More Related Content Similar to Financial analysis adecoagro sa - adecoagro s.a. is an agricultural company in south america, with operations in argentina, brazil and uruguay Similar to Financial analysis adecoagro sa - adecoagro s.a. is an agricultural company in south america, with operations in argentina, brazil and uruguay (20) 1. 20.02.2013

Company Analysis - Overview

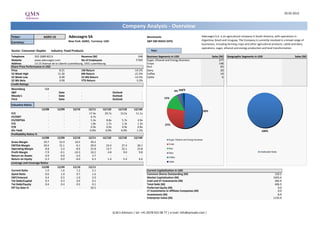

Ticker: AGRO US Adecoagro SA Benchmark: Adecoagro S.A. is an agricultural company in South America, with operations in

New York: AGRO, Currency: USD S&P 500 INDEX (SPX) Argentina, Brazil and Uruguay. The Company is currently involved in a broad range of

Currency:

businesses, including farming crops and other agricultural products, cattle and dairy

operations, sugar, ethanol and energy production and land transformation.

Sector: Consumer Staples Industry: Food Products Year:

Telephone 352-2689-8213 Revenue (M) 548 Business Segments in USD Sales (M) Geographic Segments in USD Sales (M)

Website www.adecoagro.com No of Employees 5'560 Sugar, Ethanol and Energy Business 277 Unallocated Sales 1

Address 13-15 Avenue de la Liberte Luxembourg, 1931 Luxembourg Crops 148

Share Price Performance in USD Rice 83

Price 8.21 1M Return -14.1% Dairy 20

52 Week High 11.30 6M Return -21.5% Coffee 14

52 Week Low 8.00 52 Wk Return -14.5% Cattle 6

52 Wk Beta 0.99 YTD Return -3.2%

Credit Ratings

Bloomberg IG8 1%

S&P - Date - Outlook - 4% 3%

Moody's - Date - Outlook -

Fitch - Date - Outlook - 15%

Valuation Ratios

12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E

50%

P/E - - - 17.4x 29.7x 13.5x 11.1x

EV/EBIT - - - 6.7x - - -

EV/EBITDA - - - 5.3x 8.8x 5.7x 4.9x

P/S - - - 1.8x 1.7x 1.3x 1.2x 27%

P/B - - - 0.9x 0.9x 0.9x 0.8x

Div Yield - - - 0.0% 0.0% 0.0% 1.1% 100%

Profitability Ratios %

12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E

Sugar, Ethanol and Energy Business

Gross Margin 29.7 23.9 10.5 39.3 - - -

Crops

EBITDA Margin 20.4 15.1 -0.1 29.0 23.4 27.4 30.1

Operating Margin 8.8 5.4 -8.9 22.8 13.7 22.1 23.8 Rice

Profit Margin -7.9 -0.1 -10.3 10.2 4.8 9.0 9.8 Unallocated Sales

Dairy

Return on Assets -2.0 0.0 -3.4 3.7 - - -

Coffee

Return on Equity -3.3 0.0 -6.0 6.3 1.4 5.4 6.6

Cattle

Leverage and Coverage Ratios

12/08 12/09 12/10 12/11

Current Ratio 1.0 1.6 1.2 2.1 Current Capitalization in USD

Quick Ratio 0.6 1.0 0.7 1.6 Common Shares Outstanding (M) 120.5

EBIT/Interest 0.4 0.5 -1.0 2.0 Market Capitalization (M) 1003.4

Tot Debt/Capital 0.3 0.3 0.4 0.1 Cash and ST Investments (M) 282.9

Tot Debt/Equity 0.4 0.4 0.5 0.1 Total Debt (M) 406.5

Eff Tax Rate % - - - 20.5 Preferred Equity (M) 0.0

LT Investments in Affiliate Companies (M) 0.0

Investments (M) 8.9

Enterprise Value (M) 1135.9

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

2. Company Analysis - Analysts Ratings

Adecoagro SA

Target price in USD

Broker Recommendation

Buy and Sell Recommendations vs Price and Target Price

Price

Brokers' Target Price

18 18

100% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

13% 13% 13%

22% 22% 22% 22% 22% 22%

16 16

25% 29% 29%

80% 14 14

12 12

60% 10

10

8

88% 88% 88% 8

40% 78% 78% 78% 78% 78% 78% 75% 6

71% 71% 6

4

4

20% 2

2

0

Raymond

Morgan

Securities

Credit Suisse

Stanley

HSBC

Banco BTG

Pactual SA

Itau BBA

0% 0

James

févr.12 mars.12 avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13

Buy Hold Sell Price Target Price

Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date

31-Jan-13 71% 29% 0% 20-Feb-13 8.21 13.82 Itau BBA Securities GIOVANA ARAUJO outperform 15.30 13-Feb-13

31-Dec-12 71% 29% 0% 19-Feb-13 8.29 13.82 Banco BTG Pactual SA THIAGO DUARTE neutral 11.00 30-Jan-13

30-Nov-12 75% 25% 0% 18-Feb-13 8.31 13.82 Morgan Stanley JAVIER MARTINEZ Overwt/No Rating 13.30 9-Jan-13

31-Oct-12 78% 22% 0% 15-Feb-13 8.31 13.82 Raymond James PEDRO J RICHARDS outperform 15.50 4-Jan-13

28-Sep-12 78% 22% 0% 14-Feb-13 8.25 13.82 HSBC PEDRO HERRERA overweight 14.00 17-Sep-12

31-Aug-12 78% 22% 0% 13-Feb-13 8.33 13.82 Credit Suisse LUIZ OTAVIO CAMPOS outperform 14.00 30-Mar-12

31-Jul-12 78% 22% 0% 12-Feb-13 8.40 13.82

29-Jun-12 78% 22% 0% 11-Feb-13 8.54 13.82

31-May-12 78% 22% 0% 8-Feb-13 8.50 13.82

30-Apr-12 88% 13% 0% 7-Feb-13 8.52 13.74

30-Mar-12 88% 13% 0% 6-Feb-13 8.50 13.74

29-Feb-12 88% 13% 0% 5-Feb-13 8.55 13.74

4-Feb-13 8.56 13.74

1-Feb-13 8.74 13.74

31-Jan-13 8.50 13.74

30-Jan-13 8.18 13.74

29-Jan-13 8.55 13.74

28-Jan-13 9.11 13.74

25-Jan-13 9.17 13.74

24-Jan-13 9.00 13.74

23-Jan-13 9.45 13.74

22-Jan-13 9.45 13.74

21-Jan-13 9.56 13.74

18-Jan-13 9.56 13.74

17-Jan-13 9.46 13.74

16-Jan-13 9.06 13.54

15-Jan-13 9.30 13.54

14-Jan-13 9.06 13.54

11-Jan-13 8.94 13.54

10-Jan-13 8.90 13.54

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

3. 20.02.2013

Adecoagro SA

Company Analysis - Ownership

Ownership Type

Ownership Statistics Geographic Ownership Distribution Geographic Ownership

1%2%

Shares Outstanding (M) 120.5 United States 63.97%

Float 59.4% Netherlands 16.38% 2% 2% 1%1%

3%

Short Interest (M) 0.9 Cayman Islands 10.39%

Short Interest as % of Float 1.30% Luxembourg 2.65% 10%

Days to Cover Shorts 0.96 Unknown Country 2.24%

Institutional Ownership 96.58% Britain 1.80%

Retail Ownership 1.23% Germany 1.45%

65%

Insider Ownership 2.19% Others 1.12% 16%

Institutional Ownership Distribution

97% Hedge Fund Manager 47.47%

Investment Advisor 34.25%

Pension Fund (Erisa) 12.73%

United States Netherlands Cayman Islands

Institutional Ownership Retail Ownership Insider Ownership Mutual Fund Manager 2.49%

Luxembourg Unknown Country Britain

Pricing data is in USD Others 3.07% Germany Others

Top 20 Owners: TOP 20 ALL

Institutional Ownership

Holder Name Position Position Change Market Value % of Ownership Report Date Source Country

SOROS FUND MANAGEMEN 25'911'633 0 212'734'507 21.20% 31.12.2012 13F UNITED STATES 2% 3%

SOROS FUND MANAGEMEN 25'911'633 0 212'734'507 21.20% 31.12.2012 Research UNITED STATES

HBK INVESTMENTS LP 20'471'770 0 168'073'232 16.75% 31.12.2011 20F UNITED STATES 13%

STICHTING PENSIOEN Z 15'307'824 0 125'677'235 12.53% 31.12.2011 20F NETHERLANDS

AL GHARRAFA INVESTME 12'562'906 0 103'141'458 10.28% 31.12.2011 20F CAYMAN ISLANDS 48%

OSPRAIE MANAGEMENT L 10'819'581 352'858 88'828'760 8.85% 31.12.2012 13F UNITED STATES

WELLINGTON MANAGEMEN 4'503'722 -50'952 36'975'558 3.69% 31.12.2012 13F UNITED STATES

PGGM VERMOGENSBEHEER 4'500'000 0 36'945'000 3.68% 31.12.2012 13F NETHERLANDS

JENNISON ASSOCIATES 4'439'252 -127'838 36'446'259 3.63% 31.12.2012 13F UNITED STATES

34%

GLOBAL THEMATIC PART 3'014'059 175'217 24'745'424 2.47% 31.12.2012 13F UNITED STATES

DWS INVESTMENT S A 2'583'144 142'917 21'207'612 2.11% 28.12.2012 MF-AGG LUXEMBOURG

INVESTEC ASSET MANAG 1'942'700 54'600 15'949'567 1.59% 31.12.2012 13F BRITAIN

VAN ECK ASSOCIATES C 1'807'739 -51'551 14'841'537 1.48% 31.12.2012 13F UNITED STATES

VAN ECK ASSOCIATES C 1'800'727 -856 14'783'969 1.47% 15.02.2013 MF-AGG UNITED STATES Hedge Fund Manager Investment Advisor Pension Fund (Erisa)

Mutual Fund Manager Others

DEUTSCHE BANK AG 1'577'262 -150'660 12'949'321 1.29% 31.12.2012 13F GERMANY

INVESTEC ASSET MANAG 1'471'100 -25'000 12'077'731 1.20% 30.11.2012 MF-AGG GUERNSEY

BOYCE ALAN LELAND 1'393'169 362'859 11'437'917 1.14% 31.12.2011 20F n/a

VIEIRA MARCELO 1'105'331 280'769 9'074'768 0.90% 31.12.2011 20F n/a

NEUBERGER BERMAN LLC 713'850 -547'601 5'860'709 0.58% 31.12.2012 13F UNITED STATES

NUVEEN ASSET MANAGEM 534'992 534'992 4'392'284 0.44% 31.01.2013 MF-AGG UNITED STATES

Top 5 Insiders:

Holder Name Position Position Change Market Value % of Ownership Report Date Source

BOYCE ALAN LELAND 1'393'169 362'859 11'437'917 1.14% 31.12.2011 20F

VIEIRA MARCELO 1'105'331 280'769 9'074'768 0.90% 31.12.2011 20F

BOSCH MARIANO 182'507 51'561 1'498'382 0.15% 31.12.2011 20F

2.19%

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

4. Company Analysis - Financials I/IV

Adecoagro SA

Financial information is in USD (M) Equivalent Estimates

Periodicity: Fiscal Year 12/01 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E

Income Statement

Revenue 143 244 314 426 548 592 781 828

- Cost of Goods Sold 109 172 239 381 333

Gross Income 33 73 75 45 215

- Selling, General & Admin Expenses 5 51 58 83 90

(Research & Dev Costs)

Operating Income 28 21 17 -38 125 81 173 198

- Interest Expense 12 51 34 39 62

- Foreign Exchange Losses (Gains)

- Net Non-Operating Losses (Gains) -13 -3 -12 -17 -9

Pretax Income 29 -27 -6 -61 72 25 90 140

- Income Tax Expense -0 -10 -5 -16 15

Income Before XO Items 29 -16 -0 -45 57

- Extraordinary Loss Net of Tax 0 0 0 0

- Minority Interests -1 3 -0 -1 1

Diluted EPS Before XO Items 0.10 (0.05) (0.00) (0.36) 0.48

Net Income Adjusted* 45 29 70 81

EPS Adjusted 0.28 0.61 0.74

Dividends Per Share 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.09

Payout Ratio % 0.0 0.0 0.00 0.00 0.12

Total Shares Outstanding 298 423 473 120 121

Diluted Shares Outstanding 298 423 120 122 118

EBITDA 37 50 47 -1 159 139 214 249

*Net income excludes extraordinary gains and losses and one-time charges.

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

5. Company Analysis - Financials II/IV

Periodicity: 12/01 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E

Balance Sheet

Total Current Assets 254.454 282.775 299.126 330.061 629.854

+ Cash & Near Cash Items 71 93 75 70 331

+ Short Term Investments 0 0 0 0 0

+ Accounts & Notes Receivable 79 76 106 119 141

+ Inventories 58 61 58 57 96

+ Other Current Assets 47 52 60 83 62

Total Long-Term Assets 691 745 970 1'011 1'071

+ Long Term Investments 4 9 43 52 44

Gross Fixed Assets 567 629 770 877 919

Accumulated Depreciation 29 57 87 125 159

+ Net Fixed Assets 538 571 683 752 760

+ Other Long Term Assets 149 165 244 207 268

Total Current Liabilities 146 283 190 269 296

+ Accounts Payable 33 47 62 12 114

+ Short Term Borrowings 98 224 104 252 158

+ Other Short Term Liabilities 15 12 25 6 24

Total Long Term Liabilities 182 106 322 349 310

+ Long Term Borrowings 62 4 203 139 0

+ Other Long Term Borrowings 120 102 119 210 310

Total Liabilities 328 390 512 618 606

+ Long Preferred Equity 0 0 0 0 0

+ Minority Interest 49 45 0 15 15

+ Share Capital & APIC 476 628 697 683 1'107

+ Retained Earnings & Other Equity 92 -35 60 25 -27

Total Shareholders Equity 617 638 757 723 1'095

Total Liabilities & Equity 945 1'028 1'269 1'341 1'701

Book Value Per Share 1.91 1.40 1.60 5.90 8.96 8.95 9.53 10.36

Tangible Book Value Per Share 1.83 1.36 1.55 5.66 8.65

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

6. Company Analysis - Financials III/IV

Periodicity: 12/01 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E

Cash Flows

Net Income 29 -19 -0 -44 56 13 65

+ Depreciation & Amortization 9 28 30 38 34

+ Other Non-Cash Adjustments -65 -44 -21 73 29

+ Changes in Non-Cash Capital -42 -17 -55 -39 -62

Cash From Operating Activities -68 -52 -46 27 57

+ Disposal of Fixed Assets 4 3 7 12 3

+ Capital Expenditures -130 -186 -98 -88 -90 -335 -287 -204

+ Increase in Investments 0 0 0 0

+ Decrease in Investments 0 0 0 0

+ Other Investing Activities -121 25 -24 -36 -53

Cash From Investing Activities -247 -157 -114 -112 -140

+ Dividends Paid

+ Change in Short Term Borrowings 68 19 7 12 20

+ Increase in Long Term Borrowings 51 19 80 67 35

+ Decrease in Long Term Borrowings 0 0 0 0 -82

+ Increase in Capital Stocks 0 0 0 0

+ Decrease in Capital Stocks 0 0 0 0

+ Other Financing Activities 0 0 55 0 372

Cash From Financing Activities 118 38 142 80 344

Net Changes in Cash -197 -172 -19 -5 260

Free Cash Flow (CFO-CAPEX) -198 -239 -144 -61 -34 -212 -205 -47

Free Cash Flow To Firm 16

Free Cash Flow To Equity -198 -49 31 -59

Free Cash Flow per Share -0.69 -0.58 -1.20 -0.50 -0.29

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

7. Company Analysis - Financials IV/IV

Periodicity: 12/01 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12E 12/13E 12/14E

Ratio Analysis

Valuation Ratios

Price Earnings 17.4x 29.7x 13.5x 11.1x

EV to EBIT 6.7x

EV to EBITDA 5.3x 8.8x 5.7x 4.9x

Price to Sales 1.8x 1.7x 1.3x 1.2x

Price to Book 0.9x 0.9x 0.9x 0.8x

Dividend Yield 0.0% 0.0% 0.0% 1.1%

Profitability Ratios

Gross Margin 23.3% 29.7% 23.9% 10.5% 39.3%

EBITDA Margin 26.3% 20.4% 15.1% -0.1% 29.0% 23.4% 27.4% 30.1%

Operating Margin 19.7% 8.8% 5.4% -8.9% 22.8% 13.7% 22.1% 23.8%

Profit Margin 20.5% -7.9% -0.1% -10.3% 10.2% 4.8% 9.0% 9.8%

Return on Assets -2.0% 0.0% -3.4% 3.7%

Return on Equity -3.3% 0.0% -6.0% 6.3% 1.4% 5.4% 6.6%

Leverage & Coverage Ratios

Current Ratio 1.75 1.00 1.57 1.23 2.13

Quick Ratio 1.03 0.60 0.95 0.70 1.59

Interest Coverage Ratio (EBIT/I) 2.26 0.42 0.50 -0.97 2.00

Tot Debt/Capital 0.21 0.26 0.29 0.35 0.13

Tot Debt/Equity 0.26 0.36 0.41 0.54 0.14

Others

Asset Turnover 0.25 0.27 0.33 0.36

Accounts Receivable Turnover 3.15 3.44 3.78 4.21

Accounts Payable Turnover 4.37 4.33 10.31 5.91

Inventory Turnover 2.88 4.01 6.63 4.34

Effective Tax Rate 20.5%

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

8. Company Analysis - Peers Comparision

MOLINOS RIO

ADECOAGRO SA CRESUD SA COSAN LTD - A ARCHER-DANIELS INGREDION INC SLC AGRICOLA SA BRASILAGRO SAO MARTINHO COSAN

PLAT

Latest Fiscal Year: 12/2011 06/2012 03/2012 06/2012 12/2011 12/2012 12/2011 06/2012 03/2012 03/2012

52-Week High 11.30 7.62 21.14 33.98 30.90 70.42 24.80 10.30 29.70 48.44

52-Week High Date 19.03.2012 01.02.2013 07.02.2013 10.05.2012 30.01.2013 17.01.2013 20.07.2012 24.01.2013 24.01.2013 08.02.2013

52-Week Low 8.00 4.40 11.27 24.38 16.60 45.30 15.55 6.66 17.50 28.43

52-Week Low Date 28.12.2012 04.06.2012 11.06.2012 15.11.2012 08.05.2012 17.07.2012 24.02.2012 23.05.2012 24.05.2012 24.05.2012

Daily Volume 90'149 10'460 211'838 2'982'517 15'915 187'291 109'900 6'200 41'500 407'500

Current Price (2/dd/yy) 8.21 6.70 20.41 32.68 26.70 66.72 19.85 9.94 26.51 46.56

52-Week High % Change -27.3% -12.1% -3.5% -3.8% -13.6% -5.2% -20.0% -3.5% -10.7% -3.9%

52-Week Low % Change 2.6% 52.3% 81.1% 34.0% 60.8% 47.3% 27.7% 49.2% 51.5% 63.8%

Total Common Shares (M) 120.5 501.6 270.7 659.0 250.4 77.0 97.5 58.4 112.3 404.3

Market Capitalization 1'003.4 3'360.5 5'524.7 21'521.9 6'687.0 5'107.8 1'963.1 580.7 2'995.6 18'959.9

Total Debt 158.2 3'883.2 5'199.4 10'320.0 3'199.8 1'800.0 882.4 94.4 1'232.4 5'014.1

Preferred Stock - - - - - - - - - -

Minority Interest 15.0 1'990.8 3'904.3 200.0 - 22.0 - - - 464.6

Cash and Equivalents 330.5 586.6 1'654.1 1'729.0 751.2 628.0 130.5 67.5 417.1 1'616.2

Enterprise Value 1'214.1 8'647.8 20'292.6 28'054.9 11'188.3 6'301.8 2'791.7 579.7 4'082.7 32'028.1

Valuation

Total Revenue LFY 548.1 3'457.8 24'096.9 89'038.0 12'795.5 6'532.1 1'005.6 146.2 1'367.0 24'096.9

LTM 515.0 3'457.8 27'348.9 90'559.0 15'765.2 6'532.1 1'143.4 175.0 1'491.6 27'348.9

CY+1 592.0 3'138.0 28'566.0 89'986.3 - 6'918.4 1'148.2 182.5 1'598.4 30'880.2

CY+2 781.0 3'166.0 34'337.7 89'123.8 - 7'073.2 1'255.3 193.0 1'955.6 35'485.1

EV/Total Revenue LFY 2.6x 2.2x 0.7x 0.3x 0.8x 0.9x 2.9x 4.0x 2.8x 1.2x

LTM 2.5x 2.2x 0.7x 0.3x 0.7x 0.9x 2.6x 3.3x 2.6x 1.1x

CY+1 2.2x 2.8x 0.8x - - 0.9x 2.2x 3.9x 2.5x 0.9x

CY+2 1.9x 2.8x 0.6x - - - 2.0x 3.9x 2.1x 0.8x

EBITDA LFY 159.0 893.3 1'992.3 2'890.0 268.0 914.6 325.9 4.3 581.2 5'338.7

LTM 131.4 981.7 2'010.4 2'827.0 474.1 914.7 234.6 22.3 476.2 2'707.3

CY+1 138.5 1'228.0 2'949.0 3'339.0 - 943.8 271.9 40.7 661.3 2'892.8

CY+2 214.0 1'253.0 3'888.0 3'911.8 - 1'006.8 294.4 48.6 836.2 3'740.1

EV/EBITDA LFY 9.1x 8.6x 9.0x 8.5x 40.2x 6.7x 9.1x 136.5x 6.5x 5.6x

LTM 11.0x 7.8x 8.9x 8.7x 22.7x 6.7x 12.6x 26.1x 7.9x 11.1x

CY+1 9.6x 7.1x 7.5x - - 6.3x 9.2x 17.3x 6.0x 9.3x

CY+2 7.1x 7.0x 5.6x - - - 8.4x 15.4x 5.0x 7.3x

EPS LFY 0.48 0.04 4.40 2.29 1.11 5.57 0.83 -0.32 1.12 6.34

LTM -0.25 0.20 1.77 2.38 0.28 5.58 -0.59 -0.15 0.49 1.86

CY+1 0.28 1.50 2.04 2.53 - 5.83 0.62 0.25 1.22 1.76

CY+2 0.61 2.76 2.75 3.02 - 6.42 1.20 0.08 1.89 2.46

P/E LFY - 34.4x 22.6x 13.7x 96.8x 12.0x - - 53.8x 25.0x

LTM - 74.9x 22.6x 13.7x 97.0x 12.0x - - 32.1x 25.3x

CY+1 29.7x 4.5x 19.6x 12.9x - 11.4x 31.8x 40.6x 21.7x 26.4x

CY+2 13.5x 2.4x 14.6x 10.8x - 10.4x 16.6x 132.5x 14.0x 18.9x

Revenue Growth 1 Year 28.6% 36.1% 33.4% 10.4% 15.3% 5.0% 13.2% 83.8% 5.6% 33.4%

5 Year - - 77.2% 9.3% 33.8% 14.0% 35.3% 595.7% 28.4% 83.9%

EBITDA Growth 1 Year - (3.1%) (26.2%) (19.0%) (69.4%) 2.5% 58.3% 46.2% 2.7% 159.8%

5 Year - 83.9% 17.2% 1.0% 3.1% 14.1% - - 18.6% 41.9%

EBITDA Margin LTM 22.4% 28.4% 8.0% 3.1% 3.0% 14.0% 20.5% 12.8% 32.2% 9.9%

CY+1 23.4% 39.1% 10.3% 3.7% - 13.6% 23.7% 22.3% 41.4% 9.4%

CY+2 27.4% 39.6% 11.3% 4.4% - 14.2% 23.5% 25.2% 42.8% 10.5%

Leverage/Coverage Ratios

Total Debt / Equity % 14.6% 188.2% 93.2% 57.4% 233.5% 73.3% 46.0% 16.9% 60.9% 54.8% FALSE FALSE FALSE FALSE

Total Debt / Capital % 12.6% 48.9% 35.4% 36.2% 70.0% 42.1% 31.5% 14.4% 37.8% 34.3% FALSE FALSE FALSE FALSE

Total Debt / EBITDA 3.094x 3.956x 2.936x 3.375x 11.165x 1.968x 4.023x 3.555x 3.791x 4.307x FALSE FALSE FALSE FALSE

Net Debt / EBITDA 0.941x 3.358x 1.992x 2.311x 9.495x 1.281x 3.337x -0.045x 2.283x 3.449x FALSE FALSE FALSE FALSE

EBITDA / Int. Expense 2.550x 2.210x 3.388x 6.451x 2.360x 13.570x 9.748x 0.573x 7.945x 9.844x FALSE FALSE FALSE FALSE

Credit Ratings

S&P LT Credit Rating - - BB A *- - BBB - - BB+ BB FALSE FALSE FALSE FALSE

S&P LT Credit Rating Date - - 21.10.2010 19.10.2012 - 24.11.2008 - - 22.12.2011 21.10.2010 FALSE FALSE FALSE FALSE

Moody's LT Credit Rating - - - A2 - Baa2 - - - WR FALSE FALSE FALSE FALSE

Moody's LT Credit Rating Date - - - 12.11.2004 - 14.02.2008 - - - 15.05.2011 FALSE FALSE FALSE FALSE

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |