Basic of Financial Accounting - Easy Notes

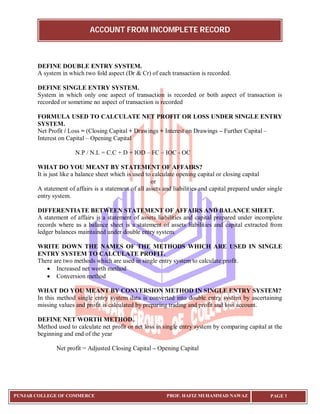

- 1. ACCOUNT FROM INCOMPLETE RECORD PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 DEFINE DOUBLE ENTRY SYSTEM. A system in which two fold aspect (Dr & Cr) of each transaction is recorded. DEFINE SINGLE ENTRY SYSTEM. System in which only one aspect of transaction is recorded or both aspect of transaction is recorded or sometime no aspect of transaction is recorded FORMULA USED TO CALCULATE NET PROFIT OR LOSS UNDER SINGLE ENTRY SYSTEM. Net Profit / Loss = (Closing Capital + Drawings + Interest on Drawings – Further Capital – Interest on Capital – Opening Capital N.P / N.L = C.C + D + IOD – FC – IOC - OC WHAT DO YOU MEANT BY STATEMENT OF AFFAIRS? It is just like a balance sheet which is used to calculate opening capital or closing capital or A statement of affairs is a statement of all assets and liabilities and capital prepared under single entry system. DIFFERENTIATE BETWEEN STATEMENT OF AFFAIRS AND BALANCE SHEET. A statement of affairs is a statement of assets liabilities and capital prepared under incomplete records where as a balance sheet is a statement of assets liabilities and capital extracted from ledger balances maintained under double entry system. WRITE DOWN THE NAMES OF THE METHODS WHICH ARE USED IN SINGLE ENTRY SYSTEM TO CALCULATE PROFIT. There are two methods which are used in single entry system to calculate profit. Increased net worth method Conversion method WHAT DO YOU MEANT BY CONVERSION METHOD IN SINGLE ENTRY SYSTEM? In this method single entry system data is converted into double entry system by ascertaining missing values and profit is calculated by preparing trading and profit and loss account. DEFINE NET WORTH METHOD. Method used to calculate net profit or net loss in single entry system by comparing capital at the beginning and end of the year Net profit = Adjusted Closing Capital – Opening Capital

- 2. ACCOUNT FROM INCOMPLETE RECORD PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 2 FORMAT STAMEN OF PROFIT & LOSS M/S… Statement of profit & loss For the year ended 31st December xxxx DETAILS AMOUNT (Rs.) Closing capital XXX Add: Drawings XXX Add: Interest on Drawings XXX Less: Fresh Capital {XXX) Less: Interest on Capital (XXX) Adjusted Closing Capital XXX Less: Opening Capital (XXX) Net Profit/ Net Loss XXX

- 3. TERMS AND CONCEPTS PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 DEFINE BUSINESS Any legal activity which is doing for the purpose of earning profit is called business. TYPE OF BUSINESS Manufacturing Trading Servicing TYPE OF BUSINESS ORGANIZATION Trading Partnership Joint stock company DEFINE TRANSACTION Any dealing between two or more person which can change the financial position of the business is called transaction. Type of transactions Cash Transaction Credit Transaction DEFINE BOOK KEEPING. Recording of business transactions in books of account in prescribed manner DEFINE ACCOUNTING. Accounting is an art of recording, clarifying, summarizing and interpreting the results from financial statements DEFINE PROPRIETOR. He is the owner of the business. He gives time and invests money into the business DEFINE CAPITAL. The amount of cash or the value of goods or both invested by the owner in establishing his business is known as capital. or Owner contribution in business assets is called capital DEFINE THE TERM DRAWING. Withdrawal of cash or goods from the business for private and personal use of the owner is called drawing. WHAT IS GOODS (MERCHANDISE)? Anything which is purchased for resale purpose are called goods e.g. cloths are goods for cloth merchant DEFINE PURCHASES. Goods purchased are called purchases, purchases are of two type Cash Purchases Credit Purchases DEFINE CASH PURCHASES. Goods purchased for cash are called cash purchases DEFINE CREDIT PURCHASES. Goods purchases on credit are called credit purchases. DEFINE PURCHASES RETURN / RETURN OUTWARD / RETURN TO SUPPLIER. If goods purchased are returned to the supplier, it is called purchases return. The good are returned when they are: Defective Not according to sample Damaged Excess of the quantity ordered for

- 4. TERMS AND CONCEPTS PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 2 DEFINE PURCHASES ALLOWANCE. If the purchaser informs the supplier that some goods are defective and the supplier reduce some amount. This reduction in price is known purchase allowance. WHAT IS SALES ALLOWANCE? If the customer informs the seller that some goods are defective and seller reduced some amount this reduction in prices is known as sales allowance. WHAT IS SALES? Goods sold are called sales. Sales are of two kinds; Cash sales Credit sales WHAT IS CASH SALES? Goods sold for cash are called cash sales WHAT IS CREDIT SALES? Goods sold on credit are called credit sales. WHAT IS SALES RETURN (RETURN INWARD)? If the customer returns the goods it is called sales return goods returned when they are Defective Not according to sample Damaged Excess of the quantity ordered for WHAT IS STOCK (INVENTORY)? Unsold goods are called stock / inventory DEFINE VOUCHER Written evidence in support of business transaction e.g Cash memo Invoice Cash receipt voucher Cash payment voucher DEFINE CASH MEMO. Written evidence in support of cash transaction WHAT IS INVOICE? Written evidence in support of a credit transaction WHAT IS DEBTORS (ACCOUNT RECEIVABLE)? Debtors (account receivable) are those persons from whom the amount is receivable for goods sold on credit. WHAT IS CREDITORS (ACCOUNTS PAYABLE)? Creditors (account payable) are those persons to whom the amount is payable for goods purchased on credit. WHAT IS DISCOUNT? Reduction in the price of non-defective goods Trade discount Cash discount o Discount allowed / Sale Discount o Discount received / Purchases Discount

- 5. TERMS AND CONCEPTS PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 3 WHAT IS ALLOWANCE? Reduction in the price of defective goods Purchases allowance Sales allowance WHAT IS TRADE DISCOUNT? It is deduction allowed by a trader on the lit price of the goods. It is not recorded in books of account WHAT IS CASH DISCOUNT? Deduction allowed by a creditor to his debtor for making prompt payment is called cash discount Types of cash discount Discount allowed Discount received WHAT IS ASSETS? Valuable things posses by the business are called asset e.g. building, machinery, furniture etc DEFINE LIABILITIES Outsider contribution in business assets are called liabilities or These are the amounts payable by the business e.g. bank loans and creditor DEFINE EXPENSES Expense is an expired portion of acquisition price. or Cost of goods and services used up in the process of generating income. Rent paid Salaries paid Wages paid Interest paid DEFINE EXPENDITURE The cost of acquiring the assets are called expenditure DEFINE INCOME (REVENUE) It is the price of goods sold or services rendered by the business e.g. Rent received Interest received Commission received Sales WHAT IS CASH TRANSACTIONS? If the value of transaction is met in cash immediately it is called cash transaction. WHAT IS Credit Transactions? If the value of transaction is not met in cash immediately it is called credit transaction. WHAT IS COMMISSION? It is remuneration for services rendered by one person to another person WHAT IS DOUBLE ENTRY SYSTEM? A system in which two fold aspect (Dr & Cr) of transaction are recorded

- 6. TERMS AND CONCEPTS PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 4 DEFINE EQUITY Claim against business assets. Equity is of two types Owner equity / capital (owner contribution in business assets) Outsider equity / liabilities (outsider contribution in business assets) WHAT IS DRAWINGS? Cash or Goods withdrawn by the owner from the business for personal use is called drawings HOW MANY TYPES OF ACCOUNTING? Financial accounting Management accounting Cost accounting WHAT IS FINANCIAL ACCOUNTING? It is an accounting which is used to calculate the profit or loss and observe the financial position of the business WHAT IS COST ACCOUNTING? It is an accounting which is used to calculate cost of product WHAT IS MANAGEMENT ACCOUNTING? It is an accounting which is used for the decision making WHAT IS CASH SYSTEM OF ACCOUNTING? It is a system in which accounting entries are made only when cash received or paid WHAT IS ACCRUAL SYSTEM OF ACCOUNTING? It is a system in which accounting entries are made when transaction carried, whether on cash or on credit DEFINE CASH SYSTEM OF ACCOUNTING It is a system in which accounting entries are made when cash is received or paid PARTIES INTERESTED IN ACCOUNTING INFORMATION? Creditors Debtors Owners Teachers Students Government Employees WHAT IS SINGLE ENTRY SYSTEM? A system in which only one effect of transaction is recorded or two effect of transaction is recorded or sometime no effect of transaction is recorded DEFINE DOUBLE ENTRY SYSTEM? A system in which two fold aspect ( Dr & Cr) of each transaction is recorded.

- 7. TERMS AND CONCEPTS PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 5 DEFINE ACCRUAL SYSTEM OF ACCOUNTING It is a system in which accounting entries are made on the basis of amount having become due for payment or receipt. WHAT IS FUNDAMENTAL ACCOUNTING EQUATION? ASSETS = LIABILITIES + CAPITAL WHAT IS MEANT BY THE TERM CONCEPT IN ACCOUNTING? Accounting concept means the basic assumptions upon which accounting is based DEFINE BUSINESS ENTITY CONCEPT. According to this concept business is treated as separate person from its owner DEFINE GOING CONCERN CONCEPT. According to this concept business will continue for a long period of time DEFINE MONEY MEASUREMENT CONCEPT. According to this concept we record only those transactions which can be measured in term of money DEFINE COST CONCEPT According to this concept an asset is recorded in the books at the price at which it was acquired DEFINE DUAL CONCEPT According to this concept every transaction have two effect (one is Dr & other is Cr) DEFINE ACCOUNTING PERIOD According to this concept life of a business is divided into small segment (1 Year) and each small segment is called accounting period e.g. 1ST JANUARY 2005 -------------------------- 31ST DECEMBER 2005 DEFINE MATCHING CONCEPT The concept of offsetting expenses against revenue is called matching concept or According to this concept expense are match with income, we should consider only those expenses which are incurred to generate income of that period Net profit (Year2005) = Income (Year 2005) Vs Expenses (Year 2005) DEFINE REALIZATIONS CONCEPT Revenue should be recognized at the time when goods are sold or services are rendered. DEFINE THE TERM CONVENTION. It means those customs or traditions which guide the accountant in maintaining the accounting record. DEFINE CONVERSION OF DISCLOSURE. It means important information relating to transaction must be disclosed. DEFINE THE CONVENTION OF MATERIALITY. It means we should record only those events which are significant and insignificant events should be ignored.

- 8. TERMS AND CONCEPTS PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 6 DEFINE CONVENTION OF CONSISTENCY. It means that accounting practice should remain unchanged from one period to another. DEFINE CONVENTION OF CONSERVATISM. It means that uncertain and risk inherit in business transaction should be given a proper consideration.

- 9. NATURE OF ACCOUNTS & RULES OF DEBIT AND CREDIT PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 DEFINE ACCOUNT. A summarized record of business transactions relating to a person or thing is called account. HOW MANY NUMBERS OF ACCOUNTS ARE IN BRITISH APPROACH? There are three types of account are in British approach: Real account Nominal account Personal account DEFINE REAL ACCOUNT (PROPERTY ACCOUNT). Real account deals with those things which tangible visible or which exist in reality like machinery, building etc. DEFINE NOMINAL ACCOUNT (PROPRIETARY ACCOUNT)? Nominal account deals with those things which are intangible or invisible or which do not exist in reality like salaries rent interest etc. DEFINE PERSONAL ACCOUNT? Accounts relating to persons firms companies and industries are personal account like EXPLAIN THE TERM OF DEBIT AND CREDIT. If we divided the page into two part then left hand side will be called debit and right hand side will be called credit. HOW MANY NUMBERS OF ACCOUNTS IN AMERICAN APPROACH. Real account Nominal account Personal account RULES OF DEBIT AND CREDIT ACCORDING TO BRITISH/TRADITIONAL APPROACH. ACCOUNTS NAME DEBIT CREDIT Real Account Coming into Business Going out from Business Nominal Account Expenses Income Personal Account Receiving Person Giving Person HOW MANY NUMBERS OF ACCOUNTS IN AMERICAN APPROACH. There are five accounts in American approach: Assets Expenses Income Liabilities Owner equity RULES OF DEBIT AND CREDIT ACCORDING TO AMERICAN/MODREN APPROACH ACCOUNTS NAME DEBIT CREDIT Assets account Increases Decreases Expenses account Increases Decreases Income account Decreases Increases Liabilities Decreases Increases Owner equity accounts Decreases Increase

- 10. NON-PROFIT MAKING ORGANIZATION PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 EXPLAIN NON-PROFIT MAKING ORGANIZATION / NON-TRADING ORGANIZATION. Non profit making organization are those which do not buy and sell goods and whose primary object is not to earn profit, Their object is to do goods to the society through welfare activities. EXPLAIN RECEIPTS AND PAYMENT ACCOUNT. Receipts and payments account is a summarized cash book for a given period. EXPLAIN INCOME AND EXPENDITURES ACCOUNT. The account through which surplus or deficit of a non-profit making organization is ascertained. DEFINE SUBSCRIPTION. The amount received from the member of the organization regularly (as per rules) is called subscription. DEFINE SPECIAL SUBSCRIPTION. The additional subscription collected from members over and above the regular subscription for some special purpose is called special subscription. DEFINE ADMISSION FEE. The amount which is paid by a new member at the time of admission is called admission fee. DEFINE LEGACY. Legacy refers to property received by virtue of a will of a person after his death. DEFINE LIFE MEMBERSHIP FEE. The amount which is paid by a member’s lump sum to become a life member of organization is called life membership fee. DEFINE DONATION. Amount received from members and general public by way of gift is known as donation. DEFINE CAPITAL FUND. Excess of total assets over external liabilities of a non-profit making organization is called capital fund. Capital Fund = Asset - Liabilities

- 11. JOURNAL PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 DEFINE JOURNAL The book of account in which business transactions are originally recorded in chronological order are called journal or Journal has been derived from the French words “Jour” which means day. “Journal is the first book of accounting in which we record business transaction chronologically.” DEFINE ENTRY. To enter the transactions in journal is called entry. DEFINE JOURNALIZING. The act of recording transactions in journal is called journalizing. DEFINE NARRATION. A short explanation of each transaction is written below each entry is called narration. DEFINE SIMPLE ENTRY. An entry in which one account is debited and one account is credited is called simple entry. DEFINE COMPOUND ENTRY. An entry in which more than one account is debited or more than one account is credited is called compound entry. WHY JOURNAL IS CALLED “DAY BOOK”? Journal is called “day book” because all transactions are recorded on daily basis WHY JOURNAL IS CALLED BOOK OF ORIGNAL ENTRY / PRIME ENTRY / BASIC ENTRY? Journal is called book of original entry because transaction first recorded in journal

- 12. CONSIGNMENT PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 DEFINE CONSIGNMENT. Consignment is an act of sending goods by owner to his agent from one place to another for the purpose of sale. ENLIST THE PARTIES INVOLVED IN CONSIGNMENT. There are two parties involve in consignment: Consignor Consignee DEFINE CONSIGNOR. The owner who sends his goods for sale purpose to his agent is known as consignor. DEFINE CONSIGNEE. The person to whom the goods are sending for sale purpose is known as consignee. DEFINE CONSIGNMENT OUTWARD. When the goods are dispatched by the consignor to the consignee, it will be a consignment outward from consignor point of view. DEFINE CONSIGNMENT INWARD. When the goods are dispatched by the consignor to the consignee, it will be a consignment inward from consignee point of view. DEFINE ACCOUNT SALE. It is a periodic statement delivered by consignee to consignor about the goods sold; price realized his commission and the expenses incurred in connection with the sale. DEFINE PERFORMA INVOICE. It is a statement sends by consignor to consignee showing quantity quality and price of goods delivered. DEFINE COMMISSION. The remuneration denoted to consignee for selling the goods of the consignor is called commission. DEFINE DELCREDRE COMMISSION. The extra commission which is paid to consignee if loss on account of bad debts is born by him DEFINE OVERRIDING COMMISSION. A commission paid to the consignee by consignor for pushing a new product in the market is called overriding commission. DEFINE CONSIGNMENT ACCOUNT. It is a nominal account which is prepared to calculate profit or loss on consignment

- 13. CONSIGNMENT PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 2 DEFINE NORMAL LOSS. The loss arises due to natural causes such as evaporation, shrinkage, leakage, evaporation etc, is called normal loss DEFINE ABNORMAL LOSS. The loss arises accidentally such as loss by fire loss by theft etc. is called abnormal loss. DEFINE NON-RECURRING EXPENSES (DIRECT EXPENSES). It include expenses incurred to bring the goods to godown of the consignee such as Cartage, Carriage, Railway charges etc DEFINE RECURRING EXPENSES (INDIRECT EXPENSES). It include expenses incurred on selling the goods e.g. Commission, Selling expenses etc FORMULA TO CALULATE UN-SOLD STOCK Cost of un-sold unit xxx Add: Consignor all expenses (Prop) xxx Add: Consignee direct expenses (Prop) xxx Un-sold Stock xxx

- 14. LEDGER & TRIAL BALANCE PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 DEFINE LEDGER. The book in which individual record of each account is maintained. or The book in which all the business transactions are finally recorded in the concerned account in a summarized and classified form is called ledger DEFINE POSTING. The process of recording business transaction in ledger called posting. EXPLAIN THE TERM BALANCE. The difference between the two sides of an account is called balance. EXPLAIN DEBIT BALANCE. If the debit side of an account is heavier. Its balance is known as debit balance. EXPLAIN CREDIT BALANCE. If the credit side of an account is heavier. Its balance is known as credit balance. EXPLAIN ZERO BALANCE. If the two sides of an account are equal then it will be called zero balance. WHAT ARE THE KINDS OF LEDGER? There are three kinds of ledger: Debtor ledger Creditor ledger General ledger DEFINE DEBTOR LEDGER. It contains the accounts of all the customers (debtors) to whom goods have been sold on credit. DEFINE CREDITOR LEDGER. It contains the accounts of all the suppliers (creditor) from whom, good have been purchased on credit. DEFINE GENERAL LEDGER. It may contain the records of real and nominal account items. DEFINE TRAIL BALANCE. A trial balance is a list of debit and credit balance of all ledger accounts. It has two purposes: Check the accuracy of accounts Prepare a summary of accounts DEFINE FOLIOING. When the page number of ledger is recorded in ledger folio column of journal & page number of journal is recorded in journal folio column of ledger is known as folioing

- 15. LEDGER & TRIAL BALANCE PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 2 TRANSACTION JOURNAL LEDGER TRIAL BALANCE FINAL ACCOUNT EXPLAIN AND DRAW ACCOUNTING CYCLE. It refers to a complete sequence of accounting procedures which are required to be repeated in same order during each accounting period.

- 16. DEPRECIATION PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 DEFINE THE TERM DEPRECIATION. Depreciation means gradual and permanent decrease in the value of fixed asset by any cause WHAT ARE THE CAUSES OF DEPRECIATION? 1. Internal Causes Wear & Tear Depletion 2. External Causes Obsolescence Accident Efflux of time DEFINE FIXED ASSETS. An asset that is not consumed or sold during the normal course of business, such as Building, Machinery etc DEFINE TANGIBLE ASSETS. Assets which have physical existence e. g. Furniture, Building, Machinery etc DEFINE INTANGIBLE ASSETS. Assets which have no physical existence like Goodwill, Trade Mark etc DEFINE CURRENT ASSETS. Asset which can be converted into cash within one year are called current asset e.g. Cash, Bank, Debtors etc DEFINE WASTING ASSETS. Natural resource such as coal, gas, oil that diminishes in value due to depletion is called wasting assets. DEFINE AMORTIZATION. Decrease in the value of intangible fixed assets is called amortization e.g. Trade Mark, Goodwill etc DEFINE DEPLETION. Decrease in the value of wasting assets is called depletion e.g. Mines, Oil wells etc DEFINE COST PRICE OF AN ASSET. It includes all expenses e.g. purchase price, installation and erection charges etc Cost Price = Purchase Price + All Capitalized Expenditures DEFINE WRITTEN DOWN VALUE. Amount yet to b allocated for depreciation is called written down value

- 17. DEPRECIATION PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 2 DEFINE ACCUMULATED DEPRECIATION. The total depreciation charged in different accounting period is called accumulated depreciation. or Sum of the depreciations of all the accounting period is called accumulated depreciation DEFINE SCRAP / BREAKUP / SALVAGE / RESIDUAL VALUE. The price at which the asset will be sold at the end of its working life is called scrape value. DEFINE BOOK VALUE OF ASSET. Value according to the books of account is called book value of asset. Book value = Cost Price of an Assets – Accumulated Depreciation DEFINE WEAR AND TEAR. Change in shape of assets due to use in business is called wear and tear. DEFINE STRAIGHT LINE METHOD. A method of depreciation in which the amount of depreciation remains same every year is called straight line method. WHAT IS THE FORMULA FOR THE CALCULATION OF ANNUAL DEPRECIATION UNDER STRAIGHT LINE METHOD? Annual Depreciation = Cost – Scrape Value Estimated life WHAT IS THE FORMULA FOR THE CALCULATION OF RATE OF DEPRECIATION UNDER DIMINISHING BALANCE METHOD? R = [ 1 - ( s / c ) ] 1 / n Where R = Rate of depreciation S = Scrape Value C = Cost price N = Life / Number of year DEFINE DIMINISHING BALANCE METHOD / REDUCING BALANCE METHOD / REDUCING INSTALLMENT METHOD / WRITTEN DOWN VALUE METHOD. Under this method depreciation is charged with fixed rate on book value of asset and amount of depreciation decrease every year. NAME OF TWO COMMON METHOD USED IN DEPRECIATION The common used method of depreciation is as follows: Straight line method Diminishing balance method

- 18. DEPRECIATION PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 3 WHAT IS THE ENTRY OF DEPRECIATION / ADJUSTING ENTRY OF DEPRECIATION? DATE PARTICULARS L.F DEBIT (Rs.) CREDIT (Rs.) Depreciation Account To Asset Account XXX XXX WHAT IS THE CLOSING ENTRY OF DEPRECIATION? DATE PARTICULARS L.F DEBIT (Rs.) CREDIT (Rs.) Profit & Loss Account To Depreciation Account XXX XXX WHAT IS THE OBJECT OF PROVIDING DEPRECIATION? The objects of providing depreciation are: To find out the net profit or loss To ascertain the cost of production To ascertain the true value of assets

- 19. CASH BOOK & BANK RECONCILIATION STATEMENT PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 DEFINE CASH BOOK. A book which is used to record cash transaction is called cash book. Cash receipts are recorded on the left side and cash payments are recorded on the right side. DEFINE SINGLE COLUMN CASH BOOK. The single column cash book makes a record of only cash transactions. Cash receipts are recorded on the left side and cash payments are recorded on the right side. DEFINE THE DOUBLE COLUMN CASH BOOK. The cash book in which cash and bank or cash and discount transactions are recorded is called double column cash book. DEFINE TREBLE COLUMN CASH BOOK. The cash book in which cash bank and discount transactions are recorded is called treble or three column cash book. EXPLAIN CONTRA ENTRY. An entry which is recorded on the both sides of cash book is called contra entry. or An entry in which cash account and bank account are involved and it is recorded on both side of cash book is called contra entry. DEFINE SUBSIDIARY BOOKS. The journal is sub-divided into different journals known as the subsidiary books/special journals e.g. Cash book Purchase journal Sales journal Purchases return journal Sales return journal B/R book B/P book DEFINE PURCHASES BOOK (INVOICE BOOK). A book in which only transactions of credit purchases are recorded is called purchases book. DEFINE SALES BOOK. A book in which only transactions of credit sales are recorded is called sales book. DEFINE SALES RETURN BOOK. A book in which all credit sales returned by customer are recorded is called sales return book. DEFINE PURCHASES RETURNS BOOK. A book in which all credit purchases returned to supplier are recorded is called purchases return book. EXPLAIN PETTY CASH BOOK. The book in which small payments are recorded which are not convenient to record in the cash book is called petty cash book.

- 20. CASH BOOK & BANK RECONCILIATION STATEMENT PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 2 DEFINE DEBIT NOTE. If goods bought on credit are returned to the seller for any solid reasons the buyer debit seller account and inform the seller through a note. This note is called debit note. DEFINE CREDIT NOTE. If goods sold on credit are returned by the buyer the seller credits buyer account and informs the buyer through a note. This note is called credit note. WHAT IS BANK RECONCILIATION STATEMENT? It is a statement which contains a complete and satisfactory explanation of the differences in balances as per cash book and pass book. DEFINE PASS BOOK. It is a book prepared by bank which contains detail about the deposits and withdrawals of the account holder. GIVE SOME EXAMPLES OF DISAGREEMENT BETWEEN CASH BOOK AND PASS BOOK. The following are some examples of disagreement: Cheques issued but not presented Cheques deposited but not credited Bank charges Any mistake made by bank Any mistake made customer DEFINE BANK OVERDRAFT / OVERDRAFT / OVERDRAWN The amount which a bank allowed to a customer to withdraw in excess of his deposits is called bank overdraft. DEFINE UN-PRESENTED CHEQUE. Cheque issued but not presented for payment is called un-presented cheque or Un-paid cheque or outstanding cheque. DEFINE UN-CREDITED CHEQUE. Cheque deposited into the bank by the customer but not credited by the bank is called un-credited cheque or un-collected cheque or un-cleared cheque

- 21. CAPITAL & REVENUE PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 1 DEFINE CAPITAL TRANSACTIONS. Transactions having long-term effect are known as capital transactions. DEFINE REVENUE TRANSACTIONS. Transactions having short-term effect are known as revenue transactions. WHAT DO YOU MEANT BY CAPITAL EXPENDITURE? Any expenditure that benefitted the business for long period of time and permanently used in the business for the purpose of earning revenue is called capital expenditure e.g. Purchased building Purchased furniture WHAT DO YOU MEANT BY REVENUE EXPENDITURES? Any expenditure that benefitted the business for short period of time is called revenue expenditure e.g. Salaries paid Rent paid WHAT IS CAAPTALIZED EXENDITURE? Expenditure connected with the purchase of fixed asset are called capitalized expenditure e.g. wages paid for the installation of machinery. WHAT ARE THE TREATMENTS OF CAPITAL AND REVENUE EXPENDITURES? Capital expenditures are shown in the balance sheet assets side while revenue expenditures are shown in the trading and profit and loss account debit side. DEFINE CAPITAL PAYMENT. The amount which is actually paid on account of capital expenditures DEFINE REVENUE PAYMENT. The amount which is actually paid on account of revenue expenditures DEFINE DEFERRED REVENUE EXPENDITURES. Actually it is revenue expenditure but it contains some properties of capital expenditure e.g. Preliminary expenses Research and development cost Heavy advertisement and repair DEFINE REVENUE RECEIPTS. Amount received against revenue income are called revenue receipt DEFINE CAPITAL RECEIPTS. Amount received against capital income are called capital receipts. DEFINE CAPITAL PROFITS. Capital profit which is earned on the sale of the fixed assets. DEFINE REVENUE PROFIT. The profit which is earned during the ordinary course of business is called revenue profit.

- 22. CAPITAL & REVENUE PUNJAB COLLEGE OF COMMERCE PROF. HAFIZ MUHAMMAD NAWAZ PAGE 2 DEFINE CAPITAL LOSS. The loss suffered by a company on the sale of fixed assets. DEFINE REVENUE LOSS. The loss suffered by the business in the ordinary course of business is called revenue loss.