PLANNING AND AUDIT

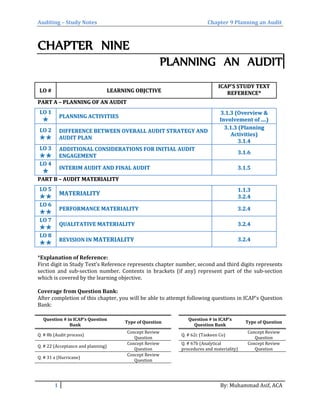

- 1. Auditing – Study Notes Chapter 9 Planning an Audit CHAPTER NINE PLANNING AN AUDIT LLOO ## LLEEAARRNNIINNGG OOBBJJCCTTIIVVEE IICCAAPP''SS SSTTUUDDYY TTEEXXTT RREEFFEERREENNCCEE** PPAARRTT AA –– PPLLAANNNNIINNGG OOFF AANN AAUUDDIITT LLOO 11 ✯✯ PPLLAANNNNIINNGG AACCTTIIVVIITTIIEESS 33..11..33 ((OOvveerrvviieeww && IInnvvoollvveemmeenntt ooff ........)) LLOO 22 ✯✯✯✯ DDIIFFFFEERREENNCCEE BBEETTWWEEEENN OOVVEERRAALLLL AAUUDDIITT SSTTRRAATTEEGGYY AANNDD AAUUDDIITT PPLLAANN 33..11..33 ((PPllaannnniinngg AAccttiivviittiieess)) 33..11..44 LLOO 33 ✯✯✯✯ AADDDDIITTIIOONNAALL CCOONNSSIIDDEERRAATTIIOONNSS FFOORR IINNIITTIIAALL AAUUDDIITT EENNGGAAGGEEMMEENNTT 33..11..66 LLOO 44 ✯✯ IINNTTEERRIIMM AAUUDDIITT AANNDD FFIINNAALL AAUUDDIITT 33..11..55 PPAARRTT BB –– AAUUDDIITT MMAATTEERRIIAALLIITTYY LLOO 55 ✯✯✯✯ MMAATTEERRIIAALLIITTYY 11..11..33 33..22..44 LLOO 66 ✯✯✯✯ PPEERRFFOORRMMAANNCCEE MMAATTEERRIIAALLIITTYY 33..22..44 LLOO 77 ✯✯✯✯ QQUUAALLIITTAATTIIVVEE MMAATTEERRIIAALLIITTYY 33..22..44 LLOO 88 ✯✯✯✯ RREEVVIISSIIOONN IINN MMAATTEERRIIAALLIITTYY 33..22..44 *Explanation of Reference: First digit in Study Text’s Reference represents chapter number, second and third digits represents section and sub-section number. Contents in brackets (if any) represent part of the sub-section which is covered by the learning objective. Coverage from Question Bank: After completion of this chapter, you will be able to attempt following questions in ICAP's Question Bank: Question # in ICAP’s Question Bank Type of Question Question # in ICAP’s Question Bank Type of Question Q. # 8b (Audit process) Concept Review Question Q. # 62c (Taskeen Co) Concept Review Question Q. # 22 (Acceptance and planning) Concept Review Question Q. # 67b (Analytical procedures and materiality) Concept Review Question Q. # 31 a (Hurricane) Concept Review Question 1 By: Muhammad Asif, ACA

- 2. Auditing – Study Notes Chapter 9 Planning an Audit PART A – PLANNING OF AN AUDIT LLOO 11:: PPLLAANNNNIINNGG AACCTTIIVVIITTIIEESS:: Planning Activities: Planning an audit involves: establishing the overall audit strategy (that sets scope, timing and direction for engagement) and developing audit plan (which includes nature, timing and extent of audit procedures to be performed by engagement team). Who is involved in Planning of audit: The engagement partner and other key members of the engagement team shall be involved in planning the audit. Importance/Benefits/Objectives of Planning: Planning helps to: 1. Identify potential problems (e.g. risks) on timely basis. 2. Pay attention to important areas of audit. 3. Assist in selection of appropriate team and proper assignment of work to them. 4. Perform direction, supervision and review of engagement team. 5. Coordinate with component auditor and experts, if any. 6. Organize and manage engagement so that it is completed efficiently and effectively. CONCEPT REVIEW QUESTION Planning an audit involves establishing the overall audit strategy for the engagement and development of an audit plan. Enumerate the adequate planning benefits during the audit of financial statements. (05 marks) (ICMA Pakistan - February 2013) LLOO 22:: DDIIFFFFEERREENNCCEE BBEETTWWEEEENN OOVVEERRAALLLL AAUUDDIITT SSTTRRAATTEEGGYY AANNDD AAUUDDIITT PPLLAANN:: Audit Strategy: Definition: Audit strategy sets the scope, timing and direction of audit, and guides the development of the audit plan. Matters documented in audit strategy: 1. Characteristics of the engagement that determine its scope: This includes consideration of Applicable Financial Reporting Framework, industry specific requirements, expected audit coverage, including the number and locations of components to be covered. 2. Reporting objectives of the engagement It relates to establishing deadlines for completion of work and key dates for expected communication. 3. Factors that are significant in directing the engagement team’s efforts: This includes consideration of materiality threshold, areas of high risks, audit approach to address risks (e.g. whether to rely on internal controls). 2 By: Muhammad Asif, ACA

- 3. Auditing – Study Notes Chapter 9 Planning an Audit 4. Nature, timing and extent of resources necessary to perform the engagement: When resources are needed (e.g. whether resources are to be used at interim audit). How much resources are to be used and where (e.g. high number and experience of staff needed on high risk areas) How to direct, supervise and review resources during audit. 5. Results of preliminary engagement activities and knowledge gained on other engagements performed for the entity. Audit Plan: Definition: The audit plan is more detailed than the overall audit strategy and includes the nature, timing and extent of audit procedures to be performed by engagement team members to obtain sufficient appropriate audit evidence to reduce audit risk to appropriate level. Matters documented in audit plan: Nature, timing and extent of planned risk assessment procedures. This includes assessment of both inherent risk and control risk at financial statement level and at assertion level. Nature, timing and extent of further audit procedures at assertion level for each material class of transactions, balance and disclosure of financial statements. This includes: o Tests of Controls (if auditor wants to rely on controls), and o Substantive Procedures (depending on risk assessment) CONCEPT REVIEW QUESTION (a) Explain the difference between “The Overall Audit Strategy” and the “Audit Plan”. (04 marks) (b) Identify the matters which are usually discussed / explained in each of the above documents. (12 marks) (CA Inter, Autumn 2008) LLOO 33:: AADDDDIITTIIOONNAALL CCOONNSSIIDDEERRAATTIIOONNSS FFOORR IINNIITTIIAALL AAUUDDIITT EENNGGAAGGEEMMEENNTT:: Why risk of audit failure is higher in first year of audit: There is an increased risk of audit failure in the first year of audit client relationship because of: Limited understanding of entity and its environment. Possibility of misstatement in opening balances which affect current year’s financial statements. Additional considers to reduce risk in initial audit engagement: To mitigate the audit risk, auditor performs following additional activities prior to starting an initial audit: 1. Perform procedures regarding accepting of client relationship and specific audit engagement (specially considering integrity of management). 2. Discuss with management major issues regarding initial selection as auditor (e.g. any disagreement on accounting treatment or any indication of scope limitation), and communicate to TCWG these matters and their effect on audit strategy and audit Plan. 3. Communicate with predecessor auditor (if there has been a change in auditor) and make arrangements e.g. arrangement to review the working papers. 4. Procedures to obtain sufficient appropriate audit evidence regarding opening balance 5. Other procedures in accordance with firm’s quality control system (e.g. assignment of quality control review for initial audit engagement) 3 By: Muhammad Asif, ACA

- 4. Auditing – Study Notes Chapter 9 Planning an Audit CONCEPT REVIEW QUESTION You are the partner of Alamgir and Company, Chartered Accountants and have received an offer for appointment as auditor of Guava Limited (GL). The previous year’s audit was carried out by Babur and Company, Chartered Accountants. Required: State the matters that you would consider in establishing the overall audit strategy, including matters which are to be considered, being the initial audit engagement. (08 marks) (CA Inter - Spring 2014) LLOO 44:: DDIIFFFFEERREENNCCEE BBEETTWWEEEENN IINNTTEERRIIMM AAUUDDIITT AANNDD FFIINNAALL AAUUDDIITT:: Interim Audit: Definition: Interim audit is that part of the audit which takes place before the year end. Interim audit is not required by ISAs. Auditor decides to conduct interim considering time pressure, size and complexity of entity, and effectiveness of controls. Typical Interim Audit Procedures: Obtaining understanding of entity and assessing inherent risk. Obtaining understanding of internal control and assessing control risk. Documentation and testing of internal controls. Preliminary analytical procedures Testing of profit and loss transactions for the year to date. identification of potential problems which may affect the final audit work Advantages of Interim audit: Interim Audit gives following benefits: a) Earlier identification of significant matters. b) Flexible planning of human resources. c) Stakeholders receive audit report quickly. d) Burden of audit team is spread, therefore, efficiency and effectiveness of audit team is increased. Final Audit: Definition: Final audit will take place after the year end and concludes with the auditor forming and expressing an opinion on the financial statements for the whole year. Typical Procedures performed at Final Audit: Agreeing financial statements to accounting records Examining adjustments made during preparation of financial statements Ensure proper cut-off on sales and purchases. Substantive Procedures for account balances and transactions. Study Tip Interim audit has nothing to do with Internal Audit or Review Engagement. 4 By: Muhammad Asif, ACA

- 5. Auditing – Study Notes Chapter 9 Planning an Audit Obtaining Confirmation Letters (e.g. from banks, debtors and creditors) Obtaining Representation Letter from Management. Inventory count and follow-up of items noted during inventory count. Review of subsequent events. Final analytical procedures. Going Concern Review CONCEPT REVIEW QUESTION Explain the difference between an interim and a final audit. (05 marks) (ACCA F8 – June 2014) PART B – AUDIT MATERIALITY LLOO 55:: MMAATTEERRIIAALLIITTYY:: What is Materiality: Misstatements, including omissions, are considered material if they, individually or in aggregate, could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements. Materiality depends on size as well as nature of misstatement. Use/Purpose of Materiality: Materiality is determined at the start of the audit but is used at: Planning stage, to determine nature, timing and extent of audit procedures to be performed. Performance stage, to ensure that misstatements identified during audit do not exceed performance materiality. Reporting stage, to evaluate the effect of uncorrected misstatements on financial statements, and in forming opinion on financial statements (i.e. whether financial statements give true and fair view in all material respects). How is Materiality determined: On the basis of size, materiality is determined as follows: Materiality = Chosen Benchmark * Chosen Percentage Benchmark depends on whether entity is profit oriented or not-for-profit. Percentage depends on Benchmark and Risk (i.e. risk and materiality have inverse relationship). Documentation of Materiality: The auditor shall document the following aspects of materiality: (i) Materiality for the financial statements as a whole (ii) Performance materiality Exam Tip Following “rule of thumb” has been established to determine materiality: 1. For profit oriented entity, materiality= Profit before tax * 5% 2. For not-for-profit entity, materiality = Total Revenue or Total Expenses or Total Assets* 0.5% (or 1%) 5 By: Muhammad Asif, ACA

- 6. Auditing – Study Notes Chapter 9 Planning an Audit (iii) Basis of computing materiality (iv) Any revision of (i) to (ii) as the audit progresses CONCEPT REVIEW QUESTION ISA 320 Materiality in Planning and Performing an Audit provides guidance on the concept of materiality in planning and performing an audit. Required: Define materiality and determine how the level of materiality is assessed. (05 marks) (ACCA F8 – June 2010) Determination of materiality level requires professional judgement on the part of the auditor. (a) Briefly describe the importance of materiality in the following stages of audit: (i) Planning stage (01 marks) (ii) Reporting stage (02 marks) (b) What aspects of materiality should be documented by an auditor in the working papers? (04 marks) (CA CAF- Spring 2016) LLOO 66:: PPEERRFFOORRMMAANNCCEE MMAATTEERRIIAALLIITTYY:: What is Performance Materiality: Performance Materiality is the amount set by the auditor, less than materiality for the financial statements as a whole, to reduce the risk that the aggregate of uncorrected and undetected misstatements exceeds materiality for the financial statements as a whole. If applicable, performance materiality also refers to the amount or amounts set by the auditor at less than the materiality level or levels for particular classes of transactions, account balances or disclosures. How is Performance Materiality determined: Determination of performance materiality is not a mathematical calculation. It involves the exercise of professional judgment and is affected by: misstatements identified in previous periods; and expected misstatements in current periods (based on auditor’s risk assessment procedures) CONCEPT REVIEW QUESTION You are the training manager in a firm of chartered accountants. Prepare brief presentation for newly inducted trainees, on Materiality and Performance Materiality. (05 marks) (CA Inter - Autumn 2014) LLOO 77:: QQUUAALLIITTAATTIIVVEE MMAATTEERRIIAALLIITTYY:: What is Qualitative Materiality: Qualitative materiality means ignoring the amounts of misstatements and considering its “qualitative characteristics” to determine whether it is material or not. 6 By: Muhammad Asif, ACA

- 7. Auditing – Study Notes Chapter 9 Planning an Audit Examples Areas where Materiality is determined on Qualitative basis: 1. Inadequate or improper description of an accounting policy and related party transactions 2. Non-compliance of legal requirements (e.g illegal payments, money laundering) 3. Fraud 4. A misstatement which is small in size but: o Converts a loss into profit (and vice-versa). o Takes financial figures below a certain threshold o Affects a key ratio (e.g. debt-covenant requirements) o Directors’ remuneration o Share capital CONCEPT REVIEW QUESTION During the course of an audit, both quantitative as well as qualitative misstatements need to be considered. Give four examples of qualitative misstatements. (04 marks) (CA Inter, Spring 2010) LLOO 88:: RREEVVIISSIIOONN IINN MMAATTEERRIIAALLIITTYY:: When is Materiality Revised: Materiality is revised if auditor obtains new information/evidence which is different from information/evidence on which original assessment was based e.g. 1. Occurrence of events substantially affecting draft financial statements 2. Revision in risk 3. Change in the auditor’s understanding of the entity and its operations 4. Change in circumstances during audit (e.g. decision to dispose a major part of the business) Effect of Revision of Materiality on Audit: If materiality is revised, it may have impact on following aspects of audit: Performance materiality Nature, timing and extent of audit procedures Risk of material misstatement CONCEPT REVIEW QUESTION Sajjad is the audit senior on the audit of Hameed Limited (HL). Upon his manager’s instruction Sajjad had determined the acceptable materiality level to be Rs. 10 million at the initial planning stage. However, at the time of evaluating the results of audit procedures carried out at the interim stage, he has reduced the materiality level to Rs. 7.5 million. Required: (i) Identify the possible causes which motivated Sajjad to reduce the materiality level. (02 marks) (ii) Discuss the impact of reduction in the materiality level on audit risk and the audit procedures to be performed. (05 marks) (CA Inter - Spring 2010) 7 By: Muhammad Asif, ACA

- 8. Auditing – Case Studies Chapter 9 Planning an Audit CHAPTER NINE (CASE STUDIES) PLANNING AN AUDIT AAPPPPEENNDDIIXX 11:: CCAASSEE SSTTUUDDYY RREELLAATTIINNGG TTOO CCAALLCCUULLAATTIIOONN AANNDD UUSSEE OOFF MMAATTEERRIIAALLIITTYY:: Structure of the Case: You may be given financial information of an audit client and misstatement(s) in the question. You will be required to calculate materiality from the financial information, and to comment whether given information is material or not. Suggested Approach to Solve: While evaluating whether effect is material or not, consider aggregate effect of misstatement as well as qualitative aspect of materiality. Model Case Study: Case Study 1: For each of the following scenarios determine: a) Planning materiality, b) Performance materiality and c) Evaluate audit findings. Scenario 1: HMK & Co. operates in retail business. The components of its financial statements are: 1. Net Profit 3,200,000 2. Total Revenue 350,000,000 3. Total Assets 240,000,000 Auditor of HMK & Co. allocates 40% of financial statement materiality to inventories. During the audit of inventories, HMK & Co.’s audit firm detected two misstatements amounting Rs. 60,000 and Rs. 50,000 respectively. Scenario 2: Welfare Hospital treats poor patients and runs on donations received from general public. The components of its financial statements are: 1. Net Profit 15,000 2. Total Revenue 30,000,000 3. Total Assets 22,000,000 Welfare Hospital’s auditor uses 50% of financial statements materiality as performance materiality. During the course of the audit, audit firm detected one misstatement that resulted in an understatement of expenses by Rs. 20,000. 1 By Muhammad Asif, ACA

- 9. Auditing – Case Studies Chapter 9 Planning an Audit Solution: Scenario 1: Planning Materiality: Auditor shall determine materiality using rule of thumb. As this audit client is a profit oriented entity hence benchmark will be Profit (total revenue and total assets will be ignored for this purpose). Hence materiality = Net Profit * 5% i.e. 3,200,000 * 5% = Rs. 160,000 Performance Materiality: Performance Materiality = Overall Materiality * 40% = 64,000. Evaluation of Result: As the amount of misstatement exceeds performance materiality, hence it is material and is required to be corrected. (Note: Misstatements in classes of transactions or account balances are compared with performance materiality and not with overall materiality). Scenario 2: Planning Materiality: Auditor shall determine materiality using rule of thumb. As this audit client is a not-for-profit entity hence benchmark will be Total Revenue or Total Assets (net profit will be ignored for this purpose). Hence materiality = Total Revenue * 1% i.e. 30,000,000 * 0.5% = Rs. 150,000 (Note: Alternatively total assets may also be used to determine materiality) Performance Materiality: Performance Materiality = Overall Materiality * 50% = 75,000. Evaluation of Result: As the amount of misstatement does not exceed performance materiality, hence it is immaterial on quantitative basis. However, if corrected, this misstatement will affect key performance indicator i.e. it will convert its profit into loss, hence it is considered material on the basis of qualitative criteria and is required to be corrected. 2 By Muhammad Asif, ACA