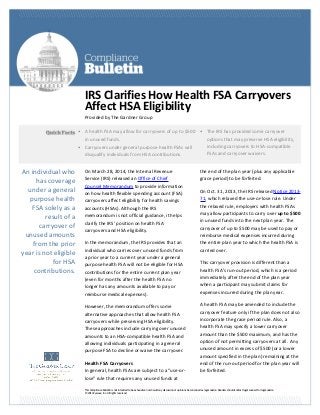

IRS Clarifies How Health FSA Carryovers Affect HSA Eligibility

•

1 like•257 views

On March 28, 2014, the IRS issued a memorandum to clarify how health FSA carryovers affect HSA eligibility. The memorandum confirms that an individual who has coverage under a general purpose health FSA solely as a result of a carryover is not eligible for HSA contributions. The memorandum also provides some alternative approaches for carryovers that preserve HSA eligibility.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

More from The Gardner Group

More from The Gardner Group (20)

HCR Pay or Play Penalties Look-Back Measurement Method Examples

HCR Pay or Play Penalties Look-Back Measurement Method Examples

Protect Your Business and Employees from Seasonal Flu

Protect Your Business and Employees from Seasonal Flu

Health Care Reform Reporting Requirements for Employers and Health Plans

Health Care Reform Reporting Requirements for Employers and Health Plans

HCR Hardship Exemption From the Individual Mandate

HCR Hardship Exemption From the Individual Mandate

Potential Penalties for Employers Under Pay or Play rules

Potential Penalties for Employers Under Pay or Play rules

Recently uploaded

Hello, Guys welcome to Manalifun Goa Escort service. Are you want Top call girls in Goa at just ₹10000 then no further anywhere because we have a large number of local beautiful girls. We are a genuine platform to provide unlimited classification escort ads service without any commission. 9316020077

Here many Goa Independent call girls and ladies, publish their ads. Our call girl in Goa is well-known for real sexual fun in Goa. We are not allow any prostitute to work here without checking the details, Firstly all ads check by our team then we publish them here. So don’t hesitate to book Low rate call girls in Goa. 9316020077

Goa call girls: A real wonder in Goa

Who are the best Goa Escort Service provider for Goa call girls

High-Class call girls in Goa escort service for 100% Satisfaction

Choose a trusted call girl service in Goa with Us +91-9316020077

Goa Escorts Provide 100% Client Satisfaction

How Our Goa Call Girls Are Perfect For Instant Satisfaction

100% Guaranteed Goa call girls will make you excited

How to Find Cheap Call Girls in Goa

Our Reliable Escort Service in Goa Local Areas

Goa Escorts (cheap escort service in Goa)

Rate Chart of Goa call girls, (call girl Rate in Goa)

5-star hotel For Goa call girls service

Call girls in Goa are the ideal sex partner for you

BOOK YOUR FAVORITE Goa CALL GIRLS SERVICE WITH US CALL! US NOW~ 9316020077

Best way to Hire call girls in Goa

What’s the cost of escort service in Goa

North Goa Call Girls

Location :-

Baga , Caclangute , Candolim , Anjuna , Panaji Arpora , Vagator , Morjim , Siolim , Mandrem , Arambol , etc.

Vasco , Bambolim , Madgaon, Colva , Etc9316020077📞Goa Call Girls Numbers, Call Girls Whatsapp Numbers Goa

9316020077📞Goa Call Girls Numbers, Call Girls Whatsapp Numbers Goarussian goa call girl and escorts service

Recently uploaded (20)

Call Girls Chandigarh 👙 7001035870 👙 Genuine WhatsApp Number for Real Meet

Call Girls Chandigarh 👙 7001035870 👙 Genuine WhatsApp Number for Real Meet

(Ajay) Call Girls in Dehradun- 8854095900 Escorts Service 50% Off with Cash O...

(Ajay) Call Girls in Dehradun- 8854095900 Escorts Service 50% Off with Cash O...

Jalna Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Jalna Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

VIP Call Girls Noida Sia 9711199171 High Class Call Girl Near Me

VIP Call Girls Noida Sia 9711199171 High Class Call Girl Near Me

Bareilly Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Bareilly Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Call Girl In Zirakpur ❤️♀️@ 9988299661 Zirakpur Call Girls Near Me ❤️♀️@ Sexy...

Call Girl In Zirakpur ❤️♀️@ 9988299661 Zirakpur Call Girls Near Me ❤️♀️@ Sexy...

Sambalpur Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Sambalpur Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Punjab❤️Call girls in Mohali ☎️7435815124☎️ Call Girl service in Mohali☎️ Moh...

Punjab❤️Call girls in Mohali ☎️7435815124☎️ Call Girl service in Mohali☎️ Moh...

Call Girl Raipur 📲 9999965857 whatsapp live cam sex service available

Call Girl Raipur 📲 9999965857 whatsapp live cam sex service available

raisen Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

raisen Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

❤️♀️@ Jaipur Call Girl Agency ❤️♀️@ Manjeet Russian Call Girls Service in Jai...

❤️♀️@ Jaipur Call Girl Agency ❤️♀️@ Manjeet Russian Call Girls Service in Jai...

Chandigarh Call Girls 👙 7001035870 👙 Genuine WhatsApp Number for Real Meet

Chandigarh Call Girls 👙 7001035870 👙 Genuine WhatsApp Number for Real Meet

Jaipur Call Girls 9257276172 Call Girl in Jaipur Rajasthan

Jaipur Call Girls 9257276172 Call Girl in Jaipur Rajasthan

Ozhukarai Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Ozhukarai Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Call Girl Gorakhpur * 8250192130 Service starts from just ₹9999 ✅

Call Girl Gorakhpur * 8250192130 Service starts from just ₹9999 ✅

Ernakulam Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

Ernakulam Call Girls 👙 6297143586 👙 Genuine WhatsApp Number for Real Meet

❤️♀️@ Jaipur Call Girls ❤️♀️@ Jaispreet Call Girl Services in Jaipur QRYPCF ...

❤️♀️@ Jaipur Call Girls ❤️♀️@ Jaispreet Call Girl Services in Jaipur QRYPCF ...

9316020077📞Goa Call Girls Numbers, Call Girls Whatsapp Numbers Goa

9316020077📞Goa Call Girls Numbers, Call Girls Whatsapp Numbers Goa

VIP Call Girl Sector 88 Gurgaon Delhi Just Call Me 9899900591

VIP Call Girl Sector 88 Gurgaon Delhi Just Call Me 9899900591

IRS Clarifies How Health FSA Carryovers Affect HSA Eligibility

- 1. This Compliance Bulletin is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. © 2014 Zywave, Inc. All rights reserved. IRS Clarifies How Health FSA Carryovers Affect HSA Eligibility Provided by The Gardner Group On March 28, 2014, the Internal Revenue Service (IRS) released an Office of Chief Counsel Memorandum to provide information on how health flexible spending account (FSA) carryovers affect eligibility for health savings accounts (HSAs). Although the IRS memorandum is not official guidance, it helps clarify the IRS’ position on health FSA carryovers and HSA eligibility. In the memorandum, the IRS provides that an individual who carries over unused funds from a prior year to a current year under a general purpose health FSA will not be eligible for HSA contributions for the entire current plan year (even for months after the health FSA no longer has any amounts available to pay or reimburse medical expenses). However, the memorandum offers some alternative approaches that allow health FSA carryovers while preserving HSA eligibility. These approaches include carrying over unused amounts to an HSA-compatible health FSA and allowing individuals participating in a general purpose FSA to decline or waive the carryover. Health FSA Carryovers In general, health FSAs are subject to a “use-or- lose” rule that requires any unused funds at the end of the plan year (plus any applicable grace period) to be forfeited. On Oct. 31, 2013, the IRS released Notice 2013- 71, which relaxed the use-or-lose rule. Under the relaxed rule, employers with health FSAs may allow participants to carry over up to $500 in unused funds into the next plan year. The carryover of up to $500 may be used to pay or reimburse medical expenses incurred during the entire plan year to which the health FSA is carried over. This carryover provision is different than a health FSA’s run-out period, which is a period immediately after the end of the plan year when a participant may submit claims for expenses incurred during the plan year. A health FSA may be amended to include the carryover feature only if the plan does not also incorporate the grace period rule. Also, a health FSA may specify a lower carryover amount than the $500 maximum, and has the option of not permitting carryovers at all. Any unused amount in excess of $500 (or a lower amount specified in the plan) remaining at the end of the run-out period for the plan year will be forfeited. • A health FSA may allow for carryovers of up to $500 in unused funds. • Carryovers under general purpose health FSAs will disqualify individuals from HSA contributions. • And then here is a little more • And a little more • The IRS has provided some carryover options that may preserve HSA eligibility, including carryovers to HSA-compatible FSAs and carryover waivers. An individual who has coverage under a general purpose health FSA solely as a result of a carryover of unused amounts from the prior year is not eligible for HSA contributions.

- 2. For ease of administration, a health FSA is permitted to treat reimbursements of all claims for expenses that are incurred in the current plan year as reimbursed first from unused amounts credited for the current plan year and, only after exhausting these current plan year amounts, as then reimbursed from unused amounts carried over from the prior plan year. HSA Eligibility Only an eligible individual may establish an HSA and have HSA contributions made on his or her behalf. To be HSA-eligible, an individual must be covered under a high deductible health plan (HDHP) and generally may not be covered under a health plan that is not an HDHP. An individual who is covered by a health FSA is eligible for HSA contributions only if the health FSA is HSA-compatible (that is, a limited purpose health FSA or a post-deductible health FSA). Thus, an individual who is covered by a health FSA that pays or reimburses all qualified medical expenses (that is, a general purpose health FSA) is not an eligible individual for purposes of HSA contributions. This disqualification extends to the entire plan year, even if the health FSA has paid or reimbursed all amounts prior to the end of the plan year. FSA Carryovers and HSA Eligibility The IRS memorandum addresses how the carryover of unused amounts under a health FSA from a prior plan year affects an individual’s HSA eligibility during the current plan year. Carryovers to General Purpose Health FSAs The IRS memorandum provides that an individual who has coverage under a general purpose health FSA solely as a result of a carryover of unused amounts from the prior year is not eligible for HSA contributions. This rule applies regardless of the amount available from the health FSA for any month during the plan year. Thus, the individual’s ineligibility for HSA contributions continues for the entire health FSA plan year, even for months in the plan year after the health FSA no longer has any amounts available to pay or reimburse medical expenses. A cafeteria plan may provide that if an individual participates in a general purpose health FSA that provides for a carryover of unused amounts, the individual may elect prior to the beginning of the following year to decline or waive the carryover for the following year. In that case, the individual who declines or waives the carryover under the terms of the cafeteria plan may contribute to an HSA during the following year (assuming he or she meets the other tax rules for HSA eligibility). Carryovers to HSA-compatible Health FSAs An individual who participates in a general purpose health FSA and elects for the following year to participate in an HSA-compatible health FSA may elect to have any unused amounts from the general purpose health FSA carried over to the HSA-compatible health FSA. This individual is eligible for HSA contributions during the following year (assuming he or she meets the other tax rules for HSA eligibility). There is no requirement that the unused amounts in the general purpose health FSA only be carried over to a general purpose health FSA. However, the carryover amounts may not be carried over to a non-health FSA or another type of cafeteria plan benefit. A cafeteria plan that offers both a general purpose health FSA and an HSA-compatible health FSA may automatically treat an individual who elects coverage in an HDHP for the following year as enrolled in the HSA- compatible health FSA and carry over any unused amounts from a general purpose health FSA to the HSA-compatible health FSA for the following year. Administration During Run-out Period If an individual elects to carry over unused amounts from a general purpose health FSA to an HSA-compatible health FSA, the uniform coverage rules may be applied during the run-

- 3. out period of the general purpose health FSA as follows: The unused health FSA amounts may be used to reimburse any allowed medical expenses incurred prior to the end of the general purpose health FSA plan year. Any claims covered by the HSA-compatible health FSA must be reimbursed in a timely fashion up to the amount elected for the HSA-compatible health FSA plan year. Any claims in excess of the elected amount may be reimbursed after the run-out period when the amount of any carryover is determined. Example: Employer offers a calendar-year general purpose health FSA and a calendar- year HSA-compatible health FSA. Both FSAs provide for a carryover of up to $500 of unused amounts and do not have a grace period. Employee has an unused amount of $600 in the general purpose health FSA on Dec. 31 of Year 1. Prior to Dec. 31 of Year 1, Employee elects $2,500 in the HSA-compatible health FSA for Year 2 and elects to have any carryover go to the HSA-compatible health FSA. Employee also elects coverage by an HDHP for Year 2. In January of Year 2, Employee incurs and submits a claim for $2,700 in dental care covered by the HSA-compatible health FSA. The plan reimburses $2,500, the amount elected, in a timely fashion. In February of Year 2, Employee submits and is reimbursed from the general purpose health FSA for $300 in medical expenses incurred prior to Dec. 31 of Year 1. At the end of the run-out period, $300 in the general purpose health FSA is unused and carried over to the HSA-compatible health FSA. Employee is then reimbursed $200 for the excess of the January claim over the amount elected for the HSA-compatible health FSA. Employee has $100 remaining in the HSA- compatible health FSA to be used for expenses incurred in the year or carried over to the next year. Employee is allowed to contribute to an HSA as of Jan. 1 of Year 2.