Event Note Proposal On Freeing Savings Bank Rate

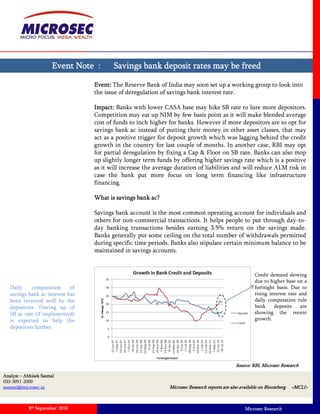

- 1. Event Note : Savings bank deposit rates may be freed Event: The Reserve Bank of India may soon set up a working group to look into the issue of deregulation of savings bank interest rate. Impact: Banks with lower CASA base may hike SB rate to lure more depositors. Competition may eat up NIM by few basis point as it will make blended average cost of funds to inch higher for banks. However if more depositors are to opt for savings bank ac instead of putting their money in other asset classes, that may act as a positive trigger for deposit growth which was lagging behind the credit growth in the country for last couple of months. In another case, RBI may opt for partial deregulation by fixing a Cap & Floor on SB rate. Banks can also mop p g y g p p up slightly longer term funds by offering higher savings rate which is a positive as it will increase the average duration of liabilities and will reduce ALM risk in case the bank put more focus on long term financing like infrastructure financing. What is savings bank ac? Savings bank account is the most common operating account for individuals and others for non-commercial transactions. It helps people to put through day-to- day banking transactions besides earning 3.5% return on the savings made. Banks generally put some ceiling on the total number of withdrawals permitted during specific time periods. Banks also stipulate certain minimum balance to be maintained in savings accounts. Credit demand slowing due to higher base on a Daily computation of fortnight basis. Due to savings bank ac interest has rising interest rate and been received well by the daily computation rule depositors. Freeing up of bank deposits are SB ac rate (if implemented) showing the recent h i h is expected to help the growth. depositors further. Source: RBI, Microsec Research Analyst – Abhisek Sasmal 033-3051-2000 asasmal@microsec.in Microsec Research reports are also available on Bloomberg <MCLI> 8th September’ 2010 Microsec Research

- 2. Banks with low CASA & reasonable CDR may go for higher Savings deposit rate Lower CASA base impedes banks in generating higher spreads over its cost of funds. Banks with higher CASA base usually deployed their incremental deposits towards higher yielding advances. We believe that further improvement in NIM for banks with high CDR (>70%) high ( 70%) & hi h CASA ( 30%) would b diffi lt as b k would need t i (>30%) ld be difficult banks ld d to invest a part of t t f their incremental deposits to meet the NDTL requirement of 25%. Public Sector Bank CASA ratio NIM% Cost of liabilities CDR FY09 FY10 FY09 FY10 FY09 FY10 FY09 FY10 Allahbad bank 34.60 34.50 2.21 2.18 6.06 5.32 69.2 67.52 Andhra bank 31.00 29.43 2.38 2.43 6.17 5.17 74.32 72.23 Bank of Baroda 29.60 29.65 2.25 2.13 5.03 4.23 74.84 72.62 Bank of India 26.76 27.80 2.44 2.10 5.45 4.81 75.33 73.33 Canara Bank 30.00 29.00 2.15 2.15 6.40 5.40 73.96 72.2 Central Bank 33.40 34.60 1.51 1.40 6.23 5.77 65.12 65 Corporation Bank 31.44 28.60 1.95 1.98 5.55 5.00 65 68 Dena B k D Bank 34.80 34 80 35.60 35 60 2.20 2 20 1.91 1 91 5.53 5 53 5.66 5 66 67 69 IOB 30.55 32.55 2.37 2.42 6.35 5.91 74.8 71.3 IDBI Bank 14.80 14.60 0.72 0.97 6.80 6.21 92 82.4 OBC 23.75 24.97 1.77 2.12 6.77 5.87 69 69 PNB 38.50 40.83 2.85 2.87 5.74 4.82 74 75 UCO 24.11 24.65 1.47 1.69 6.33 5.60 69 67 Banks with Lows CASA Union Bank 30.17 31.00 2.37 2.15 5.66 5.26 69 70 base and low CDR ratio Vijaya Bank j y 24.00 24.62 1.80 2.06 7.46 6.03 65 67 are sure to increase competition if the Private sector bank CASA ratio NIM% Cost of liabilities CDR proposal goes through. FY09 FY10 FY09 FY10 FY09 FY10 FY09 FY10 Axis bank 43.15 46.73 2.50 2.77 5.38 4.20 69.48 74 Bank of Rajasthan 27.41 32.79 2.19 1.94 6.57 6.80 51 55 City Union Bank 18.90 21.86 2.62 2.41 6.85 6.60 69 66 Development credit bank 31.00 35.40 3.32 2.31 8.97 6.17 70.5 72.3 Dhanalaxmi bank 24.30 21.86 2.16 1.74 5.77 5.50 64.3 70.53 HDFC Bank 44.40 52.00 4.05 3.77 6.12 4.48 69 75.2 ICICI Bank 28.70 41.90 2.21 2.23 7.30 5.94 99 89.7 Indusind Bank 19.24 23.70 1.66 2.51 7.72 6.00 71 77 ING Vysya Bank 27.00 32.50 2.04 2.45 5.66 4.75 67 72 J&K Bank 38.11 40.61 2.65 2.63 5.85 5.05 63.4 61.9 Karnataka Bank 19.95 23.26 2.07 1.24 7.10 7.09 58 61 Kotak Mahindra Bank 33.00 33 00 31.00 31 00 5.30 5 30 4.96 4 96 6.91 6 91 4.65 4 65 NA 87 Lakshmi Vilas Bank 16.88 17.22 1.85 2.40 6.82 7.15 71.3 69 South Indian Bank 23.80 23.13 2.57 2.23 6.35 5.94 65.5 68.8 YES Bank 8.73 10.52 2.22 2.20 8.13 5.40 76.7 82.7 Source: Bloomberg, Microsec Research 8th September’ 2010 Microsec Research Research Microsec

- 3. Kolkata Investment Banking Azimganj House, 2nd Floor d 7, Camac Street, Kolkata – 700 017, India Tel: 91 33 2282 9330, Fax: 91 33 2282 9335 Brokerage and Wealth Management Shivam Chambers, 1st Floor 53, 53 Syed Amir Ali Avenue Kolkata – 700 019 India Avenue, 019, Tel: 91 33 3051 2000, Fax: 91 33 3051 2020 Mumbai 74 A, Mittal Tower, 7th Floor 210, Nariman Point, Mumbai – 400 021, India Tel: 91 22 2285 5544, Fax: 91 22 2285 5548 Email: info@microsec.in www.microsec.in Disclaimer This document is prepared by the research team of Microsec Capital Ltd. (hereinafter referred as “MCL”) circulated for purely information purpose to the authorized recipient and should not be replicated or quoted or circulated to any person in any form. This document should not be interpreted as an Investment / taxation/ legal advice. While the information contained in the report has been procured in good faith, from sources considered to be reliable, no statement in the report should be considered to be complete or accurate. Therefore, it should only be relied upon at one’s own risk. MCL is not soliciting any action based on the report. No indication is intended from the report that the transaction undertaken based on the information contained in this report will be profitable or that they will not result in losses. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advisors, as they believe necessary. We and our affiliates, officers, directors, and employees, including persons involved in the preparation or issuance of this material may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation discussed herein or act as advisor or lender I borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. Neither the Firm, nor its directors, employees, agents, representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. 8th September’ 2010 Microsec Research