Final govt. sec mkt

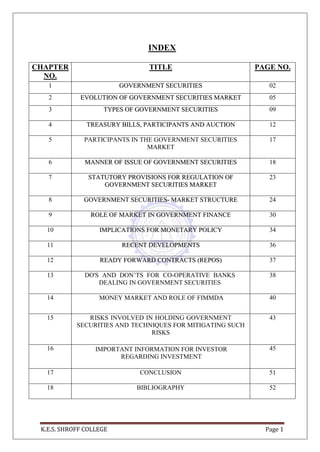

- 1. K.E.S. SHROFF COLLEGE Page 1 INDEX CHAPTER NO. TITLE PAGE NO. 1 GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS 02 2 EEVVOOLLUUTTIIOONN OOFF GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS MMAARRKKEETT 05 3 TTYYPPEESS OOFF GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS 09 4 TTRREEAASSUURRYY BBIILLLLSS,, PPAARRTTIICCIIPPAANNTTSS AANNDD AAUUCCTTIIOONN 12 5 PARTICIPANTS IN THE GOVERNMENT SECURITIES MARKET 17 6 MMAANNNNEERR OOFF IISSSSUUEE OOFF GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS 18 7 SSTTAATTUUTTOORRYY PPRROOVVIISSIIOONNSS FFOORR RREEGGUULLAATTIIOONN OOFF GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS MMAARRKKEETT 23 8 GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS-- MMAARRKKEETT SSTTRRUUCCTTUURREE 24 9 RROOLLEE OOFF MMAARRKKEETT IINN GGOOVVEERRNNMMEENNTT FFIINNAANNCCEE 30 10 IIMMPPLLIICCAATTIIOONNSS FFOORR MMOONNEETTAARRYY PPOOLLIICCYY 34 11 RREECCEENNTT DDEEVVEELLOOPPMMEENNTTSS 36 12 RREEAADDYY FFOORRWWAARRDD CCOONNTTRRAACCTTSS ((RREEPPOOSS)) 37 13 DO'S AND DON‟TS FOR CO-OPERATIVE BANKS DEALING IN GOVERNMENT SECURITIES 38 14 MONEY MARKET AND ROLE OF FIMMDA 40 15 RISKS INVOLVED IN HOLDING GOVERNMENT SECURITIES AND TECHNIQUES FOR MITIGATING SUCH RISKS 43 16 IMPORTANT INFORMATION FOR INVESTOR REGARDING INVESTMENT 45 17 CONCLUSION 51 18 BIBLIOGRAPHY 52

- 2. K.E.S. SHROFF COLLEGE Page 2 CCHHAAPPTTEERR 11 GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS Introduction The marketable debt issued by the Government and Semi-Government bodies which represents a claim on the Government is called Government Securities. It is also called as gilt-edged security. Government Securities are issued for the purpose of refunding the maturing securities for advance refunding of securities which have not yet matured, and raising fresh cash resources. Treasury Bills and Bonds are the examples of Government Securities. One of the important features of the Government Securities is that they are considered to be totally secured financial instruments. They ensure safety of both capital and income. Central Government Securities are the safest amongst all securities. Thus Government Securities are unique and important financial instruments in the financial market of any country. These securities are normally issued in the denomination of Rs.100 or Rs.1000. the face value, which was Rs.100 till the middle of 1980, was raised to Rs.1000 in the recent years. These instruments are liquid and safe and hence the rate of interest on these instruments is relatively lower. There are three forms of Central and State Government Securities. Stock certificate, Promissory note and bearer bond. Bearer bonds and stock certificates are not very popular in India Government Securities currently are in the form of Promissory notes. Government securities are issued by Central Government, State Government, Semi- Government authorities like Municipal corporations, Port Trusts, State Electricity Boards, Public Sector Enterprises and other Government agencies like IFCI, ICICI, IDBI, NABARD,SIDCS and Housing Boards. These agencies supply government securities and the demand essentially comes from banks, financial institutions and other investors. RBI plays an active role in the purchase and sale of these securities as a part of its monetary management exercise. There is no underwriting or guaranteeing required in the sale of Government Securities, as Reserve Bank of India is Policy-bound to buy a substantial portion of the loan unsubscribe by the public. Dealings in Government Securities are made through the mechanism provided by the Reserve Bank of India. The Brokers and Dealers are approved by the RBI who is eligible to deal in these securities. One of the important features of the Government Securities is that they offer wide ranging tax incentives to the investors. Therefore, these securities are popular in the market. Investors in these securities get tax rebate under the Income Tax Act. The Central Government securities have high profile of liquidity. However, state government and local government securities have limited liquidity. The government securities market in India has two segments, namely, primary market and secondary market. The issue of securities by Central and State Government constitute the primary market. The secondary market comprises the exchange of these securities by the

- 3. K.E.S. SHROFF COLLEGE Page 3 banks, financial institutions, insurance companies, provident funds trusts, primary dealers, individuals and Reserve Bank of India. The Public Debt Office (PDO) of the RBI undertakes to issue government securities. A notification for the issue of securities is made a few days before the public subscription is open. The opening of the subscription depends on the response of the market and varies between two to three days. The issue is made in a number of branches in order to avoid flooding of securities in the market. It facilitates smooth subscription to securities and helps to avoid sudden liquidity problems in the market. The offices of RBI and SBI receive applications for the securities. Government reserves the right to retain over-subscription up to a pre-specified percentage which is normally 10 percent in excess of the notified amount of issue. GOVERNMENT SECURITIES MARKET A market where the Government Securities are bought and sold is called Government Securities market. The securities are bonds, Treasury bills, Special rupee securities in payment of India subscriptions to IMF, IBRD, ADB, IDA etc. The special rupee securities are treated as a part of internal floating debt of the Government. These securities are issued by the Central Government, State Governments and Semi-Government Authorities, which include local Government authorities like City corporations and Municipalities, Port trusts, State electricity boards Public sector corporations and other agencies like IDBI, IFCI, SFCs, SIDCs, NABARD and Housing Boards. These agencies are suppliers of Government Securities and banks, financial institutions and investors demand these securities in the market. Government Securities offer a safe avenue of investment through guaranteed payment of interest and repayment of Principal by the government. They offer relatively a lower fixed rate of interest compared to interest on other securities. These Securities are issued in the denominations of Rs. 100 or Rs.1000. They have a fixed maturity period. Interest is paid half- yearly RBI Services loans as these are the liabilities of Government of India and the State Governments. These securities are safe and risk free. These securities are also eligible as SLR investments. As the date of maturity is specified in the securities they are also called as „dated government securities‟.

- 4. K.E.S. SHROFF COLLEGE Page 4 RBI plays a special role in the purchase and sale of these Securities as part of its monetary management exercise. There is no underwriting or guaranteeing required in Sale of Government Securities. Dealing in securities take place through the mechanism provided by the RBI. The brokers and dealers are approved by the RBI. A striking feature of these Securities is that they offer wide ranging tax incentives to the investors. Therefore, these securities are more popular. Under the Income Tax Act, rebates are allowed for the investment in these securities. Each sale and purchase has to be negotiated separately; the gild-edged market is an over-the-counter market. The Government Securities market has two segments namely Primary market and Secondary market. The issuers are Central and State Governments in the Primary market. The Secondary market comprises banks, Financial Institutions, Insurance Companies, Provident funds, Trusts, Individuals, Primary dealers and the RBI. The Securities of Central and State Government are issued in the form of Stock Certificate, Promissory notes and Bearer bonds. These Securities are mainly traded at Bombay Stock Exchange. In terms of Size, the primary market for Governments Securities is much bigger than the Industrial Securities Market. A notification for the issue of securities is made a few days before the Public subscription is open. The opening of the subscription depends on the response of the market and varies between two to three days. The issue is made in number of branches in a year. The offices of RBI and SBI receive the applications for the Securities. The Government, reserves the right to retain over subscription up to a pre- specified percentage which is generally 10 percent, of the notified amount. The mechanism of trading in Government Securities takes place through the Direct Sale, Securities General Ledger accounts and Bank Receipts method.

- 5. K.E.S. SHROFF COLLEGE Page 5 CCHHAAPPTTEERR 22 EEVVOOLLUUTTIIOONN OOFF GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS MMAARRKKEETT The genesis of the Government Securities market arises from the requirement of the Government to fund its deficit, which is primarily met out of borrowings. Thus, the level of deficit determines the amount of market borrowings by the Government. In almost all the developed countries, Government securities market is much wider and deeper than equity market. India, however, till recently was an exception to this trend and equity market still commanded a major share, as the Indian debt market was in its nascent stage. Pre-reform period Prior to liberalization of 1990s, the Government securities market was underdeveloped partly because of inefficient market practices and partly because of limited institutional infrastructure. Further, in order to keep the cost of Government borrowings low, the coupon rates offered on Government securities remained negative in real terms (i.e. after factoring in inflation) for several years till about mid-eighties. The Reserve Bank of India also had little control over some of the essential facets of debt management, like volume and maturity profile of debt and the interest rate structure. This, coupled with automatic monetization of budget deficit without any limits, prevented the development of a deep and vibrant Government securities market. A retail market for Government securities simply did not exist. With a captive investor base through Statutory Liquidity Ratio (SLR) prescription and interest below the market rate, secondary market for Government bonds remained dormant. Against the above backdrop and in the context of the overall economic reforms, development of the Government securities markets was initiated in the 1990s through carefully and cautiously sequenced measures within a clear cut agenda for primary and secondary market design. Post-Reforms Developments In the post reforms era, considering the significance of a vibrant Government securities market for activating internal debt management policy, a number of measures were introduced. One major step in the reforms process was the elimination of the automatic monetization of the Central‟s fiscal deficit by gradually phasing out ad hoc treasury bills, in 1997. A system of Ways and Means Advances (WMA) to the Central Government, subject to mutually agreed limits at market-related rates, was put in place instead, to meet mismatches in the cash-flows. Such phasing was necessary to permit the development of the money markets and for a credible benchmark rate to emerge. The RBI reserves the right to trigger floatation of fresh Government loans as and when the actual utilization crosses 75% of the limit, WMA does not acquire the cumulative character of ad hocs. This enables the RBI to accommodate the Government as its discretion and helps impose market discipline.

- 6. K.E.S. SHROFF COLLEGE Page 6 Features of Government Securities I. Governments of India Securities are sovereign debt obligations of Government of India. II. Government Securities, thus, is a constituent of national debt along with State Government Securities, Treasury bills and Government guaranteed bonds. III. The tenors of Government securities range from two to thirty years. IV. Coupons offered on Government Securities are either pre-determined by RBI or arrived through competitive bidding or auction process. V. Issues have varied from fixed semi-annual coupons and bullet redemption on maturity, to zero coupon bonds, floating rate bonds and also securities which are partly paid up at the time of the issue. VI. Coupons are fixed and paid out semi-annually to the holder of the security (except zero coupons). VII. Nomenclature: The coupon rate and year of maturity identifies the government security. Example: 12.25% GOI 2008 indicates the following: 12.25% is the coupon rate, GOI denotes Government of India, which is the borrower, and 2008 is the year of maturity. VIII. Eligibility: All entities registered in India like banks, financial institutions, Primary Dealers, firms, companies, corporate bodies, partnership firms, institutions, mutual funds, Foreign Institutional Investors, State Governments, Provident Funds, trusts, research organizations, and even individuals are eligible to purchase Government Securities. IX. Availability: Government securities are highly liquid instruments available both in the primary and secondary market. They can be purchased from Primary Dealers. X. Forms of Issuance of Government Securities: Banks, Primary Dealers and Financial Institutions have been allowed to hold these securities with the Public Debt Office of Reserve Bank of India in dematerialized form in accounts known as Subsidiary General Ledger (SGL) Accounts. Entities having a Gilt Account with Banks or Primary Dealers can hold these securities with them in dematerialized form. XI. Minimum Amount: In terms of RBI regulations, government dated securities can be purchased for a minimum amount of Rs. 10,000/-only. Treasury bills can be purchased for a minimum amount of Rs 25000/- only and in multiples thereof. State Government Securities can be purchased for a minimum amount of Rs 1,000/- only.

- 7. K.E.S. SHROFF COLLEGE Page 7 XII. Repayment: Government securities are repaid at par on the expiry of their tenor. The different repayment methods are as follows: 1) For SGL account holders, the maturity proceeds would be credited to their current accounts with the Reserve Bank of India. 2) For Gilt Account Holders, the Bank/Primary Dealers would receive the maturity proceeds and they would pay the Gilt Account Holders. 3) For entities having a demat account with NSDL, the maturity proceeds would be collected by their DP's and they in turn would pay the demat Account Holders. XIII. Day Count: For government dated securities and state government securities the day count is taken as 360 days for a year and 30 days for every completed month. However for Treasury bills it is 365 days for a year.

- 8. K.E.S. SHROFF COLLEGE Page 8 EXAMPLE A client purchases 7.40% GOI 2012 for face value of Rs. 10 lacs.@ Rs.101.80, i.e. the client pays Rs.101.80 for every unit of government security having a face value of Rs. 100/- The settlement is due on October 3, 2002. What is the amount to be paid by the client? The security is 7.40% GOI 2012 for which the interest payment dates are 3rd May, and 3rd November every year. The last interest payment date for the current year is 3rd May 2002. The calculation would be made as follows: Face value of Rs. 10 lacs. @ Rs.101.80%. Therefore the principal amount payable is Rs.10 lacs X 101.80% =10,18,000 Last interest payment date was May 3, 2002 and settlement date is October 3, 2002. Therefore the interest has to be paid for 150 days (including 3rd May, and excluding October 3, 2002) (28 days of May, including 3rd May, up to 30th May + 30 days of June, July, August and September + 2 days of October). Since the settlement is on October 3, 2002, that date is excluded. Interest payable = 10 lacs X 7.40% X 150 = Rs. 30833.33. 360 X 100 Total amount payable by client =10, 18,000+30833.33=Rs. 10, 48,833.33

- 9. K.E.S. SHROFF COLLEGE Page 9 CCHHAAPPTTEERR 33 TTYYPPEESS OOFF GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS Government of India (GOI) Securities is sovereign debt obligations/instruments. They are issued by Reserve Bank of India (RBI) on behalf of the Government to finance deficit and public sector development programs. Main Types: 1) Government of India Securities issued by Government of India. 2) State Government Securities issued by the state Governments. 3) Agency Bonds issued by Government agencies or public sector undertakings wherein the principal and interest are guaranteed by the Central Government or one of the state Governments. Government Securities are further classified in the following types: 1) Dated Securities: are generally fixed maturity and fixed coupon securities usually carrying semi-annual coupon. These are called dated securities because these are identified by their date of maturity and the coupon, e.g., 11.03% GOI 2012 is a Central Government security maturing in 2012, which carries a coupon of 11.03% payable half yearly. The key features of these securities are: a. They are issued at face value. b. Coupon or interest rate is fixed at the time of issuance, and remains constant till redemption of the security. c. The tenor of the security is also fixed. d. Interest /Coupon payment is made on a half yearly basis on its face value. e. The security is redeemed at par (face value) on its maturity date. 2) Zero Coupon bonds: are bonds issued at discount to face value and redeemed at par. These were issued first on January 19, 1994 and were followed by two subsequent issues in 1994-95 and 1995-96 respectively. The key features of these securities are: a. They are issued at a discount to the face value. b. The tenor of the security is fixed. c. The securities do not carry any coupon or interest rate. The difference between the issue price (discounted price) and face value is the return on this security. d. The security is redeemed at par (face value) on its maturity date.

- 10. K.E.S. SHROFF COLLEGE Page 10 3) Partly Paid Stock: is stock where payment of principal amount is made in installments over a given time frame. It meets the needs of investors with regular flow of funds and the need of Government when it does not need funds immediately. The first issue of such stock of eight year maturity was made on November 15, 1994 for Rs. 2000 crore. Such stocks have been issued a few more times thereafter. The key features of these securities are: a. They are issued at face value, but this amount is paid in installments over a specified period. b. Coupon or interest rate is fixed at the time of issuance, and remains constant till redemption of the security. c. The tenor of the security is also fixed. d. Interest /Coupon payment is made on a half yearly basis on its face value. e. The security is redeemed at par (face value) on its maturity date. 4) Floating Rate Bonds: are bonds with variable interest rate with a fixed percentage over a benchmark rate. There may be a cap and a floor rate attached thereby fixing a maximum and minimum interest rate payable on it. Floating rate bonds of four year maturity were first issued on September 29, 1995, followed by another issue on December 5, 1995. Recently RBI issued a floating rate bond, the coupon of which is benchmarked against average yield on 364 Days Treasury Bills for last six months. The coupon is reset every six months The key features of these securities are: a. They are issued at face value. b. Coupon or interest rate is fixed as a percentage over a predefined benchmark rate at the time of issuance. The benchmark rate may be Treasury bill rate, bank rate etc. c. Though the benchmark does not change, the rate of interest may vary according to the change in the benchmark rate till redemption of the security. The tenor of the security is also fixed. d. Interest /Coupon payment is made on a half yearly basis on its face value. e. The security is redeemed at par (face value) on its maturity date. 5) Bonds with Call/Put Option: First time in the history of Government Securities market RBI issued a bond with call and put option this year. This bond is due for redemption in 2012 and carries a coupon of 6.72%. However the bond has call and put option after five years i.e. in year 2007. In other words it means that holder of bond can sell back (put option) bond to Government in 2007 or Government can buy back (call option) bond from holder in 2007. This bond has been priced in line with 5 year bonds.

- 11. K.E.S. SHROFF COLLEGE Page 11 6) Capital indexed Bonds: are bonds where interest rate is a fixed percentage over the wholesale price index. These provide investors with an effective hedge against inflation. These bonds were floated on December 29, 1997 on tap basis. They were of five year maturity with a coupon rate of 6 per cent over the wholesale price index. The principal redemption is linked to the Wholesale Price Index. The key features of these securities are: a. They are issued at face value. b. Coupon or interest rate is fixed as a percentage over the wholesale price index at the time of issuance. Therefore the actual amount of interest paid varies according to the change in the Wholesale Price Index. c. The tenor of the security is fixed. d. Interest /Coupon payment is made on a half yearly basis on its face value. e. The principal redemption is linked to the Wholesale Price Index.

- 12. K.E.S. SHROFF COLLEGE Page 12 CCHHAAPPTTEERR 44 TTRREEAASSUURRYY BBIILLLLSS,, PPAARRTTIICCIIPPAANNTTSS AANNDD AAUUCCTTIIOONN A Treasury bill is a particular kind of finance bill or a promissory note put out by the Government of the country. These are two types of bills i.e. 91 days Treasury bill and the 182 day Treasury bill. These treasury bills are highly liquid. There is no risk of default in case of Treasury bills. These bills are readily available and have assured yield. The participants in the Treasury bill market are Reserve Bank of India, State Bank of India, Commercial Banks, State Governments and other approved bodies. Discount and Finance House of India is the market maker in the Treasury bill market. The other participants in the Treasury bill market are the Securities Trading Corporation of India, LIC, UTI, GIC, NABARD, IDBI, IFCI and ICICI. Foreign Financial Institutions, Corporate entities are also participating in the Treasury bill market.RBI and commercial banks are the most popular players in the Treasury bill market. Auctioning is a method of trading whereby merchants bid against one another and where the securities are sold to the highest bidder. This system was introduced in 1992, for the sale of dated Government Securities. A number of instruments of wide ranging period i.e. 14 day, 91day and 364day Treasury bills and dated Securities of Government of India are sold. Bidders have to furnish written ad sealed quotations of auction such as Multiple Price Auction and Uniform Price Auction. Under the Multiple Price Auction, mechanism, every bidder gets allocation according to his bid and the issuer collects a premium from all bidders by quoting a rate lower than the cut-off yield. Under the uniform price mechanism competitive bids are accepted on the basis of the minimum discounted price known as the cut-off price. The price of the bill is determined at the auction. This minimum price is independent of the bid-prices tendered below or at the cut-off price.

- 13. K.E.S. SHROFF COLLEGE Page 13 Different types of auctions used for issue of securities Prior to introduction of auctions as the method of issuance, the interest rates were administratively fixed by the Government. With the introduction of auctions, the rate of interest (coupon rate) gets fixed through a market based price discovery process. An auction may either be yield based or price based. i. Yield Based Auction: A yield based auction is generally conducted when a new Government security is issued. Investors bid in yield terms up to two decimal places (for example, 7.85 per cent, 7.87 per cent, etc.). Bids are arranged in ascending order and the cut-off yield is arrived at the yield corresponding to the notified amount of the auction. The cut-off yield is taken as the coupon rate for the security. Successful bidders are those who have bid at or below the cut-off yield. Bids which are higher than the cut-off yield are rejected. An illustrative example of the yield based auction is given below: Yield based auction of a new security • Maturity Date: September 8, 2018 • Coupon: It is determined in the auction (8.22% as shown in the illustration below) • Auction date: September 5, 2008 • Auction settlement date: September 8, 2008* • Notified Amount: Rs.1000 crore * September 6 and 7 being holidays, settlement is done on September 8, 2008 under T+1 cycle.

- 14. K.E.S. SHROFF COLLEGE Page 14 Details of bids received in the increasing order of bid yields Bid No. Bid Yield Amount of bid (Rs. crore) Cummulative amount (Rs.Crore) Price* with coupon as 8.22% 1 8.19% 300 300 100.19 2 8.20% 200 500 100.14 3 8.20% 250 750 100.13 4 8.21% 150 900 100.09 5 8.22% 100 1000 100.00 6 8.22% 100 1100 100.00 7 8.23% 150 1250 99.93 8 8.24% 100 1350 99.87 The issuer would get the notified amount by accepting bids up to 5. Since the bid number 6 also is at the same yield, bid numbers 5 and 6 would get allotment pro-rata so that the notified amount is not exceeded. In the above case each would get Rs. 50 crore. Bid numbers 7 and 8 are rejected as the yields are higher than the cut-off yield. *Price corresponding to the yield is determined as per the relationship given under YTM calculation in question 19. ii. Price Based Auction: A price based auctionis conducted when Government of India re-issues securities already issued earlier. Bidders quote in terms of price per Rs.100 of face value of the security (e.g., Rs.101.02, Rs.100.95, Rs.99.80, etc., per Rs.100/-). Bids are arranged in descending order and the successful bidders are those who have bid at or above the cut-off price. Bids which are below the cut-off price are rejected. An illustrative example of price based auction is given below: Price based auction of an existing security 8.24% GS 2018 • Maturity Date: April 22, 2018 • Coupon: 8.24% • Auction date: September 5, 2008 • Auction settlement date: September 8, 2008* • Notified Amount: Rs.1000 crore * September 6 and 7 being holidays, settlement is done on September 8, 2008 under T+1 cycle.

- 15. K.E.S. SHROFF COLLEGE Page 15 Details of bids received in the decreasing order of bid price Bid no. Price of bid Amount of bid (Rs. Crore) Implicit yield Cumulative amount 1 100.31 300 8.1912% 300 2 100.26 200 8.1987% 500 3 100.25 250 8.2002% 750 4 100.21 150 8.2062% 900 5 100.20 100 8.2077% 1000 6 100.20 100 8.2077% 1100 7 100.16 150 8.2136% 1250 8 100.15 100 8.2151% 1350 The issuer would get the notified amount by accepting bids up to 5. Since the bid number 6 also is at the same yield, bid numbers 5 and 6 would get allotment in proportion so that the notified amount is not exceeded. In the above case each would get Rs. 50 crore. Bid numbers 7 and 8 are rejected as the price quoted is less than the cut-off price. Depending upon the method of allocation to successful bidders, auction could be classified as Uniform Price based and Multiple Price based. In a Uniform Price auction, all the successful bidders are required to pay for the allotted quantity of securities at the same rate, i.e., at the auction cut-off rate, irrespective of the rate quoted by them. On the other hand, in a Multiple Price auction, the successful bidders are required to pay for the allotted quantity of securities at the respective price / yield at which they have bid. In the example under (ii) above, if the auction was Uniform Price based, all bidders would get allotment at the cut-off price, i.e., Rs.100.20. On the other hand, if the auction was Multiple Price based, each bidder would get the allotment at the price he/ she has bid, i.e., bidder 1 at Rs.100.31, bidder 2 at Rs.100.26 and so on.

- 16. K.E.S. SHROFF COLLEGE Page 16 An investor may bid in an auction under either of the following categories: i. Competitive Bidding: In a competitive bidding, an investor bids at a specific price / yield and is allotted securities if the price / yield quoted is within the cut-off price / yield. Competitive bids are made by well informed investors such as banks, financial institutions, primary dealers, mutual funds, and insurance companies. The minimum bid amount is Rs.10,000 and in multiples of Rs.10,000 thereafter. Multiple bidding is also allowed, i.e., an investor may put in several bids at various price/ yield levels. ii. Non-Competitive Bidding: With a view to providing retail investors an opportunity to participate in the auction process, the scheme of non-competitive bidding in dated securities was introduced in January 2002. Non-competitive bidding is open to individuals, HUFs, RRBs, co-operative banks, firms, companies, corporate bodies, institutions, provident funds, and trusts. Under the scheme, eligible investors apply for a certain amount of securities in an auction without mentioning a specific price / yield. Such bidders are allotted securities at the weighted average price / yield of the auction. In the illustration given under 4.1 (ii) above, the notified amount being Rs.1000 crore, the amount reserved for non- competitive bidding will be Rs.50 crore (5% of the notified amount). Non- competitive bidders will be allotted at the weighted average price which is Rs.100.26 in the given illustration. The participants in non-competitive bidding are, however, required to hold a gilt account with a bank or PD. Regional Rural Banks and co-operative banks which hold SGL and Current Account with the RBI can, also, participate under the scheme of non-competitive bidding without holding a gilt account. In every auction of dated securities, a maximum of 5 per cent of the notified amount is reserved for non-competitive bids. In the case of auction for Treasury Bills, the amount accepted for non-competitive bids is over and above the notified amount and there is no limit placed. However, non-competitive bidding in Treasury Bills is available only to State Governmentsand other select entities and is not available to the co-operative banks. Only one bid is allowed to be submitted by an investor either through a bank or Primary Dealer. For bidding under the scheme, an investor has to fill in an undertaking and send it along with the application for allotment of securities through a bank or a Primary Dealer. The minimum amount and the maximum amount for a single bid is Rs.10, 000 and Rs.2 crore respectively in the case of an auction of dated securities. A bank or a Primary Dealer can charge an investor up to maximum of 6 paisa per Rs.100 of application money as commission for rendering their services. In case the total applications received for non- competitive bids exceed the ceiling of 5 per cent of the notified amount of the auction for dated securities, the bidders are allotted securities on a pro-rata basis.

- 17. K.E.S. SHROFF COLLEGE Page 17 CCHHAAPPTTEERR 55 PARTICIPANTS IN THE GOVERNMENT SECURITIES MARKET Government securities are approved securities for the purpose of statutory liquidity requirements of banks. Banks, therefore, have been traditionally the largest holders of Government securities. Though the SLR has been progressively reduced to 25% (of the net demand and time liabilities of bank), it is estimated that banks hold about 37% (of the net demand and time liabilities of banks) in the form of Government securities. Banks hold about 60% of outstanding Government Securities. Apart from banks, provident funds and insurance companies are large holders of Government bonds, buying them to comply with prudential norms governing their portfolios. These institutions hold about 20% of outstanding Government Securities. Primary Dealers hold Government securities either due to development or underwriting commitments or to enable repo transactions and market making. Other investors include mutual funds, individuals, charitable trusts etc. Primary Issuance Process: The issue of Government securities is governed by the terms and conditions specified in the general notification of the Government and also the terms and conditions specified in the specific notification issued in respect of issue of each security. Who can apply: Any person including firm, company, corporate body, institution, state government, provident fund, trust, NRI, OCB predominantly owned by NRIs and FII registered with SEBI and approved by RBI can submit offers, including in electronic form, for purchase of Government securities. Denomination: For Central Government securities, the minimum denomination is Rs. 10000 and trading takes place in multiples of Rs. 5 crores. For state Government securities, it is Rs. 1000 and trading takes place in multiples of Rs. 1-5 crores. For agency bonds, it is Rs.5000 and in multiples thereof. Mode of payment: Payments for the securities are made by the applicants on such dates as mentioned in the specific notification, by means of cash or cheque drawn on RBI or Banker‟s pay order or by authority to debit their current account with RBI or by Electronic Fund Transfer in a secured environment.

- 18. K.E.S. SHROFF COLLEGE Page 18 CCHHAAPPTTEERR 66 MMAANNNNEERR OOFF IISSSSUUEE OOFF GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS As a part of reform in the financial sector a policy decision was taken to move towards market related interest rates for Government borrowing. Accordingly, with effect from June 1992 Government of India has started borrowing by issue of debt at market related rates determined by conducting auctions. Market related rates are evolved in the auctions for sale of dated securities or treasury bills. The Government issues securities through the following modes: i. Issue of securities through auction. ii. Issue of securities with pre-announced coupon rates. iii. Issue of securities through tap sale. iv. Issue of securities through conversion. The Securities can be issued through auction either on price basis or yield basis. The coupons on such securities are announced before the date of floation and the securities are issued at par. No aggregate amount is indicated in the notification in respect of the securities sold on tap. The holders of Treasury bills of certain specified maturities and holder of specified dated securities are provided an option to convert the respective Treasury bills or dated securities at specified prices into new securities offered for sale. 1) Issue of securities through auction. Securities are issued through auction either on price basis or on yield basis. Where the issue is on price basis, the coupon is predetermined and the bidders quote price per Rs. 100 face value of the security, at which they desire to purchase the security. Where the issue is on yield basis, the coupon of the security is decided in an auction and the security carries the same coupon till maturity. On the basis of the bids received, RBI determines the maximum rate of yield or the minimum offer price as the case may be at which offers for purchase of securities would be accepted at the auction. The RBI has moved from yield based auction to price based auction in 1998, though it retains the flexibility to resort to yield based auctions and notify the same in the auction notification. The auctions for issue of securities (on either yield basis or price basis) are held either on “Uniform price” (also known as Dutch auction) method or on “Multiple price” (also known as French auction) method.

- 19. K.E.S. SHROFF COLLEGE Page 19 Where an auction is held on a “Uniform price” method, competitive bids offered with rates up to and including the maximum rate of yield or the prices up to and including the minimum offer price, as determined by RBI, are accepted at the maximum rate of yield or minimum offer price so determined. Bids quoted higher than the maximum rate of yield or lower than the minimum price are rejected. Where an auction is held on “Multiple prices” method, competitive bids offered at the maximum rate of yield or the minimum offer price, as determined by RBI, are accepted. Other bids tendered at lower than the maximum rate of yield or higher than the minimum offer price are accepted at the rate of yield or price as quoted in the respective bid. Bids quoted higher than the maximum rate of yield or lower than the minimum price are rejected. Individuals and specified institutions (retail investor) can participate in the auctions on “non-competitive” basis. Allocation of the securities to non-competitive bidders is made at the discretion of RBI and at a price not higher than the weighted average price arrived at on the basis of the competitive bids accepted at the auction or any other price announced in the specific notification. The nominal amount of securities that would be allocated to retail investors on non-competitive basis is restricted to a maximum percentage of the aggregate nominal amount of the issue, within or outside the nominal amount. Sale of Government securities (except 91 days treasury bills) is held under Multiple Price Auctions; Uniform Price Auctions are held for sale of 91 days Treasury Bills. RBI has announced that it may conduct uniform price auctions for sale of dated securities on a selective and experimental basis. The notification for the respective auctions will specify the format to be used, viz., uniform price or multiple prices. 2) Issue of securities with pre-announced coupon rates. The coupon on such securities is announced before the date of flotation and the securities are issued at par. In case the total subscription exceeds the aggregate amount offered for sale, RBI may make partial allotment to all the applicants. State Governments continue to issue securities at pre-announced coupon rates and prices. However, from 1998-99 onwards an option was given to the State Government to raise a small portion of their borrowing by conducting competitive auctions. Several State Governments have availed of this facility. 3) Issue of securities through tap sale. No aggregate amount is indicated in the notification in respect of the securities sold on tap. Sale of such securities may be extended to more than one day and the sale may be closed at any time on any day.

- 20. K.E.S. SHROFF COLLEGE Page 20 4) Issue of securities on conversion of maturing treasury bills/dated securities. The holders of treasury bills of certain specified maturities and holders of specified dated securities are provided with an option to convert their holding at specified prices into new securities offered for sale. The new securities could be issued on an auction/pre- announced coupon basis. In what form can Government Securities be held and the trading of Government securities take place? Government security held in following ways : 5.1 The Public Debt Office (PDO) of the Reserve Bank of India, Mumbai acts as the registry and central depository for the Government securities. Government securities may be held by investors either as physical stock or in dematerialized form. From May 20, 2002, it is mandatory for all the RBI regulated entities to hold and t r a n s a c t i n G o v e r n m e n t s e c u r i t i e s o n l y i n dematerialized ( SGL) f o r m . Accordingly, UCBs are required to hold all Government securities in demat form. a. Physical form: Government securities may be held in the form of stock certificates. A stock certificate is registered in the books of PDO. Ownership in stock certificates cannot be transferred by way of endorsement and delivery. They are transferred by executing a transfer form as the ownership and transfer details are recorded in the books of PDO. The transfer of a stock certificate is final and valid only when the same is registered in the books of PDO. b. Demat form: Holding government securities in the dematerialized or scrip less form is the safest and the most convenient alternative as it eliminates the problems relating to custody, viz., and loss of security. Besides, transfers and servicing are electronic and hassle free. The holders can maintain their securities in dematerialised form in either of the two ways: i. SGL Account: Reserve Bank of India offers Subsidiary General Ledger Account (SGL) facility to select entities who can maintain their securities in SGL accounts maintained with the Public Debt Offices, of the Reserve Bank of India. ii. Gilt Account: As the eligibility to open and maintain an SGL account with the RBI is restricted, an investor has the option of opening a Gilt Account with a bank or a Primary Dealer which is eligible to open a Constituents' Subsidiary General Ledger Account (CSGL) with the RBI. Under this arrangement, the bank or the Primary Dealer would maintain the holdings of its constituents in a CSGL account (which is also known as SGL II account) with the RBI as a custodian on behalf of the Gilt Account holders. The servicing of securities held in the Gilt Accounts is done electronically, facilitating hassle free trading and maintenance of the securities. Receipt of maturity proceeds and periodic interest is also faster as the proceeds are credited to the current account of the custodian

- 21. K.E.S. SHROFF COLLEGE Page 21 bank / PD with the RBI and the custodian (CSGL account holder) immediately passes on the credit to the Gilt Account Holders (GAH). 5.2 Investors also have the option of holding Government securities in a dematerialized account with a depository (NSDL / CDSL, etc.). This facilitates trading of Government securities on the stock exchanges. How does the trading in Government securities take place? There is an active secondary market in Government securities. The securities can be bought / sold in the secondary market either (i) Over the Counter (OTC) or (ii) through the Negotiated Dealing System (NDS) or (iii) the Negotiated Dealing System-Order Matching (NDS-OM). I. Over the Counter (OTC)/ Telephone Market 6.2 In this market, a participant, who wants to buy or sell a government security, may contact a bank / Primary Dealer / financial institution either directly or through a broker registered with SEBI and negotiate for a certain amount of a particular security at a certain price. Such negotiations are usually done on telephone and a deal may be struck if both counterparties agree on the amount and rate. In the case of a buyer, like an urban co-operative bank wishing to buy or sell a security, the bank's dealer (who is authorized by the bank to undertake transactions in Government Securities) may get in touch with other market participants over telephone and obtain quotes. Should a deal be struck, the bank should record the details of the trade in a deal slip (specimen given at Annex 3) and send a trade confirmation to the counterparty. The dealer must exercise due diligence with regard to the price quoted by verifying with available sources (See question number 12 for information on ascertaining the price of Government securities). All trades undertaken in OTC market are reported on the secondary market module of the NDS, the details of which are given under the question number 13. ii. Negotiated Dealing System 6.3 The Negotiated Dealing System (NDS) for electronic dealing and reporting of transactions in government securi t i es w as i nt roduced i n Febr uar y 2002 . It facilitates the members to submit electronically, bids or applications for primary Issuance of Government Securities when auctions are conducted. NDS also provides an interface to the Securities Settlement System (SSS) of the Public Debt Office, RBI, Mumbai thereby facilitating settlement of transactions in Government Securities (both outright and repos) conducted in the secondary market. Membership to the NDS is restricted to members holding SGL and/or Current Account with the RBI, Mumbai.

- 22. K.E.S. SHROFF COLLEGE Page 22 6.4 In August, 2005, RBI introduced an anonymous screen based order matching module on NDS, called NDS-OM. This is an order driven electronic system, where the participants can trade anonymously by placing their orders on the system or accepting the orders already placed by other participants. NDS-OM is operated by the Clearing Corporation of India Ltd. (CCIL) on behalf of the RBI (Please see answer to the question no.15 about CCIL). Direct access to the NDS-OM system is currently available only to select financial institutions like Commercial Banks, Primary Dealers, Insurance Companies, Mutual Funds, etc. Other participants can access this system through their custodians, i.e., with whom they maintain Gilt Accounts. The custodians place the orders on behalf of their customers like the urban co-operative banks. The advantages of NDS- OM are price transparency and better price discovery. 6.5 Gilt Account holders have been given indirect access to NDS through custodian institutions. A member (who has the direct access) can report on the NDS the transaction of a Gilt Account holder in government securities. Similarly, Gilt Account holders have also been given indirect access to NDS-OM through the custodians. However, currently two gilt account holders of the same custodian are not permitted to undertake repo transactions between themselves. iii. Stock Exchanges Facilities are also available for trading in Government securities on stock exchanges (NSE, BSE) which cater to the needs of retail investors

- 23. K.E.S. SHROFF COLLEGE Page 23 CCHHAAPPTTEERR 77 SSTTAATTUUTTOORRYY PPRROOVVIISSIIOONNSS FFOORR RREEGGUULLAATTIIOONN OOFF GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS MMAARRKKEETT 1) Primary Market The Reserve Bank of India manages the public debt and issues new loans on behalf of central government in terms of Sections 20 and 21 of the Reserve Bank of India Act, 1934. The Bank manages the public debt of State Government as per agreements entered into with the state government concerned (Sec.21A of the Act). Bank has entered into agreement with 28 state governments for management of their public debt. Further, in terms of Public Debt Act, 1944, the administration of public debt devolves on the Bank. Consequently the Reserve Bank has been taking all initiatives for development of a market for government securities, which would facilitate price discovery and provide liquidity to government securities. In brief, these initiatives mainly involved the promotion of institutional infrastructure and legal reforms relating to the manner of issue and custody of government debt instruments and their transfer and settlement. The public debt management covers the issue, interest payment and repayment of rupee loan, and all matters pertaining to government debt certificates including registration, custody, transfer, conversion, sub-division etc. of government debt holdings. The 15 public debt offices of the Reserve Bank functioning at various centers attend to these functions. In addition, as manager of public debt, Bank has to advise the Government regarding the size of borrowing, timing of issue of new loans etc. Mode of holding & transfer of Government Securities: Government securities can be issued basically in three forms, viz., Government Promissory Notes, Stock or any other form as may be notified by the Central government. Promissory notes are in the physical form where as stock can be either in the physical form called "Stock Certificate" or "Book Debt Certificate" or in a book entry form called "Subsidiary General Ledger Account (SGL Account)". SGL Account which provides a secure and convenient form of holding is permitted to be opened at public Debt Offices only by institutions which maintain current account with RBI. Others can also enjoy the benefit of SGL Account form of holding by availing of the custodial services extended by banks and Primary Dealers maintaining SGL Account with PDOs. In order to segregate the custodial holdings from their own investments, SGL Account holders are allowed to maintain one more SGL Account with PDOs called "Constituents' SGL Account". While maintaining and operating such constituents' account, SGL Account holders are required to abide by the "Guidelines for Maintaining Constituents SGL Account" which have been issued by RBI.

- 24. K.E.S. SHROFF COLLEGE Page 24 The holder of the security can affect transfer of Government securities by completing the prescribed transfer form. The transfer will be complete only when the ownership of the security is changed in the name of the transferee in the books of the Public Debt Office. The transferee of securities should tender the SGL transfer form latest by the day following the deal to facilitate T+1 basis for settlement. In respect of securities held in the form of SGL Account transfer takes place in the books of Public Debt Offices on Delivery Versus payment (DVP) basis. DVP system is introduced to reduce the counter party risk in securities transactions. 2) Secondary Market Transactions in securities are governed by the Securities Contracts (Regulation) Act, 1956 as government securities are "Securities" as defined in the Act. Hence the provisions of the Act are applicable for the transactions in Government securities. Under the Act the Reserve Bank has been delegated powers by the Government of India to regulate contracts in government securities, money market securities, gold related securities and derivatives based on these securities, as also ready forward contracts in all debt instruments. Transactions on the stock exchanges will be in addition subject to the regulations prescribed by the Securities & Exchange Board of India (SEBI). Reserve Bank of India has permitted Repos and Reverse Repos subject to the terms and conditions and among the participants as specified hereunder: 1) Ready forward contracts are undertaken only in Treasury Bills and transferable dated securities of all maturities issued by the Government of India and State Governments. 2) Ready forward contracts in the securities specified at (a) above may be entered into by a banking company, a cooperative bank or any person, maintaining a Subsidiary Ledger Account and a Current Account with Reserve Bank of India, Mumbai, only among themselves. 3) Such ready forward contracts shall be settled through the Subsidiary General Ledger Accounts of the participants with Reserve Bank of India at Mumbai only, and 4) No sale transaction should be put through without actually holding the securities in the portfolio. While RBIs policy supports the establishment of a deep and liquid repo market, enlargement of the types of securities and eligible participants for the repo market will depend upon the establishment of the secure infrastructure for the securities market including establishment of a Securities Clearing Corporation to facilitate tri-partite repos. Short selling in securities is prohibited. Presently, Over- the -Counter outright transactions in government securities can be freely concluded providing for spot delivery (payment on the same day of the contract or next day) as per the Act.

- 25. K.E.S. SHROFF COLLEGE Page 25 In order to develop the securities market on healthy lines and to facilitate price discovery in the market, RBI daily makes available to the market the prices in respect of secondary market transactions in government securities, which are settled through SGL Account. This has helped in the establishment of sovereign yield curve, promoted market transparency and improved price discovery for government securities in the Indian Market. Effective management of public debt by the Reserve Bank is closely linked to the development of a deep and liquid secondary market and RBI has been taking various initiatives in this direction.

- 26. K.E.S. SHROFF COLLEGE Page 26 CCHHAAPPTTEERR 88 GGOOVVEERRNNMMEENNTT SSEECCUURRIITTIIEESS-- MMAARRKKEETT SSTTRRUUCCTTUURREE From a narrow ownership base, Government securities market has been increasingly becoming broad-based over the recent years. The main holders of government securities are banks, Primary/Satellite Dealers, LIC, All India Financial Institutions, Provident Fund Trusts, Gilt Funds and lastly corporate entities and retail holders, mainly through Mutual Funds. Although Foreign Institutional Investors are allowed to invest in government securities such investments have not picked up. A large part of outstanding government securities are held by the Reserve Bank mainly as back up for its currency issue liabilities and for conducting Open Market Operations. Introduction of the system of Primary Dealers have ensured that underwriting of the primary issues is shouldered mainly by Primary Dealers and automatic devolvement on RBI does not happen. The main participants in the Government Securities market such as banks, Primary Dealers, Financial Institutions enter into transactions in government securities market mainly as a part of their investment and trading functions. RBI has issued detailed instructions to banks about the categorization and valuation of government securities. Further banks, which maintain "Trading Book", can do so, only subject to compliance with certain preconditions specified by the RBI from risk management angle. In order to develop the market on sound lines, RBI has initiated various reforms. Thus the prices at which different securities are bought/sold are made available to the market participants on a daily basis. National Stock Exchange also publishes the security prices in respect of transactions reported to them. As mentioned earlier system of DVP has been introduced to reduce counterparty risk in security transfers. In order to protect the interest of retail holders of government securities using the system of Constituents SGL Accounts, RBI have issued guidelines regarding maintenance of such accounts. A system of retail holding through Bond Ledger Form has also been introduced in respect of certain securities. Bond Ledger Accounts can be opened with branches of specified banks and this is expected to make it convenient for retail holders, although at present only Relief Bonds can be so held. RBI extends liquidity support to Mutual Funds Dedicated to Investments in Government Securities (GILT FUNDS) to encourage such Mutual Funds, which is a convenient way of indirect investments in government securities by individuals and other market participants. Primary Dealers play an important role in the government securities market. A brief account of their role is provided in the following paragraphs:

- 27. K.E.S. SHROFF COLLEGE Page 27 Primary Dealers The Guidelines for Primary Dealers (PDs) in Government Securities were announced by the Bank in March 1995. The objectives of setting up the system of Primary Dealers are: i. To strengthen the infrastructure in the government securities market in order to make it vibrant, liquid and broad based. ii. To ensure development of underwriting and market making capabilities for government securities outside the RBI so that the latter will gradually shed these functions. iii. To improve secondary market trading system, which would contribute to price discovery, enhance liquidity and turnover and encourage voluntary holding of government securities amongst a wider investor base. iv. To make PDs an effective conduit for conducting open market operations. Eligibility for being considered for Primary Dealership The following are the eligibility standards: i. The entity should be a subsidiary of a scheduled commercial bank/an All India Financial Institution dedicated predominantly to the securities business and in particular to the government securities market, or a company incorporated under the Companies Act, 1956 and engaged predominantly in the securities business and in particular the government securities market, and ii. The applicant should have Net owned funds of a minimum of Rs.50 crore. Three basic parameters would have to be necessarily fulfilled by an applicant for PD- ship, i.e., the company should have (a) net owned funds of Rs.50 crore (b) sizeable business in government securities and (c) should not be a loss making company. The relationship between the Bank and the entities in their capacity as PDs is not statutory, but contractual in nature. Primary Dealership is renewed every year on the basis of agreement to be entered into between the Bank and these entities. Legally they are non- banking financial companies and are subject to the registration requirements for NBFCs. However, if a PD does not accept public deposits it is exempt from the related regulations. On account of the special responsibilities assigned to them in the Government Securities Market, RBI has been monitoring their activities by undertaking off as well as on site surveillance through scrutiny of prescribed returns and also by on-site inspections to check compliance with the Guidelines and other terms of appointment. RBI has prescribed capital adequacy standards to be observed by Primary Dealers. The Primary Dealers' responsibilities are: i. A Primary Dealer will be required to commit to aggregative bid for Government of India dated securities and auction Treasury Bills on an annual basis of not less than a specified amount. The agreed minimum amount of bids would be separately indicated for dated securities and Treasury Bills. ii. The Primary Dealer would have to achieve a minimum success ratio of 40 per cent for both dated securities and Treasury Bills (vis-à-vis bidding commitment).

- 28. K.E.S. SHROFF COLLEGE Page 28 iii. To maintain risk based capital adequacy as per RBI instructions iv. The PD has to quote two-way at least in a few securities v. PDs have to underwrite primary auction of government securities. Issues of Treasury Bills are not underwritten. Instead, PDs have to commit to submit minimum bids at each auction covering the entire issue amounts. The percentage of minimum bidding commitment so determined by the Reserve Bank will remain unchanged for the entire financial year. In determining the minimum bidding commitment, RBI will take into account the offer made by the PD, its net owned funds and its track record. Facilities extended to the PDs The following facilities have been extended to PDs: i. Entitlement to open one Current Account and two Subsidiary General Ledger (SGL) Accounts for government securities (one for own operations and the second for operations on behalf of constituents), at all offices of the RBI. ii. Permission to borrow and lend in the money market including call money market and to trade in all money market instruments. iii. Liquidity Support through Repos operations/demand loans with RBI collateralised by Central Government dated securities and Auction Treasury Bills up to the limit fixed by RBI. iv. Favoured access to Open Market Operations. v. Permission to raise Commercial Paper as per the provisions contained in the "Primary Dealers (Acceptance of Deposits through Commercial Paper) Directions, 1996" issued in terms of Section 45 K and 45 L of the RBI Act, 1934. vi. Facility of transfer of funds from one centre to another centre under RBIs Remittance Facility Scheme and also of clearing of cheques arising out of Government securities transactions, tendered at RBI counters. Other Obligations of PDs The following important obligations are cast on them under the PD Guidelines: i. Obligation to offer a firm two-way quotes for government securities and take principal positions ii. Achieving prescribed turn over ratios in government securities. iii. Maintenance of physical infrastructure in terms of office, computing equipment, communication facilities like Telex/Fax, Telephone, etc., and skilled manpower for efficient participation in primary issues, trading in the secondary market, and to provide advice and education to investors.

- 29. K.E.S. SHROFF COLLEGE Page 29 iv. Putting in place efficient internal control system. v. Obligation to provide to RBI access to all records, books, information and documents as may be required. vi. Adherence to all prudential and regulatory guidelines prescribed by RBI from time to time. vii. Formation of self regulatory organisation (SRO). viii. Maintenance of a separate desk for government securities business and separate accounts and has an external audit of annual accounts. ix. Maintenance separate accounts in respect of its own position and customer transactions. x. Responsibility to bring to RBIs attention any major complaint against him or action initiated/taken against him by authorities such as the Stock Exchanges, SEBI, CBI, Enforcement Directorate, Income Tax, etc. xi. Setting up prudential ceilings, with the prior approval of the Board of Directors of the company, on borrowings from the money market including repos, as a multiple of net owned funds, subject to the guidelines, if any, issued by the Reserve Bank in this regard.

- 30. K.E.S. SHROFF COLLEGE Page 30 CCHHAAPPTTEERR 99 RROOLLEE OOFF MMAARRKKEETT IINN GGOOVVEERRNNMMEENNTT FFIINNAANNCCEE Government Securities are unique and important financial instruments in the financial market. Except, Treasury bills all other instruments are held by the Reserve Bank of India. The techniques of open market operations and statutory liquidity ratio are closely connected with the dynamics of the market for these instruments. The issues of Government Securities are helpful in implementing the fiscal policy of the Government. Financial Institutions like commercial banks are required to maintain their secondary reserve requirements in the form of government securities. They can obtain accommodation from the RBI against the collateral of these securities. As Government Securities are claims on the Government, They are absolutely secured financial instruments, which guarantee the certainty of income as well as capital. Therefore, they are called gilt-edged securities. Interest on Government Securities is payable half-yearly. Interest on Government Securities along with income in the form of interest or dividends on other approved investments is exempt from income-tax subject to a certain limit. Individuals normally do not invest in these securities, saving in tax liability does not seem to be an important motivation behind investment in these securities. Government Securities are safe and liquid. But different authorities issue the Government Securities, hence the extent to which they possess these attributes, the safety and liquidity differ from authority to authority. The marketability of Government securities is relatively restricted. There is no active market for Government Securities, particularly in semi-government securities. There are three forms of Central and State Government Securities: i. Stock Certificates. ii. Promissory Notes. iii. Bearer Bonds. Bearer bonds are not usually issued and Stock Certificates are not popular in India. Most of the government securities currently are in the form of Promissory notes. Promissory notes of any loan can be converted into stock Certificates of any other loan and vice versa. Government Securities are issued through the Public Debt office of the Reserve Bank of India. The issues of Government Securities are notified a few days before they become open for subscription and they are kept open for subscription for 2 to 3 days. These issues may be closed for subscription earlier if the subscriptions approximate the amount of issue. The budgeted amount of the issues in a given year is raised in a number of branches in the year. This is done for the purpose of avoiding the flooding of the market with securities at a given time. There are small member of large issues, because the issues are mostly bought by the institutional investors. After the announcement of the new issue, the RBI suspends the sale of existing loans till the closure of subscription for the new issues. The Government reserves the right to retain subscriptions up to a specified percentage i.e. up to 10 percent in excess of notified amounts. Applications for loans are collected by the offices of the RBI and SBI. In case of issues of State Government Securities, over-subscription to loans of one

- 31. K.E.S. SHROFF COLLEGE Page 31 Government is transferable to the other government, whose loan is still open for subscription, at the option of the subscriber. These are mostly concentrated in the slack seasons. Types of Trading: The RBI practices the dealing in Government Securities in the following manner: a) Grooming: Grooming is the gradual acquisition of securities by the RBI, which are nearing maturity through the Stock Exchanges. It is done in order to facilitate redemption. The object is to keep the process of issue and redemption of Government Securities contineous and thereby facilitate availability of the securities on „tap‟ b) Switching: The Purchases of one security and Sale of another securities carried out by the RBI in the secondary market as part of its open market operations is known as „Switching‟. It helps the banks and financial institutions to improve the yield on their investments in securities. The RBI also fixes an annual quota for the Switch Transactions of each institution. c) Auctioning: Auctioning is a method of trading whereby merchants bid against one another and the securities are sold to the highest bidder. This system was introduced in 1992. Under this mechanism a number of instruments of wide trading period are sold. The period ranges from 14 days to 364 days. The Bidders give written and sealed quotations which are restricted to notified amounts. There are two types of auction, multiple price auctions and uniform price auction. Under the multiple price auction every bidder gets allocation according to his bid and the issuer collect the premium from all the bidders by quoting a rate lower than the cut-off yield. Under the uniform price auction, competitive bids are accepted on the basis of the minimum discounted price known as cut-off-price. The price is determined at the auction. The minimum price is independent of the bid prices tendered below or at the cut-off-price.

- 32. K.E.S. SHROFF COLLEGE Page 32 Trading Mechanism: Trading mechanism in Government Securities carried out under the following methods. i. Direct Sales: Under this method, Public Debt effect direct sale of securities. The loan amounts are pre-specified and the dates of opening of subscription for Government loans are also specified. ii. SGL Account Method: Under this method RBI records the transactions as book entries only in the Securities General Ledger (SGL). The date and value of transaction are recorded. The purchasing banker maintains a separate SGL account for each dealing with the RBI in respect of its purchases of securities. The selling banker also effects his transactions by filling out the prescribed SGL form, which is then lodged with the RBI. It helps to the banks to know their day to day balances. iii. Banker’s Receipt: Under this method, the bank selling Government Securities issues a Bank Receipt. There are facilities for SGL where physical transfer can be avoided. This is done in case of „repo‟ or ready forward transactions. It is a sale transaction, which buys back the securities at a stipulated future date at a price determined on the date of sale transaction. Under the „repo‟ short operations are conducted by banks which Sell government securities without owning them with a view to neutralizing the transaction by buying them at a later date. SECONDARY MARKET TRANSACTIONS: In order to encourage wider participation of all classes of investors across the country in Government Securities, the Government RBI and SEBI have introduced trading in Government Securities thorough a nationwide, anonymous order drives screen based trading system of Stock Exchanges. This facility is in addition to the Present system of dealing in Government Securities through the Negotiated Dealing System of the RBI. This measure can help in reducing time and cost in trade execution by matching orders on a strict price-time priority. It will also expand the investor base and provide country-wide access to the Government Securities market. It is also expected to enhance the operational and informational efficiency of the market as well as the transparency depth and liquidity. The Participation in the Secondary market in Government Securities is restricted to banks, financial institutions, Mutual funds, Foreign Institutional Investors and Trusts. There is no country-wide access for retail participation. The trades are done through negotiations, with the knowledge of counter parties and usually over the phone rather than the trades being matched on an anonymous automated price time priority mechanism.

- 33. K.E.S. SHROFF COLLEGE Page 33 At present most of the Secondary market trades in Government Securities take place thorough bilateral negotiations. It is essentially a telephone market where the deals are negotiated directly by counter parties who are usually banks and other financial institutions or brokers. Since February, 2002, the RBI is providing an electric platform called Negotiated Dealing System (NDS) for facilitated negotiated dealings in Government Securities. The NDS also provides an interface to the Securities Settlement System of the Public Debt office of the RBI. All outright trades in Government Securities done or reported on the NDS have the facility of guaranteed settlement extended by the Clearing Corporation of India Limited (CCIL) through the process of novation. Only the NDS members can route their deals done among themselves for settlement through the CCIL. Outright transactions in Government Securities for Cut-off amount of Rs. 20 crores and below (face value) and all „repo‟ trades are settled through the CCIL. For outright transactions of face value above Rs. 20 crores option is available to members to settle either directly through the RBI-SGL or through the CCIL. For outright transactions of face value above Rs. 20 crores option is available to members to settle either directly through the RBI-SGL or through the CCIL. The objective of the NDS is to provide online price information of transactions in Government Securities.RBI has also permitted the banks and financial institutions to transact in debt instruments among themselves or with non-bank clients through the member of the NSE, BSE, and OTCEI. The NSE provides a separate wholesale Debt Market Segment.

- 34. K.E.S. SHROFF COLLEGE Page 34 CCHHAAPPTTEERR 1100 IIMMPPLLIICCAATTIIOONNSS FFOORR MMOONNEETTAARRYY PPOOLLIICCYY An important part of monetary management is the management of Government Securities market. The Reserve Bank of India can execute its interest rate policy through changes in the Bank Rate, by fixing interest rates on government borrowing and lending and by influencing the behavior of price and yields in the gilt-edged market. The management of gilt-edged market has also a considerable bearing on the advances and liquidity of commercial bank so as to help the monetary policy. Another objective is to ensure that suitable and inexpensive finance for the exchequer is available and will continue to be available in future. The prices of Government Securities have been maintained at a remarkable stable level during the past. The rates of interest on Government Securities have been raised much less than those another claims in the economy. The open market operations have not been used much for influencing the cost and availability of credit. They have been employed by the RBI primarily to assist the Government in their borrowing operations and to maintain orderly conditions in the market. The size of debt is a function of macro-economic policy and there is on ongoing dialogue between RBI and the Government on the issue. The size of market borrow in has an impact on the interest rates, as large-scale pre-emption of resources by the government puts pressure on liquidity in the market and as a result interest rates tend to go up. RBI‟s exclusive role becomes important in the matter of short-term liquidity management in the financial system. World over Central banks operate in the Short-term market to influence liquidity conditions so that short-term interest rates, do not unduly impact the medium and long-term interest rated in the economy. In the USA and UK, open market operations in government securities for the purpose of monetary management have become limited with the growth of government debt. A combination of policies of trading in treasury bills for monetary management and in the Government Securities for debt management is adopted by them. In India, treading in treasury bills is also used for the purpose of government financing. It has not been used actively for affecting bank reserves. Favorable conditions in the Government Securities market cannot be maintained merely by not varying interest rates on Government Securities. It also requires the rejection of the traditional monetary policy, which relies on Bank rate variations to influence economic activity. In the free, market, variations in the Bank rate ought to cause variations in interest rates on government Securities and their prices.

- 35. K.E.S. SHROFF COLLEGE Page 35 The RBI has been holding in its portfolio only Central government securities, as a matter of policy. The Government Securities held by it are partly held in the form of assets of the issue department and partly in the banking department. The Securities held in Banking Department are available for sale by the RBI under its open Market Operations. The open market operations are conducted by way of purchase and sale of Central Government Securities by the RBI on outright basis or on repo basis. The repo operations of the RBI address the system liquidity is basically short term in nature and purchase and sale of securities on outright basis is long-term in nature because it causes long-term changes in the bank reserves.

- 36. K.E.S. SHROFF COLLEGE Page 36 CCHHAAPPTTEERR 1111 RREECCEENNTT DDEEVVEELLOOPPMMEENNTTSS The RBI has undertaken reforms in the Government Securities Market. The RBI has started providing liquidity support with regard to mutual funds that are dedicated exclusively to investment in Government Securities. The purpose is to create an enhanced and wider investor base for such securities. The support is made available to mutual funds to the extent of 20 percent of outstanding investment in Government Securities, either by way of outright purchase or reverses repos, Banks and selected entities are permitted to carry out Ready Forward (REPO) transactions in government Securities. As regards to „Market to Market‟ valuation of Government Securities, the ratio of investment classified in current category for public sector banks has been raised from 40 percent to 50 percent and for the new private sector banks it has been fixed at 100 percent of their investments. The RBI has extended the Delivery v/s payment system with regard to auctioning of treasury bills with effect from February 14, 1996 to the banks. With effect from October 21, 1997 all categories of foreign Institutional investors were allowed by the RBI to make Investment in Government Securities that are registered with and approved by the SEBI for making investments in gilt-edged securities has been permitted up to a ceiling of 30 percent in debt instruments. As per amended guidelines of June, 1998 equity funds were permitted to invest in dated Government Securities and Treasury bills, both in Primary and Secondary Markets within their 30 percent debt ceiling. Uniform price auction was introduced on November 6, 1998 regarding the auction of 91 days Treasury bills on an experimental basis. With effect from June, 23, 1998. Satellite Dealers were permitted to issue commercial paper with maturity ranging from 15 days to one year. There were some conditions. The issue should be made within a period of 2 months of obtaining credit rating and every renewal is treated as a fresh issue. The issue should be made in the multiple of Rs. 5 lakhs with a minimum of investment by a single investor being Rs. 25 lakhs. The aggregate limit is raised within two weeks from the date of RBI approval and the issue is not underwritten or co- accepted in any manner. The RBI and the Government have made arrangement for the setting up of a clearing corporation to provide for the opening of the repo market to PSU bonds and bonds of financial institutions held in demat form in depositories and traded in recognized Stock Exchanges with essential safeguards.