Stock Advisory for Today - Buy Stock of Dabur India Ltd and CAN FIN HOME

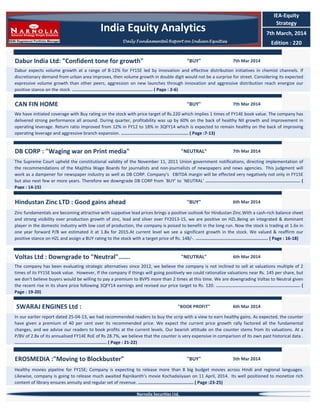

- 1. IEA-Equity Strategy India Equity Analytics 7th March, 2014 Daily Fundamental Report on Indian Equities Dabur India Ltd: "Confident tone for growth" "BUY" Edition : 220 7th Mar 2014 Dabur expects volume growth at a range of 8-12% for FY15E led by innovation and effective distribution initiatives in chemist channels. If discretionary demand from urban area improves, then volume growth in double digit would not be a surprise for street. Considering its expected expressive volume growth than other peers, aggression on new launches through innovation and aggressive distribution reach energize our positive stance on the stock. ............................................................. ( Page : 2-6) CAN FIN HOME "BUY" 7th Mar 2014 We have initiated coverage with Buy rating on the stock with price target of Rs.220 which implies 1 times of FY14E book value. The company has delivered strong performance all around. During quarter, profitability was up by 60% on the back of healthy NII growth and improvement in operating leverage. Return ratio improved from 12% in FY12 to 18% in 3QFY14 which is expected to remain healthy on the back of improving operating leverage and aggressive branch expansion. ................................................... ( Page :7-13) DB CORP : "Waging war on Print media" "NEUTRAL" 7th Mar 2014 The Supreme Court upheld the constitutional validity of the November 11, 2011 Union government notifications, directing implementation of the recommendations of the Majithia Wage Boards for journalists and non-journalists of newspapers and news agencies. This judgment will work as a dampener for newspaper industry as well as DB CORP. Company’s EBITDA margin will be effected very negatively not only in FY15E but also next few or more years. Therefore we downgrade DB CORP from `BUY’ to `NEUTRAL’ ........................................................................ ( Page : 14-15) Hindustan Zinc LTD : Good gains ahead "BUY" 6th Mar 2014 Zinc fundamentals are becoming attractive with suppotive lead prices brings a positive outlook for Hindustan Zinc.With a cash-rich balance sheet and strong visibility over production growth of zinc, lead and silver over FY2013-15, we are positive on HZL.Being an integrated & dominant player in the domestic industry with low cost of production, the company is poised to benefit in the long run. Now the stock is trading at 1.6x in one year forward P/B we estimated it at 1.8x for 2015.At current level we see a significant growth in the stock. We valued & reaffirm our positive stance on HZL and assign a BUY rating to the stock with a target price of Rs. 148/-. ....................................................... ( Page : 16-18) Voltas Ltd : Downgrade to "Neutral"……. "NEUTRAL" 6th Mar 2014 The company has been evaluating strategic alternatives since 2012, we believe the company is not inclined to sell at valuations multiple of 2 times of its FY15E book value. However, If the company if things will going positively we could rationalize valuations near Rs. 145 per share, but we don't believe buyers would be willing to pay a premium to BVPS more than 2 times at this time. We are downgrading Voltas to Neutral given the recent rise in its share price following 3QFY14 earnings and revised our price target to Rs. 120. ................................................................ ( Page : 19-20) SWARAJ ENGINES Ltd : "BOOK PROFIT" 6th Mar 2014 In our earlier report dated 25-04-13, we had recommended readers to buy the scrip with a view to earn healthy gains. As expected, the counter have given a premium of 40 per cent over its recommended price. We expect the current price growth rally factored all the fundamental changes, and we advise our readers to book profits at the current levels. Our bearish attitude on the counter stems from its valuations. At a P/BV of 2.8x of its annualised FY14E RoE of Rs 28.7%, we believe that the counter is very expensive in comparison of its own past historical data . ...................................................................... ( Page : 21-22) EROSMEDIA :"Moving to Blockbuster" "BUY" 5th Mar 2014 Healthy movies pipeline for FY15E; Company is expecting to release more than 8 big budget movies across Hindi and regional languages. Likewise, company is going to release much awaited Rajnikanth’s movie Kochadaiiyaan on 11 April, 2014. Its well positioned to monetize rich content of library ensures annuity and regular set of revenue. .......................................... ( Page :23-25) Narnolia Securities Ltd,

- 2. Dabur India Ltd. "BUY" 7th Mar' 14 "Confident tone for growth" Company update CMP Target Price Previous Target Price Upside Change from Previous BUY 173 206 19% - Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 500096 DABUR 185/128 30246 908049 6401 Stock Performance Absolute Rel. to Nifty 1M 0.3% -6.03% 1yr 30% 19% YTD 33.9% 22.0% Share Holding Pattern-% Current Promoters FII DII Others 68.64 19.94 4.47 6.95 P/BV(x)-1year forward 2QFY14 1QFY14 68.66 20.71 3.96 6.7 68.66 20.4 3.97 7 Analysis on recent management interview to media : Dabur expects volume growth at a range of 8-12% for FY15E led by innovation and effective distribution initiatives in chemist channels. If discretionary demand from urban area improves, then volume growth in double digit would not be a surprise for street. A mature segment like Hair Oil remains a concern because of competitive intensity, likely to grow slower than healthcare and home segments. Consistently, Dabur is aggresively working on innovation activities to launch new product as well as product development activities. Recently new launches would come to the people like Vatika Enriched Coconut Oil with hibiscus, Vatika Olive Enriched Hair Oil. Considering its expected expressive volume growth than other peers, aggression on new launches through innovation and aggressive distribution reach energize our positive stance on the stock. Expecting for bottomed up sign on volume growth: Post earning, management of the company expressed hypothetically its view regarding bottoming out of urban demand. The management of other FMCG bellwether like Marico had also stated that the trend of volume decline has bottomed out based on hypothesis. Recent Consumer Confidence Index indicates some upward movement than previous quarters. At a same point, recent softening in CPI and Food Inflation Index (graph on 3rd page of this company's report) hint to improve consumer discretionary demand from rural and urban area. Aggression on expending distribution reach: Dabur is working on chemist channel to drive growth of its health care and Personal care portfolio, and they are planning to distribute personal products through this channel. Dabur had direct coverage of 55,000 chemist stores, which has now increased to 75,000; plans to take it to 125,000 by FY15E. View and Valuation: Despite signs of weak discretionary demand and increased competitive intensity in the market, Dabur India has reported comparatively better volume growth in its key categories. On all operating parameters, its performance was satisfactory. Still, management is cautious for margin ramp up due to high inflation in India. The strong momentum in relatively low competition in the core categories with diversified portfolio, Dabur gets a better place than other peers and its rural distribution expansion should boost sales volumes. We retain our “Buy” view on the stock with a target price of Rs206. At a CMP of Rs 173 stock trades at 9x FY15E P/BV. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 1904.28 297.59 243.5 15.6% 12.8% 2QFY14 1748.81 329.24 249.83 18.8% 14.3% (QoQ)-% 8.9 (9.6) (2.5) 220bps 150bps 3QFY13 1635.98 274.51 209.87 16.8% 12.8% Rs, Crore (YoY)-% 16.4 8.4 16.0 120bps - (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 2

- 3. Dabur India Ltd. Segment-wise snapshot Segments Domestic Business Growth (YoY)-% 24% Hair Care 6.9% Health Supplements 19.5% Oral Care 10.4% OTC & Ethicals 13.2% Digestives 17.7% Home Care 16.0% Skin Care 13.4% Foods 18.0% International Business 26.0% Key takeaways (3QFY14) -Launched Vatika Enriched Olive Hair Oil, -Shampoo grew by 25%(YOY), -Perfumed hair oils posted 8% YoY growth, -Dabur Chyawanprash reported healthy growth with a range of 17-18% YoY, -Launched premium health supplement – Dabur Ratnaprash, -Dabur Honey performing well on the back of higher demand, -Toothpastes grew by 14% with premium offerings/added market share, -Flattish growh in Red Toothpaste, -Meswak on new packaging launched , -Honitus: Honey & Tulsi variant launched, -Ethicals portfolio grew by 15.5% YoY, -Hajmola performed well with positve response from Anadana variants, -Recently launched Pudin Hara Lemon Fizz has received emense response, -Odonil 1 Touch Freshener launched in South India, -Odonil and Sanifresh performed well during the quarter, -Gulabari performed well during the quarter, -Launch of Fem Fairness Naturals with No Added Ammonia, -Fem witnessed double digit growth led by good take from Bleaches, -Real Fruit Juice reported double digit growth, -Real in a new Diwali Gift packaging launched, -Organic International Business grew by 29% with 14% constant currency(CC) growth driven by strong growth in GCC, Egypt & Nigeria, -Namaste business registered double digit growth in CC term, (Source: Company/Eastwind) Dabur New Launches: Dabur's New Launches Ratnaprash Odonil Variant Beverage variants 3QFY14 Vatika Shampoo variant Vatika hair oil Fem portfolio with no ammonia Pudin Hara Lemon Fizz Vatika Hair Oi l with Hibiscus Q2FY14 OxyLi fe Men Odoni l re-launched with 2x perfume content Test launched Real Mi lk Shakes in Delhi and Punjab Q1FY14 Ratnaprash Vatika hair oil Vatika Shampoo Oxy life Aloe Vera Gel Bleach Real Activ Drinking Yoghurts in mango and strawberry flavours Hajmola Anardana Super Babool + Salt Power 4QFY13 New Ethnic flavour "Kokam" under Real Burrst Fem brand was introduced in Turkey Odoni l Gel Honitus Fem with no ammonia Odonil Variants (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 3

- 4. Dabur India Ltd. Key Takeaways: Slowdown in Hair Oils segment remains for long term? On 3QFY14, Hair Oils segment witnessed decline across categories. Marico reported only 2% YoY volume growth in parachute rigid packs and 8% YoY in value-added hair oils, Bajaj Corp and Navratna oil clocked 1% YoY volume growth. While, Coconut oil segment reported 3-4% YoY volume decline. Importantly, Hair Oil segment is adversely impacted by high input cost pressure leading to frequent price hike. We believe, slowdown in Hair Oil segments could be a short-term jerk. Dabur management believes that there is some structural change in Coconut Hair Oil because of consumption shifting from Coconut Hair Oil to Light Hair Oil. Dabur is carrying small exposures in Coconut Oil; still there is room to report value and volume growth because of support from new launches. Company is likely to be better placed with valueadded offerings Vatika enriched coconut oil with Hibiscus and Vatika Olive Enriched Hair Oil. Pace of innovation continues ‐ Vatika Enriched Olive Hair Oil launched during the quarter We expect that the volume growth in Hair Oil segment has bottomed out and coming quarter and next spell of growth would come largely from increasing per capita income. Innovation combined with optimum pricing strategy to maintain market share will be key growth driver of this category. How chemist channel would play a role to opportune the gain of market share? Considering the weak consumer sentiment in urban area, there was less opportunity to invest in urban growth in the past 2 years. Now, as green shoots are visible and consumer sentiment is improving, the company is beginning to invest in urban growth with Project CORE—chemist outlet and range expansion. However, there could be a few quarters of transitory period. As part of this project, Dabur has recruited 350 people in the front end and will incur Rs15cr for the first phase. Project CORE’s primary focus will be the health care portfolio(Chyawanprash, Honey, Glucose), OTC products (Honitus, Lal Tel) and personal care portfolio which are more relevant to the chemist channel than to general trade. At present, it increased its coverage to 75000 from 55000-chemist store and, plans to take it to 125,000 by FY15E. We expect that project CORE will be favorable to improve margin picture as well as revenue builder. Chemist Shope in India (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 4

- 5. Dabur India Ltd. Conference Call (Q3FY14 ): Key Facts at a glance Volume Growth Pricing Growth Urban and Rural Growth Innovation and new launches Ad spend Margin Growth Hair Care Health Care Skin Care Oral Care: -Dabur expects to achieve volume growth in the range of 8-12% in FY15%E, and if urban growth revives, volume growth could be in the range of double digit growth. -For 4QFY14E, price increase could be at a range of by 1-2% YoY. The company may hike prices by 4-5% in FY15E and focus will be on pursuing an aggressive and profitable growth strategy. -Its rural growth has been faster than urban growth since the past few quarters but now this gap has reduced. Now, Dabur believes that growth will be driven by the urban areas, which is witnessing an uptick. The company will be shifting its focus to the urban area, which will drive premiumization. -The company expects to continue with the new launches and innovations, but spread over the year and not cluttered in one quarter. Dabur could launch a range of summer products in beverages and health supplements. -Ad expenses to be maintain within the range of 13-15% at the consolidated level for FY15E. -Dabur expects to improve gross margin in FY15E, its inventory that includes the high cost raw materials (increased due to high-cost petroleum derivatives) will exist until February 2014. Dabur expects gross margin to improve by 100bps if the inflation scenario remains benign. -Dabur expects to maintain growth of high single-digit in this segment. -Dabur expects that there is huge opportunities for growth in this segment and Project CORE will help to drive growth for the same. The company expects to see growth in mid-teens helped by the pickup in winter in Q4FY14. -Dabur does not believe that launching sensitive toothpaste now will drive growth of this portfolio as big players are already present in this segment. International business Intl‐Business – New Launches For 3QFY14, The International Business (contributes around one third of consolidated sales) grew by 26%. Organic business grew by 29% with 14% constant currency growth rate led by strong performance in GCC, Egypt and Nigeria. The GCC business reported a 21% growth, while sales in Egypt and Nigeria both grew by 16%. Bangladesh remains an important geography for the company, which was impacted by political instability and economic uncertainty resulting in slow growth of 10% YoY. Dabur has organized a strong team and product portfolio for this geography. Dermoviva Face Wash Dabur will expand its footprint only in adjacent geographies of its current markets like in Iran, Iraq and Africa. It believes that Bangladesh and Pakistan together have the potential to become Rs500cr market each over the long term. 21% Fem Gold Hair Removal Cream 16% 16% GCC EGYPT Key Growth Markets –Q3FY14(%) NIGERIA Dermoviva Hand Wash (Source: Company) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 5

- 6. Dabur India Ltd. Financials Rs in Cr, Sales RM Cost Purchases of stock-in-trade WIP Employee Cost Ad Spend Other expenses Total expenses EBITDA Depreciation and Amortisation Other Income EBIT Interest PBT Tax Exp PAT Growth-% (YoY) Volume Pricing Sales EBITDA PAT Expenses on Sales-% RM Cost Ad Spend Employee Cost Other expenses Tax rate Margin-% EBITDA EBIT PAT Valuation: CMP No of Share NW EPS BVPS RoE-% P/BV P/E FY10 3391.4 811.0 750 (10) 285 493.5 438.4 2767.3 624.1 50.0 39.4 613.5 12.3 601.2 100.5 500.7 FY11 4104.5 1806.8 252 (122) 309 534.6 524.1 3304.8 799.7 95.2 32.2 736.6 29.1 707.5 139.0 568.5 FY12 5305.4 2278.8 509 (103) 387 659.5 683.1 4415.2 890.2 103.4 57.4 844.2 53.8 790.4 146.4 644.0 FY13 6178.9 2422.1 599 (2) 471 837.0 819.10 5146.6 1032.2 112.7 92.0 1011.5 58.9 952.6 182.62 770.0 FY14E 7070.30 2757.42 742.38 (71) 608.05 996.91 908.53 5942.59 1127.71 111.09 141.41 1158.03 54.69 1103.34 212.39 890.95 FY15E 8203.32 3240.31 820.33 (41) 738.30 1132.06 1066.43 6956.42 1246.90 133.15 164.07 1277.82 51.95 1225.87 232.91 992.95 10.5% 5.0% 16.0% 10.6% 11.4% 20.9% 33.9% 28.1% 21.0% 28.1% 13.5% 29.3% 11.3% 13.3% 16.5% 16.0% 19.6% 9.5% 4.5% 14.4% 9.3% 15.7% 23.9% 14.6% 8.4% 12.9% 16.7% 44.0% 13.0% 7.5% 12.8% 19.6% 43.0% 12.4% 7.3% 12.9% 18.5% 39.2% 13.5% 7.6% 13.3% 19.2% 39.0% 14.1% 8.6% 12.9% 19.3% 39.5% 13.8% 9.0% 13.0% 19.0% 18.4% 18.1% 14.8% 19.5% 17.9% 13.9% 16.8% 15.9% 12.1% 16.7% 16.4% 12.5% 16.0% 16.4% 12.6% 15.2% 15.6% 12.1% 158.6 86.8 935.4 5.8 10.8 53.5% 14.7 27.5 96.1 174.1 1391.1 3.3 8.0 40.9% 12.0 29.4 103.2 174.2 1716.9 3.7 9.9 37.5% 10.5 27.9 131 174.3 2124.38 4.4 12.19 36.2% 10.75 29.7 173.00 174.30 2689.06 5.11 15.43 33.1% 11.21 33.84 173.00 174.30 3335.36 5.70 19.14 29.8% 9.04 30.37 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 6

- 7. CAN FIN HOME "BUY" 7th March 2014 BUY 189 220 16 - We have initiated coverage with Buy rating on the stock with price target of Rs.220 which implies 1 times of FY14E book value. The company has delivered strong performance all around. During quarter, profitability was up by 60% on the back of healthy NII growth and improvement in operating leverage. Return ratio improved from 12% in FY12 to 18% in 3QFY14 which is expected to remain healthy on the back of improving operating leverage and aggressive branch expansion. Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 511196 CANFINHOME 196/113 389 15.59 Lakh 6401 Healthy NII growth on the back of robust loan growth The company’s NII grew by 39% YoY to Rs.40.2 Cr which came from impressive loan growth of 49% YoY. Margin of the company was however declined by 13 bps sequentially on account of higher cost of fund. Yield on loan remained same sequentially which restricted NII growth below than previous quarter (49% YoY). CanFin Home has about 16-17% of exposure in rural area where spread is lower. From last two quarters, yield on loan remained same while cost of borrowing increased by 10 bps which made margin lower sequentially. Stock Performance 1M Absolute 8.7 Rel.to Nifty 3.1 1yr 26.9 15.0 Loan book continued to be healthy on account of higher non housing loan growth Loan book grew by 49.1% YoY led by strong disbursement in retail segment. The Company UPDATE CMP Target Price Previous Target Price Upside Change from Previous YTD 26.9 15.0 company’s exposure to non house loan was about 7% of total loan which grew from Share Holding Pattern-% Current 4QFY13 3QFY1 3 Promoters 42.4 42.4 42.4 FII 0.6 0.6 0.6 DII 0.5 0.5 0.5 Others 56.5 56.5 56.5 CANFINHOME Vs Nifty Rs.138 cr in 3QFY13 to Rs.400 cr in 3QFY14. The company remains focus on salaried segment which account about 90% of loans. Average ticket size loan is Rs. 16 lakhs. Concentration of individual loan segment declined to 92% of total loan from 94% in March 2013 and this segment shifted towards non housing. Although revenue contribution from this segment is very low but spread is relatively thicker than housing segment. Funding compositions have high credit quality and carried low risk Funding composition of the company continued to be rate MAA+ by ICRA indicating high credit quality and carried low risk. The composition comprises 50% from NHB and 45% from banks, altogether account for 95% of total funding while remaining come from deposits. Average tenure of funding is 7-10 years due to its loan tenure portfolio of 10-15 years. From year FY12 to FY13, source of funding composition saw dramatically changed as share of NHB increased to 50% from previous year of 23% while loan from related party declined to 45% from 70% in FY12. The benefit was also come at effect as blended borrowing cost came down to 9.2% in FY13 from 9.8% in FY12. At the end of 3QFY14, borrowing cost stood at 9.3% from 9.4% in last quarter. Rs, Cr Financials 2010 2011 2012 2013 2014E NII 63 72 84 96 162 Total Income 71 77 91 110 162 PPP 54 60 68 74 114 Net Profit 39 42 44 54 80 EPS 19.1 20.5 21.4 26.4 39.3 (Source: Company/Eastwind) 7 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report.

- 8. CAN FIN HOME Aggressive branch expansion drives incremental business growth The company has opened almost 40 branches from last two years and it became double to 81 from 41 in March 2011. The company has planned to open 85 braches at the end of FY14. The incremental business came from additional branches as we got evidence from revenue growth. The company revenue was Rs.72 cr in FY11 which increased to Rs.96 cr in FY13 and in 9MFY14, it reached to Rs.115 cr while cost to income ratio was remained flat at 30% level. The company is planning to open other 25 branches by 2015 in north area which would cater for incremental loan growth outside of southern state. Being presence in Bangalore would help to get benefit naturally in realty boom The reality volume in Bangalore is higher than Mumbai, Pune and Delhi-NCR region according to our real estate analyst as we got evidence from recent result publish. Can Fin Home’s 16% total branches are in Bangalore region, so it will be natural beneficiary of this realty boom in Bangalore. At present 4 southern states constitute about 70% of loan book. Strong profit growth due to healthy NII growth and improvement in operating leverage During quarter, the company reported healthy net profit growth of 60% YoY on the back of robust loan growth of 50% YoY and declined cost income which led by improvement in operating leverage. With the improvement in operating leverage, the company’s return ratio ROE improved from 12.6% in FY12 to 18% in 3QFY14. As discuss above, the company is more aggressive in branch expansion which would increase incremental business and profitability and hence return ratio. Asset quality continues to be healthy. On asset quality front, the company continues to remain healthy with gross NPA level came down to 0.3 during quarter from 1.6 in FY07. With the strong recovery and high coverage ratio, net NPA level has been 0% since FY11. During quarter, Can Fin’s GNPA was declined to 0.32% from 0.34% in previous quarter whereas net NPA level was at 0% led by almost 100% provision provided by the company. Asset quality is expected to remain healthy going forward on the back of strict lending practice and 90%+ exposure to salaried personal where chances of slippage is relatively low. Source:Company/Eastwind Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 8

- 9. CAN FIN HOME About the company Can Fin Homes Ltd was promoted in 1987 by Canara Bank in association with reputed financial institutions including HDFC and UTI. Canara Bank holds 42.4% stake in CFHL. Today, CFHL offers a range of products on housing, such as loans for home purchase, home construction, home improvement/extension and site purchase as well as nonhousing finance. The company has 81 branches at present with a large presence in South India. Concern Any sharp increase in the interest rate would discourage consumers to purchase home and thus demand could be impacted. Around 45% of funding source come from banking and any adverse regulation like hike of interest rate could impact borrowing cost. This would impact company’s NII, NIM and profitability. View & Valuation We have initiated coverage with Buy rating on the stock with price target of Rs.220 which implies 1 times of FY14E book value. The company has delivered strong performance all around. During quarter, profitability was up by 60% on the back of healthy NII growth and improvement in operating leverage. Return ratio improved from 12% in FY12 to 18% in 3QFY14 which is expected to remain healthy on the back of improving operating leverage and aggressive branch expansion. Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 9

- 10. CAN FIN HOME CHART FOCUS Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 10

- 11. CAN FIN HOME Valuation BaND Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 11

- 12. CAN FIN HOME Quarterly Result Interest Earned Interest Expenses NII Other Income Total Income Operating Expenses PPP Provisions PBT Tax Expenses PAT 3QFY14 151.7 111.5 40.2 0.1 40.3 11.4 28.9 0.0 28.9 8.5 20.3 2QFY14 137.9 99.8 38.1 0.0 38.2 12.4 25.7 0.0 25.7 7.0 18.7 3QFY13 % YoY Gr % QoQ Gr 102.8 47.5 10.0 73.9 51.0 11.8 29.0 38.7 5.4 0.1 36.4 144.2 29.0 38.7 5.5 11.3 1.3 -8.3 17.8 62.4 12.2 0.0 17.8 62.4 12.2 5.1 66.1 22.0 12.6 60.9 8.6 Balance Sheet Capital Reserves and surplus Net Worth Borrowings TOTAL LIABILITIES Loans TOTAL ASSETS 20 428 448 4817 5265 5355 5355 20 407 427 4315 4742 4864 4864 20 366 386 3144 3530 3592 3592 Spread Analysis Yield On Advances Cost of Borrowings Spread NIM 11.3 9.3 2.1 3.0 11.3 9.2 2.1 3.1 11.5 9.4 2.1 3.2 ROE% Break-Up ROA Total Assets/ Total Equity ROE(%) 1.5 12.2 18.2 1.5 11.6 17.6 1.5 10.3 15.9 0.0 0.0 17.0 5.2 16.1 4.9 53.2 11.6 49.2 11.0 49.1 10.1 49.1 10.1 Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 12

- 13. CAN FIN HOME Financials & Assumption 2010 2011 2012 2013 2014E 208 145 63 9 71 17 54 -1 55 16 39 226 154 72 5 77 17 60 1 58 16 42 279 196 84 8 91 23 68 7 61 17 44 379 283 96 14 110 36 74 -1 75 21 54 586 424 162 0 162 48 114 0 114 34 80 BALANCE SHEET ITEMS( Rs Cr) Net Worth Borrowings Loans 275 1865 2167 311 1904 2250 348 1982 2673 392 3073 4012 463 5309 6600 SPREAD ANALYSIS(%) Yield On Advances Cost of Borrowings Spread NIM 10.7 9.9 0.8 3.1 10.5 8.1 2.4 3.2 10.7 9.9 0.8 3.1 9.8 9.2 0.6 2.4 11.3 9.3 2.0 3.0 24.4 2.9 116.2 22.3 3.2 118.2 25.2 3.1 134.8 32.8 2.4 130.6 30.0 0.8 111.2 134 0.6 4.2 152 0.7 5.2 170 0.7 5.2 191 0.7 5.2 226 0.8 4.8 PROFIT & LOSS ACCOUNT( Rs Cr) Interest Earned Interest Expenses NII Other Income Total Income Operating Expenses PPP Provisions PBT Tax Expenses PAT EFFICENCY RATIO(%) Operating Expenses to Total Income ( CI Ratio) NII to Loan fund Loan to borrowings VALUATION Book Value(Rs) P/B(x) P/E(x) Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 13

- 14. DB CORP "Neutral" 7th March' 14 "Waging war on Print media" Latest update Neutral CMP Target Price 301 Previous Target Price Upside Change from Previous - Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 533151 DBCORP 321.50/210 5521 25750 The Supreme Court upheld the constitutional validity of the November 11, 2011 Union government notifications, directing implementation of the recommendations of the Majithia Wage Boards for journalists and non-journalists of newspapers and news agencies. This will act as a huge negative for newspaper industry. They have to pay all arrears up to March 2014.It will be paid in four equal installments within one year from November 11, 2011. This would create huge financial burden to a industry already facing problems of rising raw material prices. One the other hand most of newspaper venturing into reginal market in search for better sales volume and margin. This judgment will work as a dampener for newspaper industry as well as DB CORP. Company’s EBITDA margin will be effected very negatively not only in FY15E but also next few or more years. Therefore we downgrade DB CORP from `BUY’ to `NEUTRAL’ 6261.65 3QFY14E Earning Performance: Stock Performance Absolute Rel. to Nifty 1M -6 -7.32 1yr 22 11.3 YTD 0 -0.002 During the quarter, company has seen 18.2% revenue growth from its advertisement, 14% from circulation and 25% from Radio business on YoY basis. Management expressed its interest regarding inorganic expansion in near future to maintain its healthy growth across all segments. 1QFY14 74.98 14.66 5.34 5.02 According to management, Company will maintain a pragmatic approach towards operational controls and higher efficiency. DBCORP will continue to capitalize its consumption potential of Tier 2 and 3 cities. And they are studying on marketing strategies of niche brands in Tier 2 and 3 cities. Company is expected to launch its Bihar edition on 19 Jan, 2014, and we expect to see some part of additional revenue from Bihar edition by 4QFY14E and also expect to see breakeven in 3 to 4 years. Management Commentary: Share Holding Pattern-% Promoters FII DII Others Current 74.96 17.73 2.95 4.36 2QFY14 74.97 16.46 4.00 4.57 Stock Performace with Nifty View and Valuation: In view of upcoming general election, we expect government ad spending to go up substantially. Provision of TRAI’s 12 minutes ad cap would provide revenue visibility to print media players, being one of the largest players DB Corp will be strong beneficiary in near future. But Considering latest update regarding directing implementation of the recommendations of the Majithia Wage Boards for journalists and non-journalists of newspapers and news agencies, earning visibility could not be promising. Wages hike and payment of arrers will create huge burden to the profit and loss A/C of the company as well as margin shape. And it may hamper company's plan for investing in regional market in future because it needs internal cash flow. Therefore we are downgrading this stock from`BUY' to `Neutral'. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 518.2 153.8 93.57 29.7% 18.1% 2QFY14 438 112.5 63.2 25.7% 14.4% (QoQ)-% 18.3 36.7 48.0 400bps 370bps 3QFY13 438.9 122.8 73.2 28.0% 16.7% Rs, Crore (YoY)-% 18.1 25.2 27.9 170bps 140bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 14

- 15. DB CORP Revenue Segments Revenue Geography-wise Financials; Rs,cr Sales RM Cost WIP Employee Cost Ad Spend Other expenses Total expenses EBITDA Depreciation and Amortisation Other Income EBIT Interest PBT Tax Exp PAT Growth-% (YoY) Sales EBITDA PAT Expenses on Sales-% RM Cost Employee Cost Ad Spend Event Expenses consumption of store & spare Distribution expenses Other expenses Tax rate Margin-% EBITDA EBIT PAT Valuation: CMP No of Share NW EPS BVPS RoE-% P/BV P/E FY10 1062.1 327.87 -0.0016 131.81 12.98 161.24 720.03 342.07 37.83 11.15 304.24 35.69 279.70 105.72 173.98 FY11 1265.18 383.91 -0.06 184.56 12.52 185.2 862.13 403.05 43.28 14.18 359.77 15.3 358.65 99.97 258.68 FY12 1451.51 508.04 -0.04 242.93 15.04 216.06 1105.03 346.48 50.57 24.02 295.91 9.23 310.7 98.32 212.38 FY13 1592.32 544.54 0.03 279.5 17.21 234.07 1210.25 382.07 58.06 21.34 324.01 7.99 337.36 113.18 224.18 FY14E 1861.91 623.74 -1.86 307.21 22.34 260.67 1371.5 490.5 64.5 27.9 426.0 8.0 445.9 156.1 289.8 FY15E 2176.94 740.16 -2.18 380.97 23.95 315.66 1656.7 520.3 75.4 28.3 444.9 5.1 468.1 163.8 304.3 10.5% 132.2% 265.4% 19.1% 17.8% 48.7% 14.7% -14.0% -17.9% 9.7% 10.3% 5.6% 16.9% 28.4% 29.3% 16.9% 6.1% 5.0% 30.9% 12.4% 1.2% 1.1% 4.8% 2.1% 15.2% 10.0% 30.3% 14.6% 1.0% 1.3% 4.6% 1.7% 14.6% 7.9% 35.0% 16.7% 1.0% 1.0% 5.8% 1.7% 14.9% 6.8% 34.2% 17.6% 1.1% 0.8% 6.0% 1.8% 14.7% 7.1% 32.0% 16.6% 1.2% 0.8% 6.0% 1.8% 14.0% 8.4% 34.3% 17.0% 1.1% 1.0% 6.2% 1.9% 14.5% 7.5% 32.2% 28.6% 16.4% 31.9% 28.4% 20.4% 23.9% 20.4% 14.6% 24.0% 20.3% 14.1% 26.3% 22.9% 15.6% 23.9% 20.4% 14.0% 239 18 649 9.6 36 27% 6.7 24.9 246 18 829 14.1 45 31% 5.4 17.4 219 18 927 11.6 51 23% 4.3 18.9 212.1 18.33 1029 12.2 56 22% 3.8 17.3 301 18.33 1180 15.8 64 25% 4.7 19.0 301 18.33 1344 16.6 73 23% 4.1 18.1 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 15

- 16. Hindustan Zinc LTD. "BUY" 6th March' 14 Good gains ahead Result Update BUY CMP Target Price Previous Target Price Upside Change from Previous 123 148 148 20% 0% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume (Nos.) Nifty 500188 HINDZINC 142/94 51929 5192 6329 Stock Performance-% 1M 4.3 0.0 Absolute Rel. to Nifty 1yr -1.7 9.2 YTD -3.4 11.3 Share Holding Pattern-% 3QFY14 64.9 1.8 31.4 1.8 Promoters FII DII Others 2QFY14 1QFY14 64.9 64.9 1.8 1.5 31.4 31.5 1.8 2.1 450 400 350 300 250 200 150 100 50 Jul-13 Jan-14 Jul-12 Jan-13 Jul-11 Jan-12 Jul-10 Jan-11 Jul-09 Jan-10 Jul-08 Jan-09 Jul-07 0 Jan-08 We believe Zinc price will be the core fundamental behind the Hindustan zinc’s bull story in the coming years. We see a improving volume of production through FY15.More So Govt. The attorney-general’s clearance for the Centre’s proposal to divest its residual stake in Hindustan Zinc Ltd (HZL) lifted the Street’s mood. Again the board delayed this process and guided investors that disinvestment of government's remaining stake in Hindustan Zinc will happen next fiscal year. Stake sale in HZL again seems to be back burner now. We also see gradual and sustainable recovery in global macro Scenario which supports a positive cycle in industrial metals. So, we believe there exists a strong case for significant earnings estimate for Hind Zinc in coming months. Robust Q3FY14 Performance : Hindustan Zinc’s (HZL) Q3FY14 performance was inline to our estimates on the back of healthy zinc sales volumes and higher metal premiums. Total operating income for Q3FY14 stood at Rs. 3450.1 crore higher by 8.6% YoY but lower by 3.1% QoQ. Total zinc sales in Q3FY14 came in at 196,000 tonne, up 17% YoY and 2% QoQ . The company realised premium on metal sales amounting to $241/tonne for zinc (Zn) & $305/tonne for lead (Pb) . Lead sales volume for the quarter stood at 23500 tonnes (lower by 24% QoQ and 22% YoY), while silver sales volumes stood at 78500 kg (lower by 31% YoY and 14% QoQ) . EBITDA came in at Rs.1823.8 crore and inline to our estimate of Rs. 1829.6 crore. Subsequently, net profit stood at Rs. 1722.7 crore . Valuation & Recommendation Zinc fundamentals are becoming attractive with suppotive lead prices brings a positive outlook for Hindustan Zinc.With a cash-rich balance sheet and strong visibility over production growth of zinc, lead and silver over FY2013-15, we are positive on HZL.Being an integrated & dominant player in the domestic industry with low cost of production, the company is poised to benefit in the long run. Now the stock is trading at 1.6x in one year forward P/B we estimated it at 1.8x for 2015.At current level we see a significant growth in the stock. We valued & reaffirm our positive stance on HZL and assign a BUY rating to the stock with a target price of Rs. 148/-. 1 yr Forward P/B Jan-07 Zinc market was bearish during last consecutive years having surplus in inventory, but now sentiment is slowly turning positive showing some uptrends in Zinc LME prices. Visible inventories on the London Metals Exchange, as well as on the Shanghai Futures Exchange, are down about 30% over the last year. And zinc demand is increasing steadily. Source - Comapany/EastWind Research Financials : Net Revenue EBITDA Depriciation Tax PAT Q3FY14 3450 1824 210 305 1723 Y-o-Y % 8.6 22.1 18.6 50.2 6.8 Q-o-Q % -9.8 -3.1 12.9 20.1 5.1 Q3FY13 3178 1494 177 203 1613 Q2FY14 3826 1883 186 254 1640 (In Crs) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 16

- 17. Hindustan Zinc LTD. Silver(rs/ounce) Nov-13 Dec-13 Nov-13 Dec-13 Nov-13 Dec-13 Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 Apr-13 May-13 B. A reason to wait and watch , is since the government is looking at auction, how much will Vedanta be able to garner and what price it is willing to pay is not known. Feb-13 1800 1600 1400 1200 1000 800 600 400 200 0 Mar-13 Key Concerns A. Volatile Desel Price and high Sulphuric acid price affecting the company,s PAT adversly. LME Price/Ton Jan-13 Lower Production Guideline HZL has marginally downward revised its mined metal production guidance for FY14 from 950,000 tonnes earlier to 900,000 tonnes. This reflects slower-than-expected ramp up of underground mining projects and some changes in mining sequence wherein preference has been given to primary mine development during this period. Source - Comapany/EastWind Research H. Zinc premium reaches six year high as inventories shrink I. Fees that zinc smelter charge to refine the metat that probably to increase 5%. Narnolia Securities Ltd, LME Price/Ton Lead Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 May-13 Apr-13 Mar-13 Feb-13 Jan-13 160000 140000 120000 100000 80000 60000 40000 20000 0 Source - Comapany/EastWind Research LME Price/Ton Zinc Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 May-13 Apr-13 Mar-13 Feb-13 125000 120000 115000 110000 105000 100000 95000 90000 Jan-13 C. HZL’s revenues are directly linked with the global market for products essentially, Zinc and Lead which are priced with reference to LME prices and Silver to LBMA (London Bullion Metal Association) prices. D. Lower than expected demand by galvanizing industries for zinc and industrial batteries, car batteries industries for lead would affect the company estimates. E. Disruptions in mining due to equipment failures, unexpected maintenance problems , non-availability of raw materials of appropriate price, quantity and quality for energy requirements, disruptions to or increased cost of transport services or strikes and industrial actions or disputes. Key Triggers for Growth A. Company is tracking on 95% capacity utilization. B. Captive plants enjoy the lower Tax rate and company enjoys zero tax from tax free geographycal areas. C. Smelting Plants are improvised and management is confident that the smelting plants will maintain their stance for the coming quarters also. D. The Rampura Agucha underground mine project is operational via ramps (tunnel driven downward from the surface) and commercial production already ramp up in Q3 and will in Q4 of FY14 . The Kayad mine project will also commence commercial production in the current fiscal year. E. A cash-rich balance sheet, low cost of production and inexpensive valuations make HZL an attractive bet at the current price levels. F. Disinvestment of government's remaining stake in Hindustan Zinc and Bharat Aluminium (Balco) will happen next fiscal year . G. In the past Vedanta Group has said it wanted majority control when Vedanta had earlier offered Rs 149 a share . If this is any benchmark,then investors will stand to gain. Source - Comapany/EastWind Research 17

- 18. Hindustan Zinc LTD. P/L PERFORMANCE Net Revenue from Operation Other Income Total Income Power, fuel & water Repairs Expenditure EBITDA Depriciation Interest Cost Net tax expense / (benefit) PAT ROE% B/S PERFORMANCE Share capital Reserve & Surplus Total equity Trade payables Short-term provisions Total liabilities Intangibles Tangible assets Capital work-in-progress Long-term loans and advances Inventories Trade receivables Cash and bank balances Short-term loans and advances Total Assets FY11 9912 979 10891 1023 492 4417 5496 475 19 1059 4900 22.0 FY10 423 17701 18124 478 340 20238 109 6071 1113 361 452 152 928 96 20238 FY12 11405 1543 12948 1228 568 5336 6069 611 14 1419 5526 21.0 FY11 845 21688 22533 475 567 25053 109 7145 875 594 762 209 5633 158 25053 FY13 12700 2032 14732 1070 696 6218 6482 647 29 921 6899 21.0 FY12 845 26036 26881 410 504 29485 47 8466 445 876 798 332 5255 233 29485 FY14E 13577 1787 15364 1291 707 6484 7093 718 37 1097 6967 19.0 FY13 845 31431 32276 484 825 35465 10 8474 1082 1898 1111 403 6942 373 35465 RATIOS P/B EPS Debtor to Turnover% Creditors to Turnover% Inventories to Turnover% CASH FLOWS Cash from Operation Changes In Working Capital Net Cash From Operation Cash From Investment Cash from Finance Net Cash Flow during year FY10 FY11 FY12 FY13 3.2 95.6 1.9 6.0 0.6 FY10 4001 77 4077 -3881 -187 8 2.2 11.6 2.1 4.8 0.8 FY11 4483 -212 4272 -3658 -363 250 2.1 13.1 2.9 3.6 0.7 FY12 4553 -61 4492 -3499 -1242 -248 1.7 16.3 3.2 3.8 0.9 FY13 4935 -183 4752 -3234 -1257 262 Narnolia Securities Ltd, Net Revenue from Operatio n 4000 3500 3000 2500 30.0 Revenue Growth 4500 15.0 25.0 20.0 2000 10.0 1500 5.0 1000 0.0 500 0 -5.0 Source - Comapany/EastWind Research ZinC Productions: 250000 Zinc Production (tons) 200000 150000 100000 50000 0 Source - Comapany/EastWind Research EBIDTA & Margin : 2500 EBIDTA % 2000 49 49 50 47 43 1500 60 EBIDTA 43 41 40 42 30 1000 20 500 10 0 0 Source - Comapany/EastWind Research 18

- 19. Voltas Ltd. "Neutral" 6th Mar' 14 Downgrade to "Neutral"……. Company update Neutral CMP Target Price Previous Target Price Upside Change from Previous 139 125 95 -10% 32% Market Data BSE Code NSE Symbol 52wk Range H/L Capital Mkt (Rs Crores) Vol. (Nos.) Average Daily Nifty 500575 VOLTAS 65/143 4,609 624,126 6,329 Stock Performance-% 1M 28.5 23.1 Absolute Rel. to Nifty 1yr 75.2 64.0 Promoters FII DII Others 1 yr Forward P/B Management comment on above JV : Water has been identified as a key focus area for the Tata group. With its unrivalled know-how and technological leadership in the water treatment space, the partnership, will help Voltas Water Solutions cater to the growing water treatment requirements of the Indian subcontinent. They further believe that partnership will simultaneously leverage the brand and distribution strength of Voltas, along with the technology prowess of the water and process solutions division of the Dow Group. YTD 84.2 72.9 Our View on said JV : In today scenario major Water and Waste Water Treatment market is mostly and largely catered by unorganized players. And the market which is targeted by this new joint venture will provide a branded and differentiated product line in the sector, with a focus on quality and service delivery. 2QFY13 1QFY14 30.2 30.2 14.5 18.1 29.8 25.6 25.6 26.1 About Dow Group : Dow Chemical Pacific (Singapore) Pte Ltd was established in 1992. Catering to customers in Asia Pacific, particularly South East Asia, Dow Group combines the power of science and technology to passionately innovate what is essential to human progress. The company is driving innovations that extract value from the Intersection of chemical, physical and biological sciences to help address many of the world's most challenging problems such as the need for clean water, clean energy generation and conservation, and increasing agricultural productivity. The company's integrated, market-driven, industry-leading portfolio of specialty chemical, advanced materials, agrosciences and plastics businesses delivers a broad range of technology-based products and solutions to customers in high growth sectors such as packaging, electronics, water, coatings and agriculture. Valuation : The company has been evaluating strategic alternatives since 2012, we believe the company is not inclined to sell at valuations multiple of 2 times of its FY15E book value. We estimate that at the lower end of management's guidance this translates into a 12.1%/12.7% RoE forFY14/15E. We believe management is attempting to be conservative regarding the guidance for FY14 & FY15, but even with a 60/90 bps improvement in the operating margin the RoE would be approximately 12.1%/12.7% for FY14/15E , which we believes would translate into a P/B multiple of approximately 2.0x – to 2.2x. This translates to a 12 month price target of approximately Rs. 120 based on our FY14E BVPS of Rs. 59. However, If the company if things will going positively we could rationalize valuations near Rs. 145 per share, but we don't believe buyers would be willing to pay a premium to BVPS more than 2 times at this time. We are downgrading Voltas to Neutral given the recent rise in its share price following 3QFY14 earnings and revised our price target to Rs. 120.” Share Holding Pattern-% 3QFY14 30.3 15.2 29.8 24.8 What New...??? Voltas Ltd has proposed to form a new joint venture (JV) company named –“ Voltas Water Solutions” which will have equal capital contribution from “Voltas” and “Dow Chemical Pacific” (Singapore) Pte (Dow). This JV company will market and distribute standard packaged Water Treatment Systems and Waste Water Treatment Systems of capacity up to 20 m 3/hour, to residential and commercial complexes and light industrial markets in the Indian subcontinent. The entity's operations would include designing, procuring, testing, marketing, selling and servicing of such standard water treatment systems and waste water treatment systems. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 19

- 20. Voltas Ltd. Key financials : PARTICULAR 2009A 2010A 2011A 2012A 2013A 2014E 2015E Performance Revenue 4326 4757 5191 5186 5531 5320 5852 Other Income 94 78 58 98 90 84 100 Total Income 4420 4836 5250 5284 5621 5404 5952 EBITDA 283 460 463 336 245 261 296 EBIT 262 438 442 303 217 237 268 DEPRICIATION 21 21 21 34 28 24 28 INTREST COST 11 10 17 31 40 35 42 PBT 372 532 524 219 280 286 326 TAX Extra Oridiniary Items Reported PAT Dividend (INR) DPS EPS 117 26 255 73 2.2 7.7 147 25 385 73 2.2 11.6 172 40 352 73 2.2 10.6 57 -150 162 73 2.2 4.9 73 12 207 73 2.2 6.3 74 0 211 54 61.5 6.4 85 0 241 54 61.5 7.3 6.5% 5.8% 16.2% 4.7% 32.2% 27.3% 9.7% 8.0% 6.5% 1.2% 35.4% 35.2% 8.9% 6.7% 6.2% 1.3% 25.8% 24.6% 6.5% 3.1% 4.4% 2.0% 11.0% 11.4% 4.4% 3.7% 8.3% 2.9% 12.7% 13.1% 4.9% 3.9% 4.4% 42.4% 11.9% 12.3% 5.1% 4.0% 5.0% 42.4% 12.3% 13.0% 790 181 971 33 48 1085 35 1120 33 178 1362 137 1498 33 172 1478 223 1701 33 112 Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Ammount in crores Capital Employed No of Share (Adj) INR in crores CMP 1626 1775 1955 261 225 225 (Source: Company/Eastwind) 1887 2000 2180 33 33 33 (Source: Company/Eastwind) 75 145 145 Ammount in crores (Source: Company/Eastwind) Valuation Book Value P/B Int/Coverage P/E Ammount in crore 23.9 2.0 23.8 6.2 32.8 5.4 44.5 15.3 41.2 4.2 26.7 16.1 44.7 2.5 9.6 22.9 49.1 1.5 5.5 12.1 53.7 2.7 6.8 22.7 59.1 2.5 6.4 19.9 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 20

- 21. SWARAJ ENGINES Ltd. V- "Book Profit" 6th Mar' 14 " Book Profits While The Going Is Good…. " Company update Book Profit CMP Target Price Previous Target Price Upside Change from Previous 648 648 600 0% 7% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 500407 SWARAJENG 382/672 801 1,015 6,329 Stock Performance-% Absolute Rel. to Nifty 1M 5.3 (0.2) 1yr 47.8 36.6 YTD 63.4 52.0 In our earlier report dated 25-04-13, we had recommended readers to buy the scrip with a view to earn healthy gains. As expected, the counter have given a premium of 40 per cent over its recommended price. We expect the current price growth rally factored all the fundamental changes, and we advise our readers to book profits at the current levels. We are quite positive on the Swaraj Engines, owing to its strong tractor volume growth, capacity expansion to 1,05,000 engines pa from 75,000 of current level, softening of commodity prices and company presence in all HP segments. We are upbeat on the stock on the account of core business momentum remains robust with healthy EPS growth, cash flow generation and high RoE. Moreover, we feel that caution is necessary over the recent robust financial as well as operational performance that the company has delivered over the past year. With 90 per cent of its turnover generated through parent company, the revenue stream also seems concentrated. In conclusion, looking at the above mentioned woes, we advise readers to book profits in the counter at its current levels and fresh buying may be considered at cheaper levels of around Rs. 500-550 a share. Our bearish attitude on the counter stems from its valuations. At a P/BV of 2.8x of its annualised FY14E RoE of Rs 28.7%, we believe that the counter is very expensive in comparison of its own past historical data Recommendation History Share Holding Pattern-% Promoters FII DII Others 3QFY14 50.6 1.9 10.6 36.9 1 yr Forward P/B 2QFY14 50.6 1.9 10.4 37.1 1QFY14 50.6 1.5 10.6 37.3 Date 25th April' 13 17th June' 13 10th July' 13 1st Aug' 13 26th Nov' 13 3rd Feb' 14 Report Type CMP Target Price Change From Previous in % Company Update Company Update Company Update Result Update Result Update Result Update 460 511 533 484 610 602 515 535 535 535 600 648 NA 3.9% 0.0% 0.0% 12.1% 8.0% Valuation At the CMP of INR610, the stock discounts its FY14E EPS of Rs. 54.20 by 12.0x and FY15E EPS of Rs. 61.7 by 10.5x. Given the strong revenue growth at a CAGR of 21%; PAT growth at CAGR of 26% post acquisition and stable margins at ~15%, the company is poised to grow further and capable of ustaining its healthy earnings. Furthermore, despite the capex of Rs. 38 crore, the company has strong cash flows and the company is debt free. Also, Company assurance of 3060% dividend payout ratio implies an attractive dividend yield of 4-9%. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 21

- 22. 9 SWARAJ ENGINES Ltd. Key financials : PARTICULAR 2009A 2010A 2011A 2012A 2013A 2014E 2015E 208 5 213 32 27 5 0 32 11 21 7 17.2 5.9 282 10 292 50 45 5 0 55 17 37 12 30.1 9.3 361 8 369 61 56 4 0 64 20 44 14 35.4 11.6 449 12 461 69 65 4 0 77 24 53 19 42.5 15.1 479 15 494 71 64 7 0 79 24 55 48 44.6 38.4 600 18 618 89 80 9 0 98 30 67 24 54.2 19.3 680 20 700 102 91 11 0 111 34 77 30 61.7 24.2 15.3% 15.5% 10.2% 8.0% 2.7% 21.9% 21.9% 17.6% 19.4% 13.2% 31.6% 9.8% 30.4% 30.4% 16.8% 17.8% 12.2% 12.2% 4.0% 28.8% 28.8% 15.5% 17.2% 11.8% 9.9% 3.5% 28.4% 28.4% 14.9% 16.6% 11.6% 11.3% 9.7% 28.6% 28.6% 14.8% 16.3% 11.2% 8.4% 3.0% 28.5% 28.5% 15.0% 16.3% 11.3% 9.5% 3.7% 26.6% 26.6% 97 1 214 123 1 95 152 1 290 186 1 429 194 1 395 236 1 648 287 1 648 Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Reported PAT Dividend EPS DPS Yeild % EBITDA % PBT % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth No of Share CMP (Ammount in crore) Valuation Book Value P/B P/E Net Sales/Equity (Source: Company/Eastwind) 78.3 2.7 3.5 2.1 (Source: Company/Eastwind Research) 98.8 1.0 5.3 2.3 122.6 2.4 5.6 2.4 150.0 2.9 5.1 2.4 156.0 2.5 6.8 2.5 190.2 3.4 12.0 2.5 231.5 2.8 10.5 2.4 (Figures In crore) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 22

- 23. EROSMEDIA "BUY" 5th March' 14 "Moving to Blockbuster" Initiating Report Buy CMP 160 Target Price Previous Target Price Upside Change from Previous 200 25% Market Data BSE Code NSE Symbol 533261 EROSMEDIA 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 195/107 1467 26241 6298 Stock Performance 1M Absolute Rel. to Nifty 1yr YTD 13.1 8.2 -7.3 -17.4 - Share Holding Pattern-% Promoters FII DII Others Current 74.88 2QFY14 74.88 12.45 1.56 11.11 12.16 1.87 11.09 P/BV-1 year forward 1QFY14 74.88 11.35 2.95 10.82 Healthy movies pipeline for FY15E; Company is expecting to release more than 8 big budget movies across Hindi and regional languages. Likewise, company is going to release much awaited Rajnikanth’s movie Kochadaiiyaan on 11 April, 2014. Apart from this, company is expected to release Dishkiyaaoon, Shadi Ke Side Effect, Action Jackson, Tanu weds Manu season 2, Sarkar3, Chalo China, NH-10, Dekho Magar Pyaar Se, Happy Ending and Rana in FY15E. It has largest Indian content library of films with 1100+ films and digital rights to an additional 700 films. Its well positioned to monetize rich content of library ensures annuity and regular set of revenue. Considering diversified and sustainable Business Model along with well positioned to monetize rich content of its library and block buster success ratio of movies (out of the top 10 grossing films in recent years, 3 are from Eros.) make us positive view on the stock. About Company: Eros International Media (EROS) is one of the largest films coproduction and distribution company in India and overseas, engage with presales of overseas rights, music rights and broadcasting rights. It recovers 35-40% of its costs by selling movie rights to channels, recovers another 35-40% from selling its overseas rights to overseas entities. Similarly, it gets 10-15% of the cost of movies by selling music rights . Robust 3QFY14 Result: Company reported better numbers with sales growth of 17% (YoY) led by huge spurt in catalogue monetization, which increase by approx75% (YoY). Its PAT grew by 41%(YoY). During the quarter, Its EBITDA margin improved by 680bps (YoY) to 31.3% because of reduction in operational expenses and employee expenses. Management expects to see EBITDA margin at 25% in FY14E and FY15E than 2022% range of margin in previous 4 years. Recent initiatives: Eros has struck new deals during the period with MSM Satellite Singapore private ltd for broadcast of films on Sony as well as with Viacom18 media for broadcast films on colours. Recently Eros International media has launched two new movie channels HBO DEFINED and HBO HITS, which will reduce its dependence on highly unpredictable revenue streams going forward. View and Valuation: Management is very excited to invest into different medium like internet and launching channels to generate revenue. Company’s optimistic stance towards maintaining margins, strong movies slate and very low valuation makes attractive. At a CMP of Rs 160, stock trades at 1.1 P/BVx FY15. We initiate “BUY” with a target price of Rs 200. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 432.68 135.6 92.0 31.3% 21.3% 2QFY14 201 51.2 37.0 25.4% 18.4% (QoQ)-% 115.2 165.0 148.8 590bps 290bps 3QFY13 369.3 90.6 65.2 24.5% 17.7% Rs, Crore (YoY)-% 17.2 49.6 41.1 680bps 360bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 23

- 24. EROSMEDIA Sales and Sales growth(%)(yoy) Key Concerns: 1. Piracy is the key concern for the company. Indian film industry loses approx. Rs.2000 cr. every year due to piracy (source: FICCI-KPMG report 2009). 2. Lower consumer discretionary demand. (Source: Company/Eastwind) 3. Difficult to predict fate of films. Margin-% (Source: Company/Eastwind) Upcoming Movies: Date of Release Q4FY14E 28-Feb-14 21-Mar-14 28-Mar-14 Upcoming movies Director Starcast Shaadi Ke Side Effects Dishkiyaaoon Happy Ending Saket Chaudhary Sanmjit Singh Talwar Raj and DK Farhan Akhtar,Vidya Balan Sunny Deol, Harman Baweja Saif Ali Khan, Ileana D'Cruz Q1FY15 11-Apr-14 6-Jun-14 Kochadaiiyaan Action Jackson Soundarya Ashwin Prabhu Deva Rajnikanth, Deepika Padukone Ajay Devgn, Sonakshi Sinha Q2FY15 12-Sep-14 NH-10 Navdeep singh Anushka sharma,Neil bhoopalam Tanu Weds Manu Season 2 R. Balki Untitled Aankheen 2 Illuminati Untitled Dekh Tamasha Dekh Purani Jeans Chalo china Anand Rai R.Balki Apoorva Lakhia Arif Ali Feroz Abbas Khan Tanushree Basu Shashank Ghosh R.Madhavan,Kangana Ranaut Amitabh Bachchan, Dhanush Abhishek Bachchan Armaan Jain Satish Kaushik and Others Aditya Seal Vinay Pathak, Lara Dutta FY15E (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 24

- 25. EROSMEDIA Management Guidance: 1. 2. 3. 4. 5. 6 Catalogue monetization will continue to grow strong in the upcoming quarters. Company will monetize entire portfolio across different platforms Catalogue monetization will increase from 13%-14% to 20-25% of overall revenue in coming 3 to 4 years. Management is looking for more and more free cash flows going forward. Q4 will be very positive and going forward FY15E will also be very positive for the company. Management is very confident about its performance going forward and expects EBITDA margin to be around 25% in FY14E and FY15E. Financials; Rs,cr Sales RM Cost(Operatinal expenses) WIP Employee Cost Other expenses Total expenses EBITDA Depreciation and Amortisation Other Income EBIT Interest PBT Tax Exp PAT Growth-% (YoY) Sales EBITDA PAT Expenses on Sales-% RM Cost Employee Cost Other expenses Tax rate Margin-% EBITDA EBIT PAT Valuation: CMP No of Share NW EPS BVPS RoE-% P/BV P/E FY10 640.88 480.33 0 19.7 27.81 527.84 113.04 4.39 12.62 108.65 9.02 112.25 29.63 82.62 FY11 706.97 495.13 0.84 25.28 29.57 550.82 156.15 3.82 8.95 152.33 9.39 151.89 33.67 118.22 FY12 943.88 665.45 -2.92 22.55 42.96 728.04 215.84 6 19.3 209.84 13.44 215.7 63.14 152.56 FY13 1067.95 765.78 -2.55 27.29 47.47 837.99 229.96 6.45 6.4 223.51 9.22 220.69 61.19 159.5 FY14E 1110.8 766.5 -2.7 29.4 29.4 822.7 288.1 7.7 11.1 280.4 25.4 266.2 77.7 188.5 FY15E 1229.9 860.9 -2.9 36.9 36.9 931.8 298.1 9.2 12.3 288.9 26.0 275.2 80.4 194.8 16.9% 52.8% 72.1% 10.3% 38.1% 43.1% 33.5% 38.2% 29.0% 13.1% 6.5% 4.5% 4.0% 25.3% 18.2% 10.7% 3.5% 3.4% 74.9% 3.1% 4.3% 4.6% 70.0% 3.6% 4.2% 4.8% 70.5% 2.4% 4.6% 6.7% 71.7% 2.6% 4.4% 5.7% 69.0% 2.7% 2.7% 7.0% 70.0% 3.0% 3.0% 6.5% 17.6% 17.0% 12.9% 22.1% 21.5% 16.7% 22.9% 22.2% 16.2% 21.5% 20.9% 14.9% 25.9% 25.2% 17.0% 24.2% 23.5% 15.8% 138.9 9.14 237.55 9.0 26.0 35% 5.3 15.4 138.9 9.14 670.48 12.9 73.4 17.6% 1.9 10.7 181.15 9.17 834.61 16.6 91.0 18.3% 2.0 10.9 180.53 9.19 986.5 17.4 107.3 16.2% 1.7 10.4 160.0 9.2 1158.6 20.5 126.1 16.3% 1.3 7.8 160.0 9.2 1337.0 21.2 145.5 14.6% 1.1 7.5 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 25

- 26. N arnolia Securities Ltd 402, 4th floor 7/ 1, Lord s Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 em ail: research@narnolia.com , w ebsite : w w w .narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.