Managing Accounts Payable_IOMA's Institute of Finance and Management September 2012

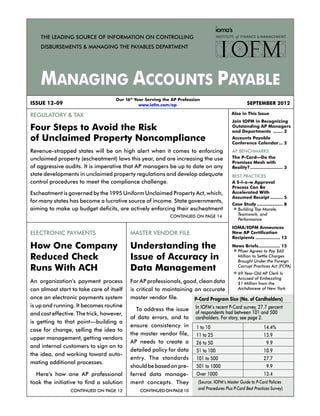

- 1. Our 16th Year Serving the AP Profession www.iofm.com/ap SEPTEMBER 2012ISSUE 12-09 CONTINUEDONPAGE10 Also in This Issue CONTINUED ON PAGE 12 ELECTRONIC PAYMENTS How One Company Reduced Check Runs With ACH An organization’s payment process can almost start to take care of itself once an electronic payments system is up and running. It becomes routine and cost effective. The trick, however, is getting to that point—building a case for change, selling the idea to upper management, getting vendors and internal customers to sign on to the idea, and working toward auto- mating additional processes. Here’s how one AP professional took the initiative to find a solution REGULATORY & TAX Four Steps to Avoid the Risk of Unclaimed Property Noncompliance Revenue-strapped states will be on high alert when it comes to enforcing unclaimed property (escheatment) laws this year, and are increasing the use of aggressive audits. It is imperative that AP managers be up to date on any state developments in unclaimed property regulations and develop adequate control procedures to meet the compliance challenge. Escheatment is governed by the 1995 Uniform Unclaimed Property Act, which, for many states has become a lucrative source of income. State governments, aiming to make up budget deficits, are actively enforcing their escheatment MASTER VENDOR FILE Understanding the Issue of Accuracy in Data Management For AP professionals, good, clean data is critical to maintaining an accurate master vendor file. To address the issue of data errors, and to ensure consistency in the master vendor file, AP needs to create a detailed policy for data entry. The standards shouldbebasedonpre- ferred data manage- ment concepts. They CONTINUED ON PAGE 14 Join IOFM in Recognizing Outstanding AP Managers and Departments ........ 2 Accounts Payable Conference Calendar.... 2 AP BENCHMARKS The P-Card—Do the Promises Mesh with Reality?......................... 3 BEST PRACTICES A S-l-o-w Approval Process Can Be Accelerated With Assumed Receipt.......... 5 Case Study.................... 8 l Building Top Morale, Teamwork, and Performance IOMA/IOFM Announces New AP Certification Recipients................... 13 News Briefs................ 15 l Pfizer Agrees to Pay $60 Million to Settle Charges Brought Under the Foreign Corrupt Practices Act (FCPA) l 69 Year-Old AP Clerk Is Accused of Embezzling $1 Million from the Archdiocese of New York P-Card Program Size (No. of Cardholders) In IOFM’s recent P-Card survey, 27.7 percent of respondents had between 101 and 500 cardholders. For story, see page 2. (Source: IOFM’s Master Guide to P-Card Policies and Procedures Plus P-Card Best Practices Survey) 1 to 10 14.4% 11 to 25 13.9 26 to 50 9.9 51 to 100 10.9 101 to 500 27.7 501 to 1000 9.9 Over 1000 13.4

- 2. 2 www.iofm.com/ap SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE MANAGING ACCOUNTS PAYABLE (ISSN 1080-5753) is published monthly for $437 per year by the Institute of Finance & Management, 1 Sound Shore Drive,Suite100,Greenwich,CT06830.Copyright2012.InstituteofFinance&Management,adivisionofManagementNetworks,LLC.Allrightsreserved. Aone-yearsubscriptionincludes12monthlyissuesplusregularfaxande-mailtransmissionsofnewsandupdates.Copyrightandlicensinginformation: It is a violation of federal copyright law to reproduce all or part of this publication or its contents by any means. The Copyright Act imposes liability of up to$150,000perissueforsuchinfringement.Informationconcerningillicitduplicationwillbegratefullyreceived.Toensurecompliancewithallcopyright regulationsortoacquirealicenseformulti-subscriberdistributionwithinacompanyorforpermissiontorepublish,pleasecontactIOFM’scorporatelicensing departmentat203-930-2705,ore-mailrd.whitney@iofm.com.PeriodicalspostagepaidatGreenwich,CT,andadditionalmailingoffices.POSTMASTER: SendaddresschangestoMANAGINGACCOUNTSPAYABLE,1SoundShoreDrive,Suite100,Greenwich,CT06830;203-889-4977;fax:203-622-1738; e-mail: andrew.fitzpatrick@iofm.com. To renew, e-mail andrew.fitzpatrick@iofm.com. Desktop Editor: MONIQUE NIJHOUT Director of Marketing: JIM SESTITO Chief Executive Officer: R.D. WHITNEY Research Manager: JOHN PITSIOS Editor-in-Chief, IOFM’s Accounts Payable Publications; Education Director, IOFM’s Accounts Payable Certification Program: PAM MILLER Editor: ELAINE STATTLER, APM Group Publisher: DAVID BECK Co-Chairman: WAYNE COOPER Co-Chairman: MARSHALL COOPER EDITORIAL ADVISORY BOARD DIANE YETTER President, Yetter™ KAREN ANDERSON Senior Compliance Advisor, Abandoned Property Services MARIANNE COUCH, ESQ. Principal, Cokala JON CASHER Senior Consultant, AP Advisory Services and Instructor AP Certification program; President, Casher & Associates Nominations for “AP Manager of the Year” and “AP Department of the Year” are now being accepted by the Institute of Financial Management (IOFM). The winners will be announced at the 11th Annual Accounts Payable 2012 Conference & Expo that will be held October 14 to 16 at Caesars Palace in Las Vegas, NV. This year, the Expo coincides with the celebration of AP Recognition Week, Octo- ber 15 through 19. This is the perfect time to recognize outstanding achievement by AP managers and departments—during the one week of the year when attention is officially focused on accounts payable. Accounts Payable Is the Unsung Hero of Many Organizations AP maintains its organization’s ability to continue functioning by ensuring that pay- ments for a myriad of goods and services are made accurately and timely. Join IOFM in recognizing the superb job that these individuals and groups do behind the scenes, generally with little or no recognition or appreciation. How to Participate Nominations for AP Manager or Director of the Year: These nominations are open to any current AP manager or director. Nominations may be submitted at thislink:https://www.surveymonkey.com/s/ S5P596M Nominations for AP Department of the Year: These nominations are open to any AP Department, no matter what the size. Nominations may be submitted at this link: https://www.surveymonkey.com/s/ FLGPPGP The deadline for submitting nominations is Friday, September 21, 2012, so submit your nominations now! q Join IOFM in Recognizing Outstanding AP Managers and Departments IOFM’s 11th Annual Accounts Payable 2012 Conference & Expo, Oct. 14-16,Caesars Palace, Las Vegas, NV. For more informa- tion, go to www.iofm.com/conference/view/apconf12. IOFM/TAPNAccountsPayableTraining&CertificationProgram, live online video class via WebEx. Sept. 12. For registration, contact Andrew Fitzpatrick, at 203-889-4977 or e-mail an- drew.fitzpatrick@iofm.com. IOFM Form 1099 Bootcamp & Certification Training Class, Las Vegas, Oct. 14. For registration, contact Andrew Fitzpatrick, at 203-889-4977 or e-mail andrew.fitzpatrick@iofm.com. ACCOUNTS PAYABLE CALENDAR

- 3. www.iofm.com/ap 3SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE By Pam Miller Card issuers consistently extol the virtues of a p-card program—including its ability to drivedownthecostofprocessinginaccounts payable by decreasing the number of small dollar invoices, increasing convenience for the organization’s employees, and provid- ing the opportunity for the organization to obtain a rebate on the money spent via the cards. But do these promises hold true in real life? AP professionals responding to an IOFM survey about their organizations’ p-card programs answer this very ques- tion,andtheresultsarereportedinIOFM’s Master Guide to P-Card Policies and Pro- cedures, Plus P-Card Best Practices Survey. Who Responded to the Survey? Most of the respondents to the survey come from the finance side of their or- ganizations rather than the procurement side, so the study presents a clear picture of how a p-card program affects AP (see Exhibit 1). The survey respondents represent a broad spectrum of sizes of organizations, from the smallest through mid-sized, and even some very large organizations (see Exhibit 2). Thus, what the respondents reveal can be useful to organizations of virtually any size. NotonlydotheIOFMrespondentscome fromawiderangeofsizesoforganizations, their card programs run the gamut from very small to extremely large. As a result, the study offers a good representation of several varieties of p-card programs (see front page exhibit). Top Benefits Chosen Line Up with Card Issuers’ Promises IOFM asked the survey respondents to choose the top three benefits they derive from their p-card programs. Themost-oftenselectedchoiceofbenefit, with a sizable lead over all other mentioned benefits, is “reduction of AP processing AP BENCHMARKS The P-Card — Do the Promises Mesh with Reality? Exhibit 1. Respondents’ Titles (Source: IOFM’s Master Guide to P-Card Policies and Procedures Plus P-Card Best Practices Survey) 20.8% 19.6% 11.3% 8.9% 7.7% 7.1% 6.5% 5.4% 4.8% 2.4% 2.4% 3.0% 0% 5% 10% 15% 20% 25% AP Manager P-card Administrator Finance Manager Accounting Other Controller AP Specialist Procurement AP Other CFO Accounting Manager Asst. Controller Other Title Exhibit 2. Number of Employees (Source: IOFM’s Master Guide to P-Card Policies and Procedures Plus P-Card Best Practices Survey) 23.5% 31.2% 17.6% 21.2% 6.5% 0% 5% 10% 15% 20% 25% 30% 35% 5,000 or more 1,000-4,999 500-999 100-499 Up to 99 NumberofEmployees

- 4. 4 www.iofm.com/ap SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE costs.” This result indicates that one of the primary selling points card issuers use to encourageorganizationstoimplementcard programs is a credible one. IOFM’s AP pros areenjoyingsubstantialcostreductionsdue to their p-card programs. The way in which the p-card cuts costs is relatively simple—the p-card removes invoices from the AP process. When an employee uses the card to purchase goods or services for the organization, it not only increases convenience (the second most popular survey response), it enables the purchaser to place the order and make the payment at the same time. This means that invoices for those goods and services do not make it to AP. And since in many organizations use of the p-card is highly encouraged or even mandated, for small dollar invoices in particular, the sce- nario in which the cost to process an invoice exceeds the value of the goods or services purchased becomes a far less frequent event. Listed in third place (see Exhibit 3) is “re- bates from card issuer for usage,” but this benefit actually ties for second place with “increasedconveniencetobuyer”inIOFM’s 2012 survey. AP pros recognize that obtain- ing a rebate from the card issuer is a real and tangible benefit. While the amount of rebateavailablevariesconsiderablyfromis- suertoissuerandfromprogramtoprogram, rebates can be substantial, particularly for larger card programs. While the amount spent on the card is the primarydriveroftheamountofrebate,there are other requirements that must be met, such as: average transaction size, number of active cards, and how long it takes the organizationtopayitsmonthlyp-cardstate- ment. Ensuring that all the requirements are met is an important part of managing a card program. The third most frequently cited benefit (actually listed fourth on the chart because of the tie in the two listings before it) is “de- crease of Purchasing/PO costs.” While this is not an AP-specific benefit, adding this cost reduction to the one achieved in AP can save an organization a substantial sum. This benefit ties in with number two, or the increased convenience to buyer. Not only is the purchase and payment easily Exhibit 3. The Most Important Benefits of a P-card Program 2012 (Source: IOFM’s Master Guide to P-Card Policies and Procedures Plus P-Card Best Practices Survey) 73.3% 49.5% 49.5% 45.5% 22.8% 20.8% 15.8% 8.9% 8.4% 5.4% 0% 10% 20% 30% 40% 50% 60% 70% 80% Reduction of AP process costs Increased convenience to buyer Rebates from card issuer for usage Decrease of Purchasing/PO costs Faster purchase-to-pay cycle Enables us to extend payment terms (enhances cash flow) Detailed reporting Reduction in the number of suppliers Decentralized purchasing Reduced or redeployed headcount Exhibit 4. Annual P-Card Program Spending (Source: IOFM’s Master Guide to P-Card Policies and Procedures Plus P-Card Best Practices Survey) 8.6% 5.6% 7.6% 10.6% 27.8% 11.1% 10.1% 12.1% 4.0% 2.5% 0% 10% 20% 30% <$100,000 $100,000 to $249,999 $250,000 to $499,999 $500,000 to $999,999 $1,000,000 to $4,999,999 $5,000,000 to $9,999,999 $10,000,000 to $24,999,999 $25,000,000 to $99,999,999 $100,000,000 to $500,000,000 Unlimited P-CardProgramSpending

- 5. www.iofm.com/ap 5SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE and quickly accomplished, but the need to generate requisition and PO paper work is virtually eliminated, saving costs and time. As card issuers put it, a p-card empowers employeestogettheirjobsdoneeffectively. Since rebates are so driven by spend, a natural question is: Just how much spend- ing are our respondents putting on the card (see Exhibit 4)? The range of between one and five mil- lion dollars is the sweet spot for annual p-card spend at IOFM’s respondent or- ganizations, although it’s difficult to judge howsuccessfulp-cardprogramsarebased on this monetary figure alone. It’s also important to understand—in order to have an idea of how well the program is working—just how much of the card’s eligible spend is actually going on the card. IOFM asked the respondents about this figure as well (see Exhibit 5). As you can see, the respondents’ p-card programs are capturing approximately 70 percent (68 percent on average) of the eligible spend. While this is a respectable number, it is clear that most respondents have room to grow their programs even more. And as they do so, the benefits of their program will grow as well. A well de- signed,implemented,andmanagedp-card program will indeed deliver on those card issuer promises. q Editor’sNote:Theinformationpresentedhere is just a sampling of what can be found in IOFM’s newly released manual, the Master Guide to P-Card Policies and Procedures: Plus P-Card Best Practices Survey. For infor- mation on how to order the guide, go towww .iofm.com/research/view/p-card-policies- and-procedures-master-guide. Exhibit 5. Actual P-Card Spending as a Percentage of Eligible Spending, by Program Size (Source: IOFM’s Master Guide to P-Card Policies and Procedures Plus P-Card Best Practices Survey) 68.4% 76.7% 64.9% 73.6% 62.0% 62.6% 69.0% 0% 20% 40% 60% 80% 100% 1 to 10 11 to 25 26 to 50 51 to 100 101 to 500 501 to 1000 Over 1000 NumberofCardholders BEST PRACTICES A S-l-o-w Approval Process Can Be Accelerated With Assumed Receipt By Pam Miller Waiting for an invoice to be approved can test the patience of any AP professional. After all, who knows better than AP how tardy approvals can hold up the entire pay- ment process? Not only does AP lose time waiting for invoice approval, AP may lose the opportu- nity to capture an early payment discount, whichwillultimatelyimpactthebottomline. That’s why the assumed receipt approval process can be such a boon to AP. It can help temperoneofAP’sbiggestheadaches—ob- taining the proper approvals for invoices in order to get them paid.

- 6. 6 www.iofm.com/ap SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE Dancing the ‘Hurry-Up and Wait’ Tango Waiting for an invoice approval can be- come something like a tango. The process usuallygoeslikethis:APreceivesaninvoice, enters it into a “received” log—or puts it into the system on hold—and then forwards it to the approver. Then AP waits. And waits. As the due date for the invoice approaches, AP calls the approver or sends a friendly reminder. And then, AP waits some more. During the wait, the vendor phones to ask when payment can be expected. So AP nudges the approver once again. Annoying for Everyone Involved Obviously, the invoice approval process can be enormously frustrating for everyone concerned. AP gets impatient with the ap- prover, the approver gets annoyed with AP, and ultimately the vendor resents having to track down the status of the payment. The truth is, while invoice approval is high on the list of priorities for AP, it barely makes top ten on the list of things to do for most approvers. That means an invoice can sit—andsit—untiltheapprovergetsaround to reviewing it. The invoice processing sys- tem breaks down because it is relying on a relatively disinterested party to perform a critical step. Moving Toward Assumed Receipt (or Negative Assurance) There is another way to tango. Instead of holding up the entire payment process waitingforaresponse,APcanmovetoanas- sumed receipt process, which is often called negative assurance. That way, payment is made without the traditional approval process—unless the approver indicates that the invoice should not be paid as is (or at all). With assumed receipt, the invoice is received and entered into the system with the proper payment date. The invoice is not placed on hold or flagged in any way to indicate approval is required to release the payment. The invoice or invoice copy is then forwarded to the approver. The pay- ment is released on the due date unless the approver specifically contacts AP to request payment be held or adjusted. This process is quite straightforward. It eliminates all the reminders and follow-up communication with the approver, results in far fewer vendor calls looking for pay- ment, and is likely to increase the number of prompt payment discounts AP can capture. Determining the Code There are a few obvious downsides to this process. For example, there is the issue of invoice coding. In many organizations, cod- ing invoices occurs as part of the approval process. Setting the invoice up for payment prior to obtaining the codes and approval means AP must determine the code. Thisisnotasdifficultasitmayseem.Many AP departments routinely enter generic codes into the system prior to requesting invoice approval. But instead of entering a generic or miscellaneous code, the code based on the goods and services listed on the invoice would be entered instead. While charts of accounts are often long, detailed,andcomplex,mostinvoicesfallinto just a handful of commonly used codes. It is relatively easy to create a simplified chart for AP’s use that includes the most common codes. Historic information in the system can help determine the proper code to be used when an invoice doesn’t appear to fit into any particular code. If an invoice is coded to the wrong cost center—or is not split as the approver would desire—a correction would be required.

- 7. www.iofm.com/ap 7SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE However,whilenumerouscorrectionscould put a damper on AP efficiency, the likeli- hood of mass corrections is not very high. Paying in Error What if AP pays an invoice it shouldn’t pay? Or what if it pays an invoice amount as stated even though it is the wrong amount? Although it might seem that the risk of payment errors would increase if AP did not receive approval before issuing the payment, the fact is that it increases only slightly. One of the responsibilities of the approveristoensurethattheinvoiceisvalid and that AP is paying the proper amount. In most cases, the approver does contact AP prior to payment, which enables AP to make the required correction prior to pay- ment being issued. In the cases in which a payment does go outinerror,acorrectionwillberequired.AP may find that the number of debit memos might go up if it is overpaying vendors more often. But the rate of increase is again likely to be small. Processing Exceptions Moving from a process that requires numerous approvers to provide feedback on every invoice to a process that requires approver feedback on just a few invoices on an exception basis greatly simplifies the approval process and eliminates time- consuming back and forth. A change in process also offers the op- portunity to change the manner in which exceptions are handled. Instead of sending invoices(orcopies)allovertheorganization, the fact that all the invoices are immedi- ately entered into the system offers AP the opportunity to stop circulating the invoices and start circulating a report instead. Many systems have reports that could serve this purpose. For those that don’t, customizing a report—or even writing a new report—is a relatively inexpensive project. It’s far easier to review a report on a regular basis than plowing through a stack of invoices that show up at various times during the day. Using Discretion: It’s Not a Matter of All or Nothing The assumed receipt approval process may not be a good fit for all invoices. In- voices over a certain high-dollar amount or from strategic or troublesome vendors may still require approval prior to issuing payment. However, most invoices that flow through AP are candidates for this process, as the dollar amounts are relatively low, the ven- dors are used repeatedly, and the goods or services provided are routine. Changing the Approval Process Presents No Big Risk The“approvalbeforesystementryorpay- mentissuance”processisnotasbulletproof as we might think. Many approvers’ review processes are cursory at best. So the ques- tion to ask is: What are we really gaining by requiring this preapproval? And what would be lost by changing to the process whereweassumethegoodsorserviceswere received and proceed to issue payment? Sometimes the best assurance is negative assurance—which is the “no news is good news” approach! q Editor’s Note: Pam Miller is Education Di- rector for IOFM. To learn about other best practicesforstreamlininginvoiceprocessing, attendIOFM’sAccountsPayableConference & Expo, Oct. 14-16 at Caesars Palace in Las Vegas, and look for the session: “AP Univer- sity: Best Practices in Invoice Processing.” To register for the conference, go to: www.iofm .com/event/apconf12.

- 8. 8 www.iofm.com/ap SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE BUILDING TOP MORALE, TEAMWORK, AND PERFORMANCE Bymakingchangesinresponsibilitiesanddepartmental structure and practices, this growing company discov- ered that a more cohesive, cross-trained AP department couldhandlestaffingsituationsandanyotherchallenges that came along. Here is how the company, National Oak, achieved its AP goals. Debra L. Nielsen, AP Supervisor, CAPA, APM, oversees an eight-person AP department for National Oak Distributors, Inc. (West Palm Beach, Fla.), a ware- house distributor for the PBE (Paint Body Equipment) industry. The company has been in business for over two decades and has more than 400 employees. National Oak Distributors, Inc. is a wholesale distribution company that services the automotive refinishing market and related industries. “Our suc- cess depends on working together harmoniously as a team to help accomplish our goals,” says Nielsen. There are currently seven people on the AP staff, plus Nielsen. Six are full-time accounts payable as- sociates (APAs) and one is the office administrator. “Of the six APAs, two are certified,” she says. The Challenge When Nielsen started with the company in 2009, there were 10 payables staff members, and yet AP’s open-invoice report had more than 5,000 entries. Multiple vendor payments were past due, and the de- partment entered only approximately 40,000 invoices in the year. Part of the problem was that the AP department was highly segmented. “Only one staff member was inputting invoices, while all the others were coding invoices.Thatmadeitdifficulttocoverforpeoplewhen someone needed to be out or extra tasks needed to be done,” says Nielsen. “Also, the one staff member who was entering invoices was only entering invoices that had a due date of the next day,” she says. “All in all, communication was lacking, and morale and teamwork were not where they needed to be for the staff to perform at their best.” The Solution Nielsen and her supervisor, Accounting Manager Karen Fielden, CAPA, recognized that in order to im- prove staff management, AP needed to immediately take the following steps (which will also work for most AP supervisors): 1. Retrain and cross-train AP employees. “We stopped coding invoices, and everyone learned how to enter invoices. Also, in order to take advantage of early-pay vendor discounts, we made sure that invoices were entered as soon as they were ready,” says Nielsen. 2. Designate accountability for specific loca- tions. “Staff was made accountable for specific Na- tionalOakDistributorlocations.Wehave14warehouse locations around the United States, and they are now divided among the APAs, who are responsible for all invoices, credits, and employee expenses for their respective assigned locations. The focus is on quality, and they make sure the errors are minimized, the invoices are in on time, and the locations are happy,” says Nielsen. 3.Teamupwithpurchasing.“Wemadesurethat the purchasing department and the payables depart- ment began sitting down in the same room together todiscusspertinentvendorinformation,”saysNielsen. “It helps associates to put faces with the names of the purchasing staff. When people have met and talked, they work together better. It is much harder to be mad at someone you have met and like, than if you have only corresponded via e-mail. The meetings build teamwork between the two departments.” 4. Establish and track performance metrics. Nielsen began to quantify the parts of the workflow processthatneededimprovement,andshedocumented where staff training was needed. “Each person now has individual goals and achievement levels set at the beginning of the year, as well as department goals to achieve,” says Nielsen. 5. Make it a priority to certify AP staffers. Neilsenprovidedtrainingsothatherstaffcouldbecome certified. “I currently have two certified staff members on staff, and three more are ready to take the test. I plan to have the entire accounts payable department become certified so we can achieve continuous im- provement in all we do,” says Nielsen. 6. Offer basic accounting training. “We began training AP associates in ‘Accounting 101’ so that they couldunderstandwhathappensoutsideofourAP‘box.’ Once employees understand accounting processes and learn which general ledger accounts to use, they pay more attention to ensuring that good information goes into the general ledger, so good information can come out of it,” she says. 7.Holdone-on-onemeetings.“Wenowdedicate at least one hour a month for what I call ‘one-on- one’ meetings. This is the time associates can discuss such things as challenges they are experiencing with AP MANAGER’S CASE STUDY

- 9. www.iofm.com/ap 9SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE AP MANAGER’S CASE STUDY a particular vendor, questions on how to create or manage a spreadsheet, or issues they are having with their individual locations,” she says. “These meetings are very important because with previous manage- ment, employees did not get this kind of personal attention. It also helps me take the temperature of the department, so I know what is happening within each location.” 8. Assign higher level responsibilities and change staff titles accordingly. “We changed staff members’ titles from ‘clerk’ to ‘associate,’ because we were asking them to make decisions on invoices, speak with the vendors, and manage the payables process. These duties were more of an ‘associate’ than a ‘clerk’ level. The title change built self-esteem and professionalism in the department, because the staff realized that management recognized the level of decisions they were making and actions they were taking,” says Nielsen. 9.Recognizeexcellentperformance. Eachyear, all the AP staff members are recognized during “Ac- counts Payable Week” in October. This shows them that the company recognizes the hard work and the effort that is put into running a smooth department. “Gifts, breakfast, lunches, and cake are always a big hit,” says Nielsen. The Results “When we closed this last fiscal year, in June 2012, our open-invoice report had approximately 700 entries, we had eight payables staff members, and no past-due vendors. In addition, the department entered more than 70,000 invoices during the year.” Nielsen also reports measurable benefits within the department in terms of morale, confidence, and efficiency. The AP department has improved substan- tially in terms of: • Skills and performance; • Vendor relations (because invoices are paid on time); • Timely reconciliation of statements each month; • Accuracy (and the ensuing trust from senior man- agement) in the reported numbers; and • A more streamlined workflow process. Lessons Learned Through making changes in responsibilities and departmental structure and practices, Nielsen discov- eredthatamorecohesive,cross-trainedAPdepartment can handle any staffing situation that comes along. “Forexample,recentlyastaffmemberhadtogoout on medical leave for three months. During that time, there was a scheduled AP expo with the purchasing department as well as an annual audit and a quarterly audit from our bank,” says Nielsen. “We were able to adjust and have staff coverage throughout these events.” “Another time, one employee abruptly quit, one went on medical leave, and one was terminated. Consequently, we needed to hire and train new employees. We were able to survive and function ef- ficiently during all these hurdles. Not only that—we became a stronger department for it,” says Nielsen. Advice for Other AP Professionals The key element in good management is com- munication. “Talk to your staff about their concerns, ideas, questions, thoughts, and issues,” Nielsen ad- vises. “Also, listen to them. They are in the trenches and can tell you things that you had no idea were happening.” “While it’s true that your staff has to conform to what you decide, they will understand and receive your decisions much better if you allow them to take part in the decision-making process,” Nielsen points out. “If employees feel valued, then their performance output is going to be better,” she says. In addition, get to know your staff personally. Ask them about what is going on in their lives and remember those things later. “You spend a lot of time with these people, and it is helpful to occasionally talk about something other than work,” says Nielsen. “Just make sure to steer clear of personal subjects that employment law precludes supervisors from discussing. For example, it’s fine to ask an employee how she enjoyed her vacation, but not what church she attends. (Talk with your company’s HR experts if you are in doubt about what topics are off limits.) Above all else, be flexible with your staff. “Some- thing is always going to happen to throw you off—that is part of life, and part of AP. When you are flexible with others, you stand a better chance of getting flex- ibility from them in return,” says Nielsen. Editor’s Note: IOFM is offering three certification programs. At the Accounts Payable Conference & Expo being held October 14-16 in Las Vegas. An AP Certification Training Class and Exam is being offered, as well as a 1099 Bootcamp and Certification Training Class and Exam. For more information, contact andrew .fitzpatrick@iofmonline.org.

- 10. 10 www.iofm.com/ap SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE also should be compatible with Internal Revenue Service and U.S. Postal Service standards. And, of course, they should be compatible with the features of your par- ticular accounting software. “Thebestapproachtodatamanagement is to establish and maintain top-grade data quality from the start of the data entry pro- cesstotheend,withusersfollowinginternal data quality standards as they input and updateinformation,”saysWilliamMcKnight, president of McKnight Consulting Group in Plano, Texas. The 15 Best Practices of AP Master Vendor File Data Entry While not every AP department will be able to adopt all of following best practice recommendations, any concerted effort to eliminate variations in data entry will lead to fewer errors in the file. Here are some helpful tips drawn from IOFM’sCompleteGuidetoAPBestPractices: 1. Avoid punctuation. Periods, com- mas, slashes, hyphens, and ampersands may seem insignificant, but their effect on a master vendor file can be enormous. These marks are common triggers of du- plicate vendor entries. If your software is not set up to require punctuation, don’t use punctuation at all. Compile a master list of vendor abbreviations. 2. Determine the use of upper and lower cases. Some accounting systems are case sensitive. This means that the system would not flag as duplicates the same vendor name entered in all upper case and then in mixed upper and lower case. To avoid this situation, establish rules about case and enforce them relentlessly. 3. Use dropdown boxes. It helps data consistencywhenstaffersenteringthedata can select from a pre-established list as opposed to entering data free-form. 4. Makeapolicyaboutinitials.Some vendor’s names contain initials. Eliminate the punctuation if you can. The choice of a standard for initials is arbitrary. But what- ever standard you use, communicate it to data entry staff, and make sure it is used consistently. 5. Drop all titles. The use of personal titles (Mr., Ms., Dr., etc.) can get compli- cated—especiallyforinternationalvendors. As a best practice, titles should be dropped from the master vendor file. 6. Make rules for ‘the’ and ‘a.’ These areproblematicbecauseitcanbedifficultto ascertain whether they are officially part of the vendor’s name. For companies that use the IRS TIN/name matching system, every effort should be made to use the vendor’s official name, even if it begins with “The” or “A.” If possible, a listing that begins with “the”shouldbeindexedorcross-referenced to the same company’s name without the article, so that data entry personnel can locate the correct record, even if they begin to key in an invoice using the shorter ver- sion of the name. 7. Develop a policy for ‘and’ and ‘&.’ When the word “and” occurs in a vendor’s name, it’s common in data entry to use an ampersand (&) in its place. However, keep in mind that as with the word “the,” you need to use the word “and” if it is part of thecompany’sofficialnameandyouusethe IRS TIN/name matching system. Similarly, you need to use the ampersand if it is part of the official name. The AP staff should be instructed to use the ampersand only when it appears on the vendor’s letterhead or other official documentation and never to substitute the symbol for the word “and.” 8. Use name of taxing authority. Invoices for state and local taxes can have Data Management Accuracy CONTINUED FROM PAGE 1

- 11. www.iofm.com/ap 11SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE all sorts of names. The official name of the jurisdictionshouldbeenteredasthevendor name.Anyinformationthatisnecessaryfor correct delivery, such as the department name, should be added on a second line elsewhere in the address. If the name of an individual in the department or agency is not absolutely required, it should be omit- ted from the master vendor file. 9. Be wary of governmental enti- ties. Cities and states are among the most common duplicated vendor entries in most vendorfiles,primarilybecauseyouarelikely to pay many separate entities within them. How exactly this is handled will depend on how your system handles entities with multiple remits, but a decision needs to be made and the policy followed consistently. 10. Be judicious with the use of the second line. Use of the second line for vendor name information can cause dif- ficulties down the line, so you want to reserve the use of it for occasions when it is truly necessary—when the lack of the information contained in the second line would cause a problem. 11. Manage multiple remits. Many vendors require that payments be sent to multipleplacesdependingonvariousrules. Some accounting systems allow multiple remittance sites for each vendor, and some donot.Ifyoursystemallowsmultipleremits, use them. If it does not, you will need to be particularly careful that the vendor name is entered identically for each remit. Be sure that everyone in AP understands how multiple remits work, stress the importance of verifying that both the vendor and the remit are correct when entering invoices into the system, and review these vendors regularly for errors. 12. Establish rules for entering ad- dresses. It is important that the address information in the file be accurate and as completeaspossible.USPSaddressingrules maybefoundinPublication28availableat: http://pe.usps.com/cpim/ftp/pubs/pub28/ pub28.pdf. Comply with the rules of other countriesaswell.TheUniversalPostalUnion can provide guidance at www.upu.int. 13. Establish rules for other fields. Telephone numbers should be entered consistently. Decide whether you want to use a period or a hyphen as a separator, or no separator at all, within the number. Yoursystemmaymakethisdecisionforyou. Also decide how you will enter taxpayer identifiers. Social security numbers have a different format than employer identifica- tion numbers. If you decide to eliminate hyphens from these numbers, you will not easily be able to tell what kind of TIN it is. Somesystemshaveseparatefieldsforeach type of TIN. You will need to determine how to use them. Make Your Policy Detailed and Comprehensive Include as many naming examples in your policy as you can think of in order to maintain data entry consistency, and add to this list as you encounter something new. The biggest trouble you’ll come across is if there has been no policy or education about the importance of naming conventions. Unless people are fully aware of the potential problems related to the naming of vendors, you will likely get a very strong negativereactionwhenyoutrytoimplement a policy. AP must educate its staff and the rest of the company as to why this is such an important issue. Youcan’texecuteadataentrypolicyhalf- way,andifyourpolicyisnotcomprehensive, you will leave the door open to allow for duplicate vendors or fraud. “The enforce- ment of business rules often conflicts with the desire to get the job done,” says David

- 12. 12 www.iofm.com/ap SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE Reducing Check Runs CONTINUED FROM PAGE 1 for eliminating volumes of paper invoices throughtheimplementationofACH,apro- cessinwhichsecureelectronictransactions are sent to bank accounts within the U.S. Checks, Checks and More Checks at Freese and Nichols “Paper check processing at my company was causing problems for the AP depart- mentandinconveniencesforvendors,”says accounting specialist Becky Baze, APS, of FreeseandNichols,aconsultingfirminFort Worth, Texas. “Checks were delayed—or on occasion lost—in the mail, making it necessary for AP to void and reissue the checks,” In addition, AP was processing four check runs per week. “It felt like we were processing checks eight hours a day, four days a week,” says Baze. AP spent at least 15 hours per week processing payments and getting the checks mailed. Movingtowardanelectronicsolutionwas a big undertaking for AP and the company. “We had been in business for more than 118 years, so making a major change re- garding payments was a big undertaking.” Here are the steps that Baze and her company took to implement their ACH program: 1. Educate yourself about automa- tion and the opportunities it offers. “AchievingmyAPCertificationempowered me and informed me. I had the knowledge and confidence to go to my controller and ask that changes be made,” she says. 2. Get your documentation ducks in a row. “Make sure you have all your documentation ready to show how much you can save your company in terms of time and money,” she recommends. “This will help you make your case to get the support you need.” 3. Present your case. “The first step was getting the controller on board for approval of an ACH process and a reduc- tion in the frequency of check runs. Once we got the controller’s approval for the changes,wewenttoourCFOforapproval,” says Baze. 4. Develop new specs and proce- dures.“APhadtocoordinatewiththebank to get the specifications we would need to get our accounting system in compliance,” Baze explains. “Then we worked with the IT group to get our security and account- ing program in compliance with the bank’s requirements for ACH.” AP also had to come up with a new payment procedure for the ACH process that had to be set up in such a way that the auditors would to be able to verify that AP was following the proper protocols. 5. Take an interdepartmental team approach. “AP worked with the controller and the CFO to implement the process,” says Baze. The group had to also select vendors to target and participate in the e-payment switchover, so they could get the ACH process up and running. Loshin, president of consultancy, Knowl- edge Integrity Inc. But the job of undoing incorrect data can be the most trying task of all. q Editor’s Note: To learn more about other best practices for managing the master vendor file, attend IOFM’s Accounts Payable Conference & Expo, Oct. 14-16 at Caesars Palace in Las Vegas and look for the ses- sion, “Managing the Master Vendor File.” To register for the conference, go to www .iofm.com/event/apconf12.

- 13. www.iofm.com/ap 13SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE Big Cost and Time-Savings Now that AP has gone to ACH payments and check runs once a week, AP spends aboutsixhoursperweekgettingcheckpay- ments together and mailed. The controller and CFO know what days they need to be available to sign checks, but they are sign- ing far fewer checks now than in the past. “This frees up their time for more important things,” Baze points out. “Thee-mailnotificationofACHpayment to the vendor results in substantial savings in time and money.” says Baze. “Our ven- dors are happier because they know when to expect payment.” Some Vendors Still Reluctant AP is currently working on getting even more of Freese and Nichols’s vendors set up on the ACH payment process. “Even though the ACH payments have been available for a while, there are still some vendors that are reluctant to receive their payments through ACH,” says Baze. IOFM recommends setting up an enroll- mentwebsitethatallowsvendorstoregister easily for e-payments. The site should also give vendors the ability to access and make changes to their online payment and re- mittance profile. Empowering vendors to easily report these changes helps prevent rejected payments. q Editor’s Note: Freese and Nichols, Inc. (Fort Worth, Texas), is a consulting firm that pro- vides services in engineering, architecture, environmentalscience,constructionservices, and planning. The firm has 15 locations and employs 525 employees. Becky Baze, APS, Accounting Specialist V, is a member IOFM, and has been in her current job for 19 years. Allegheny County Jeanne Manski, APM AMC Networks Anna Iannarone, APM Kathleen Stiene, APM Luisa Robles, APM Lynda Riheldaffer, APM Sara Bass, APM Amylin Pharm Annette Escobedo, APS ArmourEckrich Meats Michelle Rieder, APM Biomeasure Michele Lewis, APS Callanan Industries Joann Huckins, APS Carroll College Kari Weber, APM Central Washington Hospital Kathy Nystrom, APM Christus Health Anitura Joseph, APM Natonya Moore, APM Cooper Standard Automotive Inc. Rhonda Blickenstaff, APM Cross Country Healthcare Sharon Tilles, APS Davita, Inc. Brenda Kelsch, APM EMD Shared Services America, Inc. Sergio Valeiras, APM EnovaPremier, LLC Stacy Schultheis, APS Enterprise Products Co Mary Ford, APS Robert Govella, APS First Federal Bank Midwest Jennifer Hanna, APS Genpact Akos Varga, APS Balazs Eros, APS Deeksha Sehgal, APS Goodman Manufacturing Montaya.Victor, APS Hoosier Energy Amy Parrish, APM Tracy Monroe, APM Imaging Office Systems Aaron Sarber, APS Lemo USA Inc Cindi Le, APS LinkedIn Jung Park, APM Metropolitan St. Louis Sewer District Heather Davis, APS National Marrow Donor Program Linda Rustemis, APM Paula Fisher, APM San Diego State University Beth Dombrose, APS Siemens Product Lifecycle Management Soft Kathy Puckett, APS Syntel Inc. Ajeet Kumar, APS US Bank Todd Sweders, APM Vanguard Group, Inc. John D’Angelo, APM Karen Sanford, APM Michele Legrande, APM Parmashwarie (Ann) Singh, APS Susan Glasgow, APS Virginia Commonwealth University VCU Kelly McClurg, APM Thomas Smith, APM Congratulations to the AP Professionals Who Have Achieved Certification in the IOMA/TAPN Accounts Payable Certification Program in July. In July, the following AP professionals took the IOMA/TAPN one-day certification program and exam and earned an Accredited Payables Specialist (APS) certification (for key AP staff), or an Accredited Payables Manager (APM) certification (for AP department heads). For more information on the certification program, please contact Andrew Fitzpatrick at 203-889-4977, e-mail Andrew .fitzpatrick@iofm.com, or view our online video at www.iofm.com/products/view/accounts-payable-certification.

- 14. 14 www.iofm.com/ap SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE statutes, and are even deploying teams of contracted examiners and outside audit- ing firms to conduct audits. Since most unclaimed property is never claimed by its owner, organizations that don’t report the unclaimed property become a target. Unclaimed property must be reported to each state annually. The majority of states have a November 1 deadline, with March 1 being the filing date for another large group ofstates.Thesefilingsmustbedoneontime, since the states typically have a penalty for late filing (in addition to a fine for not filing at all). There are also rules for due diligence, which means there is a process you must go through to demonstrate you’ve made an effort to track missing payees. Many Organizations Are Poorly Equipped to Meet the Challenge Industry estimates indicate that just 20 percent to 25 percent of organizations are fully compliant with unclaimed property laws. If your company holds money or property that goes unclaimed for a specified period of time without the owner being located (the “dormancy period” is usually three to five years), that property must be “escheated” to the state government with jurisdiction. Filing annual reports to states is manda- tory. Not doing so will alert auditors and expose your company to payments to the state—plus interest and penalties. Manage Your Potential Liability Toavoidtheriskofincurringfines,APneeds to put in place the four following procedures for identifying unclaimed property and for complying with reporting requirements: 1. First, AP must identify what is un- claimed property and what is not. Many items that appear to be unclaimed are really the result of errors and omissions that need to be corrected. This identification process should be ongoing throughout the year. 2. The second task is following the proper requirements for the property thathasbeenidentifiedas“unclaimed.” As in other regulatory areas, the existence of written policies and procedures can help in an audit by indicating your intention to comply with regulations. 3. Third, research the states in which you do business. The unclaimed property regulations are different from state to state, and many states have recently shortened their dormancy periods. Go beyond tradi- tional items like uncashed checks, aban- doneddeposits,anddormantaccounts.And go far back into your records—there is no statuteoflimitationsonunclaimedproperty. 4.Finally,meetduediligencerequire- ments. This requires making a good faith effort to contact the owner/payee prior to reportingandremittingunclaimedproperty to the appropriate state. q Editor’s Note: To help you with your un- claimedpropertypreparationsandmaterials, a sample IOFM unclaimed property checklist can be downloaded from the following link: www.iofm.com/resource/view/escheatment- unclaimed-property-checklist. In addition, a due diligence letter can be downloaded from the following IOFM link: www.iofm.com/ resource/view/sample-due-diligence-letter. Toprovidecomprehensiveadditionaltraining on the topic, IOFM is presenting a special in-depth workshop entitled “Unclaimed Property:EvaluatingandMinimizingLiability” at the Accounts Payable Conference & Expo being held October 14-16 at Caesars Palace in Las Vegas, NV. To register for the confer- ence,gotowww.iofm.com/event/apconf12. Unclaimed Property CONTINUED FROM PAGE 1

- 15. www.iofm.com/ap 15SEPTEMBER 2012 MANAGING ACCOUNTS PAYABLE NEWS BRIEFS PFIZER AGREES TO PAY $60 MILLION TO SETTLE CHARGES BROUGHT UNDER THE FOREIGN CORRUPT PRACTICES ACT (FCPA) The Foreign Corrupt Practices Act bars publicly traded companies from bribing officials in other countries to get or retain business. Under the books and records provisions of the FCPA, organizations are required to “make and keep books, records, and accounts that accurately reflect the transactions and dispositions of the assets of the company.” Accounts payable professionals play a critical role in establishing the types of controls that will prevent individualsfromsubmittingandreceivingapprovalon false T&E requisitions. AP staffers are in a position to alert senior management about questionable reports and potentially save the organization thousands of dollars in fines and the loss of reputation. A FCPA case in point demonstrates the kind of T&E abuse that can be prevalent in FCPA cases. In the recent case, pharmaceutical giant Pfizer’s sales representatives tried to conceal their foreign bribes by recording them as business expenses for travel, entertainment, and marketing, reports the SEC. Federal authorities announced in early August that Pfizer will pay $60 million to settle charges that its employees doled out millions in bribes to doc- tors, healthcare workers, and other foreign officials in China, Italy, Russia, Croatia, and other Eastern European countries, report the Associated Press (AP) and CNN. The Securities and Exchange Commission (SEC) says that Pfizer paid the bribes to foreign govern- ment officials to boost sales and obtain regulatory approvals. “In China, for example, Pfizer employees rewarded government doctors who prescribed large amounts of the company’s drugs by inviting them to meetings with “extensive recreational and entertain- ment activities,” the SEC said. In Croatia, the agency said, government doctors received a portion of the proceeds from Pfizer’s drug sales to the doctors’ own institutions, reports CNN. Pfizer noted that there is no allegation that anyone at the company’s corporate headquarters knew of the conduct in question, which it voluntarily reported to the government. The SEC said the violations date as far back as 2001, and that Pfizer initially reported them in 2004, and cooperated with the government’s investigation. Pfizer neither admitted nor denied the allegations. 69 YEAR-OLD AP CLERK IS ACCUSED OF EMBEZZLING $1 MILLION FROM THE ARCHDIOCESE OF NEW YORK A “faithful and loyal” AP clerk was accused of embez- zling $1 million from the Archdiocese of New York in July. Although she was perceived as an exemplary employee,shehadbeenstealingfromthearchdiocese since she was hired in 2003. The archdiocese never did a background check when they hired her, authorities said, although it was on record that she had been convicted of grand larceny in 1999 for stealing from a previous employer. The AP clerk stole the money by sending the church false invoices, which she then paid by issuing 450 checks to bank accounts that she controlled. She was careful to only issue herself checks in amounts less than $2,500, since checks written above that amount required supervisor approval. What makes this case particularly surprising is that the fraud took place in a religious institution. The incidence of fraudsters in religious organizations is rather rare, according to the results revealed in The Association of Certified Fraud Examiners’ (ACFE) 2012 Report to the Nations on Occupational Fraud and Abuse. The ACFE reports that banking and financial services, government and public administration, manufacturing, and health care are most frequently victimized by fraud perpetrators. Industries suffering the largest median losses at the hand of fraud perpe- trators are mining, real estate, construction, oil and gas, banking and financial services, manufacturing, and health care. The study reveals that billing schemes involving accounts payable and vendors are the most prevalent fraud schemes, especially in organizations with fewer than 100 employees. “Losses are significantly reduced with the presence ofanti-fraudcontrols—controlslikehotlines,manage- ment review, mandatory vacation, formal fraud risk assessments, anti-fraud policies and surprise audits,” reveals the report. Interestingly, most perpetrators are first-time of- fenders with clean employment histories, and nearly halfofallorganizationsvictimizedbyfraudareunable to recover any of the money, reveals the study. To view the full study, visit www.acfe.com.

- 16. PERIODICALSMANAGING ACCOUNTS PAYABLE IOMA’s Institute of Finance & Management 1 Sound Shore Drive, Suite 100 Greenwich, CT 06830 MANAGING ACCOUNTS PAYABLE IOMA’s Institute of Finance & Management Membership/Subscription Department 1 Sound Shore Drive, Suite 100 Greenwich, CT 06830 MAP 12-09 BECOME A MEMBER TODAY! MAIL TO: Phone: 203-889-4977 or fax to: 203-622-1738 ❏ YES! I would like to join today. Membership includes 12 issues of MANAGING ACCOUNTS PAYABLE, 24/7 access to the AP information portal www.iofm.com/ ap, regular e-alerts, special $100 members discount on the 11th Annual Accounts Payable Conference & Expo, Oct. 14-16, Las Vegas, NV, plus discounts on research reports and Webinars, and 5 CEUs towards APM or APS certification renewal all for just $395, $100 off the regular $495 price*. ❏ YES! Send me the 2012 MASTER GUIDE TO FORM 1099 COMPLIANCE for just $395, plus $16.95 s/h (Report 12RA01) ❏ Enclosed is my check for $__________. ❏ Bill me/my company. ❏ Charge my: __Visa __MasterCard __ AMEX Card #: Exp. Signature: Tel.: ❍Home ❍Office Name/Title Company Street City State ZIP E-mail: Note: E-mail is required to provide you with access to the IOFM membership site. *By purchasing an individual membership/subscription, you expressly agree not to reproduce or redistribute our content without our permission, including by making our content available to non-subscribers within your company or elsewhere. 2012 Master Guide to Form 1099 Compliance 1099 reporting requirements continue to change! As closing the tax gap continues to occupy both Congress and the IRS, expect to see continued enforcement efforts designed to increase reporting by payers, increase the withholding of federal tax where required, and produce more accurate reporting of income by taxpayers. This completely updated guide will: • clear up confusion about exactly what was updated and what proposed changes were enacted • clarify which types of corporations must be reported, and which types are exempt from being reported • provideyouwithinformationonabigchangethatremains in effect for payments made in 2011 and 2012 through P-cards and electronic purchasing networks • provide advance information about changes the IRS will soon be making in the Forms W-8 and W-9 you use to document vendors and other payees • take the mystery out of this annual headache and will help you avoid increasing costly penalties. • give you the peace of mind that right on your desktop, organized in one place, is the help you need • save you time by guiding you through those thorny questions everyone gets and few people can answer, such as: »» Are you required to report payments to LLCs? »» What is your next step if a payee refuses to provide you with a Taxpayer Identification Number? »» What are best practices to ensure you do not expose your organization to substantial penalties? Order your copy today on the coupon to the left or call 203-889-4977 and ask for report 12RA01. Or, you can visit www.iofm.com/research/view/1099-compliance- guide-2012. You pay just $395 (plus $16.95 s/h). NEWLY UPDATED