TAX STATEMENT MPAMPAS 2012

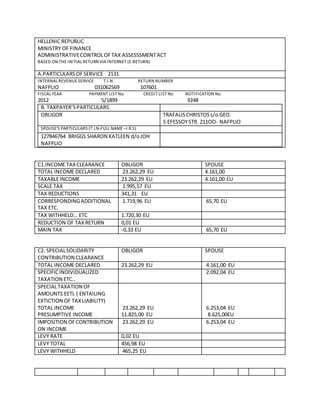

- 1. HELLENIC REPUBLIC MINISTRY OF FINANCE ADMINISTRATIVECONTROLOFTAX ASSESSSMENTACT BASED ON THE INITIAL RETURN VIA INTERNET (E-RETURN) A.PARTICULARSOFSERVICE 2131 INTERNAL REVENUE SERVICE T.I.N RETURN NUMBER NAFPLIO 031062569 107601 FISCAL YEAR PAYMENT LIST No CREDIT LIST No NOTIFICATION No 2012 5/1899 9248 B. TAXPAYER’SPARTICULARS OBLIGOR TRAFALISCHRISTOSs/o GEO. 5 EFESSOYSTR. 211OO- NAFPLIO SPOUSE’S PARTICULARS (T.I.N-FULL NAME –I.R.S) 127846764 BRIGGS SHARON KATLEEN d/oJOH NAFPLIO C1.INCOME TAXCLEARANCE OBLIGOR SPOUSE TOTAL INCOME DECLARED 23.262,29 EU 4.161,00 TAXABLEINCOME 23.262,29 EU 4.161,00 EU SCALE TAX 1.995,57 EU TAX REDUCTIONS 341,31 EU CORRESPONDINGADDITIONAL TAX ETC. 1.719,96 EU 65,70 EU TAX WITHHELD… ETC 1.720,30 EU REDUCTION OF TAXRETURN 0,01 EU MAIN TAX -0,33 EU 65,70 EU C2. SPECIALSOLIDARITY CONTRIBUTION CLEARANCE OBLIGOR SPOUSE TOTAL INCOME DECLARED 23.262,29 EU 4.161,00 EU SPECIFICINDIVIDUALIZED TAXATION ETC.. 2.092,04 EU SPECIALTAXATION OF AMOUNTS EETL ( ENTAILING EXTICTION OF TAXLIABILITY) TOTAL INCOME PRESUMPTIVE INCOME 23.262,29 EU 11.825,00 EU 6.253,04 EU 8.625,00EU IMPOSITION OFCONTRIBUTION ON INCOME 23.262,29 EU 6.253,04 EU LEVY RATE 0,02 EU LEVY TOTAL 456,98 EU LEVY WITHHELD 465,25 EU

- 2. C. CLEARANCE AMOUNTS MAIN TAX TAX DEPOSIT VOUCHER AMOUNTS OVERALL INCOME TAX SPECIAL SOLIDARITY CONTRIBUTION BUSINESS FEE TOTAL AMOUNTS OBLIGOR SPOUSE TOTAL (+) (-)0,33 (+)65,70 (-) (+)65,70 (-) 0,33 36,14 36,14 0,33 EU 101,84EU 101,84 EU 0,33 465,25 EU 465,25 EU 465,25 EU 0,33 EU 101,84 EU 567,09 EU 0,33 DIFFERENCEIN COMPENSATION -0,01EU AMOUNT OF PAYMENT 566,75 D. DESCRIPTION OFINCOMES, INCOME DEDUCTIONS,TAX REDUCTIONS… ETC 1. TOTAL INCOME OBLIGOR SPOUSE REAL ESTATES 4.161,00 EU 4.161,00 EU SALARIEDEMPLOYMENT 19.101,29EU TOTAL 23.262,29 EU 4.161,00 EU INDEPENDENTTAXABLE AMOUNTS ETC 2.092,04 EU 2. TAX: SCALE- ADDITIONAL-DEPOSIT OBLIGOR SPOUSE TAX ON INCOME 1.995,57 EU TAX REDUCTIONS 341,31 EU CORRESPONDINGTAX 1.654,26E U ADDITIONALTAX 65,70 EU 65,70 EU INCOME FORADDITIONALTAX 4.380,00 EU 4.380,00 EU 3. OTHER VOUCHER AMOUNTS OBLIGOR SPOUSE EXPENSES(SECTION 1 ARTICLE 9, I.T.C.) 7.210,28 EU 1.289,72 EU 4. DEDUCTIONS- REDUCTIONS OBLIGOR SPOUSE NUMBER OF CHILDREN 4 INTEREST LOANS 79,34 EU MEDICAL EXPENSES 18,91 EU TUTORIAL EXPENSES 160,07 EU 28,63 EU

- 3. INSURANCE 46,11 EU 8,25 EU TOTAL 304,43 EU 36,88 EU FINALREDUCTIONS 341,31 EU 0,00 EU 5. TAX WITHHELD ETC. OBLIGOR SPOUSE FROMSALARIES- EMPLOYMENT 1.720,30 EU TOTAL 1.720,30 EU DATE OF ISSUE: 17/07/2012 DATE OF COPY 29/01/2015 THE GENERAL SECRETARY FORINLANDREVENUE (SIGNATURE) K.SAVVAIDOU