Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Recomendados

Más contenido relacionado

La actualidad más candente

La actualidad más candente (17)

Bank of Canada maintains overnight rate target at 1/2 per cent

Bank of Canada maintains overnight rate target at 1/2 per cent

Reed spring econ webcast apr 2014_intro charts_part 1

Reed spring econ webcast apr 2014_intro charts_part 1

FOMC - Federal Reserve Meeting Transcript March 16 2016

FOMC - Federal Reserve Meeting Transcript March 16 2016

Reed fall econ webcast oct 17, 2013 intro charts_markstein_part 1

Reed fall econ webcast oct 17, 2013 intro charts_markstein_part 1

Similar a The Risk of Deflation

Similar a The Risk of Deflation (20)

Aranca Views | US Fed Rate Hike Potential Impact - A Report

Aranca Views | US Fed Rate Hike Potential Impact - A Report

Olivier DEsbarres: What to expect in 2016 – same, same, but worse

Olivier DEsbarres: What to expect in 2016 – same, same, but worse

US inflation will be crucial across forex markets this week

US inflation will be crucial across forex markets this week

Sticking to forecasts: Fed summer hike, Dollar hat-trick still on the cards, ...

Sticking to forecasts: Fed summer hike, Dollar hat-trick still on the cards, ...

Draghinomics Introduces Quantitative Easing to the Eurozone

Draghinomics Introduces Quantitative Easing to the Eurozone

Ivo Pezzuto - FEDERAL RESERVE'S RATE RISE. COMING SOON? The Global Analyst Se...

Ivo Pezzuto - FEDERAL RESERVE'S RATE RISE. COMING SOON? The Global Analyst Se...

Más de QNB Group

Más de QNB Group (20)

QNBFS Daily Technical Trader Qatar - November 14, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - November 14, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - November 06, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - November 06, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - October 25, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 25, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 11, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 11, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 04, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 04, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - September 28, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 28, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 24, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 24, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 19, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 19, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 07, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 07, 2023 التحليل الفني اليومي ...

Último

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. Gibson, Verified Chapters 1 - 13, Complete Newest Version.Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...rightmanforbloodline

Último (20)

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Virar Best Sex Call Girls Number-📞📞9833754194-Poorbi Nalasopara Housewife Cal...

Virar Best Sex Call Girls Number-📞📞9833754194-Poorbi Nalasopara Housewife Cal...

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Escorts Indore Call Girls-9155612368-Vijay Nagar Decent Fantastic Call Girls ...

Escorts Indore Call Girls-9155612368-Vijay Nagar Decent Fantastic Call Girls ...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

Bhubaneswar🌹Kalpana Mesuem ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswa...

Bhubaneswar🌹Kalpana Mesuem ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswa...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

GIFT City Overview India's Gateway to Global Finance

GIFT City Overview India's Gateway to Global Finance

Premium Call Girls Bangalore Call Girls Service Just Call 🍑👄6378878445 🍑👄 Top...

Premium Call Girls Bangalore Call Girls Service Just Call 🍑👄6378878445 🍑👄 Top...

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

The Risk of Deflation

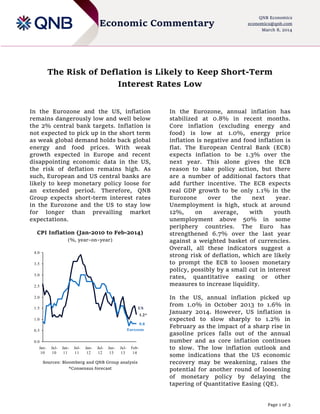

- 1. Economic Commentary QNB Economics economics@qnb.com March 8, 2014 The Risk of Deflation is Likely to Keep Short-Term Interest Rates Low In the Eurozone and the US, inflation remains dangerously low and well below the 2% central bank targets. Inflation is not expected to pick up in the short term as weak global demand holds back global energy and food prices. With weak growth expected in Europe and recent disappointing economic data in the US, the risk of deflation remains high. As such, European and US central banks are likely to keep monetary policy loose for an extended period. Therefore, QNB Group expects short-term interest rates in the Eurozone and the US to stay low for longer than prevailing market expectations. CPI Inflation (Jan-2010 to Feb-2014) (%, year–on–year) 4.0 3.5 3.0 2.5 2.0 1.5 US 1.2* 1.0 0.8 Eurozone 0.5 0.0 Jan10 Jul10 Jan11 Jul11 Jan12 Jul12 Jan13 Jul13 Feb14 Sources: Bloomberg and QNB Group analysis *Consensus forecast In the Eurozone, annual inflation has stabilized at 0.8% in recent months. Core inflation (excluding energy and food) is low at 1.0%, energy price inflation is negative and food inflation is flat. The European Central Bank (ECB) expects inflation to be 1.3% over the next year. This alone gives the ECB reason to take policy action, but there are a number of additional factors that add further incentive. The ECB expects real GDP growth to be only 1.1% in the Eurozone over the next year. Unemployment is high, stuck at around 12%, on average, with youth unemployment above 50% in some periphery countries. The Euro has strengthened 6.7% over the last year against a weighted basket of currencies. Overall, all these indicators suggest a strong risk of deflation, which are likely to prompt the ECB to loosen monetary policy, possibly by a small cut in interest rates, quantitative easing or other measures to increase liquidity. In the US, annual inflation picked up from 1.0% in October 2013 to 1.6% in January 2014. However, US inflation is expected to slow sharply to 1.2% in February as the impact of a sharp rise in gasoline prices falls out of the annual number and as core inflation continues to slow. The low inflation outlook and some indications that the US economic recovery may be weakening, raises the potential for another round of loosening of monetary policy by delaying the tapering of Quantitative Easing (QE). Page 1 of 3

- 2. Economic Commentary The Federal Reserve (Fed) has shown firm commitment to QE tapering during early 2014, despite a soft patch in economic data, which has widely been put down to bad weather. However, this resolve may be easing as recent comments from the Fed Chair, Janet Yellen, have indicated that QE tapering could be adjusted if the US economy weakens. Upcoming economic data releases in March and April should give a clearer picture on how much of the recent weak economic data can be put down to bad weather. We do not expect the picture to be clear enough for the Fed to postpone QE tapering at its next meeting on March 19, but by the time the Fed meets on April 30, there is some risk that the economic outlook could have deteriorated enough to warrant a slowdown in the pace of QE tapering (the first reading of GDP growth in Q1 2014 is also released on April 30) to offset the risk of deflation. The potential for falling inflation in the Eurozone and US will make central banks wary of falling into a deflationary trap. According to economic theory, deflation fuels expectations that prices will continue to fall, encouraging delays to purchases, thus holding back growth (Japan’s experience in the last two decades is a good example). It also increases the real value of outstanding domestic debt, thus making it more QNB Economics economics@qnb.com March 8, 2014 difficult for borrowers to make repayments. Deflation also tends to lead to a stronger exchange rate, undermining competitiveness and growth. On the other hand, a moderately inflationary environment reinforces expectations that prices will continue to rise and encourages spending, borrowing, growth and a more competitive exchange rate. For these reasons, central banks tend to use monetary policy to target moderate annual inflation of around 2%, thus avoiding the perils of a deflationary trap. Looking ahead, the risk of deflation and weak economies in the US and Eurozone, present a strong case for the Fed and ECB to loosen or refrain from tightening monetary policy. This implies that any increase in short-term interest rates in the Eurozone or in the US is still some way off. Qatar’s policy rates tend to track rates in the US owing to the pegged exchange rate. Therefore, interest rates are also likely to remain low in Qatar. A pause in tightening monetary policy in the US would have the added benefit of bringing greater stability to global financial markets. The implementation of QE tapering has led to capital outflows from a number of emerging markets, weakening their currencies and driving down asset prices. Delayed QE tapering could help bring greater stability. Contacts Joannes Mongardini Head of Economics Tel. (+974) 4453-4412 joannes.mongardini@qnb.co m.qa Rory Fyfe Senior Economist Tel. (+974) 4453-4643 rory.fyfe@qnb.com.qa Ehsan Khoman Economist Tel. (+974) 4453-4423 ehsan.khoman@qnb.com.qa Hamda Al-Thani Economist Tel. (+974) 4453-4646 hamda.althani@qnb.com.qa Page 2 of 3

- 3. Economic Commentary QNB Economics economics@qnb.com March 8, 2014 Disclaimer and Copyright Notice: QNB Group accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Where an opinion is expressed, unless otherwise provided, it is that of the analyst or author only. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. The report is distributed on a complimentary basis. It may not be reproduced in whole or in part without permission from QNB Group. Page 3 of 3