CES 2015 Resume

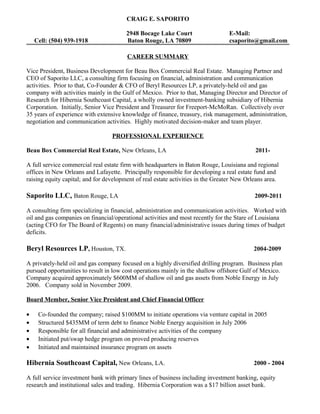

- 1. CRAIG E. SAPORITO Cell: (504) 939-1918 2948 Bocage Lake Court Baton Rouge, LA 70809 E-Mail: csaporito@gmail.com CAREER SUMMARY Vice President, Business Development for Beau Box Commercial Real Estate. Managing Partner and CEO of Saporito LLC, a consulting firm focusing on financial, administration and communication activities. Prior to that, Co-Founder & CFO of Beryl Resources LP, a privately-held oil and gas company with activities mainly in the Gulf of Mexico. Prior to that, Managing Director and Director of Research for Hibernia Southcoast Capital, a wholly owned investment-banking subsidiary of Hibernia Corporation. Initially, Senior Vice President and Treasurer for Freeport-McMoRan. Collectively over 35 years of experience with extensive knowledge of finance, treasury, risk management, administration, negotiation and communication activities. Highly motivated decision-maker and team player. PROFESSIONAL EXPERIENCE Beau Box Commercial Real Estate, New Orleans, LA 2011- A full service commercial real estate firm with headquarters in Baton Rouge, Louisiana and regional offices in New Orleans and Lafayette. Principally responsible for developing a real estate fund and raising equity capital; and for development of real estate activities in the Greater New Orleans area. Saporito LLC, Baton Rouge, LA 2009-2011 A consulting firm specializing in financial, administration and communication activities. Worked with oil and gas companies on financial/operational activities and most recently for the Stare of Louisiana (acting CFO for The Board of Regents) on many financial/administrative issues during times of budget deficits. Beryl Resources LP, Houston, TX. 2004-2009 A privately-held oil and gas company focused on a highly diversified drilling program. Business plan pursued opportunities to result in low cost operations mainly in the shallow offshore Gulf of Mexico. Company acquired approximately $600MM of shallow oil and gas assets from Noble Energy in July 2006. Company sold in November 2009. Board Member, Senior Vice President and Chief Financial Officer • Co-founded the company; raised $100MM to initiate operations via venture capital in 2005 • Structured $435MM of term debt to finance Noble Energy acquisition in July 2006 • Responsible for all financial and administrative activities of the company • Initiated put/swap hedge program on proved producing reserves • Initiated and maintained insurance program on assets Hibernia Southcoast Capital, New Orleans, LA. 2000 - 2004 A full service investment bank with primary lines of business including investment banking, equity research and institutional sales and trading. Hibernia Corporation was a $17 billion asset bank.

- 2. Managing Director & Director of Research Part of a three-member team managing overall operations of the investment bank. Directly supervised staff of 12 equity research analysts responsible for generating timely institutional research and investment ideas on over 100 companies. Research activities covered seven business sectors principally focused on Energy. • Wrote NASD Rule 2711 SOX compliance for investment bank • Participated in investment banking deal flow as managing director of firm • Assisted commercial bank in securing finance, treasury and cash management business • Increased investment portfolio opportunities and research coverage Freeport-McMoRan Companies, New Orleans, LA. 1978 - 2000 A leader in the natural resource industry, Freeport-McMoRan’s operations principally included oil and gas assets in the offshore Gulf of Mexico, copper and gold assets in Indonesia and North America, copper smelting and refining assets in Spain and Indonesia, as well as phosphate/nitrogen fertilizer and sulphur assets in the Gulf Coast area. Responsible for managing the Treasury, Risk Management, Investor Relations and Communications activities for seven NYSE-listed Freeport companies, which had combined annual revenues of more than $5 billion. Senior Vice President and Treasurer 1996 - 2000 Freeport-McMoRan Copper & Gold McMoRan Exploration Company Directed staff of 12 individuals in the Treasury, Risk Management, Investor Relations and Communications Departments of these companies which had a combined market capitalization of more than $4 billion. • Established, re-structured and administered more than $2.0 billion of credit facilities • Pursued over $5 billion of equity/debt market transactions • Maintained relationships with press, rating agencies and syndicate of over 40 banks • Directed and presented to annual securities analysts and bankers meetings, each attended by over 100 participants; presented to conferences sponsored by major Wall Street firms Vice President, Investor Relations 1988 - 1996 Freeport-McMoRan Copper & Gold; Freeport-McMoRan Inc. Freeport-McMoRan Energy Partners; McMoRan Oil & Gas Company; Freeport-McMoRan Gold Company; Freeport-McMoRan Resource Partners; Freeport Sulphur Company Managed staff of 7 individuals and coordinated all investor relations activities for the Freeport suite of NYSE listed companies, which had a combined market capitalization of approximately $10 billion. • Participated in almost $3 billion of equity and debt capital market transactions • Participated in generating in excess of $6 billion of increased market capitalization Asst. to President, Manager and Director of Investor Relations 1978 - 1988 Freeport-McMoRan, Inc. UNIVERSITY OF NEW ORLEANS – Instructor 1974 – 1978 • Taught both undergraduate and nursing students

- 3. EDUCATION University of New Orleans, 1978; MBA - Finance Tulane School of Public Health, 1974; Masters of Public Health Tulane University, 1973; Bachelor of Science LICENSES: NASD Series 7 and Series 24 (formerly held) CIVIC ACCOMPLISHMENTS • American Heart Association Board – New Orleans, Louisiana 1985 - 1989 • American Cancer Association Board -- New Orleans, Louisiana 1987 - 1993 • Member, Catholic Charities – New Orleans, Louisiana 1992 - 1997 • Mount Carmel Academy Board, Vice Chairman – New Orleans, LA 2004 - 2006 • Member Louisiana Stadium and Exposition District, Superdome Commission 2004 - 2006 • Member Energy Advisory Group -- Houston Technology Center, Houston, TX 2008 – 2009 • Chairman; Mount Carmel Academy Finance Committee – New Orleans, La. 2010 - 2013 MEMBERSHIPS • New Orleans Country Club 1999 – • Member Crillo Club ( Krewe of Acheans) 2002 – 2007 • Member Krewe of Osiris 2002 – 2007 • Houstonian Club 2007 – 2010 • Rotary Club of New Orleans 2012 – 2013