hou160531

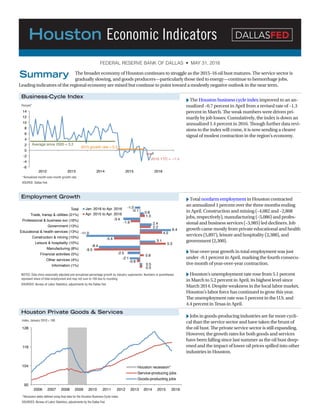

- 1. XXThe Houston business cycle index improved to an an- nualized –0.7 percent in April from a revised rate of –1.3 percent in March. The weak numbers were driven pri- marily by job losses. Cumulatively, the index is down an annualized 1.4 percent in 2016. Though further data revi- sions to the index will come, it is now sending a clearer signal of modest contraction in the region’s economy. XXJobs in goods-producing industries are far more cycli- cal than the service sector and have taken the brunt of the oil bust. The private service sector is still expanding. However, the growth rates for both goods and services have been falling since last summer as the oil bust deep- ened and the impact of lower oil prices spilled into other industries in Houston. XXTotal nonfarm employment in Houston contracted an annualized 1 percent over the three months ending in April. Construction and mining (–4,082 and –2,868 jobs, respectively), manufacturing (–5,086) and profes- sional and business services (–3,985) led decliners. Job growth came mostly from private educational and health services (5,897), leisure and hospitality (2,388), and government (2,300). XXYear-over-year growth in total employment was just under –0.1 percent in April, marking the fourth consecu- tive month of year-over-year contraction. XXHouston’s unemployment rate rose from 5.1 percent in March to 5.2 percent in April, its highest level since March 2014. Despite weakness in the local labor market, Houston’s labor force has continued to grow this year. The unemployment rate was 5 percent in the U.S. and 4.4 percent in Texas in April. Business-Cycle Index Houston Private Goods & Services Employment Growth Percent* Index, January 2010 = 100 NOTES: Data show seasonally adjusted and annualized percentage growth by industry supersector. Numbers in parentheses represent share of total employment and may not sum to 100 due to rounding. SOURCES: Bureau of Labor Statistics; adjustments by the Dallas Fed. *Annualized month-over-month growth rate. SOURCE: Dallas Fed. *Recession dates defined using final data for the Houston Business-Cycle Index. SOURCES: Bureau of Labor Statistics; adjustments by the Dallas Fed. Houston Economic Indicators FEDERAL RESERVE BANK OF DALLAS • MAY 31, 2016 DALLASFED The broader economy of Houston continues to struggle as the 2015–16 oil bust matures. The service sector is gradually slowing, and goods producers—particularly those tied to energy—continue to hemorrhage jobs. Leading indicators of the regional economy are mixed but continue to point toward a modestly negative outlook in the near term. Summary -6 -4 -2 0 2 4 6 8 10 12 14 2012 2013 2014 2015 2016 Average since 2000 = 3.2 2015 growth rate = 0.2 2016 YTD = –1.4 92 104 116 128 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Houston recession* Service-producing jobs Goods-producting jobs -1.0 0.8 -3.4 2.4 6.4 -11.0 3.1 -8.4 -2.5 -2.1 0.5 -0.1 1.0 -1.9 2.2 4.5 -5.4 5.3 -9.5 0.8 -0.6 0.5 Total Trade, transp & utilities (21%) Professional & business svc (16%) Government (13%) Educational & health services (13%) Construction & mining (10%) Leisure & hospitality (10%) Manufacturing (8%) Financial activities (5%) Other services (4%) Information (1%) Jan. 2016 to Apr. 2016 Apr. 2015 to Apr. 2016

- 2. NOTE: Data may not match previously published numbers due to revisions. CONTACT: For questions or information, contact Jesse Thompson at jesse.thompson@dal.frb.org. More Dallas Fed economic updates: www.dallasfed.org/research/update/ XXService sector growth has softened unevenly in the three months ending in April. While job growth in retail trade (2,700) accelerated slightly over that time, most other sectors and subsectors slowed. Administrative and related jobs slowed sharply, declining at an annual rate of 6 percent (–3,500 jobs), which was concentrated in employment service firms. XXAccommodation and food services was another sector to slow substantially. While it is up strongly year to year, it contracted slightly (–771 jobs) from January to April, its first three-month decline since February 2011. The recent decline was centered in restaurants and bars. XXPrivate health employment growth slowed in recent months despite a pickup in hospitals, which added 1,500 jobs from January to April. Robust hospital construction activity suggests that both public and private hospital employment growth will likely remain healthy in the coming months. XXThe Texas Leading Index ticked up in March and April as all of the index components improved. This not only suggests a better outlook for the state of Texas ahead, but suggests that the growth rate of employment in Hous- ton should recover slightly over the next three to four months. XXThe Leading Economic Index for the U.S. also perked up in April on the back of a broad improvement in its components. This implies better employment growth numbers in Houston six months from now—more so for service-producing industries than goods-producing. XX The Houston Purchasing Managers Index was 44.2 in April—remaining in the mid-40s. A powerful leading indicator for employment in Houston, this indicates that employment growth over the next three months will likely remain tepid. XXHowever, the sales and production components of the index have risen markedly in 2016 and may indicate that the overall index will soon improve. Service Sector Jobs Job Growth–Health Purchasing Managers Index and Employment Growth Leading Indicators NOTE: April Texas Leading Index data point is an estimate. SOURCES: The Conference Board; Dallas Fed. Texas Leading Index and U.S. Leading Index NOTES: Data are annualized and seasonally adjusted percent changes. Sorted from largest to smallest industry. SOURCES: Bureau of Labor Statistics; adjustments by the Dallas Fed. NOTE: Employment growth is a monthly, seasonally adjusted annual rate. Composite index values >50 indicate expansion, and index values <50 indicate contraction. SOURCES: Institute for Supply Managment; Bureau of Labor Statistics; Dallas Fed. Job Growth–Selected Service Industries -10 -8 -6 -4 -2 0 2 4 6 8 10 30 35 40 45 50 55 60 65 70 2008 2009 2010 2011 2012 2013 2014 2015 . Houston employment Houston PMI 2016 NOTES: Data show seasonally adjusted and annualized percentage employment growth. Numbers in parentheses represent share of total health employment and may not sum to 100 due to rounding. SOURCES: Bureau of Labor Statistics; adjustments by the Dallas Fed. 4.5 3.7 6.7 3.83.5 3.3 7.1 0.1 0 1 2 3 4 5 6 7 8 Total Ambulatory health (46%) Hospitals (27%) Other health (27%) Apr. 2015 to Apr. 2016 Jan. 2016 to Apr. 2016 Average since 2000 105 107 109 111 113 115 117 119 121 123 125 120 122 124 126 128 130 132 134 2012 2013 2014 2015 2016 Texas Leading Index U.S. leading index 3.4 3.7 -0.8 -2.5 -1.8 -0.3 0.7 4.0 -1.1 -1.4 -6.0 -2.6 0.4 -1.0 Retail trade Accommodation & food services Professional, scientific & technical Admin, waste mgt, remediation & related Wholesale trade Transportation Finance & insurance Apr. 2015 to Apr. 2016 Jan. 2016 to Apr. 2016 Percent Index, 1987 = 100 Index, 2010 = 100 Index Percent