Accountancy for Class XI

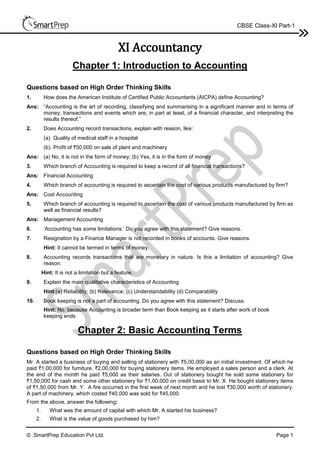

- 1. © .SmartPrep Education Pvt Ltd. Page 1 CBSE Class-XI Part-1 XI Accountancy Chapter 1: Introduction to Accounting Questions based on High Order Thinking Skills 1. How does the American Institute of Certified Public Accountants (AICPA) define Accounting? Ans: “Accounting is the art of recording, classifying and summarising in a significant manner and in terms of money; transactions and events which are, in part at least, of a financial character, and interpreting the results thereof.” 2. Does Accounting record transactions, explain with reason, like: (a) Quality of medical staff in a hospital (b). Profit of `50,000 on sale of plant and machinery Ans: (a) No, it is not in the form of money; (b) Yes, it is in the form of money 3. Which branch of Accounting is required to keep a record of all financial transactions? Ans: Financial Accounting 4. Which branch of accounting is required to ascertain the cost of various products manufactured by firm? Ans: Cost Accounting 5. Which branch of accounting is required to ascertain the cost of various products manufactured by firm as well as financial results? Ans: Management Accounting 6. ‘Accounting has some limitations.’ Do you agree with this statement? Give reasons. 7. Resignation by a Finance Manager is not recorded in books of accounts. Give reasons. Hint: It cannot be termed in terms of money. 8. Accounting records transactions that are monetary in nature. Is this a limitation of accounting? Give reason. Hint: It is not a limitation but a feature. 9. Explain the main qualitative characteristics of Accounting Hint:(a) Reliability; (b) Relevance; (c) Understandability (d) Comparability 10. Book keeping is not a part of accounting. Do you agree with this statement? Discuss. Hint: No. because Accounting is broader term than Book keeping as it starts after work of book keeping ends Chapter 2: Basic Accounting Terms Questions based on High Order Thinking Skills Mr. A started a business of buying and selling of stationery with `5,00,000 as an initial investment. Of which he paid `1,00,000 for furniture, `2,00,000 for buying stationery items. He employed a sales person and a clerk. At the end of the month he paid `5,000 as their salaries. Out of stationery bought he sold some stationery for `1,50,000 for cash and some other stationery for `1,00,000 on credit basis to Mr. X. He bought stationery items of `1,50,000 from Mr. Y. A fire occurred in the first week of next month and he lost `30,000 worth of stationery. A part of machinery, which costed `40,000 was sold for `45,000. From the above, answer the following: 1. What was the amount of capital with which Mr. A started his business? 2. What is the value of goods purchased by him?

- 2. © .SmartPrep Education Pvt Ltd. Page 2 Accountancy Practice Book 3. What are the fixed assets bought by him? 4. Who is the creditor in the above question and state the amount payable to him? 5. What are the expenses? 6. What are the gains earned? 7. What are the losses incurred? 8. Who is the debtor in the above question? What is the amount receivable from him? 9. What is the total amount of expenses and losses incurred? 10. Determine if the following are: Assets, Liabilities, revenues, expenses or loss of these: (a) Sales (b) Debtors (c) Creditors (d) Salary to manager (e) Discount to debtors (f) Drawings by the owner Ans: 1. ` 5,00,000; 2. ` 2,00,000; 3. ` 1,00,000; 4. Y, ` 1,50,000; 5. ` 5,000; 6. ` 5,000; 7. ` 30,000; 8. X, ` 1,00,000; 9. ` 35,000; 10. (a) Revenue; (b) Asset; (c) Liability; (d) Expense; (e) Loss; (f) Asset Chapter 3: Theory Base of Accounting INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS) Need for International Accounting Standards: Globalization integrates the national economies into the international economy through the trade, foreign direct investments, capital flow etc. In this age of globalization and technology, enterprises are carrying on business worldwide. Business enterprises around the world should not be speaking different accounting languages while sharing financial information. Therefore there is a need of single set of accounting standards that can unify the accounting practices worldwide. It is difficult to understand and compare worldwide financial information without a common set of accounting and financial reporting standards. The use of a single set of high quality accounting standards world facilitate investment and other economic decisions across the borders, increase market efficiency and then reduce the cost of capital. Thus, International Accounting Standards (IAS) were developed, which are being withdrawn or superseded by the internal Financial Reporting Standards (IFRS) IFRS’s are a set of Accounting Standards developed by IASB which provides guidelines to prepare accounting information at the global level. The aim of IFRS is to enable the international business firms to prepare their Financial Statements in a single set of language to make such Financial Statements understandable for the users the international level. Aims of IFRS (i) To develop and implement a single set of high quality comparable and globally enforceable accounting standards. (ii) To provide high quality, transparent and comparable information in financial statements. Advantages of IFRS (i) Utilities Business Transactions: It will enable domestic firms to display their financial Statements at similar levels as their foreign competitor. In addition to that organizations with various subsidiaries in other countries are also able to prepare their financial statements in universal accounting language that is understood by everyone. (ii) Saves Cost: IFRS enables internal consistency with regards to preparing financial reports. This means that the cost will be reduced since all the reports are going to be prepared in a uniform manner in all the different branches of the companies. (iii) Provides Consistency: It allows companies having different subsidiaries to streamline their training, auditing, reporting standards and operation standards as well as development standards. STATUS OF IFRS IN INDIA Government has opted for a four stage implementation of IFRS Starting from April 01, 2011 companies that are the part of NIFTY or SENSEX or those with shares listed overseas or with a net worth over ` 1,000 crore are expected to move to IFRS.

- 3. © .SmartPrep Education Pvt Ltd. Page 3 CBSE Class-XI Part-1 Starting from April 01, 2012, IFRS would be applicable to insurance companies. Starting from April 01, 2013, companies with a net worth of over Rs. 500 crore and large non-banking finance companies are expected to adopt IFRS. Starting from April 01, 2014, listed companies with a net worth of less Rs. 500 crore, non-banking companies with a net worth of over ₹500 crore and urban cooperative banks with net worth of ₹200 crore would be required to shift to IFRS. Questions based on High Order Thinking Skills 1. An old machinery was purchased on 5 th June, 2013 for ₹10 Lakhs. An amount of ₹5,000 was spent on transporting the machinery to the factory location. Installation cost of machinery ₹15,000 and ₹10,000 were spent as repairs in order to bring the machinery into running position. Find the cost of the machine. Ans: ₹10,30,000 2. Assets = Liabilities + Capital Which accounting principle represents the fundamental accounting equation given above? Ans: Dual Aspect Principle 3. ‘Closing stock is valued at cost or market value whichever is lower.’ Discuss the reasons of such valuation by throwing light on the relevant accounting principle. Ans: Conservatism / Prudence 4. ‘All revenues earned during an accounting year, whether or not received during the accounting year and all costs incurred whether paid during the year or not, should be taken into consideration while ascertaining the profit and loss during the accounting year.’ Which accounting principle implies this statement? Ans: Matching Principle 5. Salary for the month of February 2013 is not paid. Under which accounting assumption, it should be recorded as expense for the year ended 31 st March 2013? Ans: Accrual Assumption 6. As per which accounting principle, if advance is received against sale of goods, advance received is recorded as ‘advance against sale’ and not sales. Ans: Revenue Recognition 7. When one aspect of transaction is not recorded, which accounting principle is not followed? Ans: Dual Aspect Concept 8. Under which accounting principle, asset is recorded at cost, even if market price is more or less. Ans: Cost Principle 9. As per which accounting assumption, life of a business is broken into smaller parts. Discuss. Ans: Accounting Period Assumption 10. Which concept assumes that a business enterprise will not be liquidated in near future? Ans: Going Concern Assumption 11. Raghav purchased 2,000 sq. yards land and paid ₹ 20,00,000 towards its cost including registration charges. At the end of the year, the value of land came down to ₹15, 00,000. Raghav recorded the land at ₹ 15, 00,000 and ₹ 5, 00,000 as loss in books of accounts. Did he record the value of land and loss incurred in the correct manner? Ans: No, because as per the cost concept, an asset should be recorded in the books at the price paid. 12. As per which accounting principle, quality of manpower is not recorded in books of accounts? Ans: Money measurement principle

- 4. © .SmartPrep Education Pvt Ltd. Page 4 Accountancy Practice Book 13. Due to labour strike, the production in the factory had stopped for a week. The owner estimated the likely loss of profit arising out of loss of production and directed the accountant to record the loss in books of accounts. Is the accountant correct in recording the likely loss? Give reasons. Ans: No, only the transactions which can be measured in terms of money and on basis on evidences are recorded in books of accounts. 14. Mr. X who is the owner of Y co. purchased a car for his residence. Payment was made by issuing cheque form the account of Y co. The accountant debited the Drawings account with the amount, but, Mr. X is of view that it should be debited to the Fixed Assets. Which view is correct? Give reasons. Ans: The accountant is correct as car is purchased for personal use of the owner. Chapter 4:Basis of Accounting 1. Mr. X had made cash sales of ` 2,00,000 and credit sales of ` 3,00,000 for the year ended March 31,2013. He paid expenses of ` 50,000 and ` 30,000 are still outstanding for the current financial year. Calculate profit or loss earned during the year under: (a) Cash basis of Accounting (b) Accrual basis of Accounting Solution: Calculation of Profit or Loss Details Cash basis of accounting Accrual basis of accounting Cash Sales Credit Sales 2,00,000 …………… 2,00,000 3,00,000 Total Sales (A) 2,00,000 5,00,00 Expenses Paid Expenses Outstanding 50,000 ………… 50,000 30,000 Total Expenses 50,000 80,000 Profit / Loss 1,50,000 4,20,000 Chapter 5: Accounting Equation Effects of Incomes & Expenses on the Accounting Equation Expenses or Incomes Incomes Expenses Nature Earned and received in Cash Earned but not received Not earned but received Due and paid in Cash Due but not paid Not due but paid Defined Income of the year Accrued Income Pre-received income (Income Received in Advance in current year but relates to next year) Expense of the year Expense Outstanding (expense relating to Current Year but not paid) Pre-paid Expense (Expense relating to Next Year but paid in Current Year) Effects Capital Capital Cash Capital Capital Asset (Prepaid Expense) Cash Asset (Accrued Income Liability (Income Received in Advance) Cash Liability (Expense Outstanding) Cash

- 5. © .SmartPrep Education Pvt Ltd. Page 5 CBSE Class-XI Part-1 Formulas: 1. Total Assets = Capital + Outside Liabilities 2. Outside Liabilities = Total Assets – Capital 3. Capital = Total Assets – Outside Liabilities 4. Closing Total Assets = Closing Capital + Closing Outside Liabilities 5. Closing Outside Liabilities = Closing Total Assets – Closing Capital 6. Closing Capital = Closing Total Assets – Closing Outside Liabilities 7. Closing Capital = Opening Capital + Capital Further Introduced – Drawings – Capital Withdrawn + Profit or – Loss 8. Opening capital = Closing Capital – Capital Further Introduced + Drawings + Capital Withdrawn – Profit or + Loss 9. Profit or Loss = Closing Capital – Opening Capital – Capital Further Introduced + Drawings + Capital Withdrawn Note: Differentiate between drawings and capital withdrawn: Drawings is amount which is withdrawn by the proprietor for his day to today requirements on the regular basis and consist of small amounts whereas the capital withdrawn is the amount which is withdrawn occasionally by the proprietor and consist of big amounts like amount withdrawn for the purpose of construction of house, child’s marriage etc. Understanding Treatment of Expenses & Incomes Solved Exercise 1. Show the following information in the accounting equation: a. Rent is paid @ ₹ 200 p.m. and was paid for the whole year ₹ 2,400 b. Rent is paid @ ₹ 200 p.m and was paid for ₹ 2,000 c. Rent is paid @ ₹ 200 p.m. and was paid for ₹3,000 Solution: Accounting Equation S.No. Liabilities Assets Capital Outstanding Rent Cash Prepaid Rent a. (2,400) (2,400) b. (2,400) 400 (2,000) c. (2,400) (3,000) 6,00 2. Show the following information in the accounting equation: a. Rent is received @ ₹ 200 p.m. and was received for the whole year ₹ 2,400 b. Rent is received @ ₹ 200 p.m and was received for ₹ 2,000 c. Rent is received @ ₹200 p.m. and was received for ₹3,000 Solution: Accounting Equation S.No. Liabilities Assets Capital Pre-received Rent Cash Accrued Rent a. b. 2,400 2,400 c. d. 2,400 2,000 400 e. f. 2,400 600 3,000

- 6. © .SmartPrep Education Pvt Ltd. Page 6 Accountancy Practice Book Chapter 6: Accounting Procedures Types of Accounts& Rules of Accounting TRADITIONAL APPROACH Personal Accounts The accounts which are opened with name of the persons 1. Natural Personal Accounts: The accounts which are opened with the name of human beings. Ram Account, Debtors A/c, Creditors A/c, Capital a/c, Drawings a/c Dr: The Receiver Cr: The Giver 2. Artificial Personal Accounts: The accounts which are opened with the name of business organizations Reliance Ltd, Shyam Provisions Stores, X & Co. ,Bank a/c 3. Representative Personal A/cs: The accounts which represent amount to be received or paid Outstanding expenses Prepaid expenses Accrued Expenses Pre-received Incomes Real Accounts All assets are real accounts. They are of two types: 1. Tangible real Accounts: The assets which can be seen and touched. 2. Intangible Real Accounts: The accounts which cannot be seen and touched. 1. Furniture a/c, building a/c, cash a/c. 2. Goodwill a/c , Patents Rights a/c, copy rights/c, trade marks Dr: What comes in Cr: What goes out Nominal Accounts 1. Expenses paid (productive in nature) 1. Wages paid a/c, salaries paid a/c, Purchase a/c Dr: Expenses & Losses Cr. Incomes & Gains 2. Losses borne (non-productive in nature) 2. Loss by natural calamities, Depreciation on Assets, Bad Debts, loss on sale of assets 3. Incomes received (productive in nature) 3. Interest received, commission received, Sales a/c 4. Gains realized (non-productive in nature) 4. Appreciation on Assets, Bad Debts Recovered, Profit on Sale of Assets, Insurance Claim MODERN APPROACH ASSETS LIABILITIES CAPITAL REVENUE EXPENSES BALANCE Dr Cr Cr Cr Dr INCREASE Dr Cr Cr Cr Dr DECREASE Cr Dr Dr Dr Cr

- 7. © .SmartPrep Education Pvt Ltd. Page 7 CBSE Class-XI Part-1 Chapter 8: Journal Q1. Enter the following transactions in the books of M/s Dhanpat Rai: 2013 Transactions August 01 Purchased goods from Ram list price `10,000 at 10% trade discount & 5% cash discount. August 04 Purchased goods from Ram list price `10,000 at 10% trade discount. ¼ of the payment was made at 5% cash discount. August 08 Sold goods to Shyam list price `10,000 at 10% trade discount & 5% cash discount. August 09 Sold goods to Shyam list price `10,000 at 10% trade discount. ¼ of the payment was made at 5% cash discount. August 12 Purchased machine ` 90,000, paid wages on its installation `10,000. August 15 Received advance from Shyam (our customer) `10,000. August 21 Paid advance to Ram (our supplier) `5,000. August 23 Paid `1,000 to petty cashier. August 25 Proprietor sold personal jewellery costing `20,000 at 20% premium and brought the money into the business. August 30 Paid `5,000 as loan instalment and `2,000 as interest thereon. August 31 Purchased a car for official use costing `3,00,000 by taking loan of `2,50,000. Q2. Enter the following transactions in the books of M/s Jain & Son: 2013 Transactions April 01 Purchased goods for `1,00,000 in cash and paid Central Sales Tax @10% April 04 Sold goods to Honey for `1,00,000 and charged 10% Central Sales Tax. April 08 Central Sales Tax charged above deposited in the Government Treasury. April 09 Purchased goods from Amit for `2,00,000less 20 % Trade Discount plus VAT10%. April 12 Sold goods for `3,00,000 at 20% Trade Discount and VAT charged / collected @ 10%. April 15 VAT collected `24,000 was adjusted against VAT paid `16,000. April 22 Net VAT collected deposited into the Government Account.

- 8. © .SmartPrep Education Pvt Ltd. Page 8 Accountancy Practice Book Chapter 9: Cash Book Main journal Entries to prepare Three Column Cash Book In this type of cash book, we record transactions relating to cash, bank and discount. 1. When cash is deposited into bank, entry: Bank A/c To Cash A/c Dr 2. When cash with withdrawn from bank for office use Cash A/c To Bank A/c Dr Contra Entries: An entry in which Cash a/c and Bank a/c are involved wherein cash is debited then bank is credited and vice versa. Against these entries, the letter 'C' is written in the L.F. column to indicate that these are contra transactions and are not posted in the ledger account. 3. When the cash is withdrawn by the proprietor office for personal use. Drawings A/c To Cash A/c Dr 4. When the cheque is drawn (by the proprietor) on bank A/c of office for personal use. Drawings A/c To Bank A/c Dr 5. When the bank makes charges against its services Bank Charges A/c To Bank A/c Dr 6. When the bank allows some interests as deposits. Bank A/c To Interest Received A/c Dr 7. When the customer makes direct payment into our bank account Bank A/c To Debtor's A/c Dr 8. When the cheque is received and deposited on the same day Bank A/c To Debtor's A/c Dr 9* When the cheque is received but deposited at a later date. (a) On the date of receipt Cheque in hand A/c To Debtor's A/c Dr Note: This entry will be recorded in the General Journal. (b) On the date of deposit of cheque received earlier Bank A/c To Cheque in Hand A/c Dr Note: This entry will be recorded on the Dr side of bank Column. Alternatively: (a) On the date of Receipt of Cheque Cash A/c To Debtor's A/c Dr Note: Cheque has been treated as equal to cash. (b) On the date of deposit of cheque

- 9. © .SmartPrep Education Pvt Ltd. Page 9 CBSE Class-XI Part-1 Bank A/c To Cash A/c Dr Note: This entry becomes contra entry. Important: Former method seems to be more improved method and questions have been solved as per former method. In the absence of date of deposit of cheque, it is assumed that cheque has been deposited on the date of receipt of cheque. 10. Cheque deposited earlier proved dishonoured Debtor's A/c To Bank A/c Dr 11. Cheque issued by us proved dishonoured Bank A/c To Creditors A/c Dr 12. When the cheque is issued to petty cashier Petty Cash A/c To Cash A/c Dr Balancing of three column Cash Book (a) Cash Columns If Dr side exceeds credit side, the difference will come on the Cr side. It will be written as ‘By Balance c/d’ known as Dr Balance and it becomes the part of assets. If Dr side is equal to Cr side, the cash A/c will show nil balance. Note: In the Cash A/c, Cr column cannot exceed Dr column, as cash payments cannot exceed cash receipts. (b) Discount columns: Discount columns are never balanced. Sum of Dr column is known as ‘Discount Allowed’ Sum of Cr column is known as 'Discount Received'. (c) Bank Columns: Any column may exceed the other column. If Dr side exceeds Cr side, the difference comes on the Cr side as ‘By Balance c/d', known as Dr balance becomes part of assets. If Cr side exceeds Dr side, the difference comes on the Dr side as 'To Balance c/d' known as credit balance or overdraft. Bank Overdraft: It is the facility allowed by the banks to its Current A/c Holders (for businessman) to honour the cheques to a certain limit beyond the zero balance in the account. Opening balance of Bank Overdraft: It is written on the Dr side as ‘By Balance b/d' in the bank Solved Question Enter the following transaction in Three Column Cash Book of Banwari Las & Sons. 2013 Particulars ₹ Jan 1 Banwari commences business with cash 20,00,000 Jan 3 He paid into Bank Current A/c 19,00,000 Jan 4 He receives cheque from Kiran & Co. on account 60,000 Jan 7 He pays into Bank Kiran & Co.'s cheque 60,000 Jan 10 He pays Ratna & Co. By cheque and is allowed discount ₹ 2,000 33,000 Jan 12 Tridev & Co. Pays into his Bank A/c 47,500 Jan 15 He receives cheque from Warisha and allows him discount ₹ 3,500 45,000 Jan 20 He receives cash ₹ 7,500 and cheque ₹ 10,000 for cash sales Jan 25 He pays into Bank, including cheques received on 15th and 20th January 1,00,000 Jan 27 He pays by cheque for cash purchased 27,500 Jan 28 Cheque received from Warisha was dishonoured Jan 30 He pays sundry expenses in cash 5,000 Jan 30 He pays John & Co. In cash and is allowed discount ₹ 3,500 37,500

- 10. © .SmartPrep Education Pvt Ltd. Page 10 Accountancy Practice Book Jan 31 He pays office rent by cheque 20,000 Jan 31 He draws a cheque for personal use 25,000 Jan 31 He pays staff salaries by cheque 30,000 Jan 31 He draws a cheque for office use 40,000 Jan 31 He pays cash for stationery 2,500 Jan 31 He purchases goods for cash 12,500 Jan 31 He pays Jai by cheque for commission 30,000 Jan 31 He gives cheque to Ram Saran for purchase of furniture for office 1,57,500 Jan 31 He receives cheque for commission from Raghu & Co. and pays the same into bank 50, 000 Jan 31 Cash Sales 45,000 Solution: Dr In the Books of Banwari Las & Sons THREE-COLUMN CASH BOOK Cr Date Particulars L F Discount Allowed ` Cash (`) Bank (`) Date Particulars L F Discount Received ` Cash (`) Bank(`) 2013 2013 Jan 01 To Capital A/c 20,00,000 Jan, 3 By Bank A/c C 19,00,000 Jan 03 To Cash A/c C 19,00,000 Jan. 10 By Ratna & Co. 2,000 33,000 Jan 07 To Cheques in Hand A/c 60,000 Jan. 25 By Bank A/c C 45,000 Jan 12 To Tridev & Co. 47,500 Jan. 27 By Purchases A/c 27,500 Jan 15 To Warisha A/c 3,500 Jan 20 To Sales A/c 7,500 Jan. 28 By Warisha 3,500 45,000 Jan 25 To Cash A/c C 45,000 Jan. 30 By Sundry Exp. A/c 5,000 Jan 25 To Cheques in Hand A/c 55,000 Jan. 30 John & Co. 3,500 37,500 Jan 31 To Bank A/c C 40,000 Jan. 31 By Rent A/c 20,000 Jan 31 To Commission A/c 50,000 Jan. 31 By Drawings A/c 25,000 Jan 31 To Sales A/c 45,000 Jan. 31 By Salaries A/c 30,000 Jan. 31 By Cash A/c C 40,000 Jan. 31 Stationary A/c 2,500 Jan. 31 Purchases A/c 12,500 Jan. 31 By Commission A/c 30,000 Jan. 31 Furniture A/c 1,57,500 Jan. 31 By Balance c/d 90,000 17,49,500 3,500 20,92,500 21,57,500 9,000 20,92,500 21,57,500 Feb. 01 To Balance B/d 90,000 17,94,500 Hints: The following entries will appear in the Journal Book Date Particulars L.F. Dr Cr Jan 04 Cheques in Hand A/c Dr To Kiran & Co. 60,000 60,000 Jan 15 Cheques in hand A/c Dr To Warisha A/c 45,000 45,000 Jan 20 Cheques in hand A/c Dr To Sales A/c 10,000 10,000 Note: Discount allowed Jan 15 has been shown in the cash book as there is separate column for this purpose.

- 11. © .SmartPrep Education Pvt Ltd. Page 11 CBSE Class-XI Part-1 Chapter -10: Other Subsidiary Books All cash transactions are recorded in the Cash Book but out of non-cash transactions relating to goods in which a business enterprise deals are required to be recorded in the separate books popularly known as ‘Other Subsidiary Books’. Rest of the non-cash transactions are recorded in the Journal Proper/ General Journal / Journal Book. Main other Subsidiary Books: 1. Purchase Book: It is prepared to record credit purchase of goods. 2. Sales book: It is prepared to record credit sale of goods. 3. Purchase return Book: It is also known as Return Outward book which is prepared to record return of goods which were earlier purchased on credit. 4. Sales Return Book: It is also known as Return Inward Book which is prepared to record the return of goods which were earlier sold on credit. Transfer of Balances from Subsidiary Books: 1. Cash Book: It is itself a Ledger-cum Subsidiary Book. Closing balance of cash and bank are directly transferred to the “Trial Balance”. Cash A/c always has Dr. balance or Nil Balance whereas Bank A/c may have either Dr. balance (taken as part of Assets) or Cr. balance (taken as part of liability as Bank Overdraft). 2. Purchase Book: Balance of purchase book is directly transferred on the Dr. side of Purchase A/c. 3. Sales Book: Balance of Sales Book is directly transferred on the Cr side of Sales A/c. 4. Purchase Return Book: Balance of Purchase Return Book is directly transferred on the Cr. side of Purchase Return A/c. 5. Sales Return Book: Balance of Sales Return Book is directly transferred to the Dr side of Sales Return a/c. Purpose of Journal Proper/General Journal / Journal Book: All those transactions which cannot be recorded in any of the subsidiary books, like Cash Book, Purchase Book, Sales Book, Purchase Return Book and Sales Return Book, are recorded in the Journal Proper. Examples: Outstanding rent, accrued incomes, depreciation / appreciation on assets, interest on capital, interest on drawings, bad debts, etc. Transactions which are recorded in the Journal Proper: 1. Opening Entry: It is the entry which is entered in the Journal Book by debiting all Assets and Crediting all liabilities and capital, all appearing as closing balances in the previous year. It is to be noted, opening entry is not posted in the ledgers rather these balances are written as ‘To balance b/d’ on the debit side of assets accounts (as Assets always have debit Balance) or written as 'By Balance b/d' on the credit side of the liabilities accounts (as liabilities always have credit balances). 2. Closing Entries: All nominal accounts are closed (written off) at the end of the year by transferring their balances either to Trading A/c or Profit / Loss Account. (to be discussed later in the chapter Financial Statements) For transfer of Expenses & Losses: Expenses & Losses have debit balances and in order to write them off, their accounts are credited and trading or P/L a/c is debited. Entry: Trading or P/L a/c Dr To Expanse /Losses a/c For transfer of Incomes and Gains: Income & Gains have credit balances and in order to write them off, their accounts are debited & Trading or P/L a/c is credited. Entry: Incomes/Gains a/c Dr To Trading or P/L a/c 3. Adjusting Entries: At the end of the year when Profit / Loss and Financial Position of the Business have to be obtained, certain expenses & Losses are required to be incorporated or adjusted due to accrual concept

- 12. © .SmartPrep Education Pvt Ltd. Page 12 Accountancy Practice Book and matching principle. These adjustments relate to adjust outstanding expenses, prepaid expenses, accrued income, income received in advance, provisions/ reserves, depreciation, appreciation, interest on capital, interest on drawing etc. 4. Rectifying Entries: Rectifying entries don't involve cash or bank account. All entries relating to rectification of past errors or omissions are recorded in the Journal Proper.(Detailed discussion in the chapter “Rectification of Errors”). 5. Miscellaneous Entries: All such entries which are not related to any of the entries mentioned above or any of the subsidiary books, are recorded in the Journal Proper like sale / purchase of assets on credit, bad debts, discount allowed, discount received, abnormal losses like loss by fire, loss by theft, capital losses like loss on sale of assets/investments, capital gains like profit on sale of assets/investments etc.