2018 KPMG Nigeria Banking Industry Customer Satisfaction Survey Highlights

•

0 likes•70 views

Highlights of the 12th edition of the annual customer experience survey conducted by KPMG.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

2008 KPMG Nigeria Banking Industry Customer Satisfaction Survey

2008 KPMG Nigeria Banking Industry Customer Satisfaction Survey

2019 KPMG Nigeria Banking Industry Customer Experience Survey

2019 KPMG Nigeria Banking Industry Customer Experience Survey

Informe sobre Responsabilidad Social Corporativa 2013

Informe sobre Responsabilidad Social Corporativa 2013

2014 top 10 retail banking trends and predictions powerpoint

2014 top 10 retail banking trends and predictions powerpoint

World Retail Banking Report 2015 from Capgemini and Efma

World Retail Banking Report 2015 from Capgemini and Efma

Real-Time Customer Interactions via SMS (Juntos and Mynt)

Real-Time Customer Interactions via SMS (Juntos and Mynt)

201407 Digital Disruption in Banking - Accenture Consumer Digital Banking Sur...

201407 Digital Disruption in Banking - Accenture Consumer Digital Banking Sur...

Similar to 2018 KPMG Nigeria Banking Industry Customer Satisfaction Survey Highlights

Similar to 2018 KPMG Nigeria Banking Industry Customer Satisfaction Survey Highlights (20)

Hello You: Transforming the Customer Conversation in FS

Hello You: Transforming the Customer Conversation in FS

World Retail Banking Report 2014 from Capgemini and Efma

World Retail Banking Report 2014 from Capgemini and Efma

Investments in Customer Centricity Are Seeing Dividends for Financial Service...

Investments in Customer Centricity Are Seeing Dividends for Financial Service...

Eyes wide shut: Global insights and actions for banks in the digital age

Eyes wide shut: Global insights and actions for banks in the digital age

201407 Global Insights and Actions for Banks in the Digital Age - Eyes Wide Shut

201407 Global Insights and Actions for Banks in the Digital Age - Eyes Wide Shut

2014 KPMG Nigeria Banking Industry Customer Satisfaction Survey

2014 KPMG Nigeria Banking Industry Customer Satisfaction Survey

Whitepaper_E_Customer centricity the survival strategy for Japanese lenders

Whitepaper_E_Customer centricity the survival strategy for Japanese lenders

Future of South East Asia Digital Financial Service

Future of South East Asia Digital Financial Service

AGE OF EXPERIENCE, TRENDS RESHAPING THE FUTURE OF CUSTOMER SERVICE, by Gesner...

AGE OF EXPERIENCE, TRENDS RESHAPING THE FUTURE OF CUSTOMER SERVICE, by Gesner...

Accenture Distribution and Agency Management Survey: Reimagining insurance di...

Accenture Distribution and Agency Management Survey: Reimagining insurance di...

Recently uploaded

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Recently uploaded (20)

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

New 2024 Cannabis Edibles Investor Pitch Deck Template

New 2024 Cannabis Edibles Investor Pitch Deck Template

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

2018 KPMG Nigeria Banking Industry Customer Satisfaction Survey Highlights

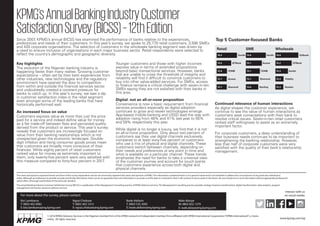

- 1. Key highlights The evolution of the Nigerian banking industry is happening faster than many realise. Growing customer expectations – often set by their best experiences from other industries, new technologies and the regulatory environment have opened the door to competition from within and outside the financial services sector and undoubtedly created a constant pressure for banks to catch up. In this year’s survey, we saw a dip in customer satisfaction index in the retail segment even amongst some of the leading banks that have historically performed well. An increased focus on value Customers express value as more than just the price paid for a service and indeed define value for money as a fair trade-off between fees and perceived quality derived from the product or service. This year’s survey reveals that customers are increasingly focused on value from their banking relationships which is not unexpected given the economic landscape. Double- digit inflation and rising consumer goods prices mean that customers are broadly more conscious of their finances. While eighty percent of retail customers ranked value for money as extremely important to them, only twenty-five percent were very satisfied with this measure compared to forty-four percent in 2017 . Younger customers and those with higher incomes express value in terms of extended propositions beyond basic transactional services. However, banks that are unable to cross the threshold of integrity and reliability will find it difficult to convince customers to buy into other value-added services. For SMEs, access to finance remains a critical challenge with seven-in-ten SMEs saying they are not satisfied with their banks in this area. Digital: not an all-or-none proposition Convenience is now a basic requirement from financial services providers especially as digital adoption continues to grow and newer technologies emerge. App-based mobile banking and USSD lead the way with adoption rising from 48% and 41% last year to 55% and 59% respectively this year. While digital is no longer a luxury, we find that it is not an all-or-none proposition. Only about two percent of customers say they use digital channels exclusively, compared to at least sixty-five percent of customers who use a mix of physical and digital channels. These customers switch between channels, depending on their needs and preferences at any point in time and what is available on a particular channel. These trends emphasise the need for banks to take a universal view of the customer journey and account for touch points that customers experience across both digital and physical channels. Continued relevance of human interactions As digital shapes the customer experience, we continue to see the value of human interactions as customers seek conversations with their bank to resolve critical issues. Seven-in-ten retail customers ranked staff willingness to assist as an extremely important factor. For corporate customers, a deep understanding of their business needs continues to be important to strengthening the banking relationship. However, less than half of corporate customers were very satisfied with the quality of their bank’s relationship management. Since 2007 , KPMG’s annual BICSS has examined the performance of banks relative to the experiences, preferences and needs of their customers. In this year’s survey, we spoke to 25,770 retail customers, 3,590 SMEs and 420 corporate organisations. The selection of customers in the wholesale banking segment was driven by a need to ensure inclusion of organisations in each major business sector. Retail respondents were selected to reflect the country’s demographic and geographic diversity. The views and opinions expressed herein are those of the survey respondents and do not necessarily represent the views and opinions of KPMG. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. The annual Banking Industry Customer Satisfaction Survey (BICSS) is a publication of the Management Consulting practice of KPMG Advisory Services. The Management Consulting practice provides strategy, business transformation, digital transformation, data analytics, program management and human resources advisory services. © 2018 KPMG Advisory Services is the Nigerian member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. KPMG’sAnnualBankingIndustryCustomer SatisfactionSurvey(BICSS)–12thEdition For more about the survey, please contact: Bisi Lamikanra T: 0803 402 0982 E: bisi.lamikanra@ng.kpmg.com Bode Abifarin T: 0803 535 3092 E: bode.abifarin@ng.kpmg.com Wale Abioye M: 0802 832 1379 E: wale.abioye@ng.kpmg.com Ngozi Chidozie T: 0803 402 1013 E: ngozi.chidozie@ng.kpmg.com Interact with us on social media: www.kpmg.com/ng 72.7 72.7 72.8 74.5 76.2 Zenith Retail SME Wholesale GTBank FCMB Access Diamond 73.6 73.7 74.1 75.1 Zenith Access FCMB Diamond Sterling 72.3 72.4 74.3 75.2 78.8 Zenith Citibank GTBank Stanbic Fidelity 75.8 Top 5 Customer-focused Banks