LLB_ibotta_wrapup

•

0 likes•353 views

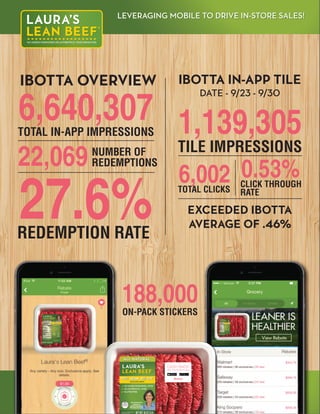

This document discusses how the Ibotta app and in-app tiles can be leveraged to drive in-store sales. The key metrics shown are that the Ibotta app had over 6.6 million total impressions and a 0.53% click through rate for its in-app tiles. It also highlights that Ibotta newsletters had a 4.5% click through rate, with most redemptions coming from retailers like Kroger, Target, and Meijer. Basket sizes were shown to be larger at retailers like Sam's Club when people used Ibotta compared to when they did not.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (11)

Mobile analytics best practices to steer your multi device strategy

Mobile analytics best practices to steer your multi device strategy

Internet of Things: From Everyday Devices to Conduits of Commerce

Internet of Things: From Everyday Devices to Conduits of Commerce

Similar to LLB_ibotta_wrapup

Similar to LLB_ibotta_wrapup (20)

Digital 2019 Southeast Asia Ecommerce Spotlight (September 2019) v01

Digital 2019 Southeast Asia Ecommerce Spotlight (September 2019) v01

Bridging the Gap: Thriving in the Real Estate Revolution with Stand-Out Exper...

Bridging the Gap: Thriving in the Real Estate Revolution with Stand-Out Exper...

Financial Results for the 2nd Quarter of the Fiscal Year Ending March 2016

Financial Results for the 2nd Quarter of the Fiscal Year Ending March 2016

Digital Marketing Insights report worldwide -October 2019

Digital Marketing Insights report worldwide -October 2019

Digital 2019 Q4 Global Digital Statshot (October 2019)

Digital 2019 Q4 Global Digital Statshot (October 2019)

Nextopia global-purchase-behavior-ecommerce-infographic

Nextopia global-purchase-behavior-ecommerce-infographic

Go pro investor relations presentation august 2017

Go pro investor relations presentation august 2017

LLB_ibotta_wrapup

- 1. LEVERAGING MOBILE TO DRIVE IN-STORE SALES!LEVERAGING MOBILE TO DRIVE IN-STORE SALES!LEVERAGING MOBILE TO DRIVE IN-STORE SALES! IBOTTA OVERVIEW IBOTTA IN-APP TILE EXCEEDED IBOTTA AVERAGE OF .46% DATE - 9/23 - 9/30 CASH BACK With The Free Ibotta App NUMBER OF REDEMPTIONS22,069 TOTAL IN-APP IMPRESSIONS 6,640,307 TILE IMPRESSIONS 1,139,305 REDEMPTION RATE 27.6% TOTAL CLICKS 6,002 CLICK THROUGH RATE 0.53% ON-PACK STICKERS 188,000

- 2. LEVERAGING MOBILE TO DRIVE IN-STORE SALES!LEVERAGING MOBILE TO DRIVE IN-STORE SALES!LEVERAGING MOBILE TO DRIVE IN-STORE SALES! IBOTTA NEWSLETTER REDMEPTIONS PER RETAILER EXCEEDED IBOTTA AVERAGE OF 4.0% 16,028 CLICK THROUGH RATE 4.5% KROGER 8,605 39% TARGET 6,703 27.5% MEIJER 1,235 5.6% FRY’S 590 2.7% GIANT 555 2.5% TOTAL CLICKS REDEMPTIONS BY STATE TX 2,116 9.6% GEORGIA 1,419 6.4% MICHIGAN 1,323 6.0% KENTUCKY 1,238 5.6% OHIO 1,`183 5.4% BASKET RING SIZE SAM’S CLUB $321.60 206.53 WITH W/O QFC $143.75 $77.83 RALPHS $133.62 $72.28 TARGET $132.13 $80.21 DILLIONS $150.96 $109.06