PatelAnkira_39x29

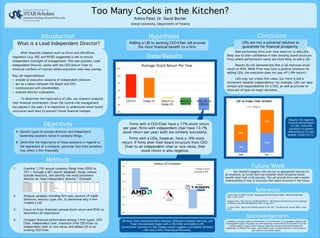

- 1. Acknowledgements Too Many Cooks in the Kitchen? Drexel University, Department of Finance Ankira Patel, Dr. David Becher References Data/Results Future Work Conclusion After financial collapses such as Enron and WorldCom, regulators (e.g. SEC and NYSE) suggested a role to ensure independent oversight of management. This new position, Lead Independent Director, works with the CEO and/or Chair to minimize conflicts of interest where executive roles may overlap. Key LID responsibilities: • preside at executive sessions of independent directors • act as a liaison between the Board and CEO • communicate with shareholders • oversee director evaluations To determine the importance of LIDs, our research analyzes their financial contribution. Given the central role management has played in the past, it is imperative to understand which board structures work best to prevent future financial mishaps. Well performing firms over time tend not to add LIDs, likely due to their confidence in their existing board structure. Firms where performance varies are more likely to add a LID. Results do not demonstrate that a LID improves stock return or ROA. While firms may have a positive intention for adding LIDs, the execution does not pay off (-9% return). LIDs may not create firm value, but there is still a movement towards independence. For example, LIDs can ease tension and responsibilities for a CEO, as well as provide an extra set of eyes on major decisions. LIDs are not a universal solution or guarantee for financial prosperity. What is a Lead Independent Director? Our research suggests LIDs are not an appropriate solution for all situations, so future work can establish which situations would benefit most from a LID and why. This will provide firms with a better understanding of how to structure their board structure in the future. Adding a LID to existing CEO-Chair will provide the most financial benefit to a firm. 1. Examine 1,700 annual company filings from 2000 to 2011, through a SEC search database. Study various outside directors, and identify the most prominent director as “lead independent director.” Example: 2. Analyze variables including firm size, percent of inside directors, industry type, etc. to determine why a firm creates a LID. 3. Focus on firms financials (annual stock return and ROA) to determine LID importance. 4. Compare financial performance among 5 firm types: CEO- Chair, independent chair, transition from CEO-Chair to independent chair or vice versa, and added LID to an existing CEO-Chair. Introduction Methods Charan, Ram & J. Neff, Thomas. “Separating CEO and Chairman Roles.” Bloomberg Business. Web. 15 Jan. 2010. Hodgson, Paul. “The Cost of a Combined CEO/Ch.” The Harvard Law School Forum on Corporate Governance and Financial Regulation. Web. 13 July 2012. S. Lubin, Joann. “More CEO’s Sharing Control at the Top.” The Wall Street Journal. Web. 6 June 2012. All three firms (Advanced Micro Devices, Affiliated Computer Services, and Taser International) began with a CEO-Chair and added a LID. Inconsistent reactions to this change cannot suggest a correlation between LIDs and a firm’s financial performance. -10% -5% 0% 5% 10% 15% 20% CEO-Ch Indep Ch Switch to Indep Ch Switch to CEO-Ch Add LID to CEO-Ch Average Stock Return Per Year Despite the negative financial performance of LIDs, firms still transition to greater independence on their Boards (2000-2011). A. Identify types of outside directors and independent leadership positions noted in company filings. B. Determine the importance of these positions in regards to the operations of a company, particular how their presence may affect a firm financially. I would like to sincerely thank my STAR mentor, Dr. David Becher, for his guidance, patience, and knowledgeable support throughout my STAR experience. He fostered an environment for my own research passion to grow, which I hope to model after his own enthusiasm and positivity. Additionally, my fellow STAR scholar, Jared Edelstein was a wonderful partner to work during our data collection and analysis phases. Hypothesis Firms with a CEO-Chair have a 17% stock return per year, firms with independent chair have 13.7% stock return per year; both are similarly successful. Firms with a LIDs, however, have a -9% stock return. If firms alter their board structure from CEO- Chair to an independent chair or vice versa, their stock return is also negative. -150% -100% -50% 0% 50% 100% 150% Added LID Examples Change in Stock Change in ROA (2006) (2007) (2002) 18% 31% 26% 36% 2000 2011 LID vs Indep Chair Growth LID Indep Ch Objectives