The 10 best financial solution providers to look for in 2019

- 1. www.mirrorreview.com Ultron Edge Are Humanoids An Indication Towards Age Of Ultron 2.0? Yashin Dahiya CEO September 2019 Robo Buzz Let’s Take A Look At The Future Of Robotics And Its Place In Human Society Data-Driven Platform To Buy Insurance Hassle-Free

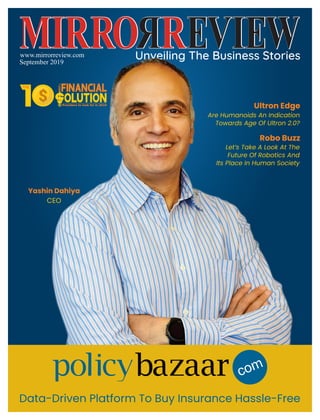

- 4. EDITOR’S LETTER It is my pleasure to introduce our latest magazine issue, “The 10 Best Financial Solution Providers to look for in 2019,” with an emphasis on how financial solution providers are transforming the financial industry. As the world moves towards increased digitalization, new challenges are emerging such as fraud, identity theft, payment security, customer-centricity services and many more for financial solution providers to address promptly. As a result, the demand for financial solution providers increases who can tackle these issues and offer better, reliable solutions. Hello Readers Lastly, in this issue, we have included interesting articles on ‘Ultron Edge’ and ‘Robo Buzz’ sections respectively. So, the team of Mirror Review has written a fantastic collection of stories regarding the best financial solution providers in the industry. These featured companies are offering novel solutions and services to make our world a better place. In our latest issue, featured on the front cover is Policybazaar, the India’s foremost insurance aggregator and a leading fintech player globally. Yashish Dahiya (CEO) and Alok Bansal (CFO) established Policybazaar as a key force in establishing an informative online financial services platform in India. Along with this, don’t miss out the Tech Insights section where Pawet Piszko (Scientific Advisor at Sinterit) explains what is SLS 3D printing. The financial sector is undergoing rapid expansion, both in terms of the strong growth of existing financial services firms and new entities entering the market. This sector encompasses commercial banks, insurance companies, financial non-banks, cooperatives, pension funds, mutual funds, and other smaller financial institutions. Deepali Sarwade Editorial Coordinator Addressing the Pain-Points of the Financial Industry www.mirrorreview.com Ultron Edge Are Humanoids An Indication Towards Age Of Ultron 2.0? Yashin Dahiya CEO September 2019 Robo Buzz Let’s Take A Look At The Future Of Robotics And Its Place In Human Society Data-Driven Platform To Buy Insurance Hassle-Free

- 5. CREDIT PAGE Mirror Review Media & Tech C-206, Wisteriaa Fortune, Wakad, Pimpri-Chinchwad, Maharashtra- 411057 +1 (850) 564-8517 info@mirrorreview.com www.mirrorreview.com Mirror Review Magazine is published by Pericles Ventures Pvt Ltd. No part of Mirror Review magazine may be reproduced, published or used in any manner without prior written consent from the publisher. The team of Mirror Review Magazine has made every effort to ensure the accuracy of the content. The publisher assumes no responsibility of any part of the content of any advertisement in this publication, including any errors and omissions therein. F O L L O W U S mirrorreviewofficial MirrorReview1 mirror-review mirrorreview Publisher : Editor-in-Chief : Archana Ghule Vikram Suryawanshi Editorial Coordinator : Deepali Sarwade Vidya Joshi Rakesh Mahto Shubham Biradar Balkishan Dalai Project Managers : William Taylor Vinayak Todchetwar Daniel Lewis Santosh Randive Jocob Eddy Surajit Dhara Joseph Thomas Pandurang Kulkarni Art Director : Visualizer : Graphic Designer : Vinod Alhat Mark Davis Sumit Bonage Aniket Diwane Sakshi Bendre Head of Distribution & Production : Aakash Mahajan Head of Operations : Robert Smith Research Analysts : James Adams Advertising : Maria Smith

- 6. Data-Driven Platform To Buy Insurance Hassle-Free COVERSTORY Yashish Dahiya CEO 10

- 7. Providing A Broad Spectrum Of Strategic Advisory Solutions Arkstons Advisory: Facilitating Global Trade With Novel Financial Services Euro Exim Bank: Eliminating Business Risks By Identifying And Stopping Financial Crime In Real-Time IdentityMind: The Most Advanced Open Source ERP Software Solution Provider OpenPro: Building The Very Fabric Of The Decentralised Future TenX: 18 20 26 28 38

- 8. What is SLS 3D printing? Pawel Piszko Scientic Advisor | Sinterit Industry Champions Articles Robo Buzz Can Fully-Automated Robots Replace Human Jobs Affecting Customer Experience? Ultron Edge Are humanoids an indication towards age of ultron 2.0? 30 22 40

- 11. n Platform To Buy ce Hassle-Free reviously, the insurance customers were facing a Prough patch due to the inconsiderate outlook of the insurance industry. There was lack of customer- centricity, and insurance companies made profits from policy surrender charges. All of this changed when a group of neophyte, with no experience in the insurance industry, started to visualize what the insurance space can be crafted into. These visionaries imagined a place that would be solely customer-centric, where the consumers could find transparent insurance information and a feature to research and compare products, so they could buy what they actually want. Yashish Dahiya (CEO) and Alok Bansal (CFO) turned this imagination to reality and created an integrated platform called PolicyBazar. Policybazaar was started as an insurance comparison website, but after a decade long period, it has transformed into a comprehensive digital channel offering end-to-end insurance solutions for the consumers. Founded in 2008, Policybazaar is now India’s foremost insurance aggregator and a leading fintech player globally. It started as the customer-centric company and even today runs Policybazaar brings an unbiased comparison of nancial services from all major insurance companies to our customers.

- 12. on the same philosophy—Customer First and Sustained Profitability for the entire Insurtech ecosystem. It works on the mission of building a safety net for 250 million-plus households in India. Currently, it records more than 10 lakh insurance purchases on its platform every month and hosts 500+ products from 40+ insurers. Strong relationships with all prominent insurance companies Policybazaar is a B2C entity, which caters to the entire population of India looking to weave a financial social security net for themselves and their families. To summarize concisely, anyone looking for protection from death, disease and disability outcomes, and those looking to achieve life goals through investment in insurance is the potential customer it would cater to. The company has proficiency in financial services due to which it delivers excellent services and helps its customers to make balanced and beneficial decisions. Furthermore, in order to chase its vision of making India a socially secure nation, the company has partnered with the prominent public and private insurance companies across India. The company utilizes these partnerships to streamline their knowledge and business operations and provide the best possible services to their consumers. Policybazaar’s team also feels fortunate to receive the assistance of a robust group of investors that believed in the company’s vision. Compare, Buy and Save at Policybazaar Today, Policybazaar has become one of the largest insurance destinations in the country. It is specialized in making a comparative analysis of the insurance products. The platform has been useful to empower the Indian consumer and give them the flexibility of buying the insurance products that fulfil their unique requirements. It brings an unbiased comparison of financial services from all major insurance companies to its customers. Moreover, to help consumers with their motor insurances, Policybazaar has introduced its game- changing product, “Self-Inspection Video”. This product helps customers to renew lapsed motor insurance within a few hours. This feature is expedient because in a country like India, nearly 30 out of 100 vehicles go lapse on motor insurance renewals. Further, to enhance the platform it has added the “Self-Claims Video” feature that helps the customers to file instant claims, which improved the customer experience of dealing with the accidental damages. Policybazaar platform embraces the online systems and offers an integrated platform to help the customers directly link to insurance companies, these benefits customers with significant savings on their investment expenses. Leveraging the latest tech, the platform also offers backing of Chatbot and human-assisted buying experience on the portal to augment the services. The Trailblazer of the Organization As aforementioned, the pioneers Yashish Dahiya (CEO), and Alok Bansal (CFO) established Policybazaar as a key force in establishing an informative online financial services platform in India. Over the years, the duo has scaled the growth of the company in terms of revenue and customer acquisition to become the largest platform of financial solutions in India. Alok is not just a great leader but also a great Our focus on online systems and integration helps you directly link to insurance companies, which in turn results in you getting signicant savings on your investment expenses. Cover Story

- 13. sports enthusiast and has an abiding love for physics. In addition, he is a bibliophile and his favorite book is ‘Atlas Shrugged’. Yashish’s childhood has been a disciplined one, as he belonged to a family of army officers and went to Lawrence School, Sanawar for early education. He has completed his engineering from IIT-Delhi followed by a stint at IIM-A and INSEAD. Yashish has always been determined about establishing a business from scratch. However, he reasonably started his entrepreneurial journey by giving tuitions to students pursuing MBA and even was earning well, but parents nagged him to get a regular job. After working for companies like Brain & Co in the UK and First Europa, he started his journey with Policybazaar. Yashish believes that people—customers, business partners, and employees—are the centre of his work. He being the Health Insurance Term Life Insurance Investment Insurance Car Insurance 2 Wheeler Insurance Travel Insurance telamon of the company holds the sixth sense that has come handy in the company’s favor. Together with Alok, he has built a stellar team at PB who he can trust blindly. Fostering Growth and Achieving the Impossible Policybazaars’ sole goal is to diverge towards fostering growth and achieve the impossible. To achieve this target, the company is constantly striving to develop new products and services for its consumers. The purpose of introducing new products is not for the means of profitability but to add value in consumers’ life, so that they are able to instil a sense of financial security in them. Policybazaar functions in India, which makes it favourable with the current scenario of the country.

- 14. Having said that, the financial security is critical because in India there is no social security particularly post- retirement, this makes insurance the only remedy for the woes. Apart from benefiting the home country, Policybazaar is also planning to expand its roots at the global level to provide financial aid. Currently, Fintech venture Paisabazaar is doing well, being the first international venture. Yashish enthusiastically commented, “It’s exciting times and we are looking to achieve what no other consumer internet company has achieved in India—operational profitability with sustainability, and all this by keeping consumer interest above all because I am okay with losing money but compromising consumer interest—NEVER!” The Success Mantra of Policybazaar The journey from a start-up company to a leading company is not easy. Policybazaar has also faced the regular hurdles that every company faces whilst expanding or starting up. The companies would revolve around finding initial capital and overcoming regulatory roadblocks. However, these obstacles did not obstruct Policybazaar; it has always survived and conquered the challenges. Besides, the industry has also named it as the germ of the industry due to its uncanny ability to adapt and survive. The team has a hidden mantra up their sleeve—’spot the silver lining and keep cracking’, which has contributed hugely to the success. Protecting consumers from the ‘3Ds’ Yashish shares that in India, 30 million+ households spend more on medical treatment than their annual income and 60% of OPD expenses are borne out of personal savings. He believes that it is the industry’s duty to provide greater protection to consumers against the 3Ds—Death, Disability, and Disease, which cripples consumers the most. The change the industry needs is how it approaches the consumers. Policybazaar has always been customer-driven and given customers the priority, while other company’s approach towards the consumer is quite different. Regardless of not being beneficial, the product is still sold to the consumer. However, the online channels have been trying to address this impediment, but problems remain and this contributes to mis-selling. Yashish encourages that the industry, irrespective of the channel should put a blanket ban on products that do not keep consumer interest above all. Envisioning the Future of the Insurance Industry Looking at the current scenario, Yashish predicts a positive future of the insurance industry. Specifically, the FinTech space is emerging rapidly and is on the cusp of fostering a fourth tech revolution in the country. Yashish added, “In my opinion, as businesses try to understand their consumers better to offer them personalized services, I envision further development taking place in the domain of progressive behavioural analysis.” Foreseeing the revolution, the predicted changes can be that the businesses will work on voice data processing and sentimental analysis, through these points they will be able to gauge the consumer feedback. This will help them understand the pinpoints that need change. Furthermore, the key area for investment will be in augmenting the field-force management systems, as it will directly affect the operations and profitability of the business. Cover Story

- 16. Don’t Miss an Issue @www.mirrorreview.com SUBSCRIBE NOW Get Inspired, Stay Updated with all the Business World Buzz with Mirror Review Magazine

- 17. Company InfoCompany Name Arkstons Advisory Binesh Balan Founder & Executive Director Arkstons Advisory offers seamless investment banking advisory services to clients seeking in-depth strategic, investing, and financial expertise. arkstons.co.uk BankMobile Jay Sidhu CEO & Co-founder BankMobile is a leader in mobile banking, provides a digital banking platform with checking and savings accounts, a great mobile banking app and more. bankmobile.com Euro Exim Bank Graham Brigh Head of Compliance & Operations Euro Exim Bank Ltd (EEB) is focused on providing its customers with a quicker and cheaper payment experience through its wide range of financial instruments and specialized services. euroeximbank.com GoCardless Tom Blomfield Hiroki Takeuchi Matt Robinson Founders GoCardless is the easy way to collect Direct Debit. Already serving more than 50000 businesses, perfect for recurring billing and B2B invoicing. gocardless.com LexisNexis is a corporation providing computer-assisted legal research as well as business research and risk management services. lexisnexis.com Policybazaar is a B2C entity, which caters to the entire population of India looking to weave a financial social security net for themselves and their families. policybazaar.com TenX is a Singapore-based blockchain company that makes cryptocurrencies spendable i.e. to give people the opportunity to make everyday purchases and withdraw money. tenx.tech/en You Need a Budget is a multi-platform personal budgeting program based on the envelope method. youneedabudget.com IdentityMind Global Garrett Gafke Chairman & CEO IdentityMind provides a new breed of risk management and compliance platform to the financial ecosystem, including banks, payment processors and gateways, payment service providers (PSP/ISO/MSP, IPSP), and online merchants. identitymindglobal.com LexisNexis Mike Walsh CEO Policybazaar Yashish Dahiya CEO TenX Toby Hoenisch Co-Founder & CEO YNABO Jesse Mecham Developer OpenPro Jim Clark Co-Founder & CEO Headquartered in Fountain Valley, CA, OpenPro ERP Software is a leading provider of licensed open source ERP software. openpro.com

- 18. 18 With the global banks shrinking their operations significantly, the boutique investment banks have come to the rescue. Currently, the complex structure, large deal sizes, and uncertainty in regulating approvals affect the execution risk highly. Therefore, the investment banks that are the core supporter of these large transactions must become aware of these execution risks. This explains the sudden rise of novel and smart M&A boutiques, which are successfully trembling up the deal street. Growing at the same pace, these firms can soon turning into merger mavens, which the clients can rely on for loyalty and the competition the global market needs to look out for. One such boutique investment banking advisory firm to look out for is . It offers seamlessArkstons Advisory investment banking advisory services to clients seeking in- depth strategic, investing, and financial expertise. The inception of the company was in the year 2016 with offices in London and Bahrain. The major operation centers of the firm are in the Middle East, Western Europe, and Southeast Asia. Remarkable Services through Specialized Solutions Arkstons Advisory strives to provide exceptional services through its specialized investment banking solutions from day one to closure. It offers wide-ranging strategic advisory solutions in due diligence, capital raising, equity offerings, debt syndications, and derivatives. It caters the services to industry verticals like Financial Institutions Group, Healthcare and Life Sciences, Natural Resources, Automobile, Media Entertainment, and other industrials. Arkstons diversified structure specializes in cross border M&A, capital raise advisory, and joint venture advisory across major sectors and geographies including manufacturing, automobile pharmaceutical, and many others. Till date, the best boutique investment banking advisory company has successfully served over more than fifty clients in around more than thirty countries and has an inclination towards working with the eminent companies having reputed stature. Turning Challenges into Capitalizing Opportunities With the number of emerging innovative consultancy companies, staying in the market and surviving the competition is itself a very big challenge. Hence, to stay ahead and stand out from the rest is the only strategy that helps to endure in the competitive marketplace. Arkstons Advisory is constantly striving to position itself uniquely in the globalized market backed by its exceptional performance and unique services. Initially, securing the deals and operating globally was a major task for the firm, as the global market is more interconnected which would increase the global market value of the M&A sector in general. Challenges are an inevitable part of the journey; it’s the way one tackles them is what makes the company exceptional than others. In this protracted journey, Arkstons Advisory has been through numerous challenges but always focused on turning those challenges into capitalizing opportunities by responding quickly and taking the right step at the right time. This unique approach has positioned the leading advisory company to distinctively stay ahead in the global market race. A Crackerjack Entrepreneur’s Pathway Towards a Leading Company Binesh Balan (Founder and Executive Director at Arkstons Advisory) has had a fascinating journey and embarked on many milestones from a very young age. His entrepreneurial voyage started when he was pursuing his undergraduate degree and got introduced to an online delivery mode. This was the time in the mid-2000s and prior to advent of mobile applications and 3G/4G, making him realize that this model was too early for the market, as the modern technology was not dominant enough. Binesh Arkstons Advisory: Providing A Broad Spectrum Of Strategic Advisory Solutions

- 19. 19 also acknowledged that he needed some experience and exposure to step up his game in the market. With the intent to enhance his managerial skills and gather expertise in the IB space, he pursued MBA in Finance and later entered into the Investment Banking/M&A advisory space to gather more experience. After knowing the ropes of the industry, he started his firm Arkstons Advisory in 2016 in India followed by Bahrain and the U.K. Presently, he holds exemplary expertise in diversified sectors such as IB, M&A, and GCC in general. The confident founder says, “In a booming deal market, many corporates spend a vast amount of their time answering ‘if’ deals need to be initiated, whereas the focus should be on ‘when’and ‘how’to initiate and execute those deals to accelerate growth and create maximum sustainable value.” Accomplishments for Performing Exceptionally Over the years, Arkstons Advisory has received many prestigious awards for its performance and excellent contribution in the industry. It has been recognized at the “Asian Arab Awards 2019”, held in the first quarter of 2019, organized by Asian Arab Chambers of Commerce (AACC) in association with the Indian Economic Trade Organisation (IETO). It was also listed among the “Most Outstanding Consulting Firms of 2019” by a leading online business magazine too. In addition, by working in conjunction with its subsidiary, Arkstons Advisory has recently been conferred with the “Outstanding Debt and Equity Firm of the Year 2019” and “Ten Trusted M&A Consulting Firms”. Integrating the Platform Might Deliver Better Outcomes Binesh believes that there are certain key changes that could improve the industry platform. To begin with, by collaborating with the dynamic business leaders and forward-thinking investors, one can deliver scalable investment strategies that would not only generate economic returns but also positive social outcomes. Additionally, welcoming the digital revolution and embracing it can also assist companies to grow. Hence, digitizing is the change that can improve global collaborations, deliver data-driven insights, reduce costs, time, and streamline the processes in a systematic manner. Improving Global Collaborations and Accelerating Transactions Looking at the key challenges like complexity, implementation, and execution, Arkstons Advisory plans to upgrade its platform with custom digitized solutions to deal with complexities and ensure smoother implementation & execution. It is making use of advanced technologies to reduce time and cost. These approaches will improve global collaborations and accelerate deal-making and transactions. Binesh Balan Founder & Executive Director “We are branching out beyond traditional practice areas such as strategy, Finance, Operations, and Human Resources to develop the next-generation areas of expertise.”

- 20. 20 The prominence of payments in the global financial services system has undeniably risen over the last few years. In fact, the traditional payment methods have massively transformed to reach its current position, i.e. towards cashless payment systems. Recently, a crypto revolution has taken place in speed and acceptance of real- time payments, enabling cryptocurrency to decrease liquidity and assist buyers where access to fiat currency has become difficult. (EEB) is focusedEuro Exim Bank Ltd on providing its customers with a quicker and cheaper payment experience through its wide range of financial instruments and specialized . It is aiming to beservices recognized as the ‘go to’ industry leader in trade finance, building on its experience servicing trade clients economically and efficiently across global locations. Leveraging Latest Technologies to Deliver Seamless Payment Experience Headquartered in St. Lucia and with a representative office in London, EEB is a regulated, supervised Bank that has been helping customers with their businesses transactions and connecting them to new opportunities. Backed by years of experience in trade finance, the EEB team supports global buyers with complex financial instruments to assist cross border transactions. The highly qualified specialists utilize advanced technologies, which overcome the restrictions of legacy applications. As a result, they developed their own systems to support the issuance and relay of trade finance instruments worldwide. Currently, the revolutionary financial institution has joined hands with Ripple, using the xCurrent system for payments and recently accomplished the fastest implementation of xRapid, which uses Ripple XRP cryptocurrency as the key element in real-timee settlement processes. As a prominent financial institution, EEB assists corporates and SME’s around the world as they purchase goods cross border for re-sell or directed to industrial hubs for re- manufacture. The company provides its services for almost all industries and verticals, handling transactions in polythene piping, building materials, cars, non-perishable food stuffs, cotton, finished garments, scrap metal, batteries, printing machinery, paper, etc. To further assist its customers, it recently launched Euro Exim Bank Smart Banking applications, available in Google Play Store and Apple App Store. The Dynamic Duo Leading EEB to Massive Success The Director of Euro Exim Bank Ltd, Kaushik Punjani, and the Head of Compliance and Operations, Graham Bright are the two powerful pillars helping the St. Lucia- based global financial institution to achieve enormous success. Having an extensive financial background, Kaushik has covered the management and delivery of financial solutions at UK businesses at all levels. He has a unique understanding of both the technical and business requirements. Currently, fully endorsing the CSR policy of the Bank he is leading Rajya Purohit Association of Brahmins U.K. organization as its President. The technically proficient industry professional, Graham has 35 years of experience (20 years at SWIFT and 5 years spanned in computer services companies). He is a Justice of the Peace, former MD of a European Bank software business and ex-Banking/Investment Management Director of a leading US data storage company. He is also a regular speaker at international trade industry conferences (GTR, TXF) and a frequent contributor to trade journals. Together, Kaushik & Graham saw immense challenges yet unique opportunities from the trade sector which is experiencing evolving regulatory pressure, non-standard national and international rules, constant threats of corruption, and cybercrime. Moreover, the absence of trust in buyers’ financing and intent to settle their financial obligations, limited access to liquidity, often harsh sanctions, and the need to create strong, reliable channels of trade were key factors affecting importers entering the sector. To overcome these obstacles, EEB have spent substantial resources, time and income on assuring Euro Exim Bank: Facilitating Global Trade With Novel Financial Services

- 21. 21 regulatory adherence, the efficacy of transactions, trust and security for clients and their company. Expanding by Conquering the Industry’s Obstacles with Team Effort The dynamic duo believes that in order to thrive and survive in a complex trade ecosystem they need all- inclusive policies, procedures, and functional systems that are easy to adapt and fast to operate Therefore, EEB’s USP. is to stay in-sync with the market, maintain close relationships with clients, and to continue the agile creation of instruments. Through this, Kaushik and Graham with their team have developed a unique blockchain-enabled platform, which is totally personalized to their business processes and unlike other available solutions present in the market. Their Simplex trade finance platform incorporates comprehensive workflow, document management, and reformatting and all-important inter-operability between systems. Kaushik and Graham aim to expand EEB by extending their agent/partner program where local representatives drive revenues, and are on-site to carry out first hand due diligence and create long-term partnerships. Through 2020, they are planning to open new offices in Asia with the potential for other regions to follow. In trade, EEB plans to embed complex details of trade instruments such as Letters of Credit with the payment instruction in Ripple message formats, facilitating real-time, guaranteed delivery and settlement for any instruction across the financial landscape. Two Vital Catalysts that are going to Make the Trade Industry Better In the trade industry, countries exchange goods with each other based on their reputation and trust. But, there are certain countries where corruption, confidence and risk of non- recoverable losses prompt global businesses to actively avoid conducting trade. EEB’s duo believes that building trust and Free Trade Agreements Graham Bright Head of Compliance & Operations “We aim to be your trusted partner, connecting you to new trade opportunities and empowering your businesses to thrive in today’s competitive world.” are just some of the tools to rectify these issues. Consequently, new trade corridors will open to assist trade flows with disintermediated countries, help them out of poverty and allow them to be competitive in global markets with raw materials and foodstuffs. The dynamic duo shares their views on this scenario by asserting, “With more successful infrastructure projects delivered, increased wealth generation and rising domestic demand and confidence, renewed trust is leading to greater sustainable borderless, frictionless, unencumbered trade flows for the good of continents and the population alike.” Forecasting the Future Technological Revolutions Being industry professionals themselves, Kaushik and Graham have witnessed an unprecedented rise and reach of challenger fintech and payments companies unhindered by legacy. The duo believes that industry transformation will come about when traditional banks invest and upgrade their internal technology and automation, providing the mobile, tablet and smartphone infrastructure, ultimately delivering benefits to demanding end-customers . The dynamic duo also predicts that Blockchain-based applications will become standard.

- 22. Artificial Intelligence will take over humans? The question all are feared of. The opinion of people, however, differs from each other. Some believe AI is going to upgrade the human race, whereas, few think ‘slavery 2.0’ will emerge as soon as robots take over. This belief was also supported by the late physicist Stephen Hawking, he believed emerging of robots can be a threat to humans. He was amongst the brightest brains of humankind but there is a rare possibility of him being wrong. After all, we are humans, and we are designed to be imperfect. The view of AI taking over depends on the intelligence level. If the robots acquire “superintelligence” they might become smarter than humans. Studying human nature is more difficult than studying quantum physics. If we being humans can’t figure out each other, imagine how much longer will it take a humanoid to study human behavior and then plan “the whole taking over the world”. Though the idea can be good for a sci-fi movie. Humans fear change and humanoids are a big change. The achievements technology has unlocked are unrealistic. Imagination is coming true with technology. Humans, however, are terrified rather than appreciating it. Mystery behind machines Machines depend on the techniques which they have learned throughout, known as “machine-learning”. Learning process benefits the machine to perform the task again without instructions. A machine is simply an algorithm that runs on the data we provide it with. For instance, if we present handwritten pictures of numbers (1- 10), and ask it to tell us about the pictures we show in the same sequence. The answer probability lies from 1-10 as that is what we have taught the machine. But when we mix the sequence of the pictures machine would pick random numbers. Here is where humans teach machines the difference and machines store it for future reference. Machines learn from their mistakes quite literally. The data gets stored and retrieved whenever required. Machines can not repeat the same mistake twice though. The task a machine will perform depends totally on what a human will teach it. Human-machine works on vice versa terms, one depends on other. Humans too have grown to be dependent totally on machines. AI upgrading and innovating If we keep sci-fi movie data aside, machines have only proven best for the human race. When humans and machines contribute their knowledge and problem solving, the goal can be easily achieved. To explain this, when we travel on a flight, half of the times the mode is set to autopilot. You already risk your life in the hands of a machine. A 2015 survey reported that the pilots spend only seven minutes manually flying the plane- automated systems handle the rest. These seven minutes are the most critical ones which require the highest order of decision- making capabilities. For a machine, all it has to do is run a specific algorithm. These algorithms can go wrong too. For achieving better outcomes we cannot depend on machines. They need human support for better performance and a favorable advantage. Technology helps to sharpen human skills and achieve unexplored uniqueness. This, in turn, would favor us to create better technology. Businesses must take advantage of such combinations. They need to see how human-machine collaboration helps improve company performance. Machines are assisting humans not replacing them Humans must not fear being replaced by a robot. AI technology needs assistance to work properly. Unlike humans, machines cannot understand general logic they 22 Are Humanoids An Indication Towards Ultron Edge

- 23. 23 need specific algorithms or commands to perform any task. Machines are perfect, they perform the given task without mistakes and probably complete the task faster than humans. But what they lack is; imperfection, creativity, and emotions. No humanoid can have these qualities (maybe in the future). Alexa, Siri, and Cortana have made working with the gadgets so easy. We ask them to do the following task and they perform it. We don’t fear these technologies but we fear a fully functional humanoid? Technology has made a remarkable growth in the following years. Humanoid is always the topic of breaking news but now humanoid anchors the breaking news. China introduced the first humanoid anchor on its news channel following with another successful humanoid female anchor. The successful humanoid project called Sophia is the most adorable humanoid, how can one fear her? Hong Kong-based company developed her and was officially activated in 2016. Sophia was originally developed as a companion at nursing homes or to help people with chores. With time the humanoid was furthers developed. Saudi Arabia gave Sophia citizenship which made her the first humanoid with nationality. Now, Sophia guest stars at conferences sharing her opinions. Another example is Ai Da, the first AI invention to blur the line between an artist and the machine. She has a robotic arm just like humans and is powered with AI technology. She analyses an image in front of her, which turns into an algorithm helping her to move the arm and produce the artwork. She is the first robotic artist to have solo work displayed at oxford. The way a humanoid thinks or behaves depends totally on how the human has programmed it. If the robot has turned evil we know whom to blame. To summarize, the machine works on command and will do as we say. The change is taking place fast which may scare the human race but the developing technology is here to help us. We are not in a sci-fi movie where machines rule, the reality is different. Machines need humans to function no matter how “super- Intelligent” they get. Still, if there is the slightest chance of machines going all ‘Ultron’ on us we must not forget- though Ultron turned out to be evil, but Vision saved the day! Have faith in technology; after all we humans are the ones creating it.

- 26. 26 A s the world moves towards increased digitalization, fraud in the financial sector is also increasing. Cybercriminals have a comprehensive range of tools at their disposal to obtain customer information. Countless breaches have exposed the confidential and private information of some 143 million U.S. consumers to hackers and other nefarious users. And everyday, there seems to be another one. IdentityMind was founded in 2013 to help companies protect their customers and themselves from financial crime. Its goal is to restore integrity to the digital world through a digital identity platform designed to reduce online risk and increase compliance efficiency. Preventing Financial Crime Credit bureaus, and the static data they use, cannot stop cybercriminals. In contrast, IdentityMind provides a new breed of risk management and compliance platform to the financial ecosystem, including banks, payment processors and gateways, payment service providers (PSP/ISO/MSP, IPSP), and online merchants. The IdentityMind platform continuously creates, validates, and risk scores digital identities to help reduce risk and improve compliance throughout the customer lifecycle. It securely tracks the entities involved in each transaction like consumers, merchants, cardholders, payment wallets, alternative payment methods to build payment reputations. It also enables companies to recognize and decrease prospective fraud, assess merchant account applications, onboard accounts, and helps with identity verification services and protection against potential money laundering. The IdentityMind platform not only reduces fraud but also improves AML, sanctions screening, and KYC compliance efforts. A Veteran Leader Working Towards Bringing a Secure Revolution in the Digital World Garrett Gafke, the Chairman and CEO of IdentityMind, has a proven track record of establishing and growing technology companies. He has completed five M&A transactions, and two successful IPO’s. He is an active angel investor and Board Member of early-stage companies around Silicon Valley. He is a successful entrepreneur and Fortune 500 Executive, blending early-stage action with public company knowledge. These experiences guide Garrett to give his best as the CEO of IdentityMind. For Mr. Gafke, the most challenging thing is to forge his route and lead the company. Garrett shares, “To bring a company’s goals into IdentityMind: Eliminating Business Risks By Identifying And Stopping Financial Crime In Real-Time

- 27. 27 reality, one needs to sell the vision and provide the guidance that helps the team leaders to execute the vision.” This process drives the product, support, sales, marketing, and everything else. Ahead Through Innovation Bad actors are always looking at new ways to infiltrate the financial system through account take over, fraud rings and a variety of techniques that involve engineering new or subverting existing identities. What puts the IdentityMind platform ahead of the competition is its patented eDNA technology and machine learning that allows the platform to create, maintain and provide a highly accurate risk assessment of the entities on the other end of the transaction, and to ultimately determine whether a company should trust that entity. Behind the scenes is a partner ecosystem that allows for comprehensive identity proofing around the world without the need to integrate with multiple data providers. With over 300 million trusted digital identities, IdentityMind provides a network where encrypted identity assets can be securely shared to get a faster and broader view of the risk that an entity poses. IdentityMind is proud to have been mentioned in Gartner Group’s ‘Hype Cycle for Identity and Access Management, 2018’ and ‘Hype Cycle for Digital Banking, 2018’, Aite Group’s ‘The AML of Tomorrow: Here’, ‘IDC Innovators: Identity Proofing Solutions to Prevent New Account Fraud and Enhance KYC Compliance, 2018’ and Forrester’s ‘Vendor Landscape: Anti-Money Laundering Solutions’, among other publications. Garrett Gafke Chairman & CEO “We provide the weapons you need to stop account takeover and prevent account origination fraud throughout the lifecycle of your customers.”

- 28. 28 Financial service providers are under escalated strain to deliver improved clients’ experience from computerized disrupters and the advanced age of flexible and digital internet knowledgeable consumers who will look at replacement financial service providers. To enhance their service, they should be ready to adapt to new technologies, business management techniques, more efficient ways of communicating with customers, and even potential challenges and problems. In this scenario, ERP (Enterprise Resource Planning) is one such set of tools and processes that delivers an entire spectrum of agile finance solutions and services. ERP software fosters flexibility and creativity, drives insight to predict with accuracy, delivers desired customer experiences, and transforms the business practices into operational excellence. Headquartered in Fountain Valley, CA, OpenPro ERP Software is a leading provider of licensed open source ERP software. Since its inception in 1998, the company has been dedicated to producing technologically superior business software solutions and backing them with the finest implementation techniques and first-class service. Moreover, it develops products so that its customers can easily choose from complete web-based ERP solutions. Today, OpenPro’s key industries that it has been serving are manufacturing, distribution, and accounting. A Pioneer Offering Dynamic Business Management Software Solutions Over the past 20 years, OpenPro’s aim is to offer an affordable and easy to use ERP solution that helps small to medium businesses perform better. The company ensures its clients receive more function and more value from their ERP software solution. The core values of OpenPro are “CILIP” which represents customer focus, innovation, leadership, integrity, and passion that reflect its strong expertise in technological advancements and robust spirit to assist its customers. With a deep understanding of clients’ industry, the leading financial solution provider build solutions that improve growth while managing complexity. OpenPro is dedicated to building dynamic business management software solutions that are designed to maximize the efficient management of clients’ business. The ERP software solutions developed by it are available in the three variants: Easy ERP, OpenPro Enterprise, and OpenPro Cloud. Its ERP software uses an open architecture technology, which allows it to penetrate all existing ERP markets. With continuous development, the company delivers a flexible, scalable and fully-featured management system for small businesses to enterprise corporations. A Seasoned Leader and Principal Technologist with Extensive Experience With over 30 years of experience and cross-industry knowledge, the Co-founder and CEO of OpenPro ERP Software, Jim Clark ensures that the company has continued access to the latest and best technology for developing flexible and industry-specific products. Jim’s expertise is in ERP software, information systems, and open-source platform software development with extensive experience in industry-standard database management systems and open source technology. He is also certified with the American Production and Inventory Control Society (APICS). Being a principal OpenPro: The Most Advanced Open Source ERP Software Solution Provider

- 29. 29 technologist, Jim understands ERP business solutions and issues and has contacts with the individuals responsible for purchasing information technology for ERP solutions. As the CEO of OpenPro, the dynamic leader maintains a network of customers, primarily of distributors, import exports, government, and manufacturing companies, to provide input for product requirements and enhancements. With his vast experience, Jim foresees more automated solutions for updating and connection business solutions to governmental agencies. He believes that OpenPro can bring the passion back to the industry by delivering best breed of ERP software solutions to businesses. However, the CEO knows that the most challenging part is to get other people to have the same passion that he has for businesses in the industry. Team Efforts to Defeat Challenges In today’s knowledge economy, the necessity of effective teamwork is critical for any business. In fact, teamwork is vital as well as essential in order to accomplish the overall objectives and goals of an organization. The highly professionals team of OpenPro is using their prior expertise and knowledge to deliver best-in-the-class solutions. But back in days, the team faced numerous Future Goals for Better Growth and Expansion Every organization has strategized goals that need to be accomplished for better growth and expansion. Similarly, OpenPro has been working hard to achieve its many intended future goals. The company is planning to deliver trusted and great services for its diverse customers according to their business needs. It is also formulating different ways to provide reliable customer support, high availability of bandwidth, enhance monitoring, and integrate with everything (other solutions and plugins). challenges and one such challenge was to let people know that OpenPro is a solution that can be both in- house and cloud-hosted solutions as it was the first fully web-based solution available in the market. The dynamic leader with his team conquered his hurdle by educating people about it which took years to accomplish. “Now 20 years later that is what all the other software companies are still trying to build,” says OpenPro CEO Jim. Jim Clark Co-founder and CEO “We can provide you with the innovative products and services you need to succeed, not only today but well into the future.”

- 30. echnologies of additive manufacturing known as 3D printing (3DP) are considered to be the future of rapid Tprototyping, small and even big production lines for industry. There are several technologies distinguished by the phenomena they are based on and materials they are utilising. Reading this article you will learn how SLS 3D printing works and what are the differences between the main 3D printing technologies. The most popular 3D printing technologies Fused Deposition Modeling (FDM) is the most known of them all. It is a bottom-up technique based on melting of the filament and depositing it on a table layer-by-layer according to the sliced model. FDM utilizes mostly plastic-based materials such as polylactide (PLA) or acrylonitrile butadiene styrene copolymer (ABS).Another popular technique is stereolithography (SLA) – it is the oldest, dating back to the 1970’s, 3DP process operating on photochemical cross-linking and curing of the material with the help of UV lasers. Materials that are feasible for this type of printing are mostly resins – synthetic or natural. Among many other techniques, there is one with extraordinary potential which is yet to be explored – Selective Laser Sintering (SLS). SLS printing? 30 Industry Champions

- 31. 3D Printing techniques comparison How Selective Laser Sintering works? SLS operation principle is powder sintering with the help of infrared laser in elevated temperature which helps the grains of the powder to consolidate before being bound with the laser beam. In the conventional SLS printer, there is a so-called “bed” on which the roller spreads a thin layer of powder followed by sintering according to the layers sliced from a 3D model file (e.g. a .stl file (derived from CAD-like designing software). 31

- 32. A “cake” from Sinterit Lisa Heart model printed with Sinterit Lisa SLS 3D Printer Afterwards, the platform moves down by a small increment and the process repeats until the last layer is formed. After the process comes the post-processing part which requires removing the model from the unsintered powder suspension and sandblasting it. There is where the real advantage of SLS comes in. Unlike FDM, SLS is available to 3D print without any support structures for models with complex geometry for they are suspended in powder. Moreover, one can easily print moveable objects right away. Scheme of a SLS 3D printer basing on the construction of Sinterit Lisa. 32 Industry Champions

- 33. MaterialsforSLS 3D printersand outlook But one can come up with a question of materials available for SLS. The variety is broad – from different metal powders utilized mostly in the automotive industry to polyamides (i.e. Sinterit – a nylon 12 powder) and thermoplastic polyurethanePA12 Smooth (TPU) such as . All powders can be altered for the specific application so everyone can achieve desired mechanicalFlexa Black propertiesof themodel. SLS is actually a zero waste technology where the unsintered powder can be used for next prints over and over again.Avital aspect is its way of reutilizing the used powder and it’s refresh ratio (amount of fresh powder you need to add to the used one to maintain the printing quality). In theory, one can use the same powder all over with the fraction of the new one. However, some of the powders can oxidize quickly and require the presence of neutral gas atmosphere such as nitrogen or oxygen to preserve the print quality.Thistypeofsolutionispresentin’ whichhas anitrogenintake.SinteritsLisaPRO Printouts from di erent kinds of materials: TPU material Bellow: TPE 33

- 34. Ear model: TPU Raspberry Pi case: PA11 Onyx Derailleur: PA12 Smooth Material: Flexa Soft There are two main types of SLS printers – industry grade and benchtop. The former are tremendously expensive (dozens of thousands of dollars) and the benchtop ones, more affordable, such as Lisa or Lisa PRO for a couple of thousands of dollars. The main difference is the print volume, automatization of the process and the material range. The benchtop ones are ideal for academic research, rapid prototyping, and even small serial production. The true potential of SLS lies in the new materials with tailored-fit properties (conductivity, heat-resistance, water-repellant, you name it!). By many futurists,Additive Manufacturing is aproductiontechniquewhichwilldefinitelyovertakethefuture! If thisarticlemadeyouhungry for knowledge,checkoutthenextpart:SelectiveLaserSinteringinDetails 34 Industry Champions

- 35. About Sinterit Sinterit is the first manufacturer of desktop selective laser sintering 3D printers, with a mission to accelerate the world’s development by giving everyone access to innovative 3D printing SLS technology. It focuses on ease of use, versatility and availability, so that tomorrow can happen today. The company, founded by former Google employees with experience in the industry since 2014, delivers reliable, high-precision printers to customers around the world. During its four years on the market, Sinterit LISA has printed thousands of 3D products. For more information visit orwww.sinterit.com follow on Facebook, or watch our new film on .@Sinterit Twitter YouTube 35

- 38. 38 To achieve this target, has progressed significantly inTenX making this novel currency mainstream. TenX is a Singapore-based blockchain company that makes cryptocurrencies spendable i.e. to give people the opportunity to make everyday purchases and withdraw money. Its unique system offers the TenX Wallet that can be funded with different cryptocurrencies and the TenX card, which can be used in almost 200 countries at over 42 million VISA points of acceptance online and offline. All in all, the company caters to anyone looking to spend or invest in cryptocurrency. The cryptocurrency’s trajectory growth by far has been similar to the technological revolutions throughout history. It has disrupted the financial system in the same way the internet did to traditional media. This modern currency has proved its usefulness in the early stages and achieved mass adoption through usability and design. Nevertheless, if cryptocurrency means to stand alongside government issued currencies and be taken seriously, it needs to achieve widespread adoption and gain the ability to transact on a massive global scale. Avenues to Spend Cryptocurrency in the Real World, in Real Time New blockchain related companies are emerging everyday where many of them operate on open-source software projects. This raises more security concerns. TenX brings a wealth of security knowledge to the crypto space. It offers access to an ever-growing range of blockchain assets at utmost convenience, all the while sticking to the highest security standards of the industry. TenX is enforced by 2- factor authentication to keep the user’s accounts secure and protected. As the application is also available on mobile devices, it supports biometrics feature for unlocking. Furthermore, to ensure that the customers are satisfied with the service, the team of TenX constantly upgrades the product depending on the user feedback. TenX remains in the build mode to ensure that its products suit the fast-paced market. The company’s core services consist of the TenX Wallet App and the TenX Card to make spending cryptocurrency and investing in crypto simple and hassle- free. TenX Wallet: TenX Wallet is an easy to use service that allows users to complete the transaction in just a few simple taps. The wallet currently supports BTC and ETH and provides control over card management i.e. if the user tends to lose the card, he/she can lock and secure the card within the app and unlock it again easily. TenX Wallet also contains multi-signature wallet management that gives the users access to multisig cold storage for treasury and long- term custody of user funds. TenX Card: This card allows the user to spend cryptocurrency at all VISA points of sale. Further, the card can be used globally at all Visa supported ATM’s to withdraw money. The user also receives notification when the card is used. Co-founder Trio’s Journey towards Building a Successful Company Toby Hoenisch (CEO) and Paul Kittiwongsunthorn (CDO) co-founded TenX in 2015. Back then, the company was known as OneBit. Michael Sperk (Engineering Lead) collaborated part-time to establish the company, and later joined full time when Toby and Paul managed to raise the first investment. Toby was always fascinated by the world of technology. He started coding at the mere age of ten. Having realized the unlimited potential of blockchain technology, he built the first prototype for TenX with Paul. He always believed that the project on which he was working on is disruptive, and he wasn’t wrong. TenX:Building The Very Fabric Of The Decentralised Future

- 39. 39 How TenX Overcame Challenges & Emerged Strong The financial sector is still trying to adjust to the sudden shift of the cryptocurrency revolution. Spreading awareness and making crypto easy to use will help in making crypto mainstream and have the biggest impact in the finance industry. Therefore, in the future, Toby foresees that blockchain will power open financial networks, giving everyone easier access to their money. The transaction will be solely based on the digital medium, which will make the payments instant and each will have complete control over their money. Though the world is moving rapidly, there is still time for the financial networks to become truly borderless, safe, convenient, and accessible. Every successful company has to learn how to deal with potential challenges and overcome them. It is also very important for leaders to share their vision with their teams so that everyone stays on the same page. Being a leader himself, Toby faces a fair set of challenges amongst which the challenge he regularly encounters is ensuring that TenX is incorporating new changes and reflecting the upgrades in its products as per the market trends. And most importantly, he makes sure that the business is running efficiently. Predictions for the Forthcoming Revolution & Changes Today, Toby draws inspiration from many great pioneers in technology, and recently got influenced by Marty Cagan, who helped the TenX team to refine their go-to-strategy and thinking. He believes that in the new fast-paced space, it is important to look for mentors that are both inspiring and challenging. In the initial years, TenX’s growth was rapid. By 2017, it had a crypto product that was a market fit. Even today, TenX remains one of the few companies that conducted a token sale, while having a working product and an existing global user base. Two years back, the company had set the standard for a well-executed token sale. However, it faced challenges with its card partners as well as was unprepared for the sudden market shift. But, Toby and the entire team of TenX remained undeterred by these setbacks and instead, emerged strong. As for Toby, the dynamic CEO believes that the most important thing is to build and ensure that the teammates you work with believe in the same long- term vision as you so that everyone remains aligned to it. Roadmap to Future Development The leading crypto service provider believes that there are still a large number of people interested in this technology, but are unsure about how to enter the market. So, TenX’s goal is to seamlessly bridge this gap. Toby and his team mates aim to give more people access to open financial systems. For 2019, the company’s key milestones include expansion of services across the Asia Pacific, support new cryptocurrencies, re-launch the TenX Cards in the European Economic Area, implementation of a referral system, several updates to TenX app and implementation of PAY TOKEN utility. Toby Hoenisch Co-founder & CEO “Our mission is to bring the entire nancial system right to your ngertips.”

- 40. Industrial robots were first installed and utilized by the manufacturing companies to eliminate unnecessary efforts, time, and money. Today, programmed robots are carrying out assignments that are difficult for humans to perform. Tasks such as firefighting, defusing bombs, or diving deep into the oceans are a few risky jobs they have been involved in for some years. As advanced technologies began disrupting every industrial sector, so did the deployment of robots in every possible field. Whether it’s a fully automated saloon, a bank or a space program, various tech companies started experimenting with robotic possibilities on a daily basis. It is now visible that robots are starting to replace humans in the workforce. Recently, China Construction Bank (CCB) came in news after opening its first fully automated bank branch in China. First of its kind, the bank branch operates entirely without human commands joined the increasing number of retail outlets, restaurants, and other integrated venues across China. Although the bank appeared on many front pages for its achievement, it is still well staffed with security guards. 40 Can Fully-Automated Robots Replace Human Jobs Affecting Customer Experience? Robo Buzz

- 41. tedious tasks such as grocery shopping and banking. There are possibilities where people can ignore an unimportant process and want to replace with a fully automated one. For example, a thermostat system starts heating when the temperature drops down at a certain limit without any human input. Automation will probably allow the customers to do what they want and walk out without any forced interactions. Moreover, full automation is preferable to semi- automation when human intervention is not a good thing to consider. For example, a recent report suggested that the engineers at Boeing and Airbus want to remove pilots from their planes reasoning that most crashes are the result of human errors. Can automated robots steal human jobs affecting customers as a result? The history is proof that whenever humans have used technology in the right way, it has resulted as a boon to humanity. But when one thinks about artificial intelligence (AI), most common thought coming to mind is whether robots will take over human jobs soon. Jobs such as cashier in a bank, receptionist, waiter staff, and attendants at train stations are a few successful experiments that have taken place in the recent years. In 2016, Amazon surprised the automation industry with Amazon Go cashier-less grocery store which is now officially opened at Seattle followed by branches in Chicago and San Francisco. As an example of Amazon Go and its successful establishment attracting people into a cashier-less environment, will it be facing a trade-off in the near future? And if yes, then what will be the reason behind it? Let’s take a deeper look. Ÿ Automation can cause security, trust, and data threats A fully automated environment might protect customers’ privacy and data with its large-scale cyber security breaches. For example, if Amazon Go is fully automated and meant to collect vast Several questions arise in our minds as to how will the future of robotics look like, can it replace humans in their society, and will they ever be able to express emotions like us? Following context explains the behavior of full robotic automation system from partial automation and companies preferences between them. We also get to gain few insights on our raised questions such as whether robots will steal human jobs and are there any risks associated in using complete automation systems. How full automation system behaves different from partial automation? Partial automation solution automates some parts of the business work while continuing the rest with the traditional methods. Services such as scanning documents electronically, touch-screen checkouts, kiosks, and ordering systems are increasingly common techniques used at shops, restaurants, and other venues. Partial or semi-automation improves labor productivity as they still need to use their brains to organize their work more efficiently. Since some tasks are automated, the workflow of a process becomes naturally easy, bringing continuous improvement in the overall operations. Although, humans still need emotional connections with others, partially automated systems allow them to interact with real people. This is the best choice for small and medium- sized companies where a small number of employees and a small number of activities exist with low- complexity. However, the demand for full automation solution is dramatically more than the partial automation. Companies seeking more profit in less time and effort want to use the full automation system in this competitive market. This can be the most suitable system for large businesses - organizations and companies – to ease the workflow in a short period. By integrating the automated systems, companies can provide customers with a seamless, swift and efficient brand experience, particularly when it comes to 41

- 42. amounts of behavioral data, like ‘what activities customers do while shopping can help AI’s integrated system to analyze what they might want or not’, can waive the right to privacy of customers. Customer data can be beneficial for both parties to improve the overall shopping experience through personalization but too much following can give customers a crawling-over-skin experience. Ÿ Humans still need real emotions to connect Few futurists claim that robots will be able to replicate emotions soon. But, many psychologists deny such claims by simply saying that this cannot be possible. The reason behind it is that humans are still the most complex living creatures on the planet. Some activities that they do are simply beyond science to comprehend. For instance, why humans dream and how they remember the same dream within another dream a year after but again forget the next morning? If somehow emotions are embedded into robots, their thoughts will be completely transparent and without manipulations, whereas humans on the other hand are capable to do so. The matter of fact is customers prefer to interact with real people as they crave for emotional connections, particularly in a high-stress situation when they need some one-on-one conversations. Robots may be programmed with zero mistakes, but are they able to assist a brand according to customer mood? This million dollar question stands the test of time. It is believed that robots have a future in reshaping the world. It is also true that robots working in factories, shops or banks can to be more productive per day than its human counterparts. But the high-voltage questions still remain out in the open: can they completely replace humans or take over their jobs where emotions are needed? It is indeed something that the coming generations are going to find out and as of now, for others to breathe easy and make the most of it. 42 Robo Buzz