Etfin pro module 1 times pro

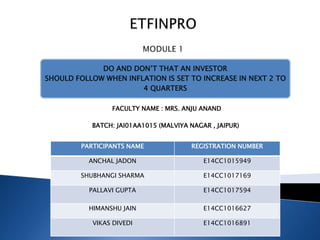

- 1. FACULTY NAME : MRS. ANJU ANAND BATCH: JAI01AA1015 (MALVIYA NAGAR , JAIPUR) DO AND DON’T THAT AN INVESTOR SHOULD FOLLOW WHEN INFLATION IS SET TO INCREASE IN NEXT 2 TO 4 QUARTERS PARTICIPANTS NAME REGISTRATION NUMBER ANCHAL JADON E14CC1015949 SHUBHANGI SHARMA E14CC1017169 PALLAVI GUPTA E14CC1017594 HIMANSHU JAIN E14CC1016627 VIKAS DIVEDI E14CC1016891

- 2. S. NO DESCRIPTION 1 INFLATION 2 INDIA’S INFLATION RATE 3 EFFECTS OF INFLATON ON MARKET 4 EFFECTS ON RBI INEREST RATES 5 DO’S FOR AN INVESTOR WHEN HIGH INFLATION IS EXPECTED 6 DONT’S FOR AN INVESTOR WHEN HIGH INFLATION IS EXPECTED 7 CASE STUDY 8 CONCLUSION

- 3. Source: Investopodia Source: Ministry of Statistics and Programme Implementation (MOSPI) INFLATION CONCEPT •Inflation is a rise in the general level of prices of goods and services in an economy over a period of time. • When the level of currency of a country exceeds the level of production inflation occurs. •Value of money depreciate with the occurrence of inflation •When the price level rises, each unit of currency buys fewer goods and services. •A rise in inflation is accompanied by a decrease in purchasing power and has an impact on corporate asset values and in financial investing. “ “The inflation rate in India was recorded at 5.11 percent in January of 2015. Inflation Rate in India averaged 8.87 percent from 2012 until 2015, reaching an all time high of 11.16 percent in November of 2013 and a record low of 4.38 percent in November of 2014. The current base year of inflation is 2011-2012”

- 5. EFFECTS OF INFLATION ON MARKET NEGATIVE EFFECTS OF INFLATION •Include loss in stability in the real value of money and other monetary items over time. •Uncertainty about future inflation may discourage investment and saving •High inflation may lead to shortages of goods if consumers begin hoarding out of concern that prices will increase in the future. POSITIVE EFFECTS OF INFLATION Include a mitigation of economic recessions, and debt relief by reducing the real level of debt. Source: http://csanad.hubpages.com/hub/Effects-of-inflation

- 6. EFFECTS ON RBI INEREST RATES BANK RATE OF INTEREST During Inflation , RBI increases the bank rate of interest due to which borrowing power of commercial banks reduces which thereby reduces the supply of money or credit in economy OPEN MARKET OPERATIONS During inflation, RBI sells securities in the open market which leads to transfer of money to RBI. STATUTORY LIQUIDITY RATIO During Inflation SLR increases and the lending capacity of commercial banks decreases, thereby decreasing the supply of money. CASH RESERVE RATIO During Inflation, RBI increases the CRR due to which commercial banks have to keep a greater portion of their deposits with the RBI, thereby decreasing the supply of money. DEFICIT FINANCING During Inflation, RBI will stop printing new currency notes thereby controlling inflation. EFFECTS ON RBI INEREST RATES Source: http://www.financialexpress.com/article/economy/raghuram-rajans-rbi-effects- surprise-repo-rate-cut-analysts-says-real-effect-not-much/30277/

- 7. Gold Bonds Stock Market Invest in Forex Bank Products Exchange Treaded partnership Exchange Traded Funds Purchase foreign securities DO’S FOR AN INVESTOR WHEN HIGH INFLATION IS EXPECTED INVEST IN A MIXED PORTFOLIO

- 8. Invest in stocks of oil, gasoline, consumer products ,gold companies and technologies. Invest in stocks of necessary good selling company stocks like toothpaste, soap will continue to purchase even when they cost more , to higher returns STOCKS MARKET Source : www.marketoracle.co.uk EQUITY MUTUAL FUNDS Invest in mutual funds to avoid direct risk

- 9. Gold is also a popular inflation hedge. Investors tend to turn to this precious metal during inflationary times, causing its price to rise silver and other metals also tend to gain value during inflationary times. GOLD Source: goldratefortoday.org NOTE: The percentage allocation can vary in the of high inflation towards higher yielding investments like mutual funds and equity in case market don’t merit investment and are on downswing then the good old gold comes to rescue. Source: http://www.investopedia.com/

- 10. INVEST IN FOREX • If it is expected that inflation will come in future, an investor should be suggested to purchase dollars or other currencies. •Weak domestic currency implies higher returns can be found abroad. Invest in foreign currencies. ETF (EXCHANGE TRADED FUNDS) •Globally ETF have opened whole new investment opportunities to retail as well as institutional managers. •They enable exposure to managers to entire stock market in different countries. It’s like a Mutual fund which they can sell and buy in real time as price changes whole day. FOREX Source: http://www.investopedia.com

- 11. PURCHASE FOREIGN SECURITIES An Inflation of India will not affect the Japan's Economy. In the same way having Japanese investment will allow an investor to have a small cushion of protection against loss due to India’s Inflation. INFLATION INDEXED BONDS There are two types of bonds issued by RBI which protect investor from inflation. IIB and IINSS-C. (Inflation Index bonds and Inflation Indexed National Saving Securities Cumulative) are issued and outsourced respectively to adjust changes in inflation and help protect investors from inflation because both their principal and their interest payments adjust as the CPI changes. FOREIGN SECURITIES AND BONDS Source: http://www.investopedia.com

- 12. DON'TS FOR AN INVESTOR WHEN HIGH INFLATION IS EXPECTED Do not buy fixed income securities Not all stocks market companies are inflation hedge. Be careful Don’t invest in long term bonds. They are not safe inflation hedges.

- 13. •Many investors buy fixed income securities because they want a stable income stream, which comes in the form of interest. •However, because the rate of interest on most fixed income securities remains the same until maturity, the purchasing power of the interest payments declines as inflation rises. • REAL RETURN = NOMINAL RETURN – INFLATION IF INFLATION > NOMINAL RETURN, REAL RETURN BECOMES “NEGATIVE’’ Source: http://articles.economictimes.indiatimes.com/2011-06- 27/news/29708973_1_debt-mutual-funds-repo-rate-interest-rate-scenario

- 14. • Not all stocks market companies are inflation hedge. One should strike a balance between safety and returns by building a diversified portfolio. • Stocks are not good short-term hedges against rapidly increasing inflation, but bonds are worse. • Investing in long-term bonds in a high-inflation environment, it's on the bond side where there's a lot more trouble. Source: http://articles.economictimes.indiatimes.com/2011-06- 27/news/29708973_1_debt-mutual-funds-repo-rate-interest-rate-scenario

- 15. INFLATION VERSUS RETURNS ON VARIOUS INVSTMENTS STATISTICS Source: http://mrraghucfa.blogspot.in/2014/05/the-debilitating- effect-of-inflation-on.html

- 16. Customer A and B have come to ABC bank to invest their money. Customer A as well as customer B want to put their money in the Fixed Deposit at a normal prevailing rate. The bank advisor advised that they should not invest their money in fixed deposits as inflation rate is expected to go up soon and the interest rates will be revised to upwards. So, in place of fixed deposits they should invest their money in gold, government bonds or invest in equity. Customer A decides to go with bank advice and customer B refuses and decide to invest in old fashion. CASE STUDY

- 17. OUTCOME After 8 weeks the customer A who invested his (x) amount gained the profit as his money became (x++) in real money term whereas the customer B who also invested his (x) amount got (x+) amount only, that means in real terms he was left with (-x) and his real value liquid assets dropped to substantial amount. He could have earned a lot more if he had followed the banker’s advice.

- 18. • Inflation will always be with us; it's an economic fact of life. • It is not intrinsically good or bad, but it certainly does impact the investing environment. • Investors need to understand the impacts of inflation and structure their portfolios accordingly. •Depending on personal circumstances, investors need to maintain a blend of income and investments with adequate real returns to address inflationary issues. CONCLUSION

- 19. THANK YOU