14 July Technical Market Report

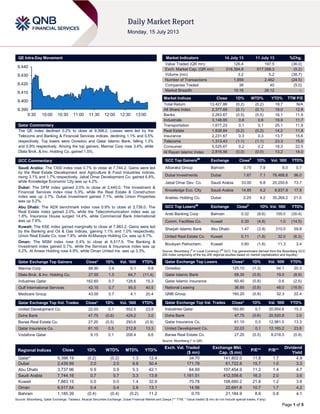

- 1. Page 1 of 5 QE Intra-Day Movement Qatar Commentary The QE index declined 0.2% to close at 9,398.2. Losses were led by the Telecoms and Banking & Financial Services indices, declining 1.1% and 0.5% respectively. Top losers were Ooredoo and Qatar Islamic Bank, falling 1.3% and 0.9% respectively. Among the top gainers, Mannai Corp rose 3.4%, while Dlala Brok. & Inv. Holding Co. gained 1.5%. GCC Commentary Saudi Arabia: The TASI index rose 0.7% to close at 7,744.2. Gains were led by the Real Estate Development and Agriculture & Food Industries indices, rising 3.1% and 1.7% respectively. Jabal Omar Development Co. gained 6.8%, while Knowledge Economic City was up 4.2%. Dubai: The DFM index gained 2.0% to close at 2,440.0. The Investment & Financial Services index rose 5.3%, while the Real Estate & Construction index was up 2.7%. Dubai Investment gained 7.1%, while Union Properties was up 5.2%. Abu Dhabi: The ADX benchmark index rose 0.9% to close at 3,738.0. The Real Estate index gained 2.0%, while the Telecommunication index was up 1.8%. Insurance House surged 14.4%, while Commercial Bank International was up 7.6%. Kuwait: The KSE index gained marginally to close at 7,883.2. Gains were led by the Banking and Oil & Gas indices, gaining 1.1% and 1.0% respectively. Union Real Estate Co. rose 7.8%, while Al-Mazaya Holding Co. was up 6.7%. Oman: The MSM index rose 0.4% to close at 6,517.5. The Banking & Investment index gained 0.7%, while the Services & Insurance index was up 0.2%. Al Anwar Holding rose 4.9%, while Oman United Ins. was up 3.3%. Qatar Exchange Top Gainers Close* 1D% Vol. „000 YTD% Mannai Corp 88.90 3.4 0.1 9.8 Dlala Brok. & Inv. Holding Co. 27.55 1.5 64.7 (11.4) Industries Qatar 162.60 0.7 128.6 15.3 Gulf International Services 42.15 0.7 85.5 40.5 Medicare Group 43.00 0.7 4.1 20.4 Qatar Exchange Top Vol. Trades Close* 1D% Vol. „000 YTD% United Development Co. 22.03 0.1 552.5 23.8 Doha Bank 47.75 (0.6) 429.2 3.0 Barwa Real Estate Co. 27.20 (0.5) 293.6 (0.9) Qatar Insurance Co. 61.10 0.5 212.8 13.3 Vodafone Qatar 9.15 0.1 208.4 9.6 Market Indicators 14 July 13 11 July 13 %Chg. Value Traded (QR mn) 126.4 197.5 (36.0) Exch. Market Cap. (QR mn) 516,394.8 517,399.3 (0.2) Volume (mn) 3.2 5.2 (38.7) Number of Transactions 1,859 2,462 (24.5) Companies Traded 38 40 (5.0) Market Breadth 15:16 26:12 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 13,427.86 (0.2) (0.2) 18.7 N/A All Share Index 2,377.69 (0.1) (0.1) 18.0 12.8 Banks 2,263.67 (0.5) (0.5) 16.1 11.9 Industrials 3,148.85 0.6 0.6 19.9 11.7 Transportation 1,677.23 0.1 0.1 25.1 11.9 Real Estate 1,839.84 (0.2) (0.2) 14.2 11.8 Insurance 2,231.67 0.3 0.3 13.7 15.6 Telecoms 1,313.43 (1.1) (1.1) 23.3 15.0 Consumer 5,525.67 0.2 0.2 18.3 22.5 Al Rayan Islamic Index 2,816.56 (0.0) (0.0) 13.2 14.0 GCC Top Gainers## Exchange Close# 1D% Vol. „000 YTD% Albaraka Group Bahrain 0.75 7.9 6.0 0.7 Dubai Investments Dubai 1.67 7.1 78,488.8 96.0 Jabal Omar Dev. Co. Saudi Arabia 33.00 6.8 20,250.6 73.7 Knowledge Eco. City Saudi Arabia 14.85 4.2 8,937.8 17.9 Arabtec Holding Co. Dubai 2.25 4.2 35,269.2 21.0 GCC Top Losers## Exchange Close# 1D% Vol. „000 YTD% Arab Banking Corp Bahrain 0.32 (8.6) 100.0 (30.4) Comm. Facilities Co. Kuwait 0.30 (4.8) 1.0 (14.5) Sharjah Islamic Bank Abu Dhabi 1.47 (3.9) 310.0 59.8 United Real Estate Co. Kuwait 0.11 (1.8) 32.0 (8.3) Boubyan Petrochem. Kuwait 0.60 (1.6) 11.3 3.4 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. „000 YTD% Ooredoo 125.10 (1.3) 54.1 20.3 Qatar Islamic Bank 68.30 (0.9) 19.0 (8.9) Qatar Islamic Insurance 60.40 (0.8) 0.6 (2.6) National Leasing 36.65 (0.8) 48.0 (18.9) QNB Group 160.20 (0.8) 32.3 22.4 Qatar Exchange Top Val. Trades Close* 1D% Val. „000 YTD% Industries Qatar 162.60 0.7 20,854.6 15.3 Doha Bank 47.75 (0.6) 20,520.8 3.0 Qatar Insurance Co. 61.10 0.5 12,981.0 13.3 United Development Co. 22.03 0.1 12,165.2 23.8 Barwa Real Estate Co. 27.20 (0.5) 8,018.5 (0.9) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,398.19 (0.2) (0.2) 1.3 12.4 34.70 141,802.0 11.8 1.7 4.9 Dubai 2,439.99 2.0 2.0 9.8 50.4 171.78 61,722.8 15.7 1.0 3.3 Abu Dhabi 3,737.96 0.9 0.9 5.3 42.1 64.69 107,454.9 11.2 1.4 4.7 Saudi Arabia 7,744.16 0.7 0.7 3.3 13.9 1,161.51 412,558.6 16.3 2.0 3.6 Kuwait 7,883.15 0.0 0.0 1.4 32.8 70.78 108,680.2 21.8 1.2 3.6 Oman 6,517.54 0.4 0.4 2.8 13.1 14.56 22,691.8 10.7 1.7 4.2 Bahrain 1,185.39 (0.4) (0.4) (0.2) 11.2 0.70 21,184.9 8.6 0.8 4.1 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,390 9,400 9,410 9,420 9,430 9,440 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QE index declined 0.2% to close at 9,398.2. The Telecoms and Banking & Financial Services indices led the losses. The index declined on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari shareholders. Ooredoo and Qatar Islamic Bank were the top losers, falling 1.3% and 0.9% respectively. Among the top gainers, Mannai Corp rose 3.4%, while Dlala Brok. & Inv. Holding Co. gained 1.5%. Volume of shares traded on Sunday declined by 38.7% to 3.2mn from 5.2mn on Thursday. Further, as compared to the 30-day moving average of 9.5mn, volume for the day was 66.6% lower. United Development Co. and Doha Bank were the most active stocks, contributing 17.5% and 13.6% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Earnings Earnings Releases Company Market Currency Revenue (mn) 2Q2013 % Change YoY Operating Profit (mn) 2Q2013 % Change YoY Net Profit (mn) 2Q2013 % Change YoY Saudi Arabia Fertilizers Co. (SAFCO) Saudi Arabia SR – – 633.0 -12.8% 693.0 -11.6% Yanbu National Petrochemical Co. (YANSAB) Saudi Arabia SR – – 756.2 -1.1% 670.5 3.2% Saudi Arabian Amiantit Co. (Amiantit) Saudi Arabia SR – – 72.8 -2.6% 30.7 0.9% Saudi Industrial Export Co. (SIECO) Saudi Arabia SR – – 2.4 293.4% 2.2 331.4% Methanol Chemicals Co. (CHEMANOL) Saudi Arabia SR – – 9.7 -74.2% 0.04 -99.8% Gulf Investment Services Holding (GIS)* Oman OMR – – – – 2.1 458.9% Source: Company data, Tadawul, (*1H2013 Results) News Qatar ABQK reports QR135.7mn net profit in 2Q2013 – Al Ahli Bank (ABQK) has reported a net profit of QR135.7mn in 2Q2013, reflecting an increase of 10.7% YoY (+0.5% QoQ). The bank’s net profit rose by 12.4% YoY in 1H2013 to QR270.7mn. ABQK’s net interest income increased by 30.7% YoY (+6.5% QoQ) to QR166.5mn in 2Q2013, while in 1H2013, it rose by 27.1% YoY to QR322.8mn. EPS stood at QR2.13 in 1H2013 as compared to QR2.02 in 1H2012. Total assets at the end of June 2013 stood at QR24.7bn over QR20.6bn in December 2012. Loans & advances rose by 13.1% YTD to QR15.9bn, while customer deposits were up by 25.5% YTD to QR17.5bn. (QE) S&P: Qatar in net external creditor position of around $50bn – According to a report by the ratings agency S&P, Qatar is in a “net external creditor” position of about $50bn despite the country’s total external debt rising steadily in recent years. S&P said Qatar’s total external debt was estimated at $166bn in 2012. However, this debt is more than offset by the external assets accumulated by the Qatar Investment Authority. S&P has associated Qatar’s current account balance and external debt position with limited vulnerability as the country has posted extremely strong current account surpluses fuelled by hydrocarbon exports. S&P also expects the trade surplus to remain strong in 2013 due to high oil & gas prices, which will more than compensate the expected higher debt service from rising gross external debt. Moreover, S&P said it considers Qatar’s economy to be in an expansionary phase with a real GDP growth of 6% in 2012. Credit growth in the banking sector has been exceptionally strong over the past five years, growing at 30% in 2011 and 21% in 2012. This growth was mainly driven by borrowing by government and quasi-government institutions, which rose by 45% and 47% in 2011 and 2012 respectively. (Gulf-Times.com) S&P: Exposure of real estate, aggressive expansion plans “weaknesses” of Qatar‟s banking sector – According to a report by S&P, severe exposure to real estate market and aggressive expansion plans are the key weaknesses for Qatar’s banking sector, despite its high stability and strong profitability. S&P expects the country’s real estate market to recover from its sharp decline since 2009, but the commercial segment remains more vulnerable than the housing segment. S&P said this is one of the main risks faced by Qatari banking sector given its high concentration on lending to cyclical sectors such as real estate & construction. S&P also said that lending concentration in the real estate & construction sectors is high at 20% of total loans at year-end 2012. In addition, foreign currency lending has recently increased dramatically and accounted for 51% of total loans at the end of 2012. However, the ratings agency said economic risks for the Qatari banking sector remain average in a global comparison. (Peninsula Qatar) BRES‟ subsidiary wins QR61mn ruling against two Bahraini firms – Barwa Real Estate Company’s (BRES) subsidiary, Barwa International has won a ruling worth QR61mn in the Bahrain Chamber of Dispute Resolution (BCDR) against the Bahraini companies: Inovest and Al Khaleeji Development Company. BRES has now obtained the attachment order from the Bahraini courts and will present it to the Central Bank of Bahrain (CBB) to instruct all banks in the country to freeze accounts of the defendants to the amount of the judgment awarded to BRES. In June 2012, BRES had filed a case in the Overall Activity Buy %* Sell %* Net (QR) Qatari 57.20% 76.85% (24,832,118.18) Non-Qatari 42.80% 23.15% 24,832,118.18

- 3. Page 3 of 5 BCDR against an investment product promoted by Inovest in 2008, prior to Inovest obtaining an appropriate license from the CBB. (Gulf-Times.com) QSRTC completes seismic data field testing – Qatar Shell Research & Technology Centre (QSRTC) has successfully completed the field testing of a new fiber-optic seismic system in the country as part of a major R&D program. This system is designed to provide a cost effective method to deliver more accurate and higher quality seismic data for oil exploration and permanent production monitoring. (Gulf-Times.com) Ooredoo‟s trading ticker changes to “ORDS” – Ooredoo’s ticker has been changed to “ORDS” from QTEL with immediate effect on all the exchanges subsequent to its name change from Qatar Telecom. Ooredoo will now trade as “ORDS” on the Qatar Exchange, the Abu Dhabi Securities Exchange, and the London Stock Exchange. (Peninsula Qatar) CBQK to disclose its 1H2013 financials on July 23 – The Commercial Bank of Qatar (CBQK) will disclose its reviewed financial results for the period ending June 30, 2013 on July 23, 2013. (QE) QFLS to disclose its semi-annual financials on July 28 – The Qatar Fuel Company (QFLS) will disclose its reviewed financial reports for the period ending June 30, 2013 on July 28, 2013. (QE) QEWS to declare its 1H2013 results on July 31 – Qatar Electricity & Water Company (QEWS) is set to declare its reviewed financial results for the period ending June 30, 2013 on July 31, 2013. (QE) QOIS to disclose its 1H2013 financials on July 30 – Qatar Oman Investment Company (QOIS) will disclose its reviewed financial results for the period ending June 30, 2013 on July 30, 2013. (QE) QGRI to declare its semi-annual results on July 28 – Qatar General Insurance & Reinsurance Company (QGRI) will disclose its reviewed financial results for the period ending June 30, 2013 on July 28, 2013. (QE) UDCD to disclose its 1H2013 financials on July 30 – The United Development Company (UDCD) will disclose its reviewed financial results for the period ending June 30, 2013 on July 30, 2013. (QE) AKHI to declare its 1H2013 results on July 29 – Al Khaleej Takaful Group (AKHI) will disclose its reviewed financial results for the period ending June 30, 2013 on July 29, 2013. (QE) International Hollande points to French economic recovery, urges optimism – French President Francois Hollande in his efforts to fight deepening pessimism said the French economy is recovering steadily. He urged his countrymen to be more positive, highlighting positive factors such as a slight rebound in industrial output data, a bump in consumer spending and an improved growth forecast from the central bank for 2Q2013. (Reuters) Spanish EM: Spain out of recession, must nurture recovery – Spain's Economy Minister Luis De Guindos said the country’s economy will grow in 2H2013, but the government must implement reforms and cut the deficit at the right pace to keep the recovery going. The Spanish economy entered into a recession at the end of 2011. However, after shrinking 0.5% in 1Q2013, the government expects growth in 2Q2013 to be closer to zero. (Reuters) China's GDP growth slows to 7.5% – GDP growth in China declined in 2Q2013 to 7.5% YoY as weak overseas demand weighed down on output and investment. Other figures showed the country’s industrial output rising slightly less than forecast in June as compared with a year earlier, but retail sales has increased more than expected. China's statistics bureau said the economy's performance in 1H2013 was stable overall and the indicators were within a reasonable range. (Reuters) China to adjust liquidity, keep credit growth steady – China's central bank, the People's Bank of China has pledged to use a range of policy tools to adjust liquidity in the banking system to ensure steady credit growth. In an apparent bid to soothe market concerns about tighter monetary conditions, the central bank said it will use a mix of price and quantitative policy tools to adjust liquidity and guide steady growth in money, credit and social financing. (Reuters) Regional Saudi Arabia is Australia‟s largest meat export market in MENA region – According to a report by the Meat & Livestock Australia (MLA), Saudi Arabia has become Australia’s largest meat export market, accounting for 30% of shipments to the MENA region. The Kingdom is followed by the UAE at 25% and Kuwait at 13% shipments. The report said significant growth in beef exports was driven by a surge of shipments to Saudi Arabia as Australian beef gained market share after Brazil was banned from the market in late 2012. Exports to Saudi Arabia totaled 18,944 tons shipped weight in FY2012-13, up by four-fold YoY, making Saudi Arabia Australia’s largest beef market in the MENA region. The Brazilian ban in Saudi Arabia has, however, increased competition in other beef markets in the region, with increased quantities of Brazilian beef entering Jordan and the UAE. Moreover, the report said that the MENA region continues to grow as an important market for Australian red meat exports with volumes reaching 160,963 tons shipped weight in FY2013, an increase of 32% over FY2012. (GulfBase.com) Kingdom‟s real GDP growth slows to 2.1% in 1Q2013 – According to the data released by the Central Department of Statistics & Information (CDSI), growth in Saudi Arabia's GDP (adjusted for inflation) slowed down to 2.13% in 1Q2013 from 6.5% in 1Q2012. The data showed that the headline figures reflect a fall in Saudi crude oil output over the year, while growth in the non-oil private sector also slowed to 4.31% from 5.18%. CDSI also revised its 1Q2012 GDP growth figure to 6.5% from the 8.3% growth announced in April. Meanwhile, analysts polled by Reuters in April had forecasted that economic growth in the Kingdom would slow down to 4.1% in 2013 from 6.8% in 2012. (GulfBase.com) BMI: Saudi non-hydrocarbon sector to continue to fuel overall – According to a report by the Business Monitor International (BMI), Saudi Arabia's non-hydrocarbon sector will continue to drive overall economic growth over the next few quarters, helping to balance a steady decline in oil production. The report said business activity in the private sector remains supported by the government’s loose fiscal policy stance, easy credit conditions and robust consumer confidence. The report forecasted a real GDP growth of 4.1% in 2013, accelerating to 4.6% in 2014 on the back of a slight rebound in oil exports. Further, inflation is expected to remain broadly subdued in 2013 on the back of declining rental costs and government subsidization of food & fuel. The report noted that a prolonged period of robust growth, coupled with loose fiscal and monetary policies pose a medium-term inflation risk. The report also forecasted that the Kingdom’s current account surplus will shrink substantially in the years ahead, falling from 23.7% of GDP in

- 4. Page 4 of 5 2012 to 10.7% of GDP by 2016. However, with both global oil prices and domestic hydrocarbon production expected to trend downward, 2013 fiscal surplus will be lower than in previous years at SR261.9bn (9.7% of GDP). (GulfBase.com) SSP gets SR250mn contracts for supplying OCTG pipes to Saudi Aramco – Saudi Steel Pipe Company (SSP) has obtained two contracts worth SR250mn for the supply of OCTG steel pipes to the Saudi Arabian Oil Company (Saudi Aramco). SSP said these pipes will be produced during the 2Q2014- 4Q2014 period. SSP expects the contract’s financial impact will be positive during 2H2014. (Tadawul) Sipchem‟s affiliate signs EPC contract for debottlenecking project – Saudi International Petrochemical Company’s (Sipchem) affiliate, International Diol Company (IDC) has signed an EPC contract with eTEC of South Korea to debottleneck and improve the efficiency of its plant facilities. The cost of constructing and licensing of the project is projected to be SR393mn. The construction will begin from July 14, 2013 and is targeted for completion during 4Q2014. (Tadawul) Mobily signs two agreements with Finnvera, EKN for $325mn each – Etihad Etisalat Company (Mobily) has signed two agreements with the Export Credit Agency of Finland (Finnvera) and the Swedish Export Credits Guarantee Board (EKN) for $325mn each (with no guarantees). The purpose of this Shari’ah-compliant financing is to acquire network equipment from Nokia Siemens Networks and Ericsson. The total tenor of the facilities is 10 years, which will be utilized over a period of 1.5 years. The loan will be repaid in 17 equal semi- annual installments and has been priced at a fixed rate of 1.71% per annum. (Tadawul) SADAFCO declares SR97.5mn dividend for FY2013 – Saudia Dairy & Foodstuff Company’s (SADAFCO) AGM has approved the distribution of SR97.5mn (SR3 per share) in dividends for FY2013 to its shareholders who are registered on the Tadawul on June 24, 2013. The dividends will be distributed on July 21, 2013. (Tadawul) Mashreq Bank expects 100% YoY rise in retail profit in 2013 – Mashreq Bank’s Retail Banking head Farhad Irani said the bank expects a 100% YoY increase in its retail profit for 2013 on the back of rapid increase in its customer base. Newly-launched innovative products and others to be introduced shortly are helping the bank expanding its customer base. (GulfBase.com) DEWA completes first phase of $67mn reservoir in Dubai – Dubai Electricity & Water Authority (DEWA) has completed the first phase of a $67mn water reservoir project in Dubai. The reservoir’s capacity of 120mn gallons of desalinated water will expand Dubai’s storage capacity to 790mn gallons, once completed. (Bloomberg) UAE asks banks to disclose exposure to Turkey – The UAE’s central bank has asked to the country’s lenders to disclose their exposure to Turkey. (Bloomberg) Dubai Airport targets 75mn passengers by 2015 – Dubai Airports Chairman Sheikh Ahmed bin Saeed Al Maktoum said the Dubai International Airport will handle 75mn passengers by 2015, helping it leapfrog over London Heathrow Airport to become the biggest & busiest airport in the world. (Bloomberg) Trade Centre Bridges project to be ready by November – The Roads & Transport Authority’s (RTA) Chairman of the Board Mattar Al Tayer said completion rate in the Trade Center Bridges Project at Zaabeel has touched 90%. He added that the project, which has a cost tag of AED719.4mn, is expected to be opened in the second half of November 2013. (GulfBase.com) Hydra Properties completes first phase of Hydra Village – Abu Dhabi-based developer Hydra Properties has completed the phase one construction of its Hydra Village, located in Al Shahama, Abu Dhabi. Hydra Properties has begun the handover of 448 properties to homeowners and investors. (AME Info) Kuwait sends $200mn oil to Egypt – Kuwait has sent two oil tankers carrying crude oil and diesel worth $200mn to Egypt, as part of a $4bn aid package pledged by the country. (Reuters) CBO: Oman‟s economy continues to grow on high oil prices – According to the report published by the Central Bank of Oman (CBO), the country’s economy has continued to grow supported by high oil prices and expansionary fiscal policies. The report showed the GDP at current prices surged by 11.6% in 2012, with inflation well under control at 2.9% as compared to 4.1% in 2011. During January-April 2013, average inflation stood lower at 2.1%, compared to 3.3% during January-April 2012. The report said that the Omani banking system continues to remain sound, profitable and well-regulated, with the recent emphasis on bank lending to SMEs, which has the potential to help in diversifying the economy. Meanwhile, the total assets of commercial banks increased by 9.5% to reach OMR21.9bn in May 2013, as compared to OMR20.0bn a year ago. Credit disbursements accounted for 66% of the total assets and increased by 6.2% YoY to OMR14.49bn at the end of May 2013. While credit to the government declined by 16.9%, credit to the private sector and public enterprises, increased by 6.3% and 11.1% respectively. (GulfBase.com) CBO‟s weekly CD issue allotted OMR288mn – The Central Bank of Oman’s (CBO) weekly issue of certificates of deposits (CD) tender allotted OMR288mn to the subscribers. The average interest rate of these certificates was 0.13%, while the maximum accepted interest rate was also 0.13%. The tenor of these certificates is 28 days, maturing by August 7, 2013. (GulfBase.com) Bank Muscat reports net profit of OMR38.1mn in 2Q2013 – Bank Muscat has reported a net profit of OMR38.1mn in 2Q2013. The bank has reported a net profit of OMR63.1mn in 1H2013, down from OMR68.4mn in 1H2012. Net impairments for 1H2013 totaled at OMR17.5mn against OMR25.1mn in 1H2012. (Reuters) Renaissance sells Topaz to Interserve for OMR17.7mn – Oman-based Renaissance Services has agreed to sell Topaz Oil & Gas Ltd (Topaz) and its subsidiaries for OMR17.7mn to UK-based Interserve, an international support services and construction group. (MSM) EWA, Panorama sign BHD3.96mn pipeline deal – Bahrain’s Electricity & Water Authority (EWA) has signed a water pipeline contract worth BHD3.96mn with the Panorama Company, funded by the Arab Fund for Economic & Social Development. Under this contract, Panorama will extend the pipeline to transport water from Al Dur pumping plant to Al Areen distribution plant. EWA expects this contract to be completed by 1Q2014, which will enable it to transfer part of the production of Al Dur Power & Water Plant to the southern and central areas of the country. (GulfBase.com)

- 5. Contacts Ahmed M. Shehada Keith Whitney Saugata Sarkar Sahbi Kasraoui Head of Trading Head of Sales Head of Research Manager - HNWI Tel: (+974) 4476 6535 Tel: (+974) 4476 6533 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 ahmed.shehada@qnbfs.com.qa keith.whitney@qnbfs.com.qa saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 Jan-10 Aug-10 Mar-11 Oct-11 May-12 Dec-12 Jul-13 QE Index S&PPan Arab S&P GCC 0.7% (0.2%) 0.0% (0.4%) 0.4% 0.9% 2.0% (0.7%) 0.0% 0.7% 1.4% 2.1% 2.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,285.70 0.0 0.0 (23.3) DJ Industrial 15,464.30 0.0 0.0 18.0 Silver/Ounce 19.94 0.0 0.0 (34.3) S&P 500 1,680.19 0.0 0.0 17.8 Crude Oil (Brent)/Barrel 109.45 0.0 0.0 (3.0) NASDAQ 100 3,600.08 0.0 0.0 19.2 Natural Gas (Henry Hub)/MMBtu 3.61 0.0 0.0 6.4 STOXX 600 296.20 0.0 0.0 5.9 LPG Propane (Arab Gulf)/Ton 810.00 0.0 0.0 (16.4) DAX 8,212.77 0.0 0.0 7.9 LPG Butane (Arab Gulf)/Ton 807.00 0.0 0.0 (16.7) FTSE 100 6,544.94 0.0 0.0 11.0 Euro 1.31 0.0 0.0 (1.0) CAC 40 3,855.09 0.0 0.0 5.9 Yen 99.22 0.0 0.0 14.4 Nikkei 14,506.25 0.0 0.0 39.5 GBP 1.51 0.0 0.0 (7.1) MSCI EM 945.36 0.0 0.0 (10.4) CHF 1.06 0.0 0.0 (3.3) SHANGHAI SE Composite 2,039.49 0.0 0.0 (10.1) AUD 0.90 0.0 0.0 (12.9) HANG SENG 21,277.28 0.0 0.0 (6.1) USD Index 82.99 0.0 0.0 4.0 BSE SENSEX 19,958.47 0.0 0.0 2.7 RUB 32.63 0.0 0.0 6.9 Bovespa 45,533.24 0.0 0.0 (25.3) BRL 0.44 0.0 0.0 (9.5) RTS 1,348.81 0.0 0.0 (11.7) 135.0 121.6 110.5