QNBFS Daily Market Report January 25, 2022

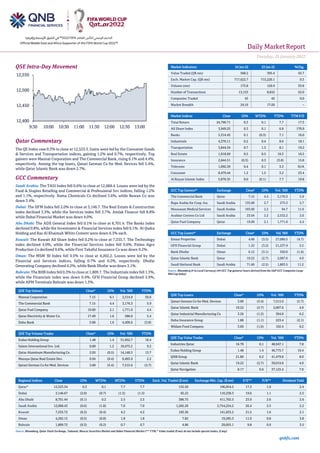

- 1. Daily MarketReport Tuesday, 25 January2022 qnbfs.com QSE Intra-Day Movement Qatar Commentary The QE Index rose 0.3% to close at 12,523.3. Gains were led by the Consumer Goods & Services and Transportation indices, gaining 1.2% and 0.7%, respectively. Top gainers were Mannai Corporation and The Commercial Bank, rising 6.1% and 4.4%, respectively. Among the top losers, Qatari German Co for Med. Devices fell 5.4%, while Qatar Islamic Bank was down 2.7%. GCC Commentary Saudi Arabia: The TASI Index fell 0.6% to close at 12,068.4. Losses were led by the Food & Staples Retailing and Commercial & Professional Svc indices, falling 1.2% and 1.1%, respectively. Nama Chemicals Co declined 3.6%, while Bawan Co was down 3.4%. Dubai: The DFM Index fell 2.0% to close at 3,146.7. The Real Estate & Construction index declined 3.3%, while the Services index fell 2.7%. Amlak Finance fell 8.8% while Dubai Financial Market was down 4.0%. Abu Dhabi: The ADX General Index fell 0.1% to close at 8,701.4. The Banks index declined 0.8%, while the Investment & Financial Services index fell 0.1%. Al Qudra Holding and Ras Al Khaimah White Cement were down 6.3% each. Kuwait: The Kuwait All Share Index fell 0.2% to close at 7,335.7. The Technology index declined 4.0%, while the Financial Services index fell 0.6%. Palms Agro Production Co declined 9.6%, while First Takaful Insurance Co was down 9.2%. Oman: The MSM 30 Index fell 0.5% to close at 4,202.2. Losses were led by the Financial and Services indices, falling 0.7% and 0.2%, respectively. Dhofar Generating Company declined 6.2%, while Bank Dhofar was down 3.1%. Bahrain: The BHB Index fell 0.3% to close at 1,809.7. The Industrials index fell 1.3%, while the Financials index was down 0.4%. GFH Financial Group declined 2.9%, while APM Terminals Bahrain was down 1.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Mannai Corporation 7.15 6.1 2,514.9 50.6 The Commercial Bank 7.15 4.4 3,176.3 5.9 Qatar Fuel Company 19.09 2.1 1,771.0 4.4 Qatar Electricity & Water Co. 17.49 1.6 586.0 5.4 Doha Bank 3.08 1.6 4,409.6 (3.8) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 1.48 1.4 31,952.7 10.4 Salam International Inv. Ltd. 0.89 1.2 18,475.2 9.2 Qatar Aluminum Manufacturing Co. 2.05 (0.5) 14,148.3 13.7 Mazaya Qatar Real Estate Dev. 0.94 (0.4) 9,493.9 2.2 Qatari German Co for Med. Devices 3.00 (5.4) 7,515.6 (5.7) Market Indicators 24 Jan 22 23 Jan 22 %Chg. Value Traded (QR mn) 568.2 395.4 43.7 Exch. Market Cap. (QR mn) 717,622.7 715,220.1 0.3 Volume (mn) 173.8 129.9 33.8 Number of Transactions 13,153 8,652 52.0 Companies Traded 45 45 0.0 Market Breadth 24:16 17:26 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 24,790.71 0.3 0.1 7.7 17.3 All Share Index 3,949.25 0.3 0.1 6.8 170.9 Banks 5,314.45 0.1 (0.3) 7.1 16.0 Industrials 4,370.11 0.2 0.4 8.6 18.1 Transportation 3,844.34 0.7 1.3 8.1 19.2 Real Estate 1,918.69 0.5 0.5 10.3 16.5 Insurance 2,644.51 (0.3) 0.3 (3.0) 15.8 Telecoms 1,092.59 0.4 0.1 3.3 N/A Consumer 8,479.44 1.2 1.5 3.2 23.4 Al Rayan Islamic Index 5,078.35 0.0 (0.1) 7.7 19.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% The Commercial Bank Qatar 7.15 4.4 3,176.3 5.9 Bupa Arabia for Coop. Ins. Saudi Arabia 135.00 2.7 275.3 2.7 Mouwasat Medical Services Saudi Arabia 193.00 2.2 94.7 11.0 Arabian Centres Co Ltd Saudi Arabia 23.04 2.2 2,532.2 2.0 Qatar Fuel Company Qatar 19.09 2.1 1,771.0 4.4 GCC Top Losers## Exchange Close# 1D% Vol.‘000 YTD% Emaar Properties Dubai 4.66 (3.5) 27,080.5 (4.7) GFH Financial Group Dubai 1.22 (3.2) 21,237.9 2.5 Bank Dhofar Oman 0.12 (3.1) 350.0 (1.6) Qatar Islamic Bank Qatar 19.22 (2.7) 2,007.6 4.9 Saudi National Bank Saudi Arabia 71.60 (2.5) 1,803.5 11.2 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/ losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatari German Co for Med. Devices 3.00 (5.4) 7,515.6 (5.7) Qatar Islamic Bank 19.22 (2.7) 2,007.6 4.9 Qatar Industrial Manufacturing Co 3.26 (1.2) 364.8 6.2 Doha Insurance Group 1.88 (1.1) 223.4 (2.1) Widam Food Company 3.60 (1.0) 102.4 0.2 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 16.70 0.1 48,947.1 7.8 Ezdan Holding Group 1.48 1.4 46,775.7 10.4 QNB Group 21.80 0.2 41,479.8 8.0 Qatar Islamic Bank 19.22 (2.7) 39,019.8 4.9 Qatar Navigation 8.17 0.6 37,125.4 7.0 Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,523.34 0.3 0.1 7.7 7.7 155.50 196,054.5 17.3 1.9 2.4 Dubai 3,146.67 (2.0) (0.7) (1.5) (1.5) 92.22 110,238.3 19.6 1.1 2.5 Abu Dhabi 8,701.44 (0.1) 0.2 2.5 2.5 386.75 411,702.5 23.9 2.6 2.6 Saudi Arabia 12,068.43 (0.6) (1.8) 7.0 7.0 1,265.26 2,754,224.2 26.4 2.5 2.2 Kuwait 7,335.72 (0.2) (0.4) 4.2 4.2 183.36 141,633.2 21.5 1.6 2.1 Oman 4,202.15 (0.5) (0.8) 1.8 1.8 7.82 19,285.3 11.0 0.8 3.8 Bahrain 1,809.72 (0.3) (0.2) 0.7 0.7 4.86 29,055.1 9.8 0.9 3.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,400 12,450 12,500 12,550 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Daily MarketReport Tuesday, 25 January2022 qnbfs.com Qatar Market Commentary • The QE Index rose 0.3% to close at 12,523.3. The Consumer Goods & Services and Transportation indices led the gains. The index rose on the back of buying support from foreign shareholders despite selling pressure from Qatari, GCC and Arab shareholders. • Mannai Corporation and The Commercial Bank were the top gainers, rising 6.1% and 4.4%, respectively. Among the top losers, Qatari German Co for Med. Devices fell 5.4%, while Qatar Islamic Bank was down 2.7%. • Volume of shares traded on Tuesday rose by 33.8% to 173.8mn from 129.9mn on Monday. Further, as compared to the 30-day moving average of 136.9mn, volume for the day was 26.9% higher. Ezdan Holding Group and Salam International Inv. Ltd. were the most active stocks, contributing 18.4% and 10.6% to the total volume, respectively. Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 33.83% 39.93% (34,616,383.8) Qatari Institutions 29.42% 29.70% (1,582,939.1) Qatari 63.25% 69.62% (36,199,323.0) GCC Individuals 0.60% 0.37% 1,320,985.1 GCC Institutions 3.93% 5.36% (8,125,695.0) GCC 4.53% 5.73% (6,804,710.0) Arab Individuals 8.52% 9.84% (7,493,470.0) Arab Institutions 0.00% 0.00% - Arab 8.52% 9.84% (7,493,470.0) Foreigners Individuals 2.94% 2.52% 2,369,534.4 Foreigners Institutions 20.77% 12.30% 48,127,968.4 Foreigners 23.70% 14.81% 50,497,502.9 Source: Qatar Stock Exchange (*as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2021 % Change YoY Operating Profit (mn) 4Q2021 % Change YoY Net Profit (mn) 4Q2021 % Change YoY ESG Emirates Stallions Group* Abu Dhabi AED 352.6 171.1% – – 63.1 218.8% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financial for FY2021) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 01/24 US Markit Markit US Manufacturing PMI Jan P 55 56.7 57.7 01/24 US Markit Markit US Services PMI Jan P 50.9 55.4 57.6 01/24 US Markit Markit US Composite PMI Jan P 50.8 – 57.0 01/24 UK Markit Markit/CIPS UK Services PMI Jan P 53.30 54.00 53.60 01/24 UK Markit Markit/CIPS UK Composite PMI Jan P 53.40 54.00 53.60 01/24 UK Markit Markit UK PMI Manufacturing SA Jan P 56.9 57.6 57.9 01/24 EU Markit Markit Eurozone Manufacturing PMI Jan P 59.0 57.5 58.0 01/24 EU Markit Markit Eurozone Services PMI Jan P 51.20 52.00 53.10 01/24 EU Markit Markit Eurozone Composite PMI Jan P 52.4 52.6 53.3 01/24 Germany Markit Markit/BME Germany Manufacturing PMI Jan P 60.5 57 57.4 01/24 Germany Markit Markit Germany Services PMI Jan P 52.2 48 48.7 01/24 Germany Markit Markit/BME Germany Composite PMI Jan P 54.3 49.4 49.9 01/24 France Markit Markit France Services PMI Jan P 53.1 55.3 57.0 01/24 France Markit Markit France Manufacturing PMI Jan P 55.5 55.3 55.6 01/24 France Markit Markit France Composite PMI Jan P 52.7 54.7 55.8 01/24 Japan Markit Jibun Bank Japan PMI Services Jan P 46.6 – 52.1 01/24 Japan Markit Jibun Bank Japan PMI Composite Jan P 48.8 – 52.5 01/24 Japan Markit Jibun Bank Japan PMI Mfg Jan P 54.6 – 54.3 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2021 results No. of days remaining Status GWCS Gulf Warehousing Company 25-Jan-22 0 Due NLCS Alijarah Holding 27-Jan-22 2 Due MARK Masraf Al Rayan 27-Jan-22 2 Due UDCD United Development Company 2-Feb-22 8 Due VFQS Vodafone Qatar 2-Feb-22 8 Due QAMC Qatar Aluminum Manufacturing Company 3-Feb-22 9 Due QCFS Qatar Cinema & Film Distribution Company 5-Feb-22 11 Due IHGS INMA Holding Group 6-Feb-22 12 Due IQCD Industries Qatar 7-Feb-22 13 Due QIMD Qatar Industrial Manufacturing Company 7-Feb-22 13 Due QISI Qatar Islamic Insurance Group 9-Feb-22 15 Due

- 3. Daily MarketReport Tuesday, 25 January2022 qnbfs.com Tickers Company Name Date of reporting 4Q2021 results No. of days remaining Status QLMI QLM Life & Medical Insurance Company 10-Feb-22 16 Due QEWS Qatar Electricity & Water Company 13-Feb-22 19 Due DOHI Doha Insurance Group 20-Feb-22 26 Due Source: QSE Qatar QIIK posts 6.8% YoY increase but 44.8% QoQ decline in net profit in 4Q2021, in-line with our estimate – Qatar International Islamic Bank's (QIIK) net profit rose 6.8% YoY (but declined 44.8% on QoQ basis) to QR163.5mn in 4Q2021, in-line with our estimate of QR158.9mn (variation of +2.9%). Total income from financing & investing activities decreased 5.7% YoY in 4Q2021 to QR527.2mn. However, on QoQ basis, total income from financing & investing activities gained 1.0%. The company's total income came in at QR605.8mn in 4Q2021, which represents a decrease of 1.3% YoY. However, on QoQ basis, total Income rose 3.2%. The bank's total assets stood at QR61.8bn at the end of December 31, 2021, up 0.8% YoY (+5.0% QoQ). Financing assets were QR37.0bn, registering a decline of 8.6% YoY (-0.9% QoQ) at the end of December 31, 2021. Customers' current accounts fell 7.0% YoY and 8.2% QoQ to reach QR7.4bn at the end of December 31, 2021. EPS amounted to QR0.59 in FY2021 as compared to QR0.55 in FY2020. QIIK has posted a net profit of QR1,003mn in 2021, which represents an overall growth of 7.0% compared to the previous year. QIIK’s board of directors proposed distribution of a cash dividend to shareholders of QR0.375 per share (37.5% of the nominal share value), subject to the approval of its 2021 financial statements by Qatar Central Bank and the bank’s AGM. Sheikh Dr Khalid said, “QIIK achieved exceptionally notable results in 2021, in alignment with Qatar’s strong overall economic growth. Our nation’s economy has been steadily growing across all sectors and indicators, which is due significantly to the vision and guidance of His Highness Sheikh Tamim bin Hamad al-Thani, Amir of the State of Qatar.” Sheikh Dr Khalid noted, "Our consecutive accomplishments and overall ranking achieved by QIIK in 2021, prompted global credit rating agencies to acknowledge the high ranking of the bank, as Moody’s and Fitch gave the bank the rating of ‘A2’ and ‘A’ respectively, with a stable outlook. QIIK chief executive officer Dr Abdulbasit Ahmed al-Shaibei noted, “By the end of the year, total revenue reached QR2.46bn, the bank’s total assets reached QR61.8bn and its financing assets stabilized at the end of the year at QR37.03bn. Customers’ deposits have also increased to QR38.65bn, representing a growth rate of 6.3%.” The CEO said, “The bank continued to improve its operational efficiency (cost to return) during the year 2021, as it decreased further to 18.8%, which is one of the best in the banking sector on both the local and international level. This shows a very high level of competence in managing expenses and revenue, controlling expenditure while simultaneously maintaining a steady growth curve for all of the bank’s key financial indicators. “By 2021, QIIK’s total equity reached QR8.7bn and the total capital adequacy of the bank under Basel III guidelines at 16.74%, demonstrating the strong financial standing of QIIK in spite of market variables and risks. (QSE, QNBFS Research, Gulf-Times.com) Nakilat takes delivery and management of fourth LNG carrier newbuild – Nakilat has taken delivery of a new build LNG carrier, “Global Sealine”, which will be commercially and technically managed in-house by Nakilat Shipping Qatar Limited (NSQL). Built by Daewoo Shipbuilding & Marine Engineering (DSME) in South Korea, this is the final LNG new build carrier to be delivered to Global Shipping Co. Ltd., a joint venture between Nakilat (60%) and Maran Ventures Inc. (Maran Ventures) (40%). Three of its sister vessels were delivered between 2020-2021 and are all under time charters. With a cargo carrying capacity of 174,000 cubic meters, “Global Sealine” is the second vessel with X-DF propulsion system to join the Nakilat fleet and is chartered to Cheniere Marketing International LLP. Nakilat’s Chief Executive Officer Eng. Abdullah Al Sulaiti said: “Nakilat is committed to its environmental goals and supporting the International Maritime Organization’s (IMO) carbon intensity reduction targets to reduce carbon emissions by 2030. The addition of this vessel to our fleet allows the company to offer greater operational flexibility to our charterers as the X-DF engine propulsion is proven to be more fuel efficient and more environmentally friendly due to the lower Carbon emissions. Moreover, the vessel features significantly lower gas boil-off rate, is equipped with onboard reliquefication units and complies with all mandatory international and national regulations pertaining to environmental protection.” The delivery of this vessel brings Nakilat’s to 74 vessels, which is about 12% of the current global LNG fleet based on carrying capacity. To date, there are 25 LNG carriers, 4 LPG carrier and 1 Floating Storage Regasification Unit (FSRU) vessel being managed and operated in-house by NSQL. (QSE) S&P Global Ratings affirmed its issuer and issue credit ratings on three Qatari banks – S&P Global Ratings affirmed its issuer and issue credit ratings on three Qatari banks. The affirmations follow a revision to criteria for rating banks and nonbank financial institutions (see "Financial Institutions Rating Methodology," and "Banking Industry Country Risk Assessment Methodology And Assumptions," both published Dec. 9, 2021, on RatingsDirect). Affirmed the following ratings: QNB Group with (A/Stable/A-1), The Commercial Bank with (BBB+/Stable/A-2), and Qatar Islamic Bank with (A-/Stable/A-2). (Bloomberg) Qatar Islamic Insurance to disclose its annual financial results on February 09 – Qatar Islamic Insurance will disclose its financial statement for the period ending December 31, 2021 on February 09, 2022. (QSE) Qatar International Islamic Bank to holds its AGM and EGM on 01/03/2022 for 2021 – Qatar International Islamic Bank announced that the AGM and EGM will be held on 01/03/2022. In case of not completing the legal quorum, the second meeting will be held on 07/03/2022. The agenda, timing and the avenue of the AGM/EGM will be announced once approved by the regulators. (QSE) Qatar Navigation to disclose its annual financial results on February 09 – Qatar Navigation will disclose its financial statement for the period ending December 31, 2021 on February 09, 2022. (QSE) Qatar Navigation holds its investors relation conference call on February 10 to discuss the financial results – Qatar Navigation announced that the conference call with the investors to discuss the financial results for the annual 2021 will be held on February 10, 2022 at 02:00 PM, Doha Time. (QSE) Qatargas starts chase for huge North Field offshore pipelay contract – Qatargas has initiated the tender process for a project that involves laying several kilometers of offshore pipelines and fiber cables for its giant North Field. Two people familiar with the development told Upstream that the Qatari state-owned giant has issued tender documents for the prized engineering, procurement, construction and installation contract (Package 1). “Technical and commercial offers are likely to be submitted on 30 March,” one person confirmed. The work being offered is said to be substantial and is part of the North Field sustainability (NFPS) compression project that aims to maintain the production profile of the gas field. (Bloomberg) OBG signs MoU with Qatar Chamber – The investment opportunities emerging across high-potential sectors of Qatar’s economy, including logistics, advanced manufacturing, sport and digital technol-ogies, will be explored in a forthcoming report by the global research and consul- tancy firm Oxford Business Group (OBG).The Report: Qatar 2022 will analyse the latest developments in the country’s drive to diversify its economy and boost non-oil growth, in line with the objectives laid out in Qatar National Vision 2030.Topical issues set for analysis include the steps taken by the government to support local small and medium-sized busi-nesses. The report will also chart Qatar’s efforts to strengthen

- 4. Daily MarketReport Tuesday, 25 January2022 qnbfs.com regional and interna-tional ties as a means of boosting both trade and FDI. The national drive to ensure the education system and curricula reflect the changing job market is another area of focus. (Peninsula Qatar) Vertical specific parks key to growing Qatar’s startup ecosystem, says industry expert – Similar to the establishment of the Qatar FinTech Hub (QFTH), setting up investment and tech hubs would be essential to the growth of Qatar’s startup ecosystem, according to an industry expert. Dr Tejinder Singh, the chapter director of Startup Grind Doha, underscored the need to set up more tech companies in Qatar to serve sectors in the country. “We need to lay our focus on tech; I think that is what we’re missing right now. We’re missing out on two things: creating vertical specific parks. These two are essential pillars of any startup ecosystem unless you want to build an ecosystem that is non-tech, which is out-of- date right now,” Singh told Gulf Times yesterday. He said, “Startups are predominantly based on tech. What you need is angel funding or seed funding, so you need to set up investment and tech hubs; in that way, more tech players would come, thus enhancing the ecosystem. We still need to see more people focusing on blockchain and other advanced technologies. As of now, we don’t have that, so you need to bring these capabilities in place. (Gulf-Times.com) New report to chart the next chapter of Qatar’s growth story as FIFA World Cup 2022 draws closer, says OBG report – The investment opportunities emerging across high-potential sectors of Qatar’s economy, including logistics, advanced manufacturing, sport, and digital technologies, will be explored in a forthcoming report by the global research and consultancy firm, Oxford Business Group (OBG). ‘The Report: Qatar 2022’ will analyze the latest developments in the country’s drive to diversify its economy and boost non-oil growth, in line with the objectives laid out in Qatar National Vision 2030. Topical issues set for analysis include the steps taken by the government to support local small and medium-sized businesses. The report will also chart Qatar’s efforts to strengthen regional and international ties as a means of boosting both trade and FDI. The national drive to ensure the education system and curricula reflect the changing job market is another area of focus. Last September, OBG has signed a memorandum of understanding (MoU) with the Qatar Chamber for its 2022 report. The MoU was signed by Izabela Kruk, country director, OBG, and Saleh bin Hamad al-Sharqi, director general, Qatar Chamber. This comes as part of the co-operation ongoing since 2008 between the two parties. Al-Sharqi said Qatar’s diversification efforts and emerging role as a host of major events, such as the forthcoming 2022 FIFA World Cup, were generating a wealth of investment opportunities across the economic sectors, while also working on raising the country’s profile on the international stage. (Gulf- Times.com) Shura Council discusses price hike, inflation issues – The Shura Council on Monday discussed the inflation issue, the rise in the cost of living, and the increase in financial burdens on society, based on a request for general discussion submitted by several members. The Shura Council meeting was chaired by Speaker HE Hassan bin Abdullah Al Ghanim. The Speaker indicated that inflation has witnessed massive jumps in the world during the last period, pointing to the importance of discussing the issue at the local level. It witnessed a great disparity compared to the countries of the region, and needs to take effective steps to address it. He pointed out that inflation and price increases necessitate the Shura Council to discuss its justifications to come up with positive and effective results and solutions. He noted that the wrong consumption culture plays a major role in raising prices, stressing the need to spread awareness about consumption and reduce spending on luxury goods and services. In turn, Deputy Speaker HE Dr Hamda bint Hassan Al Sulaiti said that inflation recently exceeded six percent, while it was expected that it would not exceed 2.5 percent. He indicated that the high inflation rate requires studying the issue and considering the laws that were enacted by the state to regulate the market, prevent monopoly, protect the consumer, and regulate the work of commercial agents. She pointed to the significant rise in freight prices, which in turn affects inflation, stressing in the same context the importance of determining the rental value and increasing subsidized food commodities according to the study of citizens’ needs, opening the field for competition and reducing investment burdens, allowing the opening of shops under residential buildings, and increasing commercial streets. She noted the need to inquire from the competent authorities about these points and determine the appropriate mechanism to deal with them. The Council members explained that the issue of high prices and inflation is a global phenomenon, but it has become a prominent phenomenon in the Qatari society, reaching high levels without clear reasons. (Qatar Tribune) Doha named world’s second safest city by Numbeo – Doha has again been ranked as the ‘second safest city’ in the world by Numbeo. Numbeo’s Crime Index by City 2022 report covered 459 cities and placed Doha in the second place with respect to low crime rate and safety. (Qatar Tribune) International Fed tries to match economic risks against market's rush to tighten – The Federal Reserve may not raise interest rates until March, but officials' tougher language about inflation is already kicking in, with borrowing costs rising for everyone from homebuyers to the federal government and stock markets kicking off the year deep in the red. The pace of that adjustment now poses an unexpectedly urgent question for US central bank officials at their latest two-day policy meeting this week: Are financial markets tightening too fast for what the Fed intends in its inflation battle, or is the Fed the one underestimating what will ultimately be needed to slow the pace of price increases? In their most recent projections, issued in December, policymakers said they expected as many as three quarter-percentage-point rate increases this year, with more in the cards in 2023 and 2024. But those projections never raise the Fed's benchmark overnight interest rate above the "neutral" level that would actually restrict the economy. Yet inflation still falls, a best-of-all- worlds outcome some analysts see as unrealistic. "The U.S. is facing the highest inflation since 1982 and there is compelling evidence that a good chunk of it will persist. The Fed has never responded this slowly ... and even today is signaling a benign hiking cycle," wrote Ethan Harris, the head of global research at Bank of America. "The biggest near-term risk is right in front of us: that the Fed is seriously behind the curve and has to get serious." (Reuters) PMI: UK businesses suffer January chills as cost pressures rage – British business activity cooled unexpectedly this month to an 11-month low but cost pressure stayed high, according to a survey that leaves the Bank of England on track to raise interest rates next week. The IHS Markit/CIPS Composite Purchasing Managers Index (PMI) slipped in January to 53.4 from 53.6. While remaining above the 50 dividing line between growth and contraction, a Reuters poll of economists had pointed to a reading of 55.0. The spread of the Omicron variant of coronavirus again hit consumer-facing companies and manufacturers said orders grew at the weakest pace for a year - although business and financial services companies saw a quicker rate of expansion. The flash PMIs suggested a similar level of economic performance for Britain, Germany and France, the three largest European economies. "All told, this PMI survey suggests that the (UK) economy is suffering a hangover from the surge in Omicron cases. Even so, we still think GDP will recover fairly swiftly over the rest of Q1," said Adam Hoyes, economist from consultancy Capital Economics. (Reuters) PMI: Eurozone recovery stumbled in Jan as Omicron hit services – The Eurozone economic recovery weakened this month, despite an upturn in Germany where factories benefited from an easing in supply chain bottlenecks, as renewed restrictions put a dent in the bloc's dominant services industry, a survey showed. With the Omicron coronavirus variant sweeping across Europe governments have been encouraging citizens to stay home and avoid socializing while soaring prices have discouraged consumers from spending. IHS Markit's Flash Composite Purchasing Managers' Index, seen as good gauge of overall economic health, dropped to 52.4 in January from 53.3 in December, its lowest since February and below the 52.6 predicted in a Reuters poll. That headline number was affected by the services PMI, which dropped to a nine-month low, although it remained in growth territory. With customers staying home, growth in demand for services almost dried up. The new business index sank to its lowest reading since April last year

- 5. Daily MarketReport Tuesday, 25 January2022 qnbfs.com just before parts of the economy reopened after a stricter lockdown. (Reuters) Bundesbank: German economy likely shrunk in Q4 – Germany’s economy likely shrank in the fourth quarter as manufacturing remained constrained by supply bottlenecks and consumption dropped on renewed coronavirus fears, the Bundesbank said in a monthly report on Monday. Growth in Europe’s biggest economy stalled in the autumn as supply shortages and shipping bottlenecks held back its vast industrial sector, even as consumption held up relatively well. But household consumption also took a hit late in the year over fears about the Omicron variant, which forced businesses to bring back restrictions on activity. “The adjustments in behaviour and the triggered containment measures in some cases had a significant impact on economic activity in the service sector, especially in December,” the Bundesbank said. “Germany’s real gross domestic product is likely to have fallen slightly in the final quarter of 2021.” (Reuters) Regional Gulf economies seen to grow faster in 2022; oil fall biggest threat – The economies in the six-member Gulf Co-operation Council will grow at their fastest paces in several years, according to a Reuters poll of economists who cautioned the risk to that outlook was skewed to the downside. Crude oil prices, a major driver for Gulf economies, climbed to their highest since 2014 last Wednesday, driven by escalating global political tensions involving major producers including UAE and Russia, which could worsen already tight supplies. That is bullish news for the six wealthy oil-exporting countries in the region. The January 11-19 poll of 25 economists forecast all six economies in the Gulf Co-operation Council would grow faster this year than was expected three months ago. Saudi Arabia was predicted to top the list with growth of 5.7%, followed by Kuwait and UAE with 5.3% and 4.8% respectively. Economic growth in Qatar, Oman and Bahrain was expected to average between 3%-4% for 2022. (Gulf-Times.com) Oil prices rise on supply disruption jitters as geopolitical tensions grow – Oil prices climbed on Tuesday, regaining some of the ground lost in the previous day's sharp losses, on concerns over possible supply disruptions amid rising geopolitical tensions in both Eastern Europe and the Middle East. Brent crude futures rose 48 cents, or 0.6%, to $86.75 a barrel at 0116 GMT, reversing a 1.8% fall in the previous session. US West Texas Intermediate (WTI) crude futures climbed 34 cents, or 0.4%, to $83.65 a barrel, having slid 2.2% on Monday. Oil prices reached seven-year highs last week, bolstered by tight worldwide supply and resurgent global demand. (Zawya) The fastest economic growth for the Gulf states in 2022… Saudi Arabia is at the top of the list with 5.7% – An economic poll expected that the Gulf countries would witness the fastest economic growth in years, but economists warned that the possibility of a drop in oil prices represents the biggest challenge to these expectations. According to “Reuters”, 25 economists said in the poll, which was conducted from January 11 to 19, that the six countries will witness faster growth this year than was expected three months ago. According to the survey, Saudi Arabia topped the list of expectations with a growth of 5.7%, followed by Kuwait and the UAE with a growth of 5.3 and 4.8%, respectively. It is expected that Qatar, Oman and Bahrain will witness an average growth between 3.0 and 4.0% in 2022, and if this is achieved, this will be the best growth rate witnessed by these countries in several years. For his part, Khadija Haq, Head of Research and Chief Economist at National Bank of Dubai, said, “Despite the relatively tight fiscal policy and some external headwinds, we expect Gulf economies to witness faster growth in 2022 as they continue to benefit from the progress achieved in 2021.” “Although the outlook for 2022 is still relatively constructive, there is still a high degree of ambiguity, especially with regard to the evolution of the pandemic,” she added. As the global economy grapples with the possibility of persistent inflation, the outlook for prices in the region is modest but mixed. Inflation is expected to remain between 2.0 and 2.8% this year, and the lowest reading was for Saudi Arabia, the UAE and Oman at 2.0%, and the highest was in Qatar at 2.8%. Saudi Arabia will witness economic growth of 5.7% this year, and if this is achieved, it will be the fastest growth rate since 2012 when oil prices averaged $ 111 a barrel. According to the poll, dependence on energy prices accompanies the challenge of economic recovery being negatively affected by any price turmoil due to geopolitical tensions or the global economic slowdown. Nine of the ten economists who answered an additional question said that any drop in oil prices and the emergence of new mutations from the Corona virus are the biggest risks to growth in the Gulf Cooperation Council this year. (Bloomberg) Refinitiv: Value of M&A deals in MENA reached more than $109bn in 2021 – Mergers & Acquisitions (M&A) that had any MENA involvement totaled $109.1 billion throughout 2021, a 57% increase from last year and the third year where any MENA involvement M&A volumes surpassed $100bn, according to newly released Refinitiv data. A total of 1,141 deals was recorded in 2021, a 40% increase from 2020 and the highest annual total since records began in 1980. M&A involving a MENA target reached $72.9bn, making it the second-highest total since records began in 1980 and the strongest year of the number of deals with 863 deals in 2021. On the other hand, outbound M&A totaled $30.2bn in 2021, up 198% from 2020 and a six-year high. The largest M&A deal in the MENA region of 2021 was Aramco Gas Pipelines Co in a deal worth $15.5bn lease and leaseback agreement for its gas pipeline network. Saudi Arabia was the most targeted nation with $27.3bn in M&A activity, equivalent to half of target M&A recorded in the region. Energy and Power was the most active sector with $38.8bn in deal activity, representing a 189% increase from last year. (Zawya) Saudi Arabia takes over the presidency of the Gulf Commercial Arbitration Center – Saudi Arabia took over the presidency of the Commercial Arbitration Center for the Cooperation Council for the Arab States of the Gulf, after the announcement was made during the meeting of the Center’s Board of Directors (via video communication), which was held last December 2021. The transfer of the presidency to the representative of Saudi Arabia in the center, Counselor Fahd bin Ali Al- Omari, comes in accordance with what is applied in the meetings of the Cooperation Council. (Bloomberg) Aramco signs 50 MoUs at iktva forum – Aramco’s supply chain resilience has been further enhanced by the signing of 50 new memoranda of understanding (MoUs) at the In-Kingdom Total Value Add (iktva) Forum and Exhibition under way in Dhahran. The 6th edition of the event was inaugurated by HRH Prince Saud bin Nayef bin Abdulaziz Al-Saud, Governor of the Eastern Province, in the presence of HRH Prince Abdulaziz bin Salman bin Abdulaziz Al Saud, Minister of Energy, HRH Ahmed bin Fahd Al Saud, Deputy Governor of the Eastern Province, and Yasir Othman Al-Rumayyan, Chairman of Aramco’s Board of Directors. Progress in the company’s flagship business continuity initiative is being showcased at the three-day gathering, which runs from January 24 to 26 at Dhahran Expo. (Zawya) Saudi Arabia's SABIC Agri-Nutrients plans to buy 49% of ETG Inputs Holdco – Saudi Arabian fertilizers maker SABIC Agri-Nutrients said on Monday it had signed a binding agreement to acquire a 49% stake in ETG Inputs Holdco LTD. ETG Inputs Holdco blends and distributes fertilizers, seeds and agro-chemicals directly to farmers and customers in several countries in Africa, according to information on its website. The transaction is based on an enterprise value of $320 million, and subject to regulatory approvals and other terms and conditions, SABIC Agri- Nutrients said in a regulatory disclosure. The company said it will finance the acquisition through company’s resources, in addition to bank facilities. (Reuters) Saudi bus operator SAPTCO signs $39.8mn deal for new transport project – Bus operator Saudi Public Transport Company (SAPTCO) has signed a contract worth more than SR149.6mn ($39.8 million) for a public bus transport project in Saudi Arabia. The contract for the project, which will be implemented in Dammam City and Al-Qatif governorate, has been signed with the Eastern Province Municipality, SAPTCO told the Saudi Stock Exchange (Tadawul) late Sunday. The project will be carried out in five years and is expected to have a positive impact on the company’s revenues during the first half of 2022. (Zawya)

- 6. Daily MarketReport Tuesday, 25 January2022 qnbfs.com Aldar enters agreement with EWEC to adopt clean energy across all assets – Aldar Properties (Aldar) has entered a clean energy agreement with Emirates Water and Electricity Company (EWEC), a leading company in the integrated coordination of planning, purchasing and supply of water and electricity across the UAE. Through the agreement, 100% of Aldar’s owned and managed operating assets will be powered by EWEC’s clean energy sources for up to five years in a move that aims to promote the adoption of clean energy and support the expansion of decarbonisation in the real estate sector. (Zawya) DLD signs MoUs with three entities specialized in smart real estate solutions – Dubai Land Department (DLD) has signed memoranda of understanding (MoUs) with three companies specialized in providing smart and advanced real estate solutions: Bayut, DXBinteract.com, and Property Finder. The MoUs aim to provide Dubai’s real estate market with the best solutions that rely on data and interactive reports, which contributes to enhancing the digital transformation trends witnessed by Dubai’s real estate sector as well as supports DLD’s vision of positioning Dubai as the world's premier real estate destination and a byword for innovation, trust, and happiness. Through the MoUs, the three companies will provide qualitative, private and interactive data on real estate prices by region, and according to real estate construction, including the regional buying and selling prices, and the changing data that takes place in the real estate market during price changes, among others, depending on the stage it is going through. (Zawya) Abu Dhabi ADX says could see first SPAC listing this year – The Abu Dhabi Securities Exchange (ADX) could see its first SPAC listing this year following the approval of a regulatory framework around blank cheque companies by the Securities and Commodities Authority. SPACs, or Special Purpose Acquisition Companies, raise funds to acquire private companies with the purpose of taking them public by listing on stock markets rather than through traditional IPOs. The SPAC regulatory framework was developed by ADX and Abu Dhabi’s Department of Economic Development (DED), along with the SCA. The move is in line with the emirate's strategy to develop its capital markets and bring in new investors. (Zawya, Reuters) Abu Dhabi Ports to set up oil & gas logistics base at Mugharraq for Eni – Abu Dhabi Ports Group has signed a new agreement with Eni Abu Dhabi B.V., a branch of the Italian energy company, to establish a marine logistics base at Mugharraq Port supporting offshore drilling operations in the heart of Al Dhafra region. Mugharraq Port’s ultra-modern infrastructure and its strategic location close to the region’s offshore oil and gas facilities will be made available to Eni Abu Dhabi operations, the ports group said in a statement on Monday. Eni has been present in Abu Dhabi since 2018 with a 10% stake in the Umm Shaif and Nasr Offshore concession plus a 5% stake in the Lower Zakum concession. It was also awarded a 25% stake in ADNOC’s Ghasha sour gas field concession. (Zawya) Kuwait KPC unit discovers gas condensate in Indonesia – A unit of state energy company Kuwait Petroleum Corporation has discovered natural gas condensate at its offshore blocks in Indonesia. According to Kuwait Foreign Petroleum Exploration Co. (KUFPEC) the discovery was made “through the successful drilling of the Anambas-2X well in 288 feet (88 meters) of water." This is company’s first discovery at an offshore block, it said in a statement on Sunday. KUFPEC, which is international oil company engaged in exploration, development and production of crude oil and natural gas active in Africa, Middle East, Asia, and Australia, said it would continue drilling at the site to determine the well's production capacity. Last year, the company said its Malaysian subsidiary made a gas discovery off Sarawak, Malaysia. (Zawya) Kuwait parliament to take up capital hike plan for KCB – Kuwait’s National Assembly will meet in a special session on Tuesday to discuss a proposal to increase the capital of state-owned Kuwait Credit Bank (KCB). The move comes as government officials are looking for ways to enable the bank to finance real estate loans in the Gulf state, Kuwait News Agency (KUNA) said.The proposed capital increase was taken up in a meeting on Sunday that was attended by Kuwait’s Finance Minister and Minister of State for Economic and Investment Affairs Abdulwahab Al-Rushaid, as well as officials from Kuwait Fund for Arab Economic Development (KFAED) and KCB. (Zawya) OMR155mn renewable energy project opens in Oman – Oman’s largest and one of its newest solar power plants is capable of providing clean electricity to 50,000 homes, marking a big step in the country’s efforts to move towards renewable and sustainable sources of energy. The Ibri II Solar PV plant, which is in the governorate of Al Dhahirah, was officially inaugurated yesterday under the patronage of Sayyid Hamoud bin Faisal Al Busaidi, the Minister of Interior. (Bloomberg)

- 7. Daily MarketReport Tuesday, 25 January2022 qnbfs.com Rebased Performance Source: Bloomberg Daily Index Performance Source: Bloomberg Asset/Currency Performance Close ($) 1D% WTD% YTD% Gold/Ounce 1,843.06 0.4 0.4 0.8 Silver/Ounce 23.99 (1.3) (1.3) 2.9 Crude Oil (Brent)/Barrel (FM Future) 86.27 (1.8) (1.8) 10.9 Crude Oil (WTI)/Barrel (FM Future) 83.31 (2.1) (2.1) 10.8 Natural Gas (Henry Hub)/MMBtu 4.17 2.0 2.0 13.9 LPG Propane (Arab Gulf)/Ton 115.00 (1.9) (1.9) 2.4 LPG Butane (Arab Gulf)/Ton 142.88 (1.3) (1.3) 2.6 Euro 1.13 (0.2) (0.2) (0.4) Yen 113.95 0.2 0.2 (1.0) GBP 1.35 (0.5) (0.5) (0.3) CHF 1.09 (0.3) (0.3) (0.2) AUD 0.71 (0.6) (0.6) (1.6) USD Index 95.92 0.3 0.3 0.3 RUB 78.77 1.7 1.7 5.5 BRL 0.18 (0.5) (0.5) 1.5 Source: Bloomberg Global Indices Performance Close 1D%* WTD%* YTD%* MSCI World Index 3,005.52 (0.6) (0.6) (7.0) DJ Industrial 34,364.50 0.3 0.3 (5.4) S&P 500 4,410.13 0.3 0.3 (7.5) NASDAQ 100 13,855.13 0.6 0.6 (11.4) STOXX 600 456.36 (4.0) (4.0) (6.9) DAX 15,011.13 (4.0) (4.0) (5.4) FTSE 100 7,297.15 (3.4) (3.4) (1.8) CAC 40 6,787.79 (4.1) (4.1) (5.6) Nikkei 27,588.37 0.1 0.1 (3.0) MSCI EM 1,222.16 (1.8) (1.8) (0.8) SHANGHAI SE Composite 3,524.11 0.2 0.2 (2.8) HANG SENG 24,656.46 (1.2) (1.2) 5.5 BSE SENSEX 57,491.51 (3.1) (3.1) (1.5) Bovespa 107,937.10 (2.0) (2.0) 3.9 RTS 1,288.17 (8.1) (8.1) (19.3) Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 160.0 180.0 Dec-17 Dec-18 Dec-19 Dec-20 Dec-21 QSE Index S&P Pan Arab S&P GCC (0.6%) 0.3% (0.2%) (0.3%) (0.5%) (0.1%) (2.0%) (2.5%) (2.0%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai 170.8 162.3 157.5

- 8. Daily MarketReport Tuesday, 25 January2022 qnbfs.com Contacts QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 info@qnbfs.com.qa Doha, Qatar Saugata Sarkar, CFA, CAIA Head of Research saugata.sarkar@qnbfs.com.qa Shahan Keushgerian Senior Research Analyst shahan.keushgerian@qnbfs.com.qa Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arisingfrom use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. Wetherefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warrantiesastotheaccuracyandcompletenessofthe informationitmaycontain,anddeclinesanyliabilityinthatrespect.Forreports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommen- dationsofQNBFSFundamentalResearchasaresultofdepending solelyonthehistoricaltechnicaldata(priceandvolume).QNBFS reservestherighttoamendtheviewsandopinionsexpressedinthispublicationat anytime.Itmayalsoexpressviewpointsormake investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS.