Investing for know nothing investor

•Descargar como PPTX, PDF•

0 recomendaciones•34 vistas

Simple tips for know-nothing investors.

Denunciar

Compartir

Denunciar

Compartir

Recomendados

Recomendados

Más contenido relacionado

La actualidad más candente

La actualidad más candente (20)

Olympic Wealth Fund, 'Javelin' Fund fact sheet class 'B' February 2015

Olympic Wealth Fund, 'Javelin' Fund fact sheet class 'B' February 2015

SBI Magnum Balanced Fund: An Open-ended Balanced Scheme - Dec 16

SBI Magnum Balanced Fund: An Open-ended Balanced Scheme - Dec 16

SBI Magnum Balanced Fund: An Open-ended Balanced Scheme - Nov 16

SBI Magnum Balanced Fund: An Open-ended Balanced Scheme - Nov 16

Monthly newsletter by seeman distributors- November edition

Monthly newsletter by seeman distributors- November edition

Similar a Investing for know nothing investor

Similar a Investing for know nothing investor (20)

GIIS_Financial_Newsletter_November_2022 (1)_compressed.pdf

GIIS_Financial_Newsletter_November_2022 (1)_compressed.pdf

Seeman_Fiintouch_LLP_INTOUCH_Newsletter_March_2023.pdf

Seeman_Fiintouch_LLP_INTOUCH_Newsletter_March_2023.pdf

Último

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girl Mumbai Indira Call Now: 8250077686 Mumbai Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Mumbai Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Mumbai understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...Call Girls in Nagpur High Profile

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Girls Waiting For You To Fuck

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...Call Girls in Nagpur High Profile

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot Indian Girls Waiting For You To Fuck

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot ...

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot ...Call Girls in Nagpur High Profile

Último (20)

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

05_Annelore Lenoir_Docbyte_MeetupDora&Cybersecurity.pptx

05_Annelore Lenoir_Docbyte_MeetupDora&Cybersecurity.pptx

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

Log your LOA pain with Pension Lab's brilliant campaign

Log your LOA pain with Pension Lab's brilliant campaign

Pooja 9892124323 : Call Girl in Juhu Escorts Service Free Home Delivery

Pooja 9892124323 : Call Girl in Juhu Escorts Service Free Home Delivery

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

Dharavi Russian callg Girls, { 09892124323 } || Call Girl In Mumbai ...

Dharavi Russian callg Girls, { 09892124323 } || Call Girl In Mumbai ...

(ANIKA) Budhwar Peth Call Girls Just Call 7001035870 [ Cash on Delivery ] Pun...![(ANIKA) Budhwar Peth Call Girls Just Call 7001035870 [ Cash on Delivery ] Pun...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![(ANIKA) Budhwar Peth Call Girls Just Call 7001035870 [ Cash on Delivery ] Pun...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

(ANIKA) Budhwar Peth Call Girls Just Call 7001035870 [ Cash on Delivery ] Pun...

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

TEST BANK For Corporate Finance, 13th Edition By Stephen Ross, Randolph Weste...

TEST BANK For Corporate Finance, 13th Edition By Stephen Ross, Randolph Weste...

CALL ON ➥8923113531 🔝Call Girls Gomti Nagar Lucknow best sexual service

CALL ON ➥8923113531 🔝Call Girls Gomti Nagar Lucknow best sexual service

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot ...

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot ...

Investing for know nothing investor

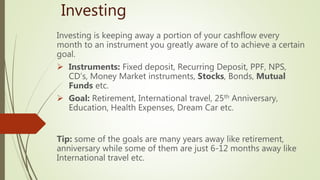

- 1. Investing Investing is keeping away a portion of your cashflow every month to an instrument you greatly aware of to achieve a certain goal. Instruments: Fixed deposit, Recurring Deposit, PPF, NPS, CD’s, Money Market instruments, Stocks, Bonds, Mutual Funds etc. Goal: Retirement, International travel, 25th Anniversary, Education, Health Expenses, Dream Car etc. Tip: some of the goals are many years away like retirement, anniversary while some of them are just 6-12 months away like International travel etc.

- 2. Prerequisites Term policy Health policy Goals – atleast 1 (e.g. wealth creation in 12 years) Risk appetite (conservative, aggressive, in middle of both)

- 3. Asset allocation MF’s, Stocks, Bonds are riskiest instruments Fixed deposits, PPF are safest instrument in India (people loose money in fixed deposit too, e.g. PMC cooperative bank) Decide your asset allocation based on your age, risk appetite, goal duration. Rule of thumb- subtract your age from 100 and the number you get should be the ideal allocation to risky instruments such as stocks and MFs. It’s also given that you don’t need your money invested in stocks/MF for the next atleast 12 years. You also ready to bear 50% downside for the portion you invested in stocks/MF. 50% downside is a real possibility in case of a war, natural disaster, unforeseen situations. Up to 20%-25% downside happens in every 7-10 years. You can’t predict when. If you can predict, you can become billionaire in just 1 year.

- 5. Know nothing investor – where to invest If you are a know nothing investor, minimum10% CAGR is a real possibility. Nifty has a CAGR of 13.4% in the last 20 years (since 1998) and 13.89% in the last 10 years (since 2008). In an ideal situation, let’s assume you have been investing 1000/- Rs. Every month, here is the return data: After 20 years: total deposit: 2,40,000 Rs., Return: 1,210,689.20, 5 times return of your total investment After 30 years: total deposit: 360,000 Rs., Return: 4,842,176.51, 13 times return of your total investment All you need to do is to invest in index fund of your country. Nifty 50 is an index fund and represent top 50 companies in India. Some of the companies are HDFC Ltd, HDFC, Reliance industries, TCS, Kotak Mahindra Bank, SBI. Index fund decides the growth of a country. Its companies monitored and replaced by other growth companies every 6 months. Eg. Nestle India was not a part of the Nifty 50 and included on around August. Example mutual fund: UTI Nifty 50 direct plan - growth

- 6. Word of caution Given the fact that we have had CAGR of ~13%, it doesn’t mean we grow with the same pace and will get the same CAGR. We might get better than this or worse than this. Usually, when inflation go down, return decreases. Eg. S&P 500 which an index from the USA has a CAGR of 6.24% (1999-2019). To be noted, the USA has 0-1% inflation. Investing in a specific equity is a risky affair, your 100% stake is at risk at all time. Until and unless you have great knowledge on reading financial statements, understanding market sentiment etc. etc. etc., don’t invest or think to invest in direct equities. You can’t compete with the thousand other fund managers, professionals who are in this field from the serval years and work very hard to bring better results for their client. When you invest in Index fund, your money is in safe hand. SEBI looks over index regularly. You pay less in expenses (0.10%)to mange your fund. At the same time, an active mutual fund demands around 1% expense ratio which may affects your return. Don’t pause your monthly cashflow to MF’s when you see market is in despair, instead put more money every month.