Calculating donor's tax for gift to son's wedding

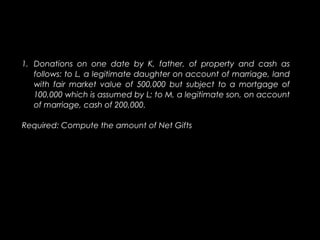

- 1. 1. Donations on one date by K, father, of property and cash as follows: to L, a legitimate daughter on account of marriage, land with fair market value of 500,000 but subject to a mortgage of 100,000 which is assumed by L; to M, a legitimate son, on account of marriage, cash of 200,000. Required: Compute the amount of Net Gifts

- 2. Problem 1 Land 500,000.00 Cash 200,000.00 Gross Gift 700,000.00 less: Deductions Mortgage 100,000.00 Account of Marriage Daughter 10,000.00 Son 10,000.00 Net Gifts 580,000.00

- 3. 2. A, donated the following during 2014: Mar 1- to his son on account of marriage 600,000 Oct 1- to daughter on account of graduation, 500,000 Dec 25- to his god-children , 400,000 Dec 31- to his neighbour, 100,000 Compute donor’s tax for: a. Relative b. Strangers

- 4. Problem 2 Donation to Relative Mar 1 Gross Gift 600,000.00 Deductions (10,000.00) Net Gift 590,000.00 Tax on 500,000 14,000.00 Excess at 6% 5,400.00 Donor's Tax 19,400.00 Oct 1 Gross Gift 500,000.00 Deduction - Net Gift 500,000.00 Net Gift, Previous 590,000.00 Aggregate Net Gift 1,090,000.00 Tax on 1000,000 44,000.00 Excess at 8% 7,200.00 Total Donor's Tax 51,200.00 Donor's Tax, Previous (19,400.00) Donor's Tax, Donation to Stranger Current 31,800.00 Dec 25 Gross Gift 400,000.00 Dec 31 100,000.00 500,000.00 x Donor's Tax Rate 30% Donor's Tax Due 150,000.00

- 5. 3. Mr. and Mrs. Dinero donated the following: Jan 5,2012- to son for birthday, 1,000,000 Mar 30, 2013- to son for graduation, 500,000 Jun 28, 2013- to son for wedding, 2,000,000 Compute the donor’s tax for donation made on June 28, 2013.

- 6. Problem 3 Mr. Dinero Mrs. Dinero Total Mar 30 Gross Gift 250,000.00 250,000.00 500,000.00 - Deductions - - Net Gift 250,000.00 250,000.00 500,000.00 Tax on 200,000 2,000.00 2,000.00 4,000.00 Excess at 4% 2,000.00 2,000.00 4,000.00 Donor's Tax 4,000.00 4,000.00 8,000.00 Jun 28 Gross Gift 1,000,000.00 1,000,000.00 2,000,000.00 Deduction (10,000.00) (10,000.00) (20,000.00) Net Gift 990,000.00 990,000.00 1,980,000.00 Net Gift, Previous 250,000.00 250,000.00 500,000.00 Aggregate Net Gift 1,240,000.00 1,240,000.00 2,480,000.00 Tax on 1,000,000 44,000.00 44,000.00 88,000.00 Excess at 8% 19,200.00 19,200.00 38,400.00 Total Donor's Tax 63,200.00 63,200.00 126,400.00 Donor's Tax Previous (4,000.00) (4,000.00) (8,000.00) Donor's Tax Current 59,200.00 59,200.00 118,400.00

- 7. Problem 3 Mr. Dinero Mrs. Dinero Total Mar 30 Gross Gift 250,000.00 250,000.00 500,000.00 - Deductions - - Net Gift 250,000.00 250,000.00 500,000.00 Tax on 200,000 2,000.00 2,000.00 4,000.00 Excess at 4% 2,000.00 2,000.00 4,000.00 Donor's Tax 4,000.00 4,000.00 8,000.00 Jun 28 Gross Gift 1,000,000.00 1,000,000.00 2,000,000.00 Deduction (10,000.00) (10,000.00) (20,000.00) Net Gift 990,000.00 990,000.00 1,980,000.00 Net Gift, Previous 250,000.00 250,000.00 500,000.00 Aggregate Net Gift 1,240,000.00 1,240,000.00 2,480,000.00 Tax on 1,000,000 44,000.00 44,000.00 88,000.00 Excess at 8% 19,200.00 19,200.00 38,400.00 Total Donor's Tax 63,200.00 63,200.00 126,400.00 Donor's Tax Previous (4,000.00) (4,000.00) (8,000.00) Donor's Tax Current 59,200.00 59,200.00 118,400.00