Laurentian Bank Securities - Economic Research and Strategy

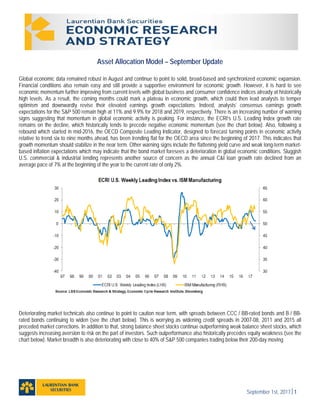

- 1. September 1st, 20171 Asset Allocation Model – September Update Global economic data remained robust in August and continue to point to solid, broad-based and synchronized economic expansion. Financial conditions also remain easy and still provide a supportive environment for economic growth. However, it is hard to see economic momentum further improving from current levels with global business and consumer confidence indices already at historically high levels. As a result, the coming months could mark a plateau in economic growth, which could then lead analysts to temper optimism and downwardly revise their elevated earnings growth expectations. Indeed, analysts’ consensus earnings growth expectations for the S&P 500 remain high at 11% and 9.9% for 2018 and 2019, respectively. There is an increasing number of warning signs suggesting that momentum in global economic activity is peaking. For instance, the ECRI’s U.S. Leading Index growth rate remains on the decline, which historically tends to precede negative economic momentum (see the chart below). Also, following a rebound which started in mid-2016, the OECD Composite Leading Indicator, designed to forecast turning points in economic activity relative to trend six to nine months ahead, has been trending flat for the OECD area since the beginning of 2017. This indicates that growth momentum should stabilize in the near term. Other warning signs include the flattening yield curve and weak long-term market- based inflation expectations which may indicate that the bond market foresees a deterioration in global economic conditions. Sluggish U.S. commercial & industrial lending represents another source of concern as the annual C&I loan growth rate declined from an average pace of 7% at the beginning of the year to the current rate of only 2%. Deteriorating market technicals also continue to point to caution near term, with spreads between CCC / BB-rated bonds and B / BB- rated bonds continuing to widen (see the chart below). This is worrying as widening credit spreads in 2007-08, 2011 and 2015 all preceded market corrections. In addition to that, strong balance sheet stocks continue outperforming weak balance sheet stocks, which suggests increasing aversion to risk on the part of investors. Such outperformance also historically precedes equity weakness (see the chart below). Market breadth is also deteriorating with close to 40% of S&P 500 companies trading below their 200-day moving

- 2. Economic Research and Strategy Asset Allocation Model – September Update September 1st, 20172 averages, despite the S&P 500 being close to its all-time high. With the U.S. Treasury possibly running out of cash in early October, negotiations to increase the U.S. federal debt ceiling could also become increasingly the focus of market participants and add to market volatility in the next few weeks. With equity markets already expensive on most metrics, we still maintain our neutral stance on equity vs. fixed income this month. Regional Allocation As for our regional allocation, we are raising our overweight position in Canadian equities at the expense of U.S. equities. Canadian stocks are historically cheap relative to U.S. equities with the S&P/TSX Composite index trading at 15.9x Forward P/E vs. 17.7x for the

- 3. Economic Research and Strategy Asset Allocation Model – September Update September 1st, 20173 S&P 500. Our expectations for higher oil prices by the end of the year should also support the relative performance of Canadian equities. Although worries remain about excess inventories, global crude stocks are falling and should help sustain rising oil prices over the next few quarters. The possibility that OPEC will extend the agreement to cut production to the end of the second quarter of 2018 will also support the inventory drawdown and should help to eliminate all excess inventories by the second half of the year. Sector Rotation Our sector allocation in Canada is unchanged this month. We still recommend investors to overweight the Industrials, Information Technology, Telecommunication Services, Financials and Energy sectors. In the U.S., we still advise clients to overweight the Information Technology, Health Care, Real Estate, Telecommunication Services and Energy sectors. However, we are adding Financials to our list of top overweight sectors as relative valuation appears attractive and 2018 expected earnings growth is elevated relative to other sectors. Financials stocks should also outperform in a rising rate scenario and the sector provides strong dividend growth. Moreover, in our opinion, the recent bond market rally might have been overdone and a correction, which would see the yield curve steepen, would support Financials. Canadian Bond Allocation In late June, we reduced our overweight position in corporate bonds largely on the back of the decline in the global net earnings revisions ratio, a deteriorating risk sentiment, historically elevated valuations and rapidly deteriorating credit metrics. This month we are cutting our overweight position in corporate bonds to neutral as our model is taking a more cautious approach and, as a result, moving up in quality. The recent underperformance of cyclical, transportation and small-cap stocks combined with weak market-based inflation expectations represent bearish signposts for investors to keep an eye on, as they may point to plateauing economic growth. Corporate spreads could also widen as central banks start withdrawing monetary stimulus later this year. Indeed, past declines in central bank net asset purchases coincided with widening credit spreads over the past ten years. As mentioned in previous publications, a sharp increase in borrowing yields which does not coincide with an improving economic backdrop could hurt the profit margin outlook and relative performance of credit. Luc Vallée, Ph.D | Chief Strategist Tel: 514 350-3000 | ValleeL@vmbl.ca Eric Corbeil, M.Sc., CFA, FRM | Senior Economist Tel: 514 350-2925 | CorbeilE@vmbl.ca This document is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author is an employee of Laurentian Bank Securities (LBS), a wholly owned subsidiary of the Laurentian Bank of Canada. The author has taken all usual and reasonable precautions to determine that the information contained in this document has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze it are based on accepted practices and principles. However, the market forces underlying investment value are subject to evolve suddenly and dramatically. Consequently, neither the author nor LBS can make any warranty as to the accuracy or completeness of information, analysis or views contained in this document or their usefulness or suitability in any particular circumstance. You should not make any investment or undertake any portfolio assessment or other transaction on the basis of this document, but should first consult your Investment Advisor, who can assess the relevant factors of any proposed investment or transaction. LBS and the author accept no liability of whatsoever kind for any damages incurred as a result of the use of this document or of its contents in contravention of this notice. This report, the information, opinions or conclusions, in whole or in part, may not be reproduced, distributed, published or referred to in any manner whatsoever without in each case the prior express written consent of Laurentian Bank Securities.