McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

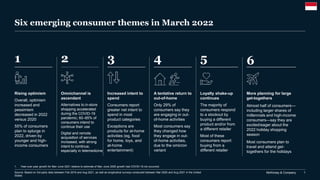

- 1. McKinsey & Company 1 Six emerging consumer themes in March 2022 Source: Based on 3rd-party data between Feb 2019 and Aug 2021, as well as longitudinal surveys conducted between Mar 2020 and Aug 2021 in the United States 1. Year-over-year growth for Mar–June 2021 relative to estimate of Mar–June 2020 growth had COVID-19 not occurred. 1 Rising optimism Overall, optimism increased and pessimism decreased in 2022 versus 2020 55% of consumers plan to splurge in 2022, driven by younger and high- income consumers 2 Omnichannel is ascendant Alternatives to in-store shopping accelerated during the COVID-19 pandemic; 60–85% of consumers intend to continue their use Digital and remote acquisition of services increased, with strong intent to continue, especially in telemedicine 3 Increased intent to spend Consumers report greater net intent to spend in most product categories Exceptions are products for at-home activities (eg, food for home, toys, and at-home entertainment) 5 Loyalty shake-up continues The majority of consumers respond to a stockout by buying a different product and/or from a different retailer Most of these consumers report buying from a different retailer 4 A tentative return to out-of-home Only 29% of consumers say they are engaging in out- of-home activities Most consumers say they changed how they engage in out- of-home activities, due to the omicron variant 6 More planning for large get-togethers Almost half of consumers— including larger shares of millennials and high-income consumers—say they are excited/eager about the 2022 holiday shopping season Most consumers plan to travel and attend get- togethers for the holidays

- 2. McKinsey & Company 2 Confidence in own country’s economic recovery after COVID-191, % of respondents 15 15 21 14 29 32 29 20 46 56 51 63 48 47 59 75 38 28 27 23 23 21 12 5 29 68 3 Mixed: The economy will be impacted for 6–12 months or longer and will stagnate or show slow growth thereafter Pessimistic: COVID-19 will have lasting impact on the economy and show regression or fall into lengthy recession Optimistic: The economy will rebound within 2–3 months and grow just as strong as or stronger than before COVID-19 Indonesian consumers are, out of those in all surveyed countries, among the most optimistic about economic recovery 1. Q: What is your overall confidence level surrounding economic conditions after the coronavirus (COVID-19) crisis subsides (ie, once there is herd immunity)? Rated from 1 “very optimistic” to 6 “very pessimistic.” Bars may not sum to 100% due to rounding. Japan 3/16–26 Australia 3/16–25 Korea 3/19–26 US 3/1–25 Change in optimistic vs last wave survey, percentage points -6 -10 +15 -2 Source: McKinsey & Company COVID-19 Consumer Pulse Survey India 3/11–24 +1 Oct 2021 Oct 2021 Oct 2021 Indonesia 3/16–26 +15 Sept 2020 Nov 2020 June 2020 Germany 3/22–28 France 3/23–28 UK 3/22–29 -10 -9 -12 Oct 2021 Oct 2021 Oct 2021 Rising optimism | Current as of March 2022

- 3. McKinsey & Company 3 9 6 9 8 8 3 40 41 52 52 38 29 51 53 39 40 53 68 May 2020 Sept 2020 June 2020 Apr 2020 Mar 20202 Mar 2022 Rising optimism | Current as of March 2022 1. Q: What is your overall confidence level surrounding economic conditions after the coronavirus (COVID-19) crisis subsides (ie, once there is herd immunity)? Rated from 1 “very optimistic” to 6 “very pessimistic.” Figures may not sum to 100% because of rounding. 2. Average of weekly pulse surveys shown for Mar and Apr 2020. Optimistic: The economy will rebound within 2–3 months and grow just as strong as or stronger than before COVID-19 Mixed: The economy will be impacted for 6-12 months or longer and will stagnate or show slow growth thereafter Pessimistic: COVID-19 will have lasting impact on the economy and show regression or fall into lengthy recession Overall optimism in Indonesia has steadily increased Confidence in own country’s economic recovery after COVID-19,1 % of respondents Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey 3/11–3/24/2022, n = 1,009; 9/22–9/28/2020, n = 1,034; 6/19–6/21/2020, n = 726; 5/20–5/22/2020, n = 715; 4/25–4/26/2020, n = 711; 3/28–3/29/2020, n = 691, sampled and weighted to match Indonesia's general population 18+ years

- 4. McKinsey & Company 4 Millennials, baby boomers, and vaccinated consumers drive economic optimism Confidence in own country’s economic recovery after COVID-191 % of respondents 17 46 40 Unvaccinated 47 14 36 Vaccinated 1. Q: What is your overall confidence level surrounding economic conditions after the coronavirus (COVID-19) crisis subsides (ie, once there is herd immunity)? Rated from 1 “very optimistic” to 6 “very pessimistic.” 2. Baby boomers includes silent generation. 3 1 3 3 34 24 34 23 62 75 63 74 Gen Z Baby boomers2 Millennials Gen X Optimistic Pessimistic Mixed Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years By generation By vaccination status Rising optimism | Current as of March 2022

- 5. McKinsey & Company 5 28 21 25 19 19 23 13 29 53 55 62 52 Baby boomers3 Gen Z Millennials Gen X 23 40 19 24 58 35 Vaccinated Unvaccinated 24 19 57 Overall 1. Q: When do you expect your routines will return to normal? Figures may not sum to 100% because of rounding. 2. Q: Which best describes your vaccination status? 3. Baby boomers includes silent generation. After June 2022 By June 2022 Not affected/already returned By generation By vaccination status2 Overall, Gen X is least optimistic about the return to normalcy ~40% of unvaccinated consumers are engaging in normal routine, reflecting the highest confidence Key findings Less than 25 percent of consumers expect pre-COVID-19 routines to be delayed beyond June 2022 Expectations for routines returning to ‘normal,’1 % of respondents Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Rising optimism | Current as of March 2022

- 6. McKinsey & Company 6 An increasing proportion of consumers describe their income and savings as stable Reduced slightly/a lot About the same Increased slightly/a lot 11 3 63 25 26 72 Past 2 weeks 47 12 41 Past 2 weeks Past month 6 58 17 20 13 77 67 Past 2 weeks 14 28 Past 2 weeks Past month 23 23 21 25 26 28 52 51 51 Past 2 weeks Past 2 weeks Past month 1. Q: How has the coronavirus (COVID-19) crisis affected the following over the past 1 month/2 weeks? Figures may not sum to 100% because of rounding. Household income1 % of respondents Household spending1 % of respondents Household savings1 % of respondents June 2020 Sept 2020 Mar 2022 June 2020 Sept 2020 Mar 2022 June 2020 Sept 2020 Mar 2022 Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Rising optimism | Current as of March 2022

- 7. McKinsey & Company 7 About 30 percent of consumers say their finances are back to ‘normal’; half expect to get there after June 2022 38 29 26 50 24 23 14 9 37 48 60 41 Gen Z Millennials Gen X Baby boomers3 32 36 19 24 49 40 Vaccinated Unvaccinated 32 19 49 Overall 1. Q: When do you expect your personal/household finances will return to normal? Figures may not sum to 100% because of rounding. 2. Q: Which best describes your vaccination status? 3. Baby boomers includes silent generation. By generation By vaccination status2 ~50% of baby boomers say their finances either were not affected or are back to normal, vs ~35% for Gen Z and millennials Expectations for personal/household finances returning to ‘normal,’1 % of respondents After June 2022 By June 2022 Not affected/already returned Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Rising optimism | Current as of March 2022

- 8. McKinsey & Company 8 While 55 percent of respondents plan to ‘splurge,’ this intent to spend is less common among older low- and middle-income consumers 45 55 Mar 2022 Plan on splurging Do not plan on splurging Millennials Gen X Baby boomers2 67 56 Gen Z 80 59 67 81 33 14 100 51 44 52 Generation Respondents who plan/do not plan to ‘splurge’ or ‘treat themselves’ in 20221 % of respondents Low (<8.5M rupiah/month) Middle (8.5M–37.5M rupiah/month) High (>37.5M rupiah/month) >70% <30% 50–70% 30–50% Respondents who plan to splurge, by household income, % Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Rising optimism | Current as of March 2022 1. Q: With regard to products and services you will spend money on, do you plan to splurge/treat yourself in 2022? For example, are there categories of products or services you have spent less on over the last year and a half which you feel you will spend more on in the next 3 months? 2. Baby boomers includes silent generation.

- 9. McKinsey & Company 9 Consumers most often say they plan to splurge on apparel, travel, and dining out Categories where consumers intend to treat themselves1 % of all respondents with intent to splurge 1. Q: You mentioned that you plan to splurge/treat yourself in next 3 months. Which categories do you intend to treat yourself to? Please select all that apply. 2. Baby boomers includes silent generation. 50 45 44 40 37 35 31 29 27 22 21 11 9 Restaurants, dining out, bars Electronics Apparel, shoes, accessories Fitness Travel, lodging, vacation Out-of-home entertainment Makeup, skin care products Personal services Items for your home Household essentials Sports apparel and equipment Outdoor living Pets Millennials Gen X Gen Z Baby boomers2 52 51 49 26 36 43 59 42 41 45 46 40 41 42 38 26 38 36 36 42 40 34 34 26 32 30 33 26 24 32 26 58 14 33 30 38 Generational cut 26 24 16 26 18 22 21 26 10 13 8 26 11 8 6 26 Between −3 and +3 < −3 > +3 Categories Difference from all respondents, percentage points Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Rising optimism | Current as of March 2022

- 10. McKinsey & Company 10 Omnichannel shopping is more prevalent across categories Omnichannel is ascendant | Current as of March 2022 1. Q: Which best describes how you have researched the following categories over the last 3 months? 2. Q: Which best described how you have purchased the following categories over the last 3 months? 55 53 43 35 29 26 25 25 25 22 22 21 21 20 17 16 12 12 11 11 9 5 39 43 51 60 59 64 65 59 63 58 68 61 64 65 64 68 72 70 69 67 67 50 6 5 6 5 12 10 10 16 12 20 10 18 15 15 19 16 16 18 19 22 24 45 Pet care services Consumer electronics Groceries/food for home Tobacco products and smoking supplies Footwear Vehicles Home improvement and gardening Personal-care products Jewelry Apparel Fitness and wellness services Books, magazines, newspapers Household supplies Vitamins, supplements, and OTC medicine Pet food and supplies Kitchen and dining Home decoration and furniture Sports and outdoors equipment, supplies Toys and baby supplies Skin care and makeup Accessories Food takeout/delivery Only online Omnichannel Only in stores Product searches1 and purchases2 by channel % of respondents who purchased and searched in these categories in the last 3 months Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years

- 11. McKinsey & Company 11 Younger consumers are significantly more influenced by social media than others are 1. Q: Think about the purchases you have made in the following categories over the past 3 months. Were you influenced toward a certain brand by a post on social media in the following categories? 2. Baby boomers includes silent generation. 78 74 74 68 65 64 63 63 62 62 58 53 53 49 49 34 Footwear Home decoration and furniture Apparel Sports and outdoors equipment and supplies Skin care and makeup Accessories (eg, handbags, sunglasses) Jewelry Consumer electronics Fitness and wellness services (eg, gym, workout classes) Personal-care products (eg, soap, shampoo, deodorant) Home improvement and garden supplies Vitamins, supplements, and over-the-counter medicine (eg, cough, cold, allergies) Kitchen and dining Household supplies (eg, cleaning and laundry) Pet food and supplies Groceries/food for home Millennials Gen X Gen Z Baby boomers2 86 80 61 40 75 73 74 72 65 72 67 62 69 69 63 44 62 61 67 100 68 65 62 45 71 62 63 23 60 67 60 33 Generational cut 74 70 50 42 59 64 55 39 56 60 48 35 53 60 48 44 Categories Categories where respondents were influenced by social media1 % of all respondents 81 72 78 83 48 56 44 38 44 57 44 37 38 46 23 15 Between −3 and +3 < −3 > +3 Difference from all respondents, percentage points Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Omnichannel is ascendant | Current as of March 2022

- 12. McKinsey & Company 12 All consumers surveyed say they engage on social-media platforms at least once a week Frequency of engagement with social-media platforms1 % of all respondents 1. Q: What social-media platforms do you engage with, and if so, how frequently? 100 98 92 89 72 69 43 40 27 24 71 2 8 11 28 31 57 60 73 76 29 Twitter Instagram Facebook TikTok Reddit Pinterest LinkedIn Snapchat Others Overall YouTube Never/less than weekly Weekly or more Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Omnichannel is ascendant | Current as of March 2022

- 13. McKinsey & Company 13 7 76 8 10 64 9 15 84 62 14 60 11 66 68 70 72 13 74 6 78 5 86 88 12 Drive-thru lane Direct chat (eg, WhatsApp/Instagram) Used an app for 2-hour or 1-hour delivery Buy online, pick up in store Downloaded/used a new store/restaurant app Used an app for same-day delivery Purchased pre-owned product Curbside pickup from a restaurant Downloaded/used deal-finding plug-ins Purchased directly from social media Intent to use when the COVID-19 crisis subsides2 % of new or increased users who intend to keep doing activity User growth since COVID-19 pandemic 1 1. User growth is calculated as % of respondents who replied that they are new users over % of respondents who replied that they were using the product/service pre-COVID-19 (using more, using the same, or using less) on Q: Which best describes when you have done or used each of these items? 2. Q: Compared to now, will you do or use the following more, less, or not at all, once the coronavirus (COVID-19) crisis subsides (ie, once there is herd immunity)? Possible answers: “will stop this”; ”will reduce this”; “will keep doing what I am doing now”; “will increase this.” Number indicates percent who chose “will keep doing what I am doing now” and “will increase this” among new or increased users. Alternatives to in-store shopping accelerated during the pandemic; 60 to 85 percent of consumers intend to continue using each Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Omnichannel is ascendant | Current as of March 2022

- 14. McKinsey & Company 14 55 83 0 9 74 56 69 53 54 78 70 57 12 66 65 58 59 84 15 60 61 91 80 62 21 63 64 18 6 67 24 68 71 72 73 82 75 76 81 77 79 86 85 89 87 88 90 92 3 0 Online fitness Telemedicine: physical health Wellness app Grocery delivery Watching online gaming Video chat: personal Restaurant food delivery Online streaming Videoconferencing: professional Playing online games Remote learning: myself Remote learning: my children TikTok Telemedicine: mental health Social media Virtual hangout: group buying Digital banking Intent to use when the COVID-19 crisis subsides2 % of new or increased users who intend to keep doing activity User growth since COVID-19 pandemic 1 1. User growth is calculated as % of respondents who replied that they are new users over % of respondents who replied that they were using the product/service pre-COVID-19 (using more, using the same, or using less) on Q: Which best describes when you have done or used each of these items? 2. Q: Compared to now, will you do or use the following more, less, or not at all, once the coronavirus (COVID-19) crisis subsides (ie, once there is herd immunity)? Possible answers: “will stop this”; ”will reduce this”; “will keep doing what I am doing now”; “will increase this.” Number indicates respondents who chose “will keep doing what I am doing now” and “will increase this” among new or increased users. Digital and remote acquisition of services also increased, with strong intent to continue, especially for telemedicine Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Omnichannel is ascendant | Current as of March 2022

- 15. McKinsey & Company 15 Cryptocurrency 20 7 38 30 44 14 6 48 37 A drive-thru line for a fast-food restaurant 19 Curbside pickup from a restaurant 31 14 43 Augmented reality/virtual reality 12 43 Delivery within 2 hours or 1 hour 40 12 33 9 43 Buy online, pick-up in store 17 53 5 35 47 13 38 Social-media direct purchase Deal-finding plug-ins 11 33 42 13 12 7 New store/restaurant app 42 13 37 38 13 9 Online secondhand products Tried making something myself/DIY project 39 29 11 10 13 6 NFTs (digital assets) 35 46 18 4 40 7 Same-day delivery 32 41 11 45 7 Direct chat (eg, WhatsApp, Instagram) 42 30 16 Changed my primary grocery store 29 47 14 10 Shopped at a new store 43 5 4 Cooked regularly for myself/my family 32 11 Personal care/grooming at home 46 28 12 14 Consumers continue to say they are trying pickup, delivery services, and digital assets, with some increased usage observed Just started using Using less Using Same Using more Intent to continue2 71 62 74 71 69 77 80 88 79 73 79 72 69 84 84 90 78 74 Which best describes when you have done or used each of these items?1 % of respondents who have used in the last 3 months Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Omnichannel is ascendant | Current as of March 2022 1. Q: Have you used or done any of the following in the last 3 months? If yes, Q: Which best describes when you have done or used each of these items? Possible answers: “just started using since COVID-19 started”; “I have not used in the last 3 months”; “I have used in the last 3 months at the same rate as before”; “I have used this more in the past 3 months than before”; “I have used this less in the past 3 months than before.” 2. Q: Compared to now, will you do or use the following more, less, or not at all, once the coronavirus (COVID-19) crisis subsides (ie, once there is herd immunity)? Possible answers: “will stop this”; ”will reduce this”; “will keep doing what I am doing now”; “will increase this.” Number indicates respondents who chose “will keep doing what I am doing now” and “will increase this” among new or increased users.

- 16. McKinsey & Company 16 Consumers have adopted at-home alternatives to out-of-home activities, with more than 70 percent intending to continue 1. Q: Have you used or done any of the following since the coronavirus (COVID-19) crisis started? If yes, Q: Which best describes when you have done or used each of these items? Possible answers: “just started using since COVID-19 started”; “using more since COVID-19 started”; “using about the same since COVID-19 started”; “using less since COVID-19 started.” 2. Q: Compared to now, will you do or use the following more, less, or not at all, once the coronavirus (COVID-19) crisis subsides (ie, once there is herd immunity)? Possible answers: “will stop this”; ”will reduce this”; “will keep doing what I am doing now”; “will increase this.” Number indicates respondents who chose “will keep doing what I am doing now” and “will increase this” among new or increased users. Wellness app (eg, meditation) 11 41 Online personal training, fitness 5 41 31 10 Virtual hangouts and video chats for personal use 8 53 6 7 38 44 Remote learning for myself 5 52 38 13 4 18 Restaurant food delivery Used TikTok 48 9 4 36 9 31 7 Grocery delivery 9 57 32 7 Playing online games Online streaming 7 56 28 7 11 5 Video conferencing for professional use 49 Telemedicine for physical health care 27 37 33 11 19 45 36 52 4 13 55 35 4 Watching online gaming 46 52 8 Telemedicine for mental health care 18 Remote learning for my kids 43 40 10 7 50 42 2 25 36 36 18 10 Virtual hangouts for group-buying 37 4 7 Used digital banking/fintech application Used social media 74 78 77 82 81 65 63 65 79 67 56 91 65 72 75 52 85 Intent to continue2 Which best describes when you have done or used each of these items?1 % of respondents who have used in the last 3 months Just started using Using less Using same Using more Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Omnichannel is ascendant | Current as of March 2022

- 17. McKinsey & Company 17 −20 −60 −80 −70 −30 −50 −40 −10 0 10 20 30 40 50 60 Mar 2020 Apr 2020 May 2020 June 2020 Sept 2020 Mar 2022 Expected spending per category over the next 2–3 months vs usual1 Net intent2 Net intent to spend is increasing in discretionary categories Skin care and makeup Groceries Consumer electronics Fitness and wellness Household supplies Personal-care products Apparel Domestic flights International flights Out-of-home entertainment 1. Q: Over the next 2–3 months, do you expect that you will spend more, about the same, or less money on these categories than usual? Figures may not sum to 100% because of rounding. 2. Net intent is calculated by subtracting the % of respondents stating they expect to decrease spending from the % of respondents stating they expect to increase spending. Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/11–3/24/2022, n = 1,009; 9/22–9/28/2020, n = 1,034; 6/19–6/21/2020, n = 726; 5/20–5/22/2020, n = 715; 4/25–4/26/2020, n = 711; 3/28–3/29/2020, n = 691, sampled and weighted to match Indonesia's general population 18+ years Increased intent to spend | Current as of March 2022

- 18. McKinsey & Company 18 Overall, consumers report greater net intent to spend, with a few exceptions, such as groceries, tobacco, toys, and household supplies Net intent >1 Net intent −15 to 0 Net intent: < −15 7 28 30 45 53 45 42 48 56 24 20 7 17 48 37 44 30 32 10 25 14 15 9 18 16 24 15 20 21 16 15 16 18 10 Apparel Groceries/food for home Tobacco and smoking Food takeout/delivery Household supplies Quick-service restaurant Restaurant Footwear Jewelry Accessories Toys and baby supplies Personal-care products Skin care and makeup Kitchen and dining Home decoration, furniture Sports and outdoors Home improvement, garden Decrease Increase Stay the same 16 11 15 32 50 42 25 22 34 15 37 48 27 40 35 39 46 43 45 29 14 11 17 14 26 12 18 15 23 26 23 21 17 17 Out-of-home entertainment Entertainment at home Consumer electronics Hotel/resort stays Pet food and supplies Vitamins and OTC medicine Books/magazines/newspapers Pet care services Fitness and wellness Vehicles Personal-care services Gasoline Adventures and tours Short-term home rentals Cruises Travel by car International flights Domestic flights 10 10 Net intent2 14 −18 −39 −25 −12 4 −22 3 −32 −5 −14 −12 −17 −30 33 −27 1. Q: Over the next 2–3 months, do you expect that you will spend more, about the same, or less money on these categories than usual? Figures may not sum to 100% because of rounding. 2. Net intent is calculated by subtracting the % of respondents stating they expect to decrease spending from the % of respondents stating they expect to increase spending. 3. Data not available or insufficient sample (n < 50) in Nov 2020 survey. Change since Sept 2020 Change since Sept 2020 −6 N/A3 28 −6 16 12 6 13 13 8 18 4 11 27 −9 41 1 15 −26 13 Net intent2 25 −11 −18 −5 −4 6 −31 4 −38 12 −36 5 −24 21 −32 8 −46 4 0 −14 −5 −26 12 4 4 24 −32 7 −28 N/A3 −13 N/A3 −21 N/A3 Expected spending per category over the next 2–3 months vs usual1 % of respondents Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16/2022–3/26/2022, n = 1,020; 9/22–9/28/2020, n = 1,034, sampled and weighted to match the Indonesia’s general population 18+ years Increased intent to spend | Current as of March 2022

- 19. McKinsey & Company 19 Consumers’ plans to increase spending are similar across vaccination status, except for personal-care items and entertainment 1. Net intent is calculated by subtracting the % of respondents stating they expect to decrease spending from the % of respondents stating they expect to increase spending. 2. Q: Over the next 2–3 months, do you expect that you will spend more, about the same, or less money on these categories than usual? +3 percentage points Likelihood of vaccinated vs unvaccinated people to spend For selected categories Net intent1 for expected spending per category over the next 2–3 months vs usual2 Unlikely Cautious Interested Vaccinated Groceries Food takeout and delivery Restaurant Quick-service restaurant Home decor Home and garden Personal-care items Fitness and wellness Entertainment at home International flights 9 −10 −15 −20 −65 26 0 −100 −22 −100 44 23 −10 −71 −75 −100 −5 70 −9 0 10 −2 −2 52 −38 −77 11 7 32 18 26 −5 −39 −32 −32 −28 13 3 14 −17 Between −3 and +3 < −3 > +3 Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Increased intent to spend | Current as of March 2022

- 20. McKinsey & Company 20 Increases in spend are mainly driven by higher-volume purchases and switching to premium brands 6 9 9 8 8 2 4 13 3 12 13 7 10 9 2 6 10 8 34 39 36 42 39 42 39 27 38 30 36 34 36 24 32 22 26 29 11 26 31 29 32 33 36 43 38 38 44 45 39 40 48 37 47 47 49 27 25 21 22 23 22 17 22 20 7 14 16 27 19 36 17 16 Household supplies Groceries Food takeout/delivery Personal-care products Meals at restaurants Home and decoration Meals at quick-serve rest Pet food and supplies Pet care services Vitamin and minerals Kitchen and dining Apparel Footwear Accessories Consumer electronics Vehicles Skin care and makeup Personal-care services Increase in price Increase in income Larger quantity Premium brands/products 1. Q: Please indicate the main reason for planning to spend more on the following categories. Reasons for increase in spend1 % of respondents who increased spend Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Increased intent to spend | Current as of March 2022

- 21. McKinsey & Company 21 Decreases in spend are mainly driven by shifts in spend to other categories 29 19 21 21 18 19 29 8 19 20 13 18 19 19 15 21 24 15 36 26 22 21 24 16 25 21 22 22 16 17 18 19 17 16 23 20 12 14 12 13 18 27 25 24 17 12 11 13 13 15 16 14 20 19 21 39 43 43 35 37 21 45 41 43 57 51 48 46 50 50 29 43 3 2 2 1 4 2 2 3 4 1 3 1 1 4 4 Kitchen and dining Household supplies Pet food and supplies Groceries Meals at quick-service rest Food takeout/delivery Meals at restaurants Vehicles Personal-care products 0 Pet care services 1 Vitamins and minerals Apparel Footwear Accessories Personal-care services Consumer electronics Home and decoration 0 Skin care and makeup Reduced price Decrease in income Smaller quantity Spend more on other categories Switch to less expensive 1. Q: Please indicate the main reason for planning to spend less on the following categories. Reasons for decrease in spend1 % of respondents who decreased spend Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Increased intent to spend | Current as of March 2022

- 22. McKinsey & Company 22 Overall 51 Unvaccinated Vaccinated 28 30 Gen Z Baby boomers3 Millennials Gen X 32 28 22 Low (<8.5M rupiah) 28 Medium (8.5M– 37.5M rupiah) High (>37.5M rupiah) 32 29 1. Q: Which best describes when you will regularly return to stores, restaurants, and other out-of-home activities? Chart shows those already participating in these activities. 2. Gen Z are people under 26 years old, millennials are 26–41 years old, Gen X are people 42–57 years old, baby boomers are 58 years old and above. 3. Baby boomers includes silent generation. By generation2 By vaccination adoption By monthly income ~32% of Gen Z are doing out- of-home activities ~32% of high-income households are doing out-of-home activities ~51% of people who are unvaccinated are doing out-of-home activities Consumers engaging in out-of-home activities,1 % of respondents Even with delta and omicron variants present, half of unvaccinated consumers say they are engaging in out-of-home activities Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020; 9/22–9/28/2020, n = 1,034, sampled and weighted to match the Indonesian general population 18+ years A tentative return to out-of-home | Current as of March 2022 29 22 Mar 2022 Sept 2020

- 23. McKinsey & Company 23 Social Personal care Entertain- ment Dine indoors at a restaurant or bar Go to a hair or nail salon Go out for family entertainment Attend an indoor cultural event Attend an outdoor event Visit a crowded outdoor public place Get together with family Go to the gym or fitness studio Get together with friends Did this in past 2 weeks 63 80 63 52 64 78 82 93 76 95 95 98 90 87 70 89 75 70 75 59 Travel more than 2 hours by car Work outside my home Use a ride-sharing service Travel by airplane Use public transportation Go to a shopping mall Shop for groceries/necessities Shop for non-necessities Travel by train Stay in a hotel Rent a short-term home Did this in past 2 weeks Work Shopping Transport/ travel 50% and above Less than 50% Consumers increased all out-of-home activity since February, with largest increases for social activities, indoor dining, and fitness Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years A tentative return to out-of-home | Current as of March 2022 1. Q: Which best describes how you are engaging in each of these activities? Possible answers: “Not doing this all”; “Doing this in the same way as pre-COVID-19 but less often”; “Doing this in a modified way vs pre-COVID-19”; “Doing this just as much and in the same way as I did pre-COVID-19.” Current engagement in out-of-home activities1 % of respondents who said they are doing this in the same or a modified way

- 24. McKinsey & Company 24 1. Q: With the rise of the omicron variant of COVID-19, how, if at all, has your out-of-home behavior changed? 6 10 12 15 53 61 55 36 25 24 1 2 Low (<8.5M rupiah) Medium (8.5– 37.5M rupiah) High (>37.5M rupiah) 7 11 20 59 48 28 25 2 Vaccinated Unvaccinated 11 59 28 2 Overall Engage less Engage more Engage same as before omicron Engage with adjusted behavior By monthly income By vaccination status Higher-income consumers are less cautious when going out A quarter of unvaccinated consumers have not reduced or changed their out-of-home behavior during the spread of the omicron variant Key findings Adjustments to out-of-home behavior due to prevalence of omicron variant,1 % of respondents Roughly 90 percent of consumers have changed the way they engage in out-of-home activities, because of the omicron variant Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years A tentative return to out-of-home | Current as of March 2022

- 25. McKinsey & Company 25 1. Q: Which best describes how you are engaging in each of these activities? Possible answers: “Not doing this at all”; “Doing this in the same way as pre-COVID-19, but less often”; “Doing this in a modified way vs. pre-COVID-19”; “Doing this just as much and in the same way as I did pre-COVID-19.” Work Shopping Transport/ travel Social Personal care Entertain- ment 8 94 Go out for family entertainment Get together with family 92 8 92 6 Go to a hair or nail salon Dine indoors at a restaurant or bar 91 9 91 Attend an indoor cultural event 13 11 89 Attend an outdoor event 8 92 Visit a crowded outdoor public place 11 89 Go to the gym or fitness studio 87 9 Get together with friends 17 86 83 14 Shop for groceries/necessities Rent a short-term home 88 12 94 Shop for non-necessities 17 Go to a shopping mall 10 6 90 Use public transportation Work outside my home 92 Travel more than 2 hours by car 83 Use a ride-sharing service 7 93 6 Travel by airplane 6 94 94 Travel by train Stay in a hotel 7 93 8 Doing less, doing in a modified way Doing as much as and in the same way as pre-COVID-19 Level of engagement in out-of-home activities1 % of respondents having engaged in activity pre-COVID-19 Most consumers—about 80 to 95 percent, depending on the behavior—have modified their behavior when out of home Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years A tentative return to out-of-home | Current as of March 2022

- 26. McKinsey & Company 26 Main life events done in the last 12 months as a result of COVID-19 pandemic,1 % of respondents The pandemic resulted in a work or study change for almost three- fourths of consumers and home renovations for nearly half 61 13 19 16 29 14 15 3 4 8 8 14 Moved into a smaller home Set up a gym at home Decided to change jobs Worked more from home Started homeschooling children Renovated/remodeled my home Got a new pet at home (eg, dog, cat) Sold a property Set up a specific work-from-home space Moved into a bigger home Bought a property Apply for loans Mar 2022 1. Q: Which of the following have you done in the last 12 months as a result of the COVID-19 crisis? 2. Total percentage of people who chose option(s) in the category. Work/study change Pet adoption House move Home renovation Investments/ divestments Total,2 % 15 72 7 45 15 14 Applied for loan from bank/fintech Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years A tentative return to out-of-home | Current as of March 2022

- 27. McKinsey & Company 27 Milestones for the Indonesian population not yet engaging with out-of-home activities1 % of respondents awaiting each milestone before engaging 31 33 11 25 Government lifts restrictions Government lifts restrictions and other requirements Vaccination coverage COVID-19 no longer spreading 71% of people are not currently engaging in ‘normal’ out-of- home activities Vaccination coverage Government lifts restrictions and … 1. Q: Which best describes when you will regularly return to stores, restaurants, and other out-of-home activities? Chart rebased to exclude those already participating in these activities and those who do not deem any of these items important. Figures may not sum to 100% because of rounding. 15% Medical authorities deem safe 14% Stores, restaurants, and other indoor places start taking safety measures 4% I see other people returning 3% Vaccine is widely distributed 7% I have been vaccinated 1% Family member(s) vaccinated Cautious consumers cite government restrictions and omicron’s spread as primary reasons for delaying out-of-home activities Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years A tentative return to out-of-home | Current as of March 2022

- 28. McKinsey & Company 28 90 64 51 49 40 33 28 Different retailer/store/website Different brand Any new shopping behavior New digital shopping method New shopping method3 New social commerce shopping Private label/store brand Consumer behavior change has been more extensive among younger and higher-income consumers 91 6 Income cut Generational cut All consumers Intent to continue behavior2 1. Q: Over the past 3 months, which of the following have you done? 10% replied “None of these.” 2. Q: Which best describes whether or not you plan to continue with these shopping changes? Possible answers: “will go back to what I did before 3 months ago”; ”will keep doing both this and what I did before 3 months ago”; ”will keep doing this and NOT go back to what I did before 3 months ago.” Intent to continue includes respondents who selected “will keep doing both this and what I did before 3 months ago” and “will keep doing this and NOT go back to what I did before 3 months ago.” 3. “New shopping method” includes curbside pickup and delivery apps. Behaviors since COVID-19 started1 % of respondents Between −3 and +3 < −3 > +3 Difference from all respondents, percentage points 90 13 87 −1 90 N/A 87 5 84 1 Millennials Low (>8.5M rupiah) Medium (8.5M– 37.5M rupiah) High (>37.5M rupiah) Gen X Gen Z Baby boomers 85 93 96 91 96 84 76 50 69 68 68 64 57 55 41 45 61 53 63 49 32 39 53 55 51 66 42 40 36 43 47 39 62 34 18 21 37 36 34 57 31 12 29 33 36 27 38 21 10 Change from Sep 2020, percentage points % of respondents Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Loyalty shake-up continues | Current as of March 2022

- 29. McKinsey & Company 29 Consumers facing stockouts are more likely to substitute retailer or brand than to wait for products to become available 1. Q: Over the last 3 months, have you wanted to buy something and not been able to purchase it because it was out of stock or otherwise not available? 2. Q: The most recent time this happened (when you wanted to buy something and it was not available), what did you do? 32 68 Mar 2022 Could not purchase at least 1 item Able to purchase all items Respondents who planned to purchase something but could not, due to unavailability1 % of respondents 37 21 16 19 6 Did not buy anything Bought the product at different retailer Bought a different brand or similar product at a different retailer Bought a different product at the same retailer Waited until product was available at the same retailer All consumers who could not make a planned purchase2 % of respondents Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Loyalty shake-up continues | Current as of March 2022

- 30. McKinsey & Company 30 Reason for trying a new brand since COVID-19 began1 % of respondents selecting reason in top 3 Value was a primary reason for brand switching; for younger consumers, better quality came next 1. Q: You mentioned you tried a new/different brand than what you normally buy. What were the main reasons that drove this decision? Select up to 3 relevant reasons. “Brand” includes different brand, new private label/store brand. Overarching reason based on % of individual respondents responding to at least 1 reason in the group. 2. Baby boomers includes silent generation. Wanted to treat myself Supporting local businesses Products are in stock Better value Better prices, promotions Better shipping, delivery cost 31 Larger package sizes 2 More sustainable, better for the environment Shares my values The company treats its employees well Wanted variety, change from my normal routine Better quality Natural, organic 7 12 13 Wanted to try a type of product I’ve never tried before Available where I’m shopping (ie, in store or online) Cleaner, safer 13 17 12 47 5 11 5 38 10 26 10 16 Wanted to try a new brand I found Novelty Personal choice Purpose-driven Quality/organic Convenience Health/hygiene Availability 12 Value 64 31 45 48 16 7 21 Baby boomers2 Gen Z/ millennials Gen X 15 15 21 47 30 51 14 0 13 6 0 5 12 7 15 12 21 14 10 21 13 5 6 3 3 0 1 39 44 35 10 28 5 25 22 29 32 29 30 9 0 14 12 15 11 15 22 16 8 6 5 All consumers Between −3 and +3 < −3 > +3 x Net % of respondents per category Difference from all respondents, percentage points Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Loyalty shake-up continues | Current as of March 2022

- 31. McKinsey & Company 31 Almost half of consumers are excited about the holiday shopping season, including majorities of high-income and millennial consumers 9 2 3 0 45 45 54 58 46 53 42 41 Baby boomers2 Gen Z Millennials Gen X 1. Q: Which best describes your general attitude toward the holiday shopping season? Selected from "Anxious," "Stressed," "Neutral," "Eager,“ "Excited," and "Other." 2. Baby boomers includes silent generation. 3 50 47 Overall Excited/ eager Neutral Stressed/ anxious Consumer attitudes toward the 2022 holiday shopping season1 % of respondents By monthly income By generation 9 4 1 54 54 45 37 42 54 Medium (8.5M–37.5M rupiah) Low (<8.5M rupiah) High (>37.5M rupiah) Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Holiday outlook | Current as of March 2022

- 32. McKinsey & Company 32 Vaccinated consumers are much more likely than the unvaccinated to be excited/eager about the holiday shopping season 1. Q: Which best describes your general attitude toward the holiday shopping season? Selected from "Anxious," "Stressed," "Neutral," "Eager," "Excited," and "Other." Consumer attitudes toward the 2022 holiday shopping season1 % of respondents 3 50 47 Stressed/ anxious Overall Excited/ eager Neutral 4 90 47 10 49 Vaccinated 0 Unvaccinated By vaccination status Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Holiday outlook | Current as of March 2022

- 33. McKinsey & Company 33 Majorities of consumers plan to spend about the same as or more than last year across categories except large household appliances 48 26 27 18 19 65 29 45 41 47 57 14 23 29 32 35 24 21 Personal travel Family travel Out-of- home eating Gifts (for myself and others) Redecorate my home/put out seasonal items Large household appliances Key findings 1. Q: If you compare the upcoming holidays 2022 with the ones last year, how much do you plan to change your spending level in the following categories? Will spend more Will spend about the same Will spend less Holiday spending plans in 2022 vs 20211 % of respondents who plan to spend on the category during the holidays in 2022 Family travel, out-of-home eating and gifts are the categories with most respondents who say that they will spend more this year vs last year Majority of consumers plan to spend less on large household appliances vs last year Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Holiday outlook | Current as of March 2022

- 34. McKinsey & Company 34 Most consumers plan to travel and attend a get-together during the upcoming holiday 1. Q: What best describes what you expect to do for the holidays this year [2022]? Figures may not sum to 100% because of rounding. 2. Q: What best describes your holiday get togethers last year [2020]? Figures may not sum to 100% because of rounding. 3. Baby boomers includes silent generation. Change by monthly income Change by generation 14 31 25 25 15 24 29 32 16 −1 −16 11 −15 −2 −4 −12 −1 −8 −7 −3 −3 −12 −6 −4 −30 −16 −6 −22 −14 −10 −14 −17 Medium (8.5M–37.5M rupiah) Low (<8.5M rupiah) High (>37.5M rupiah) Millennials Gen X Gen Z Baby boomers3 Change from 2020,2 percentage points Holiday plans in 20221 % of respondents < −3 Between −3 and +3 > +3 Difference from all respondents, percentage points 37 38 10 16 Will not travel but will have a family/friends get-together outside my immediate family Will travel to and attend a large get-together with family and friends Will travel to a limited family get-together Do not plan to travel and will limit getting together to immediate family only Holiday outlook | Current as of March 2022 Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020; 9/22–9/28/2020, n = 1,034, sampled and weighted to match the Indonesian general population 18+ years

- 35. McKinsey & Company 35 More than half of consumers plan to shop at different retailers than last year; the leading factor on where to shop is safety 59 25 49 18 11 Shop at a different place Shop more online Shop more at local/independent stores Shop more in person Shop earlier 1. Q: Please select all the ways you anticipate your holiday shopping might be different from last year. Figures may not sum to 100% because of rounding. Anticipated different holiday shopping behaviors1 % of respondents Reasons to change place to shop during holiday season % of respondents 24 45 19 Check more things off my list at once More value for money COVID-19 considerations Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Holiday outlook | Current as of March 2022

- 36. McKinsey & Company 36 Many consumers, especially youngers ones, plan to shop more online 49 18 11 Shop more in person Shop more online Shop earlier Income cut Gen Z Millen- nials Gen X Baby boomers2 Shopping behaviors Between −3 and +3 < −3 > +3 Difference from all respondents, percentage points 1. Q: Please select all the ways you anticipate your holiday shopping might be different compared to last year. Figures may not sum to 100% because of rounding. 2. Baby boomers includes silent generation. Anticipated shopping behavior change for 2022 holidays,1 % of all respondents Generational cut 65 44 49 26 16 29 11 9 15 14 12 2 50 51 47 14 16 22 10 11 12 Medium (8.5M– 37.5M rupiah) Low (<8.5M rupiah) High (>37.5M rupiah) Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Holiday outlook | Current as of March 2022

- 37. McKinsey & Company 37 Better price and quality are the top two factors in consumers’ decisions about where to shop 53 22 34 27 36 4 22 51 13 24 12 3 Better prices, promotions Better shipping, delivery costs Ability to see products in person Convenience Product availability Better quality Easy to shop across store and online Ability to purchase most gifts from 1 place Unique items offered Cleaner, better hygiene measures Supporting local businesses Company treating its employees well Generational cut 37 44 12 28 1 44 21 1 11 41 20 Gen Z 35 63 29 31 9 11 14 6 7 49 23 23 Millennials 38 44 21 36 4 25 8 3 24 42 30 24 Gen X 33 64 24 37 4 9 10 1 2 71 21 23 Baby boomers2 40 1. Q: Please tell us what your primary considerations will be when deciding where to shop. Please select up to 3. 2. Baby boomers include traditional or silent generation. Between −3 and +3 < −3 > +3 Primary considerations when deciding where to shop1 % of respondents Availability Value Convenience Quality Health/hygiene Purpose-driven Uniqueness 54 63 x Net % of respondents per category 55 51 13 24 15 Difference from all respondents, percentage points Source: McKinsey & Company COVID-19 Indonesia Consumer Pulse Survey, 3/16–3/26/2022, n = 1,020, sampled and weighted to match the Indonesian general population 18+ years Holiday outlook | Current as of March 2022