Indian Stock Market Analytics | Buy Stock of Prestige Estates, Tech Mahindra and Lupin

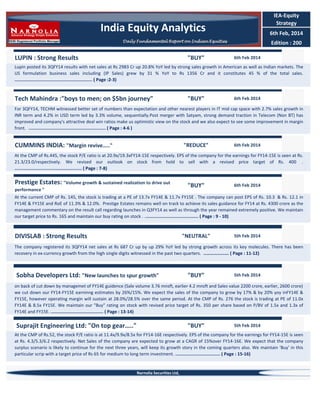

- 1. IEA-Equity Strategy India Equity Analytics 6th Feb, 2014 Daily Fundamental Report on Indian Equities LUPIN : Strong Results "BUY" Edition : 200 6th Feb 2014 Lupin posted its 3QFY14 results with net sales at Rs 2983 Cr up 20.8% YoY led by strong sales growth in American as well as Indian markets. The US formulation business sales including (IP Sales) grew by 31 % YoY to Rs 1356 Cr and it constitutes 45 % of the total sales. ........................................................... ( Page :2-3) Tech Mahindra :"boys to men; on $5bn journey" "BUY" 6th Feb 2014 For 3QFY14, TECHM witnessed better set of numbers than expectation and other nearest players in IT mid cap space with 2.7% sales growth in INR term and 4.2% in USD term led by 3.3% volume, sequentially.Post merger with Satyam, strong demand traction in Telecom (Non BT) has improved and company's attractive deal win ratios make us optimistic view on the stock and we also expect to see some improvement in margin front. ........................................................... ( Page : 4-6 ) CUMMINS INDIA: "Margin revive….." "REDUCE" 6th Feb 2014 At the CMP of Rs.445, the stock P/E ratio is at 20.9x/19.3xFY14-15E respectively. EPS of the company for the earnings for FY14-15E is seen at Rs. 21.3/23.0/respectively. We revised our outlook on stock from hold to sell with a revised price target of Rs. 400 . ................................................... ( Page : 7-8) Prestige Estates: "Volume growth & sustained realization to drive out performance " "BUY" 6th Feb 2014 At the current CMP of Rs. 145, the stock is trading at a PE of 13.7x FY14E & 11.7x FY15E . The company can post EPS of Rs. 10.3 & Rs. 12.1 in FY14E & FY15E and RoE of 11.3% & 12.0%. Prestige Estates remains well on track to achieve its sales guidance for FY14 at Rs. 4300 crore as the management commentary on the result call regarding launches in Q3FY14 as well as through the year remained extremely positive. We maintain our target price to Rs. 165 and maintain our buy rating on stock . ......................................... ( Page : 9 - 10) DIVISLAB : Strong Results "NEUTRAL" 5th Feb 2014 The company registered its 3QFY14 net sales at Rs 687 Cr up by up 29% YoY led by strong growth across its key molecules. There has been recovery in ex-currency growth from the high single digits witnessed in the past two quarters. …………………. ( Page : 11-12) Sobha Developers Ltd: "New launches to spur growth" "BUY" 5th Feb 2014 on back of cut down by managemet of FY14E guidence (Sale volume 3.76 mnsft, earlier 4.2 mnsft and Sales value 2200 crore, earlier, 2600 crore) we cut down our FY14-FY15E earninng estimates by 26%/15%. We expect the sales of the company to grow by 17% & by 20% yoy inFY14E & FY15E, however operating margin will sustain at 28.0%/28.5% over the same period. At the CMP of Rs. 276 the stock is trading at PE of 11.0x FY14E & 8.5x FY15E. We maintain our "Buy" rating on stock with revised price target of Rs. 350 per share based on P/BV of 1.5x and 1.3x of FY14E and FY15E. ........................................ ( Page : 13-14) Suprajit Engineering Ltd: "On top gear….." "BUY" 5th Feb 2014 At the CMP of Rs.52, the stock P/E ratio is at 11.4x/9.9x/8.5x for FY14-16E respectively. EPS of the company for the earnings for FY14-15E is seen at Rs. 4.3/5.3/6.2 respectively. Net Sales of the company are expected to grow at a CAGR of 15%over FY14-16E. We expect that the company surplus scenario is likely to continue for the next three years, will keep its growth story in the coming quarters also. We maintain ‘Buy’ in this particular scrip with a target price of Rs 65 for medium to long term investment. .................................. ( Page : 15-16) Narnolia Securities Ltd,

- 2. LUPIN Result Update BUY CMP Target Price Previous Target Price Upside Change from Previous 915 1000 9% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs, Cr) Average Daily Volume Nifty 500257 LUPIN 951/569 41,018 395892 6022 Stock Performance-% 1M Absolute Rel. to Nifty -2 1 1yr 53.4 52.8 YTD 48.3 35.9 "BUY" 06th Feb' 14 Strong Results Lupin posted its 3QFY14 results with net sales at Rs 2983 Cr up 20.8% YoY led by strong sales growth in American as well as Indian markets. The US formulation business sales including (IP Sales) grew by 31 % YoY to Rs 1356 Cr and it constitutes 45 % of the total sales. The Indian formulation business grew by 14% YoY to Rs 650 Cr and it contributed 22% of the company’s overall revenue for the quarter .The business from other geographies viz Japan and South Africa also have grown well with registering growth of 10% and 18% respectively.API (Active Pharmaceutical Ingredient) net sales grew by 26% to Rs 297.3 Cr during the quarter as compared to Rs 235.3 Cr for 3QFY13 and contributed 10% of company’s consolidated revenues. The operating EBITDA for the quarter came at Rs 773 Cr and OPM at 25.6%.The material cost during the quarter decreased by 30bps to Rs 1121 Cr and this constitutes 37.6% of net sales. The manufacturing and other expenses decreased by 90 bps to Rs 749 Cr for the quarter while employ cost deceased by 30 bps to Rs 387 Cr. The revenue expenditure on R&D stands at Rs 271 Cr which is 9.1 % of the 3QFY14 sales. The net profits for the quarter came at Rs 484 Cr and NPM at 15.8 % .The overall impact of Forex on net profits was a loss of Rs 68.8 Cr of which Rs 25.5 Cr forex gain is reflected in other income while the corresponding forex loss is captured across various other P&L Lines. Balance Sheet Highlights st Share Holding Pattern-% Promoters FII DII Others Current 2QFY14 1QFY1 4 46.8 46.8 46.8 31.9 31.5 30.7 11.3 12.1 12.4 10.0 9.7 10.1 One Year Price vs Nifty > Operating WC increased to Rs 2769.5 Cr as on 31 Dec 2013 as against Rs 2674.3 Cr as St on September 2013.The working capital number of days stood at 94 days as on 31 Dec 2013. > Capital Expenditure was Rs 104.1 Cr in the quarter Recent Developments Company filed 5 ANDA approvals in the quarter .Cumulative ANDA filings with US FDA now stands at 186 with the company having received 96 approvals till date. The company received 5 approvals from European regulatory authorities in the quarter. Company acquired Nanomi B.V of Netherlands and with this acquisition company has forayed into technology intensive complex injectables space. As per management with the use of Nanomi’s proprietary technology platform, Lupin would be able to make significant in roads into the niche area of complex injectables. View & Valuation The company at its CMP of Rs 915 is trading at 23 times of one year forward FY14 EPS of Rs 39.In the light of strong results ,management commentary and strong business outlook going forward we maintain BUY for the stock with Target price 1000. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 3022 773 484 25.6% 16.0% 2QFY14 2668 660 417 24.7% 15.6% (QoQ)-% 13.3 17.1 16.1 80bps 40bps 3QFY13 2501 606 342 24.2% 13.7% Rs, Crore (YoY)-% 20.8 27.6 41.5 130bps 230bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 2

- 3. LUPIN Sales and PAT Trend (Rs) Company posted its 3QFY14 results with net sales at Rs 2983 Cr up 20.8% YoY led by strong sales growth in American as well as Indian markets. (Source: Company/Eastwind) OPM % The material cost during the quarter decreased by 30bps to Rs 1121 Cr and this constitutes 37.6% of net sales. (Source: Company/Eastwind) NPM % The overall impact of Forex on net profits was a loss of Rs 68.8 Cr of which Rs 25.5 Cr forex gain is reflected in other income while the corresponding forex loss is captured across various other P&L Lines. (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 3

- 4. Tech Mahindra "BUY" 6th Feb' 14 "boys to men; on $5bn journey" Result update CMP Target Price Previous Target Price Upside Change from Previous Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty BUY 1838 2130 1875 16% 14% 532755 TECHM 1906/895 42876 191827 6022 Stock Performance Absolute Rel.to Nifty 1M 0.12 3.26 1yr 89.77 88.67 YTD 51.9 51.8 Share Holding Pattern-% Current 2QFY14 1QFY14 Promoters 36.34 36.46 47.17 FII 40.42 32.59 26.79 DII 9.08 15.13 15.83 Others 14.16 15.82 10.21 1 year forward P/E-x Broad-based performance with positive outlook, positive view retained; For 3QFY14, TECHM witnessed better set of numbers than expectation and other nearest players in IT mid cap space with 2.7% sales growth in INR term and 4.2% in USD term led by 3.3% volume, sequentially. Net profit increased to Rs 1,001cr from Rs 718.4cr including exceptional gains. After excluding that, net profit stood at Rs 663.22 cr for the quarter. The company remains confident on better demand and expects healthy client budgets in FY15E. The number of large deals in the pipeline is 6-8 at any point of time in the past few quarters, but the decision-making is unpredictable to tell about the future deal wins in the near term. EBITDA margin at steady mark: During the quarter, its EBITDA margin was unchanged at 23.2% on Sequential basis, while improved 230bps on YoY basis. Management is very confident to retain same level of margin picture in near future despite salary hike at a rate of 7-8% in next quarter. US revenue at nascent stage: During the quarter, revenue from US increased by 10%, while revenue from Europe and RoW declined by 3.6% and 1.8% on QoQ basis. US contribute 47%, Europe 31% and RoW 22% on sales. Post earning management quoted for better outlook in Asian markets with greater traction in Australia and Africa in near term. Best performance across all verticals: During the quarter, Except Technology, Media and Entertainment all verticals reported good growth. BFSI was up by 14% and Telecom, Manufacturing, retail and others reported 2.7% growth each in INR term. While, Technology, Media and Entertainment dipped by 6%, sequentially. The company is focusing on BFSI, manufacturing and telecom. Employee Metrics: The Total headcount for the year is at 87399 with QoQ net addition of 2165 as on 31st December 2013.The attrition has been slightly inching up in the last 3 quarters. However, wage hike could counter this. View and Valuation: Management is pitching an aspiration goal of USD 5bn revenue by 2015(CAGR at 24% for FY13-16E) through organic and inorganic initiatives and looking for USD 0.5bn to USD 0.8bn as acquisition target going forward. Company is focussed on its 6-pillar strategy i.e., selling 6 service lines of IT, infr- management, network management, security services, value added services and services such as analytics to telcos. On emerging space, mobility and digital would emerge as bigger bang for the buck. Post merger with Satyam, strong demand traction in Telecom (Non BT) has improved and company's attractive deal win ratios make us optimistic view on the stock and we also expect to see some improvement in margin front. At a CMP of Rs 1838, relatively the stock is trading at a fair valuation, 12.2x of FY15E earnings . We maintain “BUY” on the stock with a price target of Rs 2130. Financials Rs, Crore 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% Revenue 4898.6 4771.5 2.7 3799.1 28.9 EBITDA 1136.3 1110.85 2.3 795.7 42.8 PAT 674.3 718.2 (6.1) 626.4 7.6 EBITDA Margin 23.2% 23.3% (10bps) 20.9% 230bps PAT Margin 13.8% 15.1% (130bps) 16.5% (170bps) (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 4

- 5. Tech Mahindra. Sales (USD) and Sales growth-%(QoQ) On $term, Sales growth was up by 4.4% (QoQ) and 2.7% on INR term, (Source: Company/Eastwind) Margin-% (Source: Company/Eastwind) Employee Metrics-% Attrition increased at 17%. still, lower than other peers (Source: Company/Eastwind) Key Facts from Cnference Call (attended on 4th Feb 2014) (1)The Company aspires revenues of USD 5 billion by 2015. This expects to be through organic and inorganic initiatives (looking for USD 0.5 billion to 0.8 billion as acquisition targets) going forward. (2) Year 2014 would be better year than FY13, demand environment and Order pipeline is looking good. They are more focus for mobility and digital projects. (3) Despite salary hike in 4Q, margin would be on place. Wage hike in 4Q could impact 200bps in margin front, but management is confident to mitigate. (4)Expecting utilisation rate to 77% from 75%(3QFY14) in near term. (5)The tax rate expected to be 26% for the FY'14. (6) Cash utilization only for acquisition and investment in emerging space. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 5

- 6. Tech Mahindra. Operating Metrics Client contribution to revenue-% Customer Active Top 10 clients Top 5 clients Top client Revenue mix - onsite/offshore (%) Onsite Offshore Employee Metrics Utilisation % Attrition % 1QFY13 484.00 50.0% 40.0% 17.0% 2QFY13 475.00 51.0% 41.0% 14.0% 3QFY13 475.00 50.0% 39.0% 15.0% 4QFY13 516.00 50.0% 37.0% 13.0% 1QFY14 567.00 49.0% 37.0% 12.0% 2QFY14 576.00 48.0% 36.0% 12.0% 3QFY14 605 49% 37% 12.0% 48.0% 52.0% 48.0% 52.0% 48.0% 52.0% 48.0% 52.0% 51.0% 49.0% 51.0% 49.0% 52% 48% 75.0% 17.0% 74.0% 16.0% 76.0% 16.0% 77.0% 16.0% 76.0% 15.0% 75.0% 16.0% 75.0% 17.0% Financials Rs, Cr Net Sales(mn)-USD Net Sales Employee Cost Operation and other expenses Subcontracting Cost Total Expenses EBITDA Depreciation Other Income EBIT Interest Cost PBT Tax PAT Growth-% Sales-USD Sales EBITDA PAT Margin -% EBITDA EBIT PAT Expenses on Sales-% Employee Cost Subcontracting Cost Operation and other expenses Tax rate Valuation CMP No of Share NW EPS BVPS RoE-% Dividen Payout-% P/BV P/E FY12 1157 11702.4 6591.9 2210.1 948.6 9750.6 1951.8 319.0 501.3 1632.80 107.3 2026.8 228.9 1797.9 FY13 2633 14332.0 8099.5 2287.3 882.0 11268.8 3063.2 389.6 212.2 2673.60 92.1 2793.7 647.9 2145.8 FY14E 3099.98 18817.38 9709.77 3198.95 1599.48 14508.2 4309.18 511.53 254.03 3797.65 93.14 3958.5 1078.7 2879.8 FY15E 3595.98 21396.09 11061.78 3530.36 1711.69 16303.8 5092.27 581.63 320.94 4510.64 86.80 4744.8 1257.4 3487.4 FY16E 4099.42 24801.49 12896.77 4216.25 1984.12 19097.1 5704.34 674.20 372.02 5030.14 82.58 5319.6 1383.1 3936.5 2.7% 13.8% 11.9% 9.6% 127.6% 22.5% 56.9% 19.4% 17.7% 31.3% 40.7% 34.2% 16.0% 13.7% 18.2% 21.1% 14.0% 15.9% 12.0% 12.9% 16.7% 14.0% 15.4% 21.4% 18.7% 15.0% 22.9% 20.2% 15.3% 23.8% 21.1% 16.3% 23.0% 20.3% 15.9% 56.3% 8.1% 18.9% 11.3% 56.5% 6.2% 16.0% 23.2% 51.6% 8.5% 17.0% 27.3% 51.7% 8.0% 16.5% 26.5% 52.0% 8.0% 17.0% 26.0% 652.5 23.2 4815.8 77.4 207.3 37.3% 3.3% 3.1 8.4 1081.7 23.2 5529.1 92.4 238.0 38.8% 2.8% 4.5 11.7 1838.0 23.2 8273.0 124.0 356.1 34.8% 4.7% 5.2 14.8 1838.0 23.2 11624.6 150.1 500.4 30.0% 3.9% 3.7 12.2 1838.0 23.2 15425.2 169.5 664.0 25.5% 3.5% 2.8 10.8 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 6

- 7. CUMMINS INDIA Ltd. CUM "Reduce" 6th Feb' 14 "Margin revive….." Result update Reduce CMP Target Price Previous Target Price Upside Change from Previous 445 400 510 -10% -22% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume (Nos.) Nifty 500480 CUMMINSIND 396/550 12334 83995 6022 Stock Performance-% 1M -3 (0) Absolute Rel. to Nifty 1yr -11 (12) YTD -10 (16) Share Holding Pattern-% Promoters FII DII Others 4QFY14 51.0 17.0 18.2 13.8 1 yr Forward P/B 3QFY14 2QFY14 51.0 51.0 15.5 16.2 19.8 19.5 13.7 13.3 Strong operating performance, but weak below the line; Cummins has registered 6% fall in revenue to Rs 1023.01 crore. But the operating margin has expanded by modest 20 bps to 19.3% and that has marginally limited the impact at operating level restricting the de-growth at operating profit to 5% to Rs 197.56 crore. Eventually the net profit was lower by 37% to Rs 147.23 crore. The sharp fall in bottom-line came on escalated based as the bottom-line of corresponding previous period is boosted by an EO income of Rs 47.50 crore compared to nil in Q3FY14. But for lower other income, absence of any EO item and higher tax incidence the fall in bottom-line would have not been this steeper. downgrade to SELL after KKC’s recent un and maintain our business view on (1) lack of growth in powergen after a sharp decline, (2) weak nearterm exports outlook, (3) potential margin risk and (4) limited upside from a cyclical upturn. Result Highlights; • The Value of production for the quarter was lower by 3% to Rs 1001.97 crore. However the operating sales (excluding other operating income) was down by 7% to Rs 1000.57 crore. Subdued revenue growth seems largely on account of dip in demand for power gen-sets as there is considerable improvement in power situation in South Indian States, which hitherto drove the demand for this segment. Moreover lower realization on exports with new prices being relatively lower than corresponding previous period. • Operating margin expanded by 20 bps to 19.3% and this is largely on account of pruning of costs. Cost of traded goods as % to sales was lower by 200 bps to 4%. But all cost heads have seen an increase with material cost (excluding cost of traded goods) was higher by 80 bps to 56.1%, the staff cost was up by 50 bps to 8.5% and the other expenses was up by 130 bps to 12.1%. • Other income was lower by 64% to Rs 23.63 crore. The interest cost was up by 14% (to Rs 0.97 crore) and the depreciation cost was up by 13% to Rs 13.31 crore on the back of capacity augmentation programme. Thus the PBT (before EO) was down by 21% to Rs 206.91 crore. • EO for the quarter was nil compared to Rs 47.50 crore in the corresponding previous period. Thus on escalated base the PBT (after EO) was lower by 33% to Rs 206.91 crore. Taxation in absolute terms was lower by 21% to Rs 59.68 crore and the effective tax rate was higher at 28.8% compared to 24.4% in the corresponding previous period. Thus the net profit was down by Valuations At the CMP of Rs.445, the stock P/E ratio is at 20.9x/19.3xFY14-15E respectively. EPS of the company for the earnings for FY14-15E is seen at Rs. 21.3/23.0/respectively. We revised our outlook on stock from hold to sell with a revised price target of Rs. 400 Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 1023.0 197.6 147.2 19.3% 14.1% 2QFY14 932.7 152.6 144.8 16.4% 14.6% Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (QoQ)-% 9.7 29.4 1.7 (290)bps (50)bps Rs, Crore 3QFY13 (YoY)-% 1089.5 -6.1 208.6 -5.3 234.1 -37.1 19.1% 20 bps 20.3% (620)bps (Source: Company/Eastwind) 7

- 8. CUMMINS INDIA Ltd. Key financials : PARTICULAR 2010A 2011A 2012A 2013A 2014E 2015E 2845 122 2966 527 491 36 2 611 167 0 444 311 11.2 16.0 4043 80 4123 763 727 37 5 802 211 0 591 345 12.5 21.3 4117 123 4241 697 655 42 5 773 233 51 591 354 12.8 21.3 4589 207 4796 835 788 47 5 990 287 62 765 421 15.2 27.6 4120 207 4327 680 628 52 5 830 241 0 589 421 15.2 21.3 4532 207 4739 759 697 62 5 899 261 0 638 487 17.6 23.0 18.5% 15.0% 4.4% 3.1% 28.4% 28.6% 18.9% 14.3% 4.4% 2.5% 32.7% 33.0% 16.9% 13.9% 4.3% 2.6% 28.9% 29.2% 18.2% 15.9% 6.0% 3.3% 32.0% 32.2% 16.5% 13.6% 4.8% 3.4% 23.1% 23.2% 16.8% 13.5% 5.2% 3.9% 23.6% 23.8% 1561 0 1561 28 367 1806 0 1806 28 489 2043 0 2043 28 497 2387 0 2387 28 456 2555 0 2555 28 445 2706 0 2706 28 445 56.3 6.5 239.6 22.9 65.2 7.5 153.0 22.9 73.7 6.7 121.1 23.3 86.1 5.3 170.9 16.5 92.2 4.8 136.2 20.9 97.6 4.6 151.2 19.3 Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Extra Oridiniary Items Reported PAT Dividend (INR) DPS EPS Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Capital Employed No of Share (Adj) CMP Valuation Book Value P/B Int/Coverage P/E Ammount in crores (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 8

- 9. Prestige Estates Projects Ltd. V- "Buy" 6th Feb' 14 "Volume growth & sustained realization to drive out performance……." Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 145 165 195 14% 0% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 533274 PRESTIGE 102/195 4,947 161,912 6,022 Stock Performance-% 1M (10.1) (7.1) Absolute Rel. to Nifty 1yr (21.5) (21.9) YTD (13.1) (19.1) Share Holding Pattern-% Promoters FII DII Others 4QFY14 75.0 17.4 6.3 1.3 1 yr Forward P/B 3QFY14 2QFY14 75.0 75.0 17.4 17.2 6.3 6.1 1.3 1.7 Prestige Estates posted muted revenue recognition trajectory, degrowing 12.5% yoy to Rs. 430.5 crore. On a sequential basis, the decline was 9.4%. EBITDA margins expanded by 570bps qoq to 30.6%. PAT surged by 3.8% QoQ to Rs. 80.6 crore, increased by 12.5% yoy.. Volumes for the quarter stood at 2.075 mn sft, to Rs. 1262 crore on the back of three new residential launches in Bengaluru to the tune of 4.09 mn sft. Prestige Estates remains well on track to achieve its sales guidance for FY14 at Rs. 4300 crore as the management commentary on the result call regarding launches in Q2FY14 as well as through the year remained extremely positive. We maintain our target price to Rs. 165 and maintain our buy rating on stock. Result Highlights 3QFY14 Prestige Estates Projects said it sold 1,204 residential units and 0.026 million square feet (Mnsft) of commercial space, aggregating to 2.075 Mnsft, amounting to Rs 1262 crore of sales in Q3 December 2013. Of the above, Prestige share is 904 units -1.55 Mnsft amounting to Rs 940.20 crore of sales, up by 24.69% from that of Q3 December 2012.In Q3 December 2012, the company had sold 682 units aggregating 1.44 Mnsft of residential and commercial space, amounting to Rs 754 crore of sales - Prestige share. (Overall sales of 1.69 Mnsft of area amounting to Rs 873.90 crore). Collections rose 16.69% to Rs 592.30 crore in Q3 December 2013 over Q3 December 2012 - Prestige share. (Overall collections for the Q3 December 2013 - Rs 713.30 crore). In Q3 December 2013, the company launched the first phase of its largest residential project- Prestige Lakeside Habitat in Bangalore aggregating to 2.79 million square feet of total developable area. The project is spread across 102 acres in area and consists of apartments and villas with total developable area of 8.40 Mnsft. Management Guidence FY14E Company will exceed its presales guidance. Company has already done sales to the extent of Rs 1,200 crore plus and now it is just a question of production and these numbers getting recognised because company need to touch the trigger of 30 percent to recognise these numbers. During the year, company has made Rs 3,700 crore and guidance was Rs 4,300 crore. On his outlook for the company's business, Prestige Estates Projects, says there is no slowdown in the Bangalore market and aims to concentrate on the phase 2 and 3 of its Lakeside Habitat project newt quarter Valuation: At the current CMP of Rs. 145, the stock is trading at a PE of 13.7x FY14E & 11.7x FY15E . The company can post EPS of Rs. 10.3 & Rs. 12.1 in FY14E & FY15E and RoE of 11.3% & 12.0%. Prestige Estates remains well on track to achieve its sales guidance for FY14 at Rs. 4300 crore as the management commentary on the result call regarding launches in Q3FY14 as well as through the year remained extremely positive. We maintain our target price to Rs. 165 and maintain our buy rating on stock Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 430.5 131.9 80.6 30.6% 17.5% 2QFY14 475.3 118.7 77.6 25.0% 15.4% (Source: Company/ Eastwind Research) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (QoQ)-% -9.4% 11.1% 3.8% 560 bps 210 bps 3QFY13 492.1 142.4 92.1 28.9% 18.0% Rs, Crore (YoY)-% -12.5% -7.4% -12.5% 170 bps (50) bps (Standalone) 9

- 10. Prestige Estates Projects Ltd. Key financials : PARTICULAR 2011A 2012A 2013A 2014E 2015E 1543 68 1611 442 381 61 123 326 91 235 39 7.2 1.2 1052 34 1086 331 270 61 119 185 63 122 39 3.7 1.2 1948 64 2011 579 511 68 149 426 131 294 39 8.4 1.1 2532 64 2595 696 621 75 163 522 161 361 39 10.3 1.1 3038 64 3102 805 722 83 163 623 199 423 39 12.1 1.1 28.6% 14.6% 5.7% 1.0% 11.1% 6.5% 31.4% 11.3% 3.7% 1.2% 5.7% 3.0% 29.7% 14.6% 5.2% 0.7% 10.7% 5.7% 27.5% 13.9% 7.3% 0.8% 11.8% 6.6% 26.5% 13.7% 8.6% 0.8% 12.0% 7.4% 2114 1505 3619 33 125 2151 1864 4015 33 100 2743 2420 5163 35 163 64.4 1.9 3.1 17.5 65.6 1.5 2.3 26.8 78.4 2.1 3.4 19.4 Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Reported PAT Dividend EPS DPS Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Capital Employed No of Share CMP (Ammount in crore) 3065 3531 2420 2200 5485 5731 35 35 141 141 (Source: Company/Eastwind) Valuation Book Value P/B Int/Coverage P/E (Source: Eastwind Research) 87.6 1.6 3.8 13.7 100.9 1.4 4.4 11.7 (Figures in crore) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 10

- 11. DIVISLAB "NEUTRAL" 05th Feb' 14 Strong Results NEUTRAL 1337 1420 1350 6% 5% Result Update CMP Target Price Previous Target Price Upside Change from Previous Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs, Cr) Average Daily Volume Nifty 532488 DIVISLAB 1390/905 17842 5.43 6000 Stock Performance-% 1M Absolute Rel. to Nifty 7.6 11 1yr 26.2 26.17 YTD 15.5 3.5 Share Holding Pattern-% Promoters FII DII Others Current 2QFY14 1QFY1 4 52.1 52.1 52.2 16.3 15.8 14.8 13.2 12.5 12.5 18.5 19.5 20.5 One Year Price vs Nifty The company registered its 3QFY14 net sales at Rs 687 Cr up by up 29% YoY led by strong growth across its key molecules. There has been recovery in ex-currency growth from the high single digits witnessed in the past two quarters. The operating EBITDA for the quarter under review came at Rs 288 Cr and OPM at 41.7%.The operating margins improve by almost 760bps on the back of improvement in company’s operating metrics, currency benefits and lower power cost . The RM cost to sales for the quarter came at 36% while it was 49 % for the same time last fiscal. The employ cost as percentage of sales also showed improvement of 100 bps on yearly basis. The company has cut down its other expenses for the quarter to Rs 88 and it stands at 13 % of the net sales from 8% a year ago. The profits after tax came at Rs 218 Cr and NPM at 31.7 %.The other income for the quarter came at Rs 8 Cr verses 22 Cr for the same time last fiscal. The tax rate for the quarter was lower on yearly basis at 20 %.Forex Loss for the current quarter amounted to Rs 5 Cr while there was a forex gain of Rs 16 Cr during the corresponding quarter last year. Key takeaways from management interaction > Sales from DSN SEZ (all 5 units) are at of Rs 3.3 Bn for 9MFY14 (versus Rs 2.2 Bn in FY2013). The company has total investments of Rs 6.0 Bn in the DSN SEZ and expects the asset turnover to be 1.8-2.0 times. > Carotenoid sales for 9MFY14 are at Rs 910 Mn and expected to reach Rs1.5 Bn for FY2015. >The company expects the inspection (by regulatory/customers) for the 3 additional units at DSN SEZ in 4QFY14. Sales from these units are expected to ramp up in 2QFY15. > There has been reduction in power and fuel cost since August 2013 with 160 bps decline on a sequential basis. >CWIP is at Rs1.8 Bn at the end of 9MFY14. There has been a sharp increase in receivables at Rs 7.1 Bn – 108 days versus 86 days in FY2013. Inventory days have improved to 140 days in 9MFY14 versus 161 days in 1HFY14. View & Valuation The stock at CPM of Rs 1337 is trading at 22.05 x of one year forward FY14E EPS of Rs 61.The stock has achieved our recommended Target price of Rs 1350 and therefore we change our view to Neutral from BUY. The strong 3QFY14 results ,improvement in operating metrics, Currency movement are few factor which still provide some upsides. We have slightly revised our target price upwards to Rs 1420 based on our analysis. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 689 287 218 41.7% 31.6% 2QFY14 567 249 205 43.9% 36.2% (QoQ)-% 21.5 15.3 6.3 (230bps) (450bps) 3QFY13 534 182 143 34.1% 26.8% Rs, Crore (YoY)-% 29.0 57.7 52.4 760bps 490bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 11

- 12. DIVISLAB Sales and PAT Trend (Rs) Net sales at Rs 687 Cr up by up 29% YoY led by strong growth across its key molecules. (Source: Company/Eastwind) OPM % Operating margins improve by almost 800bps on the back of improvement in company’s operating metrics, currency benefits and lower power cost . (Source: Company/Eastwind) NPM % The tax rate for the quarter was lower on yearly basis at 20 %.Forex Loss for the current quarter amounted to Rs 5 Cr (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 12

- 13. Sobha Developers Ltd. "Buy" 5th Feb' 14 "New launches to spur growth….." Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 276 350 460 27% -24% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume (Nos.) Nifty 532784 SOBHA 282/472 3052 105448 6002 Stock Performance-% 1M -17 (14) Absolute Rel. to Nifty 1yr -36 -35 YTD -21 (27) Share Holding Pattern-% Promoters FII DII Others 3QFY14 60.6 32.7 2.9 3.9 1 yr Forward P/B 2QFY14 1QFY14 60.6 60.6 33.2 33.5 2.6 2.8 3.7 3.1 Despite of week volume numbers in NCR & Chennai Sobha reported its Q3FY14 numbers with a topline that was inline street expectations at Rs. 544.3 crore. EBITDA for the quarter stood at Rs. 149.0 crore, growing 8.4% yoy. The EBITDA margin were down 460 bps, yoy and stands at 27.4% during the quarter mainly on account of higher proportion of contractual projects segment (this segment fetches about 20 per cent margins compared with property development business’ 35 per cent and increase in input costs. However managemnet assures that goinf forward margins should be around 28 percent and at profit before tax (PBT) and profit after tax (PAT) level we are at 10 percent to 11 percent level. We maintain our "Buy" rating on stock, however on back of cut down by managemet of FY14E guidence (Sale volume 3.76 mnsft, earlier 4.2 mnsft and Sales value 2200 crore, earlier, 2600 crore) we cut down our FY14-FY15E earninng estimates by 26%/15% and also reduce our price target to Rs. 350 Lowered FY14E sales volume & revenue Guidence Sobha had at the begning of the fiscal set guidence of new sales area of 4.20 mnsft at Rs. 2600 crore for the current fiscal. At the close of 3 quarters of FY14, the company has registered a new sales area of 2.66 mnsft valued at 1737 crore. However, post 3QFY14 result, management had lowered his sales volume and booking guidence to 3.76 mnsft and Rs. 2200 crore largely attributed to delay in approvels Growth story remain intact; The firm had launched two new projects: 0.66 mnsft of developable area and 0.46 mnsft of saleable area in 3QFY14 and six new projects: 3.38 mnsft of developable area and 2.01 mnsft of saleable area in 9MFY14. In CY14, the firm has plans to launch 11 mnsft, and out of which 3 mnsft in 4QFY14 especially in the Rs7.5-15mn price bracket that continues to see stable demand as a result we able to belive that company will able to achive is revised sales volume guidence for FY14E. Valuations; on back of cut down by managemet of FY14E guidence (Sale volume 3.76 mnsft, earlier 4.2 mnsft and Sales value 2200 crore, earlier, 2600 crore) we cut down our FY14-FY15E earninng estimates by 26%/15%. We expect the sales of the company to grow by 17% & by 20% yoy inFY14E & FY15E, however operating margin will sustain at 28.0%/28.5% over the same period. At the CMP of Rs. 276 the stock is trading at PE of 11.0x FY14E & 8.5x FY15E. We maintain our "Buy" rating on stock with revised price target of Rs. 350 per share based on P/BV of 1.5x and 1.3x of FY14E and FY15E. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 544.3 149.0 58.3 27.4% 10.7% 2QFY14 540.8 143.3 56.6 26.5% 10.8% Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (QoQ)-% 0.6 4.0 3.0 90 bps (10) bps Rs, Crore 3QFY13 (YoY)-% 429.8 26.6 137.4 8.4 52.6 10.8 32.0% (460) bps 12.2% (150) bps (Source: Company/Eastwind) 13

- 14. SOBHA DEVELOPERS Ltd. Key financials : PARTICULAR 2010A 2011A 2012A 2013A 2014E 2015E 1130 4 1134 264 231 32 69 166 27 NA 139 25 2.4 13.6 1394 5 1400 360 332 28 86 251 67 NA 185 29 3.0 18.8 1408 6 1414 467 428 39 117 318 108 NA 210 49 5.0 21.4 1865 6 1870 548 489 59 171 324 107 NA 217 69 7.0 22.1 2180 6 2186 610 542 68 175 373 126 NA 247 69 7.0 25.2 2616 6 2622 746 674 72 200 479 162 NA 317 69 7.0 32.3 23.3% 12.2% 5.0% 0.9% 8.1% 6.5% 25.8% 13.2% 6.9% 1.1% 10.0% 8.7% 33.1% 14.9% 6.5% 1.5% 10.5% 10.1% 29.4% 11.6% 6.3% 2.0% 10.2% 11.1% 28.0% 11.3% 9.1% 2.5% 10.7% 11.1% 28.5% 12.1% 11.7% 2.5% 12.4% 11.8% Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Extra Oridiniary Items Reported PAT Dividend (INR) DPS EPS Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Ammount in crores (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 14

- 15. Suprajit Engineering Ltd. "Buy" 5th Feb' 14 "On top gear….." Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 52 65 NA 25% NA Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume (Nos.) Nifty 532509 SUPRAJIT 32/62 624 10772 6002 Stock Performance-% 1M -3 1 Absolute Rel. to Nifty 1yr 56 57 YTD 57 51 Share Holding Pattern-% Promoters FII DII Others 3QFY14 51.8 1.9 1.6 44.7 1 yr Forward P/B 2QFY14 1QFY14 51.8 51.8 1.4 0.9 1.7 1.4 45.1 45.9 Despite adverse market conditions, for the quarter ended December 2013, Suprajit Engineering registered a good 30% rise in consolidated sales (including other operating income) to Rs 159.53 crore. OPM jumped 260 basis points to 18.8% which lifted OP growth to 50% to Rs 30.02 crore. Other income stood at negative Rs 68 lakh (against Rs 29 lakh) and interest cost jumped 27% to Rs 3.43 crore. After providing for depreciation (up 14% to Rs 2.26 crore), PBT jumped 51% to Rs 23.65 crore. Whereas tax grew 62% to Rs 7.50 crore after which PAT grew 47% to Rs 16.1 crore. Aftermarket and non-automotive exports business clocked robust growths of 35% and 45% respectively. Suprajit Engineering (SEL) continues to deliver robust margins (at 16-17%) despite weakness in the automotive space. With healthy return ratios (RoE ~30%, RoCE ~25%) and strong balance sheet. We expect a revenue growth for FY14-16E by 15% on back of strong capacity expansion plan abd growth potential in the business. We modelled our valuation parameteres, which make us believe that share is trading at lower then fair value at current market price. We have "Buy" rating on stock with a Target price of Rs. 65. Capex will see the company having the world's largest cable capacities The Board of Directors critically assessed the business prospects for the next two years and have approved the following capex plans considering the business growth in the next two years. • A new cable plant, measuring 80,000 sf.ft at Narsapura Industrial area, Karnataka, on the land already in possession. • A new cable plant measuring 50,000 sq.ft to meet the customer requirements in Chennai at the recently allotted land at Vallam-Vadagal Industrial Park, Tamilnadu. • Significant capacity expansion at the existing Pathredi plant, Rajasthan, with an additional plant measuring 110,000 sq.ft. • Complete renovation and refurbishing of an existing plant in Bommasandra, Bangalore to relocate the aftermarket manufacturing facility to meet increased demand. • Several balancing equipment and buildings in other existing units to fine-tune the capacities to meet additional customer requirements. • Additional equipments to add capacity at its 100% owned subsidiary, Suprajit Automotive. • The capex for the above plans would be approximately Rs. 60 crore. With these capex plans spread over the next 18-24 months, the company's standalone cable capacity will exceed 200 mn cables / year and on a consolidated basis will exceed 225 mn cables year. This would be one of the world's largest cable capacities. Valuations At the CMP of Rs.52, the stock P/E ratio is at 11.4x/9.9x/8.5x for FY14-16E respectively. EPS of the company for the earnings for FY14-15E is seen at Rs. 4.3/5.3/6.2 respectively. Net Sales of the company are expected to grow at a CAGR of 15%over FY14-16E. We expect that the company surplus scenario is likely to continue for the next three years, will keep its growth story in the coming quarters also. We maintain ‘Buy’ in this particular scrip with a target price of Rs 65 for medium to long term investment. Financials Rs, Crore 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% Revenue 159.5 123.1 29.6 123.1 29.5 EBITDA 30.0 21.0 43.0 20.0 49.9 PAT 16.2 13.9 16.2 10.8 49.1 EBITDA Margin 18.8% 17.1% 170 bps 16.3% 250 bps PAT Margin 10.2% 11.1% (90) bps 8.8% 140 bps (Consolidated) (Source: Company/Eastwind) 15 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report.

- 16. SOBHA DEVELOPERS Ltd. Key financials : PARTICULAR 2010A 2011A 2012A 2013A 2014E 2015E 2016E 248 0 249 47 40 7 6 34 11 0 24 6 0.5 2.0 347 5 351 57 50 7 7 47 13 0 34 6 0.5 2.8 424 3 427 69 61 7 9 55 15 0 40 9 0.8 3.3 463 3 465 77 69 8 10 67 20 5 47 10 0.9 3.9 540 7 547 92 84 8 13 78 23 0 55 15 1.2 4.6 637 7 644 107 97 10 15 89 26 0 63 17 1.4 5.3 752 7 759 127 115 12 17 105 31 0 74 19 1.6 6.2 19.0% 9.4% 12.2% 3.1% 33.5% 22.5% 16.5% 9.6% 15.1% 2.8% 34.8% 25.3% 16.2% 9.3% 16.8% 3.8% 30.8% 23.2% 16.7% 10.1% 11.8% 2.6% 28.3% 20.6% 17.0% 10.0% 8.8% 2.4% 26.5% 19.6% 16.9% 9.8% 10.1% 2.7% 25.0% 18.9% 16.9% 9.7% 11.8% 3.0% 24.1% 18.7% 70 62 132 12 16 97 66 163 12 19 129 82 212 12 20 167 111 278 12 33 207 252 307 140 160 180 347 412 487 12 12 12 52 (Source:52 52 Company/Eastwind) 5.9 2.7 6.5 8.2 8.1 2.3 6.8 6.6 10.8 1.8 6.6 6.0 13.9 2.4 6.8 8.5 17.2 3.0 6.4 11.4 Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Extra Oridiniary Items Reported PAT Dividend (INR) DPS EPS Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Capital Employed No of Share (Adj) CMP Ammount in crores Valuation Book Value P/B Int/Coverage P/E 21.0 2.5 6.5 9.9 25.6 2.0 6.7 8.5 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 16

- 17. N arnolia Securities Ltd 402, 4th floor 7/ 1, Lord s Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 em ail: research@narnolia.com , w ebsite : w w w .narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.