4.Pension Rules.ppt

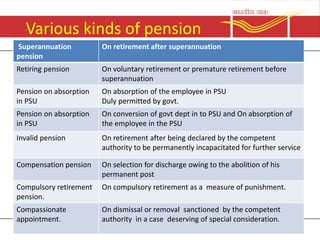

- 1. Various kinds of pension . Superannuation pension On retirement after superannuation Retiring pension On voluntary retirement or premature retirement before superannuation Pension on absorption in PSU On absorption of the employee in PSU Duly permitted by govt. Pension on absorption in PSU On conversion of govt dept in to PSU and On absorption of the employee in the PSU Invalid pension On retirement after being declared by the competent authority to be permanently incapacitated for further service Compensation pension On selection for discharge owing to the abolition of his permanent post Compulsory retirement pension. On compulsory retirement as a measure of punishment. Compassionate appointment. On dismissal or removal sanctioned by the competent authority in a case deserving of special consideration.

- 2. VARIUOS COMPONENTS TO DECIDE PENSION • Following are the various components to decide the quantum of pension. • 1.Qualifying service. • 2. Emoluments.

- 3. QUALIFYING SERVICE. • 1.Qualifying service of a govt servant commences from the date he takes charge of the post to which he is first appointed in a permanent capacity. • 2.Temporary service immediately followed by regular appointment without interruption will also qualify. • 3.Following shall constitute qualifying service • a)Duty and periods treated as duty. • b) All kinds of leave with leave salary. • c) Deputation and foreign service. • d) Exol on MC. • e) Pre appointment training immediately followed by appointment as Group C and Group D. • f) Service on probation followed by confirmation. • g) Service as SAS apprentice. • h) Suspension followed by reinstatement. • i)Suspension followed by major penalty and absence from duty including suspension if any ,ordered by the competent authority that it shall count as service.

- 4. QUALIFYING SERVICE • Following shall not constitute qualifying service • 1.Service rendered before attaching the age of 18 years. • 2.Service as apprentice except SAS apprentice. • 3.Unauthorised absence treated as Diesnon. • 4.Over stayal of leave /Joining time not regularized as leave with salary • 5.EOL without MC • 6.Suspension followed by major penalty and the suspension period ordered not to be counted for pension.

- 5. QUALIFYING SERVICE • 1.Qualfying service so arrived will be expressed in completed six monthly periods. • 2.Fractions equal to three months and above shall be treated as one six monthly period(SMP) • 3. Fractions less than three months will be ignored.

- 6. EMOLUMENTS. • 1.Emoluments for pension include only Basic pay in Pay band and Grade Pay and non-practicing allowance. • 2.Dearness allowance or any other allowance will not be taken in to account. • 3.For arriving at the basic pension, Emolument is calculated based on the Last pay drawn (BP+GP). • 4.’Average emoluments‘ mean the average of emoluments that were drawn during the last ten months.

- 7. EMOLUMENTS • 5.If an employee immediately before retirement or death in service had been on leave with salary, the emoluments which he would have drawn had he not been on leave will be taken as emoluments. • 6.If under suspension and subsequently reinstated in to service without forfeiture of service the emoluments which he would have drawn had he not under suspension will be taken as emoluments. • 7.If on EXOL emoluments drawn immediately before proceeding on such leave will be taken as emoluments. • 8.While calculating average emoluments the period of extraordinary leave, dies non, overstayal of leave or joining time and suspension not counting for pension falling within the last ten months will be ignored and a corresponding added before ten months.

- 8. CALCULATION OF PENSION • 1After arriving at the net qualifying service and Emoluments pension is calculated. • 2.The amount pension will be 50% of last pay drawn on the date of retirement or 50% of average emoluments which ever is more beneficial. • 3.The pension arrived so shall not be less than Rs.3500/-. • 4.The amount of pension should be rounded off to the next higher rupee. • 5.Pension is admissible to an employee with minimum qualifying service of not less tahn10 years .

- 9. RETIREMENT GRATUTITY • 1.Retirement gratuity is admissible to all employees who retire after completion of 5 years of servcie. • 2.RG is calculated at the rate of 1/4 th of emoluments for each completed six months service. • 3.For this purpose emolument means Basic pay +GP+DA. • 4.RG is subject to a maximum of 16.5 times of the emoluments or 10,00,000/- whichever is less. • 5.The amount of gratuity is rounded off to the next higher rupee.

- 10. DEATH GRATUTITY • On the death of a government servant in service death gratuity is payable as follows. LENGTH OFSERVICE DEATH GRATUTITY PAYABLE Less than one year. 2 times of emoluments. One year or more but less than 5 years. 6 times of emoluments. 5 years or more but less than 20 years. 12 times of emoluments. 20 years or more Half of emoluments for every completed six monthly period of qualifying service subject to a maximum of 33 times of emoluments or Rs.10,00,000/-

- 11. COMMUTATION OF PENSION • 1.Every pensioner is eligible to commute a portion of his pension for a lumpsum payment • 2.An employee or a pensioner against whom any deptl/vig/judicial case is pending ,is not eligible for commutation . • 3.A maximum of 40% monthly pension can be commuted. • 4.A person in receipt of Superannuation pension retiring pension or compensation pension can commute up to a maximum of 40% of pension without medical examination if he applies for the same within a period of one year from DOR.

- 12. COMMUTATION OF PENSION • 5.If an official is retired on invalidation/retired compulsorily as a measure of penalty or in receipt of compassionate allowance then he can commute pension only after medical examination. • 6.All other pensioners if they apply for commutation after one year from the DOR then they will have to undergo medical check up. • 7.The commutation amount will be rounded off to the next higher rupee.

- 13. CALCULATION OF COMMUTATION • Commutation amount payable is caculated as follows. • Commutationfactor X 12 X amount of pension offered for commutation. • Example; Official retired on 60 years of age with LPD (16000+4000) Rs.20,000/- • Basic pension Rs.10,000. • Mxm commutation 40% on Rs.10,000=4,000/- • Comn factor for 61 years of age =8.194 • Comn amt = 8.194 X 12 X 4000 =3,93,312/- • Commutation payable is Rs. 3,93,312/-

- 14. REDUCTION IN PENSION • 1.The reduction in the amount of pension on commutation will become operative from the date of receipt of commuted value by the pensioner or at the end of three months after issue of authority for payment. • 2.If an official retires on superannuation and applies for commutation before the date of retirement the reduction will take effect from the day following the day of retirement and reduction becomes effective from same date.

- 15. RESTORATION OF REDUCTION • The reduced portion of pension on account of Commutation will be restored on the expiry of 15 years from the date of retirement if the commutation is received in the first month of retirement. • In other cases , the commutation portion of pension will be restored after 15 years from the date of receipt of commutation amount. • If the commuted value of pension is paid in two instalments due to revision of pension the date of restoration will also be the same as for original commutation.

- 16. FAMILY PENSION • 1.Family pension is payable to the family of an employee/pensioner on his death in service/ after retirement. • 2.Family means • i) Widow or widower up to the date of death or remarriage whichever is earlier. • ii) Son/Daughter(including widowed daughter) up to the date of his/her marriage/remarriage or till the date he/she starts earning or till the age of 25 years whichever is the earliest • iii) Parents who were wholly dependent on the govt servant when he/she was alive provided the deceased employee had left behind neither a widow nor a child. • Iv) Dependant son/daughter with disabilities as also dependant brother/sisters with disabilities

- 17. CALCULATION OF FAMILY PENSION • 1.The family pension is calculated on the LPD on the date of death or retirement.LPD includes Basic pay +GP+NPA. • 2.Normal family pension is admissible at the rate of 30% of LPD subject to a minimum of Rs.3500/-pm. • 3.The family pension is rounded off to the next higher rupee. • 4.Enhanced family pension is payable as follows.

- 18. ENHANCED FAMILY PENSION In the case of death in service ; 1.Payable for a period of 10 years from the date of death of a government servant without any upper age limit. 2.The enhanced family pension is payable at the rate of 50% of the LPD. In the case of death after retirement; 1.Payable for a period of 7 years from the date of death of a pensioner or up to the date on whish he would have attained the age of 67 years had he survived which ever is less 2. 2.The enhanced family pension is payable at the rate of 50% of the LPD or the amount of pension authorized which ever is less.

- 19. DEARNESS RELEF ON PENSION / FAMILY PENSION • 1.Dearness relief is admissible to pension and family pension. • 2.While calculating DR on pension the same will be calculated on the original pension without deducting commuted portion of pension. • 3.Dearness relief is sanctioned at the same rate as applicable to DA on pay and alloeaces.