Kessan 6043476173461319

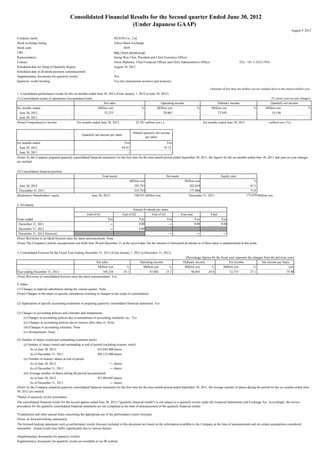

- 1. Consolidated Financial Results for the Second quarter Ended June 30, 2012 (Under Japanese GAAP) August 9, 2012 Company name: NEXON Co., Ltd. Stock exchange listing: Tokyo Stock Exchange Stock code: 3659 URL: http://www.nexon.co.jp/ Representative: Seung Woo Choi, President and Chief Executive Officer Contact: Owen Mahoney, Chief Financial Officer and Chief Administrative Officer TEL: +81-3-3523-7910 Scheduled date for filing of Quarterly Report: August 10, 2012 Scheduled date of dividend payment commencement: - Supplementary documents for quarterly results: Yes Quarterly results briefing: Yes (for institutional investors and analysts) (Amounts of less than one million yen are rounded down to the nearest million yen) 1. Consolidated performance results for the six months ended June 30, 2012 (From January 1, 2012 to June 30, 2012) (1) Consolidated results of operations (Accumulated total) (% shows year-on-year changes) Net sales Operating income Ordinary income Quarterly net income Six months ended Million yen % Million yen % Million yen % Million yen % June 30, 2012 53,253 - 28,063 - 27,045 - 19,146 - June 30, 2011 - - - - - - - - (Note) Comprehensive income Six months ended June 30, 2012: 23,501 million yen (-) Six months ended June 30, 2011: - million yen (-%) Diluted quarterly net income Quarterly net income per share per share Six months ended Yen Yen June 30, 2012 44.41 43.12 June 30, 2011 - - (Note) As the Company prepared quarterly consolidated financial statements for the first time for the nine-month period ended September 30, 2011, the figures for the six months ended June 30, 2011 and year-on-year changes are omitted. (2) Consolidated financial position Total assets Net assets Equity ratio Million yen Million yen % June 30, 2012 295,793 202,656 67.3 December 31, 2011 235,765 177,886 73.8 (Reference) Shareholders' equity June 30, 2012: 198,931 Million yen December 31, 2011: 173,979 Million yen 2. Dividends Annual dividends per share End of Q1 End of Q2 End of Q3 Year-end Total Years ended Yen Yen Yen Yen Yen December 31, 2011 ― 0.00 ― 0.00 0.00 December 31, 2012 ― 0.00 December 31, 2012 (forecast) ― ― ― (Note) Revisions to dividend forecast since the latest announcement: None (Note) The Company's articles incorporation sets forth June 30 and December 31 as the record date, but the amount of forecasted dividends as of these dates is undetermined at this point. 3. Consolidated Forecast for the Fiscal Year Ending December 31, 2012 (From January 1, 2012 to December 31, 2012) (Percentage figures for the fiscal year represent the changes from the previous year) Net sales Operating income Ordinary income Net income Net income per share Million yen % Million yen % Million yen % Million yen % yen Year ending December 31, 2012 104,334 19.1 47,082 23.1 46,043 24.8 32,737 27.1 75.88 (Note) Revisions to consolidated forecast since the latest announcement: Yes 4. Other (1) Changes in material subsidiaries during the current quarter: None (Note) Changes in the status of specific subsidiaries resulting in changes in the scope of consolidation (2) Application of specific accounting treatments in preparing quarterly consolidated financial statements: Yes (3) Changes in accounting policies and estimates and restatements (i) Changes in accounting policies due to amendment of accounting standards, etc.: Yes (ii) Changes in accounting policies due to reasons other than (i): None (iii) Changes in accounting estimates: None (iv) Restatements: None (4) Number of shares issued and outstanding (common stock) (i) Number of shares issued and outstanding at end of period (including treasury stock) As of June 30, 2012: 433,685,900 shares As of December 31, 2011: 426,132,900 shares (ii) Number of treasury shares at end of period As of June 30, 2012: ― shares As of December 31, 2011: ― shares (iii) Average number of shares during the period (accumulated) As of June 30, 2012: 431,084,043 shares As of December 31, 2011: ― shares (Note) As the Company prepared quarterly consolidated financial statements for the first time for the nine-month period ended September 30, 2011, the average number of shares during the period for the six months ended June 30, 2012 are omitted. *Status of quarterly review procedures The consolidated financial results for the second quarter ended June 30, 2012 ("quarterly financial results") is not subject to a quarterly review under the Financial Instruments and Exchange Act. Accordingly, the review procedures for the quarterly consolidated financial statements are not completed at the time of announcement of the quarterly financial results. *Explanation and other special notes concerning the appropriate use of the performance results forecasts (Notes on forward-looking statements) The forward-looking statements such as performance results forecasts included in this document are based on the information available to the Company at the time of announcement and on certain assumptions considered reasonable. Actual results may differ significantly due to various factors. (Supplementary documents for quarterly results) Supplementary documents for quarterly results are available at our IR website.

- 2. Consolidated Forecast for the three months ending September 30, 2012 (From July 1, 2012 to September 30, 2012) (Percentages figures for the three months period represent the changes from the same period of the previous year) Net sales Operating income Ordinary income Net income Net income per share Million yen % Million yen % Million yen % Million yen % yen Three months ending September 30, 2012 24,943 3.3 9,249 -15.5 9,191 -9.6 6,598 -8.8 15.24 Besides the consolidated performance forecasts for the Year ending December 31, 2012, the Company also announces the forecast for the next quarter, in this case, the third quarter ending September 30, 2012. In addition, when the Company calculates the revised performance forecast that operating income, ordinary income, net income to be deviated more than 30% from the latest released forecast, or revenue to be deviated 10% from the latest released forecast, the Company will release the announcement of updated performance forecast.

- 3. ○Index of Attachment 1. Qualitative information on consolidated performance results for the quarter ended June 30, 2012………………………… 1 (1) Qualitative information on consolidated results of operations…………………………………………………………… 1 (2) Qualitative information on consolidated financial position……………………………………………………………… 1 (3) Qualitative information on consolidated performance results forecast………………….…………………………….… 2 2. Other information …………………………………………………………………………………………………………… 2 (1) Changes in material subsidiaries during the six months ended June 30, 2012…………………………………………… 2 (2) Application of specific accounting treatments in preparing the quarterly consolidated financial statements…………… 2 (3) Changes in accounting policies and estimates, and restatements ……….……………………………………………… 3 3. Quarterly consolidated financial statements.………………………………..……………………………………………… 4 (1) Quarterly consolidated balance sheet...…………………………………….…………………………………………… 4 (2) Quarterly consolidated statements of (comprehensive) income………………………………………………………… 5 Quarterly consolidated statement of income For the six months ended June 30, 2012…………………………………………………………………………… 5 Quarterly consolidated statement of comprehensive income For the six months ended June 30, 2012…………………………………………………………………………… 6 (3) Quarterly consolidated statements of cash flows………………………………………………………………………… 7 (4) Notes related to going concern assumption……………………………………………………………………………… 8 (5) Segment information…. ………………………………………………………………………………………………… 8 (6) Notes on significant changes in Shareholders’ equity, if any…………………………………………………………… 9 (7) Significant subsequent events…………………………………………………………………………………………… 9

- 4. 1. Qualitative information on consolidated performance results for the quarter ended June 30, 2012 (1) Qualitative information on consolidated results of operations During the six months ended June 30, 2012, the world economy showed a moderate recovery, but the outlook is uncertain because of the prolonged financial crisis in Europe, delay in economic recovery in developed countries and slowdown in emerging economies’ growth. In Asia, the economic growth is slowing down due to the economic slowdown in Europe and the US and sluggish domestic demand. In Japan, however, despite concerns over the decline in overseas economies, production activities and individual consumption seem to be improving due primarily to reconstruction demands, and the Japanese economy is gradually recovering. In such environment, the Group is engaged in primarily online game business, as well as mobile game business and other businesses, and has been striving to provide wide range of customers with high quality services and to build or acquire excellent contents to accommodate diversifying needs of users through updating existing game titles and distributing new game titles. As a result of our efforts, we recorded net sales of ¥53,253 million, operating income of ¥28,063 million, ordinary income of ¥27,045 million and net income of ¥19,146 million for the six months ended June 30, 2012. Performance results by reportable segments are as follows: (a) Japan In Japan, while sales from game titles such as “Tales Weaver,” “Counter-Strike Online,” and “Sudden Attack” continued to show steady growth, sales from some of the other titles decreased. As a result, net sales amounted to ¥5,917 million and segment income amounted to ¥455 million. (b) Korea In Korea, steady growth of sales from “Sudden Attack” and an increase in royalty income due to significant increase in sales from “Dungeon&Fighter” in China contributed to net sales of ¥41,879 million and segment income of ¥26,264 million. (c) China In China, an increase in consulting income as a result of growth of the online game market in China contributed to net sales of ¥2,002 million and segment income of ¥1,360 million. (d) North America In North America, the delay in update as a consequence of the hacking attempt to “Maple Story” at the end of the previous consolidated fiscal year resulted in net sales of ¥2,496 million and segment loss of ¥244 million. (e) Other In other areas, sales slightly decreased on a year-on-year basis, and the impact of foreign exchange rates resulted in net sales of ¥958 million and segment income of ¥246 million. (2) Qualitative information on consolidated financial position (a) Cash flows Cash and cash equivalent (“cash”) at June 30, 2012 was ¥105,940 million. Cash flows from each activity for the six months ended June 30, 2012 and their major components are as follows: (Cash flows from operating activities) Net cash provided by operating activities amounted to ¥23,450 million. Major components included Income before income taxes and minority interests of ¥25,737 million, Depreciation and amortization of ¥4,810 million, and Income taxes paid of ¥9,232 million. (Cash flows from investing activities) Net cash used in investing activities amounted to ¥73,131 million. Major components included an Increase in time deposits of ¥10,020 million, Purchase of stocks of subsidiaries and affiliates of ¥4,482 million, and Purchase of investment securities of ¥56,440 million. (Cash flows from financing activities) Net cash provided by financing activities amounted to ¥37,551 million. Major components included Proceeds from short-term loans payable of ¥53,125 million and Repayment of long-term loans payable of ¥17,043 million. (b) Analysis of financial position (Assets) Total assets as of June 30, 2012 totaled ¥295,793 million, an increase of ¥60,027 million from December 31, 2011. Current assets as of June 30, 2012 amounted to ¥146,297 million, a decrease of ¥4,424 million mainly due to a decrease of Cash and deposits of ¥3,389 million from December 31, 2011. -1-

- 5. Noncurrent assets as of June 30, 2012 amounted to ¥149,495 million, an increase of ¥64,452 million due to an increase of Investment securities by ¥64,176 million from December 31, 2011. (Liabilities) Total liabilities amounted to ¥93,136 million, an increase of ¥35,257 million compared to the balance at December 31, 2011. Current liabilities at June 30, 2012 totaled ¥72,653 million, an increase of ¥48,091 million from December 31, 2011. This is mainly due to an increase of Short-term loans payable of ¥53,095 million, and a decrease of Current portion of Long-term loans payable of ¥2,828 million. Noncurrent liabilities totaled ¥20,483 million, a decrease of ¥12,833 million from December 31, 2011 due to a decrease of Long-term loans payable of ¥13,767 million. (Net assets) Net assets as of June 30, 2012 totaled ¥202,656 million, an increase of ¥24,769 million from December 31, 2011, mainly due to an increase of Retained earnings from recording Net income for the quarter of ¥19,146 million and an increase of Valuation difference on available-for-sale securities of ¥3,073 million. (3) Qualitative information on consolidated performance results forecast We revised our sales revenue for the third quarter and thereafter considering our current situation and actual business performance. Revision to consolidated full year business outlook for the fiscal year ending December 31, 2012 is as follows: The following business outlook is based on information available at the time the assumption was made, and is subject to various risks that could cause actual results to differ from expectations. Revisions to consolidated forecast figures for the full fiscal year ending December 31, 2012 are as follows: (Units: millions of yen, %) Operating Net Income per Revenues Ordinary Income Net Income Income share Previous forecast (A) 108,338 52,234 53,011 37,800 87.88 Revised forecast (B) 104,334 47,082 46,043 32,737 75.88 Difference (B-A) (4,004) (5,151) (6,967) (5,062) ― Percentage change (%) (3.7) (9.9) (13.1) (13.4) ― (Reference) Year ended 87,613 38,249 36,905 25,755 71.65 December 31, 2011 2. Other information (1) Changes in material subsidiaries during the six months ended June 30, 2012 Not applicable. (2) Application of specific accounting treatments in preparing the quarterly consolidated financial statements Tax expenses are calculated as income before income taxes and minority interests for the quarter multiplied by the estimated effective tax rate. The effective tax rate is reasonably estimated taking into consideration deferred tax accounting as the rate applicable to income before income taxes and minority interests for the consolidated fiscal year including the quarter ended June 30, 2012. Certain consolidated subsidiaries account for income taxes for the six months ended June 30, 2012 on a basis consistent with the accounting for income taxes for the fiscal year. -2-

- 6. (3) Changes in accounting policies and estimates, and restatements (Adoption of Accounting Standard for Net Income per Share, etc.) Effective January, 1, 2012, the Company adopted Accounting Standards Board of Japan (“ASBJ”) Statement No.2, “Accounting Standard for Net Income per Share”, issued on June 30, 2010 and ASBJ Guidance No.4 (revised 2006), “Guidance on Accounting Standard for Net Income per Share” issued on June 30, 2010. The Company has changed the method to calculate quarterly diluted net income per share as follows. For stock options that vest after a specified service period, the fair value of service expected to be provided to the Company in the future is included in the cash proceeds assumed to be received upon exercise of the stock options. -3-

- 7. 3. Quarterly consolidated financial statements (1) Quarterly consolidated balance sheet (Millions of yen) December 31, 2011 June 30, 2012 Assets Current assets Cash and deposits 132,479 129,089 Notes and accounts receivable-trade 13,845 12,588 Short-term investment securities 12 95 Merchandise 40 49 Other 4,367 4,482 Allowance for doubtful accounts (22) (8) Total current assets 150,722 146,297 Noncurrent assets Property, plant and equipment 16,016 17,781 Intangible assets Games Copyright 31,163 28,479 Goodwill 11,595 12,538 Other 1,315 1,396 Total intangible assets 44,074 42,413 Investments and other assets Investment securities 17,002 81,178 Other 10,766 10,840 Allowance for doubtful accounts (2,815) (2,717) Total investments and other assets 24,952 89,300 Total noncurrent assets 85,043 149,495 Total assets 235,765 295,793 Liabilities Current liabilities Notes and accounts payable-trade 981 934 Short-term loans payable - 53,095 Current portion of long-term loans payable 2,994 166 Income taxes payable 6,671 4,839 Unearned revenue 8,111 7,896 Provision for bonuses 1,082 712 Asset retirement obligations - current 47 17 Other 4,672 4,990 Total current liabilities 24,562 72,653 Noncurrent liabilities Long-term loans payable 18,567 4,800 Long-term unearned revenue 5,707 5,038 Provision for retirement benefits 203 179 Negative goodwill 3,553 3,169 Asset retirement obligations - noncurrent 117 146 Other 5,167 7,149 Total noncurrent liabilities 33,316 20,483 Total liabilities 57,878 93,136 Net assets Shareholders' equity Capital stock 50,300 51,054 Capital surplus 50,162 50,914 Retained earnings 90,757 109,903 Total shareholders' equity 191,219 211,873 Accumulated other comprehensive income Valuation difference on available-for-sale securities 471 3,545 Foreign currency translation adjustment (17,711) (16,487) Total accumulated other comprehensive income (17,239) (12,941) Subscription rights to shares 455 354 Minority interests 3,451 3,370 Total net assets 177,886 202,656 Total liabilities and net assets 235,765 295,793 -4-

- 8. (2) Quarterly consolidated statements of (comprehensive) income (Quarterly consolidated statement of income) (For the six months ended June 30, 2012) (Millions of yen) Six months ended June 30, 2012 Net sales 53,253 Cost of sales 8,223 Gross profit 45,030 Selling, general and administrative expenses 16,966 Operating income 28,063 Non-operating income Interest income 721 Amortization of negative goodwill 460 Miscellaneous income 311 Total non-operating income 1,493 Non-operating expenses Interest expenses 255 Foreign exchange losses 277 Equity in losses of affiliates 1,833 Miscellaneous expenses 143 Total non-operating expenses 2,510 Ordinary income 27,045 Extraordinary income Gain on sales of noncurrent assets 3 Gain on change in equity 92 Total extraordinary income 96 Extraordinary loss Loss on sales and retirement of noncurrent assets 40 Impairment loss 1,354 Loss on change in equity 9 Total extraordinary losses 1,404 Income before income taxes and minority interests 25,737 Income taxes 6,534 Income before minority interests 19,203 Minority interests in income 57 Net income 19,146 -5-

- 9. (Quarterly consolidated statement of comprehensive income) (For the six months ended June 30, 2012) (Millions of yen) Six months ended June 30, 2012 Income before minority interests 19,203 Other comprehensive income Valuation difference on available-for-sale securities 3,073 Foreign currency translation adjustment 1,038 Share of other comprehensive income of associates accounted for using 185 equity method Total other comprehensive income 4,297 Comprehensive income 23,501 (Comprehensive income attributable to) Comprehensive income attributable to owners of the parent 23,444 Comprehensive income attributable to minority interests 56 -6-

- 10. (3) Quarterly consolidated statements of cash flows (For the six months ended June 30, 2012) (Millions of yen) Six months ended June 30, 2012 Operating activities Income before income taxes and minority interests 25,737 Depreciation and amortization 4,810 Amortization of goodwill 1,200 Amortization of negative goodwill (460) Decrease in allowance for doubtful accounts (169) Decrease in provision for bonuses (391) Decrease in provision for retirement benefits (28) Interest and dividends income (747) Interest expenses 255 Foreign exchange losses 228 Impairment loss 1,354 Equity in losses of affiliates 1,833 Decrease in notes and accounts receivable-trade 1,669 Increase in other current assets (1,764) Decrease in notes and accounts payable-trade (63) Decrease in unearned revenue (1,089) Decrease in other current liabilities (253) Other, net 36 Subtotal 32,159 Interest and dividends income received 787 Interest expenses paid (263) Income taxes paid (9,232) Net cash provided by operating activities 23,450 Investing activities Increase in time deposits (10,020) Increase in short-term investment securities (83) Purchase of property, plant and equipment (1,473) Proceeds from sales of property, plant and equipment 43 Purchase of intangible assets (425) Payments for long-term prepaid expenses with increase (246) Payments of short-term loans receivable (110) Collection of short-term loans receivable 1,908 Collection of long-term loans receivable 4 Purchase of investment securities (56,440) Proceeds from sales of investment securities 389 Purchase of investments in subsidiaries (559) Purchase of stocks of subsidiaries and affiliates (4,482) Purchase of investments in subsidiaries resulting in change in (1,231) scope of consolidation Payments for transfer of business (1,750) Payments for deposit pledged as collateral (14,032) Proceeds from deposit released from collateral 15,043 Other, net 335 Net cash used in investing activities (73,131) Financing activities Increase in short-term loans payable 53,125 Proceeds from long-term loans payable 327 Repayment of long-term loans payable (17,043) Repayments of finance lease obligations (276) Proceeds from exercise of stock option 1,416 Other, net 1 Net cash provided by financing activities 37,551 Effect of exchange rate change on cash and cash equivalents 471 Net decrease in cash and cash equivalents (11,658) Cash and cash equivalents at beginning of period 117,598 Cash and cash equivalents at end of period 105,940 -7-

- 11. (4)Notes related to going concern assumption Not applicable. (5) Segment information (Segment information) For the six months ended June 30, 2012 (From January 1, 2012 to June 30, 2012) 1. Net sales and net income or loss by reportable segments (Millions of yen) Quarterly Reportable segments consolidate Other Adjustments statement North (Note 1) (Note 2) Japan Korea China Total of income America (Note 3) Net sales Sales to third party customers 5,917 41,879 2,002 2,496 52,295 958 - 53,253 Intersegment sales or transfer between - 2,337 - 56 2,393 - (2,393) - segments Total 5,917 44,216 2,002 2,552 54,688 958 (2,393) 53,253 Segment income 455 26,264 1,360 (244) 27,836 246 (19) 28,063 (Notes) 1. “Other” includes geographical segments not included in any of the reportable segments, such as Europe. 2. The adjustment to Segment income/loss of ¥ (19) million represents elimination of intersegment transactions. 3. Segment income is adjusted to operating income presented in the consolidated statement of income. 2. Information on impairment loss on noncurrent assets or goodwill by reportable segments (Material impairment loss on noncurrent assets) (Millions of yen) Reportable segments Other Adjustments Total North Japan Korea China Total America Impairment loss 14 1,339 - - 1,354 - - 1,354 (Material changes in goodwill) (Millions of yen) Reportable segments Other Adjustments Total North Japan Korea China Total America Amortization during the period 80 1,119 - - 1,200 - - 1,200 Ending balance at end of period 1,795 10,743 - - 12,538 - - 12,538 -8-

- 12. (Material changes in negative goodwill) (Millions of yen) Reportable segments Other Adjustments Total North Japan Korea China Total America Amortization during the period - 460 - - 460 - - 460 Ending balance at end of period - 3,169 - - 3,169 - - 3,169 (Information on gain on negative goodwill) Not applicable. 3. Information by areas (Net sales) (Millions of yen) Japan Korea China North America Other Total 5,923 15,108 25,912 2,913 3,396 53,253 (Notes) 1. Net sales are grouped into countries or areas based on customers’ location. 2. The segmentation by country or area is based on geological proximity. 3. Details of countries or areas included in each segment (1) North America: the United States of America and Canada (2) Other: European and Asian countries and Central and South America (6)Notes on significant changes in Shareholders’ equity, if any The disclosure is omitted as there was no major change. (7)Significant subsequent events (Loan refinancing) On July 31, 2012, Nexon newly obtained a long-term loan from Sumitomo Mitsui Banking Corporation and simultaneously repaid its existing loan of JPY 50,000 million obtained through a special account loan agreement executed on June 29, 2012 to Sumitomo Mitsui Banking Corporation. We believe that the refinancing will lower our overall cost of funding in Japanese yen and U.S. dollars and provide us with additional strategic flexibility in financing our growth initiatives. Details of the refinancing and repayment are as follows: (1)Lender Sumitomo Mitsui Banking Corporation (2)Details of the refinancing Debt amount: JPY 34,000 million and USD 200 million Period of debt: 5 years (from July 31, 2012 to July 31, 2017) Terms of repayment: Nexon shall make its first repayment to Sumitomo Mitsui Banking Corporation on January 31, 2013 and thereafter make repayments of JPY 5,000 million on the end date of every six months. Interest rate: 1.41% (3)Date of refinancing July 31, 2012 (4)Future outlook Nexon does not expect its interest expenses to significantly increase or decrease due to the refinancing. (5)Property subject to lien Investment securities: JPY 60,443 million The price above is the book value as of June 30, 2012. -9-

- 13. <Regarding to the accounts item in the consolidated financial statement> With respect to the accounts items stated in this consolidated financial statement, please refer to the following chart with comparison to offering circular. (1) Quarterly consolidated balance sheet Quarterly Consolidated Financial Results Offering Circular Assets Assets Current assets Current assets: Cash and deposits Cash and time deposits Notes and accounts receivable-trade Accounts receivable - trade Short-term investment securities Trading securities Merchandise Merchandise Other Other current assets Allowance for doubtful accounts Allowance for doubtful accounts Total current assets Total current assets Noncurrent assets - Property, plant and equipment Property, plant and equipment: Intangible assets Investments and other assets: Games Copyright Game copyrights Goodwill Goodwill Other Other Total intangible assets - Investments and other assets Investments and other assets: Investment securities Investment securities Other Other Allowance for doubtful accounts Allowance for doubtful accounts Total investments and other assets - Total noncurrent assets - Total assets Total assets Liabilities Liabilities and net assets Current liabilities Current liabilities: Notes and accounts payable-trade Accounts payable - trade Short-term loans payable Short-term borrowings Current portion of long-term loans payable Current portion of long-term borrowings Income taxes payable Provision for income taxes Unearned revenue Deferred income Provision for bonuses Employees' bonuses Asset retirement obligations - current - Other Other current liabilities Total current liabilities Total current liabilities Noncurrent liabilities Long-term liabilities: Long-term loans payable Long-term borrowings Long-term unearned revenue Deferred income Provision for retirement benefits Employees' retirement benefits Negative goodwill Negative goodwill Asset retirement obligations - noncurrent Asset retirement obligations Other Other non-current liabilities Total noncurrent liabilities Total long-term liabilities Total liabilities Total liabilities Net assets Net assets: Shareholders' equity Shareholders' equity Capital stock Common stock: Capital surplus Capital surplus Retained earnings Retained earnings Total shareholders' equity Total shareholders' equity Accumulated other comprehensive income - Net unrealized gains (losses) on investment securities, net Valuation difference on available-for-sale securities of tax Foreign currency translation adjustment Foreign currency translation adjustments Total accumulated other comprehensive income - Subscription rights to shares Stock options Minority interests Non-controlling interest Total net assets Total net assets Total liabilities and net assets Total liabilities and net assets - 10 -

- 14. (2) Quarterly consolidated statements of (comprehensive) income (Quarterly consolidated statement of income) Quarterly Consolidated Financial Results Offering Circular Net sales Revenues Cost of sales Cost of sales Gross profit Gross profit Selling, general and administrative expenses Selling, general and administrative expenses Operating income Operating income Non-operating income Other income (expense): Interest income Interest income Amortization of negative goodwill Negative goodwill amortization Miscellaneous income - Total non-operating income - Non-operating expenses - Interest expenses Interest expense Foreign exchange losses Foreign exchange gains (losses) Equity in losses of affiliates Equity in earnings (losses) of affiliates Miscellaneous expenses - Total non-operating expenses - Ordinary income - Extraordinary income - Gain on sales of noncurrent assets Gain (loss) on sales/disposal of fixed assets Gain on change in equity - Total extraordinary income - Extraordinary loss - Loss on sales and retirement of noncurrent assets Gain (loss) on sales/disposal of fixed assets Impairment loss Impairment losses Loss on change in equity - Total extraordinary losses - Income before income taxes and minority interests Income before income taxes Income taxes Income taxes Income before minority interests Income before minority interest Minority interests in loss Non-controlling interest in net income (loss) Net income Net income - 11 -

- 15. (3) Quarterly consolidated statements of cash flows Quarterly Consolidated Financial Results Offering Circular Operating activities Operating activities Income before income taxes and minority interests Income before income taxes Depreciation and amortization Depreciation and amortization Amortization of goodwill Goodwill amortization Amortization of negative goodwill Negative goodwill amortization Decrease in allowance for doubtful accounts Increase (decrease) in allowance for doubtful accounts Decrease in provision for bonuses Increase (decrease) in provision for employees' bonuses Decrease in provision for retirement benefits Decrease in provision for retirement benefit expenses Interest and dividends income Interest and dividend income Interest expenses Interest expense Foreign exchange losses Foreign exchange (gains) losses Impairment loss Impairment losses Equity in losses of affiliates Equity in losses of affiliates Decrease in notes and accounts receivable-trade Increase in accounts receivable- trade Increase in other current assets Decrease (increase) in other current assets Decrease in notes and accounts payable-trade Increase in accounts payable- trade Decrease in unearned revenue Increase (decrease) in deferred income Decrease in other current liabilities Increase (decrease) in other current liabilities Other, net Other - net Subtotal Subtotal Interest and dividends income received Interest and dividends received Interest expenses paid Interest paid Income taxes paid Income taxes paid Net cash provided by operating activities Net cash provided by operating activities Investing activities Investing activities Increase in time deposits Decrease (increase) in time deposits Increase in short-term investment securities Decrease (increase) in short-term investment securities Purchase of property, plant and equipment Purchases of property, plant and equipment Proceeds from sales of property, plant and equipment Proceeds from sales of property, plant and equipment Purchase of intangible assets Purchases of intangible assets Payments for long-term prepaid expenses with increase Increase in long-term prepaid expenses Payments of short-term loans receivable Payments of short-term loans receivable Collection of short-term loans receivable Collection of short-term loans receivable Collection of long-term loans receivable Collection of long-term loans receivable Purchase of investment securities Purchases of investment securities Proceeds from sales of investment securities Proceeds from sales of investment securities Purchase of investments in subsidiaries Purchases of shares of subsidiaries Purchase of stocks of subsidiaries and affiliates Purchase of shares of affiliates Purchase of investments in subsidiaries resulting in change in Proceeds from purchase of investments in subsidiaries scope of consolidation resulting in change in scope of consolidation Payments for transfer of business - Payments for deposit pledged as collateral Payments of deposits pledged as collateral Proceeds from deposit released from collateral Proceeds from withdrawal of deposits pledged as collateral Other, net Other - net Net cash used in investing activities Net cash used in investing activities Financing activities Financing activities Increase in short-term loans payable Proceeds from short-term borrowings Proceeds from long-term loans payable Proceeds from long-term borrowings Repayment of long-term loans payable Repayments of long-term borrowings Repayments of finance lease obligations Repayments of lease obligations Proceeds from exercise of stock option - Other, net Other - net Net cash provided by financing activities Net cash provided by (used in) financing activities Effect of exchange rate change on cash and cash equivalents Effect of exchange rate changes on cash and cash equivalents Net decrease in cash and cash equivalents Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at beginning of year Cash and cash equivalents at end of period Cash and cash equivalents at end of year - 12 -