Fact Sheet 1Q09

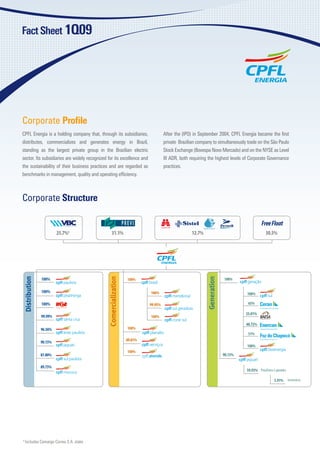

- 1. Corporate Profile CPFL Energia is a holding company that, through its subsidiaries, After the (IPO) in September 2004, CPFL Energia became the first distributes, commercializes and generates energy in Brazil, private Brazilian company to simultaneously trade on the São Paulo standing as the largest private group in the Brazilian electric Stock Exchange (Bovespa Novo Mercado) and on the NYSE as Level sector. Its subsidiaries are widely recognized for its excellence and III ADR, both requiring the highest levels of Corporate Governance the sustainability of their business practices and are regarded as practices. benchmarks in management, quality and operating efficiency. Corporate Structure Free Float 25.7% 31.1% 12.7% 30.5% 99.95% 25.01% 99.99% 48.72% 96.56% 90.15% 89.81% 87.80% 90.15% 89.75% 59.93% Paulista Lajeado 5.91% Investco 1 Includes Camargo Correa S.A. stake

- 2. Service Territory Dividends Dividends and Dividend Yield Declared Dividend¹ Dividend Yield² CPFL Price On April 30, 2009, dividends for the 2H08, on (R$ million) (last 12 months) ($/ON) - Average the amount of R$ 606 million, corresponding 35.99 36.11 33.38 to R$ 1.26 per share, were paid . Adding the 31.74 30.05 28.25 dividends for the 1H08 (paid in Sep/08), the 23.33 18.85 842 total declared amount for the full year of 2008 16.58 722 719 612 602 606 498 was R$ 1.2 billion, which corresponds to R$ 401 2.52 per share approximately. This dividend 140 represent 95% of CPFL net profit, a measure which surpasses the current dividend policy 2H04 1H05 2H05 1H06 2H06 1H07 2H07 1H08 2H08 9.6% 10.9% 9.7% which stipulates a payout of not less than 50% 9.1% 8.7% 6.5% 7.6% 7.3% of net income adjusted half-yearly. 3.7% The 2H08 dividend yield, calculated on the average share price in the period (R$ 33.38) is Since the IPO (2H04), CPFL Energia’s dividend yield has already reached 64.3%3 Payment in the next half year | 2Considering last two half-year’s dividends yield | 3IPO price per share: R$ 17.22 1 7.3% (last 12 months).

- 3. Fact Sheet 1Q09 | CPFL Energia Value Creation Agenda Goals Strategies Operational Efficiency CPFL Energia’s success is supported by clearly defined Value Synergic Growth business strategies and by management excellence Liquidity Financial Discipline criteria directed to the sustained growth of its Security Sustainability and Corporate Responsibility businesses. Differentiated Corporate Governance Market Total Energy Sales – GWh1 Sales by Customer Class2 – 1Q09 3.6% 11,253 11,661 33.6% Residential 9,168 9,333 20.0% Commercial Captive Market 18.4% Others 2,085 2,328 Free Market 28.0% Industrial 1Q08 1Q09 1 Excluding transactions between group’s companies (consolidation accouting criteria), CCEE and generation sales (except to the free market) | 2 Captive Market Financial Performance Net Revenue (R$ million) Ebitda (R$ million) Net Income (R$ million) -3.7% 2.0% 2,484 6.5% 659 283 2,392 646 265 1Q08 1Q09 1Q08 1Q09 1Q08 1Q09 Note: Numbers already incorporate the impacts of Law 11,638/07 and PM 449/08 Adjusted Net Debt/EBITDA3 (R$ billion) Debt breakdown - 1Q09 Adjusted Net Debt Net Debt /EBITDA 51.4% CDI 57.4% CDI 5.09 5.65 5.59 4.39 4.42 3.78 3.70 29.0% TJLP 1.77: excluding 30.4% TJLP Foz do Chapecó 2.85 2.25 HPP debt 1.74 1.57 1.53 2.01 1.98 15.7% IGP 10.2% IGP 2003 2004 2005 2006 2007 2008 1Q09 3.2% Dollar * 2.0% Dollar* 1Q08 1Q09 3 Last 12 monts EBITDA. * Hedge Natural.

- 4. Fact Sheet 1Q09 | CPFL Energia Corporate Governance Sustainability and Corporate Responsibility CPFL Energia adopts differentiated practices of Corporate CPFL Energia believes that the pursuit of sustainability is a process Governance, based on the principles of transparency, fair that demands the constant and innovative management of economic, ness, accountability and corporate responsibility. environmental and social impacts together with the maintenance of ethical and transparent relationships with all its stakeholders. Shares are listed on Bovespa’s Novo Mercado and ADS’s The company has a management model structured on a diversity of Level III on the New York Stock Exchange programs classified in the following groups: 100% of Common Shares with 100% of Tag Along Free Float of 30.5% Environmental education for the communities Subsidiary Companies’ Bylaws aligned to CPFL Energia Bylaws Environment Conservation of biodiversity Financial Statements in compliance with US GAAP and BR Conscientious corporate consumption. GAAP standards New Clean Development Mechanism Report in consensus with Global Reporting Initia tive - GRI Technologies and Projects (MDL) Board of Directors consists of seven members, one being Community CPFL Program of Volunteerism independent Municipal Council Support Program for the 3 Board Advisory Committees to the Board of Directors Rights of Children and Adolescents (CMDCA) Board of Directors and Fiscal Council self-evaluation The CPFL Program for the Revitalization of Review of Ethics and Corporate Conduct based on recom Philanthropic Hospitals mendations in the Sarbanes-Oxley Act CPFL complies with section 404 of the Sarbanes-Oxley Act Internal Program of Reflection and Ethical Management Personnel Respect for Diversity Program Value Network Value Chain The Tear Program Knowledge CPFL Culture Management Communications for Sustainability Shares’ Information1 03/31/2009 CPFE3 (R$) CPL (US$) Ownership breakdown Shares Price 31.50 40.57 Maximum – 52 weeks 41.95 76.40 69.5% Controlling block Minimum – 52 weeks 26.83 35.27 30.5% Free-float Market Cap R$ 15.1 Billion US$ 6.5 Billion Market Cap 479,910,938 Exchange Rate 2 R$/US$ 2.32 1 Without income adjustments | 2Dollar Ptax Investor Relations CPFL Energia – Rodovia Campinas Mogi-Mirim, km 2,5 | Zip Code 13088.900 | Campinas | SP Phone: 55 19 3756-6083 | Fax.: 55 19 3756-6089 | www.cpfl .com.br/ir | ri@cpfl.com.br