Nature of auditing and few important concepts

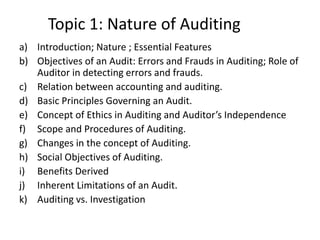

- 1. Topic 1: Nature of Auditing a) Introduction; Nature ; Essential Features b) Objectives of an Audit: Errors and Frauds in Auditing; Role of Auditor in detecting errors and frauds. c) Relation between accounting and auditing. d) Basic Principles Governing an Audit. e) Concept of Ethics in Auditing and Auditor’s Independence f) Scope and Procedures of Auditing. g) Changes in the concept of Auditing. h) Social Objectives of Auditing. i) Benefits Derived j) Inherent Limitations of an Audit. k) Auditing vs. Investigation

- 2. 1. a) Introduction; Nature ; Essential Features Auditing Defined Traditional (Narrow) Definition “An audit may be said to be such an examination of books, accounts and vouchers of a business as will enable the auditor to satisfy that the balance sheet is properly drawn up so as to give a true and fair view of the state of affairs of the business and whether the profit and loss account gives a true and fair view of the profit or loss for the financial period according to the best of his information and explanations given to him and as shown by the books and, if not, in what respect he is not satisfied.” - Spicer and Pegler Modern (Broad) Definition “Auditing is a systematic and independent examination of data, statements, records, operations and performances (financial or otherwise) of an enterprise for a stated purpose. In any auditing situation, the auditor perceives and recognizes the propositions before him for examination, collects evidence, evaluates the same and on this basis, formulates his judgement which is communicated through his audit report.” - The ICAI in its publication, General Guidelines to Internal Auditing

- 3. BOOK KEEPING ACCOUNTANCY AUDITING Journalizing Posting to Ledger Totaling of Accounts Balancing of Accounts Preparation of Trial Balance Preparation of Trading and Profit &Loss Account Preparation of Balance Sheet Making Rectifications and adjustment Entries Auditor examines the financial statements prepared by the accountant and verifies items therein with the help of relevant documentary evidence an explanations and information given to him. It is concerned with the systematic recording of transactions in the books of original entry and their posting to the ledger. An accountant summarizes the results of transactions and events recorded by the book-keeper. Assures users of financial statements as to their reliability.

- 4. Basis Accounting Auditing 1 Scope and Objective Limited to preparation of financial statements. Examines financial data and expresses opinion re: truth (compliance) and fairness of financial statements. 2 Source of authority (Status) Position in the organizational hierarchy. The accountant is usually an employee of the organization. Independent/Statutory Auditors: • Relevant Statute (e.g. Co.’s Act) • Engagement Letter/Terms Internal Auditors: • If employee: Position in orgn. • If outsider: Engagement Terms 3 Qualifications Not specified by statute. (May or may not be a CA.) Specified by relevant statute. (E.g., an independent statutory auditor under the Companies Act, 2013has to be a practicing CA.) 4 Expertise Accounting Accounting and Auditing. 5 Chronology Precedes auditing Post accounting 6 Accountability To Management/TCWG To Shareholders 7 Nature of work Constructive Analytical 8 Timing of work Round the year Year End or Continuously.

- 5. Bases of Distinction AUDITING INVESTIGATION 1 Compulsion Compulsory for companies. Not Compulsory. Unless specifically required 2 Appointing Authority Generally Shareholders. By BoD or CG in some cases. Usually Management/TCWG. CG in some cases. 3 Objective To form an opinion as to the truth and fairness of FS. To find out in detail the state of affairs or answers to specific questions in respect of some specific area. 4 Scope Determined by relevant statute or terms of engagement. Determined by appointing authority. 5 Disclosure of Remuneration Requires specific disclosure in case of companies under Schedule VI Part II of the Companies Act, 2013. No specific disclosure required. 6 Qualifications Statutory Auditor of a Company should be a CA under the meaning of the Chartered Accountants Act, 1949. No specific qualifications required. 7 Coverage Wide/Overall Narrow /Focused 8 Time Frame Annual None . Usually more than one year. 9 Submission of Report To shareholders. To appointing Authority.

- 6. Independence of Auditor Meaning of Independence Independence implies that the judgement of the auditor is not subordinate to the wishes or direction of another person who might have engaged him or to his own self-interest. It is not possible to define “independence” precisely. Rules themselves cannot create or ensure the existence of independence. Independence is a condition of mind as well as personal character and should not be confused with the superficial visible standards of independence which are sometimes imposed by law. These standards may be relaxed or strengthened but the quality of independence remains unaltered.

- 7. Definition of “Auditor’s Independence” As per the Code of Ethics for Professional Accountants, issued by the International Federation of Accountants (IFAC) Independence in Mind The state of mind that permits the provision of an opinion without being affected by influences that comprise professional judgement, allowing an individual to act with integrity, and exercise objectivity and professional skepticism. Independence in Appearance The avoidance of facts and circumstances that are so significant, a reasonable informed third party, having knowledge of all relevant information, including any safeguards applied, would reasonably conclude a firm’s or a member of the assurance team’s integrity, objectivity or professional skepticism has been compromised.

- 8. Threats to Auditor’s Independence Nature of Threat Description Example 1 Self Interest Threat Occur when an auditing firm, its partner or associate could benefit from a financial interest in the client. Direct or indirect financial interest, loan or guarantee from client, close business relationships with client, undue dependence on client’s fee, potential employment with client, contingent fee for audit engagement. 2 Self Review Threat Occur when during a review of any judgement or conclusion reached in a previous audit or non-audit engagement, or when a member of the audit team was previously a director or senior employee of the client. Auditor having recently been a director or senior officer of the company. When the auditor performs services which are themselves the subject matter of audit.

- 9. Nature of Threat Description Example 3 Advocacy Threat Occur when the auditor promotes or is perceived to promote a client’s opinion to a point where people may believe that objectivity is getting compromised. When an auditor deals with the securities of the company. Becomes client’s advocate in litigation and third-party disputes. 4 Familiarity Threat Are self-evident and occur when auditors form relationships with the client where they end up being too sympathetic to the clients interests. Close relative of an auditor working in a senior position of the client company. Former partner of the audit firm being a director or senior employee of the client. Long association between specific auditors and their specific client counterparts. Acceptance of significant gifts or hospitality from the client company, its directors or employees.

- 10. Nature of Threat Description Example 5 Intimidation Threat Occur when auditors are deterred from acting objectively and adequate degree of professional skepticism. Threats of replacement over disagreements with the application of accounting principles. Pressure to disproportionately reduce work in response to reduced audit fees.

- 11. Safeguards to Independence The Professional Accountant (CA in our case) has a responsibility to remain independent by taking into account the context in which they practice, threats to independence and safeguards to eliminate the treats. To address the issue, Members are advised to apply the following guiding principles: For the pubic to have confidence in the quality of audit, it is essential that auditors should always be and appear independent of the entities they are auditing. In case of audit the fundamental principles are integrity, objectivity and professional skepticism, which necessarily require the auditor to be independent. When such threats exist, the auditor must conscientiously consider whether it involves threats to independence. When such threats exist, the auditor should either desist from the task, or at the very least, put in place safeguards that will eliminate them. All such safeguard measures need to be recorded in a form that can serve as evidence of compliance with due process. If the auditor is unable to fully implement credible and adequate safeguards, then he must not accept the work.