2009 Best Practices In Transportation Part 2

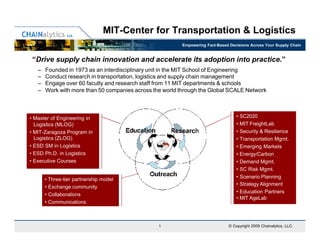

- 1. MIT-Center for Transportation & Logistics Empowering Fact-Based Decisions Across Your Supply Chain “Drive supply chain innovation and accelerate its adoption into practice.” – Founded in 1973 as an interdisciplinary unit in the MIT School of Engineering – Conduct research in transportation, logistics and supply chain management – Engage over 60 faculty and research staff from 11 MIT departments & schools – Work with more than 50 companies across the world through the Global SCALE Network • Master of Engineering in • SC2020 Logistics (MLOG) • MIT FreightLab • MIT-Zaragoza Program in • Security & Resilience Logistics (ZLOG) • Transportation Mgmt. • ESD SM in Logistics • Emerging Markets • ESD Ph.D. in Logistics • Energy/Carbon • Executive Courses • Demand Mgmt. • SC Risk Mgmt. • Three-tier partnership model • Scenario Planning • Strategy Alignment • Exchange community • Education Partners • Collaborations • MIT AgeLab • Communications 1 © Copyright 2009 Chainalytics, LLC.

- 2. Key Question Empowering Fact-Based Decisions Across Your Supply Chain What factors influence transportation rates and how much? Primary Business Sector (percent of membership) • Various methods are available . . . – Anecdotal Foods Consumer 19% Products – Survey 14% Durable – Econometric Modeling Goods Beverages 14% 16% Other 6% Industrial Whlsl/ Retail 11% Distrib 12% 8% • Econometric Modeling – requires lots of data – Annual data set contains >11M shipments for $11B in spend – 62 different companies varying in TL spend from $12M to $500M+ – Covers USA, Canada and in and out of Mexico – Equivalent to ~ 2.5% of the total North American intercity truckload market 2 © Copyright 2009. Chainalytics, LLC.

- 3. Econometric Modeling Empowering Fact-Based Decisions Across Your Supply Chain • Objective: – Develop an equation to predict the cost per load for TL freight, given characteristics of the freight • Technique: – Find the ‘best-fit’ line between all of the observations using Weighted Least Squares (WLS) Regression – Develop a “base model” – Test various policies, practices, and processes to capture impact • Complications: – We never know which characteristics are important – We can never capture ALL of the factors that influence cost – The relationships can be very complex – The data always have problems – some that are not easily fixed 3 © Copyright 2009. Chainalytics, LLC.

- 4. Testing Out Policy Impacts Empowering Fact-Based Decisions Across Your Supply Chain Is there a benefit to being “carrier friendly”? How do I even measure this? What if we try to capture the accessorial policy. Value Ranges Cost Impact Third Quartile First Quartile Range 1-3Q Responses Maximum Minimum Median Accessorial Units LHD LHR Power Unit Detention $/hour $ 23 $ 50 $ 52 $ 60 $ 80 $ 10 48 $ 4 $ (17) Drop Trailer Detention $/day $ 25 $ 25 $ 35 $ 50 $ 136 $ 25 29 $ 16 $ 73 Driver Assisted Loading $/event $ - $ 60 $ 75 $ 80 $ 100 $ 20 9 $ 23 X Driver Assisted Unloading $/event $ 60 $ 75 $ 75 $ 93 $ 125 $ 18 16 $ 22 X Driver Loading Wait Time $/event $ 45 $ 49 $ 50 $ 55 $ 70 $ 6 4 X X Driver Unloading Wait Time $/event $ - $ - $ 30 $ 50 $ 70 $ 50 11 X X Vehicle Ordered, Not Used $/event $ 100 $ 150 $ 238 $ 250 $ 300 $ 100 40 $ (10) $ 64 Layover $/event $ 150 $ 250 $ 275 $ 400 $ 500 $ 150 30 $ 14 $ (3) Redelivery $/event $ 20 $ 75 $ 113 $ 125 $ 225 $ 50 16 $ (9) $ (56) 1st Stop Off Charge $/stop $ 35 $ 60 $ 75 $ 90 $ 100 $ 30 36 $ 12 $ 57 2nd Stop Off Charge $/stop $ 35 $ 75 $ 100 $ 125 $ 175 $ 50 38 $ 22 $ 52 3rd Stop Off Charge $/stop $ 35 $ 100 $ 125 $ 156 $ 300 $ 56 36 $ 27 $ 61 4th Stop Off Charge $/stop $ 55 $ 113 $ 150 $ 213 $ 300 $ 100 23 $ 40 $ 24 5th Stop Off Charge $/stop $ 55 $ 100 $ 125 $ 175 $ 300 $ 75 13 X X 6th Stop Off Charge $/stop $ 55 $ 95 $ 138 $ 181 $ 300 $ 86 12 X X 7th Stop Off Charge $/stop $ 55 $ 95 $ 138 $ 181 $ 300 $ 86 12 X X Storage Fee $/event $ 25 $ 35 $ 40 $ 50 $ 100 $ 15 10 $ 18 $ 134 4 © Copyright 2009. Chainalytics, LLC.

- 5. Testing Out Policy Impacts Empowering Fact-Based Decisions Across Your Supply Chain • Individually, there is some limited rate impact – Hard to separate out each individual policy/charge – Potential for firms to have the same “footprint” • Looking at the collective effect – Shippers with charges consistently worse than the median = less friendly – Do these shippers tend to pay more or less in terms of line haul rates? Firms by Percentage of Accessorials & Policies > Median 16 Shippers with more than half of their Number of Firms 12 accessorials “worse” than median values 8 paid ~3-5% more per load. 4 0 0% 20% 40% 60% 80% 100% Percent of reported policies above the median 5 © Copyright 2009. Chainalytics, LLC.

- 6. Agenda Empowering Fact-Based Decisions Across Your Supply Chain • How should shippers procure transportation? • What impact do policies and practices have on rates? • How should a shipper handle fuel volatility? 6 © Copyright 2009. Chainalytics, LLC.

- 7. Predicting Fuel Prices Empowering Fact-Based Decisions Across Your Supply Chain • Delphi Study with ~30 Transportation professionals in April 2008 • What will the price of diesel be at the end of the next 4 quarters? Fuel Price Delphi - Round 2 (4/2/08) $4.50 Maximum Forecast Median Forecast $4.25 $4.00 Cost per Gallon $3.75 $3.50 Minimum Forecast $3.25 $3.00 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 1st Quartile max min 3rd Quartile Source: Chainalytics 2009 7 © Copyright 2009. Chainalytics, LLC.

- 8. US Department of Energy Empowering Fact-Based Decisions Across Your Supply Chain Energy Information Administration’s Outlook for 2009 (published June 2008) • According to EIA’s June 2008 Short-Term Energy Outlook, national average retail diesel fuel prices will peak in the third quarter of 2008 at $4.75 before falling to $4.11 per gallon by the fourth quarter of 2009 . . . However, the recent volatility seen in crude oil and petroleum product prices, if continued, may significantly alter these price projections.” Source: http://www.eia.doe.gov/bookshelf/brochures/diesel/ 8 © Copyright 2009. Chainalytics, LLC.

- 9. Fuel Price Estimates Empowering Fact-Based Decisions Across Your Supply Chain National Diesel Prices - 2004 - 2009 $5.00 $4.50 4/08 Shipper Estimates 6/08 US DOE Estimates $4.00 $3.50 $3.00 $2.50 $2.00 $1.50 04 05 06 07 08 09 04 05 06 07 08 4 5 6 7 8 05 06 07 08 09 -0 -0 -0 -0 -0 r- r- r- r- r- r- l- l- l- l- l- n- n- n- n- n- ct ct ct ct ct Ju Ju Ju Ju Ju Ap Ap Ap Ap Ap Ap Ja Ja Ja Ja Ja O O O O O 9 © Copyright 2009. Chainalytics, LLC.

- 10. We never learn . . . Empowering Fact-Based Decisions Across Your Supply Chain Source: Scenarios: An Explorer’s Guide, Shell International 2003. 10 © Copyright 2009. Chainalytics, LLC.

- 11. Fuel Impacts Empowering Fact-Based Decisions Across Your Supply Chain Change in Fuel Costs, Linehaul Costs, ALOH, and FSC Paid 200% 180% Percent Change from 10/1/07 160% 140% 120% 100% 80% 10/2/07 11/2/07 12/2/07 1/2/08 2/2/08 3/2/08 4/2/08 5/2/08 6/2/08 7/2/08 8/2/08 9/2/08 Week of Year ALOH ACPM DryFSCPaid Fuel ($/gal) Comparing each to the value as of 1 Oct 2007 – note that the FSC paid increased faster than the actual cost of fuel. 11 © Copyright 2009. Chainalytics, LLC.

- 12. Fuel Impacts Empowering Fact-Based Decisions Across Your Supply Chain Linehaul CPM versus Cost of Fuel over Modeling Time Period 14 JUL 08 $1.530 $1.520 1 OCT 07 $1.510 Linehaul Cost per Mile $1.500 29 SEP 08 $1.490 $1.480 Underlying Line Haul $1.470 Rates were modified! $1.460 No longer linked to fuel. $1.450 $3.00 $3.20 $3.40 $3.60 $3.80 $4.00 $4.20 $4.40 $4.60 $4.80 $5.00 Fuel Cost per Gallon Source: Chainalytics 2009 Each point represents the average line haul cost per mile plotted against the cost of fuel for that week – from Oct 2008 to Sep 2009. 12 © Copyright 2009. Chainalytics, LLC.

- 13. Fuel Impacts Empowering Fact-Based Decisions Across Your Supply Chain Fuel versus Linehaul Costs $1.70 Oct 2008 $1.65 Linehaul Cost ($/mile) $1.60 Oct 2006 July 2008 Nov $1.55 2007 Mar 2008 $1.50 $1.45 $2.25 $2.75 $3.25 $3.75 $4.25 $4.75 Cost of Fuel ($/gal) Longhaul Dry Van Longhaul Refrigerated Van 13 © Copyright 2009. Chainalytics, LLC.

- 14. Fuel Surcharge Programs Empowering Fact-Based Decisions Across Your Supply Chain Parameters for TL FSC programs: Effective Fuel Surcharge Programs: Base or Peg Rate – Threshold cost of fuel per gallon LHD: $1.238 Base with $0.058 Escalator and $0.01 Surcharge Escalator – Increase in fuel costs that triggers surcharge LHR: $1.240 Base with $0.054 Escalator and $0.01 Surcharge Surcharge – Amount paid to carrier in dollars per mile LHI: $1.258 Base with $0.066 Escalator and $0.01 Surcharge Impact of FSC Programs $0.80 FSC Paid to Carrier ($/mile) $0.70 $0.60 $0.50 $0.40 $0.30 $0.20 $0.10 $- $(0.10) $2.00 $2.25 $2.50 $2.75 $3.00 $3.25 $3.50 $3.75 $4.00 $4.25 $4.50 Cost of Fuel ($/gallon) Min 25th Median 75th Max 14 © Copyright 2009. Chainalytics, LLC.

- 15. Fuel Impact on Benchmark Empowering Fact-Based Decisions Across Your Supply Chain • How does a shipper’s FSC program influence line haul rates? – Two Schools of Thought: Compensating or Independent Line Haul = $1.20 FSC = $0.34 Line Haul = $1.20 FSC = $0.34 Shipper A: Line Haul = $1.26 FSC = $0.28 Line Haul = $1.20 FSC = $0.28 Shipper B: Shipper A = Shipper B Total Cost = $1.54 e sent as ping requests to other nodes. $1.48 Case 1: LH and FSC Compensate Case 2: LH and FSC are Independent • Previous Analysis – Prior to this model, FSC programs mainly varied with respect to the Escalator. – In Model 1 of 2008 we found that shippers with a $0.06 Escalator paid had higher line haul rates (~$0.125 per mile) than shippers with a $0.05 Escalator. – This year – there was greater variability across all dimensions. Direct comparisons of programs proved inconclusive. 15 © Copyright 2009. Chainalytics, LLC.

- 16. Conclusions Empowering Fact-Based Decisions Across Your Supply Chain • The more shippers expose in the Fuel Surcharge bucket the better off they are, in total rate paid – Keep the peg or base low – Keep the escalator in line with estimated fuel efficiency • The overall impact of your FSC program is only about 1%-2% of the total rate paid • Predicting the future price of fuel is futile – Create a fair FSC and stick to it 16 © Copyright 2009. Chainalytics, LLC.

- 17. Empowering Fact-Based Decisions Across Your Supply Chain Best Practices in Transportation Procurement Gary Girotti Vice President Chainalytics LLC Dr. Chris Caplice Executive Director MIT Center for Transportation & Logistics March 3, 2009 17 © Copyright 2009. Chainalytics, LLC.