If I were to tor, someone who is interested in helping all the time, and yes, real estate can be ex- train you to wholesale properties, we you achieve your business goals. If you’re tremely profitable, but the reality is, you’re would develop a battle plan, grab your looking for immediate cash, wholesaling going to have to do some work. Deals are hand to lead you onto the field, and start is the best place to begin. Black Belt In- not going to fall in your lap, deals are cre- doing the business. There is nothing bet- vestors will train and coach you on how ated. Just know that you will have some ter than hands-on training,” shared Sen- to control properties and create immediate deals that are extremely easy that will put sei. “Think about it, if you were to learn cash without the use of cash, without the cash in your pocket quickly and with oth- how to kickbox, and I had a kickboxer that use of credit, and without the use of loans. ers you’re going to run into obstacles - it’s Basically, you become the middle man of up to you as an investor to learn how to Continued on pg. 56 Realty411Guide.com PAGE 20 • 2011 reWEALTHmag.com

- 21. A Way to Effortlessly Flip or Rent Cash Generating Properties in the Hottest Markets Across the Nation We call it Remote Rehabs! Almost everything has been done for you, we have: • Strategically Targeted Markets to Buy cheap, Fix Easily and Sell Quickly • Generated a Revolving Inventory of Deeply Discounted Properties starting at $20K • Taken Away the Headaches of Deal Searching, Pencil Pushing, Rehabbing and Sales • A Success Manager to Keep you Abreast and Coach You Throughout Your Deal • Basically Put Time Back on Your Side to Rehab Houses without Lifting a Hammer • “Gain Complete Control Over Your Life and Spend Less Time on Doing Things You Hate Doing By Using Remote Rehabs, a 100% Hands-Off Fix and Flip System.” “Exceeded Expectations” “Wow! Just wow! I don’t even know where to start with all the things that Remote Rehabs has done for me. Know that list of benefits that Black Belt Investors offers? Well they are all completely, one hundred and fifty percent true! All I know is that Remote Rehabs is the simplest and most profitable program I have ever experienced.” - Pek Lee Choo - Chicago, IL “Simply Amazing” “Here is what I did: I enrolled in Sensei’s program Remote Rehabs, he found me a deal and his team did all the work A-Z. Soon after the rehab and listing the property, I was amazed to receive offers on my investment! At first I put it off to blind luck, but within 45 days I receive a check for over $17,000 in net profits and I’ve been smiling since.” - Lynn McCloskey - Concord, CA 27 Days! ash Flow 51 Days! Sold in E quity & C Sold in Indianapolis, IN Phoenix, AZ Indianapolis, IN Purchase Price: $43,000 Purchase Price: $45,300 Purchase Price: $36,500 Repairs & Misc.: $32,000 Repairs & Misc.: $4,200 Repairs & Misc.: $22,700 List Price: $110,000 Fair Market Value: $71,000 List Price: $99,900 Sold Price: $110,000 Equity Position: $21,500 Sold Price: $95,000 Net Profit: $25,100 Cash Flow: $725 mo / 8,700 yr. Net Profit: $27,250 Cash-on-Cash Return: 33% Capitalization Rate: 18% Cash-on-Cash Return: 38% Black Belt Investors’ Remote Rehabs program is a truly unique and phenomenal way to build cash quickly. Believe that Remote Rehabs is without rival in any shape and form. Black Belt Investors stake their reputation on the fact. By getting involved today, you will be receiving a profitable and automated hands-off rehab business with its time tested meth- ods, as well as Black Belt Investors’ 15 years of experience. Trust me... This is one chance you cannot afford to pass up; Take Action Now! Office: 951-280-1900 www.BlackBeltInvestors.com

- 22. Dave’s RE Tips Wealth Real Estate Fro m th eP ub lish ers of Re alt y4 11 Vol. 1 • No. 3 • 2011 How could a real estate “investor” flip houses for eight years, only to wind up with no assets, no cash flow, and no income? by Dave Lindahl Serving the Needs of Accredited Investors - INSIDE: Information to Grow and Maintain Your Wealth 8 TurnaaProfitable Business 10 Be a Private Lender, 18 Zero DownSecret Recipe into Real Estate Hobby Learn to make BANK! Learn Our Investments I started working in real estate with ture appreciation. After all, he always got expenses. The result: at the age of 65, his my friend, Walter. We both started $5,000 plus upfront in “option consider- net worth is only about $33,000. And that’s out rehabbing houses, but there were ation” and he always sold his houses and not the worst part... if he stops buying and two big differences between us. First, made a profit. Over a three year period, he selling, he’ll have no income to live on! I was a lot younger; I was 32, Walter was grossed an average of $109,000 per year. That’s because he has no income-produc- 58. Second, I grew my net worth and cre- Sounds pretty good, doesn’t it? ing assets. No positive cash flow. No an- ated a hands-free passive income. Walter, Unfortunately, the IRS calls him a “deal- nuity. And no equity. Now he looks back by contrast, got hooked on buying and er”. That’s because he rarely holds a house at all of those years and realizes he made selling. Why? for more than a year. So his profits are a big mistake. He was afraid of tenants, so he rarely taxed at the painfully high rate of “ordinary Most of the homes he bought in the mid- rented houses. When he did, it was always income”. For example, if he sold a house 90’s have doubled in value, but he sold on a “rent to own” basis. (He offered the for a $29,000 profit, that’ll cost him about them all before they had a chance to appre- tenant a lease option). After all, single $10,000 in taxes. ciate. He gave away hundreds of thousands family homes don’t generate much posi- After overhead costs and taxes, Walter’s of dollars in appreciation. (And the IRS tive cash flow. “take home pay” is only about $60,000 per took a third of his profits). He never bought Walter didn’t mind giving up his fu- year. And every dime pays for his living Continued on pg. 62 Realty411Guide.com PAGE 22 • 2011 reWEALTHmag.com

- 23. TrueWholesaleHouses, LLC “Equity Day 1, True Cash Flow, Peace of Mind” We are proud to offer a proven cash flow investment with substantial instant equity. The investor receives the best of both worlds a true turnkey investment backed and managed by a team of life long real estate professionals. The Genesis of True Wholesale Houses, LLC is taken from a deep understanding of cash flow real estate investing properties and what it takes for the passive investor to succeed. The investor that chooses to invest with True Wholesale Houses, LLC will enjoy a predictable monthly cash flow and instant equity. True Wholesale Houses, LLC takes the work and worry out True Wholesale Houses, LLC brings of owning a rental property, while maintaining a proven cash investors Wholesale to Wholesale deals flow to the investor. as opposed to Wholesale to Retail No more worrying about: 1. Collecting Rents. HERE ARE SOME OF OUR NEW ADDITIONS TO 2. Maintenance Emergencies. OUR SELECTIVE INVENTORY 3. Finding a Tenant. 4. No more worrying about managing property and managing your managers. 5. Property Taxes. 6. Finding the right home in the right neighborhood. 7. Insurance. True Wholesale Houses, LLC is your Equity Partner for the life-time of the transaction. Our partners on the ground have a stake in the home, the tenants, and preventing main- Atlanta, GA - $19,500 Equity DAY 1 Net Investor Cash Flow $340/Mo • Note Price $51,000 tenance problems by doing a quality re-habilitation on the property before we place a tenant. True Wholesale Houses, LLC pays monthly cash on cash 9% return for the term of the note. If the home has a vacancy, we still pay you every month. As your partner, True Wholesale Houses, LLC will manage the property and sell it when the market recovers. If you wish to keep the cash flow and the 9%, you as the investor can dictate an extension on the note, holding the home in Jackson, MS - $17,500 Equity DAY 1 the caring hands of True Wholesale Houses, LLC. Net Investor Cash Flow $262/Mo • Note Price $35,000 True Wholesale Houses, LLC is here to work with you to give you the best value for your money. We are your true whole- sale partners so we can all prosper together. For information, contact: 888 285 1900 Atlanta, GA - $20,000 Equity DAY 1 Net Investor Cash Flow $309/Mo • Note Price $53,000 Join True Wholesale Houses, LLC ! Now Website: http://www.TrueWholesalehouses.com

- 24. True Wholesale Houses Offers Investors Security & Returns T by Anita Cooper ruly unique, truly their profit up front. Our profit is amazing, truly one Rock-Bottom Prices, Secure deferred until the property sells. of a kind. True Returns & Built-In Exit Strategy And like the triple net lease, we of- Wholesale Houses fer the same thing — investors get is different from ev- their payment monthly, regardless ery other investment of whether it’s rented or not. company you’ve come across. With this program, investors Jay Hinrichs, managing owner of Step 1 never have a cash call and they True Wholesale Houses is uniquely True Wholesale Houses, don’t have to worry about any of acquires a foreclosed or qualified to provide investors with the maintenance. True Wholesale REO property top-notch investment opportuni- Houses deals with all the manage- ties that promise consistent returns. ment headaches associated with Hinrichs is both a licensed mortgage Step 2 owning and managing an asset. banker in the state of Oregon, and a Partner Company, Unlike other investment com- licensed real estate broker in Cali- Portland Funding LLC, panies, Hinrichs says that at True makes a loan at True fornia, Oregon and Mississippi. Wholesale Houses, both the prop- Wholesale Cost Hinrichs shared his reasoning be- Creating Instant Equity erty manager and the rehabber are hind True Wholesale Houses’ cre- owners of the property. “Our guys ation; “As a lender, back in 2008 on the ground are vested in the Step 3 and 2009, like every other lender at True Wholesale Houses properties. They have an ownership the time, we had foreclosure prob- does a complete Reha- interest, and they too are working lems, I looked at the model and bilitation of the property, for the equity bonus when we sell said, ‘There’s gotta be a better way creating a problem and these properties. Our ownership to protect the investors than just let- maintenance free interest in the properties, assures property ting them go off on their own.’” Step 4 investors that the assets are being Concerned about this trend, Hin- True Wholesale managed to their highest potential richs devised the current model that Houses tenants the for profit,” Hinrichs maintains. property creating True Wholesale Houses follows: His forecast of the market is ex- instant cash flow They provide professional invest- plained: “We believe we’re in the ment and property management middle of a ten year cycle, and that Step 5 experience that guarantees both in three to five years we’re going The investor buys the note the company and the investor yield from Portland Funding, to be coming out of that cycle and substantial profits from their col- gaining First Deed of Trust once we see a chance to sell our laboration. on the property, and a properties at a substantially higher “We’ve combined my years of 50% equity position. amount than what the note values lending knowledge and my years of are, that’s when we’ll start to roll buying and owning rental proper- Step 6 out of the properties, because that ties, and combined that knowledge Monthly interest is where our big profit is lying.” into a hybrid model that gives the checks are sent There is a steep learning curve conservative investor, who’s look- to the investor for individuals who are exploring ing for the utmost in protection Step 7 investing in real estate. According and equity preservation, another 3 - 5 years later, TWH to Hinrichs, what True Wholesale avenue.” sells the property and Houses does is “mitigate the learn- Hinrichs shares one key differ- investor gets 50% of the ing curve, give a real return based ence between his company and equity built, on top of the on years of experience owning and monthly returns from the most other investment companies: renting rental properties, giving the cash flow generated by “At the end of the day, none of the tenants utmost consideration to principal these investment companies have preservation. We’re not going to an ownership interest in the prop- lose money. You’re investing with erty going forward, they’ve taken people who do this for a living. We Realty411Guide.com PAGE 24 • 2011 reWEALTHmag.com

- 25. stay in these transactions for the throughout the life of the trans- up. “If the investor comes in he shares advantages that his long haul and for the life of the action.” with us, they already have equi- company has over its competi- transaction. I have put this mod- According to Hinrichs, when ty because we’re putting them tors. His partner, Mike Hanks, el together so that everyone is a one invests with their model, into the asset for literally up to is a successful home builder in stake holder and has skin in the they can expect a nine percent 40% less than anybody else is Oregon. He has built over 500 game. As long as we buy in the cash on cash return with no going to sell it to them for,” he homes. Hanks also has an IT area we want to be in, rehab to downside, for the life of the in- says. background and has set up prop- our standards, not just to rental vestment. Then, when it is sold, In addition to Hinrichs’ ex- erty administration systems for standards, treat our tenants like (they believe that time frame to tensive experience in mort- Guardian Management, which the gold that they are, the rest be within three to five years), gage banking and real estate, had 11,000 units, so they have falls into place. Our cash flow there’ll be another 30 to 50 the tools to manage hundreds is great, and our investors get percent equity payday for the and hundreds of houses. taken care of.” investor. “Our partners on the ground The reward is a real estate in- Compared to houses offered are people that we’ve known vestment with a steady, unwav- by other investment com- for years. They are highly ex- ering return, which may sound panies, Hinrichs says these perienced and very excited to like an oxymoron. When asked properties are truly “whole- be part of the team and have an how this is possible, Hinrichs sale.” For example, in Jackson ownership interest in the house, replies: “We assure investors of Mississippi, they were able to other than just managing the a consistent monthly cash flow, offer a home to an investor at house for somebody else and regardless of whether the prop- approximately $30,000 less not owning any of it.” erty is rented or not. We achieve than a similar home offered by Please note: this by using a conservative another investment company. Investors will be provided, upon vacancy and maintenance re- In other business models, request, with banking references serve allocation that assure that the retailer takes the equity up to validate True Wholesale the property is maintained in front, and the investor is bank- Houses’ financials. a peak performance standard ing on property values going

- 26. We Help You Get The Most Out Of Your Investment! Carolina Liquidators helps investors like yourself find the best deals on properties in your area. Along with providing a resource to help you find investment property we also pride ourselves in having the ability to educate you on making sound investments and helping your make the most out of your business. 1825 Remount Rd. Charlotte. 3 bed 2 bath home Carolina Liquidator and it’s affiliates are primarily Real Estate Wholesalers. for $55,500.00 • Tax Value $101,900.00 With over 40 years combined experience in the Real Estate and Mortgage in- $593.00 Net cash Flow dustry we are able to help you achive your Real Estate Goals that may have not otherwise have been possible. Pricing Property Location Features $55,500.00 1825 remount Rd Bedrooms: 3 We have a full staff of people hunting, researching, marketing, inspecting and Charlotte, NC 28208 Bathrooms: 2 negotiating these deals. Companies like us can supply you with deal after deal; why not let us do the work for you? We have the time and resources to find these This home is located near downtown Charlotte NC. It is a newer deals that most likely will not be available to you. 3 bed 2 bath home and will rent for $850.00 a month. With the sales price being half of the current tax value it’s a steal at We can provide everything an investor would need to make $55,500.00 and netting $593.00 a month cash flow. It is near schools, employment and shopping and less than 5 minutes to a sound decision. We have you covered every step of the down town Charlotte. Don’t let this one slip away. way from planning, based on your financial goals, to property acquisition and property rehabilitation. Breakdown: Rent: $850.00 Total Expenses: $257.00 We have been doing Real Estate Investing for the last 18 years and mortgage Approximate taxes: $122.00 Net Cash Flow: $593.00 for the last 15 years. We have the experience and know how to get deals done. Insurance: $50.00 Cash on Cash Return: 14% Whether your looking for a home to make a quick return on, or homes that Property Management: $85.00 produce a constant cash flow. We will find you what you are looking for! “ ” Carolina Liquidator made the buying process so easy. I would definitely recommend their services to anyone who is looking at investing in a home... www.CarolinaLiquidator.com 803-325-1925

- 27. Market Spotlight: South East Region LOCATIONS: Rock Hill, S.C. Charlotte, N.C. Atlanta, Ga. ting money into your retirement. They are Florida market. What we do is figure out Kansas City, Mo. as much a part of the team as anyone else what you are looking for and what your Jackson, Miss. involved. It is kind of shocking to some goals are and we put scenarios together that COMPANY: of the investors when they come out to will help you achieve those goals. We have Carolina Liquidator visit our office because we have so much a great team that works daily on achiev- CONTACT: community support, we have churches and ing the goals of our investors. Our team Kevin & Alex community leaders that work with us to includes our research specialist, Emily ph: (803) 325-1925 help keep the areas clean and safe. Harris; property manager/office manager, CarolinaLiquidator.com Cherry Stegall; and general contractor, Q: Why should investors buy rentals in Bennett James. These three work to keep Question: What kind of opportunities your area? the daily operations of our office moving are you seeing in your market? A: Investors should buy rentals in our area so that we can continue to find deals for our Answer: We currently have a 67 house because we have good, hard working peo- investors. package that we are working on. It is not only a great opportunity for us but for in- vestors who are interested in this package. About half of the homes are currently rent- ed and we should be able to place tenants in the other homes very easily. This is a once in a life time deal for our company, to buy so many of these homes, rehab them, and get tenants in them. It is a big challenge for our company, but we have a great team, and we are up for the chal- lenge. This is just one of the projects that we have currently going, we have many smaller deals also, many in the $30,000 dollar range. Q: How is your market handling the eco- nomic slump? A: Being based in the Charlotte, NC area, we haven’t felt the effects quiet as heav- ily as other cities, but we have noticed an increase in the number of tenants interested in our rent to own program. More people in Alex Franks and Kevin Burrell the area are looking to rent but still have a desire to own their own home. With a rent- ple living in our homes. People who rent Q: How long have you personally been to-own program, we are able to place good our homes are mostly blue collar workers investing in real estate? tenants in these homes who will pay each who make a living by working anywhere A: Alex Franks started real estate invest- month because they want to own the home. from retail stores to our local industrial ing in 1999 as a way to generate passive This is real simple, the property values are plants. income and long-term wealth. Wholesaling down and the rents are staying the same or For a very small investment, you can deals is something he continues to actively even going higher than previous years on turn a very good income. Literally for what pursue today. By 2006, he made the leap some occasions. Just to give you an idea, you could buy a car for, you can buy real from wholesaler to a full- time real estate we have several homes available in the mid estate in our markets with a net cash flow investor. $30,000s that are net cash flowing over of more than $400 a month. Just about ev- Kevin Burrell has 18 years experience in $400 a month with cash purchases. ery home we have is under $50,000, with Real estate and 15 years in the mortgage the majority being in the $30,000 range. lending business, after he bought his first Q: What is the best part of being an in- house in 1994, Kevin was hooked on real vestor in your city? Q: What makes your company unique? estate investing. A: We handle everything for the investor; A: We don’t just sell real estate to people, In 2008, Alex and Kevin joined forces to it is a total turnkey process for the passive we create portfolios, we are currently in create Carolina Liquidator, LLC. They both investor. We take care of our tenants just these areas: Charlotte, NC; Rock Hill, SC; specialize in being able to quickly analyze as well as we take care of our investors. Atlanta, GA; Kansas City, Mo; and Jack- After all, these are the people who are put- son, Miss. We are also expanding into the Continued on pg. 31 Realty411Guide.com PAGE 27 • 2011 reWEALTHmag.com