March 2020 Investment Commentary

- 1. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1

- 2. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 Swan Lake: Ultimate Path to Profitability & The Most Significant Non-GAAP Exercise Chapter 1, USA Series A Funding Our story begins. A passionate entrepreneur walks into a venture capital meeting and makes the following pitch: “I have what I believe to be a phenomenal investment opportunity and one for which to get in on the first round of funding; THE absolute ground floor, some might say the basement! This is the story of an amazing company, actually, think about it almost like a great country. It has truly incredible potential, but at the moment is temporarily hemorrhaging cash due to negative operating leverage associated with a high amount of fixed and variable costs, several segments which are quite capital intensive, possessing no revenues, huge headcount that have been furloughed or instructed to work from home until further notice, and possibly some that may be let go permanently; a customer base that, for the exception of a handful of total addressable market segments, is not buying products, and in many situations products & services are currently not being manufactured, produced or being provided. To be honest, there’s this deadly healthcare situation that is troubling a lot of people across the spectrum right now, some who are just plain frightened, immobilized, others are confused and many are uncertain as to what the future entails. In a nutshell there’s a lot of behavioral changes occurring as a result and the question is whether it’s a temporary thing.” The passionate entrepreneur went on further: “As a result, I

- 3. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 believe the business should be capitalized on outward year revenues, earnings and EBITDA….oh, one very small thing…the capital structure is subject to change at a moment’s notice if things don’t go too well, possibly would include some significant dilution and/or bankruptcy risk owing to potential partisan government actions/inactions that may not be in my, or the company’s control. You see, I have this uncle, Samuel, with very deep pockets. He’s willing to invest but is a stickler on terms. It’s possible too that capital markets might not be open, or as fluid as historically, which could create issues that complicate the valuation process a bit more. Profit margins, which are currently at depressed levels owing to negative operating leverage, eventually are expected to rise materially but there may be a significant shortfall relative to levels that might be assumed more normal peaks in previous cycles. I am sure you have participated in funding many other situations with similar concerns regarding “path to profitability” but given such a clear, and incredibly unequivocal, opportunity with respect to this situation, I am sure you can visibly see the distinguishing characteristics. I know my time I have left is nearing, and I can tell by your expression you seem as excited as I am to do this. So, how many shares should I put you down for?!” Chapter 2, Nightmare Land On February 25th , The Walt Disney Company announced it would hold a conference call after the market close, to detail CEO Bob Iger’s decision to step down, and the immediate transition to new CEO Bob Chapek, previously head of the company’s Park’s business. As Disney, and Iger, had always been quite transparent regarding the fact there was a very analytical, logistic-based process regarding succession, the CEO change announcement was a surprise in the context of its immediacy, and on the heels of its recently held conference call on February 4th to discuss 1Q20 earnings. Last April, Disney held a long-anticipated investor day to detail its new streaming offering, Disney+, which has been by all accounts a huge success to-date. Iger’s leadership and impact on the transformation of Disney over the past 15 years is without question a storied success. What lies ahead for a company founded by the most infamous Imangineer, possessing many global touch points, and perhaps serves a parallel for the challenges faced currently by the broader global economy, is detailed in its recently filed 8-K. The excerpts below highlight the severity of the virus’ contagion across its business, underscores the speed at which it hit, as well as offering one prognostication regarding potential changes in consumer behavior: “The impact of the novel coronavirus (“COVID-19”) and measures to prevent its spread are affecting our businesses in a number of ways. We have closed our theme parks; suspended our cruises and theatrical shows; delayed theatrical distribution of films both domestically and internationally; and experienced supply chain disruption and ad sales impacts. In addition there has been a disruption in creation and availability of content we rely on for our various distribution paths, including most significantly the cancellation of certain sports events and the shutting down of production of most film and television content. We expect the ultimate significance of the impact of these disruptions, including the extent of their adverse impact on our financial and operational results, will be dictated by the length of time that such disruptions continue which will, in turn, depend on the currently unknowable duration of the COVID-19 pandemic and the impact of governmental regulations that might be imposed in response to the pandemic. Our businesses could also be impacted should the disruptions from COVID-19 lead to changes in consumer behavior. The COVID-19 impact on the capital markets could impact our cost of borrowing. There are certain limitations on our ability to mitigate the adverse financial impact of these items, including the fixed costs of our theme park business. COVID-19 also makes it more challenging for management to estimate future performance of our businesses, particularly over the near to medium term.”—The Walt Disney Company, 8K, 3/19/20

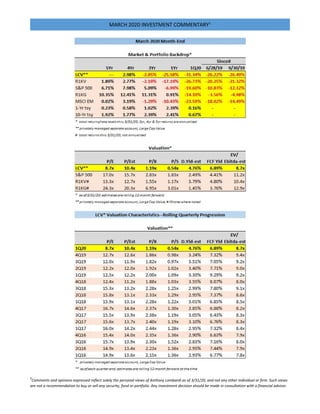

- 4. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 Transfiguration from Odette to Odile Having attained valuation levels for which we had grown increasingly concerned, the market’s underlying fundamental drivers, notably revenue/profit growth & sustaining margins, had their work cut out entering 2020. Forward P/E’s for S&P 500, Russell 1000 Growth and Value Indices had expanded to ~18x, ~23x & ~16x. A negative event was likely to have a notable market impact, a “Swan-event” would prove more severe. By curtain’s close to 1Q20, markets and economies had been exposed to an entire lake and 24x7 socially connected societies went virally anti-social. Fortunate to attend Feb. 14 opening of Balanchine’s masterpiece at NYC Ballet, and see a very special friend perform the lead, the desolate loneliness felt by Prince Siegfried served an eerie parallel. Our long-standing optimistic view was being deconstructed as our guard had increasingly been up during past 1 ½ years. As highlighted in prior commentaries, not only had multiples expanded but valuation disparities continued to materially diverge. Entering 2020 there was an 11-point multiple gap in trailing P/E, a greater-than 6-point gap in P/B and a near 3-point gap in EV/EBITDA, disparities that are pinned on relatively high aggregate multiples. While only one part of a broader mosaic, such data points have increasingly served to drive our intense focus upon capital protection measures in our portfolio actions during the past 1 ½ years. Despite such moves, we did not escape the wrath in 1Q20, and the underperformance in our portfolio returns were magnified. While remaining near fully invested, meaningful composition changes have been made as we continue actively desensitizing cyclicality where appropriate, been laser-focused on cheapening portfolio and undeterred in utilizing process-permitted cash levels to solidify MOS. Our process prism, for which we view dynamic mosaic to crystalize our vision and portfolio positioning, remains unaltered. As we have for three decades we vigilantly listen--to the market, macro backdrop, sector & company news flow, and corresponding swings in investor psychology. At the core, the market is a discounting mechanism, and we remain vigilant as to where pendulum swings at any given point. As noted in past, cumulatively, such swings serve as building blocks in our constant assault seeking out opportunities for entry into, and exit from, investment positions. Most importantly, as inoculated value investors, we place a premium on staying true to investment process with an unrelenting focus on MOS. With our typical investment horizon targeted at ~3-5 years, implicit in such a holding period is not simply low (cost) turnover, but a time-period integral to an investment discipline undeterred by short-term events and emotions. Given our process is contrarian, high- conviction, and concentrated, we need not scramble adjusting long-standing views, or portfolio positioning, due to weekly, monthly or quarterly events. We do, however, view the global pandemic-related events of 1Q20 as having material impacts on the 3-5year window, serving as an accelerant to underlying risks previously giving us concern, and emboldening existing themes. As part of our disciplined implementation, we overlay longer-term secular views pertaining to broader macroeconomic and market backdrop, resulting in active sector and stock exposures. The foundation of our disciplined process and philosophy does not allow for it to be radically altered, nor portfolio stock selection and sector allocation be impacted in same vein. Given investment backdrops do not formulate overnight, portfolio construction, in our opinion, should be result of broader mosaic that does not succumb to near-term emotions. Whether a function of near- or intermediate-term fundamentals, and/or investor psychology, our focus remains on recognizing, assessing and seizing upon opportunistic valuations, be they BUY or SELL. Inclusive of 1Q20, we like how our portfolio positioning has migrated over the past three years, unwavering on process discipline, and always mindful of the ever-evolving mosaic.

- 5. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 Portfolio Positioning & Review As noted in our prior commentary, given aggregate market and valuation levels, our guard remained up entering 2020, with a continued bias for liquidity and intensive focus on solidifying MOS. Notably, our target Cash level increased +50bps during 1Q20, with market value cash hitting an intra-quarter high of 6.1% during mid-March (similar to ~7% in late Nov-’19) as process and our value conscience dictated our actions. By quarter-end, juxtaposed against extreme volatility in the backdrop, out portfolio market value cash represented ~4%. Key sector target weighting reductions in IND and FIN, were partnered with sector target weighting increases in HC, CommSvc (Communication Services), TECH, UTE and ENE. As contrarians, entering 2020, our process and convictions led to an active reduction (-800bps) in our TECH sector weighting since 3Q18. Conversely, in addition to Cash build, we had been increasing targeted allocations to CommSvc and UTEs while patiently awaiting more compelling valuation in HC. Not only did we find opportunity to add to all three sectors in 1Q20, but we also reversed our long-standing bearish stance on ENE by moving to an overweight allocation. As noted in prior commentaries, long before COVID-19 related crisis, we chose not to ignore the stronger long-term performance experienced in our portfolio relative to benchmark, “…which coincided against broader equity market appreciation, select underlying valuation multiple expansion, and potentially more challenging forward earnings comparisons during the next two years (2020-21).” We continue to believe actions taken in the portfolio serve to reinforce a protective mindset, having reduced our near-term optimism yet remaining near fully invested. By prudently underscoring our focus on overall MOS, performance was served well during a volatile 2018 and, following our actions during 2019 and an unprecedented 1Q20, we continue to believe the portfolio is positioned well for 2020 and beyond. We are not concerned about relative underperformance during the past rolling one- year, as our focus remains on consistently executing our investment process, a long-term horizon, and risk/reward prism through which we are viewing. By consistently holding the hand of process, our contrarian value conscience is linked to an unemotional counterpart which allows for active, high-conviction portfolio decisions, which is continually remains a backdrop-agnostic exercise. Our LCV portfolio exposure remained allocated to 10 of 11 sectors. Despite several allocation changes, we remain emphasizing issues possessing compelling valuation, financial statement strength, and where near-term psychology serves to compensate for risk, providing the inherent MOS we seek when investing over a 3- to 5- year time horizon. Straying to own safety at any price has never been an acceptable paradigm as our value conscience and investment process simply will not allow us to pay any multiple for quality. We have always been hardwired, contrarian, value investors, conscious of risk factors, and continually viewing through a risk/reward prism, in active pursuit of opportunities providing the right balance. We seek companies offering a combination of cheapness, a contrarian view, possessing stable long-term balance sheets and attractive FCF characteristics. That said, we are never married to one view as valuations, sentiment and process drive our decision-making. By way of example, such patience paid dividends during 2H18 & 2019 as we felt the combination of our long-term time horizon and valuation compression in certain defensive areas hit risk/reward levels that became appealing. As opportunities present themselves, we have increasingly nibbled and reallocated our portfolio with a contrarian mindset. Despite having increasingly raised our cash target during the past several quarters, we are still finding, buying and remaining owners of cheapness, MOS and compelling free cash flow (FCF), while at the same time we are sellers when valuation criteria or process constraints are breached. While underlying performance suffered in 1Q20, patience and process rose to the surface as we the severity of the market decline made for opportunity. Specifically, target allocation decisions provide for increasing our Healthcare,

- 6. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 Communication Services, Utilities, Technology and Energy weightings, while reducing Industrials and Financial sectors via full position Sales and position weight reductions. In the aggregate, three new holdings were added during the quarter where pendulum swing created compelling opportunity. Such actions served to underscore our high-conviction, concentrated process and philosophy. Not only has deployment of investable capital in this manner been more acceptable to our contrarian, value-based discipline, but also in recognition that forward long-term returns are typically related to point-of-entry valuation multiples. When juxtaposed against our belief favorable long-term opportunities exist in the economy, and amongst companies we target, we remain steadfast in how we aim to position our LCV portfolio. Clearly, as evidenced by changes during the past two years, in conjunction with the broader macro backdrop entering 2020, we had not found such opportunities to be as vast, nor inexpensive as was the case 5-10 years ago. Dark clouds of 1Q20 served to reverse this trend and provide for an enhanced shopping list. Key Trades & Attribution We seeded our concentrated LCV strategy during the first quarter 2016. Since inception, as opportunities have been presented, we have made several active portfolio decisions, at both the stock and sector level. During 1Q20, notable actions included: Sector/Cash Target Weighting Changes: o Industrials (-) o Financials (-) o Healthcare (+) o Communication Services (+) o Technology (+) o Utilities (+) o Energy (+) o Cash (+) Position Target Weighting Changes & Rebalance Trades across several sectors: o Industrials o Technology o Consumer Staples o Consumer Discretionary o Communication Services o Energy o Financials o Healthcare o Materials o Utilities Three FULL position BUYs & SALES, five sector target weight changes. Our trend in activity level continued, underscored by the highest level of change since inception as the backdrop was altered in dramatic fashion. We have always remained steadfast in executing our investment process, for which we view as the unemotional adult in the room. During the quarter process forced sector changes and target position sales, however, we were

- 7. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 also presented with opportunities to accelerate actions we had previously been contemplating on our shopping list as valuations, fundamentals and sentiment adjusted materially. While our investment discipline is generally characterized by low turnover, when action is dictated by process, we execute accordingly—there is never hesitation with a stated process. We have repeatedly stated that we neither marry, nor fall in love with any stock or sector, nor attempt to justify going beyond embedded process constraints as reasons for portfolio exposures. Our target sector weightings are influenced by top-down and bottom-up views, while fundamentals, valuation and psychology drive stock level decisions. For the fifth consecutive quarter, we executed full position SALEs, while correspondingly initiating new target position BUYs for only the second consecutive time in six quarters. The “imbalance” in SALEs vs BUYs during the past several quarters has been due to a combination of higher Cash utilization given concerns about valuation and forward earnings, as well as increased allocation to existing target positions (given our conviction & sector views). The new BUYs and full SALEs in 1Q20 was amongst activity including changes to seven (7) sector target weightings and numerous rebalance (up and down) trades, cumulatively touching all ten (10) sectors for which the portfolio is exposed. Real Estate remained at 0% allocation (allowed by process), having made an active decision to eliminate exposure a year-ago (1Q19). Given previously stated views of the backdrop, we retained our bias for higher Cash and defensiveness (which includes valuation). During 1Q20, we lowered our target weightings in the Industrial and Financial sectors, while increasing Healthcare, Communication Services, Technology, Utilities and Energy exposures. Notably, the reduction in Industrials was driven in part by the ongoing decline in process-permitted allocation, as a host of large capitalization companies in the S&P 500 (led by Boeing) witnessed dramatic decreases in market value, serving to shrink the sectors relative capitalization. A dramatic, severe and rapid decline in interest rates, material degradation in slope of the yield curve combined with similar shrink in the sectors relative capitalization caused us to reduce bank-related exposure as well as sector target weight. Conversely, our previous moves to add target weight to Communications Services and Utilities sectors continued. Healthcare, for which we have patiently awaited valuation compression, presented selective opportunity and allowed for expansion of target sector weight. Within Technology we modestly increased exposure, reversing an 800bps reduction between 3Q18-4Q19. Lastly, and perhaps most notable, we reversed our long-standing negative position on Energy, moving to an OVERWEIGHT from UNDERWEIGHT, but underscore this is far from an all clear given we view the large cap opportunity set as relatively small in the context of the sector declining (intra-quarter) to the smallest market capitalization weight in the S&P 500. We would note that our bias to have kept Cash readily available during the past 12-18 months, in combination with a concentrated portfolio, were advantageous for executing a remix during the quarter as opportunities presented. Number of target positions held in our LCV portfolio remained 25, diversified across 10 of 11 sectors. Portfolio actions taken during 2018-2019 had tracked a more measured level, as we engaged in a paced modification to our long-standing optimistic stance. Decisions in the recent quarter, however, were accelerated due to dramatic change in the backdrop owing to COVID19-related economic shutdown. Speed aside, these portfolio moves remain founded upon our investment process for which we have long pre-telegraphed. Indicative of this migration is the combined underweight allocation to Healthcare and Consumer Staples, which stood at ~ -215bps at quarter-end, a vastly different level compared to nearly -1,200bps at the end of 3Q16; a shift that occurred through a combination of valuation compression and active allocation decisions. Further indication is presented by a -700bps reduction in our Technology sector weighting, from 22% to 15%, since 3Q18; a +500bps increase in

- 8. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 CommSvcs weighting, from 7% to 12%, since 4Q18; a +250bps increase in Utilities weighting, since 2Q19; current quarter reduction of -300bps in Financials (during Feb) and a +350bps year-over-year increase in Cast target, 1.00% to 4.50%. On a weighted average basis, the market capitalization of our portfolio holdings was $98.0 billion, a decline of 14% and 48% compared to prior and year-ago quarters, respectively. The decrease in capitalization reflects a combination of market declines, underperformance and portfolio allocation changes made in sector and target holding weightings during the past year. These changes are inclusive of full position sales and purchases, as well as our having had a bias to higher Cash levels. MOS remains our principal guide for which we are compelled by process to follow. Quarter-end target and market value weights for our LCV portfolio are detailed below, including comparisons to prior and year-ago periods for perspective on trends.

- 9. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 On market value basis, we ended 1Q20 with ~3.6% cash, up nearly 100bps vs 4Q19. Continuing a trend during 2019, our cash target weighting was raised to 4.5%, +50bps vs 4Q19 and +350bps vs 1Q19. Market value cash hit an intra-period high of ~6% during mid-March, comparable to ~7% late November, actions dictated by our process and value conscience. Recall, from a process perspective, our targeted cash range is designed to provide flexibility, to allow for repositioning within a highly concentrated, yet diversified portfolio. As noted, our LCV portfolio was comprised of 25 total equity positions at quarter-end. While we are long-term investors, we have a stated preference to monetize winners, and/or sell-down positions based on discipline, in so doing avoid placing capital at risk by simply holding investments as place-markers or allowing exposures to become excessive when selective rebalance is more appropriate. MOS is paramount and is critical in limiting potential downside. Holding a position that has attained valuation levels no longer representative of attractive risk/reward only serves to create undo diversification risk and is simply an unacceptable practice. With protection of capital a covenant we are unwilling to break, we firmly believe in utilizing process-permitted cash level when situations dictate, to adhere to this core investment principle. Similarly, significant rebalancing trades we have executed serve to protect capital in very much the same way. And, when process and valuation present opportunity, we look to not only reallocate capital but deploy excess cash levels accordingly. Such discipline is among several key distinguishing characteristics in our process. We simply have no penchant to manage a portfolio structured with individual positions not representative of our high convictions, and firmly believe in a concentrated list of holdings, yet one diversified across market sectors. As we have noted previously, with our sector band targets set at 0.5x to 1.5x respective S&P 500 capitalization weights, should a sector’s size fall materially below certain predefined thresholds our process further allows for optionality for a 0% sector target with redeployment of available capital into other sectors, or Cash. Recall we utilized this 0% optionality with the Real Estate sector during 1Q19, a lever which has been maintained. At quarter-end, the only sectors within this 0% optionality range were Materials and recent newcomer, Energy, given its precipitous decline in market capitalization representation. We have long been bearish on the Energy sector and end-markets, and actively maintained a material underweight in the portfolio. As detailed below, however, while not calling an all clear, our contrarian instincts led us to raise the Energy sector allocation of the portfolio to a process maximum overweight of 4.00%.

- 10. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 Investment Performance. For the March quarter, our LCV portfolio generated total return of -31.3% vs the Russell 1000 Value (R1KV) return of -26.7%, and broader S&P 500 return of -19.6%. For the rolling 1-year, our LCV portfolio generated total return of -25.6% vs R1KV return of -17.2% and broader S&P 500 return of -7.0%. This was the weakest absolute and relative performance quarter since inception, and one where the degree of hemorrhage was so great as to cause 3-year total returns of our LCV portfolio and the R1KV to fall below breakeven. Prior to 1Q20, since inception, the absolute total return of -11.5% in 4Q18 represented the portfolio’s weakest quarter, while the relative underperformance low was -3.0% in 2Q19. Compared to the R1KV, relative performance in 1Q20 was driven by Security Selection (~-670bps), with Allocation providing an offset (~200bps). Compared to the S&P 500, Security Selection detracted ~-1,095bps, while Allocation detracted another ~-80bps. For the rolling 1-year, our portfolio’s relative underperformance of ~-840bps vs R1KV was driven by weak Security Selection ~-1,180bps, offset by a contribution of ~+340 from Allocation. Compared to the S&P500, rolling 1-year underperformance of ~-1,865bps was driven principally by Security Selection and a modest incremental drag from Allocation. Despite materially weaker short-term relative performance, and a market environment characterized by significant volatility, our portfolio’s returns on a rolling 3-year and 4-year basis remained near parity with our primary style benchmark, the R1KV. However, as noted in prior commentaries, long-term preservation of capital has much more to do with avoiding absolute loss of capital than upside return participation. Most critical in our discipline has been a long-term historical ability to protect in downside market environments through an unrelenting focus on MOS and process. We have repeatedly underscored our radar having been up, amid growing concerns regarding valuation disparities and the forward earnings backdrop. Such concerns were acted upon during the previous 1 ½ years with active changes in portfolio allocation and target holdings. Despite such efforts, and adhering to our process, the magnitude and immediacy of events unfolding in 1Q20 lead to abrupt, unprecedented shutdowns of economies across the globe. Importantly, as illustrated by portfolio actions in 1Q20 we did not stand still, as we firmly followed our stated investment process. While disappointed with both absolute and relative performance in 1Q20, we remain humbly confident our process and execution will continue to prove beneficial over the long-term. Of note, since inception, in 11 of 16 quarters the R1KV has posted quarterly total return below 5.00%, to include the most recent hemorrhage in 1Q20. Our LCV portfolio’s cumulative underperformance for these sub-5.00% R1KV quarters totals ~-50bps, with the latest quarter responsible for detracting ~460bps, nearly 2/3 which was driven by two target positions. Our portfolio’s characteristics continue to reflect a disciplined, contrarian and value-oriented process. As illustrated in the tables on page one, staying mindful of general market valuation levels, and more importantly that of our LCV portfolio, has long remained paramount. Historically, the protection offered by the valuation discount in our portfolio versus our primary benchmark and the broader market has served us well during periods of market weakness, while also allowing for upside capture. Looking upon the investment backdrop during the past two years, our radar was dialed-up to the prospect of material, incremental valuation multiple migration in the broader market without corresponding fundamentals improving. As a result, we made increasingly active moves in the portfolio during 2018 and 2019, to solidify cheapness, as well as desensitize some cyclicality. As summarized above and detailed below, we made several changes in portfolio composition during 1Q20. Despite such efforts, the severity of 1Q20’s decline meaningfully detracted not only from the rolling 1-year, but significantly reduced the prior longer-term outperformance. Such capital loss occurred despite our LCV portfolio remaining materially cheaper across nearly every valuation metric, notably higher FCF & dividend yields, lower P/E’s (trailing & forward) and EBITDA multiples, and lower P/S and P/B compared to the broader

- 11. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 S&P 500 and R1KV, the latter our primary benchmark. At period-end, meaningful valuation gaps between our LCV portfolio and R1KV remained intact, with FCF yield and EV/EBITDA notable examples at ~+210bps premium and ~16% discount (vs R1KV), respectively. Given the immediacy of the global economic shutdown and subsequent negative impact on corporate and personal cash flows, our repeated concerns regarding certain valuation indicators were brought to the forefront. Specifically, we noted: “In lieu of the interest rate backdrop, and growing appetite by company managements to take on incremental financial leverage, we have continued to keenly monitor balance sheet trends, as well as EBITDA multiples.” Having first eclipsed 9x during 3Q18, our portfolio’s EV/EBITDA multiple hit a new high of 9.4x in 4Q19 and ended 1Q20 at 8.7x. Comparatively, however, our portfolio remains at a discount to both the S&P 500 and R1KV EV/EBITDA multiples of ~11.2x and ~10.4x, respectively at quarter-end. For several quarters prior to 2020 we had noted the continued valuation divergence between Growth and Value was attaining material levels garnering our attention, underscoring there was a valuation issue in the market BEFORE the COVID19 pandemic hit, economies were shut down, uncertainty and fear rooted, and massive global monetary and fiscal stimulus unleashed. From an attribution standpoint, 1Q20 underperformance was largely about Selection & Cash. Specifically, versus the R1KV, Security Selection and Allocation during the March 2020 quarter amounted to ~-670bps and ~+200bps, respectively. Energy, Technology and Real Estate were the most significant contributors in total attribution, while Consumer Discretionary, Industrials and Financials were the most significant detractors. By Allocation, Energy, Technology and Financial sectors had the largest positive attribution, while Utilities and Consumer Discretionary were the largest detractors. By Stock Selection, Health Care and Real Estate were the largest contributors, while Consumer Discretionary, Financials and Industrials were the largest drags. On an absolute basis, as was for the R1KV, all sectors in our portfolio posted negative returns quarter/quarter, led by Consumer Discretionary, Energy and Materials. By comparison, the negative return in the R1KV was led by Energy, Consumer Discretionary and Financials. Notably, nearly 85% of our underperformance vs R1KV was driven by CD, of which ~3/4 was due to 2 holdings. Our targeted cash position of 4.50% was up 50bps at end of 1Q20 vs 4Q19, as our bias for liquidity remained a compelling proposition in the context of our underlying concerns regarding valuations, the broader backdrop which was dramatically destabilized due to a global virus pandemic and our continued desire to have flexibility and cushion available. Intra-quarter, portfolio market value cash peaked at ~6%, the second highest since inception but within our permitted process range. Attribution due to maintenance of high cash level was material. For the full quarter our cash contributed ~+85bps given severity of the decline in our portfolio and the R1KV. Industrials: DECREASE weighting -500bps; 2 FULL position sales; 3 rebalance trades: 13.0%-->8.0% Along with TECH, CD and FIN, the IND sector has comprised a significant part of our portfolio’s cyclical bias. Although not as aggressive in reducing sector weighting as has been the case in TECH, we have acted during the past 12-18 months to reduce IND exposure through combination of target weightings and/or sales, serving to desensitize cyclical risks, particularly when viewed in context of increases we made to HC, CS, Comm Svcs, UTES and Cash targets. Notably, since inception, we have monetized several target holdings upon their attaining valuation levels that we found no longer compelling against alternative opportunities elsewhere, to include raising Cash levels. By way of example, position sales in IND in prior quarters include CSX (1Q17), EMR (3Q18) and JCI (3Q19). We temporarily increased IND sector exposure in 4Q19 through the purchase of a newly identified target holding that was a contrarian opportunity with compelling fundamental and valuation attributes. Notably, funds utilized for this purchase were derived from a combination of a partial reduction in

- 12. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 an existing IND target holding, as well as funds from the full sale of AAPL in 4Q19. During 1Q20 we returned to path of reducing cyclicality and abiding investment process, executing full position sales of Eaton Corporation (ETN) and Nielsen Holdings (NLSN), further cutting target IND exposure by -500bps. The transactions book-ended the quarter with the sale of ETN executed earlier in the period (Jan), while NLSN was sold later (Mar). While the change in sector weighting was significant, the reduction was driven by a combination of valuation, compelling alternatives (to include cash), investment process and related constraints. As we have previously noted our investment process provides for sector bands of -0.5x to +1.5x corresponding S&P 500 sector weightings. At year-end 2013, IND represented ~13% of S&P 500 market capitalization which subsequently declined to slightly more than 9% by year-end 2018. Over the course of 2019 and early 2020, the pace of IND’s decline in representation took on increasing severity, ultimately leading to a more precipitous decline during 1Q20. In prior commentaries we have called out this ongoing decline by underscoring compression in market value and events impacting some of the most significant companies in the sector. Such was the case in 1Q19: “…quarter was complete with a reopened, yet viciously bipartisan Capital, several weak global economic reports including a light (yet distorted) February US jobs report, churning yet unfinalized US-China trade negotiations, conclusion of a 2-year old Mueller investigation into 2016 elections, full-fledged Brexit chaos overseas, yield curve inversion across parts of the US term structure, black swan events impacting the largest industrial company in the S&P (Boeing) and, as the time clock on the first quarter was expiring, administration calls for Fed to execute a 50bp cut…”. ETN shares had materially underperformed on an absolute and relative basis during the 2-year period leading into our initial purchase. Specifically, compared to +10%, +7% and +4% for the S&P500, S&P IND Sector and Russell 1000 Value, ETN posted a negative total return of -20%. In terms of valuation, at time of purchase, ETN’s strong (BBB+ Fitch) balance sheet was joined by compelling multiples: 12.7x P/E, 13.4x P/Est, 1.3x P/S, 1.7x P/B, 4.2% Dividend Yield, 7.1% FCF Yield, 10.5x EV/EBITDA, low cap ex intensity (~3%) and long-term debt/cap < 35%. Sentiment on ETN was unfavorable, with 60% HOLD/SELL vs 37% BUYs and a 12-month price target ~15% above then current levels. At the time, we felt this global parts player, with good management, balance sheet quality, low capital intensity, favorable capital management, attractive FCF and margin profile was a compelling contrarian idea offering a neat fit with our desire for cyclicality, and our underweight in Energy. Since initial purchase, ETN outperformed the broader market, the IND sector and our primary Value benchmark. Specifically, ETN posted an annualized total return of 18.5% compared to 16.5%, 13.9% and 12.9% for the S&P 500, S&P Industrial Sector and R1KV, respectively. At time of sale, the shares reflected ~52% BUY vs 48% HOLD/SELL, a 12- month price target nearly double the level at time of purchase, 16.8x P/E, 17.6x P/Est, 1.9x P/S, 2.5x P/B, 2.9% Dividend Yield, 6.7% FCF Yield, 12.7x EV/EBITDA, cap ex intensity (~3%), long-term debt/cap ~ 33%, Net Cash $8 billion and a BBB+ credit rating. While ETN’s management had proven consistent, its valuation had not gone to extreme levels, nor was its balance sheet stretched in any manner, our broader concerns regarding economic and earnings deceleration in the forward outlook, combined with process driven constraints for the IND sector led to our fulling selling the position in late January; a transaction which proved fortuitous in hindsight. Like ETN, the shares of NLSN had underperformed on an absolute and relative basis during the 2-year period leading into our initial purchase. Specifically, compared to +19%, +21% and +17% for the S&P500, S&P IND Sector and Russell 1000 Value, NLSN posted a negative total return of -1%. We would also note NLSN meaningfully underperformed the S&P Media & Entertainment sub-Industry group’s 19% total return during the same

- 13. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 timeframe. In terms of valuation, at time of purchase, NLSN’s balance sheet was sub-investment grade (BB+), had 5-yr CDS spread of ~60bps, long-term debt/cap ~65% and net debt/EBITDA ~4x. Key valuation multiples were: 27.0x P/E, 15.5x P/Est, 2.3x P/S, 3.6x P/B, 3.0% Dividend Yield, 7.0% FCF Yield, 12.6x EV/EBITDA, and low cap ex intensity (~7%) due to nature of its business model. Sentiment on NLSN was moderately favorable, with 37% HOLD/SELL vs 63% BUYs and a 12-month price target ~20% above then current levels. At the time, we had recently sold a full position in CSX and, given the nature of its consumer measurement (Watch & Buy segments) and demand analysis business, we felt NLSN offered a unique diversification opportunity within the IND sector as it was better represented by classification amongst Media peers. Additionally, Media/Communication companies tended to operate at leverage ratios more comparable to NLSN’s vs those companies in the IND sector, as well as provide potential for relative MOS in the event of broader cyclical weakness. With assumption that management would be able to execute improvement in growth, margins and cash flow, combined with the previously noted diversification aspects, we found NSLN a compelling contrarian opportunity that could serve as a stealth offset to traditional cyclicality within IND. We were wrong, as NLSN failed to provide any meaningful turnaround traction, nor downside protection, despite the entry of new management, an activist investor and announced split of the company subsequent to an internal review (which included the option of a potential outright sale of the entire company). The final catalyst for executing the full SALE of NLSN was process constraints. The decline in NLSN share price during 1Q20 put its market capitalization below $5 billion, a level for which our LCV process seeks to be above. Given execution and MOS issues noted previously, our bias toward higher Cash levels, desire to maintain compliance of process at sector level, combined with market cap violation in concert with pending separation into two entities, we were compelled to exit NLSN at a material loss vs original point of entry. In addition to the above SALES, two other IND positions were rebalanced UP to target weights, one of which was done twice. Cumulatively, actions we took within the IND sector during 1Q20 comprised ~655bps of aggregate portfolio market value, the largest component of this allocation driven by the two full SALES. Compared to the S&P 500 and R1KV, our newly reduced 8% target weight allocation for IND at quarter-end represented an underweight of ~-20bps and ~-140bps, respectively. Financials: DECREASE weighting -300bps; 3 Target position reductions; 4 rebalance trades: 19.0%-->16.0% The FIN sector, along with TECH, CD, and IND has comprised a significant part of our portfolio’s cyclical bias. Unlike TECH where our actions to reduce exposure resulting in a sector weight well below the process maximum, our targets for FIN, IND and CD were at or near upper constraints. As to FIN specifically, our conviction level remained high entering 2020 as we viewed valuations compelling against healthy balance sheets and contrarian aspects for companies targeted for position holdings. By mid-1Q20, due to the voracity and speed of declines in levels and slope of yield curve, our level of concerned increased, more than previously, regarding interest rates and the potential macroeconomic signal they were sending. Additionally, a pronounced increase in Gold of 10% by late Feb, on top of its 22% climb in 2019 provided yet another data point in the mosaic. Given our experience, the two most pronounced risks for financial companies historically tends to be comprised of credit and interest rates. As to the latter, it is not so much the trajectory but the speed and volatility of sudden changes that present more severe risk management issues. With our radar already dialed up heading into 2020, combined with more recent experience of the GFC in 2008, we opted to execute an across-the-board reduction in our bank exposure within Financials during the final week of Feb, resulting in a decrease in our targeted FIN sector exposure of -

- 14. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 300bps. Given the balance sheet strength, capital management and Federal Reserve/Fiscal policy actions, we did not view the need to take incremental exposure reducing action. We were also mindful of process constraints in sector weight given FIN declined below 11% during 1Q20. Notably, prior to quarter end, a couple positions in FIN were rounded UP to target weightings. In total, we made 4 rebalance trades during the quarter, 1 DOWN and 3 UP. Cumulatively our actions in the quarter comprised ~510bps of aggregate portfolio market value. Compared to the S&P 500 and R1KV, our portfolio’s target weight allocation for FIN at quarter-end was an overweight of ~+505bps and an underweight of ~-525bps, respectively. Our newly lowered FIN target weighting of 16.0% was also process compliant to our maximum limit of 16.4%. Health Care: INCREASE weighting +300bps; 1 new BUY; 3 rebalance trades: 10.0%-->13.0% As we have reiterated for some time, we had viewed the HC sector as fundamentally unattractive in the context of our long-standing bullish view of macroeconomic and corporate profit trends. The issue has been more about valuation, and patiently awaiting opportunity to present itself. Underscoring this point was that entering 2020 it had been more than a year (3Q18) since we raised our HC sector weighting (+100bps to 10.0%). We noted, at the time, we were wading not diving into HC. That said, we always remain cognizant of all parts of our process. With the broad market hemorrhage in 1Q20, and our Cash level high, we moved decisively to seize upon opportunity with a new position BUY in HC. In doing so, we actively raised our HC target +300bps, utilizing funds made available from reductions in two cyclical sectors, FIN and IND. Given a new variable in the backdrop, the valuation, fundamentals and sentiment of our new HC target position fit neatly into key secular themes which we now believe to be compelling. At purchase, our new target holding had the following characteristics that are expected to provide downside risk mitigation: 11x P/E, 8x P/Est, 0.1x P/S, ~12% FCF Yield, ~7x EV/EBITDA est, long-term debt/cap > 70%, and a BBB-rated balance sheet. Sentiment on the shares was negative, with ~15% BUYs vs 85% HOLD/SELL, vs 70%/30% Buy/Hold-Sell 5-years ago. Estimated 12-month price target had also declined nearly ~35% during the past 5 years. While the B/S is more levered than we would typically prefer and the business model generates low operating margins, we believe potential changes in the backdrop could set the stage for material operating leverage during the next 3-5 years. In addition to our new target holding, we also rebalanced two HC positions to target weights, one UP and the other DOWN twice. Cumulatively, actions in HC represented ~520bps of aggregate portfolio market value. Compared to the S&P 500 and R1KV, our portfolio’s HC allocation remains underweight vs both benchmarks, ~-240bps and ~-250bps, respectively. Should additional opportunities present, ample headroom remains given our process would permit a maximum weighting in HC of 23.1%, vs our newly increased 13.0% target. Communication Services: INCREASE weighting +100bps; 2 rebalance trades: 11.0%-->12.0% Having raised our CommSvcs sector weighting in 1Q19, 3Q19 and 4Q19, we added further exposure by an additional +100bps in 1Q20. The latest increase puts our portfolio at a more material overweight vs process benchmark weight. The increased allocation to CommSvcs was funded through a combination of available Cash, and reductions in IND and FIN target weightings. As has been the case with previous increases, we believe the most recent target allocation serves to cheapen the portfolio, sustain defensiveness and MOS, while also underscoring our conviction by deploying all the increase to an existing target position. During the previous 12- 18 months, we have preferred to deploy increased capital toward the CommSvcs sector as compared to the Staples sector given the available opportunity set vs a more limited universe in Staples. Prior to the outbreak of the global pandemic, and subsequent economic impact, each of the three business models owned within

- 15. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 CommSvcs contributed secularly to our overall portfolio in various ways, combined with favorable balance sheet and cash flow attributes. Additionally, we believe our sector allocation provides defensive attributes, as well as leverage to participate in potential upside in the economy and markets. We are also mindful of the constitution of CommSvcs, which has in its formulation legacy Telecom, Media and Technology. Thus, our decrease in Technology sector weight must be juxtaposed against increased allocation in CommSvcs. In addition to the target weighting increase, we also executed two rebalance trades on the same holding during the quarter. Cumulatively, actions taken in the quarter comprised ~215bps of aggregate portfolio market value. At quarter- end, our target weighting in CommSvcs represented an overweight of ~+125bps and ~+340bps, compared to the S&P 500 and R1KV, respectively. Given our process maximum weight of 16.1%, there remains untapped headroom should opportunity present. Technology: INCREASE weighting +100bps; 1 new BUY; 3 rebalance trades: 14.0%-->15.0% For an extended period, we had been cyclically biased, with TECH amongst the most significant sector allocations providing related exposure in our LCV portfolio. During latter part of 2017 and much of 2018 we were active in reallocations and rebalances given material appreciation in position holdings, all which occurred in the shadow of the broader market’s growth-oriented rally. Beginning in 3Q18 through year-end 2019, we began a methodical, process-driven reduction in Technology (from 22% to 14%), executed via full SALEs of CA (3Q18, - 500bps), CSCO (2Q19, -300bps) and AAPL (4Q19, -300bps), offset by one new full position BUY (3Q18, +300bps). During 1Q20 we made further changes to our target TECH weighting that resulted in a net increase of +100bps, to 15.0%. Specifically, we reduced one existing target holding -100bps, while also seizing an opportunity to add a new position BUY, representing initial target position weight of +200bps. As was the case with our new target purchase in HC, this new TECH position was funded from existing Cash, which had been kept high to provide for increased flexibility and MOS. Available liquidity was the result of the aforementioned reduction to an existing TECH target holding, as well as reductions in two cyclical sectors, FIN and IND. Given a new variable in the backdrop, the valuation, fundamentals and sentiment of our new TECH target position fit neatly into key secular themes we believe will take on increased importance. At purchase, our new target holding had the following characteristics that are expected to provide downside risk mitigation: 12x P/E, 11x P/Est, 3x P/S, 4x P/B, ~4% Div Yield, ~9% FCF Yield, ~7x EV/EBITDA est, long-term debt/cap < 30%, and a AA-rated balance sheet. Sentiment on the shares was relatively neutral, with ~55% BUYs vs 45% HOLD/SELL, vs 60%/40% Buy/Hold-Sell 5-years ago. Estimated 12-month price target declined nearly ~15% during the past year and was 30% above current share price. Balance sheet and cash flow characteristics, capital management, prospects for EBITDA margin expansion combined with valuation give us comfort relative to the current backdrop, and during the next 3-5 years. In addition to the new position BUY and reduction of existing holding target weight, we executed three rebalance trades, rounding one DOWN to target twice and another UP. Cumulatively, our activity in 1Q20 represented ~405bps of aggregate portfolio market value. Compared to the S&P 500, our portfolio’s target weight allocation for TECH at the end of 1Q20 represented an underweighting of ~-1,050bps, although still a material overweighting of ~820bps versus R1KV. Our process compliant maximum weight for TECH was ~38% at quarter- end, increasingly highlights the valuation expansion that has occurred in the sector for which we remain quite mindful. Clearly, there is ample headroom in portfolio exposure, as well as cash on hand, should compelling opportunities present. As noted last quarter, we highlighted high multiple concentration issue within the sector. Updated for quarter-end, ~42% of the S&P 500 Tech sector market capitalization is comprised of 2 stocks, AAPL

- 16. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 & MSFT. An incremental ~9% of sector capitalization is represented by V & MA, which are not only high multiple stocks, but Financial-oriented business models classified within the TECH sector. Both experienced 30-40% declines in share price, intra-quarter peak-to-trough. Applying a 50% discount to the quarter-end weighting of the TECH sector (25.6%) results in an effective opportunity set much closer to our current target weight of 15%. Our radar has been dialed up for some time, well before the most recent COVID-19 related issues, the result of increasing concerns regarding broader market valuation. The duration of the global pandemic, and associated aftershocks, is likely determine the extent of impacts on business models across the broader market and economy. While TECH is viewed as “safe haven” we would not be so cavalier to assume mass disruption to customer end-markets, enterprise and consumer-alike, will not reverberate back through the food chain with some degree of negative consequence, as well as consideration for change in historical go-to market approach. Utilities: INCREASE weighting +150bps; 1 rebalance trade: 2.50%-->4.00% As noted in our December 2018 commentary, we believed our targeted holdings in Healthcare, Staples, CommSvcs, along with our Cash allocation, provided defensive attributes against our cyclical exposures in the portfolio. As previously noted, including 1Q20, we have raised our CommSvcs sector weight in four of the last five quarters. During 1Q20 we also raised our HC sector weight, and further increased our target Cash position. As to UTES, our process led us to make an active decision to increase sector exposure during 3Q19, and again in the most recent 1Q20 by an additional +150bps to 4.00%. As was the case in 3Q19, we again fully allocated the increased sector weight to our existing target position in UTEs. Given the UTE sector in the S&P 500 has continued to expand, ~3.60% at quarter-end, our implied process sector minimum has also risen, to ~1.80%. Although we had previously held a negative bias to UTEs exposure due to concerns regarding valuation, long term prospect for rising interest rates and more compelling opportunities elsewhere, our investment and thought process have driven changes in our upward allocation during past few quarters. Notably, the S&P 500 UTE sector has not only widened its spread over Real Estate in market capitalization, but also eclipsed Energy during 1Q20, to represent the 8th largest of 11 sectors. In addition to increasing our target position weight during the quarter, we also executing an additional rebalance trade UP on the same holding. Cumulatively our actions in 1Q20 represented ~130bps of aggregate portfolio market value. Combined with HC, CommSvcs, Staples and Cash, our combined “defensive” allocation comprised ~41.5% at quarter-end, which should serve to solidify aggregate MOS. At 4.00% target weight, our UTEs exposure represents an overweight of ~45bps and an underweight of ~-375bps compared to S&P 500 and R1KV, respectively. Relative to the S&P 500, the overweight is the first since portfolio inception. Energy: INCREASE weighting +100bps; 1 FULL position sale & 1 new BUY; 5 rebalance trades: 3.00%-->4.00% Amongst several actions, perhaps the most significant change in 1Q20 was the reversal in our long-standing bearish posture pertaining to Energy. While only an increase of +100bp in sector target weighting, the allocation was a notable decision, and builds upon rebalances UP during the prior quarter. Far from an all clear, in the face of fundamentals, sentiment, end-markets and psychology having attained levels more attuned to our long- standing bearish view, our action in 1Q20 not only removed our ENE sector underweight, but moved it to a process maximum overweight. Intra-quarter, ENE declined to the smallest S&P 500 sector as it was eclipsed by Utilities, Real Estate and Materials, and ended the period at ~2.7%. With the front-end WTI contract ticking briefly below $20, and the receding tide exposing the hemorrhage, the large cap opportunity set is defined by a handful of selective strength, for which we seized opportunity to upgrade to quality and an overweight stance.

- 17. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 To put our prior long-standing, high-conviction bearish view into context, we find the following set of facts a harsh reminder that investment process is key: In 2014, the peak for the front-end contract was ~$108/bbl. Peak 2014 market capitalization for HAL, BKR & OXY was $63 bil, $33 bil & $83 bil, respectively. That same year, HAL announced the failed $34 bil acquisition of BKR, in which a $3.5 bil breakup fee was paid to BKR. In 2019, OXY closed its $57 bil acquisition of APC, which was in a short bidding contest with CVX with the latter ultimately backing out. OXY loaded its balance sheet with debt to complete the APC acquisition, required additional costly financial backing from Berkshire Hathaway to avoid shareholder revolt, became locked in a battle with activists and subsequently has disrupted its C-suite. As of 1Q20, the front-end contract for WTI was nearly 82% below its 2014 peak, and the cumulative market capitalization of HAL, BKR and OXY was ~$27 bil. Lastly, BKR’s market capitalization was greater than HAL's by a factor of nearly 2x, with HAL's market capitalization declining intra- quarter to an amount equal to the break-up fee it paid BKR to exit its planned acquisition. As noted in the prologue of “Security Analysis”: “Many shall be restored that now are fallen, and many shall fall that now are in honor”. In a sector that has now shrunk to less than 3% and having been bearish for an extended period, we remain of the belief we don’t have to be heroes. As contrarians, however, we also believe a peak in pessimism might now be at hand. The hemorrhage has exposed weakness, as well as a finite set of high-quality large capitalization ENE opportunities, the latter a group of survivors who will likely be able to take advantage of the landscape even in a worst-case scenario. As we have for several years leading to this moment, our level of concern was based upon fundamentals and backdrop viewed over an ensuing forward 3-5 year investment horizon, with particular concern regarding negative balance sheet and cash flow dynamics, subsequent anticipated write-downs/impairments, and secular change all juxtaposed against a legacy oligopolistic market component that, while in decline, still has an impact. As we look forward over the next 3-5 years, with many of our concerns having played out, sentiment negative and market values depleted to a handful of higher quality large capitalization companies, we believe a more constructive stance is warranted. With a good amount of certainty, we would not expect survivors of the most recent hemorrhage, those now in “honor”, to fall into the trap of misguided capital deployment noted above. In contrast, they should manage to avoid and/or escape the “quintessential value trap” for which we have previously, and repeatedly detailed. In line with the above, we raised the target weighting of an existing ENE holding +100bps to 2.50%, while remixing a separate position through a full SALE and corresponding new BUY at a target weighting of 1.50%, equating to a 4.00% sector target. Despite having been correct with respect to our previous bearish stance on ENE, it did not come without pain given combination of process-mandated portfolio exposure and poor stock selection. As part of a barbell approach in an underweight ENE allocation, we purchased Apache Corp (APA) at inception with an initial target weight of 3.00%, a level which was twice-reduced during the course of inclusion in our LCV Portfolio given our bearish macro stance and process guardrails. At initial purchase, APA represented the higher beta part of our barbell strategy, possessing a BBB-rated balance sheet. APA was a $14.6 bil market cap E&P company, and was viewed as a compelling, contrarian opportunity. Among other attributes, APA was operating near free cash flow breakeven, had light debt maturities over the ensuing 2 years, possessed a unique business model and exposure versus the group, and was assumed to provide more attractive MOS & potential upside should capital projects result in favorable operating leverage. Production was mixed geographically: US (47%), Egypt (27%), North Sea (13%) and Canada (13%). APA shares had materially underperformed on an absolute and relative basis during the 2-year period leading into our initial purchase. Specifically, compared to

- 18. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 +10%, -29% and +4% for the S&P500, S&P ENE Sector and Russell 1000 Value, APA posted a negative total return of -49%. From a valuation standpoint APA possessed the following characteristics: trailing and 1-yr fwd P/E: NA, 2.6x P/S, 6.6x P/B, ~2.2% Div Yield, ~9x EV/EBITDA est, long-term debt/cap ~68%, and net debt/EBITDA ~5.5x. Sentiment on the shares was negative, with ~35%/65% BUYs/HOLD-SELL. Estimated 12-month price target declined ~35% during the preceding year and was a parity with the current share price. APA shares meaningfully outperformed the broader market and sector during 2016, the first partial year of ownership, generating a total return of +63% vs +17% and +32% for the S&P 500, Energy sector and R1KV respectively. During the ensuing 3-years ending 2019, APA shares materially underperformed as end-markets remained volatile and weak, and major capital projects failed to produce as anticipated leaving billions of dollars “in the ground” and subsequent impairment charges. Specifically, the shares generated a negative annualized total return of -24% versus +25%, -3% and 10% for the S&P 500, sector and R1KV, respectively. After an early 2020 rally of ~+30% in the shares, we rebalanced our APA position DOWN to its 1.50% target weighting in mid- January. This move was far from adequate in lieu of the near ~70% decline during the first two weeks of March, as the combination of global pandemic and Saudi-Russian spigot decisions crushed end-markets with excessive supply. The weak performance left the shares well below $5 billion market capitalization with a weakened balance sheet that drove cuts in capital expenditures and elimination of the dividend. The combination of a severe change in fundamentals and market capitalization that violated our process constraints led to our decision to exit APA. As discussed, the ongoing weakness in ENE was dramatically accelerated during 1Q20 due to impact of global pandemic’s effects on broader global demand, and breakdown of production negotiations between Saudi Arabia and Russia which resulted in a material supply flush. The swirl of events drove end-markets below $20, numerous operational and capital management pronouncements, and caused ENE sector market capitalization to plummet toward bottom of 11 S&P sectors. At this point, we seized the opportunity to remove our prior barbell, upgrade to quality and position portfolio’s sector exposure to a process overweight. During the 2-year period leading into purchase, our targeted new position underperformed broader market measures while outperforming relative to Energy sector. Specifically, compared to -4%, -55% and -16% for the S&P500, S&P ENE Sector and Russell 1000 Value, it posted a negative total return of -34%. At purchase, our new target holding had the following characteristics that are expected to provide downside risk mitigation: 10x P/E, 12x P/Est, 0.7x P/S, 0.7x P/B, ~8% Div Yield, ~10% FCF Yield, ~6x EV/EBITDA est, long-term debt/cap < 20%, 0.8x net debt/EBITDA and a AA-rated balance sheet. Sentiment on the shares was favorable, with ~73% BUYs vs 27% HOLD/SELL, vs 33%/67% Buy/Hold-Sell 5-years earlier. Estimated 12-month price target declined nearly ~20% during the past year and was 50% above current share price, although in a very fluid backdrop. Balance sheet strength, capital and operational management, cash flow characteristics, geographical and business segment mix, combined with valuation and sentiment gave us comfort relative to the current backdrop, and during the next 3-5 years. In addition to the full SALE and new BUY, we executed five rebalance trades across two position holdings, four UP and one DOWN to target. Cumulatively, actions taken in 1Q20 comprised ~580bps of aggregate portfolio market value. At quarter-end, our target weighting in ENE represented an overweight of ~+135bps and an underweight of ~-140bps, compared to the S&P 500 and R1KV, respectively.

- 19. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 Consumer Staples: No Sector weighting change; 3 Rebalance trades to target: 8.0% Following two consecutive quarters in which we reduced our target in CS, we held the weighting unchanged in 1Q20. Recall we utilized previous reductions to fund allocated increase to Communication Services. These prior two quarterly moves reflect continued recognition we will seek the most compelling value in the context of our fundamental views and investment process. Our current Staples sector target weighting of 8.00% remains below the maximum weighting of ~12% allowed per process, reflective of discipline and our belief, prior to the global pandemic impacts, that more valuation compression, and/or business model stress was possible. As we have noted in prior commentaries, CS has been among the most bruised defensive sectors given its representation in the S&P 500 was cut in half during the past decade, falling from 14% to less than 7% in 3Q18, before climbing back to 7.2% at 4Q19 and 7.8% at 1Q20. It’s this same degradation which began presenting some contrarian opportunity, for which we have continued to remain disciplined, patient and appropriately nibbled. In the wake of the global pandemic and related economic shutdown, consumer behavioral changes drove shifts from discretionary to staples categories, which was clearly visible in relative price performance. Specifically, during the month of March, the S&P 500 and Consumer Discretionary sector generated negative total returns of -12% and -13%, respectively, while Staples generated negative total return of -5%. During the quarter, we allowed process to dictate 3 rebalance trades DOWN to target weight, all on the same holding, a process which permitted funds to reallocated to Cash and other sectors where we were making active changes. Cumulatively, actions taken in the quarter comprised ~115bps of aggregate portfolio market value. Compared to the S&P 500 and R1KV, our portfolio’s target weight allocation for CS at quarter-end was an overweight of ~+20bps and underweight of ~- 255bps, respectively. Cons. Discretionary: No Sector weighting change; 2 Rebalance trades to target: 12.5% Along with TECH, IND, and FIN, the CD sector has comprised a significant part of our portfolio’s cyclical bias. During prior quarters, we have relied upon compelling valuation and contrarian instincts, seizing opportunity presented to execute rebalance trades in CD. We restrained our activity in CD during 1Q20 given concerns regarding immediacy of the global economic shut down tied to the global pandemic, and a preference to prioritize action in several other sectors such as HC, Comm Svcs, IND, FIN, ENE & UTEs. As the quarter closed, we were closely monitoring the backdrop and investment process constraints pertaining to CD, for which action would be likely during the ensuing quarter(s). As noted in prior commentary, holdings in the CD sector have been a significant source of attribution drag during the past year for which we are cognizant of the fundamental reasons. We also take comfort in our CD rebalances given we have peeled off select cyclical exposure elsewhere in the portfolio, as well as having raised target weights in defensive sectors and Cash. Of note, CD was the sole cyclical sector (TECH, IND & FIN) that did not have a weighting or position change in 1Q20. Cumulatively, our action in the quarter included rebalance trades on two positions, one UP and one DOWN to target weighting, comprising ~80bps. At quarter-end, our sector target allocation represented an overweight of ~+270bps versus the S&P 500 and ~+735bps versus R1KV. As with TECH, our process compliant maximum weight for CD at quarter- end had headroom for additional portfolio exposure given an upside limit of ~15%. We also remain quite mindful that AMZN comprises nearly 40% of the ~10% aggregate market capitalization weighting in the S&P 500 CD sector. Thus, our CD target weight is quite full adjusting for this one name. Furthermore, risk level for several consumer facing business models most likely increased with a degree of permanency during 1Q20, for which determining what type of environment will ultimately constitute “a new normal” will likely take more than a couple quarters to assess. Behavioral and financial aspects are in play for both consumers and businesses alike.

- 20. ¹Comments and opinions expressed reflect solely the personal views of Anthony Lombardi as of 3/31/20, and not any other individual or firm. Such views are not a recommendation to buy or sell any security, fund or portfolio. Any investment decision should be made in consultation with a financial advisor. MARCH 2020 INVESTMENT COMMENTARY1 Materials: No Sector weighting change; 2 Rebalance trades to target: 3.0% Given its market capitalization representation in the S&P 500, we have had one position holding in Materials (MAT) sector since inception. Compared to the S&P 500 and R1KV, our portfolio’s target weight allocation for MAT at quarter-end was an overweight of ~+55bps and an underweight of ~-115bps, respectively. At less than 3.0% weighting in the S&P 500, the MAT sector presents optionality in our process to have 0% exposure, for which we have not exercised since inception. During 1Q20, we executed two rebalance trades UP to target weighting on the one MAT holding. Cumulatively, our actions taken in 1Q20 comprised ~65bps of aggregate portfolio market value. Two sectors now with target allocations at 3.00% or lower as Energy & Utility weightings were increased Given targeting weighting increases to Energy and Utilities sectors during the quarter, our portfolio has just two of eleven sectors retaining target weightings of 3.00% or less: Materials (3.00%) and Real Estate (0.00%). Weightings in all sectors remain in alignment with our broader investment views, expected backdrop, and, process discipline and constraints. Our portfolio actions have been in line with our commentary from 2Q19: “with our radar remained dialed up, our inclination remains one which is more likely to result in further moderation in our cyclical exposure should contrarian opportunities continue to present in traditionally more defensive sectors, implying that most of these sectors, ex-UTEs, are unlikely to be targeted for increased weighting. Cash allocation could also continue to play a part in such moderation.” We subsequently noted last quarter that in addition to Utilities, another member of the 3% club might well be a candidate for increased allocation: “…the ongoing multi-year hemorrhage in ENE has played out in line with our expectations, to the point our contrarian instincts have been piqued on a selective basis.” During 1Q20, we executed upon these contrarian instincts, and remained within our process guidelines. Cash target: INCREASE +50bps; in line with bias to MOS and flexibility: 4.0%-->4.5% As noted in our June 2018 commentary, we believed building cash an appealing position heading into 3Q18. During 4Q17, 1Q18 and 2Q18, our actions led to consecutively higher portfolio liquidity at the end of each period but in the context of no target weight change to cash. In 3Q18, however, we started down a path of active decisions to increase our portfolio’s cash target, +100bps to 2.50% from 1.50%. During 4Q18 we maintained our target at 2.50% but brought it down in 1Q19 given the late December sell off. With the strong 1H19 market rally and corresponding expansion in valuation multiples, we again took the opportunity in 2Q19 to solidify aggregate MOS in our portfolio with an increase in Cash target to 3.00% from 1.00%. During 4Q19, we further raised our Cash target +100bps, to 4.00%, funded in part by a -300bps full SALE in APPL and corresponding reduction in our TECH sector target weight. In the most recent quarter, we made further changes to overall portfolio composition that netted a reduction to cyclicality and increase in our Cash target to 4.50% from 4.00%. From a market value perspective, our Cash level was 3.6% at quarter-end, versus 2.8% at the end of December. We believe our actions and targeted Cash level continue to provide MOS and flexibility, in the context of a concentrated, 25-position LCV equity portfolio. We have exited several positions during the past four years. As we have detailed above and through past commentaries, process drove numerous changes in our portfolio. Detailed below is a summary detailing quarterly history of target positions which were exited since 1Q16: