MARKET OUTLOOK FOR 03 FEB- CAUTIOUSLY OPTIMISTIC

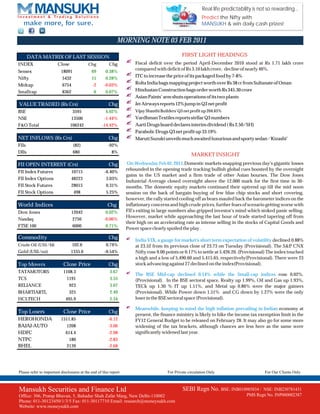

- 1. Real life predictability is not so rewarding... Predict the Nifty with MANSUKH & win daily cash prizes! MORNING NOTE 03 FEB 2011 DATA MATRIX OF LAST SESSION FIRST LIGHT HEADINGS INDEX Close Chg Chg Fiscal deficit over the period April-December 2010 stood at Rs 1.71 lakh crore compared with deficit of Rs 3.10 lakh crore, decline of nearly 46%. Sensex 18091 69 0.38% Nifty 5432 15 0.28% ITC to increase the price of its packaged food by 7-8% Midcap 6754 -2 -0.03% Rolta India bags mapping project worth over Rs 38 cr from Sultanate of Oman Smallcap 8362 6 0.07% Hindustan Construction bags order worth Rs 345.30 crore Asian Paints’ arm shuts operations of its two plants VALUE TRADED (Rs Crs) Chg Jet Airways reports 12% jump in Q3 net profit BSE 3595 4.02% Vijay Shanthi Builders' Q3 net profit up 204.65% NSE 13500 -1.44% Vardhman Textiles reports stellar Q3 numbers F&O Total 106242 -14.42% Aarti Drugs board declares interim dividend ( Rs 2.50/SH) Parabolic Drugs Q3 net profit up 33.19% NET INFLOWS (Rs Crs) Chg Maruti Suzuki unveils much awaited luxurious and sporty sedan -‘Kizashi’ FIIs (82) -92% DIIs 680 8% MARKET INSIGHT FII OPEN INTEREST (Crs) Chg On Wednesday Feb 02, 2011,Domestic markets snapping previous day's gigantic losses rebounded in the opening trade tracking bullish global cues boosted by the overnight FII Index Futures 10715 -6.40% gains in the US market and a firm trade of other Asian bourses. The Dow Jones FII Index Options 48223 3.03% Industrial Average closed overnight above the 12,000 mark for the first time in 30- FII Stock Futures 28015 0.31% months. The domestic equity markets continued their uptrend up till the mid noon FII Stock Options 498 5.25% session on the back of bargain buying of few blue chip stocks and short covering, however, the rally started cooling off as bears mauled back the barometer indices on the World Indices Chg inflationary concerns and high crude prices, further fears of scenario getting worse with Dow Jones 12042 0.02% FII's exiting in large numbers also gripped investor's mind which stoked panic selling. However, market while approaching the last hour of trade started tapering off from Nasdaq 2750 -0.06% their high on an accelerating rate as intense selling in the stocks of Capital Goods and FTSE 100 6000 0.71% Power space clearly spoiled the play . Commodity Chg India VIX, a gauge for market's short term expectation of volatility declined 0.88% Crude Oil (US$/bl) 102.6 0.74% at 23.52 from its previous close of 23.73 on Tuesday (Provisional). The S&P CNX Gold (US$/oz) 1335.6 -0.54% Nifty rose 9.00 points or 0.17% to settle at 5,426.20. (Provisional) The index touched a high and a low of 5,490.60 and 5,415.65, respectively(Provisional). There were 23 Top Movers Close Price Chg stock advancing against 27 declined on the index(Provisional). TATAMOTORS 1108.3 3.67 The BSE Mid-cap declined 0.14% while the Small-cap indices rose 0.02%. TCS 1191 3.55 (Provisional). In the BSE sectoral space, Realty up 1.99%, Oil and Gas up 1.93%, RELIANCE 923 3.07 TECk up 1.30 % IT up 1.11%, and Metal up 0.86% were the major gainers BHARTIARTL 325 2.49 (Provisional). While Power down 1.51% and CG down by 1.27% were the only HCLTECH 495.9 2.34 loser in the BSE sectoral space (Provisional). Meanwhile, keeping in mind the high inflation prevailing in Indian economy at Top Losers Close Price Chg present, the finance ministry is likely to hike the income tax exemption limit in the HEROHONDA 1511.85 -6.12 FY12 General Budget to be released on February 28. It may also go for some more BAJAJ-AUTO 1208 -3.06 widening of the tax brackets, although chances are less here as the same were HDFC 614.4 -2.98 significantly widened last year. NTPC 180 -2.83 BHEL 2139 -2.68 Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only Mansukh Securities and Finance Ltd SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

- 2. Morning Notes make more, for sure. MARKET OUTLOOK- CAUTIOUSLY OPTIMISTIC TECHNICALLY SPEAKING: The domestic equity indices which kick started the day on an optimistic note tracking strong global cues cracked under pressure approaching the last hour of trade and ended the session with modest gains only. However, Positive start of the European markets and the Smart performance of the Realty sector supported the domestic markets to some extent. FAVORED SCENARIO: Remember we have said that below 5580 there might be a sharp fall. Exactly to our expectations spot index plummet in the last session and breached 5500 though manages to close with tiny buying. Technically 5380-5400 could be the next level of support though sentiments remain subdued and we expect some more downside near to 5250 in upcoming sessions. Hence traders are advised to remain cautious at this stage and use ‘sell on rally’ strategy until and unless 5630 wouldn’t breach down with decisive volumes. VARIED SCENARIO: On the flip side any bounce back from current levels may reap indices towards 5630-5650 level where we might see some sort of consolidation. Any break out above this may generate some suggestive buying opportunities though 5800-5850 might be the next ress zone. HAPPY TRADING...... T O D A Y 'S M A R K E T L E V E L S In d e x S u p p ort 2 S u p p ort 1 P re viou s C los e R e s is ta n c e 1 R e s is ta n c e 2 T re n d SEN SEX 17630 17790 18091 18235 18495 R a ng e bo und N IF TY 5345 5380 5432 5465 5495 R a ng e bo und Index Support 2 Support 1 Previous Close Resistance 1 Resistance 2 Trend BANK NIFTY 10215 10325 10471 10695 10840 Rangebound Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only Mansukh Securities and Finance Ltd SEBI RegnRegnBSE: INB010985834 / NSE: INB230781431 SEBI No. No. BSE: INB010985834 / NSE: INB230781431 Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax:Bahadur Shah Zafar Marg, New Delhi-110002 Office: 306, Pratap Bhavan, 5, 011-30117710 Email: research@moneysukh.com Website:011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Phone: www.moneysukh.com Website: www.moneysukh.com

- 3. Morning Notes make more, for sure. INTRA DAY TECHNICAL RECOMMENDATIONS Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend ANDHRA CEM 12.6 12.5 12.3 12.7 12.9 Rangebound Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend ZYLOG 400.65 395 380 405 415 Rangebound Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only Mansukh Securities and Finance Ltd SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

- 4. Morning Notes make more, for sure. INTRA DAY TECHNICAL RECOMMENDATIONS Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend SURANA 116 112 108 116 120 Rangebound Scrip CMP Sell Near Stop Loss Target 1 Target 2 Trend AHMAD FORG 123.3 127 132 122 117 Rangebound Mansukh Securities and Finance Ltd SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

- 5. Morning Notes make more, for sure. NAME DESIGNATION E-MAIL Varun Gupta Head - Research varungupta@moneysukh.com Pashupati Nath Jha Research Analyst pashupatinathjha@moneysukh.com Vikram Singh Research Analyst vikram_research@moneysukh.com For more copies or other information, please send your query at research@moneysukh.com Note: Please refer our Derivative Report for recommendation on OPTION STRATEGIES. Additional Information with respect to the securities referred in our derivative calls is uploaded on our website. Please note that our technical calls are totally independent of our fundamental calls Technical Trends calls are based on momentum, Investors/Traders are requested to observe following discipline to take maximum advantage of the products -Entry/exit will be on the basis of price or time priority -Use strict stop loss at 15% from your average acquisition price This report is prepared for the exclusive use of Mansukh Group clients only and should not be reproduced, recirculated,published in any media, website or otherwise, in any form or manner, in part or as a whole, without the express consent in writing of Mansukh Securities and Finance Ltd. Any unauthorized use, disclosure or public dissemination of information contained herein is prohibited. This data sheet is for private circulation only and the said document does not constitute an offer to buy or sell any securities mentioned herein. While utmost care has been taken in preparing the above, we claim no responsibility for its accuracy. We shall not be liable for any direct or indirect losses arising from the use thereof and the investors are requested to use the information contained herein at their own risk. Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only Mansukh Securities and Finance Ltd SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com