Rcca e news (1st edition)

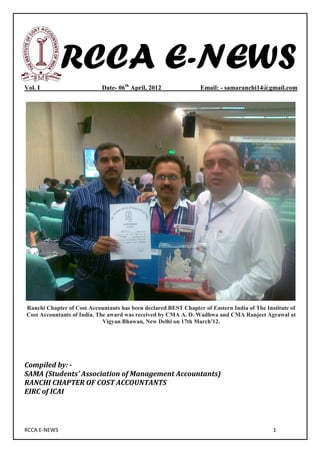

- 1. RCCA E-NEWS Vol. I Date- 06th April, 2012 Email: - samaranchi14@gmail.com Ranchi Chapter of Cost Accountants has been declared BEST Chapter of Eastern India of The Institute of Cost Accountants of India. The award was received by CMA A. D. Wadhwa and CMA Ranjeet Agrawal at Vigyan Bhawan, New Delhi on 17th March'12. Compiled by: - SAMA (Students’ Association of Management Accountants) RANCHI CHAPTER OF COST ACCOUNTANTS EIRC of ICAI RCCA E-NEWS 1

- 2. Patron’s Communique Communique Dear Students, It is a matter of great pride for me that my students of Ranchi Chapter of ICAI (earlier ICWAI) have not only formed SAMA (Students' Association of Management Accountants) but now coming out with its official mouthpiece in the form of this e-newsletter. It shows the management capacity of our students and hence, proves that we are really Management Accountants. Newsletter of any organization discusses the activities of the organization and provides a platform to its members to discuss different professional issues for mutual benefits. I am confident that this e-news letter will serve the above purpose. I congratulate the students of Ranchi Chapter of ICAI for coming out with this newsletter and pray for their success. I am really proud of them. Regards, Ajay Deep Wadhwa, FCMA wadhwa103@yahoo.co.in RCCA E-NEWS 1

- 3. Chairman’s Communique Dear All, As you all know that reading is a very good habit and it always helps us to know about the new things and let our self updated with the changes of world. As a professional we should keep our self updated with the changes in corporate world which is changing and growing very rapidly. Presently, all the companies are searching for Leaders & Managers who can do smart work and for this we have to keep grooming our personalities, our writing skills, our talents etc. In Ranchi Chapter you mostly see that students are very active in all the parts and their personality gets changed by the time passes. As I always think from my beginning of ICAI (Earlier ICWAI, The Institute of Cost & Works Accountants of India) course that how the Personalities keep themselves updated and know about so many things and not only they keep it with themselves but they tell others so nicely that others also learn from it. With all these thinking I came to a point that it is all about reading and writing regularly and then decision of publishing RCCA News (e-magazine)came to mind and then we all discussed together with our Patron A. D. Wadhwa Sir and Faculty members of Ranchi Chapter and they appreciated as they always use do with we students. We will publish articles and so many things by which we can get to know about the changes and new things with every issue of this e-magazine and of course things related to study also. In this magazine we will publish articles written by students, so you are having an opportunity to get your articles published here, and in every issue we will select an article written by student to get published in EIRC News which publishes in Eastern India of ICAI. I would like tell you a story happened with me once: A well-known speaker started off his seminar by holding up a Rs. 500 note. In the room of 50 People, He asked, "Who would like this Rs. 500 note?" Hands started going up. He said, "I am going to give this note to one of you but first let me do this." He proceeded to crumple the note up. He then asked, "Who still wants it?" Still the hands were up in the air. "Well," he replied, "What if I do this?" And he dropped it on the ground and started to grind it into the floor with his shoe. He picked it up, now all crumpled and dirty. "Now who still wants it?" Still the hands went into the air. "My friends, you have all learned a very valuable lesson. No matter what I did to the money. You still wanted it because it did not decrease in value. It was still worth Rupee 500/-. Many times in our lives, we are dropped, crumpled, and ground into the dirt by the decisions we make and the circumstances that come our way. We feel as though we are worthless. But no matter what has happened or what will happen. Never lose your value. You are special. Don't ever forget it! Never let yesterday's disappointments overshadow tomorrow's dreams. "VALUE HAS A VALUE ONLY IF ITS VALUE IS VALUED" With moving, I would like to thank our guiders for their support, Manish, Neha, Shashi and Nikunj for compiling this e-magazine under the planning of Pawan (Vice-chairman, SAMA) and also like to thank all the persons who helped us directly or indirectly for publishing this e-magazine. We will keep our magazines improving time to time by your suggestion so keep giving us your valuable comments on the magazine for improvement. Waiting for your reply…………… Diptesh Nawal Chairman, SAMA, Ranchi dipnawal@yahoo.com RCCA E-NEWS 1

- 4. COMMITTEE MEMBER OF RCCA 1. Mr. A. K. Sao, Chairman 2. Mr. Sanjay Kr. Singh, Vice-chairman 3. Mr. Ranjit Kr. Agarwal, Secretary 4. Mr. Vidyadhar Prasad, Treasurer PATRONS of SAMA 1. Mr. A. D. Wadhwa 2. Mr. Ranjit Kr. Agarwal EXECUTIVE MEMBERS OF SAMA, RANCHI 1. Diptesh Nawal, Chairman 2. Pawan Kumar, Vice Chairman 3. Rajeev Kumar Gupta, Secretary 4. Ekta Arya, Treasurer COMMITTEE MEMBERS OF SAMA, RANCHI 1. Manish Kumar Tiwari 2. Manjeeta Rana 3. Nikunj Poddar 4. Neha Kumari 5. Gautam Kumar Pandey COMPILERS OF E-MAGAZINE Pawan Kumar Shashi Kr. Pandey Nikunj Poddar Neha Kumari Vice Chairman Member Committee Member Committee Member RCCA E-NEWS 1

- 5. ROLE OF FUTURE CMA’S IN CAPITAL MARKET Swati Kumari Student, RCCA of ICAI Email: - swatiakki123@gmail.com As the outset we should know about Capital Market. It is divided into two categories i.e., Money Market & Share Market. The latter incorporates all types of shares, debentures & bonds etc. We shall now focus on the mechanism of Share Market. Share can be defined as the smallest unit or component of the capital market. Broadly shares can be classified into Equity Shares, Preference Shares, Bonus Share and Sweat Equity Share. Now to address the topic at hand, the precise role of future CMAs in the Capital Market. No doubt we are basically familiar with the job profile of CMAs; I would like to make some points at this stage. The most critical aspect of CMAs has to do with Investment. Regarding Investors, It is classified in Individual, QIB (Qualified Institutional Buyers) & HNI (High Net-worth Individual). Let’s precedes the matter by discussing the real problems faced by the new investors. Prospective investors with large amount of funds at their disposal are generally seen to be wary of investing their money, as many times happens to get nil returns etc. The root of primary cause of their reluctance to shoulder the risk factor is the lack of sound financial advisors or fund counselors to aid them to channelize their money. At this situation CMAs can really come in handy, since they are well connected with the exact nature & behavior of the roller coaster share market. They can show the way forward through lecture-cum- demonstrations, presentations about the management etc. They can offer the range of services including talking of future plans, vision & mission of the organization. Providing financial blue print strategies & landing their financial hindsight. Also it must be kept in mind that CMAs are the ones who maintain the primary valuation of shares which are listed on the Share Market. As such they are expected to foresee the trends & render accurate advice to potential investors. He / She also possess comparatively better & relevant ideas and concepts about the capital structure of the particular company. Ratio analysis yields the perfect knowledge about the gross profit, Net profit, capital assets & current liabilities & many significant points too. Apart from shares but not much a new investment funds been also accompanying in the market. It’s very true, it is non-other than mutual funds. General public basically don’t have any specific ideas regarding the investment made. How to enter & get into flow with the funds and market up & downs. How to step (invest), when is the correct time, according to the flow of markets which company would give better return and why to invest in Mutual Funds in spite of investing or introducing directly to share in open market. Above questions are very genuine and relevant in sight of investors to company as well. Because of numerous companies has captured the Market and the customer different plans, strategies, schemes, refund & lots of formalities RCCA E-NEWS 1

- 6. not only puzzle them but also misguided them too, Which lead them back with the fear of losing their huge amount. Lots of formalities, practices & procedures are required while doing investment or buying & selling of any instruments of Capital Market. In earlier days all transactions were done manually and took lots of time but today it’s not so. Every company is running with the waves of modern and high technique. To cope-up with them each & every individual requires being as observant as they are, which is quite impossible but here CMAs can favor the investor in dealing in the Share Market by opening Demat A/c & accomplishing future formalities & hurdles. Earlier it has been discussed that, cost accountant can act as an investment advisor. So, simultaneously they can also solve the queries & grievances of public being as middleman between public or investors and financial institutions like SEBI & RBI. Further the institutions strategies goes on and finally taken into consideration. Not only this, a Cost Accountant can meet the public as a share brokers. AS far as their sound knowledge is concern, they can perform the above said job very well and efficiently. Through motivation they can repulse the General Public towards investment. At the end, I would like to conclude the topic by saying that CMAs should implement ideas which are easy & convenient for the public to understand & instead of being wary they feel it satisfactory & ease. With Best Compliments from………………… Manohar Lal Smriti RANCHI (An organisation to motivate and help students of ICAI) Phone: - 0651-2560572 Country First………. RCCA E-NEWS 1

- 7. Audit Material Shashi Kr. Pandey & Nikunj Poddar ICAI (INTER) 1. Management Audit 1. Management Audit is an Independent Appraisal Activity. 2. Purpose: To find Out efficiency of Internal Control System. 3. Scope: Very wide than any other Audit. 4. Periodicity: Once in 2-3 Years. 5. Management Auditor has to report to Top Management. 6. Report Submitted to M.D/Executive Director. 7. Management Audit covers that all activities for which Top Management is Responsible. Who will Conduct Management Audit? 1. Company Talent – include - Administrative Staff - Audit Committee 2. Outside Management Consultant - CA - CWA - MANAGEMENT CONSULTANT 2. CARO-2003 1. CARO is A Modified version of MAOCARO. 2. CARO=Companies Auditor’s Report Order, 2003 3. CARO, 2003 is issued by Central Government. 4. Required to follow each and every Company but Exemption is there. 5. Following Indian Company are Exempted from the Provision Of CARO: - Banking Company - Insurance Company - Private Ltd Company which are Exempted Less Then Whose 50 Lakh Paid Up Capital + Reserves 500 Lakh Annual Turnover - Company licensed to operate as per the provisions of Sec.25 of Companies Act. 6. As per CARO,2003 Auditor has to give Expert Opinion On Following issues on Auditors’ Report: - Fixed Assets - Inventory - Loans - Public Deposits - Sickness - Fraud - Maintenance Of Cost Records - Internal Audit System - Financial Management etc. 7. To give Expert Comment is mandatory for the Auditor RCCA E-NEWS 1

- 8. 3. Branch Audit 1. Normally Company Auditor shall be appointed as a Branch Auditor. 2. Normally: Branch Auditor=Branch Auditor 3. Duty: - To Prepare Branch Audit Report - Forward Report to Company Auditor - If Company Auditor = Branch Auditor, No Need to prepare Branch Auditor. 4. Right: - Right to access Books, Accounts, Vouchers. - Right to Obtain Information and Expenses. - Right to Visit Branch. 5. Do not have a Right: - To receive Notice of General Meeting. - To Attend and participate such General Meeting. 6. Remuneration: - Remuneration received from General Meeting/BOD (as decided in General Meeting). 4. Audit Committee 1. Sec.292 (A) Company Act.1956 Apply. 2. Mandatory for: - Public Company - Having Paid Up Capital 3. Minimum: - Out Of Members minimum 3 must be Director. - Out of Directors minimum 2/3 must be M.D/W.T.D 4. Duty: - Interact with Auditors about A. Internal Control B. Financial Statement 5. Act as Suggested by B.O.D 6. Scope And Function Of Audit Committee 1. Review of Financial Statement before submission to Board of Directors 2. Selection of Statutory Auditors to be recommended for Appointment 3. To act as Liaison between Statutory Auditor and Board Of Directors 4. Administrative Control of internal control function. 5. To select and Establish Accounting Policies. 6. Review financial Statements and seek clarification from the statutory Auditors. 7. Maintain Internal Audit Operation. 8. Review Expense Accounts of Senior Officers. 7. Benefits Of Audit Committee 1. Ensures reliability and credibility of the functionality of the Management. 2. Helps Board of Directors in discharging their functions properly. 3. Act as a communication link between Internal Auditor, Statutory Auditor & Board of Directors. 4. Act as Evidence in litigation cases in which Board of Directors and other officials of the organization might be involved. 5. Presentation and Publication of statements relating to Financial Position and Business Operation. To be continued with next issue........ RCCA E-NEWS 1

- 9. CONVERGENCE WITH IFRS Pawan Kumar M.Com, ICAI (INTER) Ranchi Chapter of Cost Accountant Email- pawaniinrg@gmail.com India has been seeing a lot of changes in the legal and regulatory environment in the recent time including New Direct Tax Code, Companies Bill, 2009, Goods & Service Tax (GST) and Adoption of IFRS, even though all these proposed changes are presently in draft form. Keeping in view the fact that International Financial Reporting Standards (IFRS) are fast becoming the global accounting and financial reporting language, Indian accounting practices are set to converge with IFRS from 01.04.2011 in a phased manner as announced by Ministry of Corporate Affairs and The Institute of Chartered Accountants of India (ICAI). More than 100 countries all over the world have already adopted IFRS and many more including India, Korea, Brazil and Canada have committed to make the transition by 2011. How IFRS Can Be Adopted? IASB recognizes two ways of adopting IFRS by the member countries. These ways are: 1. Adopting IFRS in verbatim 2. Convergence with IFRS While the former refers to replacing the national Accounting Standards with International Financial Reporting Standards, the latter incorporates the IFRS provisions in the national Accounting Standards to make those IFRS compliant. Convergence with IFRS Convergence with IFRS refers to achieving harmony of national accounting practices with IFRS. It may be important to note that as per Statement of Best Practices: Working Relationship between the IASB and other Accounting Standard-Setters issued by The International Accounting Standards Board (IASB), convergence with IFRS does not mean adoption of IFRS in to, but adoption of IFRS provisions. Hence, when the Indian standards will be converged to IFRS, the compliance with Indian Accounting Standards would automatically ensure compliance with IFRS. The Accounting Standards Board is however free to eliminate any optional treatments provided in IFRS or provide for any additional disclosure requirements in the road to convergence. Benefits of Convergence with IFRS 1) Improved Access to International Capital Markets – Comparable financial reporting across firms from different countries facilitates access to international capital markets. 2) Access to Low-cost Foreign Funds – Accounting and reporting on common accounting principles provide access to foreign funds through higher acceptability of the global accounting language, thereby leading to higher FII inflow and lower cost of capital. 3) Easier Comparability with Global Peers – Global reporting language in the form of IFRS is bound to facilitate the comparability of an enterprise with not only its national competitors but global peers as well. 4) Elimination of Multiple Reporting Costs – Multinationals having global operations in IFRS driven countries will find cost savings by having all their business units/investments on a common accounting platform. Further, the IFRS-compliant financial statements will eliminate multiple reporting in different accounting standards in different countries. 5) Opportunities for Professionals – Being a comparatively new subject, professionals with sound theoretical and practical knowledge of IFRS are certain to have more opportunities in the times to come. RCCA E-NEWS 1

- 10. IFRS & IAS – Are These Terms Synonymous? IFRS stands for International Financial Reporting Standards and includes Standards & Interpretations adopted by International Accounting Standards Board (IASB) including International Accounting Standards (IAS) and Interpretations developed by International Financial Reporting Interpretation Committee (IFRIC). Hence, IFRS is a wider term and includes previously issued IAS as well. IASB started issuing the standards using the term International Financial Reporting Standards (IFRS) to emphasize upon its commitment towards better financial reporting after some Accounting Scandals such as Enron came into picture. So, it should be made clear that 29 IAS and 8 IFRS issued by IASB stand at par in terms of financial accounting & reporting and when one talks of an entity being IFRS compliant, it covers the compliance of an entity with IAS as well. Roadmap to Convergence with IFRS Ministry of Corporate Affairs has constituted a Core Group for convergence of Indian Accounting Standards with International Financial Reporting Standards (IFRS). The group has a consensus on the fact that the convergence with IFRS is to be done in a phased manner based upon the public accountability of the company. Acknowledging the fact that there would be two categories of companies at any given point of time till the convergence process gets completed, the Core Group has agreed that there will be two separate sets of Accounting Standards u/s Section 211(3C) of Companies Act, 1956. 1. First set would comprise of the Indian Accounting Standards which have been converged with IFRSs which shall be applicable to the specified class of companies. 2. The second set would comprise of the existing Accounting Standards which would be applicable to the rest of the companies to which First Set of converged Accounting Standards is not applicable including Small & Medium Companies (SMCs). Phased Applicability of Converged Accounting Standards Types of Companies Date of Applicability & Specified Class of Companies Companies other than 01.04.2011 Companies which are part of NSE – Nifty 50 Banking Companies, NBFCs Companies which are part of BSE – Sensex 30 and Insurance Companies Companies whose shares or other securities are listed On stock exchanges outside India Companies, whether listed or not, which have a net Worth in Excess of Rs. 1000 crores. 01.04.2013 Companies, whether listed or not, which have a net worth exceeding Rs. 500 crores but not exceeding Rs. 1000 crores 01.04.2014 Listed Companies which have a net worth of Rs. 500 crores or Less Companies which do not fall into the above categories i.e. RCCA E-NEWS 1

- 11. Non - listed companies with net worth of Rs. 500 crores or less and whose shares or other securities are not listed on stock exchanges outside India, and Small & Medium Companies (SMCs) will not be required to follow the converged Accounting Standards, though they can voluntarily opt to do so. Banking Companies 01.04.2013 All scheduled commercial banks All Urban Co-operative Banks (UCBs) with net worth exceeding Rs. 300 crores 01.04.2014 Urban Co-operative Banks which have a net worth Exceeding Rs. 200 crores but not exceeding Rs. 300 crores Banks which do not fall into the above categories i.e. Urban Co-operative Banks with net worth of Rs. 200 crores or less, and Regional Rural Bank (RRBs) will not be required to follow the converged Accounting Standards, though they can voluntarily opt to do so. Insurance Companies 01.04.2012 for all the insurance companies NBFCs 01.04.2013 Companies which are part of NSE – Nifty 50 Companies which are part of BSE – Sensex 30 Companies, whether listed or not, which have a net worth in excess of Rs. 1000 crores. 01.04.2014 All listed NBFCs Unlisted NBFCs which have a net worth exceeding Rs. 500 crores but not exceeding Rs. 1000 crores NBFCs which do not fall into the above categories i.e. non – listed NBFCs having a net worth of Rs. 500 crores or less will not be required to follow the converged Accounting Standards, though they can voluntarily opt to do so. The specified class of companies would be required to convert their opening balance sheets as on the specified dates according to the first set of Accounting Standards. The converged Accounting Standards would be applicable to specified class of companies in a staggered form as per the following schedule: Further, it has been made clear by the Core Group that once an entity starts following Converged Accounting Standards, it cannot switch back to the existing Accounting Standards in any case, even if it stops fulfilling any of the conditions for applicability of converged Accounting Standards. Basic Differences between Existing Standards and IFRS While there are many differences between the existing set of Accounting Standards and IFRS, few of the basic differences are being listed below, RCCA E-NEWS 1

- 12. S. No. Indian GAAP Indian GAAP 1 Financial Statements are presented upon Financial Statements are prepared on standalone basis, unless required by any other Consolidated basis. law/regulations. 2 Depreciation on Fixed Assets is charged on asset as Depreciation on Fixed Assets is charged on a whole. components of Fixed Assets. 3 Proposed Dividend is required to be shown as Dividend is to be recorded and shown in the Current Liability in the financial statements of the financial statements in the financial year in financial year to which it relates as per which it is declared requirements of Schedule VI of the Companies Act. 4 Prior Period items are shown as a separate item in Adjustments for the prior period items are Income Statement in the year it is detected. made retrospectively. 5 In case of conflict between law and AS, former In case of conflict between law and IFRS, prevails latter prevails. These are just a few of the differences between Indian GAAP (Generally Accepted Accounting Principles) and IFRS. It can be noticed that there are several legal and regulatory issues before complete convergence with IFRS can be achieved. However, steps have already been initiated in this direction by the concerned agencies: 1) The Institute of Chartered Accountants of India– ICAI has already issued Exposure Drafts for AS 17 Operating Segments (Corresponding to IFRS 8), AS 15 Employee Benefits (Corresponding to IAS 19), AS 9 Revenue (Corresponding to IAS 18), AS 39 Insurance Contracts (Corresponding to IFRS 4), AS 38 Agriculture (Corresponding to IAS 41), AS 26 Intangible Assets (Corresponding to IAS 38), AS 33 Share Based Payments (Corresponding to IFRS 2), AS 36 Accounting and Reporting by Retirement Benefit Plans (Corresponding to IAS 26), AS 22 Income Taxes (Corresponding to IAS 12), AS 28 Impairment of Assets (Corresponding to IAS 36), AS 27 Interest in Joint Ventures (Corresponding to IAS 31) and AS 24 Non-current Assets Held for Sale and Discontinued Operation (Corresponding to IFRS 5) for comments from interested groups and general public at large. 2) Securities Exchange Board of India – SEBI has already amended listing agreement allowing for voluntary adoption of IFRS by the listed companies having subsidiaries vide circular dated April 5, 2010. This is positive step towards encouraging voluntary adoption of IFRS. 3) Ministry of Corporate Affairs – Schedule VI of Companies Act, 1956 and suitable amendments in the Companies Act, 1956 are proposed to be introduced in a time bound manner. Unanswered Issues, while the Ministry of Corporate Affairs remains committed towards initiation of convergence of IFRS in India by 2011, there are several issues which remain unanswered at this point of time and suitable clarifications are awaited from the concerned regulatory authorities. Few of these issues are: 1) Deferred Tax Assets/Liabilities arising out of retrospective application of IFRS in Transition Year as per AS-22 Taxes on Income 2) Applicability of Minimum Alternative Tax (MAT) in transition year and the availability of MAT Credit thereon as the impact of transition from present Accounting Standards to the converged Accounting Standards on the financial statements and book profits especially is estimated to be huge. 3) Unrealized losses and gains on derivatives are required to be marked-to-market under IFRS. Taxation issues arising out of these notional gains & losses are still awaited to be clarified. Convergence with IFRS is hence a lengthy & tedious process and it is hoped that India makes a smooth transition towards adoption and compliance of IFRS, though the same is likely to affect India Inc. in the early years of adoption. RCCA E-NEWS 1

- 13. LIST OF FORM FOR RETURN FILLING & SERVICE TAX Diptesh Nawal Ranchi Chapter of Cost Accountants Email: - dipnawal@gmail.com Service Tax Forms FORM NO SUBJECT FORM ST- 1 Application form for Registration FORM ST- 2 Performa of Registration Certificate FORM ST- 3 New Form for Return of Service Tax FORM ST-3A Memorandum of Provisional Deposit FORM ST- 4 Form of Appeal to Commissioner (Appeals) FORM ST- 5 Form of Appeal to Tribunal FORM ST- 6 Form of Memo of cross objection to Tribunal FORM ST- 7 Form of Application to Tribunal by Department ST GAR7 Challan Service Tax GAR7 Challan FORM TR- 6 Challan Form for deposit of service tax FORM AAR (ST) Application for Advance Ruling FORM ASTR -1 Application for filing a claim of rebate of service tax and cess paid on taxable services exported FORM ASTR -2 Application for filing a claim of rebate of duty paid on inputs, service tax and cess paid on input services Vakalatnama For appointing a lawyer for hearing in court Income Tax Forms Form No. Particulars ITR-1 SAHAJ Indian Individual Income tax Return English Form ITR – V Acknowledgment ITR-2 For Individuals and HUFs not having Income from Business English Form or Profession ITR – V Acknowledgment ITR-3 For Individuals/HUFs being partners in firms and not English Form carrying out business or profession under any proprietorship ITR – V Acknowledgment SUGAM (ITR- Sugam - Presumptive Business Income tax Return English Form 4S) ITR – V Acknowledgment ITR-4 For individuals and HUFs having income from a proprietary English Form business or profession ITR – V Acknowledgment ITR-5 For firms, AOPs and BOIs English Form ITR – V Acknowledgment ITR-6 For Companies other than companies claiming exemption English Form under section 11 ITR – V Acknowledgment ITR-7 For persons including companies required to furnish return English Form under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D) Acknowledgment ITR – V Acknowledgment RCCA E-NEWS 1

- 14. Accounting Dictionary Neha Kumari ICAI (INTER) AAA is American Accounting Association, Association of Accounting Administrators, or see ACCUMULATED ADJUSTMENT ACCOUNT. AAA-CPA is American Association of Attorney-Certified Public Accountants. AACSB is American Assembly of Collegiate Schools of Business. AAFI is Associated Accounting Firms International. AAHCPA is American Association of Hispanic CPAs. A&E can mean either Appropriation & Expense or Analysis & Evaluation. A&G is Administrative & General. A&M is Additions and Maintenance. A&P is an acronym for Administrative and Personnel. AAT, in Great Britain, is Association of Accounting Technicians. ABA is the American Bar Association. See below also. ABA (Accredited Business Accountant or Accredited Business Advisor), in the US, is a national credential conferred by Accreditation Council for Accountancy and Taxation to professionals who specialize in supporting the financial needs of individuals and small to medium sized businesses. ABA is the only nationally recognized alternative to the CPA. Most accredited individuals do not perform audits. Generally, they are small business owners themselves. In addition to general accounting work, CPAs are also heavily schooled in performing audits; however, only a small fraction of America's businesses require an audit. In general, a CPA has majored in accounting, passed the CPA examination and is licensed to perform audits. An ABA has majored in accounting, passed the ABA comprehensive examination and in most states is not licensed to perform audits. ABATEMENT, in general, is the reduction or lessening. In law, it is the termination or suspension of a lawsuit. For example, an abatement of taxes is a tax decrease or rebate. ABNORMAL RETURNS is the difference between the actual return and that is expected to result from market movements (normal return). ABNORMAL SPOILAGE is spoilage that is not part of everyday operations. It occurs for reasons such as the following: out-of-control manufacturing processes, unusual machine breakdowns, and unexpected electrical outages that result in a number of spoiled units. Some abnormal spoilage is considered avoidable; that is, if managers monitor processes and maintain machinery appropriately, little spoilage will occur. To highlight these types of problems so that they can be monitored, abnormal spoilage is recorded in a Loss from Abnormal Spoilage Account in the general ledger and is not included in the job costing inventory accounts (work in process, finished goods, and cost of goods sold). ABOVE THE LINE, in accounting, denotes revenue and expense items that enter fully and directly into the calculation of periodic net income, in contrast to below the line items that affect capital accounts directly and net income only indirectly. ABOVE THE LINE, for the individual, is a term derived from a solid bold line on Form 1040 and 1040A above the line for adjusted gross income. Items above the line prior to coming to adjusted gross income, for example, can include: IRA contributions, half of the self-employment tax, self- RCCA E-NEWS 1

- 15. employed health insurance deduction, Keogh retirement plan and self-employed SEP deduction, penalty on early withdrawal of savings, and alimony paid. A taxpayer can take deductions above the line and still claim the standard deduction. ABSOLUTE CHANGE is a numerical change in an empirical value, e.g. cost of goods was reduced by $9.00. ABSORB is to assimilate, transfer or incorporate amounts in an account or a group of accounts in a manner in which the first entity loses its identity and is "absorbed" within the second entity. For example, see ABSORPTION COSTING. ABSORBED COSTS incorporates both variable and fixed costs. ABSORPTION see ABSORB. ABSORPTION COSTING is the method under which all manufacturing costs, both variable and fixed, are treated as product costs with non-manufacturing costs, e.g. selling and administrative expenses, being treated as period costs. ABSORPTION PRICING is where all costs, both fixed and variable; plus a percentage mark-up for profit; are recovered in the price. ABSORPTION VARIANCE is the variance from budgeted absorption costing of manufactured product. See also ABSORPTION COSTING. ACA is Accreditation Council for Accountancy. ACAT (Accreditation Council for Accountancy and Taxation) is a national organization established in 1973 as a non-profit independent testing, accrediting and monitoring organization. The Council seeks to identify professionals in independent practice who specialize in providing financial, accounting and taxation services to individuals and small to mid-size businesses. Professionals receive accreditation through examination and/or coursework and maintain accreditation through commitment to a significant program of continuing professional education and adherence to the Council's Code of Ethics and Rules of Professional Conduct. ACB normally refers to 'adjusted cost base.' ACCELERATED DEPRECIATION is a method of calculating depreciation with larger amounts in the first year(s). ACCEPTANCE is a drawee's promise to pay either a TIME DRAFT or SIGHT DRAFT. Normally, the acceptor signs his/her name after writing "accepted" (or some other words indicating acceptance) on the bill along with the date. That "acceptance" effectively makes the bill a promissory note, i.e. the acceptor is the maker and the drawer is the endorser. ACCOMODATION ENDORSEMENT is a) the guarantee given by one legal entity to induce a lender to grant a loan to another legal entity. b) a banking practice where one bank endorses the acceptances of another bank, for a fee, qualifying them for purchase in the acceptance market. ACCOUNT is the detailed record of a particular asset, liability, owners' equity, revenue or expense. ACCOUNT AGING usually refers to the methods of tracking past due accounts in accounts receivable based on the dates the charges were incurred. Account aging can also be used in accounts payable, to a lesser degree, to monitor payment history to suppliers. See also AGING OF ACCOUNTS. ACCOUNT ANALYSIS is a way to measure cost behavior. It selects a volume-related cost driver and classifies each account from the accounting records as a fixed or variable cost. The cost accountant then looks at each RCCA E-NEWS 1

- 16. cost account balance and estimates either the variable cost per unit of cost driver activity or the periodic fixed cost. ACCOUNTANT'S OPINION is a signed statement regarding the financial status of an entity from an independent public accountant after examination of that entities records and accounts. ACCOUNT-CLASSIFICATION METHOD, also called account analysis, is a cost estimation method that requires a study of an account in the general ledger. The experienced analysts use the account information as well as their own judgment to determine how costs will behave in the future. ACCOUNT CURRENT is a running or continued account between two or more parties, or a statement of the particulars of such an account. ACCOUNT DISTRIBUTION is the process by which debits and credits are identified to the correct accounts. ACCOUNT GROUP, in accounting, is a designation of a group of accounts of like type (for example: accounts receivable and fixed assets). ACCOUNTING is primarily a system of measurement and reporting of economic events based upon the accounting equation for the purpose of decision making. Generally, when someone says "accounting" they are referring to the department, activity or individuals involved in the application of the accounting equation. ACCOUNTING CONCEPTS are the assumptions underlying the preparation of financial statements, i.e., the basic assumptions of going concern, accruals, consistency and prudence. ACCOUNTING CONVENTION see CONVENTION. ACCOUNTING CYCLE is the sequence of steps in preparing the financial statements for a given period. It refers to the fact that because financial reports are given each period (usually a year) there are a set of steps (cycle) taken each period that result in the reports and preparation for the next period or cycle. The term cycle is used because every period there is a start and an end. The cycle usually starts with the budget, goes through the journal entries, adjusting entries, posting to the accounts, financial reports, and closings. ACCOUNTING DATA is all the information and data contained in journals, ledgers and other records that support financial statements, e.g. spreadsheets. It may be in computer readable form or on paper. ACCOUNTING DIVERSITY is the recognition that many diverse national and international accounting standards exist in the world. ACCOUNTING ENTITY ASSUMPTION states that a business is a separate legal entity from the owner. In the accounts the business’ monetary transactions are recorded only. ACCOUNTING ENTITY is an organization, institution or being that has its own existence for legal or tax purposes. An accounting entity is often an organization with an existence separate from its individual members--for example, a corporation, partnership, trust, etc. See also ACCOUNTING ENTITY ASSUMPTION. To be continued with next issue........ RCCA E-NEWS 1

- 17. STUDENTS’ASSOCIATIONOF MANAGEMENTACCOUNTANTS (SAMA) of Ranchi Chapter of Cost Accountant of EIRC of ICAI 303, Gridhar Plaza, Near Gaushala, Harmu Road, Ranchi E-mail:-samaranchi14@gmail.com REGISTRATION FORM S. No. …………. Fill in Block Letters. Leave one box blank between words. * mark fields are necessary to be filled. *Full Name: *Address : *Date of Birth *Male Female *Phone No. *E-mail Id: *Foundation Group: - I II III IV [Tick the correct box (es)] *Inst. Registration No. Year Academic Qualification…………………………………………………… Pursuing any other Course (s) / Qualification: Yes No (If Yes, write the details in the space provided.) Qualification University/Institution Remarks Association Registration No.(To be S R / 0 0 0 filled by the officials) Declaration I declare that to the best of my knowledge and belief the information given above is correct and complete in all respects, in the event of being found otherwise I shall abide by the decision of the Association to summarily reject my application. I also undertake to abide by the regulations framed by the Association. Date: Enclosure: ..………………………………………. 1. One Passport Size Photo. Signature of Applicant 2. Xerox of Inst. Identity Card. Students’ Association of Management Accountants (SAMA) For Office Use Only Sl. No.: …………… Name (Mr. / Ms.): ………………………………………………………...……………………………………………........... Association Registration No. S R / 0 0 0 Amount Towards: Registration Fees/Membership Fees In words: ` One Hundred only ` 100.00 Date: ............................................................ Recipient’s Signature RCCA E-NEWS 1

- 18. SAMA’s By-laws Objective: - SAMA, an association created by the students of ICAI (Earlier ICWAI) for the development of its members by organizing events, classes, interviews, workshops and other problems regarding their study & chapter etc. Membership: - Students of Ranchi Chapter of ICAI only can become the member of SAMA Membership Fees: - For membership of the Association Students have to pay Rs. 100/- and an Annual Subscription of Rs. 50/- only. Terms, Rules & Regulations:- 1. Office of the SAMA will be at the concerned chapter of the ICAI 2. Every member should have to attend the meeting of the association on 4th Sunday of each month at the pre-decided place (scheduled timings may change if committee think so. 3. Association should consists of two categories, a. Managing Committee- Managing Committee will be decided by the existing chairman under the guidance of Patrons and should consist of i. Chairman ii. Vice- Chairman iii. Secretary iv. Treasurer b. Patrons- Cost Accountants having the membership of the Institute, can only become the Patron of the Association by paying Rs. 500. 4. In the following cases membership of the members will be terminated: a. If they found guilty of practicing unwanted means within the Association. b. If they complete their study in the Institute or become the member of the Institute, i.e. ICAI. c. If they crosses the age of 29 years. 5. Association will have to maintain its accounts and get it audited every year by a Cost Accountant. 6. It should call its AGM on 4th Sunday of May every year and present the audited account in front of members. 7. Members should have a valid mail id for effective communication. RCCA E-NEWS 1

- 19. Desk of Compilers Dear Readers, Since its inception from 14.11.2010, SAMA is trying to magnify the quality inherent in the students in the areas of cost accountancy. To achieve the goal, Students’ Association of Management Accountants (SAMA) of Ranchi Chapter is organizing many events for development and updation of the knowledge of its members and of the chapter’s students. Recently, SAMA has organized Business Quiz in Ranchi Chapter of Cost Accountant, venue was in Capitol Hill, Ranchi on 13.11.2011 and in this Quiz many student had participated. The quiz master was Mr. A. D. Wadhwa along with Score calculator Mr. Pawan Kumar & Mr. Krishna Kr. Sharma. Besides this SAMA is also organizing many workshops time to time on different topics like dress code, personality development and some extra classes are being taken by senior student for juniors in different subjects which will help them in their examination. In future too, we look forward to carry the same for promotion and development of our members. Note: - You can also get you articles published in E-magazine, for that sends your article in our mail id, i.e. samaranchi14@gmail.com MEMORIES FROM REGIONAL COST CONFERENCE 2011 RCCA E-NEWS 1

- 20. Delegates inaugurating the Phone Directory of RCCA. Group photo of Students of RCCA with Mr. A. D Wadhwa. Contestants of Bussiness Quiz, organised by SAMA Manjeeta Rana receiving the award “Best student on the day of Annual Seminar of Ranchi Chapter. of the year 2011”. . Volunteers of annual seminar 2011. Volunteers & Students with Mr. A. D. Wadhwa Past Chairman, EIRC, Mr. Sanjay Kr. Singh Vice-chairman, RCCA & Mr. Ranjit Agarwal, Secretary RCCA in annual seminar 2011. RCCA E-NEWS 1