NMCE Trading Report 02/01/2010

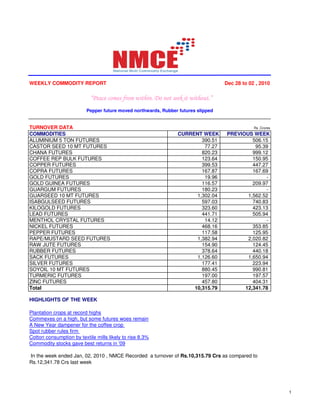

- 1. WEEKLY COMMODITY REPORT Dec 28 to 02 , 2010 Pepper future moved northwards, Rubber futures slipped TURNOVER DATA Rs .Crores COMMODITIES CURRENT WEEK PREVIOUS WEEK ALUMINIUM 5 TON FUTURES 390.51 506.15 CASTOR SEED 10 MT FUTURES 77.27 95.39 CHANA FUTURES 820.23 999.12 COFFEE REP BULK FUTURES 123.64 150.95 COPPER FUTURES 399.53 447.27 COPRA FUTURES 167.87 167.69 GOLD FUTURES 19.96 - GOLD GUINEA FUTURES 116.57 209.97 GUARGUM FUTURES 180.23 - GUARSEED 10 MT FUTURES 1,302.04 1,562.52 ISABGULSEED FUTURES 597.03 740.83 KILOGOLD FUTURES 323.60 423.13 LEAD FUTURES 441.71 505.94 MENTHOL CRYSTAL FUTURES 14.12 - NICKEL FUTURES 468.16 353.85 PEPPER FUTURES 117.58 125.95 RAPE/MUSTARD SEED FUTURES 1,382.94 2,020.82 RAW JUTE FUTURES 154.90 124.45 RUBBER FUTURES 378.64 440.18 SACK FUTURES 1,126.60 1,650.94 SILVER FUTURES 177.41 223.94 SOYOIL 10 MT FUTURES 880.45 990.81 TURMERIC FUTURES 197.00 197.57 ZINC FUTURES 457.80 404.31 Total 10,315.79 12,341.78 HIGHLIGHTS OF THE WEEK Plantation crops at record highs Commexes on a high, but some futures woes remain A New Year dampener for the coffee crop Spot rubber rules firm Cotton consumption by textile mills likely to rise 8.3% Commodity stocks gave best returns in '09 In the week ended Jan, 02, 2010 , NMCE Recorded a turnover of Rs.10,315.79 Crs as compared to Rs.12,341.78 Crs last week 1

- 2. SERIES TREND DURING THIS WEEK Castor seed futures : FEB Series CASTOR SEED 10 MT FUTURES PRICE TREND 2,930.00 2,910.00 (Rs/100 Kg) 2,890.00 2,870.00 2,850.00 2,830.00 2,810.00 2,790.00 26-Dec- 27-Dec- 28-Dec- 29-Dec- 30-Dec- 31-Dec- 1-Jan- 2-Jan- 09 09 09 09 09 09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 2,942.00 2,944.00 2,928.00 2,939.00 2,890.00 28-Dec-09 2,940.00 2,940.00 2,903.00 2,905.00 2,855.00 29-Dec-09 2,906.00 2,906.00 2,876.00 2,877.00 2,850.00 30-Dec-09 2,873.00 2,891.00 2,857.00 2,885.00 2,825.00 31-Dec-09 2,884.00 2,889.00 2,873.00 2,875.50 2,800.00 01-Jan-10 2,874.00 2,878.00 2,867.00 2,871.40 2,795.00 02-Jan-10 2,876.00 2,901.00 2,876.00 2,896.00 2,815.00 Castor seed futures negative Castor seed futures FEB series Closed at Rs.2896 down by Rs.43 from Rs.2939 the previous week.During the outgoing week, intra-day trade touched a high of Rs.2940 and a low of Rs.2857 .Spot Price Closed at Rs.2815 losing Rs.75 over Rs.2890 the previous week Market Buzz: NMCE castor seed futures were weak Improved demand for mustard oil in the physical market pushed up mustard seed prices. Acreage under rapeseed and mustard so far stood at 62.555 lakh hectares, as against 63.984 lakh hectares during this period last year. Arrivals were reported around 30,000 sacks in Rajasthan on the morning of 1 January 2010. Castor traded range-bound in Patan market. Arrivals were reported at 750 quintals. Disa and Dhanera markets were closed due to full-moon day. 2

- 3. Chana futures : JAN Series CHANA FUTURES PRICE TREND 2,495.00 (Rs/100 Kg) 2,470.00 2,445.00 2,420.00 26- 27- 28- 29- 30- 31- 1-Jan- 2-Jan- Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 2,475.00 2,512.00 2,475.00 2,512.00 2,470.00 28-Dec-09 2,512.00 2,531.00 2,501.00 2,504.00 2,490.00 29-Dec-09 2,504.00 2,517.00 2,479.00 2,483.00 2,450.00 30-Dec-09 2,483.00 2,491.00 2,468.00 2,482.00 2,440.00 31-Dec-09 2,482.00 2,487.00 2,466.00 2,469.00 2,438.00 01-Jan-10 2,469.00 2,485.00 2,464.00 2,466.00 2,425.00 02-Jan-10 2,466.00 2,474.00 2,440.00 2,440.00 2,425.00 Chana futures closes in red Chana futures JAN series Closed at Rs.2440 down by Rs.72 from Rs.2512 the previous week.During the outgoing week, intra-day trade touched a high of Rs.2531 and a low of Rs.2440 .Spot Price Closed at Rs.2425 losing Rs.45 over Rs.2470 the previous week Market Buzz: Chana futures slipped at NMCE Chana futures traded weakly due to sluggish demand and hopes of higher supply after an increase in area under cultivation adding to ample carry-forward stocks. However, higher progressive acreage under chana and apprehension that government may impose curbs to check rising food inflation may pressurize prices. India's chana acreage as on Dec. 31 stood at 8.2 million hectares, compared with 7.87 million hectares the same period a year ago. In north-western Rajasthan state, the yield may go down this year due to falling soil moisture level. Demand was reported to be moderate in the physical market. Arrivals were reported at 45 to 50 trucks in Lawrence road mandi on the morning of 1 January 2010. Out of these, 15 trucks were of Rajasthani desi variety and remaining were of MP desi variety of chana 3

- 4. Coffee rep bulk futures : JAN Series COFFEE REP BULK FUTURES PRICE TREND 7,750.00 7,675.00 (Rs/100 Kg) 7,600.00 7,525.00 7,450.00 7,375.00 7,300.00 26-Dec- 27-Dec- 28-Dec- 29-Dec- 30-Dec- 31-Dec- 1-Jan- 2-Jan- 09 09 09 09 09 09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 7,715.00 7,733.00 7,715.00 7,718.00 7,470.00 28-Dec-09 7,718.00 7,750.00 7,670.00 7,688.00 7,425.00 29-Dec-09 7,688.00 7,701.00 7,670.00 7,678.00 7,415.00 30-Dec-09 7,690.00 7,713.00 7,687.00 7,698.00 7,425.00 31-Dec-09 7,698.00 7,769.00 7,698.00 7,708.00 7,430.00 01-Jan-10 7,708.00 7,723.00 7,700.00 7,703.00 7,435.00 02-Jan-10 7,703.00 7,722.00 7,703.00 7,710.00 7,425.00 Coffee rep bulk futures range bound Coffee rep bulk futures JAN series Closed at Rs.7710 down by Rs.8 from Rs.7718 the previous week.During the outgoing week, intra-day trade touched a high of Rs.7769 and a low of Rs.7670 .Spot Price Closed at Rs.7425 losing Rs.45 over Rs.7470 the previous week Market Buzz: Coffee futures remained range bound at NMCE. Vietnam's December coffee exports dropped by 4.6 percent from the same month last year to an estimated 130,000 tonnes, or 2.2 million bags The possible reason for lower exports this month could be that Vietnamese growers have been holding back beans in hopes of higher prices, while exporters faced shortages of funds to buy beans locally. The data for November and December brought coffee exports from Vietnam, the world's second- largest producer after Brazil, to 1.17 million tonnes, or 19.5 million bags, in the calendar year of 2009, up 10.2 percent from last year, the report said. 4

- 5. Copra futures : JAN Series COPRA FUTURES PRICE TREND 3,498.00 3,478.00 (Rs/100 Kg) 3,458.00 3,438.00 3,418.00 3,398.00 3,378.00 26- 27- 28- 29- 30- 31- 1-Jan- 2-Jan- Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 3,445.00 3,585.00 3,445.00 3,502.00 3,458.00 28-Dec-09 3,435.00 3,544.20 3,435.00 3,490.00 3,425.00 29-Dec-09 3,425.00 3,559.00 3,425.00 3,481.00 3,425.00 30-Dec-09 3,412.00 3,550.60 3,412.00 3,470.00 3,417.00 31-Dec-09 3,400.00 3,539.10 3,400.60 3,451.00 3,383.00 01-Jan-10 3,382.00 3,519.00 3,382.00 3,464.00 3,400.00 02-Jan-10 3,394.00 3,520.00 3,394.70 3,458.00 3,417.00 Copra future drops Copra futures JAN series Closed at Rs.3458 down by Rs.44 from Rs.3502 the previous week.During the outgoing week, intra-day trade touched a high of Rs.3559 and a low of Rs.3382 .Spot Price Closed at Rs.3417 losing Rs.41 over Rs.3458 the previous week Market Buzz: Copra futures prices dropped at NMCE this week The State Cooperative Department is preparing to foray into procurement of fresh coconut through cooperative societies, The National Agricultural Cooperative Marketing Federation (NAFED) had approved the procurement of fresh coconuts by cooperatives. The plan was to procure fresh coconuts via primary cooperative societies, hand them over to the Marketfed, Kerafed and the Consumerfed, who in turn would process them into copra before handing over to NAFED but agencies deputed to procure fresh coconuts had failed miserably, which was why the cooperative department had decided to step in. 5

- 6. Guarseed futures : JAN Series GUARSEED 10 MT FUTURES PRICE TREND 2,755.00 2,735.00 2,715.00 (Rs/100 Kg) 2,695.00 2,675.00 2,655.00 2,635.00 2,615.00 2,595.00 26-Dec- 27-Dec- 28-Dec- 29-Dec- 30-Dec- 31-Dec- 1-Jan- 2-Jan- 09 09 09 09 09 09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 2,614.00 2,644.00 2,614.00 2,641.00 2,600.00 28-Dec-09 2,641.00 2,694.00 2,589.00 2,694.00 2,685.00 29-Dec-09 2,694.00 2,747.00 2,641.00 2,710.00 2,675.00 30-Dec-09 2,710.00 2,764.00 2,657.00 2,724.00 2,670.00 31-Dec-09 2,724.00 2,756.00 2,671.00 2,756.00 2,700.00 01-Jan-10 2,756.00 2,810.00 2,702.00 2,749.00 2,680.00 02-Jan-10 2,749.00 2,766.00 2,742.00 2,744.00 2,685.00 Guarseed future surges Guarseed futures JAN series Closed at Rs.2744 up by Rs.103 from Rs.2641 the previous week.During the outgoing week, intra-day trade touched a high of Rs.2810 and a low of Rs.2589 .Spot Price Closed at Rs.2685 gaining Rs.85 over Rs.2600 the previous week Market Buzz: NMCE Guar seed futures prices climbed this week India's guar futures traded in thin volume due to sluggish trade and poor domestic and overseas demand. Lower area and poor yields due to patchy rains are estimated to have cut guar seed output by over 80 percent to 241,000 tonnes in top producer Rajasthan in 2009/10. 6

- 7. Isabgulseed futures : FEB Series ISABGULSEED FUTURES PRICE TREND 6,775.00 6,745.00 (Rs/100 Kg) 6,715.00 6,685.00 6,655.00 6,625.00 6,595.00 26- 27- 28- 29- 30- 31- 1-Jan- 2-Jan- Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 6,735.00 6,763.00 6,721.00 6,721.00 6,600.00 28-Dec-09 6,721.00 6,790.00 6,712.00 6,743.00 6,618.00 29-Dec-09 6,743.00 6,803.00 6,730.00 6,770.00 6,631.00 30-Dec-09 6,770.00 6,797.00 6,760.00 6,786.00 6,675.00 31-Dec-09 6,786.00 6,818.00 6,726.00 6,739.00 6,644.00 01-Jan-10 6,739.00 6,763.00 6,735.00 6,748.00 6,656.00 02-Jan-10 6,748.00 6,809.00 6,743.00 6,743.00 6,650.00 Isabgulseed future picks up Isabgulseed futures FEB series Closed at Rs.6743 up by Rs.22 from Rs.6721 the previous week.During the outgoing week, intra-day trade touched a high of Rs.6818 and a low of Rs.6712 .Spot Price Closed at Rs.6650 gaining Rs.50 over Rs.6600 the previous week Market Buzz: NMCE Isabgul futures moved northwards over the week New arrivals are due after a period of 3 months Gujarat has so far seen isabgul cultivation in 54,000 hectares Isabgul acreage in other isabgul growing states is likely to increase due to firm prices, which averaged around Rs. 1,000 per 20 kg 7

- 8. Pepper futures : JAN Series PEPPER FUTURES PRICE TREND 14,283.00 14,208.00 (Rs/100 Kg) 14,133.00 14,058.00 13,983.00 13,908.00 13,833.00 26- 27- 28- 29- 30- 31- 1-Jan- 2-Jan- Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 13,800.00 13,850.00 13,770.00 13,838.00 14,004.00 28-Dec-09 13,913.00 14,269.00 13,913.00 14,207.00 14,164.00 29-Dec-09 14,260.00 14,260.00 14,000.00 14,013.00 14,324.00 30-Dec-09 14,020.00 14,085.00 13,900.00 14,026.00 14,233.00 31-Dec-09 14,000.00 14,190.00 14,000.00 14,112.00 14,280.00 01-Jan-10 14,080.00 14,150.00 14,000.00 14,100.00 14,258.00 02-Jan-10 14,105.00 14,225.00 14,105.00 14,181.00 14,291.00 Pepper future northwards Pepper futures JAN series Closed at Rs.14181 up by Rs.343 from Rs.13838 the previous week.During the outgoing week, intra-day trade touched a high of Rs.14269 and a low of Rs.13900 .Spot Price Closed at Rs.14291 gaining Rs.287 over Rs.14004 the previous week Market Buzz: NMCE Pepper futures were bullish this week Indian pepper futures were weak due to little or no export demand and expectations of arrivals is hurting the sentiment. Domestic prices are expected to ease further during this month when the new crop arrivals start, Higher production forecast and commencement of fresh arrivals is likely to limit the gains in near futures. Farmers were reported to be holding back stocks as they were expecting higher prices in the future. In the international market, demand has slowed due to New Year celebrations. 8

- 9. Rape/mustard seed futures : JAN Series RAPE/MUSTARD SEED FUTURES PRICE TREND 529.00 524.00 519.00 (Rs/20 Kg) 514.00 509.00 504.00 499.00 494.00 489.00 26-Dec- 27-Dec- 28-Dec- 29-Dec- 30-Dec- 31-Dec- 1-Jan- 2-Jan- 09 09 09 09 09 09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 498.00 507.90 488.10 502.20 496.00 28-Dec-09 502.00 512.10 492.30 508.00 495.00 29-Dec-09 508.00 518.10 497.90 506.00 498.00 30-Dec-09 506.00 516.00 496.00 499.00 494.00 31-Dec-09 499.00 508.90 489.10 503.00 495.00 01-Jan-10 503.00 513.00 493.00 510.00 498.00 02-Jan-10 510.00 520.10 499.90 516.00 495.00 Rape/mustard seed future climbs Rape/mustard seed futures JAN series Closed at Rs.516 up by Rs.13.8 from Rs.502.2 the previous week.During the outgoing week, intra-day trade touched a high of Rs.520.1 and a low of Rs.489.1 .Spot Price Closed at Rs.495 losing Rs.1 over Rs.496 the previous week Market Buzz: Rape seed futures were in green this week Improved demand for mustard oil in the physical market has pushed up mustard seed prices. Acreage under rapeseed and mustard so far stood at 62.555 lakh hectares, as against 63.984 lakh hectares during this period last year. Arrivals were reported around 30,000 sacks in Rajasthan on the morning of 1 January 2010. Arrivals in Disa were reported at 500 quintals. In Dhanera, arrivals were down by 250 quintals at 550 quintals, while in Palanpur; arrivals were down by 300 quintals at 700 quintals. 9

- 10. Raw jute futures : JAN Series RAW JUTE FUTURES PRICE TREND 2,836.40 2,816.40 2,796.40 (Rs/100 Kg) 2,776.40 2,756.40 2,736.40 2,716.40 2,696.40 2,676.40 26- 27- 28- 29- 30- 31- 1-Jan- 2-Jan- Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 2,832.00 2,847.00 2,775.40 2,821.00 2,714.10 28-Dec-09 2,821.00 2,853.00 2,770.00 2,770.00 2,681.40 29-Dec-09 2,770.00 2,792.00 2,755.00 2,792.00 2,722.90 30-Dec-09 2,792.00 2,835.00 2,780.00 2,835.00 2,750.00 31-Dec-09 2,835.00 2,891.60 2,778.40 2,846.00 2,741.00 01-Jan-10 2,846.00 2,869.00 2,833.00 2,833.00 2,748.60 02-Jan-10 2,833.00 2,859.00 2,824.00 2,824.00 2,750.00 Raw jute future gains Raw jute futures JAN series Closed at Rs.2824 up by Rs.3 from Rs.2821 the previous week.During the outgoing week, intra-day trade touched a high of Rs.2891.6 and a low of Rs.2755 .Spot Price Closed at Rs.2750 gaining Rs.35.9 over Rs.2714.1 the previous week Market Buzz: Raw jute futures made gains during the week In order to avert a crisis in packaging food grains amid the continuing strike in the jute industry in West Bengal, the Centre has diluted the mandatory order for packaging food grains in jute bags, issuing a notification which allows a relaxation of up to 3.8 lakh bales for the kharif marketing season 2009-10 and rabi marketing season 2010-11. The Indian Jute Mills Association, the apex industry association, has said that its ability to make better payments was conditional upon workers bringing better productivity and the Centre paying them higher prices as recommended by the Tariff Commission 10

- 11. Rubber futures : JAN Series RUBBER FUTURES PRICE TREND 14,417.00 14,317.00 (Rs/100 Kg) 14,217.00 14,117.00 14,017.00 13,917.00 26- 27- 28- 29- 30- 31- 1-Jan- 2-Jan- Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 14,395.00 14,535.00 14,355.00 14,505.00 14,047.00 28-Dec-09 14,550.00 14,550.00 14,213.00 14,247.00 14,095.00 29-Dec-09 14,205.00 14,294.00 13,920.00 14,269.00 14,011.00 30-Dec-09 14,156.00 14,310.00 14,030.00 14,178.00 13,922.00 31-Dec-09 14,215.00 14,275.00 14,163.00 14,250.00 13,926.00 01-Jan-10 14,250.00 14,350.00 14,184.00 14,303.00 13,969.00 02-Jan-10 14,350.00 14,425.00 14,340.00 14,402.00 14,010.00 Rubber future slips Rubber futures JAN series Closed at Rs.14402 down by Rs.103 from Rs.14505 the previous week.During the outgoing week, intra-day trade touched a high of Rs.14550 and a low of Rs.13920 .Spot Price Closed at Rs.14010 losing Rs.37 over Rs.14047 the previous week Market Buzz: NMCE rubber futures prices slipped over the week The spot price of natural rubber ruled steady in the Kottayam market. It was ruling at Rs.137-141 per kg in the morning trade. The market was witnessing stable mood due to dull trading because of the holiday mood. Traders expect price to remain stable for another few days. Deliverable rubber inventories in warehouses monitored by the Shanghai Futures Exchange rose by 2 percent in the week ended on Thursday. Deliverable rubber inventories rose to 144,548 tonnes from last week's 141,693 tonnes, and stocks on warrant rose to 107,970 tonnes from 105,390 tonnes last week. International markets remained closed due to holiday season. 11

- 12. Sack futures : JAN Series SACK FUTURES PRICE TREND 3,027.60 3,017.60 (Rs/100 Bag) 3,007.60 2,997.60 2,987.60 2,977.60 2,967.60 26- 27- 28- 29- 30- 31- 1-Jan- 2-Jan- Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 3,044.00 3,104.80 2,983.20 3,032.00 2,972.60 28-Dec-09 3,032.00 3,092.50 2,971.50 3,007.00 2,972.60 29-Dec-09 3,007.00 3,067.00 2,947.00 3,022.00 2,972.60 30-Dec-09 3,022.00 3,060.00 3,012.00 3,028.00 2,972.60 31-Dec-09 3,028.00 3,065.00 2,990.00 3,012.00 2,972.60 01-Jan-10 3,012.00 3,050.00 2,980.00 3,023.00 2,972.60 02-Jan-10 3,023.00 3,083.40 2,962.60 3,011.00 2,972.60 Sack futures dull Sack futures JAN series Closed at Rs.3011 down by Rs.21 from Rs.3032 the previous week.During the outgoing week, intra-day trade touched a high of Rs.3092.5 and a low of Rs.2947 .Spot Price Closed at Rs.2972.6 gaining Rs.0 over Rs.2972.6 the previous week Market Buzz: NMCE Sack futures were sluggish this week Sack January 2010 series last traded around With the jute workers going on a strike this week the prices are clueless about the directions 12

- 13. Soyoil futures : JAN Series SOYOIL 10 MT FUTURES PRICE TREND 500.00 495.00 (Rs/10 Kg) 490.00 485.00 480.00 475.00 26-Dec- 27-Dec- 28-Dec- 29-Dec- 30-Dec- 31-Dec- 1-Jan-10 2-Jan-10 09 09 09 09 09 09 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 481.00 483.25 481.00 483.25 481.00 28-Dec-09 483.00 488.60 483.25 484.30 483.00 29-Dec-09 486.00 488.20 481.70 481.70 482.00 30-Dec-09 481.00 483.70 480.00 483.70 480.00 31-Dec-09 483.00 489.05 483.70 488.50 484.00 01-Jan-10 488.00 489.30 487.80 488.10 484.00 02-Jan-10 489.00 494.05 489.10 493.55 486.00 Soyoil future climbs Soyoil futures JAN series Closed at Rs.493.55 up by Rs.10.3 from Rs.483.25 the previous week.During the outgoing week, intra-day trade touched a high of Rs.494.05 and a low of Rs.480 .Spot Price Closed at Rs.486 gaining Rs.5 over Rs.481 the previous week Market Buzz: NMCE soy oil futures moved upwards this week Despite fall in price of soybean demand is not picking up especially from crushers because of poor export enquiries for soy meal from South East Asian countries. There is no good demand for soybean in the spot market despite lower arrivals. 13

- 14. Turmeric futures : JAN Series TURMERIC FUTURES PRICE TREND 10,985.00 10,785.00 (Rs/100 Kg) 10,585.00 10,385.00 10,185.00 9,985.00 26- 27- 28- 29- 30- 31- 1-Jan- 2-Jan- Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 Dec-09 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 26-Dec-09 9,971.00 10,010.00 9,971.00 9,990.00 10,325.00 28-Dec-09 9,990.00 10,132.00 9,990.00 10,039.00 10,350.00 29-Dec-09 10,039.00 10,122.00 10,039.00 10,122.00 10,500.00 30-Dec-09 10,122.00 10,490.00 10,122.00 10,490.00 11,000.00 31-Dec-09 10,490.00 10,490.00 10,450.00 10,478.00 11,025.00 01-Jan-10 10,478.00 10,493.00 10,451.00 10,451.00 11,000.00 02-Jan-10 10,470.00 10,547.00 10,470.00 10,547.00 11,000.00 Turmeric future zooms up Turmeric futures JAN series Closed at Rs.10547 up by Rs.557 from Rs.9990 the previous week.During the outgoing week, intra-day trade touched a high of Rs.10547 and a low of Rs.9990 .Spot Price Closed at Rs.11000 gaining Rs.675 over Rs.10325 the previous week Market Buzz: NMCE Turmeric futures surged this week India's turmeric futures traded steady on hopes of higher output and a drop in November exports outweighed good spot demand and dwindling stocks. Carry-forward stocks were low as output had fallen steeply last year due to low acreage and bad weather. Good spot demand amid lower stocks at the key trading centres is supporting turmeric futures. 14

- 15. SATURDAY SUMMARY Total Volume Traded 41046 Lots Total Value Recorded 985.89 Crores. * PEPPER FUTURES upwards * CASTOR SEED 10 MT FUTURES in green * COFFEE REP BULK FUTURES up * RUBBER FUTURES turn northwards * SACK FUTURES dips * GUARSEED 10 MT FUTURES slips * COPRA FUTURES turn southwards * ISABGULSEED FUTURES slips * RAPE/MUSTARD SEED FUTURES turn northwards DISCLAIMER __________________________________________________________________________________________ The information in this report has been provided by National Multi-Commodity Exchange of India Ltd for general reference purposes only.Although Care has been taken to ensure the accuracy of the information /data in the report, there is no warranty or representation expressed or implied by National Multi-Commodity Exchange of India Ltd as to the accuracy or completeness of the materials herein. The Exchange shall not be liable for any claims or losses of any nature, arising directly or indirectly, from the use of application of the data or material accessed from this report For more details, contact: Neha Bhandari. +91 79 4008 6038 Or write to: research@nmce.com ; contact@nmce.com 15