Financial Analysis - Osisko Mining Corporation is a gold exploration compa…

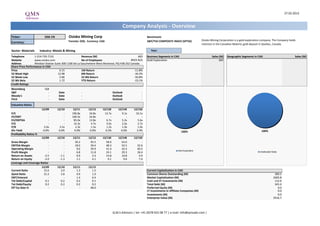

- 1. 27.02.2013 Company Analysis - Overview Ticker: OSK CN Osisko Mining Corp Benchmark: Toronto: OSK, Currency: CAD S&P/TSX COMPOSITE INDEX (SPTSX) Osisko Mining Corporation is a gold exploration company. The Company holds Currency: interests in the Canadian Malartic gold deposit in Quebec, Canada. Sector: Materials Industry: Metals & Mining Year: Telephone 1-514-735-7131 Revenue (M) 665 Business Segments in CAD Sales (M) Geographic Segments in CAD Sales (M) Website www.osisko.com No of Employees #N/A N/A Gold Exploration 665 Unallocated Sales 1 Address Windsor Station Suite 300 1100 De La Gauchetiere West Montreal, PQ H3B 2S2 Canada Share Price Performance in CAD Price 6.15 1M Return -11.8% 52 Week High 12.98 6M Return -34.2% 52 Week Low 5.68 52 Wk Return -50.8% 52 Wk Beta 1.72 YTD Return -23.1% Credit Ratings Bloomberg IG8 S&P - Date - Outlook - Moody's - Date - Outlook - Fitch - Date - Outlook - Valuation Ratios 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E P/E - - 196.8x 34.8x 12.7x 9.1x 10.1x EV/EBIT - - 160.3x 16.8x - - - EV/EBITDA - - 85.0x 12.8x 6.7x 5.2x 5.6x P/S - - 14.3x 4.7x 3.0x 2.6x 2.7x P/B 2.6x 3.5x 2.3x 1.5x 1.2x 1.0x 1.0x Div Yield 0.0% 0.0% 0.0% 0.0% 0.2% 0.6% 3.4% 100% 100% Profitability Ratios % 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Gross Margin - - 30.2 45.5 58.0 63.0 - EBITDA Margin - - 18.0 39.4 48.3 54.5 52.6 Operating Margin - - 9.6 29.9 41.4 42.4 40.5 Gold Exploration Profit Margin - - 6.8 11.8 24.1 29.3 26.4 Unallocated Sales Return on Assets -2.5 -1.1 0.9 3.3 14.8 10.8 4.9 Return on Equity -3.0 -1.3 1.1 4.1 9.1 9.6 7.4 Leverage and Coverage Ratios 12/09 12/10 12/11 12/12 Current Ratio 15.6 3.0 1.3 1.5 Current Capitalization in CAD Quick Ratio 15.3 2.8 0.9 1.0 Common Shares Outstanding (M) 389.5 EBIT/Interest - - 1.4 6.4 Market Capitalization (M) 2683.8 Tot Debt/Capital 0.1 0.2 0.2 0.1 Cash and ST Investments (M) 112.6 Tot Debt/Equity 0.2 0.2 0.2 0.2 Total Debt (M) 345.4 Eff Tax Rate % - - - 48.0 Preferred Equity (M) 0.0 LT Investments in Affiliate Companies (M) 0.0 Investments (M) 0.0 Enterprise Value (M) 2916.7 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. Company Analysis - Analysts Ratings Osisko Mining Corp Target price in CAD Broker Recommendation Buy and Sell Recommendations vs Price and Target Price Price Brokers' Target Price 25 14 100% 6% 6% 5% 5% 6% 6% 6% 6% 6% 6% 6% 6% 12 22% 21% 21% 24% 24% 20 80% 29% 25% 29% 28% 29% 31% 31% 10 15 8 60% 6 40% 10 69% 72% 74% 74% 71% 71% 4 65% 63% 63% 65% 67% 65% 2 20% 5 0 Genuity Corp BMO Capital Raymond GMP Securities Inc. Macquarie Securities Corp RBC Capital Scotia Capital Capital Inc Credit Suisse Securities National Bank Stifel Nicolaus TD Securities Dimensions CIBC World Paradigm Canaccord James Clarus Markets Markets Markets 0% 0 Financial Cormark EVA Dundee févr.12 mars.12 avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13 Buy Hold Sell Price Target Price Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date 31-Jan-13 71% 24% 6% 27-Feb-13 6.15 10.13 BMO Capital Markets JOHN P HAYES speculative outperform 9.25 26-Feb-13 31-Dec-12 65% 29% 6% 26-Feb-13 6.15 10.13 Credit Suisse ANITA SONI neutral 8.00 26-Feb-13 30-Nov-12 71% 24% 6% 25-Feb-13 6.20 10.13 Cormark Securities Inc. RICHARD GRAY buy 10.00 26-Feb-13 31-Oct-12 74% 21% 5% 22-Feb-13 6.20 10.30 GMP ANDREW MIKITCHOOK buy 10.00 25-Feb-13 28-Sep-12 74% 21% 5% 21-Feb-13 5.79 10.42 TD Securities DANIEL EARLE buy 10.00 25-Feb-13 31-Aug-12 67% 28% 6% 20-Feb-13 5.84 10.53 Macquarie MICHAEL SIPERCO outperform 9.00 23-Feb-13 31-Jul-12 72% 22% 6% 19-Feb-13 6.07 10.53 Raymond James BRAD HUMPHREY market perform 10.00 22-Feb-13 29-Jun-12 65% 29% 6% 18-Feb-13 5.95 10.53 CIBC World Markets COSMOS CHIU sector outperform 13.00 22-Feb-13 31-May-12 63% 31% 6% 15-Feb-13 5.95 10.53 Dundee Securities Corp JOE FAZZINI buy 11.00 22-Feb-13 30-Apr-12 69% 25% 6% 14-Feb-13 6.38 10.53 National Bank Financial STEPHEN PARSONS outperform 10.75 22-Feb-13 30-Mar-12 63% 31% 6% 13-Feb-13 6.14 10.65 Clarus Securities JAMIE SPRATT buy 10.75 22-Feb-13 29-Feb-12 65% 29% 6% 12-Feb-13 6.41 10.61 EVA Dimensions CRAIG STERLING hold 22-Feb-13 11-Feb-13 6.39 10.61 RBC Capital Markets DAN ROLLINS outperform 9.00 21-Feb-13 8-Feb-13 6.54 10.61 Scotia Capital LEILY OMOUMI sector outperform 10.50 21-Feb-13 7-Feb-13 6.35 10.61 Canaccord Genuity Corp STEVEN BUTLER buy 8.50 21-Feb-13 6-Feb-13 6.52 10.61 Stifel Nicolaus GEORGE J TOPPING buy 12.25 8-Feb-13 5-Feb-13 6.70 10.61 Paradigm Capital Inc DON BLYTH buy 12.50 13-Nov-12 4-Feb-13 6.79 10.61 1-Feb-13 6.88 10.70 31-Jan-13 6.91 10.66 30-Jan-13 7.03 10.66 29-Jan-13 6.77 10.66 28-Jan-13 6.86 10.60 25-Jan-13 6.97 10.77 24-Jan-13 7.13 11.11 23-Jan-13 7.07 11.58 22-Jan-13 7.60 11.58 21-Jan-13 7.73 11.58 18-Jan-13 7.79 11.64 17-Jan-13 7.87 11.64 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 27.02.2013 Osisko Mining Corp Company Analysis - Ownership Ownership Type Ownership Statistics Geographic Ownership Distribution Geographic Ownership 1% Shares Outstanding (M) 389.5 United States 41.38% 2% 2% Float 99.0% Canada 32.88% 2% 2% Short Interest (M) 30.1 Germany 14.81% 3% Short Interest as % of Float 7.80% Luxembourg 2.71% 41% Days to Cover Shorts 6.98 Britain 2.42% 15% 48% 51% Institutional Ownership 50.97% Unknown Country 1.95% Retail Ownership 48.02% Switzerland 1.78% Insider Ownership 1.02% Others 2.05% Institutional Ownership Distribution 33% Investment Advisor 83.17% Mutual Fund Manager 7.84% Hedge Fund Manager 6.79% United States Canada Germany Institutional Ownership Retail Ownership Insider Ownership Individual 1.95% Luxembourg Britain Unknown Country Pricing data is in CAD Others 0.24% Switzerland Others Top 20 Owners: TOP 20 ALL Institutional Ownership Holder Name Position Position Change Market Value % of Ownership Report Date Source Country EURASIA HOLDING AG 33'356'367 0 205'141'657 7.64% 27.10.2009 SEDI GERMANY 2% 0% GCIC LTD/CANADA 32'648'396 -7'713'560 200'787'635 7.48% 14.02.2012 Co File CANADA 7% BLACKROCK 17'126'608 4'083'693 105'328'639 3.92% 25.02.2013 ULT-AGG UNITED STATES TOCQUEVILLE ASSET MA 14'515'480 3'600'860 89'270'202 3.33% 30.09.2012 13F UNITED STATES 8% FRANKLIN RESOURCES 12'169'560 266'190 74'842'794 2.79% 31.12.2012 ULT-AGG UNITED STATES OPPENHEIMERFUNDS INC 10'295'653 200'000 63'318'266 2.36% 30.12.2012 MF-AGG UNITED STATES IG INVESTMENT MANAGE 8'527'738 -1'029'374 52'445'589 1.95% 28.09.2012 MF-AGG CANADA ROYAL BANK OF CANADA 8'173'682 409'466 50'268'144 1.87% 31.01.2013 ULT-AGG CANADA FMR LLC 7'783'520 1'696'471 47'868'648 1.78% 31.12.2012 ULT-AGG UNITED STATES VAN ECK ASSOCIATES C 5'989'691 0 36'836'600 1.37% 25.02.2013 MF-AGG UNITED STATES 83% FIRST EAGLE INVESTME 5'274'540 0 32'438'421 1.21% 30.09.2012 MF-AGG UNITED STATES UNITED SERVICES AUTO 4'604'600 0 28'318'290 1.06% 30.11.2012 MF-AGG UNITED STATES VANGUARD GROUP INC 4'222'430 49'580 25'967'945 0.97% 31.12.2012 MF-AGG UNITED STATES LOMBARD ODIER DARIER 3'183'664 110'000 19'579'534 0.73% 31.12.2012 MF-AGG LUXEMBOURG Investment Advisor Mutual Fund Manager Hedge Fund Manager Individual Others IA CLARINGTON INVEST 3'075'000 -371'400 18'911'250 0.70% 30.09.2012 MF-AGG CANADA WELLS FARGO FUNDS MA 3'059'400 0 18'815'310 0.70% 31.12.2012 MF-AGG UNITED STATES SPROTT INC 2'848'612 0 17'518'964 0.65% 30.06.2011 MF-AGG CANADA AGF INVESTMENTS INC 2'614'064 507'300 16'076'494 0.60% 28.09.2012 MF-AGG CANADA TD ASSET MANAGEMENT 2'603'325 -1'662'844 16'010'449 0.60% 31.12.2011 MF-AGG CANADA HEXAVEST INC 2'323'686 403'129 14'290'669 0.53% 31.12.2012 13F CANADA Top 5 Insiders: Holder Name Position Position Change Market Value % of Ownership Report Date Source WARES ROBERT P 1'471'000 -10'000 9'046'650 0.34% 11.09.2012 SEDI ROOSEN SEAN E O 788'812 2'798 4'851'194 0.18% 17.01.2013 SEDI STORM NORMAN 671'500 -5'000 4'129'725 0.15% 04.09.2012 SEDI BURZYNSKI JOHN 538'900 10'000 3'314'235 0.12% 18.12.2012 SEDI COATES BRYAN A 409'954 2'798 2'521'217 0.09% 01.02.2013 SEDI Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 4. Company Analysis - Financials I/IV Osisko Mining Corp Financial information is in CAD (M) Equivalent Estimates Periodicity: Fiscal Year 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Income Statement Revenue 0 0 0 0 0 0 0 263 665 906 1'037 984 - Cost of Goods Sold 184 363 Gross Income 79 303 525 653 - Selling, General & Admin Expenses 0 1 2 2 8 12 11 21 34 54 104 (Research & Dev Costs) 0 0 0 Operating Income -0 -1 -2 -2 -8 -12 -11 -21 -34 25 199 375 440 398 - Interest Expense 0 0 0 0 0 0 0 0 18 31 - Foreign Exchange Losses (Gains) 0 0 0 0 3 -6 5 -3 1 -2 - Net Non-Operating Losses (Gains) 0 -0 -0 -0 -0 -4 -3 -3 -12 -5 19 Pretax Income -0 -2 -2 -8 -12 -3 -23 -20 11 151 356 478 401 - Income Tax Expense 0 0 0 0 0 -4 -2 -2 -7 72 Income Before XO Items -0 -1 -2 -2 -8 -12 1 -21 -18 18 78 - Extraordinary Loss Net of Tax 0 0 0 0 0 0 0 0 0 0 0 - Minority Interests 0 0 0 0 0 0 0 0 0 0 0 Diluted EPS Before XO Items (0.02) (0.03) (0.04) (0.02) (0.07) (0.09) 0.01 (0.08) (0.05) 0.05 0.20 Net Income Adjusted* -2 -2 -8 -12 -21 -0 18 180 218 304 259 EPS Adjusted (0.04) (0.02) (0.07) (0.09) (0.08) (0.06) 0.05 0.46 0.48 0.68 0.61 Dividends Per Share 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.02 0.04 0.21 Payout Ratio % 0.0 0.0 0.0 0.03 0.06 0.35 Total Shares Outstanding 21 40 64 89 114 160 166 336 382 385 390 Diluted Shares Outstanding 20 26 60 89 106 132 168 260 360 390 391 EBITDA -2 -2 -8 -12 -11 -21 -34 47 262 437 565 517 *Net income excludes extraordinary gains and losses and one-time charges. Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 5. Company Analysis - Financials II/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Balance Sheet Total Current Assets 0.008393 0.695511 0.66 5.174321 18.342519 195.332 119.272 812.602 426.855 209.3 274.484 + Cash & Near Cash Items 0 1 0 4 6 108 58 674 358 101 93 + Short Term Investments 0 0 0 0 7 73 20 90 17 0 19 + Accounts & Notes Receivable 0 0 0 1 5 14 22 38 31 39 62 + Inventories 0 0 0 0 0 0 0 0 0 48 74 + Other Current Assets 0 0 0 0 1 20 12 21 22 26 Total Long-Term Assets 0 1 1 2 13 69 199 526 1'532 1'860 2'394 + Long Term Investments 0 0 0 1 0 6 Gross Fixed Assets 13 68 200 506 Accumulated Depreciation 0 0 1 2 + Net Fixed Assets 0 1 1 2 13 68 199 504 1'478 1'801 2'330 + Other Long Term Assets 0 0 0 0 0 16 54 59 64 Total Current Liabilities 0 0 1 0 4 12 27 52 144 162 179 + Accounts Payable 0 0 0 4 12 25 46 74 75 101 + Short Term Borrowings 0 0 0 0 0 1 6 70 86 77 + Other Short Term Liabilities 0 0 0 0 0 0 0 0 0 1 1 Total Long Term Liabilities 0 0 0 0 0 0 24 185 229 261 348 + Long Term Borrowings 0 0 0 0 0 0 24 185 225 253 269 + Other Long Term Borrowings 0 0 0 0 0 0 0 3 8 79 Total Liabilities 0 0 1 0 4 12 51 238 373 423 527 + Long Preferred Equity 0 0 0 0 0 0 0 0 0 0 0 + Minority Interest 0 0 0 0 0 0 0 0 0 0 0 + Share Capital & APIC 2 4 6 13 42 278 292 1'146 1'663 1'725 2'134 + Retained Earnings & Other Equity -2 -3 -5 -6 -14 -26 -24 -45 -77 -79 8 Total Shareholders Equity 0 1 1 7 28 253 267 1'101 1'586 1'646 2'142 Total Liabilities & Equity 0 1 2 7 32 264 318 1'339 1'959 2'069 2'668 Book Value Per Share 0.01 0.03 0.02 0.07 0.25 1.57 1.61 3.27 4.15 4.27 5.50 5.22 5.94 6.40 Tangible Book Value Per Share 0.01 0.03 0.02 0.07 0.25 1.57 1.61 3.27 4.15 4.27 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 6. Company Analysis - Financials III/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Cash Flows Net Income -0 -1 -2 -2 -8 -12 1 -21 -18 18 78 212 338 308 + Depreciation & Amortization 0 0 0 0 0 0 0 22 64 + Other Non-Cash Adjustments 0 0 1 1 4 9 -6 3 -4 36 132 + Changes in Non-Cash Capital 0 -0 0 -1 -2 -0 1 8 0 10 -27 Cash From Operating Activities -0 -0 -1 -2 -5 -3 -3 -10 -21 86 247 + Disposal of Fixed Assets 0 0 0 0 0 0 2 0 0 0 0 + Capital Expenditures -0 -1 -2 -1 -11 -51 -130 -276 -498 -357 -229 -235 -285 -337 + Increase in Investments 0 0 0 0 0 0 0 0 0 0 0 + Decrease in Investments 0 0 0 0 0 0 0 0 0 0 0 + Other Investing Activities 0 0 -0 0 -7 -67 50 -85 99 -1 -9 Cash From Investing Activities -0 -1 -2 -1 -18 -118 -78 -361 -399 -358 -238 + Dividends Paid 0 0 0 0 0 0 0 0 0 0 0 + Change in Short Term Borrowings 0 0 0 0 0 0 0 0 0 0 0 + Increase in Long Term Borrowings 0 0 0 0 0 0 20 150 75 0 15 + Decrease in Long Term Borrowings 0 0 0 0 0 0 -0 -1 -11 -12 -28 + Increase in Capital Stocks 0 2 2 7 24 223 13 841 41 39 19 + Decrease in Capital Stocks 0 0 0 0 0 0 -1 0 0 0 0 + Other Financing Activities 0 0 0 -0 0 0 -1 -3 -1 -13 -23 Cash From Financing Activities 0 2 2 7 24 223 31 987 104 14 -17 Net Changes in Cash -0 1 -1 4 2 102 -50 616 -315 -258 -7 Free Cash Flow (CFO-CAPEX) -0 -1 -2 -3 -16 -54 -134 -286 -519 -271 18 127 141 5 Free Cash Flow To Firm 34 Free Cash Flow To Equity -0 -1 -2 -3 -16 -54 -112 -137 -455 -283 5 Free Cash Flow per Share -0.01 -0.04 -0.04 -0.04 -0.15 -0.41 -0.82 -1.10 -1.44 -0.71 0.05 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 7. Company Analysis - Financials IV/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Ratio Analysis Valuation Ratios Price Earnings 364.0x 196.8x 34.8x 12.7x 9.1x 10.1x EV to EBIT 160.3x 16.8x EV to EBITDA 85.0x 12.8x 6.7x 5.2x 5.6x Price to Sales 14.3x 4.7x 3.0x 2.6x 2.7x Price to Book 2.5x 6.7x 9.0x 10.4x 22.5x 3.7x 2.3x 2.6x 3.5x 2.3x 1.5x 1.2x 1.0x 1.0x Dividend Yield 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.2% 0.6% 3.4% Profitability Ratios Gross Margin 30.2% 45.5% 58.0% 63.0% EBITDA Margin 18.0% 39.4% 48.3% 54.5% 52.6% Operating Margin 9.6% 29.9% 41.4% 42.4% 40.5% Profit Margin 6.8% 11.8% 24.1% 29.3% 26.4% Return on Assets -57.8% -70.5% -149.0% -35.3% -39.0% -8.0% 0.5% -2.5% -1.1% 0.9% 3.3% 14.8% 10.8% 4.9% Return on Equity -102.3% -94.2% -199.2% -39.1% -43.3% -8.4% 0.6% -3.0% -1.3% 1.1% 4.1% 9.1% 9.6% 7.4% Leverage & Coverage Ratios Current Ratio 0.25 31.61 1.28 16.12 5.18 16.48 4.49 15.57 2.97 1.29 1.53 Quick Ratio 0.25 31.39 1.24 16.05 5.16 16.42 3.74 15.35 2.82 0.87 0.98 Interest Coverage Ratio (EBIT/I) 1.42 6.45 Tot Debt/Capital 0.50 0.15 0.11 0.00 0.00 0.00 0.09 0.15 0.16 0.17 0.14 Tot Debt/Equity 0.99 0.17 0.12 0.00 0.00 0.00 0.10 0.17 0.19 0.21 0.16 Others Asset Turnover 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.13 0.28 Accounts Receivable Turnover 0.00 0.00 0.00 0.00 0.00 0.00 0.00 7.51 13.09 Accounts Payable Turnover 3.13 4.43 Inventory Turnover 7.74 5.98 Effective Tax Rate 48.0% Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 8. Company Analysis - Peers Comparision BARRICK GOLD FREEPORT- DETOUR GOLD ANGLOGOLD KIRKLAND LAKE YAMANA GOLD AGNICO-EAGLE OSISKO MINING KINROSS GOLD BHP BILLITON LTD RIO TINTO LTD VALE SA-PF SILVER WHEATON GOLDCORP INC PAN AMER SILVER CRP MCMORAN CORP ASHANT GO INC MIN Latest Fiscal Year: 12/2012 12/2012 12/2012 12/2012 12/2011 06/2012 12/2012 12/2012 12/2011 04/2012 12/2011 12/2012 12/2012 12/2012 12/2012 52-Week High 12.98 49.44 11.47 44.23 29.07 39.34 32'983.00 72.30 43.43 17.66 41.18 50.17 20.61 26.78 57.00 52-Week High Date 09.03.2012 28.02.2012 28.02.2012 29.02.2012 05.10.2012 20.02.2013 29.02.2012 14.02.2013 29.02.2012 29.02.2012 01.11.2012 29.02.2012 09.11.2012 29.02.2012 31.10.2012 52-Week Low 5.68 30.75 7.14 30.54 18.45 30.09 22'175.00 48.37 31.73 5.11 23.11 32.32 12.76 13.79 31.91 52-Week Low Date 20.02.2013 20.02.2013 09.05.2012 06.12.2012 15.05.2012 12.07.2012 22.02.2013 30.08.2012 04.09.2012 13.12.2012 16.05.2012 12.07.2012 16.05.2012 24.07.2012 23.04.2012 Daily Volume 3'807'044 10'462'030 7'069'131 15'396'816 986'151 7'807'427 11'207 2'879'459 23'958'800 819'429 2'349'771 4'885'598 4'671'708 362'834 1'242'819 Current Price (2/dd/yy) 6.15 32.07 8.14 31.93 21.24 36.69 22'600.00 66.01 35.15 6.22 33.50 34.44 15.82 17.64 43.03 52-Week High % Change -52.6% -35.1% -29.0% -27.8% -26.9% -6.7% -31.5% -8.7% -19.1% -64.8% -18.6% -31.4% -23.2% -34.1% -24.5% 52-Week Low % Change 8.3% 4.3% 14.0% 4.6% 15.1% 21.9% 1.9% 36.5% 10.8% 21.7% 45.0% 6.6% 24.0% 27.9% 34.8% Total Common Shares (M) 389.5 1'001.1 1'140.1 949.0 101.9 5'297.6 384.9 1'847.0 5'097.3 70.2 353.5 811.5 745.8 151.9 172.3 Market Capitalization 2'683.8 32'105.5 9'280.5 30'318.5 2'504.1 182'793.3 87'001.5 101'728.3 193'312.7 436.3 11'871.6 27'948.7 11'900.2 2'678.1 7'409.2 Total Debt 345.4 13'943.0 2'632.6 3'527.0 413.2 28'330.0 30'376.0 26'819.0 49'121.0 8.8 78.6 783.0 431.8 78.0 843.0 Preferred Stock - - - - - - - - - - - - - - - Minority Interest - 2'663.0 75.5 3'768.0 - 1'215.0 186.5 11'156.0 3'144.0 - - 213.0 46.8 7.3 - Cash and Equivalents 112.6 2'093.0 1'982.7 3'705.0 764.2 4'781.0 7'562.2 7'615.0 7'573.0 30.2 840.2 918.0 550.4 542.3 332.0 Enterprise Value 2'916.7 45'815.6 9'773.8 33'908.5 2'628.9 218'602.9 110'001.7 134'407.7 237'523.1 485.1 11'076.8 27'327.7 12'014.6 2'154.1 7'734.8 Valuation Total Revenue LFY 665.4 14'547.0 4'311.4 18'010.0 0.0 72'226.0 52'160.3 50'967.0 103'195.0 159.8 730.0 5'435.0 2'336.8 928.6 1'917.7 LTM 665.4 14'547.0 4'311.4 18'010.0 - 66'950.0 52'152.1 50'967.0 91'893.7 153.6 754.2 5'435.0 2'336.8 928.6 1'917.7 CY+1 905.7 15'576.2 4'593.8 22'676.3 - 68'522.1 67'169.1 58'856.0 91'162.9 155.1 821.0 6'044.5 2'929.3 1'160.5 1'962.4 CY+2 1'037.2 16'616.2 4'842.6 23'753.0 435.9 75'406.9 77'137.2 62'661.4 98'446.2 273.6 1'108.4 7'553.0 3'467.1 1'249.6 2'235.3 EV/Total Revenue LFY 5.0x 3.4x 2.7x 2.0x #DIV/0! 3.3x 2.4x 3.1x 2.3x 4.6x 18.6x 5.5x 6.3x 2.6x 5.0x LTM 5.0x 3.4x 2.7x 2.0x - 3.5x 2.3x 3.1x 2.5x 4.8x 18.0x 5.5x 6.5x 2.6x 5.0x CY+1 3.0x 2.9x 2.1x 1.8x #DIV/0! 3.2x 1.6x 2.3x 2.7x 3.5x 13.3x 4.6x 3.9x 1.8x 3.9x CY+2 2.3x 2.6x 2.0x 1.7x 6.5x 2.8x 1.3x 2.1x 2.5x 1.9x 10.5x 3.6x 3.1x 1.5x 3.4x EBITDA LFY 262.4 7'358.0 1'962.2 6'934.0 (57.0) 33'421.0 19'105.5 15'902.0 60'071.0 55.7 618.8 2'798.0 1'301.1 367.4 791.4 LTM 262.4 7'358.0 1'962.2 6'934.0 (56.6) 22'246.0 19'105.5 15'486.0 39'812.0 38.8 627.8 2'798.0 1'218.5 362.0 791.4 CY+1 437.5 8'488.3 2'174.1 10'395.4 (57.3) 29'030.4 30'056.4 22'112.5 37'568.1 31.1 686.7 3'308.5 1'709.8 513.7 870.8 CY+2 565.0 9'279.3 2'483.4 10'992.4 162.1 34'724.0 35'739.9 24'211.3 44'006.6 116.4 939.5 4'510.8 2'123.6 585.2 1'058.4 EV/EBITDA LFY 12.8x 6.7x 6.0x 5.2x -58.5x 7.1x 6.5x 9.9x 3.9x 13.3x 21.9x 10.7x 11.3x 6.5x 12.1x LTM 12.8x 6.7x 6.0x 5.2x - 10.6x 6.3x 10.1x 5.8x 19.1x 21.6x 10.7x 12.3x 6.6x 12.1x CY+1 6.2x 5.4x 4.5x 4.0x - 7.4x 3.5x 6.1x 6.5x 17.6x 15.9x 8.5x 6.7x 4.1x 8.8x CY+2 4.3x 4.7x 3.8x 3.7x 17.4x 6.1x 2.7x 5.4x 5.7x 4.4x 12.4x 6.0x 5.1x 3.2x 7.2x EPS LFY 0.23 3.82 0.77 3.19 0.20 3.61 21.85 6.45 7.21 0.57 1.55 1.99 0.93 1.04 1.89 LTM 0.23 3.69 0.77 3.22 -0.03 1.83 24.22 -1.63 4.60 0.27 1.56 1.89 0.63 1.08 2.08 CY+1 0.48 4.36 0.80 4.44 (0.52) 2.56 33.23 6.07 4.18 0.06 1.66 2.11 1.12 1.60 2.09 CY+2 0.68 4.68 0.90 4.54 0.95 3.12 40.65 6.82 4.73 0.78 2.12 2.90 1.40 1.79 2.53 P/E LFY 26.7x 8.5x 10.3x 9.9x - 20.6x 9.3x - 7.6x 23.0x 20.9x 17.7x 24.5x 15.9x 20.2x LTM 26.7x 8.5x 10.3x 9.9x - 13.4x 9.1x - 7.6x 23.0x 20.9x 17.7x 24.5x 15.9x 20.2x CY+1 12.7x 7.2x 9.9x 7.2x - 14.7x 6.8x 11.1x 8.4x 103.7x 19.7x 15.9x 13.8x 10.8x 20.1x CY+2 9.1x 6.7x 8.8x 7.0x 21.9x 12.0x 5.6x 9.9x 7.4x 8.0x 15.4x 11.6x 11.0x 9.6x 16.6x Revenue Growth 1 Year 152.6% 2.2% 12.2% (13.7%) - 0.7% (4.1%) (15.8%) 24.0% 54.7% 72.4% 1.4% 7.5% 8.6% 5.3% 5 Year - 17.9% 34.9% 15.3% - 6.8% 24.6% 11.2% 19.2% 72.4% 39.3% 19.3% 203.5% 47.9% 54.5% EBITDA Growth 1 Year 453.3% (11.6%) 1.9% (31.8%) 7.0% (12.1%) (17.8%) (39.5%) 29.9% 110.9% 95.7% (7.7%) 3.0% (17.6%) 5.1% 5 Year - 24.5% 40.7% (2.4%) - 8.0% 86.9% 8.7% 26.2% - 44.0% 21.0% 27.4% 25.6% 31.8% EBITDA Margin LTM 39.4% 50.6% 45.5% 38.5% - 33.2% 36.6% 30.4% 43.3% 25.3% 83.2% 51.5% 52.1% 39.0% 41.3% CY+1 48.3% 54.5% 47.3% 45.8% - 42.4% 44.7% 37.6% 41.2% 20.1% 83.6% 54.7% 58.4% 44.3% 44.4% CY+2 54.5% 55.8% 51.3% 46.3% 37.2% 46.0% 46.3% 38.6% 44.7% 42.6% 84.8% 59.7% 61.3% 46.8% 47.4% Leverage/Coverage Ratios Total Debt / Equity % 16.1% 63.8% 26.7% 20.1% 32.7% 43.0% 65.8% 57.2% 34.2% 3.8% 3.0% 3.4% 5.8% 2.9% 24.7% Total Debt / Capital % 13.9% 36.3% 21.0% 14.2% 24.6% 29.7% 39.6% 31.6% 25.1% 3.7% 2.9% 3.3% 5.4% 2.8% 19.8% Total Debt / EBITDA 1.316x 1.895x 1.342x 0.509x - 1.595x 1.540x 1.732x 1.472x 2.286x 0.091x 0.280x 0.638x 0.215x 1.065x Net Debt / EBITDA 0.887x 1.610x 0.331x -0.026x - 1.366x 1.156x 1.240x 1.033x 1.257x -0.793x -0.048x 0.305x -1.283x 0.646x EBITDA / Int. Expense 8.512x 9.890x 13.838x - - 44.266x 10.074x 22.980x 24.998x 224.702x - 93.267x 26.129x 47.844x 13.672x Credit Ratings S&P LT Credit Rating - BBB+ BBB- BBB - A+ BBB- A- A- - - BBB+ - - NR S&P LT Credit Rating Date - 30.07.2012 15.08.2011 29.07.2011 - 15.11.2010 10.12.2012 18.04.2011 23.11.2011 - - 01.06.2009 - - 12.03.2003 Moody's LT Credit Rating - Baa1 Baa3 Baa3 - (P)A1 - - Baa2 - - - - - WR Moody's LT Credit Rating Date - 17.05.2011 15.08.2011 13.10.2010 - 15.11.2010 - - 29.08.2008 - - - - - 05.03.2002 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |