The deleveraging cycle

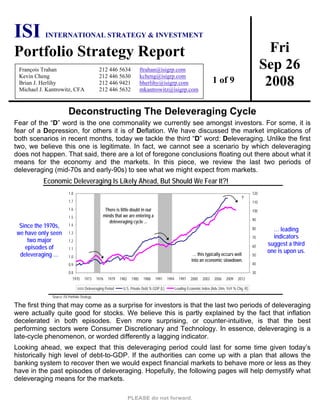

- 1. Fri Sep 26 2008 ISI INTERNATIONAL STRATEGY & INVESTMENT Portfolio Strategy Report François Trahan 212 446 5634 ftrahan@isigrp.com Kevin Cheng 212 446 5630 kcheng@isigrp.com Brian J. Herlihy 212 446 9421 bherlihy@isigrp.com Michael J. Kantrowitz, CFA 212 446 5632 mkantrowitz@isigrp.com 1 of 9 Deconstructing The Deleveraging Cycle Fear of the “D” word is the one commonality we currently see amongst investors. For some, it is fear of a Depression, for others it is of Deflation. We have discussed the market implications of both scenarios in recent months, today we tackle the third “D” word: Deleveraging. Unlike the first two, we believe this one is legitimate. In fact, we cannot see a scenario by which deleveraging does not happen. That said, there are a lot of foregone conclusions floating out there about what it means for the economy and the markets. In this piece, we review the last two periods of deleveraging (mid-70s and early-90s) to see what we might expect from markets. Economic Deleveraging Is Likely Ahead, But Should We Fear It?! Since the 1970s, we have only seen two major episodes of deleveraging … 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 2012 30 40 50 60 70 80 90 100 110 120 Deleveraging Period U.S. Private Debt % GDP (L) Leading Economic Index (Adv 24m, YoY % Chg, R) … this typically occurs well into an economic slowdown. ? There is little doubt in our minds that we are entering a deleveraging cycle ... … leading indicators suggest a third one is upon us. Source: ISI Portfolio Strategy. The first thing that may come as a surprise for investors is that the last two periods of deleveraging were actually quite good for stocks. We believe this is partly explained by the fact that inflation decelerated in both episodes. Even more surprising, or counter-intuitive, is that the best performing sectors were Consumer Discretionary and Technology. In essence, deleveraging is a late-cycle phenomenon, or worded differently a lagging indicator. Looking ahead, we expect that this deleveraging period could last for some time given today’s historically high level of debt-to-GDP. If the authorities can come up with a plan that allows the banking system to recover then we would expect financial markets to behave more or less as they have in the past episodes of deleveraging. Hopefully, the following pages will help demystify what deleveraging means for the markets.

- 2. 2 9/26 ISI Group Market and Economic Implications of Deleveraging Thus far, 2008 has been a year filled with “D” words. The credit crisis has caused fear to loom over the markets as “D” words ranging from Deleverage to Depression have created investor anxiety. In recent months, fears of inflation have transitioned into hopes for Disinflation with some even raising the specter of Deflation. We think the largest-ever policy response from the Fed is likely to minimize the likelihood of the two most worrisome “D” words – Depression and Deflation. However we believe that Disinflation and Deleveraging are two trends that lie ahead of us. As the cover chart illustrates, economic deleveraging in not something new, it is a normal symptom of our economic cycle. In every decade since the 70s we have seen periods of deleveraging, albeit some longer than others. In the following pages we deconstruct two of the longer periods of economic deleveraging in the past 30 years, the mid 1970s and the early 1990s, and discuss the potential implications for markets and the economy from the likely upcoming deleveraging cycle. Macroeconomic & Market Trends To Expect During A Deleveraging Cycle In the past couple of days, investors have been glued to the television watching Bernanke and Paulson plead their case while they are probed by politicians asking questions regarding the solution for the current financial and economic disarray. To be sure, the outcome of a future deleveraging cycle will also depend on the resolution of the bailout in question. Our studies of financial market history, specifically of past booms and bust cycle, showed that busts met with an aggressive policy response are more likely to avoid a “Minskey Moment” (a downward spiral of asset/debt deflation). On the contrary, students of the Austrian school of Economics would argue that ineffective central bank policies are partly to blame for past boom and bust cycles. Putting the Keynesian vs. Austrian economics debate aside, we believe that the Fed’s proactive policy response will help the U.S. economy avoid a debt deflation spiral and more likely allow for a more ‘normal’ deleveraging process in the years to come. The chart on the cover suggests that debt as a percent of GDP should likely slow for at least the next two years. Seeing that this deleveraging process is inherently lagging, we would caution investors from becoming overly bearish going forward for this reason alone. In fact, the last two major periods of deleveraging were actually very good periods for equities and the economy. In some respects, this process of economic normalization is a natural part of the economy cycle. The table above summarizes the 1970s and 1990s periods of deleveraging. On balance, these were periods where inflation was declining and economic prospects, particularly in the housing sector, improved. On the policy front, deleveraging periods typically saw an accommodative Fed. For stocks, market returns were above average and sector leadership came from Discretionary and Technology. Ironically, the evidence suggests that deleveraging, and in many ways credit, is a lagging phenomenon, as these periods were actually some of the best for equity investors.

- 3. 3 9/26 ISI Group During previous deleveraging cycles, one of the primary beneficiaries was the homebuilding industry. As the chart below demonstrates, building permits bottomed near the start of both deleveraging cycles in the early 70’s and mid 90’s and steadily rose thorough out the entire deleveraging process. Currently, building permits sit at their lowest levels in 18-years. In the third quarter, homebuilding stocks have performed particularly well on a relative basis. Interestingly, both periods of deleveraging saw homebuilders outperform the market. One Of The Primary Beneficiaries During Deleveraging Cycles: Homebuilding 200 700 1200 1700 2200 2700 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 80 90 100 110 120 130 140 150 160 170 180 Building permits (000s, L) Private Debt (As a % of GDP, R) near term bottoms in building permits ? ? Counter- intuitively, the housing sector has typically benefitted from past deleveraging cycles. Source: ISI Portfolio Strategy. Another important economic factor that is typically influenced during deleveraging cycles is inflation. As the chart below illustrates, inflation typically trends lower during deleveraging cycles. Notably during both these cycles, core PCE declined by an average of 2.3%, suggesting that disinflation may be on the short-term horizon. Moreover, headline CPI also fell by an average of 4.7% ppts during both these deleveraging periods – lending further evidence for Ed and Nancy’s inflation estimate of 1% by the second half of 2009. Inflation Transitions Towards Disinflation During Deleveraging Cycles 0.5 1.5 2.5 3.5 4.5 5.5 6.5 7.5 8.5 9.5 10.5 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 80 90 100 110 120 130 140 150 160 170 180 Core PCE Price Index (YoY % Chg, L) Private Debt (As a % of GDP, R) Inflation measures typically decline during deleveraging cycles ? ? Inflation tends to ebb in deleveraging cycles. Source: ISI Portfolio Strategy.

- 4. 4 9/26 ISI Group From a historical perspective, the beginning of deleveraging cycles has typically signaled shifts in monetary policy. As the chart below shows, the Fed had previously adopted a more accommodative monetary policy during past deleveraging cycles. During the ‘74 deleveraging cycle, the Fed cut the overnight target rate by 450bps, while the early 90’s deleveraging cycle saw rate cuts of 275bps. Not surprisingly, the end of a deleveraging cycle is typically marked by monetary policy as well, as the Fed typically hikes rates. Policy Is Typically Accommodative During These Deleveraging Cycles The Fed has typically eased during prior deleveraging cycles … 0.0 5.0 10.0 15.0 20.0 25.0 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 80 90 100 110 120 130 140 150 160 170 180 Fed Funds Target Rate (%) Private Debt (As a % of GDP, R) Another rate cut in the cards? ? ? … this cycle has followed the same path so far. Source: ISI Portfolio Strategy. As we’ve previously written, one of the best indicators of future economic performance has been the yield curve. What typically happens during deleveraging cycles is that the Fed begins to cut rates to stimulate lending and economic prospects causing the yield curve to steepen notably. As the table below illustrates, the yield curve has historically steepened during periods of deleveraging and so far the current deleveraging cycle has traced a similar path. Since March 2008 (the estimated start of the current cycle), the yield curve has steepened by 65bps. At the margin, should the current deleveraging cycle play out like prior ones, this would imply that the Fed has more rate cuts in the pipeline ahead – consequently strengthening Tom Gallagher’s forecast for further rate cuts by the end of 2008. The Yield Curve Typically Steepens During Deleveraging Cycles Yield Curve Shifts During Deleveraging Cycles Start End Change in Slope of the Yield Curve Deleveraging Cycle: Sept '74 - Mar '76 -1.31 2.91 + 4.22 Deleveraging Cycle: Dec '90 - Jun '94 1.06 3.07 + 2.01 Yield curve typically steepens during deleveraging cycles. Source: ISI Portfolio Strategy.

- 5. 5 9/26 ISI Group Despite all the bearish sentiment in the market regarding the deleveraging process, stocks have generally rallied during past cycles. As illustrated in the diagram below, during the 1974 deleveraging cycle, the S&P 500 rose 48% (or 37% CAGR), while during the deleveraging cycle of the early 90’s, the S&P 500 gained 38% (or 14% CAGR). At the margin, this suggests that equity markets can, and have rallied in past while the credit markets were still contracting. It was also interesting to note that each deleveraging cycle had been preceded by a market correction. The Market Has Proven Resilient In Past Deleveraging Cycles The past two deleveraging periods were preceded by market corrections … 1.5 1.7 1.9 2.1 2.3 2.5 2.7 2.9 3.1 3.3 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 80 90 100 110 120 130 140 150 160 170 180 S&P 500 (L) Private Debt (As a % of GDP, R) Past periods of economic deleveraging have been good for equity investors. ? … and both periods also coincided with the beginning of bull markets. Source: ISI Portfolio Strategy. One of the notable implications of the deleveraging cycle on financial markets can be summed up into the cliché “size matters”. As the diagram below illustrates, small caps have typically outperformed their large cap counterparts during past deleveraging cycles. For example, during the 1974 deleveraging cycle, small caps outperformed large caps by 24%. In addition, small caps outperformed by 34% during the relative longer deleveraging cycle of the early 90’s. Size Matters: Small Caps Tend To Outperform During Deleveraging 0.50 1.50 2.50 3.50 4.50 5.50 6.50 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 85 95 105 115 125 135 145 155 165 175 185 Small to Large Cap Relative Performance Private Debt (As a % of GDP, R) Small Caps Typically Surge During Deleveraging ? During deleveraging cycles, small caps usually outperform their large cap counterparts. Source: ISI Portfolio Strategy.

- 6. 6 9/26 ISI Group Don’t Be Defensive About Deleveraging Drilling down further, we analyzed what impact the deleveraging cycle had on various sector performances. As the table below illustrates, past deleveraging cycles had typically favored early- cyclicals sectors (i.e. Discretionary, Technology and Industrials). In contrast, we found that defensive sectors such as Utilities, Health Care and Telecom Services, generally underperformed during that part of the cycle. In fact, Discretionary and Technology were the only two sectors to outperform in both periods while Healthcare, Energy, Utilities and Telecom all underperformed in both episodes. Hence the title of this section, don’t be defensive about deleveraging! Annualized Sector Performance During Past Deleveraging Periods In the chart below, we illustrate one of the primary defensive sectors, the Healthcare sector. The chart demonstrates that Healthcare sector underperforms during the first deleveraging cycle of 74 by 14ppts. Indeed, this underperformance is also present during the 94 cycle, with Healthcare underperforming on a relative basis by 4ppts. Coincidentally, the Utility sector also demonstrated considerable underperformance during these two periods, with relative underperformance of 13 ppts in the ’74 cycle and 10 ppts in the early 90’s. Healthcare & Defensive Sectors Have Typically Underperformed In These Cycles 90 92 94 96 98 100 102 104 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 0.16 0.18 0.20 0.22 0.24 0.26 0.28 0.30 0.32 Private Debt (As a % of GDP, L) Health Care Relative Sector Performance (R) Healthcare stocks underperformed in both periods of deleveraging! Healthcare tends to underperform in deleveraging cycles as leading indicators grind higher. Source: ISI Portfolio Strategy.

- 7. 7 9/26 ISI Group In contrast to the defensive sectors, early-cyclical stocks typically performed well during periods of deleveraging. One of the early cyclical segments that faired the best was Discretionary. As the chart below demonstrates, the Discretionary sector managed to outperform the index by 4.2 ppts during the previous deleveraging cycle. Through our lens, we expect this trend in outperformance to be maintained during this deleveraging cycle as economic prospects rebound. Discretionary Was Among The Top Performers In The Last Two Cycles 80 90 100 110 120 130 140 150 160 170 180 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 55 65 75 85 95 105 115 125 135 Private Debt (As a % of GDP, L) Consumer Discretionary Relative Sector Performance (R) Discretionary stocks were the strongest performers in past deleveraging periods. ? ? The Discretionary was one of the top relative performers during the last deleveraging cycle. Source: ISI Portfolio Strategy. As we’ve previously written, the flipside to Discretionary outperformance has been Energy underperformance and this thematic trade remained largely intact during the prior two deleveraging cycles. As the chart below illustrates, the Energy sector underperformed by about 13 ppts during the early 1990 deleveraging cycle and also underperformed by 10 ppts during the cycle of 1974. In our view, given the current needs of the energy sector (i.e., high capital intensive costs and therefore high demand for debt) the existing deleveraging cycle should likely have a significant impact on the sector’s funding needs and ultimately their return on equity / profitability metrics. Energy Lagged During Both Prior Deleveraging Cycles Energy outperformed ahead of the last deleveraging cycle. 90 100 110 120 130 140 150 160 170 180 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 20 40 60 80 100 120 140 160 180 Private Debt (As a % of GDP, L) Energy Relative Sector Performance (R) Energy stocks underperformed in both deleveraging episodes. ? Source: ISI Portfolio Strategy.

- 8. 8 9/26 ISI Group Portfolio Factor Positioning For a Deleveraging Environment Now that we have some understanding of how past periods of deleveraging have panned out for market indices and sectors, we thought we should dive a little deeper into some of the quantitative factors that outperformed during these periods. As we have shown, periods of deleveraging have typically coincided with periods of economic normalization and above-average equity market returns. Accordingly, the factors that have typically outperformed are also those that usually coincide with improving economic prospects. On balance, stocks that are smaller in size, cheaper in valuation and more domestically focused were the strongest. Below we list a handful of factors and the corresponding speculative/defensive end of the spectrum that outperformed. Factors That Have Outperformed In Past Deleveraging Periods Interestingly, in the past few months we have seen some of these same factor performance trends emerge in concert with the ascension of ‘deleveraging’ speak. Ironically, in a lower debt-to-GDP environment, those firms with greater amounts of leverage were the ones to outperform their conservative low-levered counterparts. The chart below illustrates the relative performance of Higher vs. Lower ROE stocks in the S&P 500 during the last deleveraging period. The relative performance trends tracked the ratio of leverage-to-GDP rather closely. If you believe we are entering into a deleveraging period, this chart suggests that a portfolio stocked with high ROE firms would be inconsistent the past performance trends. S&P 500 Factor Chart: Higher vs. Lower ROE 1.10 1.12 1.14 1.16 1.18 1.20 1.22 1.24 1.26 1.28 1.30 1990 1991 1992 1993 1994 1995 1996 1997 1998 0.70 0.75 0.80 0.85 0.90 0.95 1.00 1.05 Private Debt % GDP (L) S&P 500 Relative Performance of ROE: High vs Low (R) Lower ROE equities outperformed during the 1990 deleveraging cycle The past cycle of deleveraging suggest a bias for lower ROE stocks. Source: ISI Portfolio Strategy.

- 9. 9 9/26 ISI Group Stocks With Factor Profiles Consistent With Outperformance During Past Deleveraging Periods The following screen lists the top five stocks in each sector that possess the factor characteristics of stocks that have historically outperformed during past periods of deleveraging. Although the data show that a preference for Consumer Discretionary and Technology share is suggested, we understand that many investors may be unable to take measureable sector positions. Therefore, we provide the list below to help investors on an intra-sector basis. Email strategy@isigrp.com and your ISI salesperson for a more complete list, or the entire S&P 500 ranked by these factors. Company Foreign Market Debt / Earnings Div LT Price Symbol Company Name Industry Exposure Cap Equity Yield ROE BETA Div Yld Growth 9/24/08 Consumer Discretionary JNY Jones Apparel Group Inc. Apparel Accessories & Luxury Goods 8.5 1,529 39 6 3 2 3 10 18.33 LEN Lennar Corp. (Cl A) Homebuilding 0.0 2,373 75 -68 2 5 9 14.77 AN AutoNation Inc. Automotive Retail 0.0 2,244 42 11 6 2 0 9 12.70 KBH KB Home Homebuilding 1,575 170 -68 2 5 9 20.32 MDP Meredith Corp. Publishing 0.0 1,272 52 11 17 1 3 27.98 Consumer Staples SVU SUPERVALU Inc. Food Retail 0.0 4,825 138 13 10 2 3 8 22.76 CCE Coca-Cola Enterprises Inc. Soft Drinks 29.8 8,191 285 8 1 2 6 16.79 SLE Sara Lee Corp. Packaged Foods & Meats 46.2 9,147 83 8 1 3 7 12.95 PBG Pepsi Bottling Group Inc. Soft Drinks 32.3 6,508 141 8 21 1 2 9 30.41 WFMI Whole Foods Market Inc. Food Retail 0.0 2,729 56 6 10 1 0 16 19.45 Energy TSO Tesoro Corp. Oil & Gas Refining & Marketing 0.0 2,588 60 -4 2 2 10 18.78 VLO Valero Energy Corp. Oil & Gas Refining & Marketing 13.8 17,851 34 12 13 1 2 1 34.00 SUN Sunoco Inc. Oil & Gas Refining & Marketing 4,525 71 5 9 1 3 11 38.72 MRO Marathon Oil Corp. Integrated Oil & Gas 8.8 28,563 35 10 16 1 2 8 40.23 MEE Massey Energy Co. Coal & Consumable Fuels 0.0 3,313 147 2 1 0 50 41.02 Financials HBAN Huntington Bancshares Inc. Regional Banks 0.0 3,406 130 17 2 1 7 5 9.30 GGP General Growth Properties Inc. Retail REITs 0.0 4,240 2 3 2 8 7 15.84 CMA Comerica Inc. Diversified Banks 5,269 253 11 9 1 9 6 35.02 AIV Apartment Investment & Management Co. Residential REITs 0.0 2,884 854 -4 1 7 6 32.99 DDR Developers Diversified Realty Corp. Retail REITs 0.0 3,744 244 3 5 1 8 6 31.18 Health Care CVH Coventry Health Care Inc. Managed Health Care 0.0 5,078 44 11 17 1 0 12 33.48 KG King Pharmaceuticals Inc. Pharmaceuticals 0.0 2,369 15 15 5 0 0 9.61 WLP WellPoint Inc. Managed Health Care 0.0 23,370 46 10 13 1 0 12 45.64 THC Tenet Healthcare Corp. Health Care Facilities 2,864 -1 0 0 11 6.01 UNH UnitedHealth Group Inc. Managed Health Care 0.0 30,371 58 11 19 1 0 12 25.10 Industrials AW Allied Waste Industries Inc. Environmental & Facilities Services 0.0 4,848 150 6 9 2 0 11 11.19 RRD R.R. Donnelley & Sons Co. Commercial Printing 23.3 5,267 78 11 5 1 4 15 24.88 CTAS Cintas Corp. Diversified Support Services 0.0 4,328 41 7 14 1 1 11 28.33 MAS Masco Corp. Building Products 21.2 6,324 100 6 4 1 5 13 17.97 TXT Textron Inc. Industrial Conglomerates 39.2 8,090 176 10 26 2 2 12 32.55 Information Technology UIS Unisys Corp. IT Consulting & Other Services 57.0 1,111 272 -1 2 0 9 3.09 CIEN Ciena Corp. Communications Equipment 16.1 985 79 6 9 2 0 16 10.91 CVG Convergys Corp. Data Processing & Outsourced Services 13.9 1,813 18 9 11 1 0 13 14.88 FIS Fidelity National Information Services Inc. Data Processing & Outsourced Services 3,693 106 9 12 1 1 13 19.48 JAVA Sun Microsystems Inc. Computer Hardware 59.3 5,881 23 8 7 2 0 8 7.82 Materials NUE Nucor Corp. Steel 0.0 14,303 38 11 23 2 4 5 45.18 IP International Paper Co. Paper Products 21.9 11,836 94 8 10 1 4 6 27.68 MWV MeadWestvaco Corp. Paper Products 30.9 4,299 62 8 8 1 3 11 25.17 WY Weyerhaeuser Co. Forest Products 19.1 12,867 92 -4 1 4 6 60.90 EMN Eastman Chemical Co. Diversified Chemicals 42.0 4,414 72 9 17 1 3 6 57.84 Telecommunication Services Q Qwest Communications International Inc. Integrated Telecommunication Services 6,002 2,658 15 534 2 8 3 3.44 EQ Embarq Corp. Integrated Telecommunication Services 0.0 6,065 6,616 11 818 1 6 2 42.06 Utilities PNW Pinnacle West Capital Corp. Electric Utilities 0.0 3,534 82 8 8 1 6 4 35.09 NI NiSource Inc. Multi-Utilities 0.0 4,108 126 8 6 0 6 4 14.98 AEE Ameren Corp. Multi-Utilities 0.0 8,314 90 8 10 1 6 4 39.57 CMS CMS Energy Corp. Multi-Utilities 0.0 2,841 250 4 5 1 3 3 12.60 DTE DTE Energy Co. Multi-Utilities 0.0 6,659 123 6 8 1 5 5 40.83