Report

Share

Download to read offline

Recommended

Recommended

The Portuguese tax regime for non-habitual residents (NHR) is motivating high net worth individuals, pensioners and high value added professionals like digital nomads to relocate to Portugal, either on a permanent or on a temporary and expatriate basis. The regime is granted to individuals who become resident for tax purposes in Portugal without having been so in the five years preceding its acquisition. Non-habitual resident individuals may enjoy such status for a ten-year period, after which they will be taxed under the standard regime. This regime may grant an exemption on foreign source income as well as a limited taxation on Portuguese domestic source income deriving from high value added activities. Entrants into the NHR regime that became Portuguese tax residents after April 1st 2020 are subject to a flat tax rate of 10% on foreign-sourced pensions (instead of the previous exemption), as well as on other payments, such as pre-retirement benefits and "lump-sum" payments from pension funds and similar retirement schemes. With effect as from January 1st, 2022, Sweden - following the precedent of Finland - terminated its tax treaty with Portugal. RPBA has revised, updated and developed its newsletter, explaining this regime in great detail.RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Key insights for prospective foreign investors in Poland from country's leading law firm.Baker & McKenzie's Doing Business in Poland - Chapter 2 (International Invest...

Baker & McKenzie's Doing Business in Poland - Chapter 2 (International Invest...Baker & McKenzie Poland

More Related Content

Similar to MF-odpowiedz-49.pdf

The Portuguese tax regime for non-habitual residents (NHR) is motivating high net worth individuals, pensioners and high value added professionals like digital nomads to relocate to Portugal, either on a permanent or on a temporary and expatriate basis. The regime is granted to individuals who become resident for tax purposes in Portugal without having been so in the five years preceding its acquisition. Non-habitual resident individuals may enjoy such status for a ten-year period, after which they will be taxed under the standard regime. This regime may grant an exemption on foreign source income as well as a limited taxation on Portuguese domestic source income deriving from high value added activities. Entrants into the NHR regime that became Portuguese tax residents after April 1st 2020 are subject to a flat tax rate of 10% on foreign-sourced pensions (instead of the previous exemption), as well as on other payments, such as pre-retirement benefits and "lump-sum" payments from pension funds and similar retirement schemes. With effect as from January 1st, 2022, Sweden - following the precedent of Finland - terminated its tax treaty with Portugal. RPBA has revised, updated and developed its newsletter, explaining this regime in great detail.RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Key insights for prospective foreign investors in Poland from country's leading law firm.Baker & McKenzie's Doing Business in Poland - Chapter 2 (International Invest...

Baker & McKenzie's Doing Business in Poland - Chapter 2 (International Invest...Baker & McKenzie Poland

Similar to MF-odpowiedz-49.pdf (20)

Lawyers in cyprus how we help you for company establishment

Lawyers in cyprus how we help you for company establishment

Serbia: Tax Alert - Amendments of Serbian Tax Laws (Dec 2017)

Serbia: Tax Alert - Amendments of Serbian Tax Laws (Dec 2017)

Baker & McKenzie's Doing Business in Poland - Chapter 5 (Tax System)

Baker & McKenzie's Doing Business in Poland - Chapter 5 (Tax System)

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

Baker & McKenzie's Doing Business in Poland - Chapter 2 (International Invest...

Baker & McKenzie's Doing Business in Poland - Chapter 2 (International Invest...

More from ssuserab165d

More from ssuserab165d (20)

Recently uploaded

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974🔝✔️✔️ Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes. We provide both in- call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease. We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us. Our services feature various packages at competitive rates: One shot: ₹2000/in-call, ₹5000/out-call Two shots with one girl: ₹3500 /in-call, ₱6000/out-call Body to body massage with sex: ₱3000/in-call Full night for one person: ₱7000/in-call, ₱10000/out-call Full night for more than 1 person : Contact us at 🔝 9953056974🔝. for details Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations. For premium call girl services in Delhi 🔝 9953056974🔝. Thank you for considering us !Delhi Escorts SASTI 🔝 9953056974🔝– ONLINE CALL GRILS IN DELHI [BOOKING क्या आप सेक्स के लिए लड़की चाहते हैं अगर चाहते है तो कॉल करे x-) {} • In Call and Out Call Service in Delhi • 3* 5* 7* Hotels Service x-) {} • 24 Hours Available • Indian, Punjabi, Kashmiri Escorts x-) {} • Real Models, College Girls, House Wife, Also Available • Short Time and Full Time Service Available x-) {} • Hygienic Full AC Neat and Clean Rooms Avail. In Hotel 24 hours • Daily New Escorts Staff Available • Minimum to Maximum Range Available

9953056974 Call Girls In Pratap Nagar, Escorts (Delhi) NCR

9953056974 Call Girls In Pratap Nagar, Escorts (Delhi) NCR9953056974 Low Rate Call Girls In Saket, Delhi NCR

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974🔝✔️✔️ Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes. We provide both in- call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease. We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us. Our services feature various packages at competitive rates: One shot: ₹2000/in-call, ₹5000/out-call Two shots with one girl: ₹3500 /in-call, ₱6000/out-call Body to body massage with sex: ₱3000/in-call Full night for one person: ₱7000/in-call, ₱10000/out-call Full night for more than 1 person : Contact us at 🔝 9953056974🔝. for details Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations. For premium call girl services in Delhi 🔝 9953056974🔝. Thank you for considering us !call girls inMahavir Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7![call girls inMahavir Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![call girls inMahavir Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

call girls inMahavir Nagar (delhi) call me [🔝9953056974🔝] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Article in The Times of Israel by Andy Blumenthal: This is not about free speech but about a takeover of America. These vile terrorist supporters are using our very Constitution against us as they falsely cry Islamophobia and free speech, all the while impeding, threatening, and committing acts of violence against students, citizens, and an orderly democracy. It is time for Americans to stop being complacent or fooled by their terrorist talking points and rhetoric of hate, racism, and Communist ideology. In the face of this evil, we are finally seeing Patriots emerge, proudly carrying and defending the American flag, singing the Star-Spangled Banner, and boldly chanting USA!America Is the Target; Israel Is the Front Line _ Andy Blumenthal _ The Blogs...

America Is the Target; Israel Is the Front Line _ Andy Blumenthal _ The Blogs...Andy (Avraham) Blumenthal

Recently uploaded (20)

{Qatar{^🚀^(+971558539980**}})Abortion Pills for Sale in Dubai. .abu dhabi, sh...

{Qatar{^🚀^(+971558539980**}})Abortion Pills for Sale in Dubai. .abu dhabi, sh...

Job-Oriеntеd Courses That Will Boost Your Career in 2024

Job-Oriеntеd Courses That Will Boost Your Career in 2024

KING VISHNU BHAGWANON KA BHAGWAN PARAMATMONKA PARATOMIC PARAMANU KASARVAMANVA...

KING VISHNU BHAGWANON KA BHAGWAN PARAMATMONKA PARATOMIC PARAMANU KASARVAMANVA...

Politician uddhav thackeray biography- Full Details

Politician uddhav thackeray biography- Full Details

Transformative Leadership: N Chandrababu Naidu and TDP's Vision for Innovatio...

Transformative Leadership: N Chandrababu Naidu and TDP's Vision for Innovatio...

THE OBSTACLES THAT IMPEDE THE DEVELOPMENT OF BRAZIL IN THE CONTEMPORARY ERA A...

THE OBSTACLES THAT IMPEDE THE DEVELOPMENT OF BRAZIL IN THE CONTEMPORARY ERA A...

9953056974 Call Girls In Pratap Nagar, Escorts (Delhi) NCR

9953056974 Call Girls In Pratap Nagar, Escorts (Delhi) NCR

Unveiling the Characteristics of Political Institutions_ A Comprehensive Anal...

Unveiling the Characteristics of Political Institutions_ A Comprehensive Anal...

call girls inMahavir Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7![call girls inMahavir Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![call girls inMahavir Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

call girls inMahavir Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7

America Is the Target; Israel Is the Front Line _ Andy Blumenthal _ The Blogs...

America Is the Target; Israel Is the Front Line _ Andy Blumenthal _ The Blogs...

Dubai Call Girls Pinky O525547819 Call Girl's In Dubai

Dubai Call Girls Pinky O525547819 Call Girl's In Dubai

*Navigating Electoral Terrain: TDP's Performance under N Chandrababu Naidu's ...

*Navigating Electoral Terrain: TDP's Performance under N Chandrababu Naidu's ...

MF-odpowiedz-49.pdf

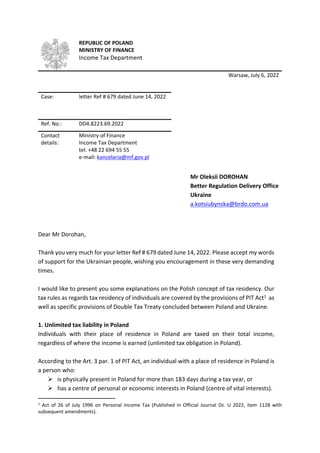

- 1. REPUBLIC OF POLAND MINISTRY OF FINANCE Income Tax Department Warsaw, July 6, 2022 Case: letter Ref # 679 dated June 14, 2022 Ref. No.: DD4.8223.69.2022 Contact details: Ministry of Finance Income Tax Department tel. +48 22 694 55 55 e-mail: kancelaria@mf.gov.pl Mr Oleksii DOROHAN Better Regulation Delivery Office Ukraine a.kotsiubynska@brdo.com.ua Dear Mr Dorohan, Thank you very much for your letter Ref # 679 dated June 14, 2022. Please accept my words of support for the Ukrainian people, wishing you encouragement in these very demanding times. I would like to present you some explanations on the Polish concept of tax residency. Our tax rules as regards tax residency of individuals are covered by the provisions of PIT Act1 as well as specific provisions of Double Tax Treaty concluded between Poland and Ukraine. 1. Unlimited tax liability in Poland Individuals with their place of residence in Poland are taxed on their total income, regardless of where the income is earned (unlimited tax obligation in Poland). According to the Art. 3 par. 1 of PIT Act, an individual with a place of residence in Poland is a person who: is physically present in Poland for more than 183 days during a tax year, or has a centre of personal or economic interests in Poland (centre of vital interests). 1 Act of 26 of July 1996 on Personal Income Tax (Published in Official Journal Dz. U 2022, item 1128 with subsequent amendments).

- 2. The above rules are applied taking into account the provisions of relevant tax treaties. Therefore even, if in the light of Poland’s national legislation, a person passes the residence test for Poland, the appropriate criteria contained in an international treaty must be applied to determine what state is that person’s actual place of residence for tax purposes. 2. Limited tax liability in Poland According to the Art. 3 par. 2a of PIT Act, individuals who do not have a place of residence in Poland are taxed solely on income earned in Poland. Sources of revenue subject to tax in Poland are i.a.: - a labour-based relationship and an employment relationship, including a cooperative employment relationship, retirement or disability pension; - personal services, - non-agricultural business activity; - special departments of agricultural production; - lease, sublease, tenancy, subtenancy and other similar agreements; - monetary capital and property rights; - paid disposal of, among other things, real property or parts thereof and real property interests, movables; - activity conducted through controlled foreign company (CFC); - other sources. 3. Double Tax Treaty On January 12, 1993 Poland and Ukraine concluded the Double Tax Treaty. The text of the Treaty is available at the Polish Ministry of Finance website: https://www.podatki.gov.pl/podatkowa-wspolpraca-miedzynarodowa/wykaz-umow-o- unikaniu-podwojnego-opodatkowania/ In case an individual passes the residency test both in Poland and in Ukraine, the tie-breaker rules given in the Art. 4 par. 2 of the Treaty shall be applied. In case the criterion of permanent home may not be used, the criterion of the centre of vital interests is the most important feature. As far as the Ukrainian residents in Poland are concerned, I would like to ensure you on very flexible and individual approach of the Polish tax authorities. Generally speaking, as a basic rule we do not deny the possibility to maintain the centre of vital interests in Ukraine in wartime. Moreover, taking into account the special needs of Ukrainian taxpayers, we introduced a special regulation for the Ukrainian citizens, that allow them, upon their request, to choose taxation as they would be Polish tax residents. This special treatment is voluntary and it is available only during the period from February 24, 2022 to December 31, 2022 for the

- 3. Ukrainian citizens who benefit of the Act of March 12, 2022 on aid to the citizens of Ukraine in connection with the armed conflict in the territory of this state2. Ukrainian citizens are free to choose this special treatment in order to be taxed in more favourably way than under general rules. I hope you find my explanations helpful. In case you need some more information, please do not hesitate to contact us. Yours faithfully, Jakub Jankowski Job_position <select from list> Income Tax Department 2 Published in Official Journal Dz. U. 2022, item 583, with subsequent amendments.