Residential status sec 6 (1)

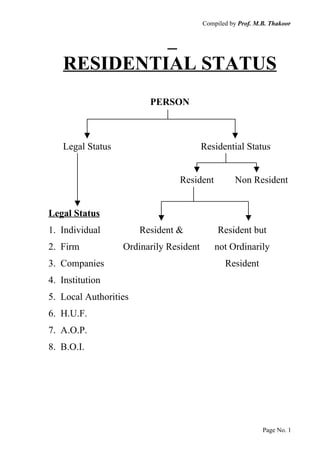

- 1. Compiled by Prof. M.B. Thakoor RESIDENTIAL STATUS PERSON Legal Status Residential Status Resident Non Resident Legal Status 1. Individual Resident & Resident but 2. Firm Ordinarily Resident not Ordinarily 3. Companies Resident 4. Institution 5. Local Authorities 6. H.U.F. 7. A.O.P. 8. B.O.I. Page No. 1

- 2. Compiled by Prof. M.B. Thakoor RESIDENTIAL STATUS: SEC. 6 (1) After determining the legal status of an Assessee u/s. 2 (31) the Residential Status of an Assessee is to be determined. 1. Determined of every PREVIOUS YEAR: Residential Status is determined for every previous year. It depends on the number of days a person is in India during the concerned previous year. 2. Different terms of Citizenship An Individual may be a Citizen of Britain, but a resident in India. In the same way a Citizen of India may be a non-resident of India. 3. Residential Status is important in deciding whether Foreign Income of a person is Taxable or not. TEST OF RESIDENCE 1. For an INDIVIDUAL Basic 2 conditions An Individual is said to be resident when he satisfies any one of the basic 2 conditions. 1. He must be in India for 182 days or more in that relevant pervious year. OR 2. a. He must be in India for 365 days or more during 4 previous year immediately preceeding the relevant previous year. AND b. He must be in India during that relevant previous year for a period of 60 day or more. Page No. 2

- 3. Compiled by Prof. M.B. Thakoor EXCEPTION: FOLLOWING ARE THE TWO EXCEPTIONS TO RULE OF STAY IN INDIA FOR A PERIOD OF 60 DAYS IN THE SECOND CONDITION ABOVE. 1. If a citizen of India or a member of a crew of an Indian ship leaves India in the previous year for the purpose of employment then he becomes resident if the 60 days are replaced by 182 days. Employment : Self Employment Salaried Employed Professional Non-professional i.e. he becomes resident only if he stays in India for 182 days or more and not 60 days or more. 2. A citizen of India or a person of Indian Origin staying outside India, come on a visit to India in the previous year, then the 60 days must be replaced by 182 days. i.e. he become resident only if he stay’s in India for 182 days and not 60 days. Note: A person is deemed to be of an Indian origin, if he or his parents or any of his grand parents were born in Undivided India. (i.e. India, Pakistan, Bangladesh) For Current ASSESSMENT YEAR An Individual will become a resident in India in the P.Y. 2006-2007 i.e. for current assessment year 2007-2008 if he satisfies any one of the following 2 basic conditions. 1. He is in India for 182 days or more in the previous year 2006-2007. OR Page No. 3

- 4. Compiled by Prof. M.B. Thakoor 2. He is in India for 365 days or more during the period 1.04.2002 to 31.03.2006 AND He is in India for 60 days or more in the pervious year 2006-2007. EXCEPTIONS 1. If a citizen of India, or a member of crew of Indian ship, leaves India in 2006-2007 for the purpose of employment will became a resident only if he stays in India for 182 days or more & not 60 days during 2006-2007 and he must be in India for 365 days or more during 4 pervious years preceeding the P.Y. 2006-2007 i.e. He must be in India for 365 days or more from 01/04/2002 to 31/03/2006. 2. A citizen of India or a person of Indian Origin, who is staying outside India comes on a visit to India in 2006-20074 becomes a resident only if he stays in India for 182 days or more (and not 60 days) during 2006-2007 and he must be in India for 365 days or more during 4 previous year preceeding the previous year 2006-2007 i.e. He must be in India for 365 days or more from 1.04.2002– 31.03.2006. NON-RESIDENT FOR AN INDIVIDUAL Non-resident is a person who is not a resident. An Individual who does not satisfy the test laid down in Sec (1) above is called a non-resident i.e. An individual who do not satisfy any of the basic conditions above is called a non-resident. Page No. 4

- 5. Compiled by Prof. M.B. Thakoor RESIDENT & ORDINARILY RESIDENT - Sec 6 (6) If an Individual satisfies the test of Resident then further 2 tests are to be made i.e. If an Individual is a Resident in India, he may be either Resident and Ordinarily Resident or Resident but not ordinarily resident. An Individual may be Resident and Ordinarily Resident if he satisfies following 2 conditions. 1. He has been resident in India for at least 2 out of 10 years immediately preceeding the previous year. AND 2. He has been present in India for a period of 730 days or more during 7 years immediately preceding the previous year. Current A.Y. 2007-2008 Thus during the current Assessment Year 2007-2008 a Resident Individual is tested as an Ordinary resident. If 1. He has been a resident in India for at least 2 out of 10 years immediately preceeding the P.Y. 2006-2007. 1. 1996-1997 2. 1997-1998 3. 1998-1999 4. 1999-2000 5. 2000-2001 6. 2001-2002 7. 2002-2003 8. 2003-2004 9. 2004-2005 10. 2005-2006 i.e. from 1st April 1996 to 31st March 2006 for these 10 years he must have been a resident for 2 years i.e. from 1.04.1996-31.03.2006. Page No. 5

- 6. Compiled by Prof. M.B. Thakoor 2. He has been physically present in India for a period of 730 days or more during 7 years immediately preceeding the previous year 2006-2007. 1. 1999-2000 2. 2000-2001 3. 2001-2002 4. 2002-2003 5. 2003-2004 6. 2004-2005 7. 2005-2006 i.e. He must have stayed in India physically for 730 days from 1.04.1999 – 31.03.2006. If both the above conditions are satisfied then the Individual is Resident and Ordinarily Resident. But if the additional 2 tests are not satisfied by an Individual then he is said to be Resident but not Ordinarily Resident. Counting of Days While counting of number of days in all the above cases the following points are to be noted. 1. The stay need not be at the same place. 2. The stay need not be continuous. 3. Where the stay is for part of the day, physical presence should be calculated on timely basis. Stay of 24 Hrs. will be counted as stay for 1 day. Where such information is not available, both the days of entry and exit will be counted as full days. 4. A stay in a boat anchored in territorial area of India, is treated as stay in India. Page No. 6

- 7. Compiled by Prof. M.B. Thakoor RESIDENTIAL STATUS FOR HUF SEC 6 (2) A Hindu Undivided Family (HUF), is said to be resident in India IF ITS CONTROL AND MANAGEMENT IS SITUATED IN INDIA either WHOLLY OR PARTLY during that PREVIOUS YEAR. A Resident HUF is an ORDINARILY RESIDENT if the KARTA or MANAGER of the Family is a Resident and Ordinarily Resident. A Hindu Undivided Family (HUF), is said to be ‘NON RESIDENT’ in India. IF ITS CONTROL AND MANAGEMENT IS SITUATED WHOLLY OUTSIDE INDIA during that PREVIOUS YEAR. CONTROL AND MANAGEMENT IS SITUATED AT A PLACE WHERE THE HEAD/BRAIN, THE SEAT OF THE DIRECTING POWER IS SITUATED. RESIDENT BUT NOT ORDINARY RESIDENT Sec.(6) (g) A HINDU UNDIVIDED FAMILY IS SAID TO BE ‘NON ORDINARILY RESIDENT IN INDIA in any previous year if its Manager is treated as an ‘NOT ORDINARILY RESIDENT’ in India during that previous year. Page No. 7

- 8. Compiled by Prof. M.B. Thakoor RESIDENTIAL STATUS FOR A COMPANY Sec. 6 (3) A COMPANY SAID to be ‘Resident in India’ in any previous year if – 1) It is an INDIAN COMPANY OR 2) DURING THAT YEAR THE CONTROL AND MANAGEMENT OF ITS AFFAIRS IS SITUATED WHOLLY IN INDIA. THUS AN INDIA COMPANY IS ALWAYS RESIDENT IF CONTROL & MANAGEMENT IS IN INDIA OR OUTSIDE INDIA. FOREIGN COMPANY IS ALWAYS RESIDENT IF CONTROL & MANAGEMENT OF ITS AFFAIRS IS SITUATED WHOLLY IN INDIA, DURING THAT YEAR. CONTROL & MANAGEMENT indicates THE HEAD AND BRAIN WHICH DIRECT THE AFFAIR OF THE COMPANY IN RESPECT OF ITS POLICY, FINANCE, DISPOSAL OF PROFIT, MANAGEMENT ETC. i.e. PLACE WHERE THE MEETING OF ITS BOARD OF DIRECTOR ARE HELD. Page No. 8

- 9. Compiled by Prof. M.B. Thakoor RESIDENTIAL STATUS OF A FIRM OR AN ASSOCIATION OF PERSON EVERY OTHER PERSON S 6(4) A PARTNERSHIP FIRM OR AN ASSOCIATION OF PERSONS (AOP) OR EVERY OTHER PERSON IS SAID TO BE A RESIDENT IN INDIA IF THE CONTROL AND MANAGEMENT OF ITS AFFAIRS ARE SITUATED IN INDIA EITHER WHOLLY OR PARTLY during that pervious year. A PARTNERSHIP FIRM OR AN ASSOCIATION OF PERSONS (AOP) or every other person is SAID TO BE NON RESIDENT IN INDIA IF ITS CONTROL AND MANAGEMENT IS SITUATED WHOLLY OUTSIDE INDIA during THAT PREVIOUS YEAR. “CONTROL AND MANAGEMENT IS SITUATED AT A PLACE WHERE THE HEAD/BRAIN THE SEAT OF THE DIRECTING POWER IS SITUATED”. Page No. 9