Task 2C - GST Basics

•

0 likes•559 views

Task 2C - GST Basics

Report

Share

Report

Share

Download to read offline

Recommended

More Related Content

What's hot

What's hot (16)

6. accounting for management lecture 15 final account

6. accounting for management lecture 15 final account

Viewers also liked

Viewers also liked (18)

Apple 2015 Financial Analysis (Full year ended 30 September)

Apple 2015 Financial Analysis (Full year ended 30 September)

Similar to Task 2C - GST Basics

Similar to Task 2C - GST Basics (20)

ACC 305 TUTOR Lessons in Excellence--acc305tutor.com

ACC 305 TUTOR Lessons in Excellence--acc305tutor.com

ACCOUNTING FOR BUSINESS – ASSIGNMENT SP1 2015PAGE ACCOUNTIN.docx

ACCOUNTING FOR BUSINESS – ASSIGNMENT SP1 2015PAGE ACCOUNTIN.docx

E5-15 Financial AccountingE5-15Journalizing purchase transactions

E5-15 Financial AccountingE5-15Journalizing purchase transactions

Accounting for Receivables ASSIGNMENT CLASSIFICATION TABLE Learning Objective...

Accounting for Receivables ASSIGNMENT CLASSIFICATION TABLE Learning Objective...

More from VCE Accounting - Michael Allison

More from VCE Accounting - Michael Allison (20)

Chapter 22 Analysis and Interpretation - Test 2 Solutions

Chapter 22 Analysis and Interpretation - Test 2 Solutions

Chapter 22 Analysis and Interpretation - Test 1 Solutions

Chapter 22 Analysis and Interpretation - Test 1 Solutions

Chapter 18 Product Costs, Period Costs, NRV - Test Solutions

Chapter 18 Product Costs, Period Costs, NRV - Test Solutions

Chapter 18 Product Costs, Period Costs, NRV - Test

Chapter 18 Product Costs, Period Costs, NRV - Test

Chapter 17 Buying and Selling Non-Current Assets - Test Solutions

Chapter 17 Buying and Selling Non-Current Assets - Test Solutions

Chapter 17 Buying and Selling Non-Current Assets - Test

Chapter 17 Buying and Selling Non-Current Assets - Test

Chapter 16 Reducing Balance Depreciation - Test Solutions

Chapter 16 Reducing Balance Depreciation - Test Solutions

Chapter 15 Accounting for Returns - Test Solutions

Chapter 15 Accounting for Returns - Test Solutions

Chapter 14 Prepaid and Accrued Expenses - Test Solutions

Chapter 14 Prepaid and Accrued Expenses - Test Solutions

Chapter 13 Straight-Line Depreciation - Test Solutions

Chapter 13 Straight-Line Depreciation - Test Solutions

Recently uploaded

Recently uploaded (20)

Disha NEET Physics Guide for classes 11 and 12.pdf

Disha NEET Physics Guide for classes 11 and 12.pdf

IGNOU MSCCFT and PGDCFT Exam Question Pattern: MCFT003 Counselling and Family...

IGNOU MSCCFT and PGDCFT Exam Question Pattern: MCFT003 Counselling and Family...

A Critique of the Proposed National Education Policy Reform

A Critique of the Proposed National Education Policy Reform

Call Girls in Dwarka Mor Delhi Contact Us 9654467111

Call Girls in Dwarka Mor Delhi Contact Us 9654467111

Measures of Dispersion and Variability: Range, QD, AD and SD

Measures of Dispersion and Variability: Range, QD, AD and SD

Beyond the EU: DORA and NIS 2 Directive's Global Impact

Beyond the EU: DORA and NIS 2 Directive's Global Impact

Task 2C - GST Basics

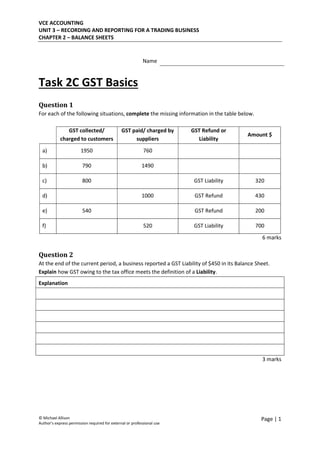

- 1. VCE ACCOUNTING UNIT 3 – RECORDING AND REPORTING FOR A TRADING BUSINESS CHAPTER 2 – BALANCE SHEETS © Michael Allison Author’s express permission required for external or professional use Page | 1 Name Student50 Task 2C GST Basics Question 1 For each of the following situations, complete the missing information in the table below. GST collected/ charged to customers GST paid/ charged by suppliers GST Refund or Liability Amount $ a) 1950 760 b) 790 1490 c) 800 GST Liability 320 d) 1000 GST Refund 430 e) 540 GST Refund 200 f) 520 GST Liability 700 6 marks Question 2 At the end of the current period, a business reported a GST Liability of $450 in its Balance Sheet. Explain how GST owing to the tax office meets the definition of a Liability. Explanation 3 marks

- 2. VCE ACCOUNTING UNIT 3 – RECORDING AND REPORTING FOR A TRADING BUSINESS CHAPTER 2 – BALANCE SHEETS © Michael Allison Author’s express permission required for external or professional use Page | 2 Question 3 During the current period a firm paid $800 in GST on $8,000 stock it had purchased. With reference to the elements of accounting, explain whether the $800 GST paid of meets the definition of an Expense. Explanation 2 marks Question 4 A business provided the following information for the current period: GST collected on cash sales $1,600 GST charged on credit purchases $1,200 GST paid on cash purchases $2,300 GST charged on credit sales $1,500 With reference to the elements of accounting, explain how GST will be classified in the Balance Sheet of the business at the end of the period. Explanation 1 + 3 = 4 marks Total /15 marks