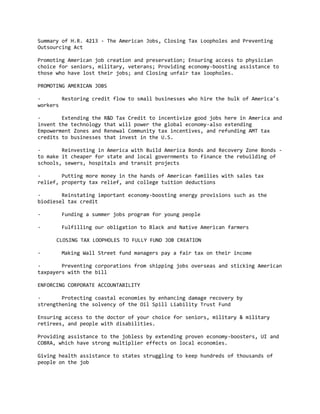

Summary: American Jobs, Closing Tax Loopholes and Preventing Outsourcing Act

- 1. Summary of H.R. 4213 - The American Jobs, Closing Tax Loopholes and Preventing Outsourcing Act Promoting American job creation and preservation; Ensuring access to physician choice for seniors, military, veterans; Providing economy-boosting assistance to those who have lost their jobs; and Closing unfair tax loopholes. PROMOTING AMERICAN JOBS · Restoring credit flow to small businesses who hire the bulk of America's workers · Extending the R&D Tax Credit to incentivize good jobs here in America and invent the technology that will power the global economy-also extending Empowerment Zones and Renewal Community tax incentives, and refunding AMT tax credits to businesses that invest in the U.S. · Reinvesting in America with Build America Bonds and Recovery Zone Bonds - to make it cheaper for state and local governments to finance the rebuilding of schools, sewers, hospitals and transit projects · Putting more money in the hands of American families with sales tax relief, property tax relief, and college tuition deductions · Reinstating important economy-boosting energy provisions such as the biodiesel tax credit · Funding a summer jobs program for young people · Fulfilling our obligation to Black and Native American farmers CLOSING TAX LOOPHOLES TO FULLY FUND JOB CREATION · Making Wall Street fund managers pay a fair tax on their income · Preventing corporations from shipping jobs overseas and sticking American taxpayers with the bill ENFORCING CORPORATE ACCOUNTABILITY · Protecting coastal economies by enhancing damage recovery by strengthening the solvency of the Oil Spill Liability Trust Fund Ensuring access to the doctor of your choice for seniors, military & military retirees, and people with disabilities. Providing assistance to the jobless by extending proven economy-boosters, UI and COBRA, which have strong multiplier effects on local economies. Giving health assistance to states struggling to keep hundreds of thousands of people on the job

- 2. Jobs and Infrastructure The American Jobs legislation would provide for an extension of Build America Bonds, which is a federal subsidy of state and local government municipal bonds. The legislation would exclude bonds that finance water and sewer facilities from state volume caps and eliminate AMT costs from tax-exempt private activity bonds. The legislation would extend a new category of tax credit bonds that was created in the Recovery Act. These bonds are for investment in economic recovery zones. There will also be additional allocation of these bonds based on the local municipalities' share of the national unemployment rate. Funding Summer Jobs The American Jobs legislation would provide resources to support over 350,000 jobs for youth ages 16 to 21 through summer employment programs. This age group has some of the highest unemployment levels, 25% for those aged 16 to 24. This funding will allow local Workforce Investment Boards to expand successful summer jobs programs that were funded in the Recovery Act. Health Provisions and State Medicaid Assistance The American Jobs legislation would prevent a 21% reduction in Medicare and TRICARE physician fees and reforms the physician payment system. In addition, the bill extends through December 31st eligibility for the COBRA subsidy originally enacted in ARRA, and it also extends for 6 months the enhanced FMAP originally enacted in AARA, which otherwise expires December 31st. Assisting Unemployed Workers (UI/TANF/COBRA) The American Jobs legislation would extend these proven economy-boosting safety- net programs, which have strong multiplier effects on local economies. The legislation would continue through the end of the year those programs currently assisting jobless workers that were established or extended by the Recovery Act, including the Emergency Unemployment Compensation program, which provides federally-funded extended benefits. Additionally, the bill would provide a one- year extension for the TANF Emergency Fund, which provides funding to States to establish employment programs and to respond to the increased need for assistance. National Flood Insurance The American Jobs legislation would extend the National Flood Insurance Program through December 31, 2010. Small Business Lending The American Jobs legislation would extend the Recovery Act small business lending program that eliminates the fees normally charged for loans through the SBA 7(a) and 504 loan programs and increases the government guarantees on 7(a) loans from 75% to 90%. Since its creation, the program has supported over $26 billion in small business lending, which has helped to create or retain over 650,000 jobs.

- 3. National Housing Trust Fund The American Jobs legislation would provide needed resources for the National Housing Trust Fund (NHTF) and for new project-based Section 8 assistance to be used in conjunction with the NHTF. The NHTF will provide communities with funds to build, preserve, and rehabilitate rental homes that are affordable for extremely and very low income households. These homes will help address the serious shortage of housing affordable and available for the lowest income families, including people who are unemployed or employed in the low wage work force, veterans, and elderly and disabled people on fixed incomes. It is estimated that an infusion of capital funds into the NHTF and the additional project-based vouchers to couple with NHTF capital grants, will support the immediate production of 10,000 rental homes, creating 15,000 new construction jobs and 4,000 new jobs in ongoing operations. Fulfilling our National Obligation to African American and Native American Farmers The American Jobs legislation would also fully fund the settlement of both the Cobell and Pigford class action lawsuits. The Cobell settlement concerns the government's management and accounting for over 300,000 American Indians trust accounts, and the Pigford settlement ends a decades-old discrimination lawsuit brought by black farmers against USDA. Veterans Concurrent Receipt The American Jobs legislation would fund two years of veterans' concurrent receipt. This would allow concurrent receipt of both DOD military retirement pay and VA military disability pay for two years. No other federal employees are required to offset their federal retirement benefits if they also receive VA disability compensation. Disability is to compensate for the impact on quality of life, an issue that military retired pay does not address. Pension Funding Relief The American Jobs legislation would include temporary relief from the minimum required contributions that employers must make to pension plans. The primary relief would extend the amortization period over which single and multiemployer pension plans must make up funding shortfalls. The provisions would also provide temporary relief to employers who have contributed more than the minimum contributions in prior years, would provide temporary relief from funding based restrictions on worker benefit accruals and social security level payments, and would provide for extended funding recovery periods for multiemployer plans in critical or endangered status. Surface Transportation Funding Equity The American Jobs legislation would address an inequity in the funding of surface transportation projects. The bill would distribute the Projects of National and Regional Significance (PNRS) and National Corridor Infrastructure Improvement (National Corridor) program funding among all States based on each State's share

- 4. of FY 2009 highway apportioned funds rather than to only 29 States and Washington, D.C., that had PNRS and National Corridor projects under SAFETEA-LU. In addition, the legislation would distribute "additional" highway formula funds (which the bill makes available in lieu of additional Congressionally-designated projects) among all of the highway formula programs rather than among just six formula programs. Closing Tax Loopholes to Fully Fund Job Creation The American Jobs legislation would provide significant tax relief by renewing for one year, provisions that expired at the end of 2009. This includes individual tax relief, e.g., deductions for state and local taxes, and business tax relief, e.g., the R&D tax credit. The bill also extends more than $7 billion of tax provisions that encourage charitable contributions, provide community development incentives, and support the deployment of alternative vehicles and alternative fuels. The entire cost of this portion of the American Jobs legislation will be covered by eliminating tax incentives for shipping jobs overseas and closing other tax loopholes. The bill closes loopholes that allow wealthy taxpayers to avoid paying taxes that working families are required to pay. For example, the bill would close the carried interest tax loophole that allows wealthy investment fund managers to pay capital gains tax rates on income that they receive for providing investment management services. Every other American is required to pay taxes at ordinary income tax rates on their service income. The bill would also address a tax avoidance scheme that allows well-paid service professionals (e.g., lobbyists and lawyers) to avoid paying employment taxes on part of their service income. The bill would prevent individuals from abusing S corporations to avoid employment taxes while preserving the basic rule that S corporation earnings are generally not subject to employment tax. The remaining cost of these tax provisions will be offset by eliminating tax provisions that encourage companies to ship jobs overseas and eliminating unintended tax benefits for other types of transactions (e.g., Reverse Morris Trust transactions). In particular, the bill would prevent corporations from using current U.S. foreign tax credit rules to subsidize their foreign activities. The foreign tax credit rules were enacted to ensure that companies were not subject to double taxation on income earned overseas. Over time, companies have developed a variety of techniques to abuse these rules in a manner that shifts the burden of paying foreign taxes onto U.S. taxpayers. For example, some taxpayers have developed schemes where the foreign tax credit is split from the underlying income that is subject to foreign tax. Once the credit is split from the underlying income, the foreign tax credit can be used to shelter income that is earned in low-tax jurisdictions, such as tax havens. The bill would prevent taxpayers from engaging in these and other similar types of abuses.