24 February Daily market report

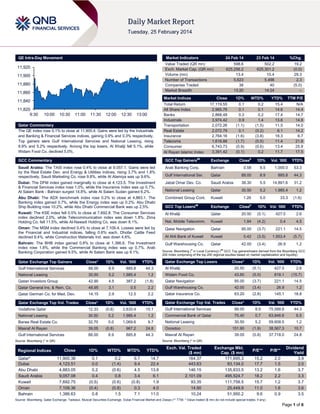

- 1. QE Intra-Day Movement Market Indicators 11,920 11,900 11,880 11,860 23 Feb 14 %Chg. 598.6 625,256.2 13.4 5,623 38 13:20 502.2 625,301.2 10.4 5,498 40 14:24 19.2 (0.0) 29.3 2.3 (5.0) – Market Indices 11,840 11,820 9:30 24 Feb 14 Value Traded (QR mn) Exch. Market Cap. (QR mn) Volume (mn) Number of Transactions Companies Traded Market Breadth 10:00 10:30 11:00 11:30 12:00 12:30 13:00 Qatar Commentary The QE index rose 0.1% to close at 11,900.4. Gains were led by the Industrials and Banking & Financial Services indices, gaining 0.9% and 0.3% respectively. Top gainers were Gulf International Services and National Leasing, rising 8.9% and 5.2% respectively. Among the top losers, Al Khaliji fell 5.1%, while Widam Food Co. declined 5.0%. Close Total Return All Share Index Banks Industrials Transportation Real Estate Insurance Telecoms Consumer Al Rayan Islamic Index 1D% WTD% YTD% TTM P/E 17,119.55 2,965.76 2,868.48 3,974.42 2,072.26 2,072.79 2,764.16 1,618.88 6,743.73 3,391.42 0.1 0.1 0.3 0.9 (1.1) 0.1 (1.6) (1.7) (0.9) (0.1) 0.2 0.1 0.2 1.4 (1.5) (0.2) (3.8) (0.5) (0.6) 0.2 15.4 14.6 17.4 13.6 11.5 6.1 18.3 11.4 13.4 11.7 N/A 14.4 14.7 14.8 14.0 14.2 6.7 21.8 25.9 17.5 GCC Commentary GCC Top Gainers## Exchange Saudi Arabia: The TASI index rose 0.4% to close at 9,057.1. Gains were led by the Real Estate Dev. and Energy & Utilities indices, rising 3.7% and 1.8% respectively. Saudi Marketing Co. rose 9.8%, while Al Alamiya was up 9.6%. Arab Banking Corp. Bahrain Gulf International Ser. Dubai: The DFM index gained marginally to close at 4,123.5. The Investment & Financial Services index rose 1.0%, while the Insurance index was up 0.7%. Al Salam Bank - Bahrain surged 14.8%, while Al Salam Sudan gained 6.2%. Abu Dhabi: The ADX benchmark index rose 0.2% to close at 4,883.1. The Banking index gained 0.7%, while the Energy index was up 0.2%. Abu Dhabi Ship Building rose 10.2%, while Abu Dhabi Commercial Bank was up 2.5%. Combined Group Cont. GCC Top Losers Exchange Kuwait: The KSE index fell 0.5% to close at 7,692.8. The Consumer Services index declined 2.0%, while Telecommunication index was down 1.8%. Zima Holding Co. fell 11.5%, while Al-Nawadi Holding Co. was down 8.1%. Al Khaliji Qatar 20.50 (5.1) 427.5 2.6 Nat. Mobile Telecomm. Kuwait 1.84 (4.2) 0.4 4.5 Oman: The MSM index declined 0.4% to close at 7,109.4. Losses were led by the Financial and Industrial indices, falling 0.6% each. Dhofar Cattle Feed declined 8.4%, while Construction Materials Ind. was down 4.6%. Qatar Navigation Qatar 95.00 (3.7) 221.1 14.5 Al Ahli Bank of Kuwait Kuwait 0.42 (3.5) 1,953.4 (5.7) Gulf Warehousing Co. Qatar 42.00 (3.4) 26.9 1.2 Bahrain: The BHB index gained 0.8% to close at 1,386.6. The Investment index rose 1.8%, while the Commercial Banking index was up 0.7%. Arab Banking Corporation gained 9.5%, while Al Salam Bank was up 9.1%. Qatar Exchange Top Gainers Gulf International Services Close* 1D% Vol. ‘000 YTD% 88.00 8.9 885.8 44.3 Close# 1D% 0.58 9.5 1,000.0 53.3 Qatar 88.00 8.9 885.8 44.3 Jabal Omar Dev. Co. Saudi Arabia 38.30 5.5 14,891.6 31.2 National Leasing Qatar 30.50 5.2 1,985.4 1.2 Kuwait 1.26 5.0 33.3 (1.6) ## # Close Vol. ‘000 1D% Vol. ‘000 YTD% YTD% Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Close* 1D% Vol. ‘000 Al Khaliji 20.50 (5.1) 427.5 2.6 43.60 (5.0) 818.1 (15.7) 14.5 Qatar Exchange Top Losers YTD% National Leasing 30.50 5.2 1,985.4 1.2 Widam Food Co. Qatari Investors Group 42.90 4.5 387.2 (1.8) Qatar Navigation 95.00 (3.7) 221.1 Qatar General Ins. & Rein. Co. 48.95 3.1 0.5 2.2 Gulf Warehousing Co. 42.00 (3.4) 26.9 1.2 Qatar German Co. for Med. Dev. 14.15 2.9 12.5 2.2 Qatar Insurance Co. 63.20 (2.8) 145.1 18.8 Close* 1D% Vol. ‘000 YTD% Close* 1D% Val. ‘000 YTD% Vodafone Qatar 12.33 (0.6) 2,633.4 15.1 Gulf International Services 88.00 8.9 75,588.8 44.3 National Leasing 30.50 5.2 1,985.4 1.2 Commercial Bank of Qatar 75.40 0.7 63,846.6 6.5 Barwa Real Estate Co. 32.70 0.0 1,069.6 9.7 National Leasing 30.50 5.2 59,608.5 1.2 Masraf Al Rayan 39.05 (0.8) 967.2 24.8 151.90 (1.9) 38,567.3 10.7 Gulf International Services 88.00 8.9 885.8 44.3 39.05 (0.8) 37,718.0 24.8 Qatar Exchange Top Vol. Trades Qatar* Dubai Abu Dhabi Saudi Arabia Kuwait Oman Bahrain Ooredoo Masraf Al Rayan Source: Bloomberg (* in QR) Source: Bloomberg (* in QR) Regional Indices Qatar Exchange Top Val. Trades Close 1D% WTD% MTD% YTD% 11,900.38 4,123.51 4,883.05 9,057.08 7,692.75 7,109.36 1,386.63 0.1 0.0 0.2 0.4 (0.5) (0.4) 0.8 0.2 (1.4) (0.6) 0.8 (0.6) (0.8) 1.5 6.7 9.4 4.5 3.4 (0.8) 0.3 7.1 14.7 22.4 13.8 6.1 1.9 4.0 11.0 Exch. Val. Traded ($ mn) 164.37 443.63 146.15 2,101.09 93.35 14.90 10.24 Exchange Mkt. Cap. ($ mn) 171,695.3 83,134.0 135,833.5 495,524.7 111,758.5 25,449.9 51,950.2 P/E** P/B** 15.2 17.7 13.2 18.2 15.7 11.0 9.6 2.0 1.5 1.6 2.2 1.2 1.6 0.9 Dividend Yield 3.9 2.0 3.7 3.3 3.7 3.6 3.5 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) Page 1 of 6

- 2. Qatar Market Commentary The QE index rose 0.1% to close at 11,900.4. The Industrials and Banking & Financial Services indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Gulf International Services and National Leasing were the top gainers, rising 8.9% and 5.2% respectively. Among the top losers, Al Khaliji fell 5.1%, while Widam Food Co. declined 5.0%. Overall Activity Buy %* Sell %* Net (QR) Qatari 64.98% 68.42% (20,550,669.72) Non-Qatari 35.02% 31.59% 20,550,669.72 Source: Qatar Exchange (* as a % of traded value) Volume of shares traded on Monday rose by 29.3% to 13.4mn from 10.4mn on Sunday. Further, as compared to the 30-day moving average of 12.7mn, volume for the day was 5.3% higher. Vodafone Qatar and National Leasing were the most active stocks, contributing 19.6% and 14.8% to the total volume respectively. Earnings and Global Economic Data Earnings Releases Revenue (mn) 4Q2013 % Change YoY Operating Profit (mn) 4Q2013 % Change YoY Net Profit (mn) 4Q2013 % Change YoY SR – – 94.2 30.0% 95.4 20.7% Saudi Arabia SR 376.3 25.2% – – 0.6 46.9% Saudi Arabia SR – – 400.4 9.7% 235.4 16.8% Saudi Arabia SR 555.8 24.5% – – 14.4 55.3% Saudi Arabia SR – – 172.4 10.4% 192.5 12.1% Saudi Arabia SR 671.1 84.3% – – 6.6 -1.0% Saudi Arabia SR – – – – 2.1 NA Company Market Currency Saudi Marketing Co. * Saudi Arabian Cooperative Insurance Co. * (SAICO) Zamil Industrial Investment Co. * Al-Rajhi Company for Cooperative Insurance * (AlRajhi Takaful) Abdullah Al Othaim Markets Co. * AXA Cooperative Insurance Co. * Aljazira Takaful Taawuni Co. * Al Wathba National Insurance Co. * Oman Ceramic Co. * Construction Materials IND. * Takaful International Co. * Saudi Arabia Gulf Finance House (GFH) * Delmon Poultry Co. (POLTRY) * Trafco Group * Abu Dhabi AED 231.5 9.1% – – 148.8 279.4% Oman OMR 3.8 -7.8% – – 0.0 -93.6% Oman OMR 3.6 7.5% – – -1.3 -1857.9% Bahrain BHD 10.6 11.4% – – 0.3 -19.9% Bahrain BHD 37.4 -41.2% – – 6.3 -37.5% Bahrain BHD 14.5 -1.1% – – 0.8 -31.6% Bahrain BHD 41.8 5.7% – – 1.5 4.0% Source: Company data, DFM, ADX, MSM (*FY2013 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/24 EU Eurostat CPI MoM January -1.10% -1.10% 0.30% 02/24 EU Eurostat CPI YoY January 0.80% 0.70% 0.80% 02/24 EU Eurostat CPI Core YoY January 0.80% 0.80% 0.70% 02/24 Germany IFO Institute IFO Business Climate February 111.3 110.5 110.6 02/24 Germany IFO Institute IFO Current Assessment February 114.4 112.8 112.4 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Page 2 of 6

- 3. Qatar QGTS’ 4Q2013 results in-line on an operating basis – Nakilat (QGTS) reported 4Q2013 results with: (1) Revenue from whollyowned vessels in line vs. our estimate at QR763mn (flat QoQ and YoY). (2) Share of operating profits from JVs falling to QR72mn (-11% QoQ, +35% YoY) and was 7% below our estimate due to possible sequential softness of LPG shipping rates beyond our expectations. EBITDA of QR579mn (flat QoQ and YoY) was only 1% ahead of our estimate mostly driven by better-than-expected operating costs for the quarter. (3) Adjusted EBITDA of QR661mn (-2% QoQ and YoY) was also just 1% below our estimate of QR671mn driven primarily by interest, vessel sub-chartering and other income. (4) Net income, before appropriations, of QR177mn (-9% QoQ, -13% YoY) was also impacted by QR6mn in losses from derivative instruments in JVs, which we do not model. Excluding this, net income was 9% softer than our estimate of QR201mn. Items such as depreciation & amortization and finance costs also impacted earnings vs. our estimate. DPS of QR1.10 a share is in line with our estimate. This represents an annual growth of 10% and represents a payout of almost 84%. We continue to expect QR1.20 in DPS for 2014. We continue to remain positive on Nakilat over the long term given its steady operating model and solid dividend yield. QGTS remains Qatar’s primary LNG carrier and benefits from stable/visible revenue and cash flow through 25-year fixed (price and quantity) charter contracts with the state-controlled LNG producers, Qatargas and RasGas. With fleet expansion completed in 2010, we expect strong FCF generation to allow QGTS to meet its debt repayments (2013 net debt: QR21.2bn) comfortably and lead to EPS accretion. Moreover, the shipyard business could surprise positively later in 2014/2015. QGTS also trades at decent 2014 dividend yield of 5.4%. We maintain our Market Perform rating with a price target of QR22.89. (QE, QNBFS) CBQK completes $1bn syndicated term loan facility – The Commercial Bank of Qatar (CBQK) has successfully completed a $1bn senior unsecured term loan facility. The loan facility comprises two tranches: a $600mn two-year term loan and a $400mn three-year term loan, paying margins of 100bps and 120bps over LIBOR, respectively. The facility is CBQK’s largest syndicated loan, whose proceeds will be used for refinancing and to fund business growth. The lender group consisted of 21 major banks from the GCC, US, Europe, Asia and Australia. (QE) KCBK partners with IP Global for property investment opportunities – Al Khalij Commercial Bank (KCBK) announced its business partnership with IP Global, a property investment company. This tie-up took effect from September 2013 and since then KCBK customers have been enjoying access to a range of unique investment opportunities across international markets. KCBK has access to the Qatari market, with additional branches in the UAE and France. This partnership allows KCBK’s customers to benefit from investments in new markets, with a main focus on high-end property in London. (QE) QIBK to focus on Islamic banking services – The Qatar Islamic Bank’s (QIBK) Chairman Sheikh Jassim bin Hamad bin Jassim bin Jaber al-Thani said that the bank is committed to derive maximum yields from foreign investments. Jaber al-Thani said the bank, at the same time, would shed its non-productive investments and focus on operations within its mandate as an Islamic financial institution. At the local level, QIBK broadened its scope of activities by opening new branches, introducing new schemes for SMEs. Further, the bank succeeded in adding a number of high-profile clients to its investment portfolio. (GulfTimes) MCGS’ AGM to be held on March 12 – Medicare Group (MCGS) announced that its AGM will be held on March 12, 2014 at Ezdan Towers, Al-Dafna Area. In case of lack of quorum, the second meeting will be held on March 17, 2014. The AGM’s agenda includes the recommendation for distributing cash dividends of 30% of the nominal share value (i.e. QR3.00 per share) and to allocate an amount of QR1mn for the treatment of eligible medical cases that cannot afford the cost of medical care at Al-Ahli Hospital. (QE) BRES’ BoD to meet on March 12, to hold AGM on April 8 – Barwa Real Estate Company’s (BRES) board of directors will meet on March 12, 2014 to discuss the company’s financial results for the year ended December 31, 2013. Further, BRES announced that its AGM will be held on April 8, 2014 at AlDasha Hall in Al-Sharq. In case of lack of quorum, a second meeting will be held on April 14, 2014. (QE) QE suspends trading in ABQK, QEWS shares on February 25 – The Qatar Exchange (QE) has announced a trading suspension on the shares of Ahli Bank (ABQK) and the Qatar Electricity & Water Company (QEWS) on February 25, 2014 due to their AGMs and EGMs being held on that day. (QE) Microsoft to empower 10,000 Qatari SMEs with cloud technology – Microsoft is seeking to empower some 10,000 SMEs in Qatar with cloud technology. Microsoft International's President Jean-Philippe Courtois said that, apart from cloud technology, the software company aims to create a group of devices that will enable businesses to virtually engage with banks, clients and other stakeholders through seamless communication. (Gulf-Times.com) International Eurozone inflation shows biggest monthly fall in January – Eurozone consumer prices fell in January at their fastest ever pace on a monthly basis, dragged down by a slump in the cost of non-energy industrial goods, keeping annual inflation well below the European Central Bank's (ECB) target. EU's statistics office Eurostat said the inflation rate in the 18 countries sharing the Euro dropped by 1.1% in January when compared with December, keeping the annual inflation rate at 0.8% for the second consecutive month. According to Eurostat’s flash estimate on January 31, the annual inflation rate was revised from 0.7%. Economists polled by Reuters expected consumer price inflation to accelerate slightly to 0.9% in January, a level that is still well below the ECB's target of close to but below 2%. (Reuters) US debt risk almost cut in half as economy outperforms Germany – Treasuries risk has fallen to about half of what it was four months ago, trading near Germany’s level as the US economy outperforms the European nation. The cost to protect US debt against non-payment was 26.5 basis points, falling from 46 basis points in October. Germany’s was 25 basis points. The US plans to sell $109bn of notes this week, starting with a twoyear auction today. The government earlier this month suspended its debt limit until March 2015, avoiding another stalemate in Congress after earlier disputes over borrowing raised the default threat. (Bloomberg) BOJ Deputy Governor Nakaso says overseas risks receding – Bank of Japan (BOJ) Deputy Governor Hiroshi Nakaso said on Tuesday that the risks from overseas economies are receding as a whole, which would allow Japan's economy to continue recovering moderately. He said, “If risks force us to change our projections toward meeting our 2% inflation target, we'll make necessary policy adjustments". Nakaso further added that Eurozone economies have bottomed out and emerging Page 3 of 6

- 4. economies will gradually see growth pick-up as they benefit from robust demand in advanced nations. The BOJ has kept monetary policy steady since offering an intense burst of stimulus in April last year, under which it pledged to accelerate consumer inflation to 2% in roughly two years via aggressive asset purchases. (Reuters) Harsh weather tests optimism over US economy – Unusually cold weather will take a bite out of US economic growth this quarter, but a rebound seems likely on the horizon and expectations for stronger growth this year have not changed. Economists estimate that freezing temperatures and the ice & snow storms that have blanketed much of the nation will shave as much as 0.5% point from gross domestic product in the first quarter. Moody's Analytics is keeping its 3.1% estimate for 2014 growth and most other economists are sticking with their fullyear forecasts as well, despite data from retail sales to manufacturing and employment that show the economy braked sharply in January. (Reuters) Regional S&P: Extra costs charged by Islamic banks in Gulf reducing – According to a study conducted by Standard & Poor's (S&P), the extra costs charged by Islamic banks in the Gulf on consumers as compared to conventional banks appear to be reducing. For years, bankers assumed that Islamic institutions charge higher costs because of several factors such as the relative complexity of Shari’ah-compliant products and Islamic financial markets being younger, smaller and less liquid. Further, other factors that may also push up costs are a lack of clear regulation in an industry where scholars may issue contradictory rulings, and adverse tax treatment. Now, the cost gap for Gulf Islamic banks rated by S&P seems to be narrowing, to as little as 30 basis points in 1H2013 from a high of 110 bps in 2009. S&P’s Primary Credit Analyst Mohamed Damak said the study used financial data from 2007 to 2013 to calculate the ratios of interest income to average assets of conventional banks and the equivalent ratios for Islamic institutions. (GulfBase.com) Abunayyan, Toray create SR300m JV on water treatment – Saudi Arabia’s Abunayyan Holding and Japan’s Toray Industries, Inc. have successfully launched Toray Membrane Middle East (TMME), a JV in water & wastewater treatment technologies in Dammam. Established with a projected investment of SR300mn, TMME will manufacture water treatment membranes in addition to providing technical services. TMME plans to construct a world-class production factory by applying Toray’s production technology and global quality control standards. The factory will be located near Dammam in the Third Industrial City in the Kingdom, and will begin production of reverse osmosis membrane elements from 2015. (GulfBase.com) Aswak Al Othaim to raise capital, declares SR67.5mn dividends for 2013 – Abdullah Al Othaim Markets Company’s board of directors has recommended a capital increase of 100% through the issue of bonus shares. The company’s capital will be raised from SR225mn to SR450mn by offering one bonus share for every existing share. Consequently, the company’s share will rise from 22.5mn to 45mn shares. Eligibility of bonus shares is limited to the shareholders who are registered in the Securities Depository Center at the close of trading on the EGM, which will be determined later. Meanwhile, Aswak Al Othaim’s board has recommended the distribution of dividends worth SR67.5mn for 2013. The dividend per share will be SR3, representing 30% of the face value. Those shareholders who are registered with the Securities Depository Center on the day of the general assembly meeting will be eligible for this dividend. (Tadawul) SASCO declares SR33.8mn dividends for 2013 – The Saudi Automotive Services Company’s (SASCO) board of directors has recommended the distribution of dividends worth SR33.8mn to its shareholders for 2013. The dividend per share will be SR0.75, representing 7.5% of the face value. Those shareholders who are registered with the Securities Depository Center on the day of the general assembly meeting will be eligible for this dividend (to be announced later). (Tadawul) Alesayi Group, Accor ME sign deal to build 10 hotels – Accor Middle East, a leading hospitality group, has forged a strategic alliance with Alesayi Group to develop 10 new hotel properties across the Kingdom by 2018. The first Ibis Hotel in the Kingdom was launched in Riyadh in December 2012 and the second property, ibis Yanbu, is set to open by 1Q2014. Accor ME said it aims to strengthen its position in the Kingdom with a development target of 30 to 40 Ibis properties. (GulfBase.com) Zamil Steel Egypt to expand into new African markets – Zamil Steel Buildings Company, Egypt, announced that the company has begun exporting from its new Northern Egyptian factory located in Sadat City. Product orders worth total tonnage of 2,500MT have been shipped to three African countries (Algeria, Ethiopia and Togo). The new factory operates with an annual production capacity of 24,000MT, which will be raised to about 50,000MT after the second production line is added within a year’s time. The manufacturing facility, which spans across 30,000 square meters, employs 350 people and is expected to employ 700 workers within the next two years. (GulfBase.com) Kingdom inflation to fall to 3% in 1Q2014 – Saudi Arabia's central bank expects the annual inflation rate to fall further below 3% in 1Q2014 in line with the fall of the inflationary pressures in the food & beverages group. Consumer prices in the world's top oil exporter have been easing gradually since hitting a peak of 4.0% in April 2013. Analysts polled by Reuters in January expected the Saudi average inflation to remain steady at 3.5% in 2014 and climb to 4.0% in 2015. (Reuters) KHC to pay SR0.125 per share dividend for 4Q2013 – The Kingdom Holding Company (KHC), has announced plans to distribute dividends worth SR656mn for 2013. The company said it has recommended the board to distribute quarterly cash dividends from retained earnings of 1.25% of the nominal value, by distributing 12.5 halalas per share for 4Q2013 for a total of SR163.9mn as quarterly cash dividends. The figure was determined after Alwaleed gave up his full entitlement of his share of the proposed annual cash distributions, which totaled 34 halalas per share (SR1197 million), or 8.5 halalas per share (SR299.2 million quarterly). (Bloomberg) Union Properties to lift foreign ownership cap to 25% – Dubai's Union Properties said that its board of directors had recommended increasing the cap on the stakes owned by foreign investors to 25%. According to bourse data, foreigners currently own 4.35% of the company’s shares. (Reuters) Arabtec in talks to buy Kuwaiti firm – According to sources, Dubai-based Arabtec Holding is in the advanced stages of talks to fully acquire a construction company in Kuwait. The company is in talks with Kharafi National, a Kuwait-based contractor and facilities management firm, which has operations in across the Middle East, to buy all its assets. The deal, which is expected to be completed in 2-3 months, would be worth about AED2bn. (Reuters) Dubai Investments targets 40% surge in glass demand in 2014 – Dubai Investments (DI) stated that it is targeting 40% Page 4 of 6

- 5. growth in the demand for glass products during 2014, driven by the acceleration in construction and infrastructure projects in the UAE and across the region. DI will be catering to this demand through its subsidiaries – Emirates Float Glass, Emirates Glass, Lumiglass Industries, Saudi American Glass and Emirates Insolaire. Saudi American Glass has announced a major upgrade in its facility in Riyadh, ordering new machinery and equipment to increase its production capacity by 50% to 1.4mn square meters of high-performance coated glass per annum. Similarly, Lumiglass Industries is in the process of expanding its production capacity of bullet-resistant glass by 50% from 130 units to 260 units per month. (DFM) Drake & Scull Rail wins AED35mn Dubai Airport Passenger Movement project – Drake & Scull Rail, a subsidiary of Drake & Scull International, has won a contract worth AED35mn for a new airport passenger movement system at the Dubai International Airport. The Dubai Civil Aviation Authority has commissioned the construction of Concourse 4 at the Dubai International Airport which will be connected to Terminal 1 via an automated passenger mover system (APM). Drake & Scull Rail will provide the complete MEP works and railway services for the APM locations, which is its first rail project in the Middle East. (DFM, Zawya) Waha recommends 10% dividend – Abu Dhabi-based investment company Waha Capital has recommended a dividend of 10 fils per share for FY2013, which is equivalent of 10% of its paid-up capital. Meanwhile, the company’s AGM will be held on March 20, 2014. (Bloomberg) Oman CMA: Omani insurance firms report 10% rise in direct premiums – Insurance companies in Oman have posted a 10.4% growth in total direct premiums at OMR364mn in 2013, from OMR329.6mn for 2012. The Omani Capital Market Authority (CMA) said that health insurance posted a 38% growth over the previous year, marking the highest rise among different insurance segments. Health insurance premiums reached OMR63mn by the year ended December 2013. Property insurance rose 21%, reaching OMR51.8mn, while life insurance posted 16% fall to OMR33.6mn from OMR40.5mn in 2012. The CMA report said that vehicle insurance had the biggest share in the direct premiums with 41% of the total premiums, followed by health insurance 17% and properties insurance 14%. Investments by national insurance companies stood at OMR277mn in 2013 as compared to 261.6mn in the previous year. The investments in Oman was about 95%, while the foreign companies' investments in Oman and outside were OMR170mn as compared to OMR150mn by the end of 2012. (Bloomberg) UGB’s total assets stood at $1.26bn as on December 31, 2013 as compared to $1.23bn in 2012. Meanwhile, the bank’s BoD will not be recommending any dividend for 2013. (Bahrain Bourse) Alba launches Project Titan – Aluminium Bahrain (Alba) announced the launch of Project Titan – a two-year efficiency program initiated with the objective to reduce costs by $150/MT by January 2016. Project Titan is expected to generate a significant amount of savings, majority of which will be invested in strategic areas of business for future growth. Alba’s Manager for Operational Excellence, Waleed Tamimi said that the results of Project Titan will be measured against baseline of 2013 actuals and not the budget, and will be visible in the company’s financial statements. (Bahrain Bourse) Trafco declares 13% cash dividend – Trafco Group’s board of directors has recommended a cash dividend of 13% (i.e. 13 fils per share) to its shareholders registered on the date of the AGM. (GulfBase.com) Delmon Poultry declares 15% cash dividend – Delmon Poultry Company’s board of directors has recommended a cash dividend of 15 fils per share (i.e. 15% of its paid-up capital) to its shareholders who are registered on the date of the AGM. (GulfBase.com) SICO declares 7.5% cash dividend – Securities & Investment Company’s (SICO) board of directors has recommended a cash dividend of 7.5% of fully paid-up capital to its shareholders who are registered on the date of the AGM. (GulfBase.com) GFH decides not to distribute dividends – Gulf Finance House’s (GFH) board of directors announced that it will not distribute any dividend to its shareholders for the financial year ended December 31, 2013. (GulfBase.com) ABG’s BoD recommends cash dividend – Al Baraka Banking Group’s (ABG) board of directors recommended a cash dividend of 3.5 cents per share (bonus share of 1 share for every 23 shares held) to its shareholders who are registered on the date of the AGM. (GulfBase.com) Batelco ties up with ABS – Batelco's teleport has been chosen by ABS as a site to support operations of its newly launched satellite, ABS-2. Batelco offers a portfolio of managed and dedicated teleport hosting services complimented by dedicated internet access, IP transit, MPLS and SDH services. ABS-2 is a multi-mission satellite, featuring up to 89 active C, Ku and Kaband transponders across 10 different beams. ABS-2 provides direct-to-home and cable television distribution, VSAT services, data networks and telecommunications services. (GulfBase.com) UGB posts $4.2mn net profit for 2013 – The United Gulf Bank (UGB) reported a net profit of $4.2mn for 2013 as compared to $6.7mn in 2012. For the entire 2013, the bank’s net profit stood at $2.6mn as compared to $11mn in 2012. The decrease in profit was due to provisions taken at one of the commercial banking associates. UGB managed to reduce its interest and operating expenses. EPS amounted to $0.32 vs. $1.34 in 2012. Page 5 of 6

- 6. Rebased Performance Daily Index Performance 180.0 170.0 160.0 150.0 140.0 130.0 120.0 110.0 100.0 90.0 80.0 0.8% 0.8% 144.2 131.4 0.4% 0.4% 0.2% 0.1% 0.0% 0.0% (0.4%) S&P Pan Arab Dec-13 S&P GCC Source: Bloomberg Asset/Currency Performance Dubai May-13 Oman Oct-12 Abu Dhabi QE Index Mar-12 Bahrain Aug-11 Kuwait Jan-11 (0.4%) (0.5%) Qatar (0.8%) Saudi Arabia Jun-10 1.2% 171.0 Source: Bloomberg Close 1D% WTD% YTD% 16,207.14 0.6 0.6 (2.2) S&P 500 1,847.61 0.6 0.6 (0.0) (0.1) NASDAQ 100 4,292.97 0.7 0.7 2.8 0.2 43.3 STOXX 600 338.19 0.6 0.6 3.0 (4.6) (4.6) 2.0 DAX 9,708.94 0.5 0.5 1.6 124.25 (3.3) (3.3) (8.5) FTSE 100 6,865.86 0.4 0.4 1.7 Euro 1.37 (0.1) (0.1) (0.1) CAC 40 Yen* 102.51 0.0 0.0 (2.7) Nikkei GBP 1.67 0.2 0.2 0.6 MSCI EM CHF 1.12 (0.1) (0.1) 0.4 SHANGHAI SE Composite AUD 0.90 0.6 0.6 1.3 USD Index 80.20 (0.0) (0.0) RUB 35.47 (0.2) (0.2) BRL 0.43 0.2 0.2 0.9 Gold/Ounce Silver/Ounce Crude Oil (Brent)/Barrel (FM Future) Natural Gas (Henry Hub)/MMBtu North American Spot LPG Propane Price North American Spot LPG Normal Butane Price Close ($) 1D% WTD% YTD% Global Indices Performance 1,336.98 1.0 1.0 10.9 DJ Industrial 21.98 0.6 0.6 12.9 110.64 0.7 0.7 6.22 0.2 129.00 4,419.13 0.9 0.9 2.9 14,837.68 (0.2) (0.2) (8.9) 958.42 (0.1) (0.1) (4.4) 2,076.69 (1.8) (1.8) (1.9) HANG SENG 22,388.56 (0.8) (0.8) (3.9) 0.2 BSE SENSEX 20,811.44 0.5 0.5 (1.7) 7.9 Bovespa 47,393.50 0.0 0.0 (8.0) 1,318.98 0.3 0.3 (8.6) Source: Bloomberg (*Market Closed on February 24, 2014) RTS Source: Bloomberg Contacts Saugata Sarkar Ahmed M. Shehada Keith Whitney Sahbi Kasraoui Head of Research Head of Trading Head of Sales Manager - HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6535 Tel: (+974) 4476 6533 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa ahmed.shehada@qnbfs.com.qa keith.whitney@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6