Black Friday Vs. Cyber Monday: ‘Tis The Season For Shopper Social Sentiment [Infographic]

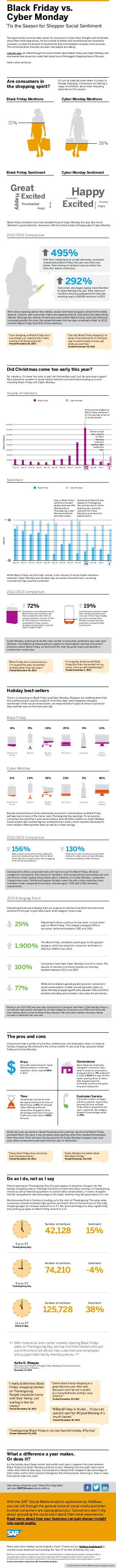

- 1. Black Friday vs. Cyber Monday Tis the Season for Shopper Social Sentiment ‘ The opportunity has never been easier for consumers to share their thoughts and sentiment about their retail experiences. As the number of tablets and smartphones per household increases, so does the amount of touchpoints that exist between company and consumer. The communication channels are open, and people are talking. Like last year, we sifted through the social chatter about Black Friday and Cyber Monday and discovered how consumers really feel about two of the biggest shopping days of the year. Here’s what we found. Are consumers in the shopping spirit? It’s not all yuletide cheer when it comes to holiday shopping. Consumers are feeling a range of emotions about their shopping experiences this season. Black Friday Mentions Cyber Monday Mentions 72% 28% Black Friday Sentiment Cyber Monday Sentiment Great Excited Excited Angry Concerned Frustrated Frustrated Bored Happy Happy Amazing Angry Black Friday mentions more than doubled those of Cyber Monday this year. But not all attention is good attention. Consumers felt the most excited and happy about Cyber Monday. 2012/2013 Comparison 495% With their mobile devices armed and ready, consumers chatted about Black Friday this year more than ever before. Total volume of mentions was more than five times the volume of last year. 292% Consumers also began paying more attention to Cyber Monday this year. Total volume of mentions almost quadrupled from last year, reaching nearly 330,000 mentions in 2013. With stores opening earlier this holiday season and more shoppers armed with mobile devices, retailers and consumers had more opportunities to chat about the deals being offered. Although the volume of mentions around both Black Friday and Cyber Monday increased greatly this year, the spread between the two days remained similar to 2012, in which Black Friday had 70% of the mentions. “I love shopping on Black Friday since everything is on sale but then I hate waiting in all these long lines.” “ The only Black Friday shopping I’ve done is the online kind. It’s the best way to avoid crowds and you get what you want too.” Posted November 29, 2013 Posted November 29, 2013 Did Christmas come too early this year? For retailers, it’s never too early to get into the holiday spirit, but do consumers agree? We tracked the number of social media mentions and sentiment leading up to and including Black Friday and Cyber Monday. Volume of mentions Black Friday Cyber Monday While volume peaked on Black Friday, sentiment for the day was at one of its lowest points. 1,600,000 Volume of mentions 1,400,000 Similar to last year, volume of Cyber Monday mentions swelled right before the day. 1,200,000 1,000,000 800,000 600,000 400,000 200,000 0 Nov 20 Nov 21 Nov 22 Nov 23 Nov 24 Nov 25 Nov 26 Nov 27 Nov 28 29 Nov 30 Dec 1 2 Sentiment Black Friday Cyber Monday Even as Black Friday sentiment trended deeply downward the Monday before Thanksgiving, Cyber Monday sentiment remained steady. Sentiment for Black Friday dipped on Thanksgiving Day, perhaps due to stores opening early. Ironically, sentiment for Cyber Monday was at one of its highest points. Sentiment 100 0 Nov 20 Nov 21 Nov 22 Nov 23 Nov 24 Nov 25 Nov 26 Nov 27 Nov 28 29 Nov 30 Dec 1 2 While Black Friday was the clear winner in the volume of social media mentions received, Cyber Monday was the deal day consumers favored most, receiving consistently high positive sentiment. 2012/2013 Comparison 72% 19% Consumers were feeling the love for Black Friday much more this year than compared to 2012. With an average sentiment increase of 72% for the almost two-week period around Black Friday, it seems shoppers are beginning to view the day in a brighter light. Cyber Monday continues to gain favor among consumers year over year. In the 13 days leading up to and including Cyber Monday, average consumer sentiment increased by 19% over last year. Cyber Monday continues to be the clear winner in consumer sentiment year over year. However, the additional shopping hours appear to have helped improve consumers’ emotions about Black Friday, as sentiment for that day grew leaps and bounds in comparison to last year. “I’m enjoying all discounts Black Friday But from the comfort of my home. I love you #CyberMonday!!” “Black Friday was a successssssss. I’m so glad the sales we wanted started earlier than last years.” Posted December 2, 2013 Posted November 29, 2013 Holiday best-sellers There’s no browsing on Black Friday and Cyber Monday. Shoppers are whittling down their lists and focusing on specific products. From the major retail categories shoppers mentioned in their social conversations, we measured which types of stores in particular they had their eyes on the most each day. Black Friday 11% 9% 36% 29% 3% 12% Department Stores Apparel Big-Box Stores Electronics Specialty Online Retailers Cyber Monday 6% 13% 18% 15% 2% 46% Department Stores Apparel Big-Box Stores Electronics Specialty Online Retailers Big-box and electronics stores dominated consumers’ conversations on Black Friday, perhaps due to many of the stores’ early Thanksgiving Day openings. To no surprise, consumers focused their social conversations around online retailers on Cyber Monday. Social chatter also involved big-box and electronics stores, which could be attributed to more retailers offering online deals as well as in-store savings. 2012/2013 Comparison 156% Big-box stores received more than double the volume of mentions they had in 2012 on Black Friday. Was this a result of more stores engaging in the social conversations? 130% 2013 saw a drastic increase in social media chatter for online stores on Cyber Monday, more than doubling its 2012 mentions. Compared to 2012, consumers had a lot more to say this Black Friday. All retail categories increased in the volume of mentions, with conversations around big-box and electronics stores seeing the greatest gains. However, on Cyber Monday, consumers stayed more mum: Online and apparel retailers were the only stores receiving more mentions when compared to last year, increasing by 7,335 and 1,002 mentions, respectively. 2013 Emerging Trend Interesting trends are emerging from our analysis of volume of mentions and consumer sentiment from year to year about each retail category. Have a look. 25% Department stores continue to lose favor in consumers’ eyes on Black Friday: The category dropped 25% in consumer sentiment between 2011 and 2013. 1,900% The Black Friday comeback award goes to the apparel category, which increased its consumer sentiment in 2013 by 1,900% from 2012. 100% Consumers have kept Cyber Monday true to its name. The volume of mentions of online retailers on that day doubled between 2011 and 2013. 77% While online retailers gained greater ground in consumers' social conversations, chatter around specialty stores on Cyber Monday dropped significantly between 2011 and 2013, possibly indicating price remains a key value for consumers. Based on our 2011-2013 year-over-year comparisons of consumer sentiment, Cyber Monday shows a consistently high positive sentiment for all retail categories. Consumers are a little more fickle with their feelings when it comes to Black Friday, however, with only online retailers showing a steady increase in sentiment year over year. The pros and cons Consumers hold a variety of priorities, preferences, and drawbacks when it comes to holiday shopping. We listened to the online chatter to see what they valued on Black Friday and Cyber Monday. Price Convenience Price still remains king for Cyber Monday based on consumer sentiment, which reached 99% in 2013. Black Friday has drastically changed in consumers’ eyes when it comes to convenience, increasing from a -7% sentiment in 2012 to 63% this year. Did the earlier opening times of stores help shoppers gain the immediate access to the goods they were looking for? Time Customer Service Consumers weren’t as happy with the customer service they received this year on Black Friday. When compared to last year’s sentiment, the category dropped 11 percentage points to 21%. As expected, consumers held the lowest sentiment for time on Black Friday at 8%. And though Cyber Monday sentiment around time dropped by three percentage points from last year, it still was a clear driver at 80% this year. While last year consumers valued the prices and customer service that Black Friday provided them, this year it was all about easily getting what they needed that pleased them the most. Price remains the top priority for Cyber Monday shoppers year over year, while convenience overtook time this year in sentiment. “These black Friday lines are worse than Disneyland lines.” “Cyber Monday has better deals than Black Friday.” Posted November 29, 2013 Posted November 28, 2013 Do as I do, not as I say Stores opening on Thanksgiving Day this year appear to be game-changers for the holiday shopping season. Although mentions of early-bird sales starting on Thanksgiving stirred up some interesting opinions in social media conversations, it seems shoppers still felt compelled to take advantage of the deals, whether they felt good about it or not. We discovered that in the hours leading up to the start of Thanksgiving Thursday sales, consumers showed relatively high positive sentiment. But as the mentions of Thursday shopping began to increase around 5 p.m. ET, the sentiment began to drop significantly, only picking up again on Black Friday around 11 a.m. Number of mentions: Sentiment: 42,128 15% Number of mentions: Sentiment: 74,210 -4% Number of mentions: Sentiment: 125,728 38% 5 p.m. ET Thanksgiving Day 9 p.m. ET Thanksgiving Day 11 a.m. ET Black Friday With more brick-and-mortar retailers starting Black Friday sales on Thanksgiving Day, we may find that retailers who opt out of this trend will attract new customers and employees who support their family-friendly policies. Anita D. Bhappu PhD, Associate Professor & Program Chair, Retailing & Consumer Sciences at The University of Arizona November 15, 2013 “ I really dislike how Black Friday shopping started on Thanksgiving. People should be home with their family, not waiting in line for stores.” Posted November 29, 2013 “Online black friday shopping is a great decision year after year. Because I can't be out in public in a fuzzy bathrobe, eating Lucky Charms.” Posted November 29, 2013 “#BlackFriday is brutal... If you can avoid it wait for #CyberMonday it's much tamer.” Posted November 29, 2013 “Thanksgiving/Black Friday is my new favorite holiday. #TurnUp” Posted November 29, 2013 What a difference a year makes. Or does it? As the holiday deals begin earlier and earlier each year, it appears the lines between Black Friday and Cyber Monday continue to blur, blending into one giant sales event rather than distinct deal days. Conversations indicate that shoppers take advantage of both online and in-store specials throughout the entire period, choosing to shop in ways that satisfy them the most. How did you shop this year? Share this infographic and your #BFCMconvo stories with us. With the SAP® Social Media Analytics application by NetBase, you can sift through the general noise of social media and listen to what consumers are saying about you. Consumers aren’t shy about spreading the social word about their retail experiences. Read more about how your business can gain deeper insight into social media. Want even more holiday social analytics cheer? Check out our holiday dashboard to see the social sentiment surrounding the Toys“R”Us Hot 15 Holiday Toy List. * Data from social analytics expressed here is 80% accurate and based on a statistically representative sample of publicly accessible posts, which are related to search terms defined by SAP and captured between 11/16/11 and 11/28/11; 11/14/12 and 11/26/12; and 11/20/13 and 12/02/13. The views expressed here are those of the original posters, not SAP. Social conversations captured by SAP Social Media Analytics. © 2013 SAP AG or an SAP affiliate company. All rights reserved.