More Related Content

Similar to Mnm Tata Motor Maruti

Similar to Mnm Tata Motor Maruti (20)

Mnm Tata Motor Maruti

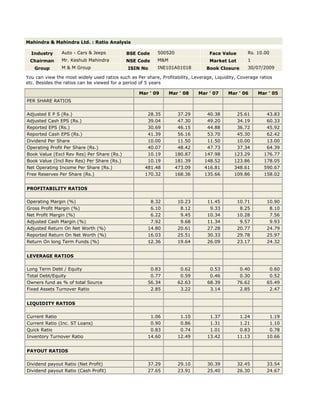

- 1. Mahindra & Mahindra Ltd. : Ratio AnalysisIndustryAuto - Cars & JeepsBSE Code500520Face ValueRs. 10.00ChairmanMr. Keshub MahindraNSE CodeM&MMarket Lot1GroupM & M GroupISIN NoINE101A01018Book Closure30/07/2009You can view the most widely used ratios such as Per share, Profitability, Leverage, Liquidity, Coverage ratios etc. Besides the ratios can be viewed for a period of 5 years Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 PER SHARE RATIOS Adjusted E P S (Rs.) 28.35 37.29 40.38 25.61 43.83Adjusted Cash EPS (Rs.) 39.04 47.30 49.20 34.19 60.33Reported EPS (Rs.) 30.69 46.15 44.88 36.72 45.92Reported Cash EPS (Rs.) 41.39 56.16 53.70 45.30 62.42Dividend Per Share 10.00 11.50 11.50 10.00 13.00Operating Profit Per Share (Rs.) 40.07 48.42 47.73 37.34 64.39Book Value (Excl Rev Res) Per Share (Rs.) 10.19 180.87 147.98 123.29 176.77Book Value (Incl Rev Res) Per Share (Rs.) 10.19 181.39 148.52 123.86 178.05Net Operating Income Per Share (Rs.) 481.48 473.09 416.81 348.61 590.67Free Reserves Per Share (Rs.) 170.32 168.36 135.66 109.86 158.02 PROFITABILITY RATIOS Operating Margin (%) 8.32 10.23 11.45 10.71 10.90Gross Profit Margin (%) 6.10 8.12 9.33 8.25 8.10Net Profit Margin (%) 6.22 9.45 10.34 10.28 7.56Adjusted Cash Margin (%) 7.92 9.68 11.34 9.57 9.93Adjusted Return On Net Worth (%) 14.80 20.61 27.28 20.77 24.79Reported Return On Net Worth (%) 16.03 25.51 30.33 29.78 25.97Return On long Term Funds (%) 12.36 19.64 26.09 23.17 24.32 LEVERAGE RATIOS Long Term Debt / Equity 0.83 0.62 0.53 0.40 0.60Total Debt/Equity 0.77 0.59 0.46 0.30 0.52Owners fund as % of total Source 56.34 62.63 68.39 76.62 65.49Fixed Assets Turnover Ratio 2.85 3.22 3.14 2.85 2.47 LIQUIDITY RATIOS Current Ratio 1.06 1.10 1.37 1.24 1.19Current Ratio (Inc. ST Loans) 0.90 0.86 1.31 1.21 1.10Quick Ratio 0.83 0.74 1.01 0.83 0.78Inventory Turnover Ratio 14.60 12.49 13.42 11.13 10.66 PAYOUT RATIOS Dividend payout Ratio (Net Profit) 37.29 29.10 30.39 32.45 33.54Dividend payout Ratio (Cash Profit) 27.65 23.91 25.40 26.30 24.67Earning Retention Ratio 59.63 63.99 66.22 53.46 64.87Cash Earnings Retention Ratio 70.69 71.61 72.28 65.14 74.48 COVERAGE RATIOS Adjusted Cash Flow Time Total Debt 3.81 2.29 1.40 1.11 1.56Financial Charges Coverage Ratio 10.43 17.37 77.85 39.60 29.94Fin. Charges Cov.Ratio (Post Tax) 9.41 16.33 65.57 40.23 24.04 COMPONENT RATIOS Material Cost Component(% earnings) 70.15 70.41 69.92 72.33 73.22Selling Cost Component 4.38 7.11 6.40 5.63 5.60Exports as percent of Total Sales 5.26 7.81 7.18 6.24 5.14Import Comp. in Raw Mat. Consumed 1.39 1.59 1.97 1.86 2.41Long term assets / Total Assets 0.63 0.63 0.50 0.53 0.52Bonus Component In Equity Capital (%) 62.58 71.36 71.67 73.09 47.0Maruti Suzuki India Ltd. : Ratio Analysis IndustryAuto - Cars & JeepsBSE Code532500Face ValueRs. 5.00ChairmanMr. R C BhargavaNSE CodeMARUTIMarket Lot1GroupMNC AssociateISIN NoINE585B01010Book Closure02/09/2009You can view the most widely used ratios such as Per share, Profitability, Leverage, Liquidity, Coverage ratios etc. Besides the ratios can be viewed for a period of 5 years Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 PER SHARE RATIOS Adjusted E P S (Rs.) 55.94 53.69 43.87 28.85 21.16Adjusted Cash EPS (Rs.) 75.61 63.09 53.75 45.23 40.80Reported EPS (Rs.) 59.91 54.07 41.16 29.55 18.76Reported Cash EPS (Rs.) 79.57 63.46 51.04 45.92 38.40Dividend Per Share 5.00 4.50 3.50 2.00 1.50Operating Profit Per Share (Rs.) 88.31 76.30 64.59 54.35 43.35Book Value (Excl Rev Res) Per Share (Rs.) 291.28 237.23 188.73 151.56 123.74Book Value (Incl Rev Res) Per Share (Rs.) 291.28 237.23 188.73 151.56 123.74Net Operating Income Per Share (Rs.) 625.34 512.49 422.20 382.34 327.07Free Reserves Per Share (Rs.) 286.28 231.89 183.18 144.13 116.91 PROFITABILITY RATIOS Operating Margin (%) 14.12 14.88 15.29 14.21 13.25Gross Profit Margin (%) 10.97 13.05 12.95 10.08 8.01Net Profit Margin (%) 9.34 10.29 9.53 7.57 5.61Adjusted Cash Margin (%) 11.79 12.01 12.45 11.59 12.21Adjusted Return On Net Worth (%) 19.20 22.63 23.24 19.03 17.10Reported Return On Net Worth (%) 20.56 22.78 21.80 19.49 15.16Return On long Term Funds (%) 27.35 30.74 33.47 28.12 22.71 LEVERAGE RATIOS Long Term Debt / Equity 0.05 0.08 0.01 0.06 0.08Total Debt/Equity 0.10 0.09 0.01 0.07 0.08Owners fund as % of total Source 90.33 91.57 98.70 93.43 92.00Fixed Assets Turnover Ratio 2.48 2.41 2.46 2.19 2.07 LIQUIDITY RATIOS Current Ratio 1.03 1.42 1.77 1.68 1.17Current Ratio (Inc. ST Loans) 0.91 1.40 1.77 1.67 1.15Quick Ratio 0.66 1.13 1.31 1.25 0.85Inventory Turnover Ratio 22.93 28.76 18.78 22.97 30.43 PAYOUT RATIOS Dividend payout Ratio (Net Profit) 9.78 9.72 9.69 7.73 9.02Dividend payout Ratio (Cash Profit) 7.36 8.28 7.81 4.97 4.40Earning Retention Ratio 89.53 90.21 90.91 92.09 92.01Cash Earnings Retention Ratio 92.25 91.67 92.58 94.95 95.86 COVERAGE RATIOS Adjusted Cash Flow Time Total Debt 0.41 0.34 0.04 0.23 0.26Financial Charges Coverage Ratio 50.46 68.23 104.61 49.70 32.32Fin. Charges Cov.Ratio (Post Tax) 39.57 49.76 73.28 37.85 25.71 COMPONENT RATIOS Material Cost Component(% earnings) 77.25 73.36 77.25 78.30 74.47Selling Cost Component 3.10 3.37 2.91 3.34 7.05Exports as percent of Total Sales 4.10 3.90 4.78 8.89 9.96Import Comp. in Raw Mat. Consumed 10.84 12.62 18.75 19.69 20.40Long term assets / Total Assets 0.74 0.61 0.49 0.52 0.62Bonus Component In Equity Capital (%) 0.00 0.00 0.00 0.00 0.00Tata Motors Ltd. : Ratio AnalysisIndustryAuto - LCVs/HCVsBSE Code500570Face ValueRs. 10.00ChairmanMr. Ratan N TataNSE CodeTATAMOTORSMarket Lot1GroupTata GroupISIN NoINE155A01014Book Closure25/08/2009You can view the most widely used ratios such as Per share, Profitability, Leverage, Liquidity, Coverage ratios etc. Besides the ratios can be viewed for a period of 5 years Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 PER SHARE RATIOS Adjusted E P S (Rs.) 42.91 43.76 35.57 34.08 23.24Adjusted Cash EPS (Rs.) 61.50 61.18 51.10 48.38 35.54Reported EPS (Rs.) 52.63 49.65 39.94 34.19 22.96Reported Cash EPS (Rs.) 71.22 67.07 55.47 48.49 35.26Dividend Per Share 15.00 15.00 13.00 12.50 8.00Operating Profit Per Share (Rs.) 77.84 67.12 56.06 55.29 48.94Book Value (Excl Rev Res) Per Share (Rs.) 202.54 177.33 143.58 113.15 101.08Book Value (Incl Rev Res) Per Share (Rs.) 203.20 178.00 144.26 113.15 101.08Net Operating Income Per Share (Rs.) 745.47 691.91 524.73 475.44 369.11Free Reserves Per Share (Rs.) 182.38 157.16 123.34 93.85 81.54 PROFITABILITY RATIOS Operating Margin (%) 10.44 9.70 10.68 11.62 13.25Gross Profit Margin (%) 8.17 7.50 8.09 9.01 10.32Net Profit Margin (%) 6.96 6.94 7.35 7.02 6.10Adjusted Cash Margin (%) 8.13 8.55 9.41 9.94 9.45Adjusted Return On Net Worth (%) 21.18 24.67 24.77 30.12 22.98Reported Return On Net Worth (%) 25.98 28.00 27.81 30.21 22.71Return On long Term Funds (%) 22.73 31.18 28.65 28.72 32.21 LEVERAGE RATIOS Long Term Debt / Equity 0.50 0.31 0.41 0.59 0.32Total Debt/Equity 0.80 0.58 0.53 0.60 0.35Owners fund as % of total Source 55.43 63.05 65.23 62.22 74.02Fixed Assets Turnover Ratio 2.68 3.08 2.55 2.62 2.18 LIQUIDITY RATIOS Current Ratio 0.89 1.24 1.24 0.99 0.72Current Ratio (Inc. ST Loans) 0.64 0.85 1.07 0.98 0.69Quick Ratio 0.66 0.91 0.96 0.76 0.47Inventory Turnover Ratio 14.43 13.26 12.63 14.06 14.91 PAYOUT RATIOS Dividend payout Ratio (Net Profit) 32.51 35.34 37.13 41.68 39.27Dividend payout Ratio (Cash Profit) 24.02 26.16 26.73 29.39 25.57Earning Retention Ratio 60.13 59.90 58.31 58.18 61.20Cash Earnings Retention Ratio 72.18 71.32 70.98 70.54 74.63 COVERAGE RATIOS Adjusted Cash Flow Time Total Debt 2.65 1.70 1.50 1.43 1.00Financial Charges Coverage Ratio 7.19 7.62 8.08 10.24 8.69Fin. Charges Cov.Ratio (Post Tax) 6.82 6.67 7.06 8.49 6.51 COMPONENT RATIOS Material Cost Component(% earnings) 72.69 74.55 72.84 71.19 65.84Selling Cost Component 4.10 4.00 3.78 3.48 3.49Exports as percent of Total Sales 9.89 10.18 11.87 8.70 7.80Import Comp. in Raw Mat. Consumed 4.60 3.88 4.64 2.30 2.43Long term assets / Total Assets 0.58 0.45 0.39 0.47 0.62Bonus Component In Equity Capital (%) 28.86 28.87 29.06 30.76 31.5