More Related Content Similar to Financial analysis mining and metallurgical company norilsk nickel ojsc or gmk norilsk nickel is a producer of base and precious metals. the company's main products are nickel and palladium Similar to Financial analysis mining and metallurgical company norilsk nickel ojsc or gmk norilsk nickel is a producer of base and precious metals. the company's main products are nickel and palladium (20) 1. 24.04.2013

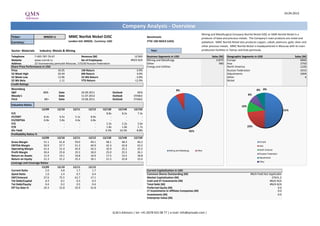

Company Analysis - Overview

Mining and Metallurgical Company Norilsk Nickel OJSC or GMK Norilsk Nickel is a

Ticker: MNOD LI MMC Norilsk Nickel OJSC Benchmark: producer of base and precious metals. The Company's main products are nickel and

Currency: London Intl: MNOD, Currency: USD FTSE 100 INDEX (UKX) palladium. MMC Norilsk Nickel also produces copper, cobalt, platinum, gold, silver and

other precious metals. MMC Norilsk Nickel is headquartered in Moscow with its main

Sector: Materials Industry: Metals & Mining Year: production facilities in Taimyr and Kola peninsula.

Telephone 7-495-787-76-67 Revenue (M) 12'065 Business Segments in USD Sales (M) Geographic Segments in USD Sales (M)

Website www.nornik.ru No of Employees #N/A N/A Mining and Metallurgy 11075 Europe 6066

Address 22 Voznesensky pereulok Moscow, 115230 Russian Federation Other 990 Asia 2750

Share Price Performance in USD Energy and Utilities North America 1226

Price 16.05 1M Return -3.9% Russian Federation 1015

52 Week High 20.44 6M Return 4.0% Adjustments 1004

52 Week Low 13.96 52 Wk Return -3.8% Other 4

52 Wk Beta 1.11 YTD Return -12.9% Nickel

Credit Ratings

Bloomberg - 8% 8% 0%

S&P BBB- Date 26.09.2011 Outlook NEG

Moody's - Date 11.07.2012 Outlook STABLE 8%

Fitch BB+ Date 19.08.2011 Outlook STABLE

Valuation Ratios 10%

12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E 51%

P/E - - - - 8.8x 8.2x 7.3x

EV/EBIT 8.4x 6.5x 5.1x 8.0x - - -

EV/EBITDA 6.8x 5.8x 4.6x 6.8x - - -

P/S - - - - 2.2x 2.2x 2.0x

P/B - - - - 1.8x 1.8x 1.7x 23%

Div Yield - - - - 9.3% 10.3% 8.8% 92%

Profitability Ratios %

12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Gross Margin 51.1 61.8 59.0 49.1 48.1 48.3 46.2 Europe

EBITDA Margin 50.9 57.7 51.3 40.9 42.3 42.8 43.2 Asia

Operating Margin 41.4 51.4 45.9 34.3 35.9 35.2 35.2 North America

Mining and Metallurgy Other

Profit Margin 30.4 25.8 25.5 18.0 25.0 25.5 26.1 Russian Federation

Return on Assets 11.9 14.1 16.8 10.9 17.5 15.5 18.8

Adjustments

Return on Equity 21.3 21.2 25.3 18.1 21.5 22.8 23.4

Other

Leverage and Coverage Ratios

12/09 12/10 12/11 12/12

Current Ratio 2.0 4.8 1.7 1.7 Current Capitalization in USD

Quick Ratio 1.0 2.4 0.7 0.4 Common Shares Outstanding (M) #N/A Field Not Applicable

EBIT/Interest 27.6 75.5 61.7 17.1 Market Capitalization (M) 27631.2

Tot Debt/Capital 0.3 0.1 0.3 0.3 Cash and ST Investments (M) #N/A N/A

Tot Debt/Equity 0.4 0.2 0.5 0.4 Total Debt (M) #N/A N/A

Eff Tax Rate % 24.3 22.8 25.9 31.8 Preferred Equity (M) 0.0

LT Investments in Affiliate Companies (M) 0.0

Investments (M) 0.0

Enterprise Value (M)

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

2. Company Analysis - Analysts Ratings

MMC Norilsk Nickel OJSC

Target price in USD

Broker Recommendation

Buy and Sell Recommendations vs Price and Target Price

Price

Brokers' Target Price

25 30

100% 6% 5% 5%

7% 7% 7% 6% 6% 7% 7%

13% 18% 25

80% 20

37% 20

44% 42%

24%

40% 15

60% 67% 64% 15

75% 10

81%

87% 87% 87%

40% 10 5

59% 58% 0

50% 53%

Morgan Stanley

Barclays

Otkritie Capital

Gazprombank

UFS-Finance Investment

Credit Suisse

JPMorgan

HSBC

Sberbank CIB

Societe Generale

BCS

Aton LLC

VTB Capital

TKB Capital

Alfa-Bank

Goldman Sachs

Renaissance Capital

Deutsche Bank

47%

20% 5

27% 29%

Company

19%

13%

7% 7% 7%

0% 0

avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13 févr.13 mars.13

Buy Hold Sell Price Target Price

Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date

29-Mar-13 58% 37% 5% 24-Apr-13 16.05 19.82 Gazprombank NATALIA SHEVELEVA overweight 20.00 24-Apr-13

28-Feb-13 53% 42% 5% 23-Apr-13 15.53 19.82 Morgan Stanley DMITRIY KOLOMYTSYN Underwt/In-Line 11.00 23-Apr-13

31-Jan-13 50% 44% 6% 22-Apr-13 15.78 20.55 HSBC VLADIMIR ZHUKOV neutral 16.50 21-Apr-13

31-Dec-12 59% 24% 18% 19-Apr-13 15.74 20.84 Deutsche Bank ERIK DANEMAR hold 20.00 19-Apr-13

30-Nov-12 47% 40% 13% 18-Apr-13 15.50 20.84 Alfa-Bank BARRY EHRLICH equalweight 17.30 16-Apr-13

31-Oct-12 29% 64% 7% 17-Apr-13 15.25 20.84 Sberbank CIB MIKHAIL STISKIN hold 18.32 16-Apr-13

28-Sep-12 27% 67% 7% 16-Apr-13 15.68 21.18 UFS-Finance Investment Company ILYA BALAKIREV buy 23.60 16-Apr-13

31-Aug-12 19% 75% 6% 15-Apr-13 15.89 21.47 Societe Generale ABHISHEK SHUKLA buy 23.00 15-Apr-13

31-Jul-12 13% 81% 6% 12-Apr-13 16.57 21.58 Credit Suisse SEMYON MIRONOV outperform 19.60 3-Apr-13

29-Jun-12 7% 87% 7% 11-Apr-13 16.76 21.58 Goldman Sachs YULIA CHEKUNAEVA neutral/neutral 21.00 15-Mar-13

31-May-12 7% 87% 7% 10-Apr-13 17.17 21.48 Otkritie Capital DENIS GABRIELIK buy 19.70 15-Mar-13

30-Apr-12 7% 87% 7% 9-Apr-13 17.07 21.48 JPMorgan YURIY A VLASOV neutral 19.10 21-Feb-13

8-Apr-13 16.59 21.60 Barclays VLADIMIR SERGIEVSKIY overweight 22.50 14-Feb-13

5-Apr-13 16.48 21.60 Renaissance Capital BORIS KRASNOJENOV buy 23.00 28-Jan-13

4-Apr-13 16.60 21.60 BCS KIRILL CHUYKO buy 23.00 18-Jan-13

3-Apr-13 16.73 21.60 VTB Capital NIKOLAY SOSNOVSKIY hold 20.00 21-Dec-12

2-Apr-13 16.85 21.81 Aton LLC DINNUR GALIKHANOV sell 14.60 4-Dec-12

1-Apr-13 16.89 21.81 TKB Capital MARIA KALVARSKAIA buy 27.00 11-Jan-11

29-Mar-13 16.89 21.81

28-Mar-13 16.89 21.81

27-Mar-13 16.65 21.81

26-Mar-13 16.51 21.81

25-Mar-13 16.27 21.72

22-Mar-13 16.71 21.72

21-Mar-13 16.76 21.59

20-Mar-13 16.74 21.59

19-Mar-13 16.59 21.70

18-Mar-13 16.65 21.70

15-Mar-13 17.21 21.70

14-Mar-13 17.35 21.57

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

3. 24.04.2013

MMC Norilsk Nickel OJSC

Company Analysis - Ownership

Ownership Type

Ownership Statistics Geographic Ownership Distribution Geographic Ownership

1%

Shares Outstanding (M) #N/A Field Not Applicable Others 100.00%

0% 0% 0%

0%

Float 0.00% 0% 0%

Short Interest (M) 0.00%

Short Interest as % of Float 0.00%

Days to Cover Shorts 0.00%

Institutional Ownership 0.00%

Retail Ownership 0.00%

Insider Ownership Others 0.00%

Institutional Ownership Distribution

Others 100.00% 100%

0.00%

0.00%

Institutional Ownership Retail Ownership Insider Ownership 0.00%

Pricing data is in USD Others 0.00% Others Others

Top 20 Owners: TOP 20 ALL

Institutional Ownership

Holder Name Position Position Change Market Value % of Ownership Report Date Source Country

VANGUARD GROUP INC 8'318'711 -446'840 133'515'312 0.48% 31.12.2012 MF-AGG UNITED STATES 0%

0% 0%

BARING INTERNATIONAL 8'137'574 8'137'574 130'608'063 0.47% 31.12.2012 13F BRITAIN 0%

BNP PARIBAS INV PART 5'129'290 1'274'754 82'325'105 0.30% 28.02.2013 ULT-AGG FRANCE

FRANKLIN RESOURCES 5'073'960 75'900 81'437'058 0.29% 31.12.2012 ULT-AGG UNITED STATES

BARING ASSET MANAGEM 4'797'930 944'039 77'006'777 0.28% 31.12.2012 MF-AGG IRELAND

JP MORGAN 4'561'641 25'615 73'214'338 0.26% 28.02.2013 ULT-AGG

VAN ECK ASSOCIATES C 4'434'338 52'940 71'171'125 0.26% 23.04.2013 ULT-AGG UNITED STATES

BLACKROCK 4'352'197 432'194 69'852'762 0.25% 22.04.2013 ULT-AGG UNITED STATES

DWS INVESTMENT SA 3'536'560 300'000 56'761'788 0.21% 28.02.2013 MF-AGG LUXEMBOURG

GRANTHAM MAYO VAN OT 3'337'724 0 53'570'470 0.19% 31.05.2012 MF-AGG UNITED STATES 100%

ALLIANZ ASSET MANAGE 2'533'017 903'464 40'654'923 0.15% 31.03.2013 ULT-AGG GERMANY

ALLIANCE BERNSTEIN 2'528'259 900'371 40'578'557 0.15% 28.02.2013 ULT-AGG UNITED STATES

TEMPLETON INVESTMENT 2'453'764 0 39'382'912 0.14% 31.12.2012 MF-AGG BRITAIN

SEB 2'103'863 7'738 33'767'001 0.12% 31.12.2012 ULT-AGG

Others Others

PICTET CONSEIL EN IN 1'655'244 819'149 26'566'666 0.10% 31.01.2013 MF-AGG LUXEMBOURG

CARNEGIE FONDER AB/S 1'573'000 0 25'246'650 0.09% 28.02.2013 MF-AGG SWEDEN

THAMES RIVER CAPITAL 1'504'605 0 24'148'910 0.09% 30.09.2012 MF-AGG BRITAIN

STATE STREET 1'373'744 -1'964 22'048'591 0.08% 23.04.2013 ULT-AGG UNITED STATES

PRINCIPAL FINANCIAL 1'179'718 451'070 18'934'474 0.07% 31.03.2013 ULT-AGG UNITED STATES

PICTET & CIE 1'157'555 1'157'555 18'578'758 0.07% 31.01.2013 MF-AGG SWITZERLAND

Top 5 Insiders:

Holder Name Position Position Change Market Value % of Ownership Report Date Source

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

4. Company Analysis - Financials I/IV

MMC Norilsk Nickel OJSC

Financial information is in USD (M) Equivalent Estimates

Periodicity: Fiscal Year 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Income Statement

Revenue 3'133 5'201 7'033 7'169 11'550 17'119 13'980 8'542 12'775 14'122 12'065 12'301 12'833 13'838

- Cost of Goods Sold 1'774 2'873 3'179 2'994 3'158 5'882 7'626 4'177 4'883 5'793 6'145

Gross Income 1'360 2'328 3'854 4'175 8'392 11'237 6'354 4'365 7'892 8'329 5'920 5'912 6'201 6'386

- Selling, General & Admin Expenses 568 751 866 841 1'090 3'878 1'869 830 1'325 1'851 1'777

(Research & Dev Costs) 40 14 20 18 19

Operating Income 792 1'577 2'988 3'334 7'302 7'359 4'485 3'535 6'567 6'478 4'143 4'415 4'518 4'876

- Interest Expense 109 40 68 83 67 284 397 128 87 105 242

- Foreign Exchange Losses (Gains) -17 -15 12 25 -65 -146 397 141 22 334 -214

- Net Non-Operating Losses (Gains) -174 213 355 110 523 -514 3'964 -40 -324 393 972

Pretax Income 874 1'339 2'553 3'116 6'777 7'735 -273 3'306 6'782 5'646 3'143 3'933 4'198 4'425

- Income Tax Expense 290 493 696 838 1'805 2'459 282 802 1'548 1'460 1'000

Income Before XO Items 584 846 1'857 2'278 4'972 5'276 -555 2'504 5'234 4'186 2'143

- Extraordinary Loss Net of Tax 0 0 0 -74 -993 0 0 -147 2'145 560 0

- Minority Interests -8 -16 -21 -3 -24 -51 -106 51 -209 22 -27

Diluted EPS Before XO Items

Net Income Adjusted* 592 862 1'878 2'281 4'996 5'327 4'279 2'651 5'442 4'164 3'119 3'071 3'269 3'610

EPS Adjusted 1.83 1.96 2.21

Dividends Per Share 1.50 1.66 1.41

Payout Ratio % 24.6 33.6 16.4 12.3 7.7 14.9 48.2 20.7 0.82 0.85 0.64

Total Shares Outstanding

Diluted Shares Outstanding

EBITDA 1'215 2'029 3'528 3'912 7'888 8'296 5'788 4'352 7'370 7'240 4'932 5'202 5'487 5'983

*Net income excludes extraordinary gains and losses and one-time charges.

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

5. Company Analysis - Financials II/IV

Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Balance Sheet

Total Current Assets 3265.99906 3701.64305 3967 5553 5205 12510 7059 8408 12974 6569 6814

+ Cash & Near Cash Items 262 958 1'346 922 2'178 4'008 1'995 3'632 5'405 1'627 1'037

+ Short Term Investments 94 136

+ Accounts & Notes Receivable 212 361 290 278 534 661 278 683 995 970 697

+ Inventories 1'826 1'503 1'442 1'301 1'471 2'108 1'959 1'990 2'246 2'623 3'197

+ Other Current Assets 873 744 889 3'052 1'022 5'733 2'827 2'103 4'328 1'349 1'883

Total Long-Term Assets 6'424 7'633 9'665 9'177 11'074 23'186 13'764 14'352 10'935 12'343 14'160

+ Long Term Investments 104 163 1'407 690 2'615 2'982 523

Gross Fixed Assets 6'731 8'190 9'276 8'985 10'892 19'432 18'071 18'548 19'730 19'477 23'100

Accumulated Depreciation 415 920 1'424 1'840 2'758 4'451 7'334 7'531 10'577 9'892 11'173

+ Net Fixed Assets 6'315 7'270 7'852 7'145 8'134 14'981 10'737 11'017 9'153 9'585 11'927

+ Other Long Term Assets 4 199 406 1'342 325 5'223 2'504 3'335 1'782 2'758 2'233

Total Current Liabilities 1'468 1'638 1'383 1'594 1'251 6'434 2'126 4'112 2'697 3'830 3'969

+ Accounts Payable 211 156 151 170 191 352 281 243 374 346 449

+ Short Term Borrowings 453 267 552 357 158 3'973 872 2'986 1'256 2'754 2'526

+ Other Short Term Liabilities 804 1'215 680 1'067 902 2'109 973 883 1'067 730 994

Total Long Term Liabilities 956 1'088 1'606 1'739 1'892 7'441 6'912 3'893 3'238 3'860 4'065

+ Long Term Borrowings 146 182 657 635 632 4'103 5'568 2'378 1'575 2'401 2'497

+ Other Long Term Borrowings 810 906 949 1'104 1'260 3'338 1'344 1'515 1'663 1'459 1'568

Total Liabilities 2'425 2'726 2'989 3'333 3'143 13'875 9'038 8'005 5'935 7'690 8'034

+ Long Preferred Equity 0 0 0 0 0 0 0 0 0 0 0

+ Minority Interest 101 346 366 334 319 2'318 1'054 1'080 598 120 109

+ Share Capital & APIC 688 751 792 9 619 1'398 1'398 1'398 1'519 1'519 1'519

+ Retained Earnings & Other Equity 6'476 7'511 9'485 11'054 12'198 18'105 9'333 12'277 15'857 9'583 11'312

Total Shareholders Equity 7'265 8'609 10'643 11'397 13'136 21'821 11'785 14'755 17'974 11'222 12'940

Total Liabilities & Equity 9'690 11'335 13'632 14'730 16'279 35'696 20'823 22'760 23'909 18'912 20'974

Book Value Per Share 8.78 8.90 9.41

Tangible Book Value Per Share

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

6. Company Analysis - Financials III/IV

Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Cash Flows

Net Income 592 862 1'878 2'355 5'989 5'327 -449 2'600 3'298 3'604 2'170 2'763 2'984 3'419

+ Depreciation & Amortization 423 451 540 578 586 937 1'303 817 803 762 789

+ Other Non-Cash Adjustments -276 133 -3'412 -3'913 -655 1'026 -309 586 1'826 996 1'071

+ Changes in Non-Cash Capital -127 208 3'498 3'974 -273 75 370 -560 -410 -658 -595

Cash From Operating Activities 611 1'655 2'504 2'994 5'647 7'365 915 3'443 5'517 4'704 3'435

+ Disposal of Fixed Assets 4 21 57 38 46 88 88 38 33 23 10

+ Capital Expenditures -353 -440 -618 -773 -743 -1'140 -2'360 -1'061 -1'728 -2'201 -2'692 -2'441 -2'324 -2'216

+ Increase in Investments -40 -142 0 0

+ Decrease in Investments 191 5 0 0

+ Other Investing Activities -271 -60 -1'467 -720 1'075 -11'732 2'730 513 249 300 -233

Cash From Investing Activities -470 -617 -2'028 -1'455 378 -12'784 458 -510 -1'446 -1'878 -2'915

+ Dividends Paid -170 -147 -618 -201 -1'079 -849 -1'670 -1'208 -1'234 -960

+ Change in Short Term Borrowings -660 -292 -36 85 -482

+ Increase in Long Term Borrowings 228 175 872 112 10'183 3'723 113 628 3'694 2'478

+ Decrease in Long Term Borrowings -20 -213 -197 -417 -11 -3'915 -5'240 -1'193 -3'048 -1'351 -2'666

+ Increase in Capital Stocks 0 0 0 0 1'705 1'246 0

+ Decrease in Capital Stocks 0 0 0 -1'457 -999 -29 -8'995 0

+ Other Financing Activities -109 16 47 -64 -2'198 1'838 -2'617 -78 -111 36 38

Cash From Financing Activities -731 -461 68 -1'942 -4'769 7'257 -5'804 -1'187 -2'034 -6'604 -1'110

Net Changes in Cash -590 577 544 -403 1'256 1'838 -4'431 1'746 2'037 -3'778 -590

Free Cash Flow (CFO-CAPEX) 258 1'214 1'886 2'221 4'904 6'225 -1'445 2'382 3'789 2'503 743

Free Cash Flow To Firm 331 1'239 1'935 2'282 4'953 6'419 2'479 3'856 2'581 908

Free Cash Flow To Equity -190 905 2'582 2'039 4'457 12'581 -2'874 1'340 1'402 4'869 565

Free Cash Flow per Share

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

7. Company Analysis - Financials IV/IV

Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Ratio Analysis

Valuation Ratios

Price Earnings 8.8x 8.2x 7.3x

EV to EBIT 7.7x 3.8x 8.4x 6.5x 5.1x 8.0x

EV to EBITDA 6.8x 3.0x 6.8x 5.8x 4.6x 6.8x

Price to Sales 2.2x 2.2x 2.0x

Price to Book 1.8x 1.8x 1.7x

Dividend Yield 9.3% 10.3% 8.8%

Profitability Ratios

Gross Margin 43.4% 44.8% 54.8% 58.2% 72.7% 65.6% 45.5% 51.1% 61.8% 59.0% 49.1% 48.1% 48.3% 46.2%

EBITDA Margin 38.8% 39.0% 50.2% 54.6% 68.3% 48.5% 41.4% 50.9% 57.7% 51.3% 40.9% 42.3% 42.8% 43.2%

Operating Margin 25.3% 30.3% 42.5% 46.5% 63.2% 43.0% 32.1% 41.4% 51.4% 45.9% 34.3% 35.9% 35.2% 35.2%

Profit Margin 18.9% 16.6% 26.7% 32.8% 51.9% 31.1% -3.2% 30.4% 25.8% 25.5% 18.0% 25.0% 25.5% 26.1%

Return on Assets 6.1% 8.2% 15.0% 16.6% 38.6% 20.5% -1.6% 11.9% 14.1% 16.8% 10.9% 17.5% 15.5% 18.8%

Return on Equity 8.9% 11.2% 20.3% 22.1% 50.2% 33.0% -3.0% 21.3% 21.2% 25.3% 18.1% 21.5% 22.8% 23.4%

Leverage & Coverage Ratios

Current Ratio 2.22 2.26 2.87 3.48 4.16 1.94 3.32 2.04 4.81 1.72 1.72

Quick Ratio 0.39 0.89 1.18 0.75 2.17 0.73 1.07 1.05 2.37 0.68 0.44

Interest Coverage Ratio (EBIT/I) 7.27 39.40 43.94 40.17 108.99 25.91 11.30 27.62 75.48 61.70 17.12

Tot Debt/Capital 0.08 0.05 0.10 0.08 0.06 0.27 0.35 0.27 0.14 0.31 0.28

Tot Debt/Equity 0.08 0.05 0.11 0.09 0.06 0.37 0.55 0.36 0.16 0.46 0.39

Others

Asset Turnover 0.32 0.50 0.56 0.51 0.74 0.66 0.49 0.39 0.55 0.66 0.60

Accounts Receivable Turnover 14.07 18.41 21.62 25.24 28.45 28.65 29.78 17.78 15.23 14.37 14.48

Accounts Payable Turnover 6.63 13.05 20.31 17.78 18.44 24.01 23.62 16.06 16.66 17.14 16.90

Inventory Turnover 0.95 1.72 2.16 2.18 2.28 3.29 3.75 2.12 2.31 2.38 2.11

Effective Tax Rate 33.1% 36.8% 27.3% 26.9% 26.6% 31.8% 24.3% 22.8% 25.9% 31.8%

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

8. Company Analysis - Peers Comparision

MMC NORILSK POLYUS GOLD IMPALA TECK RESOURCES-

EVRAZ PLC BHP BILLITON LTD UNITED CO RUSAL XSTRATA PLC ANGLO AMER PLC LONMIN PLC MAGNITOGORSK SEVERSTAL NLMK OAO MECHEL RIO TINTO LTD

ADR OJSC PLATINUM B

Latest Fiscal Year: 12/2012 12/2012 06/2012 12/2012 12/2012 12/2012 12/2012 09/2012 12/2012 12/2012 06/2012 12/2012 12/2012 12/2012 12/2012

52-Week High 20.44 384.30 39.34 5.70 1'310.00 1'201.00 2'440.00 568.60 12.70 470.00 17'600.00 69.86 264.00 39.90 72.30

52-Week High Date 25.01.2013 30.04.2012 20.02.2013 26.04.2012 01.02.2013 01.02.2013 02.05.2012 02.05.2012 02.05.2012 14.09.2012 15.01.2013 17.09.2012 27.04.2012 10.01.2013 14.02.2013

52-Week Low 13.96 151.10 30.09 3.81 787.60 760.47 1'540.00 226.96 6.70 233.00 10'845.00 45.51 111.30 24.10 48.37

52-Week Low Date 01.06.2012 18.04.2013 12.07.2012 02.04.2013 27.11.2012 27.06.2012 18.04.2013 09.11.2012 15.04.2013 17.04.2013 15.04.2013 04.04.2013 23.04.2013 23.04.2013 30.08.2012

Daily Volume 3'278'994 3'241'562 16'783'219 4'595'000 15'793 4'406'533 3'018'744 1'024'259 11'494'300 1'967'720 1'045'689 4'623'300 693'255 9'034'012 6'203'716

Current Price (4/dd/yy) 16.05 166.30 31.70 3.94 918.00 989.80 1'616.50 267.60 7.20 255.80 12'014.00 54.09 119.70 25.60 54.68

52-Week High % Change -21.5% -56.7% -19.4% -30.9% -29.9% -17.6% -33.8% -52.9% -43.3% -45.6% -31.7% -22.6% -54.7% -35.8% -24.4%

52-Week Low % Change 15.0% 10.1% 5.4% 3.4% 16.6% 30.2% 5.0% 17.9% 7.5% 9.8% 10.8% 18.9% 7.5% 6.2% 13.0%

Total Common Shares (M) - 1'339.9 5'297.6 15'193.0 3'032.2 3'002.7 1'391.0 381.8 11'006.0 837.7 615.8 5'993.2 416.3 582.3 1'847.0

Market Capitalization 27'631 2'449 158'638 59'860 174'996 29'721 22'529 1'521 80'455 214'288 75'954 324'174 49'828 14'926 86'882

Total Debt 5'023.0 8'169.0 28'330.0 11'334.0 348.3 17'067.0 16'760.0 736.0 3'867.0 5'709.5 3'609.0 4'631.7 9'870.1 7'195.0 26'819.0

Preferred Stock - - - - - - - - - - - - 25.3 - -

Minority Interest 109.0 200.0 1'215.0 - 282.6 2'339.0 6'130.0 257.0 155.0 20.8 2'307.0 (32.9) 362.3 176.0 11'156.0

Cash and Equivalents 1'037.0 1'320.0 4'781.0 490.0 1'038.3 1'983.0 9'094.0 315.0 424.0 1'750.1 1'193.0 1'058.2 295.0 3'267.0 7'320.0

Enterprise Value - 10'788 194'666 18'554 5'152 62'800 48'193 3'001 6'154 10'788 80'872 13'839 11'546 19'514 119'939

Valuation

Total Revenue LFY 12'065.0 14'726.0 72'226.0 10'891.0 2'848.1 31'618.0 28'761.0 1'614.0 9'328.0 14'103.7 27'593.0 12'156.6 11'274.9 10'343.0 50'967.0

LTM 12'065.0 14'726.0 66'950.0 10'891.0 2'028.1 31'618.0 28'761.0 1'614.0 9'328.0 14'103.7 27'342.0 12'156.6 11'274.9 10'126.0 50'967.0

CY+1 12'301.2 14'735.6 67'569.0 11'064.4 - 33'840.4 34'519.9 1'621.9 9'462.2 14'606.9 32'481.6 12'518.1 11'482.4 9'828.8 55'585.9

CY+2 12'832.7 15'475.0 73'914.3 11'619.3 - 35'525.1 36'176.5 1'995.0 10'023.3 15'369.4 37'931.1 13'450.3 11'466.8 10'752.2 61'445.4

EV/Total Revenue LFY 2.8x 0.9x 3.3x 1.9x 4.1x 2.2x 2.0x 1.6x 0.8x 1.0x 3.9x 1.3x 1.1x 2.1x 3.1x

LTM 2.8x 0.9x 3.5x 1.9x 6.7x 2.2x 2.0x 1.6x 0.8x 1.0x 3.9x 1.3x 1.1x 2.1x 3.1x

CY+1 2.5x 0.7x 2.9x 1.6x - 1.8x 1.5x 1.5x 0.6x 0.7x 2.5x 1.1x 1.0x 2.0x 2.2x

CY+2 2.5x 0.7x 2.6x 1.5x - 1.7x 1.4x 1.2x 0.6x 0.7x 2.2x 1.0x 1.0x 1.8x 1.9x

EBITDA LFY 4'932.0 1'599.0 33'421.0 1'223.0 1'426.1 8'122.0 7'682.0 776.0 1'218.0 2'127.4 7'300.0 1'900.5 462.4 3'736.0 15'486.0

LTM 4'932.0 1'599.0 27'133.0 1'223.0 673.9 8'122.0 7'682.0 776.0 1'218.0 2'127.4 5'736.0 1'900.5 462.4 3'508.0 15'486.0

CY+1 5'201.9 2'102.6 28'726.6 1'221.2 - 9'266.4 9'657.0 182.5 1'317.7 2'252.8 6'759.4 2'044.6 1'538.3 3'245.5 21'006.8

CY+2 5'487.1 2'415.1 33'552.1 1'417.8 - 10'563.3 10'177.3 418.0 1'485.8 2'403.5 8'936.5 2'322.0 1'510.4 3'945.0 23'251.3

EV/EBITDA LFY 6.8x 7.9x 7.1x 16.7x 8.2x 8.5x 7.4x 3.2x 6.1x 6.7x 14.6x 8.2x 27.6x 5.7x 10.2x

LTM 6.8x 7.9x 8.7x 16.7x 17.4x 8.5x 7.4x 3.2x 6.1x 6.7x 18.6x 8.2x 27.6x 6.0x 10.2x

CY+1 6.0x 5.0x 6.7x 14.8x - 6.7x 5.3x 13.1x 4.6x 4.8x 12.0x 6.7x 7.4x 6.1x 5.7x

CY+2 5.8x 4.2x 5.7x 12.3x - 5.7x 5.1x 5.7x 3.9x 4.3x 9.2x 5.8x 7.4x 5.0x 5.0x

EPS LFY - -0.36 3.61 0.02 - 1.26 2.59 0.36 - - 6.85 - - 2.59 4.06

LTM - -0.23 1.83 -0.02 2.19 0.40 -1.13 -1.08 -0.01 0.85 2.40 0.10 -3.93 2.33 -1.63

CY+1 1.83 0.16 2.53 0.06 - 1.21 2.17 0.05 0.00 1.00 5.24 0.15 (0.62) 2.14 5.72

CY+2 1.96 0.31 3.05 0.07 - 1.45 2.61 0.26 0.02 1.10 8.48 0.18 0.11 2.79 6.62

P/E LFY - - 17.9x - 13.3x 37.8x - - - 9.5x 50.1x 17.3x - 11.0x -

LTM - - 11.7x - - 12.0x 9.8x 11.4x - - 50.0x - - 11.0x -

CY+1 8.8x 15.9x 12.9x 9.1x - 12.4x 11.4x 90.8x 57.2x 8.2x 22.9x 11.5x - 12.0x 9.8x

CY+2 8.2x 8.1x 10.7x 7.0x - 10.4x 9.5x 15.5x 12.7x 7.4x 14.2x 9.4x 33.7x 9.2x 8.5x

Revenue Growth 1 Year (14.6%) (10.2%) 0.7% (11.4%) 18.5% (6.7%) (5.9%) (19.0%) 0.2% (10.8%) (16.7%) 3.6% (10.1%) (10.2%) (15.8%)

5 Year (4.4%) - 6.8% - 28.0% 3.5% 13.5% (1.6%) 2.6% 17.8% 0.9% 6.9% 9.2% 9.2% 11.2%

EBITDA Growth 1 Year (31.9%) (42.8%) (12.1%) (55.7%) 38.9% (30.3%) (32.5%) 89.7% (2.7%) (40.6%) (36.9%) (15.7%) (81.2%) (30.4%) (41.1%)

5 Year (9.9%) - 8.0% (23.3%) 47.8% (5.7%) (5.8%) (2.5%) (12.0%) (10.3%) (13.0%) (11.0%) (22.8%) 5.7% 8.1%

EBITDA Margin LTM 40.9% 10.9% 40.5% 11.2% 38.5% 25.7% 26.7% 48.1% 13.1% 15.1% 21.0% 15.6% 4.1% 34.6% 30.4%

CY+1 42.3% 14.3% 42.5% 11.0% - 27.4% 28.0% 11.2% 13.9% 15.4% 20.8% 16.3% 13.4% 33.0% 37.8%

CY+2 42.8% 15.6% 45.4% 12.2% - 29.7% 28.1% 21.0% 14.8% 15.6% 23.6% 17.3% 13.2% 36.7% 37.8%

Leverage/Coverage Ratios

Total Debt / Equity % 39.1% 157.9% 43.0% 103.8% 8.3% 38.4% 44.5% 29.6% 40.0% 79.4% 7.2% 41.6% 313.1% 40.4% 57.2%

Total Debt / Capital % 28.0% 60.3% 29.7% 50.9% 7.2% 26.7% 27.7% 21.1% 28.3% 44.2% 6.4% 29.5% 73.6% 28.6% 31.6%

Total Debt / EBITDA 1.018x 5.109x 1.308x 9.267x 0.302x 2.101x 2.182x 0.948x 3.175x 2.684x 0.720x 2.437x 21.346x 2.094x 1.732x

Net Debt / EBITDA 0.808x 4.283x 1.120x 8.867x -0.446x 1.857x 0.998x 0.543x 2.827x 1.861x 0.447x 1.880x 20.708x 1.253x 1.259x

EBITDA / Int. Expense 20.380x 2.479x 44.266x 1.637x 62.969x 20.458x 7.080x 17.244x 5.462x 4.825x 21.283x 27.760x 0.691x 6.026x 14.848x

Credit Ratings

S&P LT Credit Rating BBB- - A+ - - BBB+ *- BBB - NR BB+ - BBB- - BBB A-

S&P LT Credit Rating Date 26.09.2011 - 15.11.2010 - - 29.11.2012 04.04.2013 - 20.01.2010 21.06.2012 - 23.07.2008 - 16.04.2010 18.04.2011

Moody's LT Credit Rating - - (P)A1 - - - Baa1 - - Ba1 - - - Baa2 -

Moody's LT Credit Rating Date - - 15.11.2010 - - - 23.02.2009 - - 07.06.2012 - - - 17.11.2010 -

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |