Designing a Portfolio for a Customer. Considering Tax, Benefits, Good Returns.

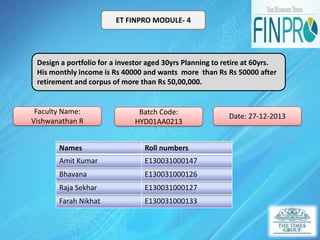

- 1. ET FINPRO MODULE- 4 Design a portfolio for a investor aged 30yrs Planning to retire at 60yrs. His monthly income is Rs 40000 and wants more than Rs Rs 50000 after retirement and corpus of more than Rs 50,00,000. Faculty Name: Vishwanathan R Batch Code: HYD01AA0213 Names Roll numbers Amit Kumar E130031000147 Bhavana E130031000126 Raja Sekhar E130031000127 Farah Nikhat E130031000133 Date: 27-12-2013

- 2. CONTENT S. NO DESCRIPTION 1 Importance Of Retirement 2 What is a Portfolio Management 3 Tax Slabs 4 List of Retirement Products RD,FD, POMIS Monthly Income Plan Unit Linked Insurance Plan 5 Entire Portfolio 6 BIBLIOGRAPHY 7 CONCLUSION

- 3. Importance of planning for Retirement Two components of retirement Financial Planning Personal Planning Follow this step Identify & compare your income and expenses to determine any shortfalls or surpluses. Review & analyse the various retirement income strategies. Review & compare the retirement income options available. Develop an action plan

- 4. Portfolio Management The art and science of making decisions about investment mix and policy, matching investments to objectives Evaluate and select program to fund. Evaluate and select programes to fund. Determine the availability and sources of fund. Monitor and report on portfolio performance

- 5. Tax Slabs

- 6. ICICI Bank's Recurring Deposits are the ideal way to invest small amounts of money every month and end up with a large saving on maturity. FEATURES Encourages savings without stress on your finances. High rates of interest (identical to the fixed deposit rates). Non-applicability of Tax Deduction at Source (TDS) Can avail loan on deposit till 90% of the amount.

- 7. MINIMUM BALANCE The minimum balance of deposit is Rs. 500 per month and thereafter, in multiples of Rs. 100. PERIOD OF DEPOSIT The minimum period is 6 months, and thereafter in multiples of 3 months. Maximum 10 years NOMINATION The facility of Nomination is available for relationships in the names of individuals. Eligibility Resident Indian

- 8. Calculation Tax Calculation with Interest w/o Compoun Amount Compoun ding the /Yearly ding amount Years 1 60000 62817 2817 2 60000 131147 11147 3 60000 205472 25472 4 60000 286319 46319 5 60000 374260 74260 6 60000 469917 109917 7 60000 573969 153969 8 60000 687151 207151 9 60000 810264 270264 10 60000 944180 344180 Withdr aw 944180 Interest amount = 344180 As he comes in 10% tax bracket so he is liable to pay 14418 as tax. Education cess =288 Secondary and Higher education= 144 Total tax Liability = 14850 Total Amount = 9,29,330

- 9. Features A wide range of tenures, ranging from 7 days to 10 years, to suit your investment plan. Partial withdrawal is permitted in units of Rs 1,000 with penalty charges. Safe custody of your fixed deposit receipts. Auto renewal is provided. Loan facility is available up to 90% of principal and accrued interest

- 10. Calculation Amount = 9,29,330 Tenure = 10 years ROI = 8.50% Interest = Simple Interest Interest Amount = 7,89930 10,000 and above interest amount is taxable @10% Tax amount for 10 years = 69000 Total interest = 72,0930 Total amount = 16,50,260

- 11. Documentation Identity proof 1. 2. 3. 4. 5. 6. Passport PAN card Voter ID card Driving licence Government id Photo ration card Address proof 1. 2. 3. 4. Passport Telephone bill Electricity bill Bank Statement with cheque 5. Certificate/ ID card issued by Post office

- 12. Post Office Monthly Income Scheme Features Guaranteed returns investment instrument available at post office On the deposits made with P.O one gets an assured monthly income It provides capital protection Risk free Liquid

- 13. Min- 1500 Max in single a/c- 4,50,000 Joint a/c- 9,00,000 Multiples of -1500 Nomination facility also available Maturity period:5 years There is no tax rebate No TDS Penalty on premature withdrawal Depositors exempt from wealth tax Interest rate:8.4 % p.a.

- 14. Calculation 2 Joint a/c of 9,00,000 each Tenure = 5 years /each ROI = 8.40% Amount in hand = 16,50,260 1,99,740 taken from savings Interest amount = Rs 1340800 Total amount = Rs 2480400 Monthly Returns=Rs 12600

- 15. Documentation Identity proof 1. 2. 3. 4. Passport PAN card Voter ID card Driving license Address proof 1. 2. 3. 4. Passport Telephone bill Electricity bill Letter from any recognised authority 3 passport size photographs

- 17. MONTHLY INCOME PLAN A type of investment that provides a specified monthly payment to the investor. It is intended to be a stable form of income and it is typically suited for retired persons or senior citizens MIP’s are debt oriented mutual funds, they invest heavily in debt instruments like debentures, corporate bonds and government securities etc Generally it has 75 to 80 % of its money in debt and rest in equity The income you can get from monthly income plan is not limited to monthly option. we can also choose to receive income quaterly,half-yearly or annually.

- 19. TYPES OF MONTHLY INCOME PLAN DIVIDEND OPTION: In this option investor receives income monthly,quaterly andhalf-yearly,These can be declared only from profits not from capital. GROWTH OPTION: In this option money is not paid out to investor in the form of dividends, instead it keeps growing in mutual fund

- 20. Features Of MIP Low risk No TDS for dividend option and as per tax slab for growth option Moderate complexity Return range on average (6-13%) MIP’s returns are influenced by interest rates and stock market

- 21. TOP PERFORMING MIP SCHEMES:

- 22. Calculation Per month:15000/1 year:180000 For 30 years:5400000 Interest rate:12% Interest amount:648000 Total amount :6048000 Per month after retirment:25200/-

- 23. ULIPS Unit linked insurance plans (ULIPs) are a category of goal-based financial solutions that combine the safety of life insurance protection along with long term wealth creation opportunities In ULIPs, a part of the premium goes towards providing you life cover &the remaining portion is invested in fund(s) which in turn is invested in stocks or bonds

- 26. Tax Benefits ULIPs are an efficient tax saving instrument too .The tax benefits that you can avail in case you invest in ULIPs are described below: Life insurance plans are eligible for deduction under Sec. 80C Pension plans are eligible for a deduction under Sec. 80CCC The maturity proceeds or withdrawals of life insurance policies are exempt under Sec 10(10D), subject to norms prescribed in that section

- 27. Staying for Long Term Unit-Linked Insurance Plans (ULIPs) are meant to help you achieve your financial goals over the long-term If you Invest in Short term, they will not give you considerable return on your investments, because of a product cost structure which is higher in the initial years To get the best out of your ULIP, you should remain invested in the ULIP for the long-term of at least 8-10 years

- 28. PENSION PLANS Pension plans from insurance companies ensure that regular, disciplined savings in such plans can accumulate over a period of time to provide a steady income post-retirement. Usually all retirement plans have two distinctive phases The accumulation phase when you are saving and investing during your earning years to build up a retirement corpus The withdrawal phase when you actually reap the benefits of your investment as your annuity payouts begin

- 29. CALCULATION Investment= 10,000/month Period =30 years ROI=7% Total Amount=1,13,35,249 Annuity =40% of total amount is 45,34,117 Monthly he can withdraw after retirement is 18,892.

- 31. Total Accumulated Amount 24,80,400 Annual Amt Recurring Deposit 9,29,330 Fixed Deposit 16,50,260 POMIS Products Returns(Corpus) Returns(Monthly) RD,FD,POMIS 24,80,400 12,600 MIP 60,48,000 25,200 ULIP 45,34,117 18,892 Total Amount(60yr) 1,30,62,517 56,692 12,600 Monthly

- 32. Conclusion “ People may live as much retired from the world as they like , but sooner or later they find themselves debtor or creditor to someone “ -Johann Wolfgang