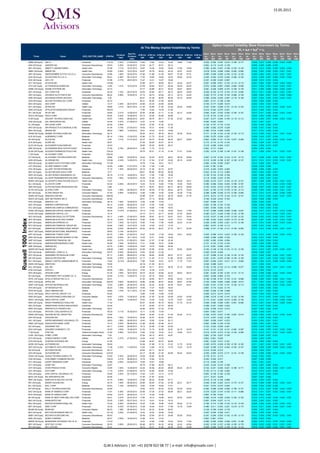

Russell 1000 Index - Dividends and Implied Volatility Surfaces Parameters

- 1. 15.05.2013 Ticker Name GICS_SECTOR_NAME ATM Ref Dividend Yield Next Ex- Dividend Date ATM Vol - 30D ATM Vol - 60D ATM Vol - 90D ATM Vol - 6M ATM Vol - 12M ATM Vol - 18M ATM Vol - 24M Skew (a) - 30D Skew (a) - 60D Skew (a) - 90D Skew (a) - 6M Skew (a) - 12M Skew (a) - 18M Skew (a) - 24M Skew (b) - 30D Skew (b) - 60D Skew (b) - 90D Skew (b) - 6M Skew (b) - 12M Skew (b) - 18M Skew (b) - 24M MMM UN Equity 3M CO Industrials 110.79 2.33% 21.08.2013 13.64 13.82 14.23 15.22 16.69 17.68 -0.232 -0.335 -0.325 -0.215 -0.189 -0.177 0.026 0.013 0.008 0.006 0.003 0.002 AAN UN Equity AARON'S INC Consumer Discretionary 29.03 0.25% 03.09.2013 23.34 24.77 25.51 26.10 0.000 -0.110 -0.145 -0.128 0.000 0.005 0.006 0.003 ABT UN Equity ABBOTT LABORATORIES Health Care 37.46 1.71% 10.07.2013 15.87 16.39 16.65 16.94 17.60 18.89 -0.385 -0.303 -0.247 -0.186 -0.155 -0.140 0.016 0.012 0.009 0.006 0.003 0.002 ABBV UN Equity ABBVIE INC Health Care 45.89 3.55% 10.07.2013 22.97 23.78 25.03 24.33 23.97 24.53 -0.018 -0.024 -0.058 -0.052 -0.052 -0.062 0.002 0.003 0.004 0.003 0.001 0.001 ANF UN Equity ABERCROMBIE & FITCH CO-CL A Consumer Discretionary 53.88 1.48% 30.05.2013 47.96 41.98 41.20 39.67 37.36 37.01 -0.265 -0.246 -0.209 -0.165 -0.133 -0.125 0.005 0.004 0.003 0.002 0.001 0.001 ACN UN Equity ACCENTURE PLC-CL A Information Technology 80.51 2.36% 09.10.2013 17.52 18.95 19.62 19.54 20.82 22.34 -0.345 -0.302 -0.278 -0.240 -0.209 -0.183 0.010 0.009 0.007 0.005 0.002 0.002 ACE UN Equity ACE LTD Financials 91.96 2.17% 26.07.2013 13.47 14.31 14.97 16.68 -0.331 -0.339 -0.322 -0.267 0.008 0.010 0.010 0.005 ACT UN Equity ACTAVIS INC Health Care 123.86 33.99 30.71 28.60 26.27 24.54 24.27 -0.091 -0.006 0.001 -0.134 -0.114 -0.112 0.001 0.004 0.004 -0.002 0.004 0.003 ATVI UW Equity ACTIVISION BLIZZARD INC Information Technology 15.60 1.41% 10.03.2014 27.09 29.64 30.01 29.28 28.20 28.20 -0.072 -0.065 -0.067 -0.083 -0.093 -0.090 0.014 0.006 0.003 0.002 0.002 0.001 ADBE UW Equity ADOBE SYSTEMS INC Information Technology 44.72 27.77 25.96 25.31 25.23 25.87 26.97 -0.281 -0.238 -0.206 -0.167 -0.148 -0.130 0.011 0.009 0.006 0.003 0.002 0.001 ADT UN Equity ADT CORP/THE Industrials 42.39 1.18% 29.07.2013 25.53 25.64 26.71 28.73 28.93 29.00 -0.229 -0.192 -0.170 -0.143 -0.110 -0.092 0.013 0.011 0.008 0.003 0.001 0.001 AAP UN Equity ADVANCE AUTO PARTS INC Consumer Discretionary 86.22 0.28% 19.06.2013 27.10 25.74 24.92 24.13 23.14 23.64 -0.225 -0.174 -0.146 -0.144 -0.099 -0.100 0.006 0.003 0.001 0.001 0.000 0.000 AMD UN Equity ADVANCED MICRO DEVICES Information Technology 4.40 60.51 61.38 59.93 56.08 53.74 52.89 -0.098 -0.034 -0.035 -0.087 -0.119 -0.108 0.007 0.005 0.004 0.002 0.002 0.001 ACM UN Equity AECOM TECHNOLOGY CORP Industrials 30.72 26.21 26.90 27.49 28.63 0.000 -0.141 -0.198 -0.186 0.000 0.004 0.005 0.003 AES UN Equity AES CORP Utilities 13.17 2.35% 26.07.2013 22.69 23.33 23.46 22.88 -0.105 -0.177 -0.209 -0.214 0.002 0.003 0.004 0.005 AET UN Equity AETNA INC Health Care 59.66 1.41% 09.07.2013 21.20 20.96 21.50 23.28 25.04 25.86 -0.347 -0.261 -0.208 -0.151 -0.116 -0.103 0.013 0.010 0.007 0.003 0.002 0.001 AMG UN Equity AFFILIATED MANAGERS GROUP Financials 164.53 17.60 18.92 19.78 21.09 -0.410 -0.324 -0.276 -0.241 0.010 0.006 0.003 0.002 AFL UN Equity AFLAC INC Financials 54.65 3.31% 12.08.2013 20.44 20.88 21.17 21.34 22.14 23.06 -0.492 -0.391 -0.330 -0.240 -0.184 -0.157 0.014 0.011 0.009 0.005 0.003 0.002 AGCO UN Equity AGCO CORP Industrials 55.64 0.54% 15.08.2013 23.12 25.00 25.95 26.66 -0.116 -0.143 -0.149 -0.131 0.002 0.004 0.005 0.003 A UN Equity AGILENT TECHNOLOGIES INC Health Care 45.97 1.04% 28.06.2013 29.61 28.76 28.17 27.39 27.63 28.62 -0.307 -0.277 -0.246 -0.185 -0.119 -0.112 0.013 0.009 0.007 0.004 0.003 0.002 GAS UN Equity AGL RESOURCES INC Utilities 43.49 4.37% 21.08.2013 13.27 13.16 13.05 -0.093 -0.093 -0.093 0.001 0.001 0.001 AL UN Equity AIR LEASE CORP Industrials 29.38 0.09% 29.32 27.82 27.20 27.25 -0.126 -0.157 -0.170 -0.144 0.002 0.004 0.005 0.003 APD UN Equity AIR PRODUCTS & CHEMICALS INC Materials 91.34 3.15% 27.06.2013 16.09 16.31 16.56 17.28 -0.269 -0.282 -0.278 -0.228 0.006 0.007 0.006 0.003 ARG UN Equity AIRGAS INC Materials 99.22 1.98% 13.09.2013 18.51 18.32 18.75 19.85 -0.396 -0.419 -0.369 -0.245 0.011 0.012 0.009 0.004 AKAM UW Equity AKAMAI TECHNOLOGIES INC Information Technology 48.14 26.25 35.51 38.76 38.44 35.38 35.54 -0.171 -0.136 -0.124 -0.120 -0.120 -0.112 0.012 0.005 0.002 0.001 0.001 0.000 ALB UN Equity ALBEMARLE CORP Materials 65.14 1.54% 13.09.2013 20.96 21.75 22.42 23.70 -0.309 -0.275 -0.254 -0.221 0.008 0.008 0.007 0.004 AA UN Equity ALCOA INC Materials 8.54 1.41% 31.07.2013 22.27 24.70 25.55 26.24 28.27 29.68 0.063 -0.093 -0.121 -0.100 -0.077 -0.059 0.010 0.011 0.009 0.004 0.002 0.002 ALR UN Equity ALERE INC Health Care 26.61 27.08 29.25 30.27 30.73 -0.172 -0.174 -0.170 -0.153 0.002 0.006 0.007 0.003 ALEX UN Equity ALEXANDER & BALDWIN INC Financials 34.03 29.95 29.26 28.85 28.01 -0.316 -0.286 -0.264 -0.231 0.004 0.008 0.010 0.007 ARE UN Equity ALEXANDRIA REAL ESTATE EQUIT Financials 77.59 3.18% 26.06.2013 11.95 11.73 12.19 0.000 -0.177 -0.252 0.000 0.002 0.004 ALXN UW Equity ALEXION PHARMACEUTICALS INC Health Care 105.24 28.75 30.41 31.16 31.40 31.51 32.84 -0.253 -0.216 -0.189 -0.146 -0.161 -0.148 0.011 0.006 0.004 0.001 0.002 0.001 Y UN Equity ALLEGHANY CORP Financials 394.40 ATI UN Equity ALLEGHENY TECHNOLOGIES INC Materials 28.96 2.49% 20.09.2013 34.40 34.29 34.97 36.67 38.38 39.68 -0.207 -0.176 -0.160 -0.143 -0.121 -0.110 0.011 0.008 0.005 0.002 0.001 0.001 AGN UN Equity ALLERGAN INC Health Care 103.86 0.24% 14.08.2013 21.16 21.54 21.97 23.60 25.19 24.95 -0.313 -0.228 -0.186 -0.167 -0.148 -0.137 0.014 0.014 0.010 0.003 0.002 0.001 ADS UN Equity ALLIANCE DATA SYSTEMS CORP Information Technology 177.26 16.76 17.44 18.01 19.17 -0.462 -0.330 -0.258 -0.207 0.013 0.009 0.007 0.003 LNT UN Equity ALLIANT ENERGY CORP Utilities 52.49 3.66% 31.07.2013 11.39 11.38 11.38 0.159 0.160 0.162 0.008 0.008 0.008 ATK UN Equity ALLIANT TECHSYSTEMS INC Industrials 77.16 1.35% 05.09.2013 20.10 21.35 22.15 22.97 -0.315 -0.302 -0.293 -0.262 0.009 0.009 0.008 0.005 ANV UA Equity ALLIED NEVADA GOLD CORP Materials 8.17 66.51 65.95 65.63 65.36 -0.223 -0.154 -0.112 -0.069 0.007 0.004 0.002 0.001 AWH UN Equity ALLIED WORLD ASSURANCE CO Financials 92.19 2.17% 19.06.2013 16.27 17.20 17.80 18.55 -0.138 -0.153 -0.159 -0.156 0.002 0.004 0.004 0.003 ALSN UN Equity ALLISON TRANSMISSION HOLDING Consumer Discretionary 23.30 1.54% 15.08.2013 33.39 31.50 31.13 33.17 -0.118 -0.200 -0.224 -0.185 0.000 0.006 0.007 0.002 MDRX UW Equity ALLSCRIPTS HEALTHCARE SOLUTI Health Care 14.01 32.73 35.94 37.62 38.87 39.50 39.21 -0.049 -0.219 -0.271 -0.163 -0.116 -0.101 0.001 0.005 0.006 0.003 0.001 0.001 ALL UN Equity ALLSTATE CORP Financials 50.32 2.05% 29.05.2013 15.43 15.16 15.85 17.86 19.30 19.94 -0.390 -0.395 -0.344 -0.235 -0.189 -0.167 0.015 0.015 0.012 0.005 0.003 0.002 ANR UN Equity ALPHA NATURAL RESOURCES INC Energy 6.88 59.17 58.91 59.07 60.74 58.33 59.69 -0.193 -0.243 -0.219 -0.150 -0.108 -0.121 0.009 0.007 0.005 0.002 0.001 0.001 ALTR UW Equity ALTERA CORP Information Technology 33.24 1.56% 09.08.2013 24.40 26.38 27.50 28.82 29.75 30.83 -0.221 -0.195 -0.178 -0.150 -0.134 -0.112 0.008 0.006 0.004 0.003 0.001 0.001 MO UN Equity ALTRIA GROUP INC Consumer Staples 37.40 4.95% 14.06.2013 13.56 13.98 14.40 15.29 16.39 17.54 -0.368 -0.289 -0.238 -0.174 -0.106 -0.084 0.013 0.012 0.010 0.006 0.006 0.004 AMZN UW Equity AMAZON.COM INC Consumer Discretionary 268.58 23.68 23.91 25.43 28.78 30.69 31.74 -0.274 -0.214 -0.175 -0.144 -0.121 -0.101 0.015 0.010 0.006 0.003 0.001 0.001 AMCX UW Equity AMC NETWORKS INC-A Consumer Discretionary 65.55 26.41 27.13 28.06 30.53 -0.189 -0.230 -0.232 -0.163 0.003 0.006 0.006 0.004 DOX UN Equity AMDOCS LTD Information Technology 36.18 1.55% 16.09.2013 14.45 14.66 14.94 -0.021 -0.085 -0.127 0.000 0.002 0.004 AEE UN Equity AMEREN CORPORATION Utilities 36.12 4.43% 09.09.2013 12.97 13.36 13.68 14.07 0.000 -0.106 -0.152 -0.192 0.000 0.004 0.006 0.006 ACC UN Equity AMERICAN CAMPUS COMMUNITIES Financials 44.69 2.42% 14.08.2013 15.71 16.80 17.48 18.42 0.000 -0.050 -0.083 -0.126 0.000 0.000 0.000 0.002 AGNC UW Equity AMERICAN CAPITAL AGENCY CORP Financials 28.79 17.37% 21.06.2013 19.13 17.54 17.30 19.26 16.54 17.80 -0.157 -0.096 -0.058 -0.028 -0.056 -0.007 0.020 0.017 0.014 0.007 0.010 0.005 ACAS UW Equity AMERICAN CAPITAL LTD Financials 14.14 23.13 23.77 24.17 24.65 27.00 28.69 -0.360 -0.277 -0.228 -0.186 -0.122 -0.106 0.018 0.013 0.010 0.005 0.002 0.001 AEO UN Equity AMERICAN EAGLE OUTFITTERS Consumer Discretionary 20.11 2.49% 27.06.2013 38.59 35.67 34.15 33.97 33.51 34.04 -0.315 -0.237 -0.189 -0.157 -0.130 -0.123 0.004 0.003 0.003 0.002 0.001 0.001 AEP UN Equity AMERICAN ELECTRIC POWER Utilities 49.19 4.04% 07.08.2013 12.82 12.99 13.00 13.07 14.31 15.08 -0.188 -0.233 -0.244 -0.222 -0.173 -0.155 0.003 0.007 0.008 0.007 0.003 0.002 AXP UN Equity AMERICAN EXPRESS CO Financials 72.57 1.30% 02.10.2013 16.60 17.49 17.90 18.69 20.54 21.44 -0.428 -0.363 -0.305 -0.221 -0.172 -0.148 0.014 0.010 0.008 0.005 0.003 0.002 AFG UN Equity AMERICAN FINANCIAL GROUP INC Financials 49.64 1.69% 10.07.2013 13.35 14.05 14.27 13.79 0.000 -0.074 -0.106 -0.113 0.000 0.001 0.002 0.002 AIG UN Equity AMERICAN INTERNATIONAL GROUP Financials 46.06 0.43% 09.09.2013 25.30 25.35 26.57 27.70 29.11 30.28 -0.256 -0.191 -0.182 -0.131 -0.105 -0.093 0.013 0.010 0.008 0.003 0.001 0.001 ANAT UW Equity AMERICAN NATIONAL INSURANCE Financials 98.65 3.14% 04.09.2013 AMT UN Equity AMERICAN TOWER CORP Financials 83.76 1.32% 27.06.2013 15.47 16.53 17.36 18.50 19.61 20.62 -0.425 -0.366 -0.314 -0.233 -0.156 -0.129 0.012 0.012 0.009 0.005 0.004 0.002 AWK UN Equity AMERICAN WATER WORKS CO INC Utilities 42.60 2.63% 18.11.2013 14.32 15.31 15.80 16.22 -0.529 -0.388 -0.285 -0.162 0.023 0.014 0.009 0.004 AMP UN Equity AMERIPRISE FINANCIAL INC Financials 80.82 2.61% 01.08.2013 19.63 21.07 21.80 22.26 -0.252 -0.282 -0.294 -0.284 0.006 0.005 0.004 0.004 ABC UN Equity AMERISOURCEBERGEN CORP Health Care 54.98 1.64% 16.08.2013 17.31 18.66 19.27 19.66 -0.101 -0.143 -0.153 -0.145 0.002 0.009 0.009 0.004 AME UN Equity AMETEK INC Industrials 42.75 0.56% 13.09.2013 19.53 19.70 19.96 20.80 -0.173 -0.261 -0.290 -0.257 0.001 0.006 0.008 0.005 AMGN UW Equity AMGEN INC Health Care 108.08 1.44% 16.08.2013 23.56 23.59 23.94 24.72 25.82 26.99 -0.163 -0.148 -0.138 -0.124 -0.112 -0.106 0.014 0.010 0.007 0.003 0.002 0.001 APH UN Equity AMPHENOL CORP-CL A Information Technology 80.75 0.54% 09.09.2013 15.55 20.03 21.04 -0.322 -0.279 -0.249 0.009 0.008 0.007 APC UN Equity ANADARKO PETROLEUM CORP Energy 87.17 0.50% 09.09.2013 27.82 28.84 29.06 28.07 27.77 28.27 -0.107 -0.099 -0.103 -0.138 -0.140 -0.132 0.014 0.008 0.005 0.002 0.001 0.001 ADI UW Equity ANALOG DEVICES INC Information Technology 46.49 2.97% 29.05.2013 21.17 21.25 21.37 21.69 22.00 22.53 -0.291 -0.251 -0.225 -0.186 -0.149 -0.128 0.008 0.007 0.006 0.004 0.002 0.002 NLY UN Equity ANNALY CAPITAL MANAGEMENT IN Financials 14.82 12.15% 28.06.2013 17.60 16.20 16.01 16.72 17.72 17.67 -0.607 -0.455 -0.341 -0.217 -0.111 -0.064 0.024 0.020 0.015 0.008 0.006 0.005 ANSS UW Equity ANSYS INC Information Technology 76.58 20.18 21.09 22.14 -0.342 -0.269 -0.231 0.011 0.006 0.003 AOL UN Equity AOL INC Information Technology 37.75 33.46 32.71 33.61 36.35 37.18 36.89 -0.192 -0.155 -0.134 -0.114 -0.095 -0.077 0.010 0.006 0.004 0.001 0.001 0.001 AON UN Equity AON PLC Financials 66.08 1.06% 30.07.2013 14.54 14.35 14.79 -0.214 -0.310 -0.316 0.004 0.009 0.008 APA UN Equity APACHE CORP Energy 81.35 1.00% 18.07.2013 22.72 23.23 23.65 24.40 25.63 26.70 -0.281 -0.222 -0.194 -0.167 -0.131 -0.113 0.012 0.009 0.006 0.003 0.003 0.002 AIV UN Equity APARTMENT INVT & MGMT CO -A Financials 32.59 3.13% 14.08.2013 21.23 20.18 19.63 19.47 0.000 -0.028 -0.064 -0.133 0.000 -0.001 -0.001 0.003 APOL UW Equity APOLLO GROUP INC-CL A Consumer Discretionary 20.51 41.50 44.63 45.77 44.86 45.33 44.70 -0.199 -0.166 -0.147 -0.122 -0.101 -0.099 0.008 0.005 0.003 0.002 0.001 0.001 AAPL UW Equity APPLE INC Information Technology 435.50 2.80% 08.08.2013 25.66 24.88 26.81 25.80 26.67 27.69 -0.105 -0.094 -0.084 -0.056 -0.029 -0.014 0.011 0.007 0.004 0.002 0.001 0.000 AMAT UW Equity APPLIED MATERIALS INC Information Technology 14.93 2.68% 26.08.2013 25.40 24.42 24.50 24.49 24.91 25.41 -0.295 -0.237 -0.193 -0.151 -0.129 -0.112 0.013 0.008 0.005 0.003 0.002 0.001 ATR UN Equity APTARGROUP INC Materials 56.30 1.78% 05.08.2013 15.46 17.47 18.38 19.05 0.000 -0.175 -0.222 -0.175 0.000 0.005 0.006 0.003 WTR UN Equity AQUA AMERICA INC Utilities 32.85 1.74% 15.11.2013 21.39 19.95 18.81 16.55 -0.553 -0.346 -0.199 -0.098 0.024 0.011 0.003 0.004 ACGL UW Equity ARCH CAPITAL GROUP LTD Financials 54.26 12.80 13.48 13.86 14.28 -0.206 -0.213 -0.215 -0.214 0.004 0.004 0.004 0.004 ADM UN Equity ARCHER-DANIELS-MIDLAND CO Consumer Staples 34.81 1.67% 13.08.2013 20.06 21.50 22.28 23.08 23.62 24.58 -0.266 -0.216 -0.182 -0.147 -0.122 -0.106 0.021 0.013 0.007 0.004 0.002 0.001 ARCC UW Equity ARES CAPITAL CORP Financials 17.91 8.65% 13.09.2013 12.63 13.35 13.52 14.78 12.67 14.25 -0.173 -0.241 -0.269 -0.210 -0.252 -0.154 0.012 0.012 0.011 0.008 0.008 0.006 ARIA UW Equity ARIAD PHARMACEUTICALS INC Health Care 17.42 50.57 50.09 50.15 50.83 51.79 53.16 -0.048 -0.085 -0.096 -0.061 -0.051 -0.060 0.013 0.007 0.004 0.002 0.000 0.000 AWI UN Equity ARMSTRONG WORLD INDUSTRIES Industrials 53.54 21.57 25.83 27.74 28.29 -0.309 -0.301 -0.285 -0.223 0.014 0.007 0.004 0.003 ARW UN Equity ARROW ELECTRONICS INC Information Technology 38.47 25.06 26.63 27.43 27.90 -0.234 -0.236 -0.233 -0.214 0.007 0.005 0.004 0.005 AJG UN Equity ARTHUR J GALLAGHER & CO Financials 45.29 3.11% 30.09.2013 12.11 12.38 13.00 0.000 0.002 -0.017 0.000 0.000 0.000 ASNA UW Equity ASCENA RETAIL GROUP INC Consumer Discretionary 19.84 35.04 32.84 31.63 31.46 30.95 31.31 -0.338 -0.274 -0.227 -0.160 -0.081 -0.012 0.008 0.006 0.004 0.003 0.000 0.000 ASH UN Equity ASHLAND INC Materials 89.45 1.52% 19.08.2013 24.46 24.57 25.20 26.81 -0.313 -0.257 -0.222 -0.184 0.011 0.008 0.006 0.003 AHL UN Equity ASPEN INSURANCE HOLDINGS LTD Financials 38.63 1.86% 09.08.2013 18.45 18.95 19.34 20.13 0.000 -0.029 -0.047 -0.072 0.000 0.000 0.001 0.001 ASBC UW Equity ASSOCIATED BANC-CORP Financials 15.10 3.05% 08.08.2013 21.89 22.58 22.98 23.41 0.000 -0.069 -0.106 -0.154 0.000 0.003 0.004 0.003 AIZ UN Equity ASSURANT INC Financials 49.11 2.04% 29.08.2013 19.12 20.68 21.69 23.26 -0.123 -0.202 -0.228 -0.201 0.003 0.005 0.005 0.004 AGO UN Equity ASSURED GUARANTY LTD Financials 24.53 1.63% 16.08.2013 31.53 31.74 32.06 32.87 34.15 34.93 -0.141 -0.191 -0.192 -0.131 -0.092 -0.087 0.018 0.009 0.005 0.003 0.002 0.002 T UN Equity AT&T INC Telecommunication Services 37.50 4.85% 10.07.2013 13.82 14.02 15.03 15.21 16.88 18.12 -0.414 -0.270 -0.215 -0.132 -0.104 -0.095 0.017 0.014 0.011 0.007 0.004 0.002 ATML UW Equity ATMEL CORP Information Technology 7.24 37.54 39.12 40.67 44.87 0.000 -0.155 -0.207 -0.165 0.000 0.006 0.007 0.001 ATO UN Equity ATMOS ENERGY CORP Utilities 44.73 2.37% 27.08.2013 14.29 14.25 14.33 0.000 0.003 -0.026 0.000 0.000 0.000 ATW UN Equity ATWOOD OCEANICS INC Energy 51.95 23.06 24.67 25.57 26.59 -0.281 -0.242 -0.213 -0.161 0.009 0.005 0.004 0.004 ADSK UW Equity AUTODESK INC Information Technology 39.49 34.54 31.98 31.10 31.23 31.75 32.30 -0.328 -0.273 -0.226 -0.159 -0.135 -0.125 0.011 0.007 0.004 0.002 0.001 0.001 ADP UW Equity AUTOMATIC DATA PROCESSING Information Technology 71.48 2.53% 11.09.2013 13.20 13.69 14.18 14.78 15.42 16.18 -0.245 -0.306 -0.319 -0.240 -0.192 -0.167 0.006 0.008 0.008 0.006 0.003 0.002 AN UN Equity AUTONATION INC Consumer Discretionary 46.13 22.64 24.11 24.78 -0.212 -0.244 -0.215 0.006 0.009 0.007 AZO UN Equity AUTOZONE INC Consumer Discretionary 418.93 24.17 22.28 21.25 20.69 20.02 20.03 -0.330 -0.263 -0.219 -0.171 -0.141 -0.128 0.012 0.008 0.006 0.003 0.002 0.002 AVGO UW Equity AVAGO TECHNOLOGIES LTD Information Technology 33.82 2.54% 20.06.2013 33.28 30.92 30.39 -0.178 -0.131 -0.115 0.004 0.004 0.003 AVB UN Equity AVALONBAY COMMUNITIES INC Financials 136.03 3.21% 26.06.2013 14.78 14.65 15.18 -0.353 -0.343 -0.317 0.007 0.009 0.008 AVY UN Equity AVERY DENNISON CORP Industrials 43.86 2.64% 03.09.2013 19.09 18.61 18.98 -0.110 -0.093 -0.109 0.001 0.001 0.002 AVT UN Equity AVNET INC Information Technology 32.87 25.79 27.80 28.76 29.12 -0.232 -0.224 -0.216 -0.189 0.010 0.007 0.006 0.003 AVP UN Equity AVON PRODUCTS INC Consumer Staples 23.59 1.02% 15.08.2013 23.32 24.56 26.22 28.80 29.25 29.10 -0.152 -0.241 -0.255 -0.221 -0.188 -0.171 0.003 0.005 0.004 0.002 0.001 0.001 AVX UN Equity AVX CORP Information Technology 11.79 2.97% 07.08.2013 24.79 24.85 24.92 27.66 -0.120 -0.113 -0.106 -0.083 0.010 0.010 0.010 0.004 AXS UN Equity AXIS CAPITAL HOLDINGS LTD Financials 45.99 2.22% 03.10.2013 13.30 13.81 14.14 14.70 0.000 -0.138 -0.180 -0.108 0.000 0.003 0.004 0.002 BEAV UW Equity B/E AEROSPACE INC Industrials 63.94 21.48 21.87 22.63 -0.211 -0.231 -0.229 0.007 0.007 0.006 BWC UN Equity BABCOCK & WILCOX CO/THE Industrials 27.75 0.86% 16.08.2013 27.89 26.42 25.99 27.31 -0.016 -0.118 -0.146 -0.088 0.000 0.005 0.007 0.004 BHI UN Equity BAKER HUGHES INC Energy 45.74 1.49% 08.08.2013 24.96 26.40 27.02 27.48 28.21 28.77 -0.449 -0.345 -0.283 -0.215 -0.170 -0.147 0.012 0.009 0.006 0.003 0.002 0.001 BLL UN Equity BALL CORP Materials 45.53 1.19% 30.08.2013 15.62 16.40 16.93 17.61 -0.241 -0.274 -0.270 -0.200 0.006 0.008 0.008 0.006 BYI UN Equity BALLY TECHNOLOGIES INC Consumer Discretionary 52.90 19.52 19.57 20.43 22.50 24.29 25.64 -0.383 -0.286 -0.255 -0.256 -0.198 -0.151 0.012 0.010 0.007 0.005 0.004 0.003 BAC UN Equity BANK OF AMERICA CORP Financials 13.41 0.30% 04.09.2013 25.56 27.24 27.02 26.96 28.21 29.20 -0.316 -0.225 -0.197 -0.150 -0.111 -0.089 0.015 0.011 0.007 0.003 0.002 0.001 BOH UN Equity BANK OF HAWAII CORP Financials 49.92 3.61% 28.08.2013 13.17 14.39 14.98 0.000 -0.180 -0.223 0.000 0.003 0.005 BK UN Equity BANK OF NEW YORK MELLON CORP Financials 30.01 2.07% 25.07.2013 17.85 19.12 19.86 20.67 22.62 23.63 -0.496 -0.419 -0.358 -0.249 -0.180 -0.163 0.018 0.013 0.009 0.005 0.002 0.001 BKU UN Equity BANKUNITED INC Financials 25.45 3.30% 05.07.2013 18.12 19.01 19.34 19.18 0.000 -0.004 -0.027 -0.113 0.000 0.000 0.001 0.005 BAX UN Equity BAXTER INTERNATIONAL INC Health Care 70.32 2.83% 04.09.2013 16.34 17.90 18.86 19.87 20.62 21.19 -0.186 -0.174 -0.168 -0.142 -0.115 -0.104 0.008 0.005 0.004 0.003 0.002 0.001 BBT UN Equity BB&T CORP Financials 32.39 3.03% 07.08.2013 15.28 16.04 16.67 17.96 19.78 19.98 -0.480 -0.411 -0.352 -0.241 -0.219 -0.173 0.018 0.011 0.008 0.004 0.001 0.001 BEAM UN Equity BEAM INC Consumer Staples 68.70 1.38% 05.08.2013 19.74 20.33 20.64 20.87 -0.129 -0.189 -0.209 -0.178 0.006 0.007 0.007 0.004 BDX UN Equity BECTON DICKINSON AND CO Health Care 101.45 2.02% 07.06.2013 15.40 16.42 16.84 16.59 -0.227 -0.245 -0.248 -0.211 0.006 0.005 0.005 0.004 BBBY UW Equity BED BATH & BEYOND INC Consumer Discretionary 68.43 20.59 23.50 24.70 24.69 25.06 25.02 -0.341 -0.249 -0.200 -0.152 -0.136 -0.119 0.012 0.008 0.006 0.003 0.002 0.001 BMS UN Equity BEMIS COMPANY Materials 40.57 2.59% 16.08.2013 14.08 14.61 15.33 0.000 0.004 -0.034 0.000 0.000 0.000 BRK/B UN Equity BERKSHIRE HATHAWAY INC-CL B Financials 112.47 14.07 14.56 14.88 15.40 16.35 17.50 -0.365 -0.300 -0.260 -0.228 -0.221 -0.186 0.020 0.015 0.012 0.007 0.004 0.002 BBY UN Equity BEST BUY CO INC Consumer Discretionary 26.35 2.69% 26.06.2013 60.48 56.72 54.32 49.39 43.02 40.84 -0.222 -0.150 -0.157 -0.188 -0.195 -0.176 0.006 0.003 0.002 0.001 0.001 0.001 BIG UN Equity BIG LOTS INC Consumer Discretionary 37.41 34.74 32.31 31.62 32.29 33.03 33.06 -0.259 -0.266 -0.239 -0.159 -0.134 -0.124 0.015 0.010 0.006 0.002 0.001 0.001 Option Implied Volatility Skew Parameters by Terms: IVt = atx + btx 2 + ct At The Money Implied Volatilities by Terms Russell1000Index Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. 15.05.2013 Ticker Name GICS_SECTOR_NAME ATM Ref Dividend Yield Next Ex- Dividend Date ATM Vol - 30D ATM Vol - 60D ATM Vol - 90D ATM Vol - 6M ATM Vol - 12M ATM Vol - 18M ATM Vol - 24M Skew (a) - 30D Skew (a) - 60D Skew (a) - 90D Skew (a) - 6M Skew (a) - 12M Skew (a) - 18M Skew (a) - 24M Skew (b) - 30D Skew (b) - 60D Skew (b) - 90D Skew (b) - 6M Skew (b) - 12M Skew (b) - 18M Skew (b) - 24M BIO UN Equity BIO-RAD LABORATORIES-A Health Care 115.79 20.46 20.80 21.17 22.19 -0.069 -0.155 -0.192 -0.210 0.001 0.006 0.008 0.005 BIIB UW Equity BIOGEN IDEC INC Health Care 227.93 32.41 32.00 32.10 32.55 32.94 33.53 -0.261 -0.201 -0.171 -0.149 -0.127 -0.109 0.013 0.008 0.005 0.002 0.001 0.001 BMRN UW Equity BIOMARIN PHARMACEUTICAL INC Health Care 68.68 34.16 31.98 31.18 31.31 31.05 30.25 0.095 -0.092 -0.150 -0.153 -0.122 -0.096 0.003 0.010 0.008 0.001 0.002 0.003 BMR UN Equity BIOMED REALTY TRUST INC Financials 22.74 4.22% 28.06.2013 12.20 14.19 15.03 14.95 0.000 0.026 0.022 -0.035 0.000 -0.001 0.000 0.001 BLK UN Equity BLACKROCK INC Financials 284.66 2.42% 07.06.2013 20.27 21.48 21.80 21.70 22.22 22.93 -0.403 -0.289 -0.253 -0.233 -0.175 -0.150 0.013 0.008 0.005 0.002 0.001 0.001 BMC UW Equity BMC SOFTWARE INC Information Technology 45.38 5.90 6.01 5.95 5.94 4.18 3.58 0.100 -0.235 -0.342 -0.155 -0.253 -0.181 0.000 0.007 0.008 0.008 0.007 0.004 BA UN Equity BOEING CO/THE Industrials 96.73 2.08% 14.08.2013 19.23 19.63 20.78 21.27 21.82 23.02 -0.412 -0.355 -0.279 -0.193 -0.160 -0.135 0.017 0.011 0.007 0.004 0.002 0.001 BOKF UW Equity BOK FINANCIAL CORPORATION Financials 65.19 2.64% 14.08.2013 24.38 20.76 18.97 17.79 0.000 0.056 0.086 0.065 0.000 0.011 0.015 0.009 BAH UN Equity BOOZ ALLEN HAMILTON HOLDINGS Information Technology 16.25 2.77% 03.06.2013 27.39 27.30 27.04 26.22 0.000 -0.128 -0.186 -0.177 0.000 0.000 0.000 0.003 BWA UN Equity BORGWARNER INC Consumer Discretionary 83.37 21.17 22.23 23.32 -0.264 -0.283 -0.266 0.007 0.006 0.005 BXP UN Equity BOSTON PROPERTIES INC Financials 110.47 2.44% 26.06.2013 14.27 14.40 15.21 17.10 -0.205 -0.244 -0.242 -0.195 0.004 0.006 0.006 0.005 BSX UN Equity BOSTON SCIENTIFIC CORP Health Care 9.00 28.91 29.26 29.39 29.32 30.36 31.80 -0.057 -0.066 -0.078 -0.117 -0.082 -0.085 0.002 0.009 0.010 0.005 0.002 0.001 BDN UN Equity BRANDYWINE REALTY TRUST Financials 15.71 3.82% 02.07.2013 16.38 16.38 16.93 0.000 0.000 0.000 0.000 0.000 0.000 BRE UN Equity BRE PROPERTIES INC Financials 52.64 3.02% 13.09.2013 17.57 18.33 18.73 -0.060 -0.019 -0.036 0.000 0.000 0.001 EAT UN Equity BRINKER INTERNATIONAL INC Consumer Discretionary 40.52 2.20% 12.06.2013 22.37 21.95 22.74 0.000 -0.134 -0.168 0.000 0.005 0.006 BMY UN Equity BRISTOL-MYERS SQUIBB CO Health Care 44.07 3.22% 03.07.2013 19.16 18.56 18.30 18.41 19.36 20.75 -0.361 -0.305 -0.262 -0.196 -0.147 -0.131 0.017 0.012 0.009 0.006 0.004 0.002 BRCM UW Equity BROADCOM CORP-CL A Information Technology 36.70 1.20% 28.08.2013 22.05 24.67 26.00 26.96 26.96 27.83 -0.342 -0.259 -0.216 -0.171 -0.132 -0.113 0.011 0.007 0.005 0.003 0.002 0.001 BR UN Equity BROADRIDGE FINANCIAL SOLUTIO Information Technology 26.39 2.84% 13.09.2013 19.66 18.67 18.09 17.35 0.000 -0.033 -0.066 -0.160 0.000 0.002 0.004 0.004 BRCD UW Equity BROCADE COMMUNICATIONS SYS Information Technology 5.61 34.83 32.10 31.67 32.67 32.87 33.91 -0.160 -0.071 -0.067 -0.118 -0.112 -0.109 0.002 0.005 0.004 0.002 0.004 0.002 BKD UN Equity BROOKDALE SENIOR LIVING INC Health Care 29.35 34.47 34.01 34.34 34.90 -0.238 -0.233 -0.211 -0.173 0.007 0.008 0.006 0.003 BRO UN Equity BROWN & BROWN INC Financials 32.71 1.15% 05.08.2013 19.05 19.01 18.97 19.17 -0.170 -0.170 -0.171 -0.156 0.000 0.000 0.000 0.004 BF/B UN Equity BROWN-FORMAN CORP-CLASS B Consumer Staples 72.53 1.48% 06.06.2013 16.54 16.50 16.48 16.58 -0.186 -0.197 -0.194 -0.156 0.005 0.005 0.004 0.002 BRKR UW Equity BRUKER CORP Health Care 16.89 31.91 32.27 32.67 33.76 -0.160 -0.206 -0.222 -0.200 0.003 0.004 0.005 0.003 BG UN Equity BUNGE LTD Consumer Staples 72.12 1.58% 16.08.2013 17.92 18.78 19.46 20.55 21.34 21.87 -0.348 -0.287 -0.241 -0.192 -0.169 -0.146 0.011 0.010 0.008 0.004 0.002 0.001 CA UW Equity CA INC Information Technology 27.45 3.64% 16.08.2013 18.10 19.82 20.61 21.23 21.15 23.03 -0.180 -0.217 -0.217 -0.150 -0.127 -0.111 0.006 0.006 0.005 0.003 0.002 0.002 CVC UN Equity CABLEVISION SYSTEMS-NY GRP-A Consumer Discretionary 15.56 3.86% 22.08.2013 30.10 32.08 32.97 33.30 33.78 34.43 0.219 0.125 0.066 -0.033 -0.060 -0.085 0.007 0.006 0.005 0.004 0.000 0.000 CBT UN Equity CABOT CORP Materials 38.03 2.26% 28.08.2013 28.08 27.93 27.99 -0.160 -0.103 -0.120 0.002 0.001 0.002 COG UN Equity CABOT OIL & GAS CORP Energy 67.87 0.09% 12.08.2013 32.07 32.30 33.50 35.87 35.70 34.81 -0.231 -0.211 -0.200 -0.184 -0.152 -0.136 0.008 0.006 0.004 0.002 0.001 0.001 CDNS UW Equity CADENCE DESIGN SYS INC Information Technology 14.19 18.61 22.10 23.78 24.69 0.000 -0.157 -0.208 -0.202 0.000 0.005 0.005 0.004 CPN UN Equity CALPINE CORP Utilities 21.15 20.85 21.03 21.29 22.38 22.37 22.33 -0.224 -0.247 -0.247 -0.185 -0.189 -0.141 0.005 0.008 0.008 0.005 0.002 0.002 CPT UN Equity CAMDEN PROPERTY TRUST Financials 74.52 3.42% 28.06.2013 13.72 15.02 15.44 15.15 0.000 -0.037 -0.051 -0.051 0.000 0.000 0.001 0.001 CAM UN Equity CAMERON INTERNATIONAL CORP Energy 63.14 27.52 28.71 29.53 30.86 31.31 31.83 -0.293 -0.272 -0.252 -0.201 -0.167 -0.143 0.007 0.005 0.003 0.002 0.001 0.001 CPB UN Equity CAMPBELL SOUP CO Consumer Staples 47.95 2.50% 11.07.2013 17.57 16.64 16.09 15.76 16.38 16.62 -0.224 -0.249 -0.235 -0.182 -0.084 -0.064 0.005 0.008 0.008 0.005 0.003 0.002 COF UN Equity CAPITAL ONE FINANCIAL CORP Financials 59.65 2.01% 08.08.2013 20.48 23.07 23.08 23.55 25.74 26.43 -0.418 -0.322 -0.259 -0.194 -0.143 -0.121 0.014 0.009 0.007 0.003 0.002 0.001 CSE UN Equity CAPITALSOURCE INC Financials 9.47 1.48% 14.06.2013 21.49 18.23 17.35 0.000 0.004 -0.042 0.000 0.000 0.001 CFFN UW Equity CAPITOL FEDERAL FINANCIAL IN Financials 11.99 2.50% 31.07.2013 13.40 13.40 13.40 13.40 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 CRR UN Equity CARBO CERAMICS INC Energy 70.11 1.71% 01.08.2013 30.98 34.92 36.80 37.91 37.15 37.68 -0.301 -0.211 -0.164 -0.134 -0.059 -0.064 0.011 0.006 0.004 0.001 0.002 0.001 CAH UN Equity CARDINAL HEALTH INC Health Care 46.56 2.72% 25.09.2013 15.02 16.92 17.81 18.01 19.70 19.90 -0.191 -0.201 -0.202 -0.195 -0.146 -0.134 0.004 0.006 0.006 0.004 0.003 0.002 CFN UN Equity CAREFUSION CORP Health Care 33.73 19.87 20.35 20.71 21.26 -0.196 -0.254 -0.270 -0.222 0.004 0.006 0.006 0.004 CSL UN Equity CARLISLE COS INC Industrials 67.06 1.28% 14.08.2013 22.13 22.09 22.23 22.70 -0.381 -0.420 -0.423 -0.349 0.006 0.007 0.008 0.006 KMX UN Equity CARMAX INC Consumer Discretionary 48.19 30.57 28.37 27.41 -0.282 -0.262 -0.238 0.011 0.008 0.005 CCL UN Equity CARNIVAL CORP Consumer Discretionary 35.17 2.99% 21.08.2013 23.03 22.25 22.38 23.40 24.80 26.03 -0.204 -0.243 -0.234 -0.185 -0.148 -0.132 0.005 0.008 0.007 0.004 0.002 0.001 CRS UN Equity CARPENTER TECHNOLOGY Materials 46.92 1.56% 30.08.2013 24.76 26.37 27.27 28.24 -0.303 -0.261 -0.229 -0.168 0.008 0.006 0.005 0.003 CRI UN Equity CARTER'S INC Consumer Discretionary 70.55 0.23% 20.96 22.15 22.98 24.31 -0.288 -0.275 -0.256 -0.196 0.007 0.006 0.005 0.003 CTRX UW Equity CATAMARAN CORP Health Care 53.24 34.65 34.59 34.50 -0.172 -0.208 -0.194 0.007 0.005 0.004 CAT UN Equity CATERPILLAR INC Industrials 86.72 2.42% 18.07.2013 20.53 20.40 22.03 22.39 24.03 25.04 -0.225 -0.181 -0.192 -0.156 -0.114 -0.098 0.018 0.011 0.007 0.004 0.002 0.001 CBL UN Equity CBL & ASSOCIATES PROPERTIES Financials 25.91 3.59% 28.06.2013 18.22 19.31 19.78 19.59 0.000 -0.010 -0.030 -0.098 0.000 0.000 0.001 0.003 CBOE UW Equity CBOE HOLDINGS INC Financials 40.13 1.72% 28.08.2013 17.88 17.79 17.62 17.06 17.09 17.20 -0.215 -0.253 -0.265 -0.234 -0.169 -0.150 0.011 0.010 0.008 0.006 0.004 0.003 CBG UN Equity CBRE GROUP INC - A Financials 24.84 26.09 27.52 28.47 30.26 30.68 30.92 -0.231 -0.260 -0.263 -0.226 -0.159 -0.141 0.006 0.005 0.004 0.002 0.001 0.001 CBS UN Equity CBS CORP-CLASS B NON VOTING Consumer Discretionary 49.97 1.08% 11.06.2013 27.72 27.70 27.85 28.81 27.63 28.59 -0.228 -0.174 -0.147 -0.129 -0.121 -0.108 0.011 0.007 0.005 0.002 0.001 0.001 CE UN Equity CELANESE CORP-SERIES A Materials 48.40 0.79% 18.07.2013 27.77 28.69 29.26 29.99 29.65 29.38 -0.308 -0.250 -0.219 -0.198 -0.193 -0.156 0.008 0.006 0.005 0.002 0.002 0.002 CELG UW Equity CELGENE CORP Health Care 130.10 29.38 29.71 30.05 30.91 32.84 34.42 -0.147 -0.153 -0.142 -0.118 -0.120 -0.116 0.015 0.009 0.006 0.003 0.002 0.001 CNP UN Equity CENTERPOINT ENERGY INC Utilities 24.16 2.61% 16.08.2013 19.19 19.05 19.09 19.52 19.79 20.43 -0.050 -0.165 -0.182 -0.090 -0.068 -0.075 0.001 0.006 0.007 0.004 0.002 0.002 CTL UN Equity CENTURYLINK INC Telecommunication Services 38.00 5.68% 07.06.2013 16.83 16.79 17.23 18.19 19.05 19.45 -0.250 -0.315 -0.278 -0.175 -0.129 -0.111 0.007 0.011 0.010 0.006 0.004 0.003 CERN UW Equity CERNER CORP Health Care 95.94 23.98 26.09 27.12 27.62 28.47 29.10 -0.324 -0.240 -0.197 -0.179 -0.139 -0.120 0.013 0.007 0.004 0.002 0.002 0.001 CF UN Equity CF INDUSTRIES HOLDINGS INC Materials 190.60 0.63% 15.08.2013 26.17 26.92 27.36 28.01 29.12 29.94 -0.228 -0.191 -0.165 -0.146 -0.113 -0.100 0.009 0.006 0.004 0.002 0.001 0.001 CHRW UW Equity C.H. ROBINSON WORLDWIDE INC Industrials 57.31 2.44% 04.09.2013 20.95 23.29 24.32 24.29 24.20 24.65 -0.232 -0.215 -0.201 -0.152 -0.141 -0.128 0.008 0.006 0.004 0.003 0.002 0.001 CRL UN Equity CHARLES RIVER LABORATORIES Health Care 45.67 23.91 25.80 26.74 27.34 -0.183 -0.188 -0.182 -0.152 0.004 0.006 0.006 0.002 SCHW UN Equity SCHWAB (CHARLES) CORP Financials 18.57 1.29% 14.08.2013 23.28 23.97 24.34 24.79 24.04 24.64 -0.135 -0.180 -0.197 -0.186 -0.119 -0.124 0.003 0.003 0.003 0.001 0.002 0.001 CHTR UW Equity CHARTER COMMUNICATION-A Consumer Discretionary 113.88 20.48 21.99 23.01 24.70 -0.120 -0.176 -0.197 -0.186 0.002 0.004 0.004 0.002 LNG UA Equity CHENIERE ENERGY INC Energy 30.49 35.79 36.19 36.43 36.68 37.12 37.74 -0.173 -0.173 -0.169 -0.146 -0.141 -0.122 0.009 0.006 0.004 0.001 0.001 0.000 CHK UN Equity CHESAPEAKE ENERGY CORP Energy 20.64 1.94% 11.07.2013 30.51 30.83 31.54 33.40 35.42 36.14 -0.193 -0.193 -0.193 -0.179 -0.146 -0.129 0.016 0.010 0.007 0.004 0.002 0.002 CVX UN Equity CHEVRON CORP Energy 123.01 2.44% 16.08.2013 13.39 14.48 14.75 15.42 17.20 18.19 -0.401 -0.354 -0.280 -0.214 -0.196 -0.173 0.015 0.013 0.011 0.007 0.004 0.002 CBI UN Equity CHICAGO BRIDGE & IRON CO NV Industrials 57.97 0.35% 20.09.2013 26.81 27.80 28.44 29.28 30.58 31.76 -0.285 -0.229 -0.197 -0.161 -0.128 -0.118 0.011 0.006 0.004 0.002 0.001 0.001 CHS UN Equity CHICO'S FAS INC Consumer Discretionary 19.49 1.15% 12.09.2013 40.83 36.94 34.80 33.56 33.96 34.48 -0.193 -0.167 -0.152 -0.135 -0.117 -0.097 0.005 0.005 0.004 0.002 0.001 0.001 CIM UN Equity CHIMERA INVESTMENT CORP Financials 3.25 11.07% 26.06.2013 24.19 24.21 24.23 21.45 22.72 23.55 0.021 0.021 0.021 0.014 -0.218 -0.064 0.000 0.000 0.000 0.000 0.004 0.002 CMG UN Equity CHIPOTLE MEXICAN GRILL INC Consumer Discretionary 374.49 24.21 26.53 27.81 29.20 29.81 30.58 -0.296 -0.236 -0.201 -0.166 -0.139 -0.126 0.010 0.006 0.004 0.002 0.001 0.001 CHH UN Equity CHOICE HOTELS INTL INC Consumer Discretionary 40.60 1.93% 02.10.2013 17.32 18.52 19.02 18.87 0.000 -0.168 -0.224 -0.171 0.000 0.003 0.004 0.005 CB UN Equity CHUBB CORP Financials 90.10 2.00% 19.06.2013 12.57 12.81 13.50 15.19 -0.475 -0.361 -0.298 -0.232 0.016 0.012 0.009 0.005 CHD UN Equity CHURCH & DWIGHT CO INC Consumer Staples 64.45 1.78% 15.08.2013 14.06 13.28 13.50 -0.079 -0.009 0.003 0.001 0.000 0.000 CI UN Equity CIGNA CORP Health Care 67.72 0.09% 07.03.2014 20.65 20.71 21.16 22.38 23.85 24.74 -0.223 -0.232 -0.209 -0.141 -0.112 -0.094 0.013 0.008 0.005 0.002 0.001 0.000 XEC UN Equity CIMAREX ENERGY CO Energy 69.74 0.83% 14.08.2013 31.05 32.56 33.30 33.72 -0.164 -0.172 -0.173 -0.162 0.010 0.006 0.004 0.002 CINF UW Equity CINCINNATI FINANCIAL CORP Financials 50.20 3.28% 16.09.2013 12.76 13.79 14.51 15.72 0.000 -0.123 -0.167 -0.188 0.000 0.006 0.007 0.006 CNK UN Equity CINEMARK HOLDINGS INC Consumer Discretionary 30.19 2.78% 06.06.2013 18.64 19.51 20.09 21.12 0.000 -0.167 -0.219 -0.163 0.000 0.006 0.007 0.005 CTAS UW Equity CINTAS CORP Industrials 45.27 1.79% 05.11.2013 15.00 17.11 18.00 17.73 19.03 19.22 -0.162 -0.293 -0.313 -0.205 -0.127 -0.108 0.002 0.008 0.009 0.006 0.004 0.003 CSCO UW Equity CISCO SYSTEMS INC Information Technology 21.24 3.63% 02.07.2013 25.88 23.19 24.57 22.70 23.77 24.85 -0.225 -0.243 -0.194 -0.160 -0.123 -0.103 0.011 0.008 0.005 0.004 0.003 0.002 CIT UN Equity CIT GROUP INC Financials 44.42 17.75 17.84 18.58 20.45 21.97 22.71 -0.160 -0.246 -0.213 -0.156 -0.218 -0.194 0.006 0.011 0.010 0.004 0.002 0.001 C UN Equity CITIGROUP INC Financials 50.72 0.45% 08.08.2013 23.37 25.19 25.23 25.20 26.62 27.79 -0.402 -0.313 -0.257 -0.197 -0.140 -0.127 0.013 0.009 0.005 0.003 0.002 0.002 CTXS UW Equity CITRIX SYSTEMS INC Information Technology 65.57 27.20 29.14 30.12 30.84 30.09 30.97 -0.057 -0.107 -0.132 -0.148 -0.115 -0.107 0.005 0.003 0.002 0.001 0.000 0.000 CYN UN Equity CITY NATIONAL CORP Financials 60.33 2.15% 29.07.2013 15.93 16.36 17.15 19.90 -0.173 -0.350 -0.377 -0.252 0.003 0.011 0.011 0.004 CLH UN Equity CLEAN HARBORS INC Industrials 55.24 27.68 28.41 29.22 -0.207 -0.233 -0.223 0.002 0.007 0.007 CCO UN Equity CLEAR CHANNEL OUTDOOR-CL A Consumer Discretionary 8.02 40.51 38.83 37.69 35.97 0.000 -0.005 -0.031 -0.139 0.000 -0.003 -0.003 0.003 CLWR UW Equity CLEARWIRE CORP-CLASS A Telecommunication Services 3.21 46.98 41.86 38.13 30.82 23.55 19.31 0.121 0.072 0.045 -0.035 -0.011 -0.011 0.001 0.007 0.009 0.009 0.013 0.011 CLF UN Equity CLIFFS NATURAL RESOURCES INC Materials 21.64 2.77% 15.08.2013 54.90 55.02 55.06 54.77 53.01 51.70 -0.178 -0.167 -0.150 -0.132 -0.107 -0.091 0.007 0.004 0.003 0.002 0.001 0.001 CLX UN Equity CLOROX COMPANY Consumer Staples 87.78 3.24% 21.10.2013 13.19 13.44 13.65 14.16 15.18 15.57 -0.253 -0.335 -0.310 -0.221 -0.163 -0.137 0.005 0.010 0.009 0.005 0.003 0.002 CME UW Equity CME GROUP INC Financials 63.39 2.84% 07.06.2013 16.34 16.67 17.15 18.47 19.77 20.34 -0.309 -0.284 -0.263 -0.216 -0.149 -0.133 0.009 0.008 0.007 0.005 0.003 0.002 CMS UN Equity CMS ENERGY CORP Utilities 28.88 3.70% 31.07.2013 16.10 16.04 15.99 15.64 -0.162 -0.162 -0.161 -0.166 0.002 0.002 0.002 0.005 CNA UN Equity CNA FINANCIAL CORP Financials 34.97 2.43% 13.08.2013 16.04 16.82 17.32 17.80 0.000 0.019 0.004 -0.101 0.000 0.000 0.000 0.003 CNH UN Equity CNH GLOBAL N.V. Industrials 42.74 05.04.2014 29.10 29.46 29.94 31.31 -0.076 -0.128 -0.156 -0.179 0.006 0.006 0.005 0.004 COH UN Equity COACH INC Consumer Discretionary 58.79 2.30% 06.06.2013 23.07 27.05 28.78 29.19 28.54 29.12 -0.200 -0.199 -0.189 -0.137 -0.123 -0.103 0.012 0.006 0.003 0.001 0.001 0.001 CIE UN Equity COBALT INTERNATIONAL ENERGY Energy 26.91 31.74 36.52 40.89 46.78 46.10 43.52 -0.138 -0.126 -0.135 -0.155 -0.132 -0.109 0.011 0.007 0.005 0.002 0.001 0.000 KO UN Equity COCA-COLA CO/THE Consumer Staples 42.77 2.67% 11.09.2013 13.83 14.89 15.03 15.44 16.60 18.01 -0.420 -0.318 -0.239 -0.172 -0.129 -0.109 0.017 0.011 0.009 0.005 0.003 0.002 CCE UN Equity COCA-COLA ENTERPRISES Consumer Staples 38.57 2.15% 04.09.2013 16.63 17.62 18.25 18.86 19.46 20.37 -0.195 -0.263 -0.273 -0.193 -0.155 -0.121 0.004 0.008 0.008 0.004 0.002 0.002 CTSH UW Equity COGNIZANT TECH SOLUTIONS-A Information Technology 62.58 32.74 31.96 32.29 33.47 33.69 33.84 -0.225 -0.177 -0.147 -0.125 -0.126 -0.108 0.008 0.007 0.005 0.002 0.001 0.001 CFX UN Equity COLFAX CORP Industrials 48.07 22.68 24.07 24.93 26.14 -0.172 -0.197 -0.204 -0.201 0.003 0.005 0.006 0.004 CL UN Equity COLGATE-PALMOLIVE CO Consumer Staples 124.00 2.25% 26.07.2013 14.14 15.16 15.49 15.42 16.63 17.48 -0.645 -0.486 -0.381 -0.266 -0.196 -0.160 0.020 0.015 0.011 0.007 0.003 0.002 CMCSA UW EquityCOMCAST CORP-CLASS A Consumer Discretionary 43.17 1.92% 01.07.2013 17.03 17.36 18.35 20.38 22.06 23.52 -0.378 -0.299 -0.242 -0.173 -0.133 -0.105 0.016 0.011 0.008 0.004 0.002 0.001 CMA UN Equity COMERICA INC Financials 39.13 1.87% 11.09.2013 18.29 20.68 21.38 21.89 23.62 24.44 -0.441 -0.332 -0.280 -0.231 -0.195 -0.175 0.015 0.010 0.007 0.004 0.002 0.001 CBSH UW Equity COMMERCE BANCSHARES INC Financials 41.69 2.16% 04.09.2013 32.99 27.48 23.66 22.54 0.000 -0.001 -0.004 0.345 0.000 -0.001 0.000 0.010 CMC UN Equity COMMERCIAL METALS CO Materials 15.18 3.16% 11.07.2013 25.73 27.41 28.35 29.36 -0.198 -0.270 -0.286 -0.219 0.003 0.003 0.003 0.002 CWH UN Equity COMMONWEALTH REIT Financials 20.11 4.98% 26.07.2013 37.99 41.88 41.78 -0.166 -0.153 -0.107 0.002 0.009 0.008 CYH UN Equity COMMUNITY HEALTH SYSTEMS INC Health Care 45.48 28.00 29.43 30.27 31.27 -0.279 -0.221 -0.186 -0.147 0.009 0.006 0.004 0.002 CMP UN Equity COMPASS MINERALS INTERNATION Materials 88.75 2.53% 30.08.2013 16.02 18.10 19.11 19.69 -0.341 -0.277 -0.226 -0.135 0.012 0.006 0.004 0.007 CSC UN Equity COMPUTER SCIENCES CORP Information Technology 46.50 1.72% 12.06.2013 37.88 35.65 34.21 32.30 30.38 30.18 -0.255 -0.249 -0.241 -0.196 -0.173 -0.139 0.007 0.004 0.003 0.002 0.001 0.001 CPWR UW Equity COMPUWARE CORP Information Technology 11.26 37.55 34.99 32.62 27.34 0.000 -0.176 -0.219 -0.059 0.000 0.002 0.002 0.004 CNW UN Equity CON-WAY INC Industrials 36.13 0.83% 15.08.2013 28.23 29.68 30.78 32.90 -0.319 -0.275 -0.243 -0.186 0.007 0.006 0.005 0.003 CAG UN Equity CONAGRA FOODS INC Consumer Staples 35.97 2.95% 31.07.2013 14.72 15.13 15.35 15.63 15.68 15.84 -0.249 -0.268 -0.266 -0.224 -0.185 -0.146 0.006 0.008 0.008 0.006 0.003 0.002 CXO UN Equity CONCHO RESOURCES INC Energy 81.12 31.31 32.55 33.20 33.66 33.43 33.73 -0.260 -0.234 -0.216 -0.175 -0.192 -0.172 0.008 0.006 0.004 0.003 0.002 0.001 CNQR UW Equity CONCUR TECHNOLOGIES INC Information Technology 83.48 24.77 27.13 28.15 28.41 -0.315 -0.258 -0.225 -0.190 0.009 0.006 0.005 0.002 COP UN Equity CONOCOPHILLIPS Energy 62.14 4.30% 25.07.2013 15.99 15.86 16.08 16.94 18.53 19.23 -0.441 -0.310 -0.242 -0.184 -0.158 -0.133 0.015 0.013 0.011 0.006 0.003 0.002 CNX UN Equity CONSOL ENERGY INC Energy 33.89 1.48% 07.08.2013 34.13 34.33 34.72 35.59 37.04 38.36 -0.316 -0.290 -0.251 -0.177 -0.139 -0.124 0.012 0.007 0.005 0.002 0.001 0.001 ED UN Equity CONSOLIDATED EDISON INC Utilities 60.65 4.06% 12.08.2013 11.57 11.98 12.13 12.40 13.25 13.78 -0.106 -0.141 -0.162 -0.198 -0.149 -0.125 0.001 0.002 0.003 0.006 0.003 0.002 STZ UN Equity CONSTELLATION BRANDS INC-A Consumer Staples 50.33 24.29 25.27 25.74 25.85 26.30 27.53 -0.088 -0.216 -0.228 -0.174 -0.147 -0.144 0.006 0.007 0.005 0.002 0.001 0.000 CLR UN Equity CONTINENTAL RESOURCES INC/OK Energy 83.51 29.54 30.43 30.96 31.60 32.18 32.81 -0.198 -0.176 -0.165 -0.156 -0.160 -0.137 0.007 0.005 0.003 0.002 0.001 0.001 COO UN Equity COOPER COS INC/THE Health Care 111.62 0.05% 18.07.2013 25.22 22.75 21.61 21.93 -0.254 -0.228 -0.207 -0.164 0.006 0.006 0.006 0.005 CPA UN Equity COPA HOLDINGS SA-CLASS A Industrials 139.82 29.05.2014 24.49 25.18 25.58 26.02 -0.122 -0.146 -0.154 -0.140 0.002 0.002 0.002 0.001 CPRT UW Equity COPART INC Industrials 36.79 37.50 34.62 32.98 31.80 -0.120 -0.116 -0.116 -0.128 0.009 0.007 0.005 0.002 CLGX UN Equity CORELOGIC INC Information Technology 28.15 28.73 26.66 26.81 -0.172 -0.202 -0.216 0.002 0.008 0.009 GLW UN Equity CORNING INC Information Technology 15.65 2.62% 30.08.2013 20.98 20.81 23.59 24.15 24.94 25.74 -0.128 -0.120 -0.145 -0.118 -0.093 -0.086 0.007 0.008 0.006 0.003 0.002 0.002 OFC UN Equity CORPORATE OFFICE PROPERTIES Financials 29.10 3.78% 26.09.2013 14.51 16.05 16.85 17.51 0.000 -0.058 -0.087 -0.116 0.000 0.001 0.002 0.003 CXW UN Equity CORRECTIONS CORP OF AMERICA Financials 38.76 4.64% 01.07.2013 17.37 19.39 20.39 21.14 22.16 23.45 -0.152 -0.267 -0.286 -0.151 -0.148 -0.097 0.002 0.005 0.006 0.004 0.003 0.002 COST UW Equity COSTCO WHOLESALE CORP Consumer Staples 112.33 1.14% 07.08.2013 16.36 15.75 15.73 16.47 17.80 19.02 -0.381 -0.330 -0.269 -0.189 -0.158 -0.135 0.014 0.011 0.009 0.006 0.003 0.002 CVD UN Equity COVANCE INC Health Care 77.12 17.14 19.33 20.24 20.36 -0.220 -0.204 -0.189 -0.148 0.003 0.004 0.005 0.004 CVA UN Equity COVANTA HOLDING CORP Industrials 20.33 3.27% 21.06.2013 18.17 18.70 18.95 19.08 0.000 -0.054 -0.088 -0.131 0.000 0.001 0.002 0.005 COV UN Equity COVIDIEN PLC Health Care 66.13 1.71% 01.08.2013 16.70 16.64 17.23 18.81 20.70 22.04 -0.125 -0.220 -0.218 -0.163 -0.162 -0.140 0.004 0.008 0.008 0.005 0.002 0.001 BCR UN Equity CR BARD INC Health Care 106.58 0.79% 18.07.2013 16.32 15.80 15.83 -0.222 -0.326 -0.339 0.005 0.007 0.007 Option Implied Volatility Skew Parameters by Terms: IVt = atx + btx2 + ct At The Money Implied Volatilities by Terms Russell1000Index Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 15.05.2013 Ticker Name GICS_SECTOR_NAME ATM2 Ref Dividend Yield Next Ex- Dividend Date ATM2 Vol - 30D ATM2 Vol - 60D ATM2 Vol - 90D ATM2 Vol - 6M ATM2 Vol - 12M ATM2 Vol - 18M ATM2 Vol - 24M Skew (a) - 30D Skew (a) - 60D Skew (a) - 90D Skew (a) - 6M Skew (a) - 12M Skew (a) - 18M Skew (a) - 24M Skew (b) - 30D Skew (b) - 60D Skew (b) - 90D Skew (b) - 6M Skew (b) - 12M Skew (b) - 18M Skew (b) - 24M CR UN Equity CRANE CO Industrials 59.67 1.98% 28.08.2013 18.07 18.79 19.48 21.02 -0.075 -0.289 -0.358 -0.287 0.001 0.009 0.011 0.007 CREE UW Equity CREE INC Information Technology 60.07 37.68 40.77 42.24 42.88 41.50 40.82 -0.073 -0.121 -0.138 -0.115 -0.119 -0.104 0.009 0.005 0.003 0.001 0.000 0.000 CCI UN Equity CROWN CASTLE INTL CORP Telecommunication Services 79.62 18.44 17.66 17.96 19.46 -0.184 -0.234 -0.230 -0.183 0.006 0.008 0.008 0.004 CCK UN Equity CROWN HOLDINGS INC Materials 44.00 15.69 17.07 17.31 -0.223 -0.236 -0.239 0.005 0.004 0.005 CST UN Equity CST BRANDS INC Consumer Discretionary 33.24 33.84 33.82 33.02 31.98 0.410 0.157 0.048 0.045 -0.003 0.002 0.004 0.004 CSX UN Equity CSX CORP Industrials 25.92 2.31% 30.08.2013 18.63 19.66 20.40 21.46 22.81 24.26 -0.224 -0.239 -0.240 -0.206 -0.156 -0.136 0.005 0.007 0.007 0.004 0.003 0.001 CFR UN Equity CULLEN/FROST BANKERS INC Financials 63.00 3.17% 30.08.2013 13.12 13.00 13.81 -0.063 -0.064 -0.129 0.000 0.001 0.003 CMI UN Equity CUMMINS INC Industrials 114.14 2.36% 14.08.2013 23.63 24.97 25.93 27.56 29.42 30.71 -0.325 -0.245 -0.202 -0.166 -0.135 -0.113 0.011 0.007 0.005 0.003 0.002 0.001 CVS UN Equity CVS CAREMARK CORP Consumer Staples 59.89 1.60% 25.07.2013 15.91 17.01 17.56 17.98 19.39 20.23 -0.535 -0.417 -0.339 -0.252 -0.202 -0.169 0.019 0.014 0.010 0.006 0.003 0.002 CY UW Equity CYPRESS SEMICONDUCTOR CORP Information Technology 11.09 3.97% 24.09.2013 31.04 33.38 34.50 35.40 36.98 38.30 -0.470 -0.292 -0.196 -0.136 -0.140 -0.120 0.013 0.007 0.004 0.002 0.000 0.000 CYT UN Equity CYTEC INDUSTRIES INC Materials 71.65 0.77% 09.08.2013 23.25 25.21 25.98 25.88 -0.204 -0.190 -0.193 -0.228 0.004 0.003 0.003 0.004 DHR UN Equity DANAHER CORP Industrials 61.87 0.19% 02.10.2013 15.28 16.47 17.28 18.64 20.13 21.40 -0.305 -0.289 -0.273 -0.232 -0.168 -0.147 0.007 0.007 0.007 0.005 0.003 0.002 DRI UN Equity DARDEN RESTAURANTS INC Consumer Discretionary 53.97 4.15% 10.07.2013 21.02 20.30 20.42 21.59 22.43 22.64 -0.308 -0.297 -0.248 -0.166 -0.146 -0.133 0.009 0.009 0.007 0.003 0.001 0.001 DVA UN Equity DAVITA HEALTHCARE PARTNERS I Health Care 129.82 19.51 20.48 21.19 -0.416 -0.243 -0.183 0.014 0.013 0.009 DDR UN Equity DDR CORP Financials 19.32 2.87% 13.09.2013 15.87 15.85 15.83 -0.224 -0.219 -0.213 0.009 0.009 0.009 DF UN Equity DEAN FOODS CO Consumer Staples 19.98 26.41 29.15 30.40 31.26 32.07 32.50 -0.173 -0.205 -0.216 -0.208 -0.136 -0.115 0.002 0.001 0.001 0.002 0.002 0.001 DECK UW Equity DECKERS OUTDOOR CORP Consumer Discretionary 55.25 36.90 37.25 39.72 42.45 43.10 43.25 -0.199 -0.175 -0.169 -0.146 -0.143 -0.128 0.010 0.005 0.003 0.001 0.001 0.000 DE UN Equity DEERE & CO Industrials 88.88 2.34% 28.06.2013 22.27 21.13 20.67 21.04 23.10 24.25 -0.342 -0.283 -0.241 -0.185 -0.131 -0.115 0.011 0.008 0.007 0.004 0.003 0.001 DELL UW Equity DELL INC Information Technology 13.46 0.59% 27.06.2013 17.78 17.91 16.89 15.73 16.51 16.02 -0.270 -0.404 -0.256 -0.278 -0.119 -0.122 0.016 0.015 0.021 0.012 0.006 0.004 DLPH UN Equity DELPHI AUTOMOTIVE PLC Consumer Discretionary 46.39 1.51% 12.06.2013 21.39 23.52 24.61 25.36 26.48 27.59 -0.219 -0.247 -0.243 -0.166 -0.137 -0.113 0.006 0.005 0.004 0.003 0.001 0.001 DAL UN Equity DELTA AIR LINES INC Industrials 19.30 1.24% 06.11.2013 37.75 39.31 40.22 41.26 42.16 42.77 -0.262 -0.250 -0.234 -0.188 -0.150 -0.142 0.013 0.008 0.006 0.003 0.002 0.001 DNR UN Equity DENBURY RESOURCES INC Energy 18.21 28.67 30.11 30.83 31.05 33.56 33.60 -0.001 -0.082 -0.124 -0.162 -0.148 -0.132 0.007 0.006 0.005 0.003 0.002 0.001 XRAY UW Equity DENTSPLY INTERNATIONAL INC Health Care 42.75 0.60% 26.06.2013 18.70 16.59 16.53 -0.182 -0.326 -0.303 0.001 0.012 0.011 DVN UN Equity DEVON ENERGY CORPORATION Energy 58.65 1.50% 13.09.2013 23.95 24.98 25.46 25.71 26.21 27.08 -0.165 -0.155 -0.149 -0.134 -0.114 -0.104 0.019 0.011 0.006 0.003 0.002 0.001 DV UN Equity DEVRY INC Consumer Discretionary 30.12 1.20% 21.06.2013 30.33 34.44 36.33 37.10 -0.281 -0.230 -0.198 -0.137 0.008 0.005 0.004 0.002 DO UN Equity DIAMOND OFFSHORE DRILLING Energy 69.74 0.72% 01.08.2013 19.28 20.57 21.36 22.45 23.30 24.01 -0.337 -0.342 -0.328 -0.251 -0.165 -0.145 0.009 0.005 0.004 0.002 0.002 0.001 DKS UN Equity DICK'S SPORTING GOODS INC Consumer Discretionary 52.86 0.95% 03.06.2013 30.55 28.04 26.70 26.06 26.23 26.78 -0.357 -0.271 -0.216 -0.153 -0.144 -0.121 0.009 0.006 0.004 0.002 0.001 0.001 DBD UN Equity DIEBOLD INC Information Technology 30.53 2.84% 30.08.2013 19.77 21.64 22.48 22.69 0.000 -0.087 -0.112 -0.083 0.000 0.003 0.003 0.002 DLR UN Equity DIGITAL REALTY TRUST INC Financials 65.04 4.89% 13.09.2013 23.94 23.90 23.93 -0.334 -0.280 -0.243 0.009 0.009 0.008 DDS UN Equity DILLARDS INC-CL A Consumer Discretionary 88.50 0.23% 28.06.2013 31.18 29.98 29.31 28.79 29.41 29.63 -0.243 -0.220 -0.204 -0.183 -0.140 -0.123 0.006 0.004 0.003 0.001 0.001 0.001 DTV UW Equity DIRECTV Consumer Discretionary 64.50 21.20 21.48 21.75 22.60 22.70 24.31 -0.254 -0.211 -0.184 -0.153 -0.138 -0.122 0.014 0.010 0.008 0.004 0.002 0.002 DFS UN Equity DISCOVER FINANCIAL SERVICES Financials 47.18 1.78% 02.07.2013 21.18 21.43 22.20 24.12 26.02 26.70 -0.438 -0.313 -0.250 -0.195 -0.134 -0.120 0.015 0.011 0.007 0.003 0.002 0.001 DISCA UW Equity DISCOVERY COMMUNICATIONS-A Consumer Discretionary 79.00 21.07 21.32 21.87 -0.295 -0.269 -0.235 0.010 0.009 0.008 DISH UW Equity DISH NETWORK CORP-A Consumer Discretionary 39.01 36.57 35.81 35.56 36.09 35.82 35.80 -0.211 -0.182 -0.166 -0.154 -0.140 -0.115 0.012 0.007 0.004 0.002 0.002 0.001 DLB UN Equity DOLBY LABORATORIES INC-CL A Information Technology 34.52 23.37 25.79 27.15 28.61 -0.171 -0.161 -0.153 -0.135 0.007 0.007 0.006 0.004 DG UN Equity DOLLAR GENERAL CORP Consumer Discretionary 53.11 27.74 25.58 24.68 25.52 25.57 25.78 -0.106 -0.148 -0.166 -0.143 -0.067 -0.069 0.004 0.004 0.004 0.002 0.000 0.001 DLTR UW Equity DOLLAR TREE INC Consumer Discretionary 49.52 28.97 27.54 26.84 26.77 26.73 26.31 -0.226 -0.204 -0.186 -0.151 -0.138 -0.127 0.009 0.006 0.005 0.002 0.002 0.001 D UN Equity DOMINION RESOURCES INC/VA Utilities 60.47 3.78% 28.08.2013 12.66 12.72 12.97 -0.227 -0.302 -0.292 0.005 0.010 0.010 UFS UN Equity DOMTAR CORP Materials 73.98 2.97% 17.09.2013 26.64 27.24 27.61 -0.275 -0.264 -0.226 0.012 0.010 0.009 DCI UN Equity DONALDSON CO INC Industrials 38.39 1.20% 05.06.2013 20.81 22.12 22.14 21.35 -0.213 -0.251 -0.253 -0.205 0.004 0.006 0.007 0.005 DEI UN Equity DOUGLAS EMMETT INC Financials 27.37 2.70% 26.06.2013 18.29 18.29 17.40 0.000 0.000 -0.069 0.000 0.000 0.002 DOV UN Equity DOVER CORP Industrials 75.68 1.99% 28.08.2013 17.93 19.00 19.76 20.94 -0.508 -0.350 -0.267 -0.220 0.018 0.012 0.008 0.004 DOW UN Equity DOW CHEMICAL CO/THE Materials 35.50 3.86% 30.09.2013 22.22 22.96 23.40 23.92 24.79 25.18 -0.443 -0.336 -0.270 -0.206 -0.153 -0.134 0.015 0.010 0.007 0.004 0.002 0.002 DHI UN Equity DR HORTON INC Consumer Discretionary 27.42 0.27% 10.02.2014 30.88 32.51 33.41 34.34 34.31 35.07 -0.263 -0.238 -0.213 -0.156 -0.083 -0.074 0.013 0.008 0.005 0.002 0.001 0.000 DPS UN Equity DR PEPPER SNAPPLE GROUP INC Consumer Staples 49.69 3.12% 20.06.2013 16.04 17.23 17.95 18.15 -0.167 -0.176 -0.176 -0.151 0.003 0.005 0.005 0.005 DWA UW Equity DREAMWORKS ANIMATION SKG-A Consumer Discretionary 21.99 26.19 29.62 31.27 32.29 -0.057 -0.097 -0.112 -0.105 0.005 0.004 0.003 0.002 DRC UN Equity DRESSER-RAND GROUP INC Energy 62.36 36.26 35.79 35.50 35.12 0.013 -0.013 -0.032 -0.065 0.008 0.005 0.003 0.002 DST UN Equity DST SYSTEMS INC Information Technology 69.94 2.18% 09.08.2013 15.50 16.85 17.56 18.40 -0.104 -0.150 -0.176 -0.210 0.002 0.003 0.004 0.006 DSW UN Equity DSW INC-CLASS A Consumer Discretionary 70.24 1.03% 18.06.2013 31.32 29.33 28.64 -0.144 -0.220 -0.242 0.015 0.005 0.001 DTE UN Equity DTE ENERGY COMPANY Utilities 71.02 3.69% 12.09.2013 13.63 13.24 13.28 -0.202 -0.281 -0.295 0.004 0.007 0.008 DUK UN Equity DUKE ENERGY CORP Utilities 71.81 4.34% 14.08.2013 12.36 12.45 12.55 13.13 14.73 16.49 -0.193 -0.274 -0.264 -0.205 -0.155 -0.126 0.005 0.009 0.008 0.006 0.004 0.002 DRE UN Equity DUKE REALTY CORP Financials 18.47 2.76% 15.08.2013 18.80 18.20 17.77 16.83 0.000 -0.007 -0.006 0.019 0.000 -0.001 -0.001 0.003 DNB UN Equity DUN & BRADSTREET CORP Industrials 96.63 1.69% 28.08.2013 18.87 21.13 21.94 21.37 -0.113 -0.150 -0.160 -0.138 0.002 0.004 0.004 0.003 DNKN UW Equity DUNKIN' BRANDS GROUP INC Consumer Discretionary 42.10 2.45% 08.08.2013 19.92 21.37 22.38 24.25 24.88 26.25 -0.261 -0.182 -0.136 -0.096 -0.080 -0.067 0.010 0.006 0.004 0.003 -0.001 0.000 ETFC UW Equity E*TRADE FINANCIAL CORP Financials 11.35 29.06 30.47 30.80 30.86 31.94 32.56 -0.206 -0.218 -0.205 -0.170 -0.138 -0.130 0.013 0.009 0.006 0.003 0.001 0.001 EWBC UW Equity EAST WEST BANCORP INC Financials 25.21 2.62% 09.08.2013 17.47 18.78 19.20 0.000 -0.104 -0.129 0.000 0.002 0.003 EMN UN Equity EASTMAN CHEMICAL CO Materials 69.38 1.84% 12.09.2013 26.02 27.03 27.61 28.14 28.49 29.36 -0.300 -0.280 -0.265 -0.216 -0.170 -0.147 0.016 0.009 0.005 0.003 0.002 0.001 ETN UN Equity EATON CORP PLC Industrials 64.96 2.71% 08.08.2013 22.14 22.12 22.45 23.54 25.56 26.75 -0.307 -0.290 -0.266 -0.225 -0.193 -0.170 0.007 0.008 0.007 0.003 0.001 0.001 EV UN Equity EATON VANCE CORP Financials 42.91 1.93% 31.07.2013 23.75 22.64 22.43 23.88 -0.026 -0.186 -0.249 -0.248 0.000 0.007 0.009 0.006 EBAY UW Equity EBAY INC Information Technology 56.49 22.59 26.00 27.22 28.07 29.85 31.19 -0.289 -0.241 -0.195 -0.135 -0.114 -0.097 0.013 0.008 0.005 0.002 0.002 0.001 SATS UW Equity ECHOSTAR CORP-A Information Technology 39.60 24.90 23.76 24.22 -0.128 -0.139 -0.141 0.002 0.003 0.003 ECL UN Equity ECOLAB INC Materials 88.08 1.14% 20.09.2013 15.73 15.44 15.79 -0.256 -0.278 -0.271 0.006 0.008 0.007 EIX UN Equity EDISON INTERNATIONAL Utilities 49.30 2.85% 26.09.2013 15.49 15.22 15.30 -0.196 -0.294 -0.278 0.004 0.009 0.009 EW UN Equity EDWARDS LIFESCIENCES CORP Health Care 71.83 25.04 29.39 31.03 30.70 29.72 29.72 0.001 -0.051 -0.074 -0.079 -0.065 -0.072 0.009 0.004 0.002 0.002 0.002 0.001 DD UN Equity DU PONT (E.I.) DE NEMOURS Materials 55.33 2.49% 15.08.2013 17.37 17.44 17.80 18.68 19.87 20.61 -0.382 -0.290 -0.248 -0.206 -0.157 -0.140 0.015 0.014 0.011 0.006 0.004 0.002 EA UW Equity ELECTRONIC ARTS INC Information Technology 22.66 36.38 36.14 36.01 35.99 35.21 35.30 -0.270 -0.212 -0.177 -0.138 -0.119 -0.105 0.008 0.005 0.003 0.002 0.001 0.001 LLY UN Equity ELI LILLY & CO Health Care 56.64 3.46% 15.08.2013 16.29 17.67 18.35 19.04 19.94 20.49 -0.385 -0.267 -0.211 -0.164 -0.128 -0.110 0.018 0.014 0.010 0.004 0.002 0.001 EMC UN Equity EMC CORP/MA Information Technology 22.89 21.76 22.49 22.75 23.14 24.86 26.43 -0.303 -0.235 -0.197 -0.154 -0.118 -0.098 0.017 0.012 0.009 0.004 0.002 0.001 EMR UN Equity EMERSON ELECTRIC CO Industrials 58.54 3.01% 14.08.2013 16.46 17.73 18.19 19.26 20.43 21.62 -0.495 -0.406 -0.323 -0.231 -0.206 -0.166 0.016 0.012 0.009 0.005 0.003 0.002 ENDP UW Equity ENDO HEALTH SOLUTIONS INC Health Care 33.47 36.97 36.02 35.63 35.44 34.80 34.21 -0.219 -0.206 -0.163 -0.102 -0.121 -0.096 0.005 -0.001 -0.002 0.001 0.001 0.001 ENH UN Equity ENDURANCE SPECIALTY HOLDINGS Financials 50.99 2.53% 14.06.2013 14.92 15.57 16.13 0.000 -0.152 -0.154 0.000 0.004 0.004 EGN UN Equity ENERGEN CORP Energy 51.09 0.86% 15.08.2013 24.03 22.90 22.94 -0.214 -0.220 -0.221 0.006 0.004 0.003 ENR UN Equity ENERGIZER HOLDINGS INC Consumer Staples 101.60 1.57% 16.08.2013 18.58 22.32 23.67 23.57 -0.304 -0.261 -0.224 -0.149 0.009 0.007 0.006 0.003 EGL UN Equity ENGILITY HOLDINGS INC Industrials 23.62 ETR UN Equity ENTERGY CORP Utilities 69.18 4.80% 06.08.2013 15.79 15.18 15.08 15.97 -0.149 -0.179 -0.182 -0.122 0.002 0.005 0.006 0.002 EOG UN Equity EOG RESOURCES INC Energy 135.44 0.57% 16.10.2013 28.84 28.34 28.42 28.85 28.68 28.49 -0.241 -0.236 -0.228 -0.209 -0.191 -0.181 0.010 0.007 0.005 0.003 0.002 0.001 EQT UN Equity EQT CORP Energy 76.86 0.16% 07.08.2013 24.85 25.52 25.79 25.65 -0.387 -0.302 -0.258 -0.232 0.010 0.008 0.006 0.004 EFX UN Equity EQUIFAX INC Industrials 63.67 1.43% 30.08.2013 16.90 18.21 18.69 -0.091 -0.064 -0.088 0.001 0.001 0.002 EQIX UW Equity EQUINIX INC Information Technology 230.86 25.63 27.05 28.04 29.91 30.59 30.99 -0.309 -0.248 -0.209 -0.157 -0.109 -0.087 0.012 0.008 0.006 0.003 0.001 0.000 ELS UN Equity EQUITY LIFESTYLE PROPERTIES Financials 83.49 2.44% 25.09.2013 18.12 19.07 19.97 15.82 -0.381 -0.385 -0.386 -0.171 0.005 0.004 0.004 0.002 EQR UN Equity EQUITY RESIDENTIAL Financials 59.15 3.13% 19.06.2013 15.82 15.70 16.13 -0.221 -0.215 -0.211 0.004 0.006 0.006 ERA UN Equity ERA GROUP INC Energy 26.13 ERIE UW Equity ERIE INDEMNITY COMPANY-CL A Financials 81.38 3.01% 04.10.2013 ESS UN Equity ESSEX PROPERTY TRUST INC Financials 165.18 2.98% 28.06.2013 12.60 12.69 13.22 -0.106 -0.130 -0.164 0.001 0.003 0.005 EL UN Equity ESTEE LAUDER COMPANIES-CL A Consumer Staples 71.84 1.04% 24.09.2013 22.18 21.75 22.23 23.32 23.51 23.81 -0.642 -0.439 -0.314 -0.209 -0.155 -0.126 0.015 0.010 0.007 0.004 0.002 0.001 RE UN Equity EVEREST RE GROUP LTD Financials 136.25 1.46% 22.05.2013 14.92 15.07 15.54 -0.157 -0.119 -0.122 0.002 0.002 0.003 XCO UN Equity EXCO RESOURCES INC Energy 7.94 2.52% 14.06.2013 41.26 43.45 44.58 45.75 45.17 46.65 -0.373 -0.259 -0.185 -0.112 -0.051 -0.032 0.017 0.010 0.006 0.002 0.001 0.000 XLS UN Equity EXELIS INC Industrials 11.84 3.49% 28.08.2013 26.06 27.04 26.92 0.000 -0.296 -0.296 0.000 0.005 0.005 EXC UN Equity EXELON CORP Utilities 35.08 2.65% 16.08.2013 16.17 16.13 16.15 16.37 17.17 17.66 -0.213 -0.229 -0.232 -0.202 -0.145 -0.115 0.004 0.006 0.007 0.007 0.004 0.003 EXPE UW Equity EXPEDIA INC Consumer Discretionary 60.94 0.90% 28.08.2013 32.79 32.80 34.46 37.72 38.76 39.72 -0.180 -0.179 -0.166 -0.140 -0.128 -0.110 0.007 0.005 0.003 0.001 0.001 0.001 EXPD UW Equity EXPEDITORS INTL WASH INC Industrials 38.66 1.55% 03.12.2013 22.79 24.78 25.54 25.07 24.88 26.08 -0.098 -0.111 -0.121 -0.122 -0.109 -0.095 0.008 0.006 0.005 0.003 0.002 0.001 ESRX UW Equity EXPRESS SCRIPTS HOLDING CO Health Care 61.00 20.09 19.84 22.60 23.69 24.51 25.60 -0.289 -0.248 -0.212 -0.170 -0.135 -0.115 0.015 0.008 0.007 0.003 0.001 0.001 EXR UN Equity EXTRA SPACE STORAGE INC Financials 43.94 2.37% 14.06.2013 14.99 15.73 16.25 17.24 0.000 -0.027 -0.042 -0.060 0.000 0.001 0.001 0.000 XOM UN Equity EXXON MOBIL CORP Energy 90.87 2.91% 08.08.2013 13.17 13.38 13.54 14.02 15.53 16.61 -0.563 -0.422 -0.339 -0.260 -0.213 -0.172 0.018 0.014 0.011 0.008 0.004 0.003 FFIV UW Equity F5 NETWORKS INC Information Technology 78.01 30.66 32.77 34.76 37.28 38.17 39.06 -0.108 -0.123 -0.117 -0.100 -0.099 -0.086 0.010 0.006 0.004 0.001 0.001 0.000 FB UW Equity FACEBOOK INC-A Information Technology 26.87 27.90 28.37 30.80 34.35 33.04 34.78 -0.192 -0.194 -0.155 -0.091 -0.079 -0.072 0.013 0.007 0.004 0.001 0.002 0.001 FDS UN Equity FACTSET RESEARCH SYSTEMS INC Information Technology 97.72 1.43% 28.08.2013 26.02 23.99 23.03 23.07 -0.364 -0.288 -0.243 -0.218 0.010 0.008 0.006 0.004 FCS UN Equity FAIRCHILD SEMICONDUCTOR INTE Information Technology 14.74 33.11 33.63 33.96 34.29 -0.256 -0.308 -0.299 -0.180 0.000 0.005 0.006 0.003 FDO UN Equity FAMILY DOLLAR STORES Consumer Discretionary 65.11 1.64% 12.06.2013 23.10 25.02 25.52 25.49 25.79 25.88 -0.113 -0.073 -0.072 -0.087 -0.091 -0.099 0.003 0.003 0.002 0.001 0.000 0.000 FAST UW Equity FASTENAL CO Industrials 51.86 1.66% 26.07.2013 21.62 23.15 23.92 24.65 25.29 25.71 -0.288 -0.276 -0.262 -0.234 -0.186 -0.156 0.008 0.006 0.005 0.003 0.002 0.001 FRT UN Equity FEDERAL REALTY INVS TRUST Financials 117.32 2.62% 20.09.2013 14.55 12.31 12.15 15.76 -0.090 -0.337 -0.405 -0.165 0.000 0.007 0.008 0.003 FII UN Equity FEDERATED INVESTORS INC-CL B Financials 25.37 3.78% 08.08.2013 24.78 24.45 24.41 -0.205 -0.114 -0.097 0.005 0.003 0.002 FDX UN Equity FEDEX CORP Industrials 100.68 0.64% 18.06.2013 23.54 22.18 21.83 22.12 22.56 23.05 -0.303 -0.246 -0.207 -0.158 -0.123 -0.107 0.009 0.008 0.006 0.003 0.002 0.001 FNF UN Equity FIDELITY NATIONAL FINL-A Financials 25.42 2.60% 16.09.2013 20.94 21.38 21.57 21.67 0.000 -0.133 -0.181 -0.152 0.000 0.005 0.007 0.005 FIS UN Equity FIDELITY NATIONAL INFORMATIO Information Technology 43.99 2.05% 13.09.2013 15.70 17.32 17.93 -0.340 -0.323 -0.285 0.011 0.011 0.009 FITB UW Equity FIFTH THIRD BANCORP Financials 18.02 2.66% 26.06.2013 17.11 17.87 18.50 20.02 22.41 23.56 -0.212 -0.301 -0.298 -0.192 -0.157 -0.128 0.005 0.011 0.011 0.006 0.001 0.001 FCNCA UW Equity FIRST CITIZENS BCSHS -CL A Financials 196.33 0.61% 19.09.2013 FHN UN Equity FIRST HORIZON NATIONAL CORP Financials 11.36 2.02% 11.09.2013 23.01 23.83 24.80 26.76 0.000 -0.270 -0.344 -0.207 0.000 0.007 0.008 0.003 FNFG UW Equity FIRST NIAGARA FINANCIAL GRP Financials 9.89 3.24% 31.07.2013 19.82 20.17 20.87 0.000 0.000 0.000 0.000 0.000 0.000 FRC UN Equity FIRST REPUBLIC BANK/CA Financials 40.03 1.20% 30.07.2013 21.84 20.05 19.63 21.98 0.000 0.010 0.002 -0.074 0.000 0.000 0.000 0.003 FE UN Equity FIRSTENERGY CORP Utilities 42.79 5.14% 05.08.2013 15.26 15.02 14.98 15.25 15.96 16.26 -0.153 -0.157 -0.181 -0.179 -0.124 -0.112 0.004 0.003 0.005 0.005 0.002 0.002 FISV UW Equity FISERV INC Information Technology 89.80 15.32 16.60 17.20 17.48 -0.300 -0.299 -0.291 -0.256 0.006 0.006 0.006 0.005 FLT UN Equity FLEETCOR TECHNOLOGIES INC Information Technology 82.18 26.05 28.03 28.65 27.88 -0.037 -0.094 -0.121 -0.137 0.001 0.003 0.003 0.002 FLIR UW Equity FLIR SYSTEMS INC Information Technology 24.79 1.45% 22.08.2013 20.87 22.50 23.50 -0.148 -0.134 -0.139 0.007 0.003 0.002 FLO UN Equity FLOWERS FOODS INC Consumer Staples 34.14 2.03% 12.06.2013 27.94 27.14 26.45 -0.144 -0.149 -0.143 0.001 0.002 0.002 FLS UN Equity FLOWSERVE CORP Industrials 164.23 0.52% 28.06.2013 19.20 20.05 20.98 -0.266 -0.257 -0.238 0.014 0.009 0.006 FLR UN Equity FLUOR CORP Industrials 62.12 1.09% 04.09.2013 24.09 24.60 25.46 27.03 27.99 28.57 -0.298 -0.237 -0.204 -0.174 -0.139 -0.126 0.010 0.006 0.004 0.002 0.002 0.001 FMC UN Equity FMC CORP Materials 62.69 0.89% 25.09.2013 19.33 19.03 19.45 -0.027 -0.142 -0.186 0.000 0.004 0.005 FTI UN Equity FMC TECHNOLOGIES INC Energy 56.16 25.24 26.03 27.01 -0.267 -0.287 -0.266 0.008 0.006 0.004 FL UN Equity FOOT LOCKER INC Consumer Discretionary 36.51 2.25% 17.07.2013 29.17 28.03 27.32 26.84 27.41 28.24 -0.256 -0.233 -0.209 -0.167 -0.150 -0.126 0.007 0.006 0.005 0.002 0.001 0.001 F UN Equity FORD MOTOR CO Consumer Discretionary 14.68 3.00% 26.07.2013 22.65 22.70 24.50 24.70 25.83 27.03 -0.309 -0.208 -0.176 -0.134 -0.112 -0.094 0.013 0.010 0.007 0.004 0.002 0.002 FCE/A UN Equity FOREST CITY ENTERPRISES-CL A Financials 19.75 0.30% 30.05.2013 22.87 25.85 27.16 27.45 0.000 -0.005 -0.014 -0.050 0.000 -0.002 -0.002 -0.001 FRX UN Equity FOREST LABORATORIES INC Health Care 38.82 20.57 22.30 22.99 22.93 23.14 23.42 -0.330 -0.258 -0.220 -0.196 -0.126 -0.114 0.010 0.008 0.007 0.004 0.003 0.002 FTNT UW Equity FORTINET INC Information Technology 18.11 42.09 46.31 48.30 49.26 48.02 47.59 -0.103 -0.100 -0.094 -0.072 -0.072 -0.068 0.008 0.005 0.004 0.001 0.001 0.001 Option Implied Volatility Skew Parameters by Terms: IVt = atx + btx 2 + ct At The Money Implied Volatilities by Terms Russell1000Index Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |