Valuation Model (DCF)

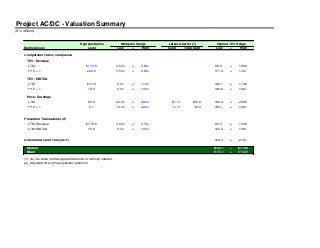

- 1. Project AC/DC - Valuation Summary ($ in millions) Representative Multiples Range Latest Quarter (1) Implied TEV Range Methodology Level Low -- High Cash Total Debt Low -- High Comparable Public Companies TEV / Revenue LTM $176.6 0.50x -- 0.60x 88.3 -- 106.0 FYE + 1 222.8 0.50x -- 0.60x 111.4 -- 133.7 TEV / EBITDA LTM $15.8 9.0x -- 11.0x 142.1 -- 173.6 FYE + 1 18.6 8.0x -- 10.0x 148.6 -- 185.7 Price / Earnings LTM $6.8 24.0x -- 28.0x $17.0 $36.9 182.4 -- 209.5 FYE + 1 8.1 18.0x -- 22.0x 17.0 36.9 165.7 -- 198.1 Precedent Transactions (2) LTM Revenue $176.6 0.60x -- 0.70x 88.3 -- 103.0 LTM EBITDA 15.8 9.5x -- 10.5x 125.0 -- 138.1 Discounted Cash Flow (DCF) 164.3 -- 218.1 Median $142.1 -- $173.6 Mean $135.1 -- $162.9 (1) AC/DC does not have preferred stock or minority interest. (2) Adjusted for a 20% acquisition premium.

- 2. Comparable Public Companies Analysis ($ in millions) Comparable Companies - Consumer Electronics | Retail THERE SHOULD BE NO HARDCODES ON THIS TAB Multiples Analysis Share Price % of 52- Market Enterprise TEV / Revenue TEV / EBITDA Price / Earnings Company Name Ticker 11/20/2006 week High Capitalization Value Cash Debt LTM FYE+1 LTM FYE+1 LTM FYE+1 Best Buy Co., Inc. BBY $54.63 8.2% $27,262.9 $24,903.9 $2,668.0 $680.0 0.76x 0.70x 10.8x 9.7x 21.9x 19.0x Circuit City Stores, Inc. CC 23.55 25.3% 4,191.8 3,679.3 599.6 87.0 0.30x 0.28x 7.8x 7.3x 20.7x 18.0x RadioShack Corp. RSH 17.88 25.3% 2,428.5 2,762.1 276.4 610.0 0.55x 0.56x 10.2x 9.0x 32.9x 24.9x Median 25.3% $4,191.8 $3,679.3 $599.6 $610.0 0.55x 0.56x 10.2x 9.0x 21.9x 19.0x Mean 19.6% $11,294.4 $10,448.4 $1,181.3 $459.0 0.54x 0.52x 9.6x 8.7x 25.2x 20.6x Margins Analysis Revenue Growth EBITDA Growth EPS Growth LTM CapEx % EBIT Margin EBITDA Margin Net Margin Company Name FYE '05-06 FYE '06-07 FYE '05-06 FYE '06-07 FYE '05-06 FYE '06-07 of Revenue LTM FYE+1 LTM FYE+1 LTM FYE+1 Best Buy Co., Inc. 12.4% 14.9% 10.6% 22.2% 22.1% 26.1% 2.2% 5.6% 6.0% 7.1% 7.3% 3.8% 4.1% Circuit City Stores, Inc. 10.8% 11.7% 36.9% 19.1% 68.6% 33.3% 1.7% 2.4% 2.6% 3.9% 3.9% 1.7% 2.0% RadioShack Corp. 5.0% -3.2% -28.2% -35.1% -20.0% -63.8% 2.2% 2.8% 3.6% 5.4% 6.2% 1.5% 2.0% Median 10.8% 11.7% 10.6% 19.1% 22.1% 26.1% 2.2% 2.8% 3.6% 5.4% 6.2% 1.7% 2.0% Mean 9.4% 7.8% 6.4% 2.0% 23.6% -1.5% 2.0% 3.6% 4.1% 5.5% 5.8% 2.3% 2.7% Source: Company filings, Yahoo! Finance, equity analyst research and press releases.

- 3. Effective Tax Rate 35% FYE - 1 2005 FY + 1 2007P Stock Valuation Date 11/20/2006 FYE 2006 FY + 2 2008P Ticker BBY CC RSH Name Best Buy Co., Inc. Circuit City Stores, Inc. RadioShack Corp. Company Name Company Name Company Name Company Name Company Name Company Name Company Name Company Name Company Name Company Descriptions Best Buy Co., Inc. is a specialty retailer of consumer electronics, home- office products, entertainment software, appliances and related services. Circuit City Stores, Inc. is a national retailer of brand- name consumer electronics, personal computers (PCs) and entertainment software. RadioShack Corporation is primarily engaged in the retail sale of consumer electronic goods and services through its RadioShack store Insert Company Information Insert Company Information Insert Company Information Insert Company Information Insert Company Information Insert Company Information Insert Company Information Insert Company Information Insert Company Information Stock Price as of (11/20/06) $54.63 $23.55 $17.88 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 52 Wk High $59.50 $31.54 $23.95 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 52 Wk Low $42.75 $20.21 $13.73 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 % Off High 8.2% 25.3% 25.3% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Enterprise Value $24,903.9 $3,679.3 $2,762.1 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Equity Value $27,262.9 $4,191.8 $2,428.5 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 EV / Sales 0.81x 0.32x 0.54x NA NA NA NA NA NA NA NA NA EV / LTM Sales 0.76x 0.30x 0.55x NA NA NA NA NA NA NA NA NA EV / 2007P Sales 0.70x 0.28x 0.56x NA NA NA NA NA NA NA NA NA EV / 2008P Sales 0.59x 0.26x 0.54x NA NA NA NA NA NA NA NA NA EV / EBITDA 11.8x 8.7x 5.8x NA NA NA NA NA NA NA NA NA EV / LTM EBITDA 10.8x 7.8x 10.2x NA NA NA NA NA NA NA NA NA EV / 2007P EBITDA 9.7x 7.3x 9.0x NA NA NA NA NA NA NA NA NA EV / 2008P EBITDA 8.3x 5.8x 6.9x NA NA NA NA NA NA NA NA NA EV / EBIT 15.1x 14.3x 7.9x NA NA NA NA NA NA NA NA NA EV / LTM EBIT 13.8x 12.3x 19.6x NA NA NA NA NA NA NA NA NA EV / 2007P EBIT 11.8x 11.0x 15.5x NA NA NA NA NA NA NA NA NA EV / 2008P EBIT 9.8x 7.9x 10.2x NA NA NA NA NA NA NA NA NA Gross Margin 25.0% 24.4% 46.7% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! LTM Gross Margin 24.9% 24.3% 45.2% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! EBITDA Margin 6.8% 3.6% 9.3% NA NA NA NA NA NA NA NA NA LTM EBITDA Margin 7.1% 3.9% 5.4% NA NA NA NA NA NA NA NA NA 2007P EBITDA Margin 7.3% 3.9% 6.2% NA NA NA NA NA NA NA NA NA 2008P EBITDA Margin 7.1% 4.5% 7.8% NA NA NA NA NA NA NA NA NA EBIT Margin 5.3% 2.2% 6.9% NA NA NA NA NA NA NA NA NA LTM EBIT Margin 5.6% 2.4% 2.8% NA NA NA NA NA NA NA NA NA 2007P EBIT Margin 6.0% 2.6% 3.6% NA NA NA NA NA NA NA NA NA 2008P EBIT Margin 6.0% 3.3% 5.3% NA NA NA NA NA NA NA NA NA Other Metric Basic Shares Out. 480.3 175.2 135.8 Cash and Cash Equivalents $2,668.0 $599.6 $276.4 Total Debt on Balance Sheet 680.0 87.0 610.0 Less: Convertible Debt figured in FD Shares (402.0) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Preferred Equity 0.0 0.0 0.0 Less: Preferred Equity figured into FD Shares 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Minority Interest 31.0 0.0 0.0 Net Debt ($2,359.0) ($512.6) $333.6 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Current Debt $496.0 $38.8 $265.3 Total Current Liabilities 6,366.0 1,729.3 923.3 Total Current Assets 7,887.0 2,844.5 1,488.1 Net Working Capital ($651.0) $554.4 $553.7 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Shareholders' Equity $5,434.0 $1,915.3 $600.9 Total Assets $12,407.0 $4,129.9 $1,984.5 F.D. Shares Outstanding 499.0 178.0 135.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Equity Value $27,262.9 $4,191.8 $2,428.5 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Net Debt (2,359.0) (512.6) 333.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Enterprise Value $24,903.9 $3,679.3 $2,762.1 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

- 4. 10-Q Current 8/26/2006 8/31/2006 9/30/2006 Net Sales $14,562.0 $5,456.2 $3,319.4 Gross Profit 3,667.0 1,316.2 1,568.0 SG&A 3,000.0 1,292.7 1,509.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Reported EBIT 667.0 14.1 11.1 Reported NI 464.0 16.4 (11.1) D&A 267.0 91.0 97.5 Non-Recurring Oper. Exp. (Inc.) 0.0 9.5 47.3 Final EBIT 667.0 23.6 58.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Final EBITDA 934.0 114.6 155.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Non-Recurring Non-Oper. Exp. (Inc.) 0.0 0.0 0.0 Final Net Income 464.0 22.6 19.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 CapEx 299.0 102.9 62.4 10-Q Previous Year 8/26/2005 8/31/2005 9/30/2005 ############# ############# ############# ############# ############# ############# ############# ############# ############# Net Sales $12,820.0 $4,784.9 $3,409.8 Gross Profit 3,269.0 1,167.5 1,688.5 SG&A 2,769.0 1,186.5 1,421.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Reported EBIT 500.0 (23.6) 267.5 Reported NI 358.0 (8.0) 215.8 D&A 222.0 80.4 91.6 Non-Recurring Oper. Exp. (Inc.) 0.0 4.6 0.0 Final EBIT 500.0 (19.0) 267.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Final EBITDA 722.0 61.4 359.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Non-Recurring Non-Oper. Exp. (Inc.) 0.0 0.0 0.0 Final Net Income 358.0 (5.0) 215.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 CapEx 238.0 99.4 121.7 Current 10-K 2/25/2006 2/28/2006 12/31/2005 Net Sales $30,848.0 $11,597.7 $5,081.7 Gross Profit 7,726.0 2,830.9 2,375.4 SG&A 6,082.0 2,573.9 2,025.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Reported EBIT 1,644.0 220.4 349.9 Reported NI 1,140.00 151.11 269.90 D&A 460.0 163.8 123.8 Non-Recurring Oper. Exp. (Inc.) 0.0 36.6 Final EBIT 1,644.0 257.0 349.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Final EBITDA 2,104.0 420.8 473.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Non-Recurring Non-Oper. Exp. (Inc.) 0.0 0.0 0.0 Final Net Income 1,140.0 174.9 269.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 CapEx 648.0 199.1 167.9 10-K Previous Year 2/25/2005 2/28/2005 12/31/2004 ############# ############# ############# ############# ############# ############# ############# ############# ############# Net Sales $27,433.0 $10,469.5 $4,841.2 Gross Profit 6,495.0 2,568.1 2,434.5 SG&A 5,073.0 2,414.7 1,876.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Reported EBIT 1,422.0 92.8 558.3 Reported NI 934.0 64.4 337.2 D&A 481.0 153.9 101.4 Non-Recurring Oper. Exp. (Inc.) 0.0 60.6 0.0 Final EBIT 1,422.0 153.4 558.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Final EBITDA 1,903.0 307.3 659.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Non-Recurring Non-Oper. Exp. (Inc.) 0.0 0.0 0.0 Final Net Income 934.0 103.7 337.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 CapEx 502.0 162.7 226.9 LTM 8/26/2006 8/31/2006 9/30/2006 1/0/1900 1/0/1900 1/0/1900 1/0/1900 1/0/1900 1/0/1900 1/0/1900 1/0/1900 1/0/1900 Net Sales $32,590.0 $12,268.9 $4,991.3 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Gross Profit 8,124.0 2,979.6 2,254.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 SG&A 5,808.0 2,505.6 1,984.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Reported EBIT 1,811.0 258.0 93.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Reported NI 1,246.0 175.5 43.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 D&A 505.0 174.5 129.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Non-Recurring Oper. Exp. (Inc.) 0.0 41.5 47.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Final EBIT 1,811.0 299.5 140.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Final EBITDA 2,316.0 474.0 270.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Non-Recurring Non-Oper. Exp. (Inc.) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Final Net Income 1,246.0 202.5 73.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 CapEx 709.0 202.7 108.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Kaufman Brothers_10250 Kaufman Brothers_10250 Kaufman Brothers_10250 2007P FYE 2006P Sales $35,430.0 $12,951.0 $4,919.7 EBIT 2,119.0 333.4 177.8 EBITDA 2,571.0 501.2 307.2 EPS $2.88 $1.31 $0.72 CapEx 770.8 213.9 107.0 2008P FYE 2007P Sales $42,426.0 $14,231.3 $5,076.2 EBIT 2,554.0 467.2 269.5 EBITDA 3,006.0 635.0 397.5 EPS $3.30 $1.79 $1.08 CapEx 923.0 235.1 110.4

- 5. Convertible Debt Amount Outstanding $402.00 $0.00 $0.00 Conversion Price $46.00 $0.00 $0.00 Number of Shares 8.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Amount of Debt to Subtract from Net Debt (402.0) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Amount of Shares to add to FD Shares 8.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Preferred Equity - Convertible Amount Outstanding $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Conversion Price $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Number of Common Shares 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Amount of Debt to Subtract from Net Debt 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Amount of Shares to add to FD Shares 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Number of Options Exercisable A 19.60 0.37 2.44 B 0.98 4.31 C 1.75 1.84 D 0.25 3.91 E 0.50 4.93 F 0.83 G 0.12 H 4.08 I 1.10 Weighted Average Strike Price A $26.60 $5.69 $19.88 B $7.40 $27.39 C $8.32 $31.29 D $10.06 $38.35 E $12.27 $47.10 F $14.43 $34.79 G $15.66 H $23.46 I $27.20 Calculation A 10.1 0.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 B 0.0 0.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 C 0.0 1.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 D 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 E 0.0 0.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 F 0.0 0.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 G 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 H 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 I 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Sum 18.8 2.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 EPS 5 Yr Growth FX Country USD / FX

- 6. Precedent Transactions - Consumer Electronics | Retail ($ in millions) Announce Target LTM Transaction Implied TEV / Date Acquiror Target Target Description Revenue EBITDA Value Revenue EBITDA 02/22/06 Best Buy Co. (1) Pacific Sales & Kitchen Privately owned retailer of high-end home improvement products that perates 14 showrooms in Southern California $431.6 $58.6 $410.0 0.95x 7.00x 04/17/05 GameStop Corp. (2) Electronics Boutique Leading global specialty retailer of video game hardware, software and related accessories. 1,989.4 116.8 1,210.4 0.61x 10.4x 02/15/05 Highfields Capital Management Circuit City Stores National retailer of brand-name consumer electronics, PCs and entertainment software. 10,154.0 253.0 2,576.7 0.25x 10.2x Median 0.61x 10.2x Mean 0.60x 9.2x Source: (1) Best Buy Co. Press Release (2) GameStop's 8K as of April 18, 2005, including Electronics Boutique's 10K as of January 29, 2005. (3) Circuit City's 10Q as of November 30, 2004 and 10K as of February 29, 2004, including a Boston Business Journal article as of February 15, 2005.

- 7. Discounted Cash Flow (DCF) Analysis BEST BUY CO. - EXAMPLE ONLY Fiscal Year Ending ($MMs) 02/25/06 02/25/07 02/25/08 02/25/09 02/25/10 02/25/11 Revenue $30,848 $35,430 $42,426 $48,790 $56,108 $64,525 EBITDA $2,571 $3,006 $3,684 $4,236 $4,872 EBIT $2,119 $2,554 $2,927 $3,367 $3,871 Less: Estimated Taxes at 35% 742 894 1,025 1,178 1,355 Tax-effected EBIT $1,377 $1,660 $1,903 $2,188 $2,516 Plus: D&A 452 452 756 870 1,000 Less: CapEx (771) (923) (921) (1,059) (1,218) Less: Changes in Working Capital (458) (700) (636) (732) (842) Free Cash Flow $600 $490 $1,102 $1,267 $1,457 Assumed Tansaction Date of 11/20/06 PV of FCF @ a Discount Rate of 11% $584 $429 $870 $901 $933 Assumed EBITDA Exit Multiple of 9.0x PV of Terminal Value of $28,084 TEV - Sensitivity Analysis Terminal EBITDA Multiple $31,801 7.0x 8.0x 9.0x 10.0x 11.0x 9.0% 27,503 30,875 34,247 37,619 40,992 10.0% 26,508 29,752 32,995 36,238 39,482 11.0% 25,560 28,680 31,801 34,921 38,042 12.0% 24,655 27,658 30,661 33,664 36,667 13.0% 23,790 26,682 29,573 32,464 35,356 Source: Discount Rate Links to 'Comp Spread' Tab

- 8. Discounted Cash Flow (DCF) Analysis - Project AC/DC THERE SHOULD BE NO HARDCODES ON THIS TAB Fiscal Year Ending ($MMs) 02/25/06 02/25/07 02/25/08 02/25/09 02/25/10 02/25/11 Revenue $185.7 $222.8 $267.4 $320.9 $385.1 $462.1 EBITDA $22.3 $26.7 $32.1 $38.5 $46.2 EBIT $20.1 $24.1 $28.9 $34.7 $41.6 Less: Estimated Taxes at 0% 7.0 8.4 10.1 12.1 14.6 Tax-effected EBIT $13.0 $15.6 $18.8 $22.5 $27.0 Plus: D&A 2.2 2.7 3.2 3.9 4.6 Less: CapEx (11.1) (13.4) (16.0) (19.3) (23.1) Less: Changes in Working Capital 1.1 (0.8) (1.6) (2.2) (2.8) Free Cash Flow $5.2 $4.2 $4.3 $4.9 $5.7 Assumed Tansaction Date of 11/20/06 PV of FCF @ a Discount Rate of 21% $4.9 $3.3 $2.8 $2.6 $2.5 Assumed EBITDA Exit Multiple of 8.5x PV of Terminal Value of $174 TEV - Sensitivity Analysis Terminal EBITDA Multiple $190 6.5x 7.5x 8.5x 9.5x 10.5x 19.0% 159.7 181.7 203.7 225.7 247.7 20.0% 154.4 175.6 196.8 218.1 239.3 21.0% 149.3 169.8 190.3 210.8 231.3 22.0% 144.5 164.3 184.0 203.8 223.6 23.0% 139.8 158.9 178.0 197.1 216.2 Source: Discount Rate

- 9. Weighted Average Cost of Capital (WACC) Analysis ($ in millions) Comparable Companies Market Debt to Preferred to Equity to Preferred Value of Total Debt to Total Total Total Debt Stock Equity Capitalization Equity Capitalization Capitalization Capitalization Best Buy Co., Inc. $680.0 $0.0 $27,262.9 $27,942.9 2.5% 2.4% 0.0% 97.6% Circuit City Stores, Inc. 87.0 0.0 4,191.8 4,278.9 2.1% 2.0% 0.0% 98.0% RadioShack Corp. 610.0 0.0 2,428.5 3,038.5 25.1% 20.1% 0.0% 79.9% Median $610.0 $0.0 $4,191.8 $4,278.9 2.5% 2.4% 0.0% 97.6% Mean $459.0 $0.0 $11,294.4 $11,753.4 #DIV/0! 8.2% 0.0% 91.8% Decile Adjusted Equity Size Levered Unlevered Based Unlevered Risk Risk Cost of Cost of Cost of Beta Beta Beta Beta Premium (1) Premium (1) Equity Debt Preferred WACC Best Buy Co., Inc. 1.05 1.03 0.91 1.60 6.3% -0.37% 10.8% 4.7% 0.0% 10.7% Circuit City Stores, Inc. 0.12 0.12 1.10 0.15 6.3% 0.75% 6.1% 5.4% 0.0% 6.1% RadioShack Corp. 1.09 0.94 1.13 1.17 6.3% 1.07% 12.5% 6.8% 0.0% 10.9% Median 1.05 0.94 1.10 1.17 10.8% 5.4% 0.0% 10.7% Mean 0.75 0.70 1.05 0.97 9.8% 5.6% 0.0% 9.2% Footnotes: Source: Company filings, equity analyst research and Bloomberg. Weighted Average Cost of Capital (WACC) = (Cost of Debt * (1-Tax Rate) * Debt to Enterprise Value) + (Cost of Equity * Equity to Enterprise Value) + (Cost of Preferred * Preferred to Enterprise Value). Cost of Equity = Risk Free Rate + (Levered Beta * Equity Risk Premium) + Size Risk Premium. Risk-free rate as of November 20, 2006. (1) Ibbotson Associates, Stocks Bonds Bills and Inflation 2005 Yearbook, pp. 138, 140, 169, and 179.

- 10. Weighted Average Cost of Capital (WACC) Analysis (cont.) Project AC/DC Market Assumptions Beta Assumptions Capital Structure Assumptions 20-Year Treasury Bond Yield 4.6% Company Specific Decile Beta 1.41 Preferred to Enterprise Value 0.0% Equity Risk Premium (1) 6.30% Selected Adjusted Unlevered Beta 1.17 Debt to Enterprise Value 2.4% Size Risk Premium (1) 6.41% Levered Beta 1.19 Equity to Enterprise Value 97.6% Company Specific Risk Premium 3.00% Cost of Debt 9.0% Tax Rate 35.0% Cost of Preferred 0.0% Cost of Equity 21.5% Concluded Weighted Average Cost of Capital 21.1% Footnotes: Source: Company filings, equity analyst research and Bloomberg. Weighted Average Cost of Capital (WACC) = (Cost of Debt * (1-Tax Rate) * Debt to Enterprise Value) + (Cost of Equity * Equity to Enterprise Value) + (Cost of Preferred * Preferred to Enterprise Value). Cost of Equity = Risk Free Rate + (Levered Beta * Equity Risk Premium) + Size Risk Premium. Risk-free rate as of November 20, 2006. (1) Ibbotson Associates, Stocks Bonds Bills and Inflation 2005 Yearbook, pp. 138, 140, 169, and 179.