Makerere University partnership accounting questions

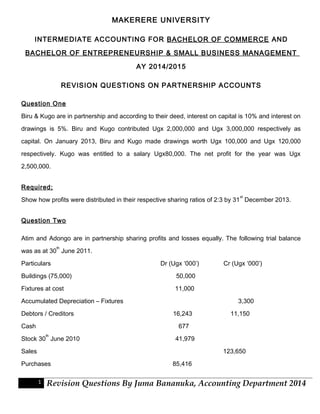

- 1. MAKERERE UNIVERSITY INTERMEDIATE ACCOUNTING FOR BACHELOR OF COMMERCE AND BACHELOR OF ENTREPRENEURSHIP & SMALL BUSINESS MANAGEMENT AY 2014/2015 REVISION QUESTIONS ON PARTNERSHIP ACCOUNTS Question One Biru & Kugo are in partnership and according to their deed, interest on capital is 10% and interest on drawings is 5%. Biru and Kugo contributed Ugx 2,000,000 and Ugx 3,000,000 respectively as capital. On January 2013, Biru and Kugo made drawings worth Ugx 100,000 and Ugx 120,000 respectively. Kugo was entitled to a salary Ugx80,000. The net profit for the year was Ugx 2,500,000. Required; Show how profits were distributed in their respective sharing ratios of 2:3 by 31st December 2013. Question Two Atim and Adongo are in partnership sharing profits and losses equally. The following trial balance was as at 30th June 2011. Particulars Dr (Ugx ‘000’) Cr (Ugx ‘000’) Buildings (75,000) 50,000 Fixtures at cost 11,000 Accumulated Depreciation – Fixtures 3,300 Debtors / Creditors 16,243 11,150 Cash 677 Stock 30th June 2010 41,979 Sales 123,650 Purchases 85,416 1 Revision Questions By Juma Bananuka, Accounting Department 2014

- 2. Carriage outwards 1,288 Discount allowed 115 Interest on loan 4,000 Office expenses 2,416 Salaries & wages 18,917 Bad debts 503 Provision for bad debts 400 Long-term loan 40,000 Capital accounts Atim 35,000 Adongo 29,500 Current accounts Atim 1,306 Adongo 298 Drawings Atim 6,400 Adongo 5,650 Additional information Stock on 30th June 2011 was Ugx56,340,000 Accrued expenses; Office expenses Ugx 96,000 Wages Ugx 200,000 Depreciate fixtures at 10% per annum on reducing balance. Depreciation on buildings was Ugx 1,000,000. Provision for bad debts is to be decreased to Ugx 320,000 Interest on drawings was Ugx 180,000and Ugx 120,000 2 Revision Questions By Juma Bananuka, Accounting Department 2014

- 3. Interest on capital balance is to be provided for at 10% Partnership salary of Ugx 800,000 for Atim is not yet paid. Required a) Statement of Profit or Loss for Atim & Adongo partnership for year ended 30th June 2011 b) Statement of financial position as at 30th June 2011 Question Three Bakiddawo and Nyindo are partners sharing profits and losses equally. They do not maintain proper books of accounts but the following information was obtained from the available records as at 31 March: 2013 2012 Shs ‘000’ Shs ‘000’ Balance at bank 16,968 9,480 Inventory of goods for sale 48,864 54,120 Trade debtors ? 61,200 Trade creditors 30,576 ? Furniture 36,000 Motor vehicles (book value) 192,000 Total sales during the year ended 31 March 2013 amounted to Shs 384,912,000 while purchases, all on credit, for the same period were Shs 295,248,000. On 31 March 2012 Bakiddawo’s capital was Shs 20,000,000 less than that of Nyindo. The analysis of the cash book for the year ended 31 March 2013 shows the following: Shs ‘000’ Receipts: Cash from credit sales 349,152 Additional capital by Bakiddawo 24,000 Cash sales 58,680 3 Revision Questions By Juma Bananuka, Accounting Department 2014

- 4. Payments: For purchases 307,008 Salaries 42,000 Rent (for 6 months to 30 September 2012) 14,400 Rates (for 6 months to 30 September 2013) 12,000 Electricity 6,000 Advertising 4,176 Motor vehicle expenses 11,952 Sundry expenses 3,360 Drawings: -Bakiddawo 13,248 -Nyindo 10,200 On 31 March 2013 liabilities were as follows: Shs ‘000’ Electricity 1,248 Advertisement 624 Sundry expenses 360 On 20 March 2013 the firm decided to dispose of its motor vehicles. One vehicle was sold on credit for Shs 64,000,000 while the other was taken over by Kefazo at a valuation of Shs 25,000,000. The combined book value of the two vehicles was Shs 66,000,000. These transactions have not been recorded in the books. Depreciation at the rate of 10 percent is to be provided on furniture and motor vehicles on hand at 31 March 2013. No depreciation is to be provided for the vehicles which were disposed of. Required: (a) Statement of comprehensive income for the year ended 31 March 2013. (b) Statement of financial position as at 31 March 2013. (c) Partners’ capital accounts. Question Four A,B,C are partners and have always shared it is and losses in the ratio 4:3:1 respectively. They are altering the ratio to 3:5:2 respectively. Their balance sheet as 31/12/2006 was; Net assets 14,000 4 Revision Questions By Juma Bananuka, Accounting Department 2014

- 5. Capital A 6000 B 4800 C 3200 14000 The partner is agreed to value good will at ugx12,000 on change Required; Prepare; i. Good will a/c ii. Capital a/c iii. Balance sheet if; a) Using revolution method b) Using memorandum revolution method Question Five Natu & Sight are in partnership sharing profits and losses equally. They decided to admit Travor and by agreement, goodwill was valued at 6,000,000 and to be introduced in the books. Travor is required to provide capital equal to that of Sight after he has been credited with his share of goodwill. The new profit sharing ratio will be 4:3:3 for Natu, Sight, Trevor respectively. The balance sheet before the admission of Trevor was as follows; Balance sheet Noncurrent assets 15,000 Bank 2,000 17,000 Capital Natu 8,000 Sight 4,000 5 Revision Questions By Juma Bananuka, Accounting Department 2014

- 6. Current Liabilities 5,000 17,000 Required Open the ledger accounts to reflect the admission of Trevor and treatment of goodwill using a) Revaluation method b) Memorandum revaluations of treating goodwill c) Show the goodwill account and the balance sheet using (a) and (b) Question Six Alan and Brenda have been in partnership for several years, compiling their financial statements for the year ending 31 March and sharing profits in the ratio 3:2 after allowing for interest on capital accounts balances at 10% per year. Extracts from their trial balance at 31 March 2010 are given below: Notes Shs ‘000’ Capital accounts: Alan 150,000 Brenda 150,000 Current accounts: Alan - Cr 11,400 Brenda - Dr 7,800 Drawings: Alan 145,200 Brenda 110,700 Office equipment: cost 1 144,900 Accumulated depreciation, 1 April 2009 38,400 Inventory, 1 April 2009 2 46,800 Trade receivables 3 205,200 Provision for doubtful debts, 1 April 2009 3 11,400 Sales revenue 1,346,100 Purchases 553,800 6 Revision Questions By Juma Bananuka, Accounting Department 2014

- 7. Rent paid 4 90,000 Salaries 264,000 Insurance 5 12,000 Sundry expenses 118,200 Notes: 1. Office equipment should be depreciated at 20% per year on the reducing balance basis. 2. Closing inventory amounted to Shs 64,200,000. 3. Debts of Shs 7,200,000 are to be written off, and the allowance for doubtful debts is to be adjusted to 5% of trade receivables. 4. Rent paid Shs 90,000,000 is the amount for the nine months to 31 December 2009. From that date rent was increased by 10%. 5. Insurance paid in advance amounted to Shs 4,500,000. Required: (a) Prepare the partnership’s statement of comprehensive income and a statement showing the division of profit among the partners for the year ended 31 March 2010. (10 marks) (b) Write up the partners’ current accounts for the year ended 31 March 2010. (5 marks) (c) List five points that will apply in the absence of a partnership agreement. (5 marks) (Total 20 marks) Question Seven Vero and Tio are in partnership operating Happy Teens Nursery School, and share profits and losses in the ratio of 3:2, respectively. Below is the school’s trial balance as at 31 December 2011: Dr Cr 7 Revision Questions By Juma Bananuka, Accounting Department 2014

- 8. Shs 000s Shs 000s Capital accounts: Vero 90,00 0 Tio 60,00 0 Current accounts: Vero 37,20 0 Tio 22,80 0 Furniture and fittings 22,400 Library books 5,200 Admission fees 3,500 School fees receipts 235,00 0 Salaries and wages 68,900 Meals 82,072 Payables 12,00 0 Commission on sale of uniforms 3,680 Accumulated depreciation 1 Jan 2011: Furniture and fittings 6,420 Library books 2,100 Donations 40,00 0 Other income 7,600 Rent and utilities 90,600 Stationery 32,488 Transport costs 15,200 General expenses 27,100 15% investment (1 year) 120,000 Bank balance 37,140 8 Revision Questions By Juma Bananuka, Accounting Department 2014

- 9. Cash balance 600 Drawings: Vero 10,200 Tio 8,400 520,300 520,30 0 Additional information: (i) The school has 210 pupils, each paying school fees of Shs 1,110,000 per annum (comprising of 3 terms). In November 2011, 20 pupils paid their school fees for the first term of 2012 at the rate of Shs 380,000 each, while some pupils were in arrears at 31 December 2011. All the arrears are receivable in 2012. (ii) The investment was made on 1 April 2011 for a period of one year. Interest is receivable on maturity. (iii) At 31 December 2011, utilities expenses of Shs 1,180,000 were unpaid, while stationery of Shs 920,000 was unused. These transactions had not yet been accounted for. (iv) Donations were of a revenue nature. (v) Depreciation is charged on cost at the rate of 10% per annum on furniture and fittings, and 20% per annum on library books. (vi) The partners maintain fixed capitals and earn interest on their capital contributions at the rate of 5% per annum. Required: Prepare: (a) The school fees account for the year 2011. (2 marks) (b) Income statement for the year ended 31 December 2011. (9 marks) 9 Revision Questions By Juma Bananuka, Accounting Department 2014

- 10. (c) Partners’ current accounts, in columnar form. (2 marks) (d) Statement of financial position as at 31 December 2011. (7 marks) Question Eight MATOVU, MUSOKE and MUKASA have been partners for some time sharing profits in the ratio of 3:2:1 respectively. MATOVU, MUSOKE & MUKASA STATEMENT OF FINANCIAL POSITION AS AT 31ST AUGUST 2014 ASSETS UGX Plant & Machinery 200,000 Equipment 300,000 Motor vehicles 250,000 Accounts recievable 100,000 Inventory 500,000 Bank 200,000 Total 1,550,000 EQUITY & LIABILITIES Capital MATOVU 600,000 MUSOKE 500,000 MUKASA 300,000 1,400,000 Liabilities Accounts payable 150,000 Total 1,550,000 10 Revision Questions By Juma Bananuka, Accounting Department 2014

- 11. On the same date NAMU was admitted to contribute UGX350,000 as capital to share 1/5 of the profit. The assets were revalued as follows; UGX Plant and Machinery 220,000 Equipment 350,000 Motor vehicles 200,000 Provision for bad debts 5% of accounts receivable Inventory was valued at 450,000 On the retirement of MUSOKE, Goodwill was valued at UGX150,000. The new business of MATOVU, NAMU & MUKASA decided to eliminate goodwill from the books. The profit sharing ratios for MATOVU, MUKASA & NAMU was 3:1:1 respectively. MUSOKE is paid UGX150,000 and the balance remains as a loan. Required; To prepare a revaluation a/c, capital a/c, goodwill a/c, any other relevant ledger a/c to reflect the above transaction & opening balance sheet for MATOVU, MUKASA & NAMU. Question Nine Muqadimah & Almuqadimah are partners sharing profits and losses in the ratio of 2:1. On 31st June 2014, they decided to dissolve the partnership. The statement of financial position as at that date was as below. MUQADIMAH & ALMUQADIMAH STATEMENT OF FINANCIAL POSTION AS AT 31ST JUNE 2014 Non – current assets UGX Land & Buildings 150,000 Furniture 100,000 Motor vehicles 100,000 Current assets 11 Revision Questions By Juma Bananuka, Accounting Department 2014

- 12. Inventory 150,000 Accounts recievable 200,000 Bank 50,000 400,000 Total Assets 750,000 Capital and liabilities Capital account Muqadimah 500,000 Almuqadimah 200,000 700,000 Current account Muqadimah 100,000 Almuqadimah (300,000) Accounts payable 250,000 750,000 On that date the following transactions took place. Buildings and furniture realized UGX 170,000 and UGX 80,000 respectively, motor vehicles were taken over by Muqadimah at UGX 85,000, and Inventory was taken over by Muqadimah at UGX 130,000. Accounts receivables were factored to Walugyo at UGX 180,000. The external liabilities were paid off less 5% discount. Realization expenses amounted to UGX 40,000 Required; Prepare the following ledger account to close off the books of the partnership a) Realization account b) Capital account c) Bank account 12 Revision Questions By Juma Bananuka, Accounting Department 2014

- 13. Question Ten NUWAMANYA, AMANYA, AKAMANYA & NUWE are partners sharing profits and losses in the ratio 0f 2:1:1:1. On 31st December 2013, they decided to dissolve the partnership. The statement of financial position is as follows NUWAMANYA, AMANYA, AKAMANYA & NUWE STATEMENT OF FINANCIAL POSITION AS AT 31ST DECEMBER 2013 Non – current assets Plant and machinery 200,000 Equipment 250,000 Motor vehicles 150,000 Current assets Inventory 90,000 Accounts receivable 80,000 Bank 30,000 200,000 Total Assets 800,000 Capital and liabilities Capital account Nuwamanya 300,000 Amanya 200,000 Akamanya 100,000 Nuwe 50,000 Accounts payable 100,000 Current account Nuwamanya 100,000 Amanya 150,000 Akamanya (120,000) Nuwe (80,000) 13 Revision Questions By Juma Bananuka, Accounting Department 2014

- 14. Capital and liabilities 800,000 Assets realized; UGX Plant and machinery 170,000 Equipment 260,000 Inventory 80,000 NUWAMANYA took a motor vehicle at UGX 140,000. Accounts receivable realized UGX70,000. Accounts payables were paid less 21/2% discount. Realization expenses were UGX30,000. Both AKAMANYA & NUWE are insolvent. AKAMANYA could only bring half of his deficiency. Required; a) Realization account b) Partners capital accounts c) Bank a/c 14 Revision Questions By Juma Bananuka, Accounting Department 2014